Bioprocess Bags Market Outlook:

Bioprocess Bags Market size was valued at USD 4.78 Billion in 2025 and is set to exceed USD 23.57 Billion by 2035, registering over 17.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of bioprocess bags is estimated at USD 5.52 Billion.

The increasing prevalence of chronic diseases such as cancer, diabetes, autoimmune diseases, and rare genetic disorders has resulted in demand for biopharmaceuticals that require bioprocess bags. These bags facilitate sterile containment and processing of cell cultures, which is required for treating chronic conditions. Several biopharmaceutical companies are focused on expanding production capacity to meet the rising demand for bioprocessing solutions, including bioprocess bags. For instance, in March 2024, MilliporeSigma, the U.S and Canada Life Science business of Merck Group, invested around USD 325 million in its new Bioprocess Production Center in Daejeon, South Korea. The company plans to expand its production capacities in the fastest growing region, Asia Pacific, and foster deep collaboration to enhance the speed of production of new therapies.

Several companies are also forming strategic alliances to enhance the production of bioprocessing bags. For instance, in February 2022, Dow, SÜDPACK Medica, and Sartorius parented in the global COVID-19 vaccination effort by manufacturing efficient bioprocess bags. These bags are made from multilayer films to achieve better speed and quality, along with flexibility in the vaccine development and commercial manufacturing operations.

Key Bioprocess Bags Market Insights Summary:

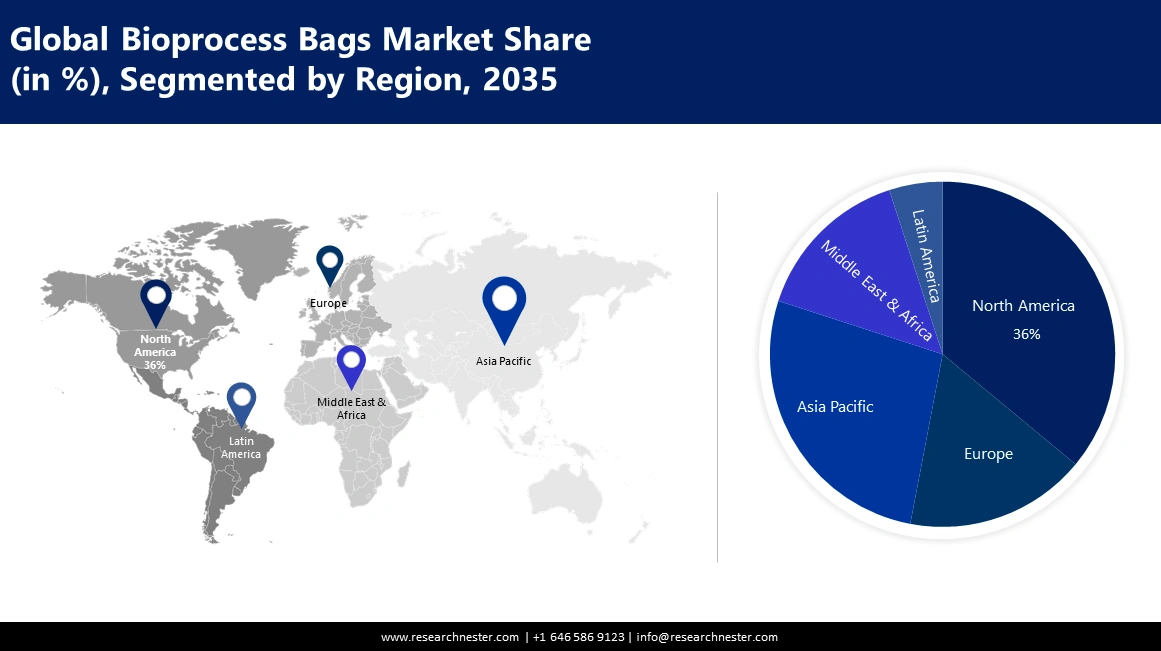

Regional Highlights:

- Asia Pacific’s bioprocess bags market is expected to capture 37% share by 2035, driven by an increasing number of biologics and rising R&D, boosting bioprocess bags demand.

- North America’s market will exhibit significant growth during the forecast timeline, attributed to the presence of biopharmaceutical firms, rapid bioprocessing technology advances, and personalized medicine demand.

Segment Insights:

- The multi-use bioprocess bags segment in the bioprocess bags market is expected to witness significant growth through 2035, driven by demand for vaccines, cell therapies, and sustainability trends.

Key Growth Trends:

- Increasing number of contract development and manufacturing organizations (CDMOs)

- Rapid advancements in bioprocessing technology

Major Challenges:

- Surging cost of raw material

- Rising environmental issues with the adoption of single use bioprocess bags

Key Players: Thermo Fisher Scientific Inc., Sartorius AG, Merck KGaA, GE Healthcare, Eppendorf AG, Avantor, Inc., Lonza Group Ltd., Fluidigm Corporation, Saint-Gobain Performance Plastics Corporation, Entegris, Inc.

Global Bioprocess Bags Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.78 Billion

- 2026 Market Size: USD 5.52 Billion

- Projected Market Size: USD 23.57 Billion by 2035

- Growth Forecasts: 17.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (37% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 11 September, 2025

Bioprocess Bags Market Growth Drivers and Challenges:

Growth Drivers

- Increasing number of contract development and manufacturing organizations (CDMOs): CDMOs play a crucial role in the biopharmaceutical sector as these help to scale up production quickly without the need for robust in-house infrastructure. These rely heavily on single-use technologies like bioprocess bags to ensure faster turnaround times and lower costs. As CDMOs handle multiple clients, single use bags can prevent cross-contamination between batches. Many small to medium-scale companies with limited manufacturing capabilities often prefer CDMOs as these provide cost-effective access to advanced bioprocessing facilities. Thus, the rising number of CDMOs across the globe is expected to fuel market growth going ahead.

- Rapid advancements in bioprocessing technology: Continuous innovation in the biomanufacturing processes, such as automation and digitalization, has resulted in better production methods. These advancements allow better scalability, reduced operational costs, and enhanced product yield, increasing the need for advanced bioprocess bags. For instance, in April 2023, Merch announced the launch of Ultimus, a single-use process container film to offer superior strength along with leak resistance for single use assemblies for bioprocessing liquid applications.

Challenges

- Surging cost of raw material: Bioprocess bags require high-quality, specialized materials that are often expensive than conventional plastics. Moreover, the sterilization process ensures their suitability for biopharmaceutical applications, which adds to the production costs.

- Rising environmental issues with the adoption of single use bioprocess bags: The rising use of single use bioprocess bags made from non-biodegradable plastics can contribute to plastic waste and greenhouse gas emissions. This can affect the overall market growth going ahead.

Bioprocess Bags Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

17.3% |

|

Base Year Market Size (2025) |

USD 4.78 Billion |

|

Forecast Year Market Size (2035) |

USD 23.57 Billion |

|

Regional Scope |

|

Bioprocess Bags Market Segmentation:

Type Segment Analysis

The multi-use segment in bioprocess bags market is estimated to hold the largest revenue share of 60% by 2035, as multi-use bioprocess bags provide a cost-effective solution over multiple production cycles. The growing demand for vaccines, cell therapies, and biologics is fueling the demand for bioprocess bags for storage and transport. In addition, multi-use bioprocess bags generate less plastic waste than single-use ones, aligning well with the global sustainability trends.

End user Segment Analysis

The biopharmaceutical segment in bioprocess bags market is likely to register rapid growth during the forecast period, owing to rapidly growing biopharmaceutical production and rising production of flexible bioprocessing solutions to meet the demand for biologics and personalized medicines. These bags also eliminate cleaning, sterilization, and validation requirements, which speeds up production and reduces the overall capital expenses. Moreover, the contract manufacturing organizations are increasingly using bioprocess bags to offer flexible, scalable production for biopharma clients.

Our in-depth analysis of the global bioprocess bags market includes the following segments:

|

Type |

|

|

End user |

|

|

Product |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Bioprocess Bags Market Regional Analysis:

APAC Market Insights

The bioprocess bags market in Asia Pacific is projected to hold the largest revenue share of 37% by the end of 2035. An increasing number of biologics and rising R&D has resulted in the growing need for efficient and scalable bioprocessing solutions, including bioprocess bags. Asia Pacific is steadily establishing itself as a global innovative hub, with India, China, and Japan leading the space in overall innovative pipelines. In addition, the growing prevalence of various chronic diseases, the rising need for advanced bioprocessing solutions, and current trends for single-use technologies in the biopharmaceutical industry are other factors expected to boost the market in this region.

In India, the market is expected to grow at a rapid pace during the forecast period, owing to increasing investments in biopharmaceutical manufacturing and the prevalence of several chronic diseases. In addition, the government is actively investing in healthcare infrastructure and biopharmaceutical research. For instance, the government invested USD 2957.4 million, aiming to enhance the infrastructure and research capabilities. In addition, high focus on sustainable manufacturing practices and rising number of contract manufacturing and research organizations are expected to fuel growth in India.

North America Market Insights

North America in bioprocess bags market is expected to register significant growth between 2026 and 2035 due to the presence of biopharmaceutical firms, contributing to a substantial demand for bioprocess bags. Rapid advancements in bioprocessing technologies, high prevalence of chronic diseases, and rising need for personalized medicines are expected to fuel the demand for efficient bioprocess bags. Moreover, the favorable regulatory policies and framework in the region encourage innovation and the adoption of advanced bioprocessing solutions.

In the U.S., the rising demand for personalized medicine to cater to the increasing prevalence of chronic diseases is expected to boost demand for bioprocess bags. Several key players in the country are investing in R&D activities to meet the demand. For instance, in August 2022, Thermo Fisher announced an investment of USD 76 million to expand its bioprocessing unit in the U.S. The company plans to expand to cater to the rising demand for cell culture media. In addition, this expansion is expected to create more than 100 new jobs across the R&D, manufacturing, operations, and human resources departments.

Bioprocess Bags Market Players:

- Thermo Fisher Scientific Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Developments

- Regional Presence

- SWOT Analysis

- Sartorius AG

- Merck KGaA

- GE Healthcare

- Eppendorf AG

- Avantor, Inc.

- Lonza Group Ltd.

- Fluidigm Corporation

- Saint-Gobain Performance Plastics Corporation

- Entegris, Inc.

The market is highly competitive, characterized by robust competition among several key players, and driven by escalating demand for biopharmaceuticals and advancements in single-use technologies. Major companies such as Thermo Fisher Scientific Inc, Sartorius AG, Merck KGaA, and Saint-Gobain have established a significant market presence through comprehensive bioprocessing solutions and strategic initiatives. These key players are also focused on expanding their manufacturing capabilities to cater to the rising demand. Here is a list of key players operating in the global market:

Recent Developments

- In September 2024, TekniPlex Healthcare announced the launch of its new single use bioprocessing solutions, including bioprocess bags, at CPHI Milan 2024. The company also showcased other products, such as customizable barrier cleanroom films, weldable TPE, and TPV.

- In March 2022, ILC Dover LP, a leading company specializing in single-use solutions for biotherapeutics and pharmaceutical processing, launched single-use bioprocessing bags for the handling and supply of sterile liquids for the biotherapeutic industry.

- Report ID: 5343

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Bioprocess Bags Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.