Cell Line and Membrane Market Outlook:

Cell Line and Membrane Market size was valued at USD 7 billion in 2025 and is projected to reach USD 16.5 billion by the end of 2035, rising at a CAGR of 9% during the forecast period, i.e., 2026-2035. In 2026, the industry size of cell line and membrane is assessed at USD 7.6 billion.

The global market is gaining traction, fueled by its amplifying demand in biopharmaceutical production, drug discovery, and academic research. The market comprises a substantial patient pool requiring biopharmaceuticals, regenerative medicine, and diagnostic applications. Most people affected with cancer, diabetes, and autoimmune disorders require biologic intervention. In this regard, as the patient base is expanding FDA in 2024 has approved nearly 19 biological license applications, all of which are reliant on these core technologies.

The supply chain for these products is complex and globalized and involves cross-border trade in biological raw materials, specialty polymers, and finished single-use assemblies. Major manufacturing centers in Europe and North America are major importers of some specialty chemicals and export finished cell line products and filtration systems. For example, NIST international trade data for the U.S. indicates a stable import volume of artificial filaments applied to membrane spinning, underlining reliance on certain material streams. Production lines are increasingly focused on single-use technology to maximize flexibility and reduce risks from contamination, a trend driven by supply chain disruptions caused by the pandemic. In addition, RDD investment remains strong, with public institutions having a key role.

Key Cell Line and Membrane Market Insights Summary:

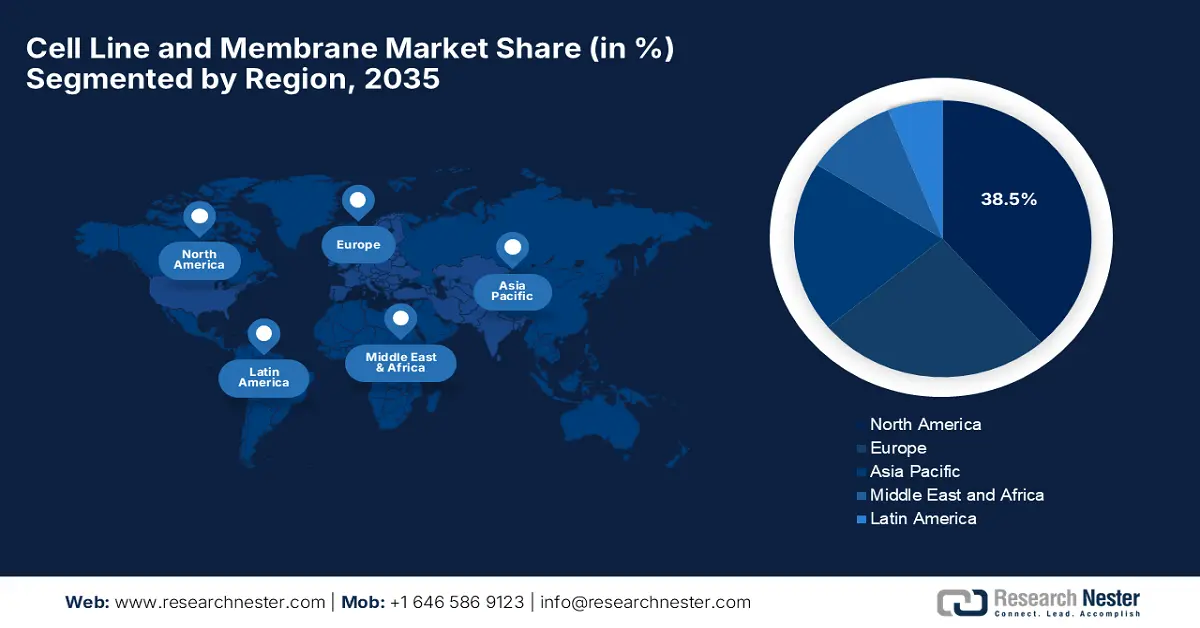

Regional Insights:

- North America is predicted to hold the largest share of 38.5% by 2035, driven by extensive federal funding, advanced pharma R&D, and high healthcare expenditure.

- Europe is steadily expanding, impelled by strong regulatory frameworks, high biopharmaceutical R&D investment, and EU-level funding.

Segment Insights:

- The recombinant cell lines segment is projected to account for 35.7% share by 2035, propelled by the rising demand for monoclonal antibodies in oncology, autoimmune diseases, and infectious disorders.

- The biopharmaceutical production segment is anticipated to grow significantly during 2026–2035, owing to the exceptional demand for biosimilars in emerging nations.

Key Growth Trends:

- Technological advancements

- Rising global burden of chronic diseases

Major Challenges:

- Delayed regulatory approvals

- High out-of-pocket costs

Key Players: Thermo Fisher Scientific (USA), Merck KGaA (Germany), Corning Incorporated (USA), Lonza Group (Switzerland), ATCC (USA), Charles River Laboratories (USA), Sartorius AG (Germany), Cytiva (UK), Eurofins Scientific (Luxembourg), Evotec SE (Germany), Takara Bio Inc. (Japan), Fujifilm Holdings Corporation (Japan), REPROCELL Inc. (Japan), Mesoblast Ltd (Australia), LG Chem (South Korea), Lotte Biologics (South Korea), Biocon Limited (India), Syngene International Ltd (India), DKSH (Switzerland), Sonacare (Malaysia).

Global Cell Line and Membrane Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7 billion

- 2026 Market Size: USD 7.6 billion

- Projected Market Size: USD 16.5 billion by 2035

- Growth Forecasts: 9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.5% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, Germany, France, Japan, China

- Emerging Countries: India, Brazil, South Korea, Canada, Italy

Last updated on : 16 October, 2025

Cell Line and Membrane Market - Growth Drivers and Challenges

Growth Drivers

- Technological advancements: The presence of a vast and substantial consumer base is encouraging the global firms to innovate more of such effective products, thereby driving growth in the market. Advancements in terms of gene editing, CRISPR technology, and synthetic biology are enhancing both efficiency and specificity of cell lines being utilized in therapeutic applications. Besides, the development of novel membrane materials is significantly improving dialysis performance and filtration systems, thus uplifting the market demand.

- Rising global burden of chronic diseases: The growing cancer disease, diabetes, and autoimmune disorders are the key drivers demanding the market. These conditions are treated via biologic drugs, requiring the production capability that cell lines and membranes provide. As per the NIH report in January 2025, nearly 2,041,910 new cancer cases were registered in 2025. This rising patient pool directly drives into a long-term demand for biopharmaceuticals and, consequently, the tools for their manufacture.

- Proliferation of biologics and biosimilars: The unprecedented growth in biologics, particularly monoclonal antibodies, is the primary market driver. As biologics face patent expiration, a boom in biosimilar development generates enormous, long-term demand for high-yielding, consistent cell lines and high-efficiency purification membranes. According to the FDA data 2025, almost 13 new biologics were approved in 2025. This pipeline requires strong manufacturing infrastructure, driving the market straight away as firms ramp up production to grab market share.

Approved Cell Therapies in June 2023

|

Product name |

Generic name |

Originator company |

Modality |

Disease(s) |

|

Vyjuvek |

Beremagene geperpavec |

Krystal Biotech |

HSV-1 gene therapy |

Epidermolysis bullosa |

|

Adstiladrin |

Nadofaragene firadenovec |

Merck |

Adenoviral gene therapy |

Bladder cancer |

|

Hemgenix |

Etranacogene dezaparvovec |

uniQure |

AAV5 gene therapy |

Hemophilia B |

|

Roctavian |

Valoctocogene roxaparvovec |

BioMarin |

AAV5 gene therapy |

Hemophilia A |

Source: NLM November 2023

Challenges

- Delayed regulatory approvals: The presence of bureaucratic hurdles in the market causes significant barriers in the treatment rollout. For instance, in Japan, PMDA created an 8-month delay for Lonza’s cell therapy in 2022 owing to additional efficacy data requirements. Besides, the U.S. FDA’s review procedure takes tome, thereby delaying the product entry and creating an additional price burden on manufacturers.

- High out-of-pocket costs: The aspect of increased treatment costs and limited insurance coverage hampers adoption in the market across all nations. In this regard, it is noted that in the U.S., only few of patients receive coverage for advanced membrane-based therapies due to their exacerbated costs. Besides, NIH notes that the average cost for cell-line-based biologics is over costly making it a significant challenge in emerging nations.

Cell Line and Membrane Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

9% |

|

Base Year Market Size (2025) |

USD 7 billion |

|

Forecast Year Market Size (2035) |

USD 16.5 billion |

|

Regional Scope |

|

Cell Line and Membrane Market Segmentation:

Product Type Segment Analysis

The recombinant cell lines segment is expected to garner the highest share of 35.7% by the end of 2035. The dominance of the segment effectively caters to the booming demand for monoclonal antibodies owing to their widespread applications in oncology, autoimmune diseases, and infectious disorders. Besides, NIH notes that checkpoint inhibitors usage such as Keytruda and Opdivo, is expanding in terms of cancer and immunotherapy. Moreover, the NLM study in November 2023 depicts that the most common type of gene therapy is genetically modified cell therapies, and nearly 1,150 are in active development hence a positive segment outlook.

Application Segment Analysis

The biopharmaceutical production segment is projected to grow at a considerable rate during the forecast period. The growth in the segment originates from the exceptional demand for biosimilars, especially in emerging nations. Testifying to this, the Association for Accessible Medicines report in 2025 depicts that nearly USD 408 billion generic and biosimilar drugs are generated in 2022, owing to the significant growth in the biopharmaceutical sector. Besides the NIST reports, the adoption of single-use bioreactors improved production efficiency, hence reducing contamination risks.

Membrane Type Segment Analysis

Hollow fiber membranes will dominate the type of membrane segment because of their higher efficiency in cell culture and downstream processing. Their large surface-area-to-volume relationship is essential for high-intensity perfusion bioreactor systems applied in high-end cell and gene therapy production. The U.S. Food and Drug Administration shows a significant rise in approvals for continuous bioprocessing, which is a method reliant on hollow fiber technology. This trend, combined with their extensive use in tangential flow filtration (TFF) for concentrating and purifying sensitive biologics, ensures their continued dominance.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Product Type |

|

|

Application |

|

|

Membrane Type |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cell Line and Membrane Market - Regional Analysis

North America Market Insights

North America is dominating the cell line and membrane market and is expected to hold the largest share of 38.5% by the end of 2035. The market is driven by the federal funding, advanced R&D in the pharma sector, and high healthcare expenditure. Some key trends of the region are the rising adoption of single-use technologies for biomanufacturing, demand for monoclonal antibodies and vaccines, and significant government and private investment in cell biology research. Furthermore, regulatory support with accelerated pathways and Health Canada’s biomanufacturing strategy propels growth in the region.

The cell line and membrane market in the U.S. is leading the North America market and is led by funding grants, R&D investments and trade activities. The Congressional Research Service report in March 2023 depicts that the NIH's enacted budget was USD 47.683 billion, which is a key driver for the market. This budget highlights the foundational research and technology development in cell biology, biomanufacturing, and membrane science. Furthermore, the CRISPR-based cell line engineering appreciably boosts yield, whereas modular cleanroom facilities cut production expenses, thus positioning the U.S. as the global leader in the market.

Canada is steadily dominating its position in the cell line and membrane market and is driven by federal initiatives to bolster domestic biomanufacturing and coordinated provincial health spending. Canada’s Budget 2023 released in March 2023, states that investments of USD 198.3 billion were allocated over 10 years to strengthen Canada’s public health care system, along with a USD 46.2 billion new funding component of the Canada Health Transfer. These funding are used in research, diagnostics, and therapeutic development, further supporting and demand for cell culture technologies, membranes, and related consumables. Furthermore, Health Canada notes that domestic API production is poised to rise by the end of 2035, thereby reducing import reliance on the EU, hence uplifting the market demand.

Summarizing Biologics Approvals in the U.S. and Canada Related to Cell Line and Membrane Technologies

|

Year |

Country |

Biologic Product |

Description |

|

2023 |

U.S. |

Omisirge (omidubicel-onlv) |

Cord blood-derived hematopoietic progenitor cells for hematologic malignancies |

|

2023 |

U.S. |

Lyfgenia (lovotibeglogene autotemcel) |

Autologous cell-based gene therapy for sickle cell disease |

|

2024 |

Canada |

Yesafili (aflibercept biosimilar) |

Biosimilar to Eylea for vascular endothelial growth factor inhibition |

|

2025 |

USA |

Ryoncil (remestemcel-L) |

First mesenchymal stem cell therapy approved for pediatric SR-aGVHD |

Source: FDA December 2024, Biocon Biologics June 2025, FDA December 2023, FDA May 2023

Asia Pacific Market Insights

Asia Pacific’s market is poised to witness the fastest growth, rising at a CAGR of 7.2%. The region benefits from the expanded occurrence of chronic diseases, government investments in terms of regenerative medicine, and biopharmaceutical research activities. Besides, the adoption of 3D cell culture technologies propels business in the region, due to which South Korea increased its R&D budget towards advanced cell models. Furthermore, public-private partnerships, such as in Malaysia's bioeconomy corporation have funded in cell therapy startups, are expected to augment the region’s growth.

Japan's market is characterized by its enhanced regenerative medicine industry and favorable regulatory environment. According to the EU Japan Center report of August 2024, the Japan biopharmaceutical market would expand at a rate of 9.6% per annum between 2019 and 2026, to fuel growing demand for cell line and membrane technologies. Expansion in biologics, cell therapies, and other innovative therapeutics, supported by government policies and an aging population, is increasing the demand for stable cell lines and membrane-based bioprocessing solutions in drug development and production.

The cell line and membrane market in India is fueled by the increasing pharmaceutical research activities and government-backed initiatives. As per the BIRAC report in October 2025, INR 349 crore is allocated for biotech startups, highlighting more companies to start and focus on developing cell-based therapies, biologics, and advanced research tools, all of which depend on cell lines and membrane technologies. Investment in these startups accelerates R&D, scaling of manufacturing processes, and commercialization in this market segment. Further, the strong clinical trial ecosystem in the country creates a positive market environment.

Government Investment in Biopharma in 2024

|

Country |

Biopharma Investment |

Notes |

|

China |

USD 15 billion in R&D investment |

Strong central govt. & regional subsidies; focus on clusters & innovation hubs |

|

India |

USD 250 million |

Mission supports infrastructure, innovation & market growth in biopharma |

|

Japan |

USD 3.3 billion |

Emphasis on innovation, aging population, and advanced therapies |

Source: MERICS April 2025, JETRO April 2024, PIB August 2024

Europe Market Insights

The cell line and membrane market in Europe is a steadily growing market and is driven by strong regulatory framework, high investment in biopharmaceutical R&D, and significant government and EU-level funding. Main drivers are the growing incidence of chronic conditions, the fast development of advanced therapeutic medicinal products (ATMPs) such as cell and gene therapies, and the demand for effective biomanufacturing processes. One of the key trends is the strategic thrust for health sovereignty, with efforts by the European Union consolidating the health technology value chain, including production of biologics.

The cell line and membrane market in the UK is dominating the Europe region. The market is driven by its world-class life sciences industry and the government's strategy. According to the SCI report in September 2025, UK cell and gene therapy companies secured £200 million in venture capital, facilitating the launch of 47 clinical trials in 2024 within this sector. This strong investment and clinical development highlight the UK's dedication to developing pioneering cell-based therapies and positioning itself in the global marketplace.

Germany is Europe's largest market, defined by high healthcare expenditure and a robust manufacturing sector. As per GTAI report in 2025, Germany is Europe's biggest pharmaceutical market with biopharmaceutical producers achieving revenues of approx. €19.2 billion in 2023, increasing by 8.9% compared to the last year. This growth further exemplifies Germany's strategic significance in leading innovation and uptake in the European market.

Key Cell Line and Membrane Market Players:

- Thermo Fisher Scientific (USA)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Merck KGaA (Germany)

- Corning Incorporated (USA)

- Lonza Group (Switzerland)

- ATCC (USA)

- Charles River Laboratories (USA)

- Sartorius AG (Germany)

- Cytiva (UK)

- Eurofins Scientific (Luxembourg)

- Evotec SE (Germany)

- Takara Bio Inc. (Japan)

- Fujifilm Holdings Corporation (Japan)

- REPROCELL Inc. (Japan)

- Mesoblast Ltd (Australia)

- LG Chem (South Korea)

- Lotte Biologics (South Korea)

- Biocon Limited (India)

- Syngene International Ltd (India)

- DKSH (Switzerland)

- Sonacare (Malaysia)

- Thermo Fisher Scientific is a key player in the market that have significant advancement in bioproduction by incorporating its Gibco cell culture media and reagents with cGMP cell lines. In 2024, the company has invested USD 1.4 billion in R&D to provide new technologies and break new ground in their important work. This fusion creates an optimized, off-the-shelf bioproduction systems, which streamlines the biologics development and ensures the consistency and scalability from research to commercial manufacturing.

- Merck KGaA, operating as MilliporeSigma, is a pioneer in providing certified raw materials for the market. The worldwide sales in the fourth quarter in 2024 reached USD 15.6 billion, which is a rise of 7% in 2023 Q4. The company advancements surges in embedding extensive biosafety testing and regulatory support directly into its portfolio of cell lines and filtration membranes. This ensures the product accelerates and is reliable to regulatory compliance for clients developing enhanced biologics and therapies.

- Corning Incorporated is also a pioneer in developing the physical substrates for the cell line and membrane market. The company is significantly advanced in vitro research by integrating its specialized surface technologies, like the Transwell permeable supports, into standard laboratory practice. These membrane-based systems enable advanced cell culture models that replicate biological barriers, ensuring more predictive data for drug transport and toxicity studies.

- Lonza Group is a trailblazer in the cell line and membrane market, mainly for bioproduction and has significantly advanced the industry by commercializing its proprietary GS Xceed gene expression system. This platform provides the development of high-yielding, stable mammalian cell lines, which ensure optimized and scalable production of complex monoclonal antibodies and other recombinant proteins for therapeutic developers worldwide.

- ATCC is a pioneer in biological standards for the cell line and membrane market. The company has significant advancements in scientific reproducibility by offering a comprehensive collection of authenticated cell lines and primary cells. Further, its commitment to contamination testing and robust characterization enables a foundation of reliable biological models for research and drug discovery, which directly address the vital requirement for data integrity in biomedical sciences.

Below is the list of some prominent players operating in the global market:

The worldwide market presents an intensifying and competitive landscape the key organizations making significant investments in bioprocessing automation, single-use technologies, and personalized medicine. For instance, in August 2025, WuXi Biologics has launched WuXia293, which is a new platform that is designed for the development and manufacturing of innovative, difficult-to-express molecules that are expressed in HEK293 cells. On the other hand, companies in Asia, such as WuXi AppTec and Samsung Biologics, are undergoing expansion through CDMO partnerships, hence denoting a sustained growth in the market.

Corporate Landscape of the Cell Line and Membrane Market:

Recent Developments

- In September 2025, ARCHIMED acquired cell line development pioneer ExcellGene to surge the expansion into biosimilars and high-performance transfection solutions. This partnership forms a group that encompasses gene transfer, cell line development, and cell culture-based manufacturing for the high-performance production of recombinant proteins and other advanced therapeutics.

- In September 2025, ProteoNic launched 2G UNic transposon platform to support superior cell line productivity and increased ease of use that are used by biopharma customers.

- In July 2024, StemCell Technologies launched the novel CellPore Transfection System, an advanced cell-engineering technology designed to advance cell engineering research and the development of novel cell therapies for disease treatment.

- Report ID: 7769

- Published Date: Oct 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cell Line and Membrane Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.