Single Use Cystoscope Market Outlook:

Single Use Cystoscope Market size was valued at USD 127.78 million in 2025 and is set to exceed USD 278.43 million by 2035, registering over 8.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of single use cystoscope is estimated at USD 137.1 million.

The single use cystoscope market has gained immense expansion opportunities and exposure due to the increased demand for single use cystoscopes, reduced reprocessing time, and the rising production values. They are easy to use with a lowered risk of contamination, allowing proper visualization of urinary areas. This has encouraged key players to launch more of such devices across the world. In August 2023, Asieris Pharmaceuticals (USA) Inc. declared that it received acceptance for the registration applications for its Uro-G and Uro-V Disposable Cystoscopic System from the Hong Kong Department of Health. Thus, this denotes a positive outlook for the market growth for enhanced visualization during cystoscopy procedures.

Furthermore, the market is gaining traction, fueled by the increasing prevalence of conditions such as urinary cancer and urinary tract infections. It has a large consumer base being adopted for single use diagnostic procedures to avoid the risk of infections. According to the report from the World Cancer Research Fund in 2022, 614,298 new cases of bladder cancer were reported, which necessitates proper diagnostic and treatment procedures to avoid long-term complications. It further reported that China, the U.S., and Italy are leading with higher occurrences of cancer, 92,883, 80,404, and 34,580. This is encouraging global firms, as there’s a greater need for specialized manufacturing process to support their production.

Bladder Cancer Statistics

|

Rank |

Country |

New Cases in 2022 |

|

1 |

Germany |

29,035 |

|

2 |

UK |

23,643 |

|

3 |

India |

22,548 |

|

4 |

Spain |

21,418 |

|

5 |

France(metropolitan) |

19,733 |

Source: WCRF,2022

Key Single Use Cystoscope Market Insights Summary:

Regional Highlights:

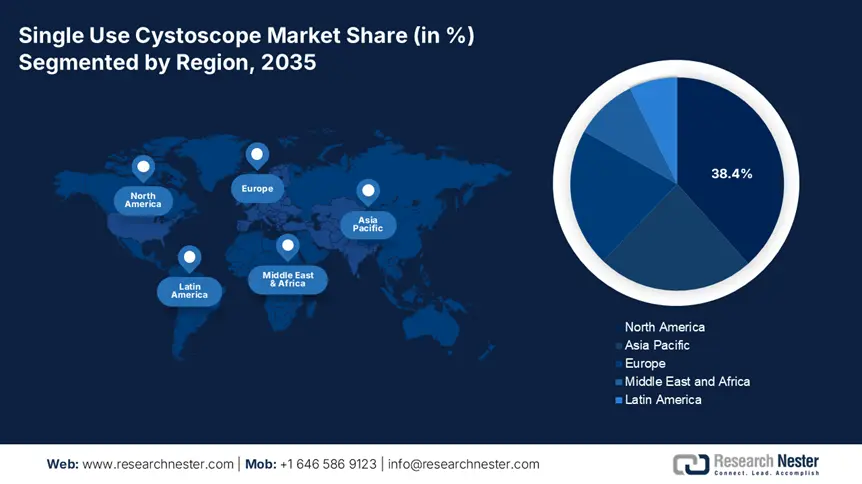

- North America holds a 38.4% share in the Single Use Cystoscope Market, with enhanced accuracy and U.S. FDA approvals for advanced cystoscopy devices driving its dominance through 2026–2035.

- Asia Pacific’s single use cystoscope market anticipates lucrative growth through 2026–2035, fueled by higher medical expenditure and cost-effective devices reducing infection risk.

Segment Insights:

- The Hospitals segment is expected to grow at a considerable rate through 2026-2035, driven by the increasing use of single-use flexible cystoscopes offering lower costs and reduced contamination risks.

- The flexible cystoscope segment is expected to achieve an 89.4% share by 2035, fueled by its advantages in patient comfort, reduced tissue damage, and enhanced diagnostic accuracy.

Key Growth Trends:

- Increasing prevalence of urological disorders

- Rising utilization of single use cystoscopes

Major Challenges:

- Budget restraints

- Environmental concerns

- Key Players: Ambu A/S, Boston Scientific Corporation, Coloplast Group, OTU Medical Inc., NeoScope Inc..

Global Single Use Cystoscope Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 127.78 million

- 2026 Market Size: USD 137.1 million

- Projected Market Size: USD 278.43 million by 2035

- Growth Forecasts: 8.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, Brazil, Mexico, Russia

Last updated on : 12 August, 2025

Single Use Cystoscope Market Growth Drivers and Challenges:

Growth Drivers

- Increasing prevalence of urological disorders: The rising number of urological disease cases is driving the single use cystoscope market, as it boosts demand for cystoscopy devices that can address the root cause of these diseases. The technological advancements to meet the complicated diagnostic procedures also significantly impact the industry expansion. In September 2022, KARL STORZ and Photocure ASA together notified the launch of the Blue Light Cystoscopy in Europe, featuring the POWER LED SAPHIRA light source to enhance bladder carcinoma detection when used with Photocure’s Hexvix. This, in turn, amplifies the market growth with improved outcomes.

- Rising utilization of single use cystoscopes: The market is subject to a huge expansion due to the increased number of healthcare facilities using the disposable cystoscopes in their diagnostic and surgical procedures. This has further inspired the key players in the market to invest in more of such devices. In June 2024, UroMems declared that it raised a record USD 47 million (€44 million) in series C funding in support of its clinical trials of its UroActive System, the first automated implant for treating stress urinary incontinence. Hence, the funding will aid in the regulatory process across the U.S and other countries, thus augmenting market progression.

Challenges

- Budget restraints: Affordability is one of the major barriers restricting the growth in the single use cystoscope market. Additionally, these treatments are often complicated, limiting the consumer base in particular areas, while maintaining affordability poses a significant challenge. The healthcare facilities charge higher for the single used products than reusable ones, further exacerbating the costs, and requiring innovative approaches to reduce expenses without compromising quality.

- Environmental concerns: This is another major factor affecting the upliftment of the single use cystoscope market, which occurs due to the intricate nature of cystoscopes. While disposing of the one-time use cystoscopes leads to healthcare-related wastage, it is a huge concern for sustainability. The recent authorizations and policies are highly requisite eco-friendly alternatives to accommodate the environmental safety standards. This makes it essential to develop rigorous recycling systems that can manage variability efficiently.

Single Use Cystoscope Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.1% |

|

Base Year Market Size (2025) |

USD 127.78 million |

|

Forecast Year Market Size (2035) |

USD 278.43 million |

|

Regional Scope |

|

Single Use Cystoscope Market Segmentation:

Product (Flexible Cystoscope, Rigid Cystoscope)

Based on product, the flexible cystoscope segment is projected to dominate single use cystoscope market share of around 89.4% by the end of 2035. The dominance is mainly attributed to the substantial advantages offered, such as patient comfort and lowered risk of tissue damage, enhancing diagnostic accuracy. In this regard, as per an NLM report in March 2024, single use cystoscopes reduce total hands-on time when compared with reusable ones. Preparation and breakdown of single use took 2’22 versus 4’53 for reusables, and with reprocessing they required 80% more labor time Therefore, this efficiency supports the growing preference for flexible cystoscopes in the market.

End-User (Hospitals, Ambulatory Surgical Centers, Diagnostic Centers)

Based on the end user, the hospitals segment is projected to grow at a considerable rate in the single use cystoscope market during the forecast period. A wide range of diagnostic procedures use cystoscopes in several hospital settings due to minimized contamination risks. According to a urology article published in September 2022, evaluating 84 cases, single use flexible cystoscopes were increasingly used in 93% of cases, for which the cost per use was lower for about USD 185.0 when compared to reusable ones, which is USD 272.4. It further reported that using the single use cystoscopes could save approximately USD 39,142.8 annually. Due to this, companies are undertaking several initiatives to enhance their presence in the single use cystoscope market.

Our in-depth analysis of the global market includes the following segments:

|

Product |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Single Use Cystoscope Market Regional Analysis:

North America Market Analysis

North America single use cystoscope market is projected to hold revenue share of more than 38.4% by 2035. Domestic players in the country are leveraging their cystoscopy devices with enhanced accuracy due to the higher instances of urinary tract infections. For instance, in April 2024, ImmunityBio, Inc. declared that it received the U.S. FDA approval for ANKTIVA (N-803, or nogapendekin alfa inbakicept-pmln) and Bacillus Calmette-Guérin (BCG) for patients with BCG-unresponsive non-muscle invasive bladder cancer, carcinoma in situ, with or without papillary tumors. Such improved approvals act as a positive outlook for market development.

The single use cystoscope market in the U.S. is evolving at a rapid pace, driven by factors such as the presence of key market players and the rising awareness among the population and healthcare providers regarding the benefits of single-use. Moreover, the manufacturers are focusing on new developments to meet the higher market demand. In May 2022, Teleflex Incorporated launched an innovative tissue control system UroLift 2 System and UroLift ATC, for people with obstructive middle lobes. Hence, the launch of advanced, groundbreaking solutions in the cystoscope market will amplify the industry expansion.

Canada's single use cystoscope market is expanding steadily, supported by the government, a strong competitive environment, and collaborative industry partnerships. The country’s focus on innovation and advancements supports the industrial growth in the region. For instance, in January 2022, Photocure ASA declared the commercial operations of Cysview in Canada after reacquiring marketing and distribution rights from BioSyent Pharma Inc. Cysview is used during blue light cystoscopy to help detect non-muscle invasive bladder cancer. This is the evidence for a wider scope, strengthening the single use cystoscope market in the country.

APAC Market Statistics

The Asia Pacific region houses a substantial number of patients with a higher occurrence of urinary tract infections and urinary cancer, which necessitates the use of single use cystoscopes. This grants lucrative market prospects for establishing manufacturing hubs in the region, thereby uplifting market growth. The region also boasts higher medical expenditure, with a great awareness of the single use of cystoscopes in restricting infections with multiple usage. Thus, these factors, along with the cost-effectiveness of the devices, are boosting the region’s market.

India’s single use cystoscope market is witnessing steady growth, particularly driven by factors such as early adoption of minimally invasive technologies and the increased requirement of infection control to eliminate the risk associated with multiple device usages. Moreover, the country’s government support makes India a global hub for single-use cystoscopes. For instance, in April 2024, AIIMS Bhubaneswar launched an advanced artificial urinary sphincter (AUS) implantation service to help patients with severe urinary incontinence. Hence, such adaptive solutions help to boost cystoscope development and manufacturing in the country.

The China single use cystoscope market is driven by a large patient base with unmet medical needs. Additionally, the country’s geriatric population with a great awareness of infection control fosters a favorable environment for substantial business opportunities. In March 2025, Endoso Life Technology Co., Ltd. showcased its endoscopy products: single-use ureteroscope, single-use cystoscope, single-use bronchoscope, and others at the Japan International Medical Exhibition. Hence, the country’s market is anticipated to witness considerable growth during the forecast period with the launch of such exclusive products internationally.

Key Single Use Cystoscope Market Players:

- Ambu A/S

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Boston Scientific Corporation

- Coloplast Group

- OTU Medical Inc.

- NeoScope Inc.

- YouCare Tech

- LiNA Medical ApS

- iCLear Limited

- UroViu Corporation

- Richard Wolf GmbH

- Photocure ASA

- EziSurg Medical Co., Ltd

- ImmunityBio, Inc.

- Teleflex Incorporated

- Endoso Life Technology Co., Ltd.

- Asieris Pharmaceuticals (USA)Inc

- UroMems

- KARL STORZ

One of the key strategies adopted by the companies involved in the single use cystoscope market is enhancing their product portfolio. This is mostly done through the launch of new products or upgrading the existing ones with enhanced efficacy. In June 2024, EziSurg Medical Co., Ltd. received approval for a single-use digital cystoscope and medical endoscope image processor (ESP20) for sale in China. Intended to embellish the endoscopy platform, the device helps in video-monitored imaging for scrutinizing, detecting, and treating the urethra, bladder, and percutaneous renal pelvis. Therefore, these launches and other strategic activities will influence significant single use cystoscope market growth, maintaining healthy competition between the players.

Some of the prominent players are listed below:

Recent Developments

- In August 2024, Richard Wolf GmbH and Photocure ASA announced that with a deliberate partnership, they are developing a flexible blue light-enabled cystoscope for photodynamic diagnostics (PDD). It is particularly designed for screening, detection, and surveillance cystoscopies on outpatients with bladder cancer.

- In October 2023, Ambu A/S declared the exclusive launch and CR mark approval of Ambu aScope 5 Cysto HD, which is an HD cystoscope solution within Europe, allowing the procedures to be performed in hospitals and outpatient clinics.

- Report ID: 7552

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Single Use Cystoscope Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.