Phosphate Ester Market Outlook:

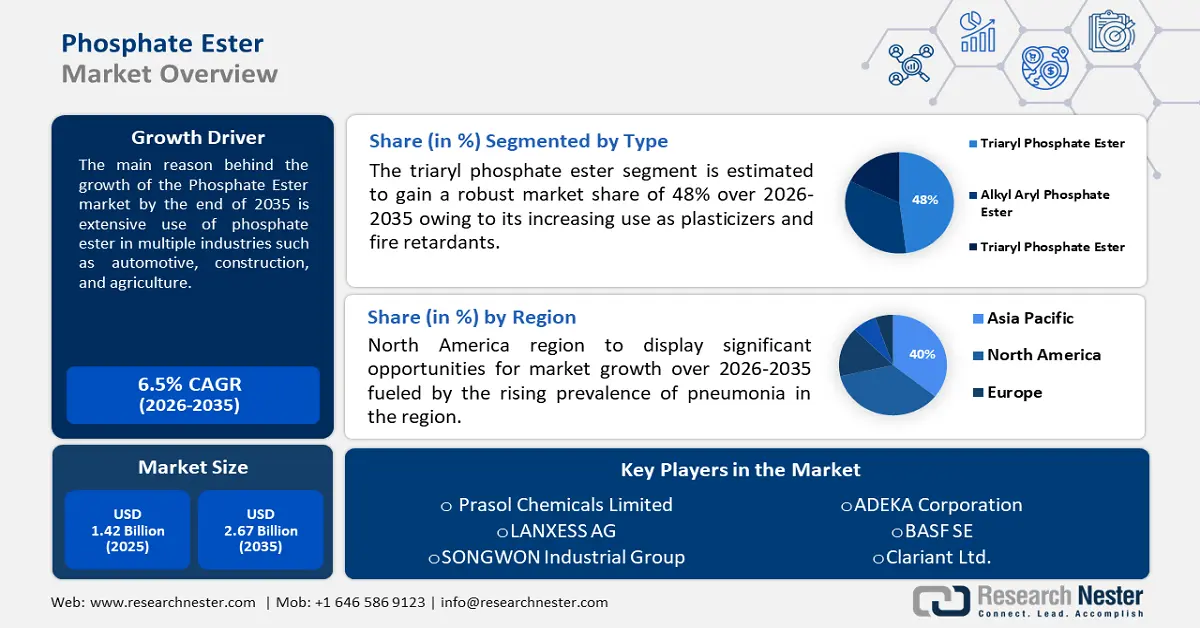

Phosphate Ester Market size was over USD 1.42 Billion in 2025 and is anticipated to cross USD 2.67 Billion by 2035, witnessing more than 6.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of phosphate ester is assessed at USD 1.5 Billion.

The extensive use of phosphate ester in multiple industries such as automotive, construction, and agriculture is expected to provide the stimulus necessary for the growth of the global phosphate ester market. Further, the increasing incidences of fire outbreaks are bound to raise the demand for fire extinguishers across the world. This, in turn, is also estimated to boost the market growth. According to the United States Fire Administration, there were almost 1.3 million incidents of fires in the US in 2019, and more than 24% rise in deaths as a result of fire, compared to the year 2010.

Phosphate esters are also called Organophosphates (OPEs). They form the backbone of nucleic acids - DNA and RNA, that are vital for the storage and transmission of genetic material. They are highly used in the production of cleaners and detergents used in homes, institutions and industries owing to their wetting, anti-static and emulsifying properties. As per research, there was a rise in the amount spent by Europeans on household cleaning products such as surface care, dishwashing and bleaches, from USD 30 billion in 2019 to almost USD 33 billion in 2020, on the back of the pandemic. Besides this, the boosting demand of phosphate esters as agrochemical additives is also fueling the growth of the market over the projected timeframe.

Key Phosphate Ester Market Insights Summary:

Regional Highlights:

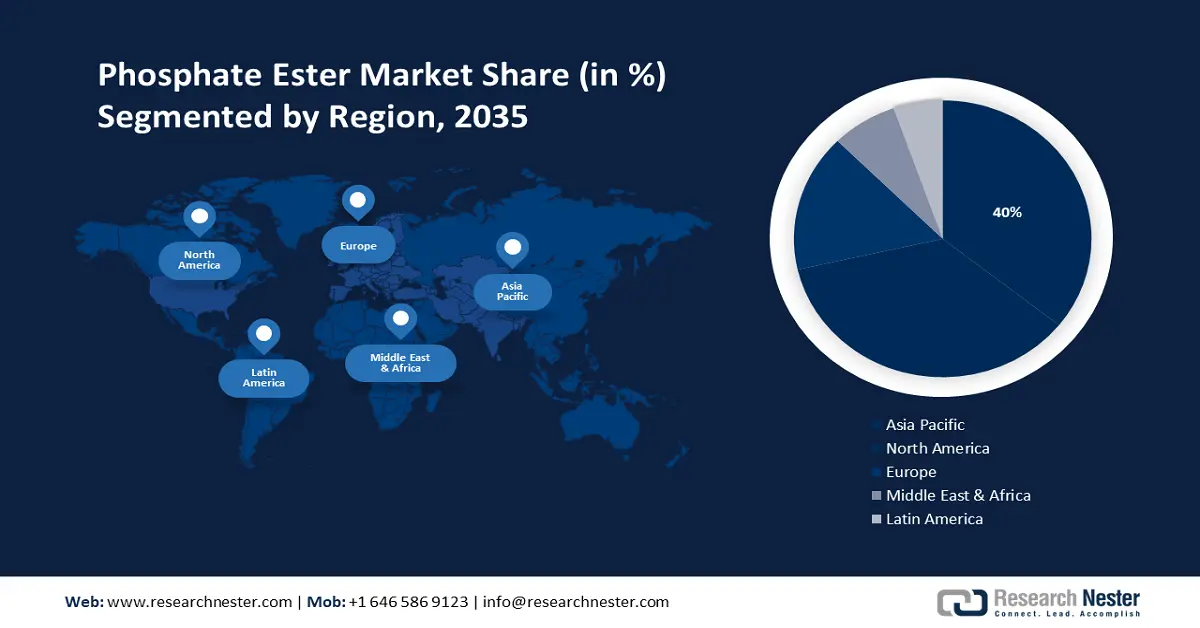

- North America’s phosphate ester market will secure around 40% share by 2035, fueled by demand for power supply and use of phosphate esters in turbofluids for power generation.

Segment Insights:

- The triaryl phosphate ester segment in the phosphate ester market is projected to exhibit the highest CAGR from 2026-2035, fueled by increasing use as plasticizers and fire retardants.

Key Growth Trends:

- Widespread Use in Automotive Industry

- Increasing Use in Pesticides

Major Challenges:

- Hefty Cost of Phosphate Ester

- Health Hazard if Exposed for Longer Period

Key Players: LANXESS AG, SONGWON Industrial Group, ADEKA Corporation, BASF SE, Clariant Ltd., Stepan Company, Ashland Inc., Solvay S.A., Elementis plc.

Global Phosphate Ester Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.42 Billion

- 2026 Market Size: USD 1.5 Billion

- Projected Market Size: USD 2.67 Billion by 2035

- Growth Forecasts: 6.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 9 September, 2025

Phosphate Ester Market Growth Drivers and Challenges:

Growth Drivers

-

Widespread Use in Automotive Industry – Used mainly as lubricant additives in vehicles, the global phosphate ester market is expected to expand on the back of the growth in automotive industry. For instance, around 80 million motor vehicles were manufactured worldwide in 2021, a rise of 2% compared to the numbers in 2020.

-

Increasing Use in Pesticides – Phosphate Esters are extensively used in agriculture as a pesticide owing to their toxic nature as well as their biodegradability. Over 2.6 million tons of pesticides were used all over the world in 2020, according to the Food and Agriculture Organization of the United Nations.

-

Growing Use in Mosquito Control- According to the World Health Organization (WHO), globally around 241 million people were afflicted with malaria in 2020.

-

Expansion in Cosmetics Industry – For instance, the global cosmetics industry grew by nearly 12% in 2021 compared to the year before, as per industry research.

-

Growth in Construction Industry – Phosphate esters are used in the manufacture of a whole range of products used in construction industry such as PVC, TPU, thermosets and others. The construction industry in India grew by 6% in 2020 and contributed about USD 34 billion to the country’s GDP in 2019, according to a recent study.

Challenges

- Hefty Cost of Phosphate Ester - Phosphate esters are usually five times as expensive than their mineral counterparts. Phosphate esters are an organophosphorus chemical family that consists of a complex mixture of monoester, diester, phosphoric acid, and free nonionic material. The price hike is being caused by the increasing raw material costs. This factor is estimated to lower the growth of the market during the forecast period.

- Health Hazard if Exposed for Longer Period

- Need for Special Handling and Storage

Phosphate Ester Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 1.42 Billion |

|

Forecast Year Market Size (2035) |

USD 2.67 Billion |

|

Regional Scope |

|

Phosphate Ester Market Segmentation:

Type Segment Analysis

The global phosphate ester market is segmented and analyzed for demand and supply by type into alkyl aryl phosphate ester, trialkyl phosphate ester, and triaryl phosphate ester. Of these segments, the triaryl phosphate ester division is expected to observe the highest growth during the forecast period owing to its increasing use as plasticizers and fire retardants. Triaryl phosphate esters are used in aircraft flight control systems, power steering systems as well as in fire-resistant hydraulic fluids. From around USD 500 billion in 2021, the worldwide commercial airlines revenue grew to almost USD 790 billion in 2022. The aviation industry is estimated to grow by approximately 4% in the coming decades. This steady development in the aerospace industry is likely to propel the global phosphate ester market growth.

Our in-depth analysis of the global market includes the following segments:

|

By Source |

|

|

By Type |

|

|

By Application |

|

|

By End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Phosphate Ester Market Regional Analysis:

North America Market Insights

North America industry is predicted to dominate majority revenue share of 40% by 2035. The population expansion, rapid urbanization. Moreover, massive demand for power supply are predicted to impel the growth of the phosphate ester market in the region, as specially refined phosphate base stocks and additives are used in the manufacture of turbofluids that are employed in power generation applications.

Phosphate Ester Market Players:

-

Prasol Chemicals Limited

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- LANXESS AG

- SONGWON Industrial Group

- ADEKA Corporation

- BASF SE

- Clariant Ltd.

- Stepan Company

- Ashland Inc.

- Solvay S.A.

- Elementis plc

Recent Developments

-

Solvay S.A. launched biosurfactants called Mirasoft SL L60 and Mirasoft SL A60 to be used in a wide range of cosmetics such as shampoos, conditioners and face washes. They are biodegradable, effective and cost-efficient.

-

Ashland Inc. announced the launch of innovative coating additive called the Strodex PK-86NV, a phosphate ester surfactant, that is able to provide substrate wetting, increased gloss, and enhanced color to waterborne architectural coatings.

- Report ID: 4329

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Phosphate Ester Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.