Pediatric Orthopedic Implant Market Outlook:

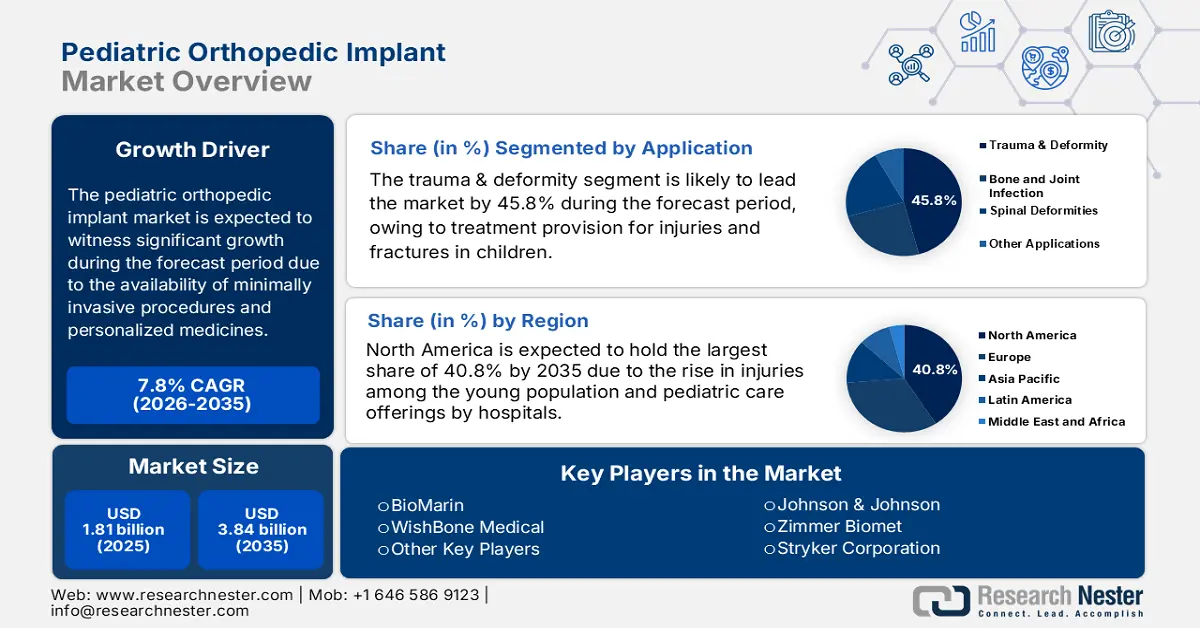

Pediatric Orthopedic Implant Market size was over USD 1.81 billion in 2025 and is poised to exceed USD 3.84 billion by 2035, witnessing over 7.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of pediatric orthopedic implant is estimated at USD 1.94 billion.

The implementation of biodegradable materials in the clinical field of orthopedics has gained nationwide application. This includes increased emphasis on children and their unusual skeletal development patterns, such as varied material tolerances and dynamic growth plates require unique fixture strategies, thus driving the growth of the market globally. According to an article published by Bioactive Materials in April 2025, the mechanical strength integrity of 50% can be inspected with polyglycolic acid after 14 to 28 days of degradation. Besides, in the case of magnesium alloys, the suggested intake is between 375 mg to 500 mg, constituting a blood serum concentration of 0.73 to 1.06 mM, thus ensuring market upliftment.

The development of the pediatric orthopedic implant market is attributed to the existence of different treatment types, ranging from non-surgical solutions, such as physical therapy, to surgical procedures, including joint reconstruction, fracture repairment, and scoliosis correction. In this regard, an article was published by NLM in March 2025, wherein a compliant pricing strategy has been provided for pediatric orthopedic surgeries. A review was conducted on 50 pediatric orthopedic hospitals in the United States, and the gross charge for current procedural terminology ranged between USD 3,012 to USD 109,320 for arthroscopic Bankart repair. Additionally, the negotiated cost was USD 14,478 in 24% of hospitals out of the total number in the country, thereby ensuring market evolution.

Key Pediatric Orthopedic Implant Market Insights Summary:

Regional Highlights:

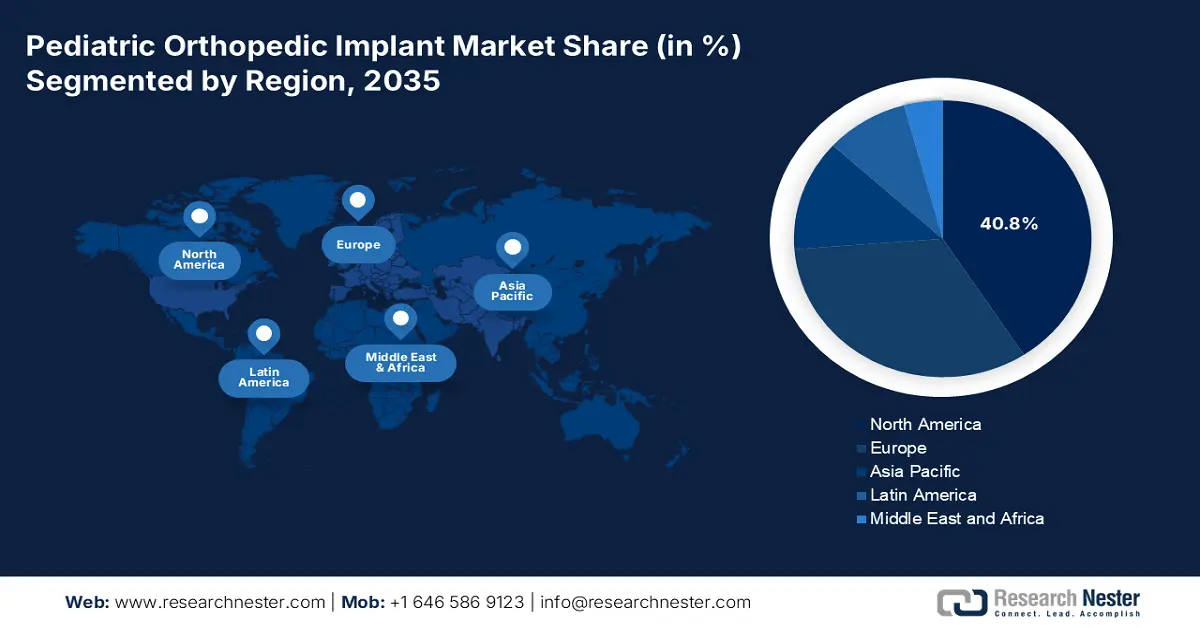

- North America leads the pediatric orthopedic implant market with a 40.8% share, propelled by the rise in injuries and congenital defects among children, increasing surgeries and pediatric care facilities, supporting strong growth prospects through 2035.

- The Pediatric Orthopedic Implant Market in Asia Pacific is anticipated to achieve the fastest growth by 2035, fueled by rise in sports injuries, increased medical expenditure, technological innovation, government initiatives, and collaborations.

Segment Insights:

- The Trauma & Deformity segment is expected to secure a 45.8% share by 2035, supported by its critical role in providing alignment and stability for children.

- The hip implants segment is projected to hold a 43% share by 2035, driven by the treatment of trauma injuries and congenital hip disorders in pediatric patients.

Key Growth Trends:

- Rise in pediatric orthopedic disorders

- Innovative implant technology

Major Challenges:

- Huge cost of orthopedic implantation

- Presence of strict regulations

- Key Players: Smith & Nephew, NuVasive, Pega Medical, BioMarin.

Global Pediatric Orthopedic Implant Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.81 billion

- 2026 Market Size: USD 1.94 billion

- Projected Market Size: USD 3.84 billion by 2035

- Growth Forecasts: 7.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 12 August, 2025

Pediatric Orthopedic Implant Market Growth Drivers and Challenges:

Growth Drivers

- Rise in pediatric orthopedic disorders: The aspect of lifestyle choice, sports, and obesity-based injuries is fueling the increasing demand for the pediatric orthopedic implant market across nations. According to the October 2020 Current Problems in Pediatric and Adolescent Health Care article, 20% of pediatric visits take place due to a surge in musculoskeletal conditions. Besides, metatarsus adductus is a common foot anomaly with a 16% incidence rate, which can be overcome by parental observation and medical assistance, thus enhancing the market globally.

- Innovative implant technology: The adoption of advanced technologies, including the utilization of cutting-edge materials, is a crucial driver for boosting the pediatric orthopedic implant market across nations. Several organizations are initiating strategies to focus on innovation for pediatric implantation. For instance, in September 2024, OrthoPediatrics Corp. announced the introduction of its Enabling Technologies division. This will influence the organization's central mission of addressing unmet pediatric requirements in orthopedics, thus a prolific opportunity for market upliftment.

Challenges

- Huge cost of orthopedic implantation: The enhancement of the pediatric orthopedic implant market is hindered by the expensive surgery expenditure. The inclusion of sophisticated devices and machines caters to the majority of the expense. This eventually makes the overall surgery procedure expensive, especially for the middle-class population worldwide. Besides, certain hospitals are unable to make investments to make the required devices available in their facilities, ultimately leading to inappropriate diagnosis and treatment.

- Presence of strict regulations: The aspect of regulatory approval from governments and administrative organizations is essential before commercialization in the existing market. The entire process is time-consuming as well as complicated, leading to slow progress of the market. This eventually forces manufacturers to undergo stringent regulatory policies that include clinical assessment and trials, resulting in the delayed launch of the latest implant technology in the market arena.

Pediatric Orthopedic Implant Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.8% |

|

Base Year Market Size (2025) |

USD 1.81 billion |

|

Forecast Year Market Size (2035) |

USD 3.84 billion |

|

Regional Scope |

|

Pediatric Orthopedic Implant Market Segmentation:

Application (Trauma & Deformity, Bone and Joint Infection, Spinal Deformities)

Based on the application, the trauma & deformity segment is poised to account for the highest share of 45.8% in the pediatric orthopedic implant market by the end of 2035. The growth is attributed to the segment’s pivotal role in providing alignment, support, and stability to ensure suitable development and growth for long-term benefit. As stated in the November 2024 NLM article, the utilization of metal implants during the implantation procedure results in cost reduction by 6%, and it is highly encouraged in case of mechanical failure and infection. These are extremely useful for children, while catering to trauma and deformity correction, thus driving the segment.

Type (Hip Implants, Dental Implants, Spine Implants, Knee Implants)

Based on type, the hip implants segment is expected to hold a share of 42.6% in the pediatric orthopedic implant market during the forecast timeline. The growth is fueled by catering to the treatment of trauma injuries, hip joint disorders, and congenital hip dysplasia to ensure uninterrupted and holistic growth among children. As stated in the February 2024 NLM article, the average survival rate ranges between 81% to 100% within a 9.4-year follow-up period. The implant procedure includes prosthesis-based modifications, depending on technological advancements and the patients’ condition. The overall outcome is extremely positive that portrays pain improvement.

Our in-depth analysis of the global pediatric orthopedic implant market includes the following segments:

|

Application |

|

|

Type |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Pediatric Orthopedic Implant Market Regional Analysis:

North America Market Analysis

The North America region is projected to garner the highest share of 40.8% in the pediatric orthopedic implant market by the end of 2035. Factors including the rise in the cause of injuries and congenital defects among the child population, resulting in increased surgeries, and the presence of numerous clinics and hospitals to provide pediatric care are crucial for the market’s growth in the region. In addition, the population in the region is also aware of the occurrence of pediatric orthopedic conditions, which is deliberately fueling the market expansion.

The pediatric orthopedic implant market growth in the U.S. highly depends on the presence and operations of administrative and regulatory bodies. For instance, in September 2023, OrthoPediatrics Corp. received the 510(k) clearance from the U.S. FDA for its Pediatric Nailing platform, Tibia surgical system. The platform provides a solution for treating patients with fractures and deformities in the lower extremities. Besides, it effectively implements 51 exclusive surgical systems designed precisely to help treat the needs of pediatric patients, thereby a boost for the market in the country.

The pediatric orthopedic implant market in Canada is anticipated to develop since healthcare facilities and research institutes are collaborating for the health maintenance of children. For instance, in December 2024, Shriners Hospitals for Children Canada joined forces with CHEO Research Institute to inaugurate the first-of-its-kind combined pediatric metabolic and genetic bone disorders fellowship. This assisted physicians in gaining expertise in both genetics and endocrinology, and aid children with chronic bone disorders, thus a suitable growth opportunity for the market in the country.

APAC Market Statistics

The Asia Pacific pediatric orthopedic implant market is projected to be the fastest-growing region during the forecast period. Factors such as a rise in sports-based injuries, a surge in medical expenditure, and innovation in technology are highly responsible for uplifting the market in the region. Besides, the government initiatives in India and organizational offerings by Japan are also fueling the expansion in the region. Besides, collaborations among research institutions, medical professionals, and health manufacturers are also bolstering the market growth.

The pediatric orthopedic implant market in India is gaining more exposure since regional hospitals are making exceptional offerings in this industry. For instance, in November 2024, Sarvodaya Hospital, located in Faridabad, magnificently accomplished the country’s youngest Cochlear implant surgery on a 5-month-old infant. The infant was suffering from congenital hearing impairment, making him the youngest in the country to undergo a cochlear implant surgery. Therefore, with such surgery conducted, the market is gaining popularity in the country.

The pediatric orthopedic implant market in China is expanding significantly, owing to contributions initiated by regional organizations. For instance, as stated in the April 2025 Bioactive Materials article, Dongguan YiAn Technology Company lately developed the Biodegradable Mg Bone Fixation Screw, which has been accepted by the Special Application Review of Innovative Medical Devices for investigation and agreement and is currently under clinical use. These screws demonstrate long-term durability and efficacy, thus enhancing the market demand in the country.

Key Pediatric Orthopedic Implant Market Players:

- Johnson & Johnson

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Zimmer Biomet

- Stryker Corporation

- OrthoPediatrics Corp.

- Smith & Nephew

- NuVasive

- Pega Medical

- BioMarin

- WishBone Medical

- Asensus Surgical, Inc.

- Dongguan YiAn Technology Company

- Explorer Surgical

- Momentum Health

- OSSIO, Inc.

- ZimVie Inc.

- MicroPort NaviBot

Key organizations in the pediatric orthopedic implant market are employing standard strategies such as strengthening their reach, developing cutting-edge products, and expanding their product portfolio. For instance, in March 2022, Explorer Surgical, part of the GHX company, extended its presence in the pediatric orthopedic medical device space with the announcement of its newest customer, Pega Medical. This specializes in the design, development, evaluation, and manufacturing of medical devices for pediatric orthopedics, as well as making implantable devices available to children residing in over 70 countries with orthopedic conditions, thus creating a suitable growth opportunity for the market globally.

Here's the list of some key players:

Recent Developments

- In April 2024, Momentum Health received the FDA 510(k) clearance for its Momentum Spine mobile application to offer a non-invasive, radiation-free solution to quantify postural asymmetries, including scoliosis, directly targeting a long-standing challenge in managing spinal deformities.

- In December 2023, OSSIO, Inc. received the U.S. FDA approval of OSSIOfiber bio-integrative fixation technology for use in orthopedic surgery for children and adolescents needing bone fractures fixed, osteotomies, or fusions.

- Report ID: 7611

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Pediatric Orthopedic Implant Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.