Adult and Pediatric Hemoconcentrators Market Outlook:

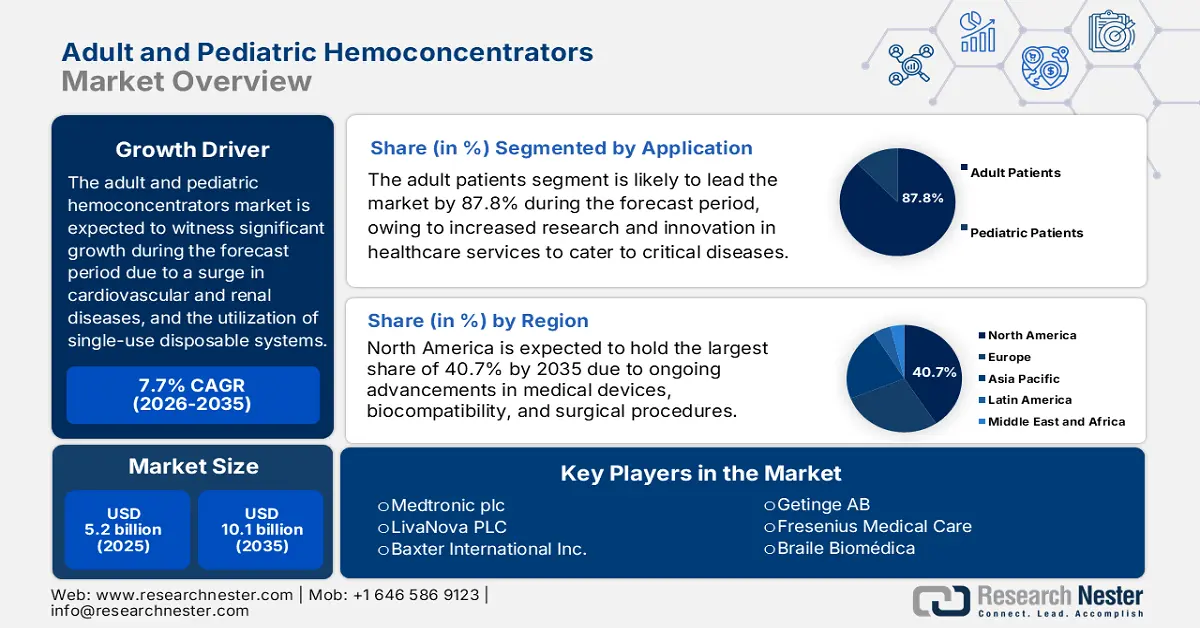

Adult And Pediatric Hemoconcentrators Market size was USD 5.2 billion in 2025 and is expected to reach USD 10.1 billion by the end of 2035, increasing at a CAGR of 7.7% during the forecast period, i.e., 2026-2035. In 2026, the industry size of adult and pediatric hemoconcentrators is assessed at USD 5.6 billion.

The market is poised for effective growth, which is driven by a confluence of economic, technological, demographic, and clinical factors. These include a rise in the international burden of renal and cardiovascular disorders, an expansion in complicated surgical-based procedures, an increase in the utilization of extracorporeal membrane oxygenation (ECMO), and a sudden shift towards single-use and disposable systems. According to an article published by NLM in March 2022, chronic kidney disorder readily affects more than 10% of the global population, which amounts to over 800 million individuals. In addition, owing to diabetes mellitus and obesity, the disease has also increased and further affected 843.6 million, thus positively impacting the overall market.

Moreover, as per an article published by NLM in June 2023, ECMO has been successfully utilized on 151,683 patients in the past five years. This also includes 45,205 neonates, 30,743 children, and 75,735 adults. Besides, the inclusion criteria for this comprise over 70 years aged patients, along with cardiopulmonary arrest to first CPR within 5 minutes. Meanwhile, pediatric-based and miniaturization designs, as well as connectivity and integrity, the presence of strict administrative emphasis on patient safety, value-specific healthcare procurement, and increased development of health and medical infrastructure in emerging economies are also uplifting the market across different nations.

Key Adult and Pediatric Hemoconcentrators Market Insights Summary:

Regional Insights:

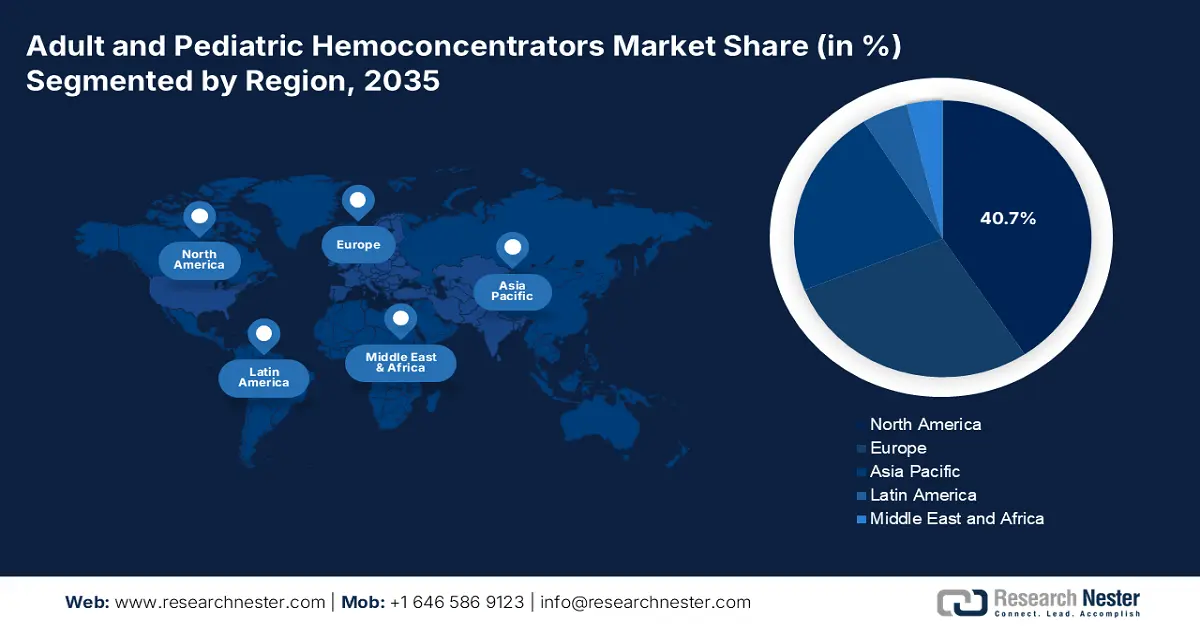

- By 2035, North America is predicted to hold a 40.7% share of the Adult and Pediatric Hemoconcentrators Market, owing to a surge in cardiovascular diseases, continuous device innovations, and a strong reimbursement environment.

- Asia Pacific is expected to record the fastest growth during 2026–2035, impelled by rising healthcare modernization, higher expenditure, and accelerated adoption of smart filtration technologies.

Segment Insights:

- The adult patients segment in the Adult and Pediatric Hemoconcentrators Market is projected to account for 87.8% share by 2035, propelled by growing research involvement and improved health outcomes enhancing care decisions.

- The hospitals segment is anticipated to secure the second-largest share by 2035, supported by its critical role in conducting complex cardiac surgeries and managing patients requiring continuous renal and cardiorespiratory therapies.

Key Growth Trends:

- Growth in surgical volumes

- Enhancement in biocompatibility

Major Challenges:

- Reference pricing and government price caps

- Restrictive formularies and limited reimbursement

Key Players: Medtronic plc (Ireland), LivaNova PLC (UK), Baxter International Inc. (U.S.), Getinge AB (Sweden), Fresenius Medical Care AG & Co. KGaA (Germany), Braile Biomédica (Brazil), Eurosets S.r.l. (Italy), Microport Scientific Corporation (China), Chalice Medical Ltd. (UK), Gish Biomedical, Inc. (U.S.), Andocor Ltd. (Finland), LMED (Korea), Boston Scientific Corporation (U.S.), Armstrong Medical (UK), Medos Medizintechnik AG (Switzerland).

Global Adult and Pediatric Hemoconcentrators Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.2 billion

- 2026 Market Size: USD 5.6 billion

- Projected Market Size: USD 10.1 billion by 2035

- Growth Forecasts: 7.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Indonesia, Mexico

Last updated on : 15 September, 2025

Adult and Pediatric Hemoconcentrators Market - Growth Drivers and Challenges

Growth Drivers

- Growth in surgical volumes: The aspect of surgery caters to its ability to relieve pain, improve quality of life, save lives, and restore function by aiding deformities, injuries, and diseases through instrumental techniques, thereby positively impacting the market internationally. According to the September 2024 Health Organization data report, 31 trusts in England with recently established health facilities readily undertook 21.9% more increased surgical volume, including cataract removals and hip replacements. In addition, this effectively constituted to almost 29,000 more procedures, thus suitable for the market’s growth.

- Enhancement in biocompatibility: Biocompatibility is extremely essential since it has the capability to ensure that medical implants and devices do not harm or produce undesirable responses, including immune reaction, toxicity, and inflammation. As stated in the October 2023 MDPI article, in the case of cardiovascular implants, biocompatibility includes stent insertion by conducting an angioplasty to operate widespread blocks, which are more than 70%. Besides, subchronic toxicity tests are utilized to recognize the negative impacts, ultimately resulting in test material exposure by covering almost 10% of the complete life cycle, which is also boosting the market.

- Efficacy in economic and operational aspects: These aspects are effectively crucial for improving resource allocation, optimizing efficiency, diminishing expenses, and enhancing accessibility to care, which eventually benefits providers, patients, and the overall economy. For instance, as stated in the June 2025 PIB report, the national TB Elimination Programme in India constituted an improvement in the operational treatment rate from 85% to 89%. In addition, there has been an increase in microscopy centres by 88%, along with 8,540 molecular laboratories, thereby denoting a huge growth opportunity for the adult and pediatric hemoconcentrators market.

Historical Healthcare Spending as a Share of GDP Driving the Adult and Pediatric Hemoconcentrators Market

|

Years |

GDP % |

|

2015 |

8.7 |

|

2016 |

8.8 |

|

2017, 2018 |

8.7 |

|

2019 |

8.8 |

|

2020 |

9.6 |

|

2021 |

9.7 |

|

2022, 2023 |

9.1 |

|

2024 |

9.3 |

Source: OECD

Global Cardiovascular Disease Prevalence (1990-2022) Uplifting the Adult and Pediatric Hemoconcentrators Market

|

Cardiovascular Disease Type |

Prevalent Cases |

Deaths |

Prevalence Rate |

Deaths Rate |

Disability-Adjusted Life Years |

|

Rheumatic heart disease |

46,358,651 |

386,947 |

575.5 |

4.5 |

162.5 |

|

Ischemic heart disease |

315,390,626 |

9,239,181 |

3,610.2 |

108.8 |

2,275.9 |

|

Ischemic stroke |

86,661,746 |

3,542,299 |

994.5 |

42.3 |

819.5 |

|

Intracerebral hemorrhage |

20,509,587 |

3,428,876 |

237.9 |

39.4 |

923.8 |

|

Subarachnoid hemorrhage |

9,281,913 |

344,872 |

107.2 |

4.0 |

120.7 |

|

Hypertensive heart disease |

13,052,641 |

1,353,074 |

150.9 |

1.8 |

292.7 |

Source: JACC Organization, December 2023

Challenges

- Reference pricing and government price caps: Different governments adopt stringent price controls, which negatively impact the adult and pediatric hemoconcentrators market globally. Besides, external pricing benchmarks the latest device’s cost against expenses in neighboring nations, thus developing a race to the bottom. Internal reference pricing tends to set reimbursement on current therapeutic alternatives, which ignores any kind of potential premium for advancements. These policies, in turn, cap the potential revenue per unit, which has drastically squeezed profit margins.

- Restrictive formularies and limited reimbursement: The aspect of achieving reimbursement decision is a separately major obstacle for the adult and pediatric hemoconcentrators market internationally. For instance, in bundled payment systems, the hospital absorbs the device’s expenses within a fixed procedure payment. Therefore, the hospital’s procurement department emerges as the key decision-maker, which is solely focused on cost containment. Besides, manufacturers need to convince these stakeholders of the device’s value in optimizing operational efficacy or diminishing complications to effectively justify its expense in the fixed bundle.

Adult and Pediatric Hemoconcentrators Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.7% |

|

Base Year Market Size (2025) |

USD 5.2 billion |

|

Forecast Year Market Size (2035) |

USD 10.1 billion |

|

Regional Scope |

|

Adult and Pediatric Hemoconcentrators Market Segmentation:

Application Segment Analysis

Based on the application, the adult patients segment in the adult and pediatric hemoconcentrators market is projected to account for the highest share of 87.8% by the end of 2035. The segment’s growth is highly attributed to its engagement in research and improved health outcomes, and is crucial for informed care decisions. As per an article published by the World Health Organization (WHO) in September 2023, 1 in 10 adult patients are severely impacted by pressure ulcers. Despite being highly preventable, they have an effective impact on the physical and mental health of these individuals, along with their quality of life, which is positively impacting the overall segment.

End user Segment Analysis- Hospitals

Based on the end user, the hospitals segment in the adult and pediatric hemoconcentrators market is anticipated to garner the second-highest share by the end of the projected timeline. The segment’s upliftment is highly driven by its role as the primary facility for conducting complicated cardiac surgeries and housing the required facilities, such as dedicated perfusionists and ICU teams, along with managing patients with renal and acute cardiorespiratory complications, that demand continuous renal replacement therapy or EMCO. Besides, procurement decisions are heavily impacted by value-specific assessments, which are conducted by hospital professionals, that weigh the increased upfront expenses of disposable systems.

Product Type Segment Analysis

Based on the product type, the disposable systems segment in the adult and pediatric hemoconcentrators market is expected to constitute the third-highest share during the forecast period. The segment’s development is subject to its suitability for infection reduction by providing single-use and sterile products that tend to combat patient-to-patient, as well as worker-to-patient contamination. According to the January 2023 NLM article, it has been estimated that 15% of the overall amount of produced healthcare waste (HCW) is infectious and hazardous. Therefore, there is a huge demand for the segment, which in turn, is positively impacting the overall market globally.

Our in-depth analysis of the adult and pediatric hemoconcentrators market includes the following segments:

|

Segment |

Subsegments |

|

Application |

|

|

End user |

|

|

Product Type |

|

|

Modality |

|

|

Technology |

|

|

Material |

|

|

Filtration Method |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Adult and Pediatric Hemoconcentrators Market - Regional Analysis

North America Market Insights

North America in the adult and pediatric hemoconcentrators market is anticipated to garner the largest share of 40.7% by the end of 2035. The market’s exposure in the region is highly fueled by a surge in chronic and cardiovascular diseases, continuous innovation for medical devices, improvements in biocompatibility, a surge in operational procedures, and the presence of a stringent reimbursement environment. According to the October 2024 CDC report, heart disease is one of the leading causes of death in the region, and 919,032 people die, which is significantly uplifting the market in the overall region.

The adult and pediatric hemoconcentrators market in the U.S. is growing significantly, owing to an increase in surgical procedures, a surge in chronic disease, the presence of administrative bodies, private insurance reimbursement, the adoption of IoT and AI-based devices, and increased investments in pediatric programs. As per the April 2025 NLM article, the international software as a medical device (SaMD) has been valued at USD 1.1 billion as of 2023, which is projected to grow more than 16% and reach USD 5.4 billion by the end of 2032. Therefore, this increase is anticipated to uplift the market in the country.

The adult and pediatric hemoconcentrators market in Canada is also growing due to the existence of provincial and national funding, enhanced focus on advancements in public hospitals, a rise in public health investment for cardiac procedures, and national emphasis on locally manufactured and approved medical technologies. As per a data report published by the ITA in November 2023, the medical device market in the country has been valued at USD 6.8 billion as of 2022, which is projected to increase at 5.4% by the end of 2028. In addition, the healthcare spending in the country is totaled to an estimated CAD 331 billion, which denotes a huge opportunity for the overall market.

2024 Death Rate By Heart Disease in North America

|

Race or Ethnic Group |

% of Deaths |

|

America-India or Alaska Native |

15.5 |

|

Black (Non-Hispanic) |

22.6 |

|

Native Hawai or Other Pacific Islander |

18.3 |

|

White (Non-Hispanic) |

18.0 |

|

Hispanic |

11.9 |

|

All |

17.4 |

Source: CDC

APAC Market Insights

Asia Pacific in the adult and pediatric hemoconcentrators market is expected to emerge as the fastest-growing region during the forecast period. The market’s growth in the region is highly subject to a surge in healthcare modernization and expenditure, optimized accessibility through upgraded infrastructure and public programs, and aggressiveness in innovative filtration technologies and smart devices adoption. As stated in the February 2025 NLM article, an estimated 38% of diabetes cases occur in the region, while 152 million are projected to suffer in the Southeast Asia region by the end of 2045, which denotes an optimistic outlook for the overall market in the region.

The adult and pediatric hemoconcentrators market in India is effectively developing, owing to rapid expansion in cardiac surgical facilities and hospital infrastructure, escalation in public insurance and government expenditure, an upsurge in patient volumes, an increase in regional manufacturing capability and cost-effective devices, along with regional awareness campaigns for pediatric cardiac diseases. As per the October 2024 NLM article, the country’s National Health Policy, since its inception, has constituted an increase in the public spending from 0.9% to 1.6% of its GDP. Besides, the country currently ranks in 179th position among 189 other nations, with focus on government budget for healthcare, which is positively impacting the overall market.

The adult and pediatric hemoconcentrators market in China is also growing due to the availability of investments for dialysis-based facilities across both rural and urban areas, subsidized pricing, and centralized government procurement for public hospitals, an increase in the aging population, robust support for localized manufacturing and innovation for medical instruments, and expansion of tertiary hospital networks. As per the 2025 WHO report, the health insurance system in the country effectively covers more than 95% of the population. Besides, the country’s government has tripled the healthcare spending from RMB 482 billion to RMB 1,640 billion over the past seven years, thus suitable for the market’s growth.

Medical Instruments 2023 Export and Import in Asia

|

Countries |

Export |

Import |

|

Hong Kong |

USD 731 million |

USD 96.5 million |

|

Japan |

USD 644 million |

USD 1.1 billion |

|

India |

USD 500 million |

USD 49 million |

|

South Korea |

USD 213 million |

USD 259 million |

|

Malaysia |

USD 103 million |

USD 135 million |

|

Vietnam |

USD 102 million |

- |

|

Indonesia |

USD 183 million |

- |

Source: OEC

Europe Market Insights

Europe in the adult and pediatric hemoconcentrators market is anticipated to account for a considerable share by the end of the forecast timeline. The market’s development in the region is highly subject to an increase in the prevalence of renal disorders, progressive public healthcare facilities, increased MIS implementation, administrative support with strict medical device regulations, and generous investment in advanced medical devices to optimize efficacy and patient monitoring. According to the October 2022 NLM article, patients in Germany are required to pay 10% of the overall medication expense, while this ranges between 0%, 10%, and 25% in Greece, thereby suitable for bolstering the overall market.

The adult and pediatric hemoconcentrators market in the UK is gaining increased traction, owing to the existence of the NHS, with generous investment to enhance heart care accessibility, boosted healthcare budget allocation for hemoconcentrators, effective partnerships between medical and pharmaceutical device associations, and a huge growth demand associated with surgical advancements. According to the May 2024 Office for National Statistics data report, the healthcare expenditure in the country was nearly £292 billion in 2023. Besides, the health spending in terms of GDP reduced to 10.9% from 11.1%, thereby uplifting the overall market.

The adult and pediatric hemoconcentrators market in Germany is growing due to an increase in healthcare spending, the presence of robust federal funding, promoting ongoing advancement in extracorporeal technologies, a rise in cardiac surgeries, and the existence of public health initiatives fueling pediatric and biocompatible-based hemoconcentrators. As stated in the August 2025 ITA report, the medical device market in the country accounts for USD 44 billion in yearly revenue. Besides, healthcare employment caters to a yearly economic footprint of USD 838 billion, which is approximately 12.8% of the country’s GDP, which is positively impacting the overall market.

Key Adult and Pediatric Hemoconcentrators Market Players:

- Medtronic plc (Ireland)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- LivaNova PLC (UK)

- Baxter International Inc. (U.S.)

- Getinge AB (Sweden)

- Fresenius Medical Care AG & Co. KGaA (Germany)

- Braile Biomédica (Brazil)

- Eurosets S.r.l. (Italy)

- Microport Scientific Corporation (China)

- Chalice Medical Ltd. (UK)

- Gish Biomedical, Inc. (U.S.)

- Andocor Ltd. (Finland)

- LMED (Korea)

- Boston Scientific Corporation (U.S.)

- Armstrong Medical (UK)

- Medos Medizintechnik AG (Switzerland)

The international adult and pediatric hemoconcentrators market is extremely dominated and consolidated by established and large med-tech giants with expanded portfolios in critical and cardiac surgery care. Besides, these key players tend to compete on technological advancement, especially in pediatric and disposable devices, which include clinical evidence and in-depth relationships with perfusionists and hospital procurement networks. Meanwhile, tactical approaches are focused on enhanced biocompatibility, strategic acquisitions, and R&D for miniaturization to extend portfolio and geographic reach, along with navigating value-specific procurement by displaying superior total expense of patient outcomes and ownership in comparison to reusable systems, thus suitable for bolstering the adult and pediatric hemoconcentrators market.

Here is a list of key players operating in the global market:

Recent Developments

- In August 2024, Novartis declared that it has received the U.S. FDA approval for Fabhalta, which is a first-in-class complement inhibitor for reducing proteinuria among adults with primary immunoglobulin A nephropathy (IgAN).

- In September 2024, Samsung Electronics unveiled the latest Samsung Health Software Development Kit (SDK) Suite, which has been designed to provide effective support to researchers and developers to develop advanced healthcare solutions.

- Report ID: 8104

- Published Date: Sep 15, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Adult and Pediatric Hemoconcentrators Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.