Phosphoric Acid Market Outlook:

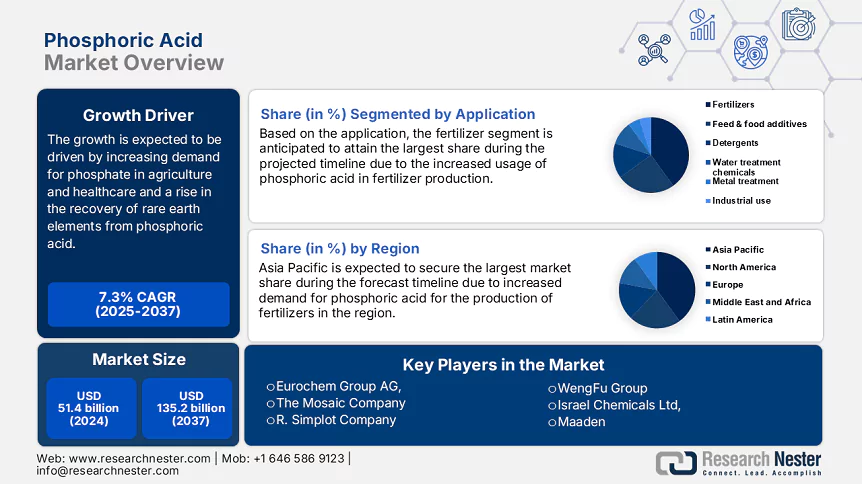

Phosphoric Acid Market size was over USD 42.72 billion in 2025 and is poised to exceed USD 66.98 billion by 2035, growing at over 4.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of phosphoric acid is estimated at USD 44.49 billion.

The growth of the market can be attributed to the increasing demand for phosphoric acid from various end-user industries. For instance, the global demand for fertilizers is estimated to reach 45 million metric tonnes by the year 2025. Further, the growing population and need for more crop production are also estimated to contribute to the growth of the market in the forecast period.

In addition to these, factors that are believed to fuel the market growth of phosphoric acid include the rise in investments and collaboration between major key players. For instance, on May 21st, 2021, Desmet Ballestra entered into an agreement to acquire BusschemTech AG. Phosphoric acid is produced by Buss ChemTech AG in various end-user applications. This is anticipated to increase the product range of Desmet Ballestra Group and its activities. The main strategies adopted by the world's biggest manufacturers to reinforce their position on the competitive landscape are partnerships, acquisitions, and agreements. In order to expand their business, market players further focus on the production of phosphoric acid at the national level as well as exporting it into other regions. Additionally, the increasing product launches in the field of phosphoric acid are also expected to contribute to the growth of the market.

Key Phosphoric Acid Market Insights Summary:

Regional Highlights:

- The Asia Pacific phosphoric acid market is projected to capture a 38% share by 2035, driven by increasing production of fertilizers and rising demand in end-use industries like agriculture.

- The North America market is expected to secure a 24% share by 2035, driven by increasing demand from food & beverages and pharmaceutical industries, supported by government regulations.

Segment Insights:

- The fertilizers application segment in the phosphoric acid market is expected to capture a 38% share by 2035, driven by increasing use of phosphoric acid in fertilizers production.

- The wet process type segment in the phosphoric acid market is expected to achieve a significant share by 2035, influenced by significant growth in demand for fertilizers and lower operating costs.

Key Growth Trends:

- Increasing Demand for Phosphate Fertilizers in Agriculture

- Rising Product Launches to Flourish the Market

Major Challenges:

- Reduced supply of phosphate

- Environmental concerns & stringent regulations

Key Players: Eurochem Group AG, The Mosaic Company, R. Simplot Company, WengFu Group, Israel Chemicals Ltd, Maaden, Prayon S.A., OCP Group, Solvay, Yara International, CECA (Arkema Group).

Global Phosphoric Acid Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 42.72 billion

- 2026 Market Size: USD 44.49 billion

- Projected Market Size: USD 66.98 billion by 2035

- Growth Forecasts: 4.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (38% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Russia, India, Japan

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 11 September, 2025

Phosphoric Acid Market Growth Drivers and Challenges:

Growth Drivers

- Increasing Demand for Phosphate Fertilizers in Agriculture – The increased demand for phosphoric acid is driven by the growing population across the globe, which has made fertilizer production from phosphoric acid more and more important. The world's population is expected to increase, as set out by the UN Department of Economic and Social Affairs. Increase by a further two billion, which will reach 9.9 billion in 2050. The growing population is contributing to an increased demand for food, which can be supplied by the cultivation of crops fed with fertilizers.

- Rising Product Launches to Flourish the Market – In order to improve the accuracy and overall functionality of new products, manufacturers have introduced a set of measures. For instance, in March 2017, the Phosphoric Acid catalyst Polymax 850 was introduced by Clariant, a producer of specialty chemicals that is capable of converting oils to gasoline for plasticizers. In addition, market players are looking to expand their phosphoric acid product range in various sectors of the pharmaceutical industry and commercial sectors.

- Surge in Usage of Phosphoric Acid in Healthcare Application – According to the most recent expenditure data, global health spending has grown over the past 20 years, doubling in real terms to reach USD 8.5 trillion in 2019 and 9.8% of GDP, up from 8.5 percent in 2000. It is predicted that this boom would continue over the forecast period.

- Increasing Recovery of Rare Earth Elements from Phosphoric Acid – Based on the elimination of impurities from phosphoric acid and phosphogypsum a process called sulfuric acid recovery is used to extract precious metal elements. The main challenge is that these products dilute the rare earth element content. In other decomposition, rare earth elements are transported completely to leaching solutions in the process of HNO3, H3PO4, or HCl, which is followed up by extraction of these rare earth elements from this solution. Reports cite about 50 million tonnes of rare earth are stored in phosphate resources worldwide, with around one hundred thousand tons mined each year for the production of phosphate rock.

Challenges

- Reduced supply of phosphate - Phosphates are used as a basic component for the production of phosphatic acid and phosphate products such as fertilizers, food, or beverages. Nevertheless, the excessive application of phosphate as a fertilizer has caused widespread pollution and eutrophication. As a consequence, the world is beginning to run out of large reserves. So, the diminished supply of phosphates is a major growth-hindering factor.

- Environmental concerns & stringent regulations

- Side effects of phosphoric acid

Phosphoric Acid Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.6% |

|

Base Year Market Size (2025) |

USD 42.72 billion |

|

Forecast Year Market Size (2035) |

USD 66.98 billion |

|

Regional Scope |

|

Phosphoric Acid Market Segmentation:

Application

The global phosphoric acid market is segmented and analyzed for demand and supply by application type into fertilizers, feed & food additives, detergents, water treatment, chemicals, metal treatment, and industrial use. Out of the seven types of phosphoric acid, the fertilizers segment is estimated to gain the largest market share of about 38% in the year 2035. The growth of the segment can be attributed to the increasing use of phosphoric acid in fertilizers production. Phosphoric acid is an intermediate used to manufacture fertilizers. Fertilizers like Monoammonium Phosphate (MAP), Diammonium Phosphate (DAP), and Trisodium Phosphate (TSP) are produced from phosphoric acid. As phosphoric acid is a multifunction agent used for the nutrition of plants, pH adjustment, and disinfection of irrigation equipment, it forms an essential component in many fertilizers. For instance, in 2019, the total area of potential for global crop production remains at some 2.7 billion hectares, which is concentrated in Asia Pacific countries South and Central America, and Sub-Saharan Africa. The demand for fertilizers is increasing, with the world's population growing at a rate of around 1.05% per year, in 2020, 1.08% per year, in 2018, and 1.12% per year, in order to meet the ever-increasing food needs of the world's population. This is anticipated to contribute to the growth of the segment in the forecast period.

Process Type

The global phosphoric acid market is also segmented and analyzed for demand and supply by process type into wet and thermal. Amongst these two segments, the wet segment is expected to garner a significant share in the year 2035. Phosphoric acid obtained through the wet process may be impure but can be directly applied for the production of fertilizer that is not subject to purification. The main factor behind the wet process is the significant growth in demand for fertilizers. With a lower operating cost and less process time, the growth is supported by lower operating temperatures and easy operation. In the wet phase, rock with low phosphorus content may also be utilized as input material. In the phosphoric acid market, a significant issue is the decreasing availability of rock phosphate. This, as a result, is anticipated to create numerous opportunities for the growth of the segment in the coming years.

Our in-depth analysis of the global market includes the following segments:

|

By Process Type |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Phosphoric Acid Market Regional Analysis:

APAC Market Insights

The market share of phosphoric acid in Asia Pacific, amongst the market in all the other regions, is projected to be the largest with a share of about 38% by the end of 2035. The growth of the market can be attributed majorly to the increasing production of fertilizers in the region. It is expected that the fertilizer industry in the Asia Pacific will grow by a CAGR of 6 % over the next five years, ensuring regular demand for phosphoric acid to produce fertilizers such as Monoammonium Phosphate and Trisodium phosphate which are used in growing crops. For instance, China made up over 40% of the Asia-Pacific phosphoric acid market in 2019, becoming the nation that is a major producer of fertilizers. It is expected that demand in China will be strengthened by the growth of end-use industries over the forecast period. In turn, India has a wide range of chemical manufacturing bases that will lead to the growth of its economy. Further, the market growth in this area is driven by increased disposable income for the middle-class population, as well as food processing expenditure. The market is also expected to grow owing to the growing demand for processed foods in emerging countries such as India and China. All these factors are anticipated to boost market growth during the forecast period.

North American Market Insights

The North American phosphoric acid market is estimated to be the second largest, registering a share of about 24% by the end of 2035. The growth of the market can be attributed majorly to the increasing demand for phosphoric acid from the food & beverages, and pharmaceuticals industry. Moreover, the market in North America is further stimulated by strict government rules on phosphoric acid. However, North American phosphoric acid market growth is expected to be impeded by significant innovation and the introduction of new products. Furthermore, the availability of substituted products could create additional obstacles to the North American market for phosphoric acid over the coming years.

Europe Market Insights

Europe region is poised to witness substantial growth through 2035. The growth of the market can be attributed majorly to the increasing demand for phosphoric acid in pharmaceutical industries, as well as growing demand from fertilizer producers. Moreover, the European market for phosphates is also expanding due to rigorous government regulations. However, the growth of the phosphoric acid market in Europe is expected to be slowed down by significant innovation and new product launches.

Phosphoric Acid Market Players:

- Eurochem Group AG,

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- The Mosaic Company,

- R. Simplot Company,

- WengFu Group,

- Israel Chemicals Ltd,

- Maaden,

- Prayon S.A.,

- OCP Group,

- Solvay,

- Yara International,

- CECA (Arkema Group)

Recent Developments

- With a view to financing the planned expansion of the Paradeep Phosphates plant in Goa, it has increased its capital by about INR 1,255 billion. The company's production capacity will increase to a combined 2.22 million tons per annum for fertilizers like Di-ammonium Phosphate (DAP) and Nitrogen, Phosphorous, Potassium (NPK), and Phosphoric acid.

- EuroChem Group has signed an agreement to purchase the Serra do Salitre phosphates project based in Minas Gerais of Brazil from Norway's Yara. In 2023, the project is designed to bring into operation a 1 million tonnes per annum phosphate plant producing MAP NP as well as SSP and TSP.

- Report ID: 4918

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Phosphoric Acid Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.