Power Generation Market Outlook:

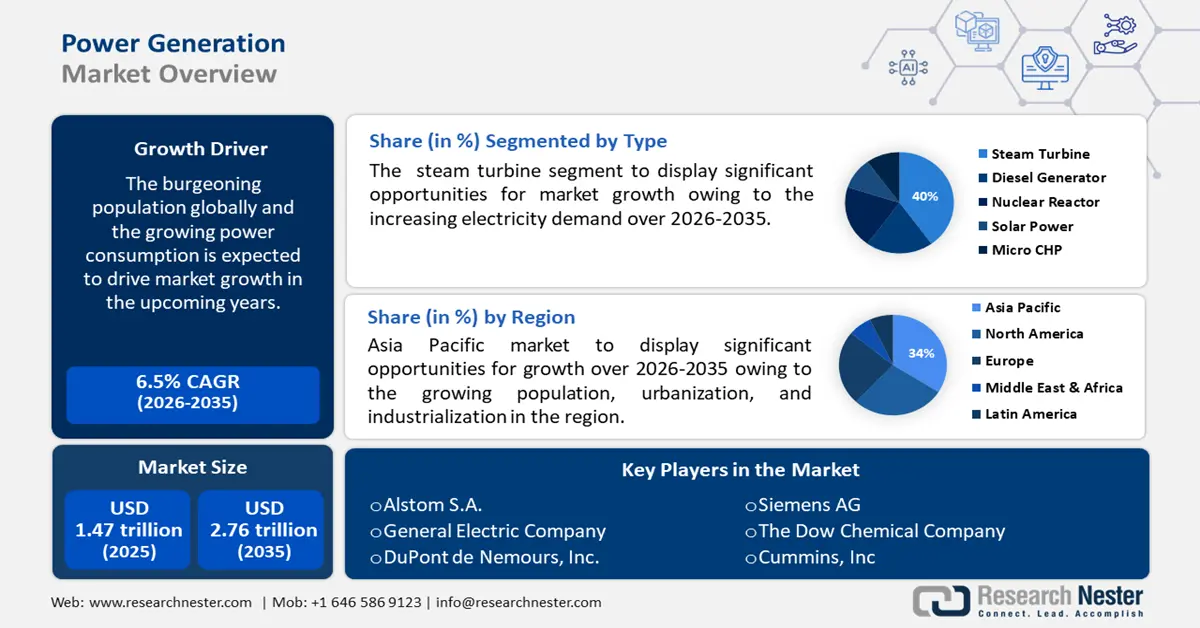

Power Generation Market size was over USD 1.47 trillion in 2025 and is poised to exceed USD 2.76 trillion by 2035, witnessing over 6.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of power generation is estimated at USD 1.56 trillion.

The burgeoning population globally and the growing power consumption is expected to drive market growth in the upcoming years.

The global energy sector's transition from fossil-based systems of energy to clean sources of energy and the increasing government initiatives all over the world for creating new energy infrastructure are facilitating rapid growth and advancement in power generation.

Moreover, as the ability to create energy from renewable resources such as wind, solar, and hydro has been made possible by technological advancements, the market is further anticipated to rise to further eliminate the utilization of conventional fossil fuels.

Key Power Generation Market Insights Summary:

Regional Highlights:

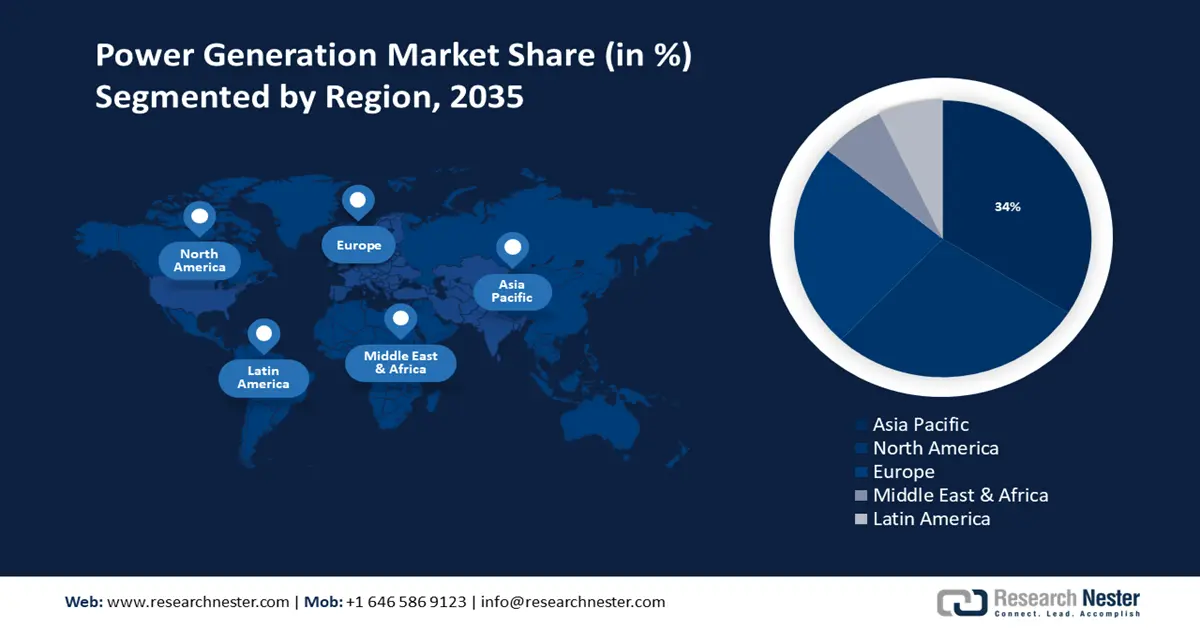

- Asia Pacific power generation market achieves a 34% share by 2035, driven by population growth and demand for renewable energy in emerging countries.

- North America market will account for 28% share by 2035, attributed to adoption of renewables and infrastructure investment in power grids.

Segment Insights:

- The steam turbine segment in the power generation market is expected to capture a 40% share by 2035, driven by rising electricity demand and high conversion efficiency of turbines.

- The nuclear reactor segment in the power generation market is poised for the highest CAGR through 2035, driven by efforts to reduce carbon emissions through nuclear power adoption.

Key Growth Trends:

- Growing Demand for Electricity

- Increasing Concern About Greenhouse Gas Emissions

Major Challenges:

- Regulatory Compliance

- Exorbitant Initial Cost

Key Players: Envision Group, Alstom S.A., General Electric Company, DuPont de Nemours, Inc., Siemens AG, The Dow Chemical Company, Cummins, Inc., Tokyo Electric Power Company Holdings (TEPCO), ExxonMobil, ABB Ltd.

Global Power Generation Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.47 trillion

- 2026 Market Size: USD 1.56 trillion

- Projected Market Size: USD 2.76 trillion by 2035

- Growth Forecasts: 6.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (34% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, India, Japan, Germany

- Emerging Countries: China, India, Brazil, Mexico, Russia

Last updated on : 9 September, 2025

Power Generation Market Growth Drivers and Challenges:

Growth Drivers

- Growing Demand for Electricity – The increasing industrial activities across the globe and the rise in demand for energy-intensive activities such as manufacturing, and mining together with the augmenting urban settlements are propelling the electricity demand. For instance, on the account of rise in world population, it is predicted that the energy demand would increase globally by more than 40% over the next 20 years. Hence, this rising demand for energy is expected to expand the investment in power generation to discover various types of technology for electricity production.

- Increasing Concern About Greenhouse Gas Emissions – For instance, in the U.S. alone, carbon dioxide (CO2) emissions from energy increased by over 290 million metric tons in 2021. The increasing air pollution across the globe and the rising need for cleaner and more sustainable energy sources are predicted to drive power generation market growth. Moreover, the rising awareness among people about the damaging effects of greenhouse gas emissions on the environment and the increasing adoption of steam boilers, wind turbines, biofuels, and other technologies to produce electricity is fueling market growth.

Challenges

- Regulatory Compliance - The development of new power generation technology must be in adherence to the emerging climate change regulations which is one of the major factors predicted to slow down the market growth. As the demand for clean energy is advancing to help mitigate climate change, funding new power plants with developed technology that have less environmental impact is a major challenge.

- Exorbitant Initial Cost

- Deteriorating Infrastructure for Electricity Production

Power Generation Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 1.47 trillion |

|

Forecast Year Market Size (2035) |

USD 2.76 trillion |

|

Regional Scope |

|

Power Generation Market Segmentation:

Type

The steam turbine segment in the power generation market is estimated to gain the largest revenue share of 40% by the year 2035 owing to the increasing electricity demand is fueling segment domination. For instance, the global energy demand is increasing by over 1% per year. To address the rising power demand, developing nations are increasing the utilization of steam turbines for steam power plants with the target of generating electricity. In addition, the conversion of thermal energy into mechanical energy by steam turbines is quite effective, since they can transform up to 90% of the heat energy into mechanical energy, which makes them a desirable alternative for generating electricity.

The nuclear reactor segment is projected to witness the highest growth through 2035, owing to the increasing emphasis being placed to reduce global carbon emissions with the rising erection of nuclear power plants worldwide.

Application

Power generation market from the industrial segment is predicted to pool in significant revenue during 2035. To satisfy the energy demand, the industrial sector makes use of a variety of power generation. For instance, by harnessing the power of steam, steam turbines are utilized to produce energy in industrial settings. Besides this, CHP systems are frequently utilized in industrial settings, such as manufacturing factories, where there is a large need for both power and heat. All such factors are predicted to bring numerous opportunities for the growth of the segment in the upcoming years.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Power Generation Market Regional Analysis:

APAC Market Insights

The power generation market in Asia Pacific is projected to largest share of about 34% by the end of 2035. The growing population, urbanization, and industrialization in the region are driving up the demand for power in emerging countries such as China and India. The need for power in India dramatically grew by over 8% in 2022. To increase the effectiveness and dependability of their power grids, technologies such as smart grid technology that allows for more effective and efficient distribution of power, by reducing wastage are in demand in the Asia Pacific region.

Further, the growing demand for renewable energy sources, such as solar, wind, hydro, and geothermal, is also anticipated to contribute to the market growth in the region.

North American Market Insights

The power generation market in North America is estimated to be the second largest, registering a share of about 28% by the end of 2035. The growth of the market can be attributed majorly to the increasing adoption of renewable energy sources including wind, solar, and hydropower specifically in the U.S. and Canada to meet the increasing energy demands in the region. Almost 20% of the total electricity in the United States is generated by renewable sources.

Moreover, the surging investment in new infrastructure, such as transmission lines and energy storage facilities to enable the grid integration of renewable energy sources in the region and the availability of a large number of power plants is also anticipated to contribute to the market growth in the region.

Power Generation Market Players:

- Envision Group

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Alstom S.A.

- General Electric Company

- DuPont de Nemours, Inc.

- Siemens AG

- The Dow Chemical Company

- Cummins, Inc.

- Tokyo Electric Power Company Holdings (TEPCO)

- ExxonMobil

- ABB Ltd.

Recent Developments

- Envision Group collaborated with Analog Devices, Inc., to allow new levels of wind turbine safety by improving real-time monitoring of vibration, tilt, and other information that may be utilized to guide safer windmill operation and construction.

- DuPont de Nemours, Inc. acquired Rogers Corporation to strengthen its position in innovative materials. Further, these efforts will also accelerate top-line growth, strengthen operating EBITDA margins, and significantly improve cross-cycle earnings stability.

- Report ID: 3479

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Power Generation Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.