Sulfuric Acid Market Outlook:

Sulfuric Acid Market size was valued at USD 17.6 billion in 2025 and is likely to cross USD 49.08 billion by 2035, registering more than 10.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of sulfuric acid is assessed at USD 19.31 billion.

The growth of the market can be attributed to the increasing usage of sulfuric acid in the agriculture sector and in the manufacturing processes of various chemicals. There are significant quantities of sulphuric acid used for the production of fertilizers such as ammonium sulfate and superphosphate. Many pesticides use sulfuric acid as raw materials such as copper sulfate and zinc sulfate to act as fungicides for plants, and ferrous sulfate and copper sulfate as herbicides. A major end-user market for sulfuric acid, accounting for more than 60 % of total worldwide consumption in 2020, is the production of fertilizers, especially phosphate fertilizers from the wet process of phosphoric acid. These factors are anticipated to contribute to the growth of the market.

In addition to these, factors that are believed to fuel the sulfuric acid market growth include the rise in the use of sulfuric acid in the automotive industry. Increasing usage of sulfuric acid in car batteries is yet another factor contributing to the growth of the market. Sulfuric acid acts as an electrolyte in car batteries. H2SO4 is formed when sulphuric acid and water are mixed. The compound has a strong electrolytic quality and can be used to generate electricity. The H+ ions will move on the neutral electrode and SO42 ions to the positive electrode after the application of a voltage to the solution. An electric current can be derived from this, helping to drive the vehicle. Reports cite that over 100 million car batteries are replaced in the USA alone in a year. These factors are estimated to boost the market.

Key Sulfuric Acid Market Insights Summary:

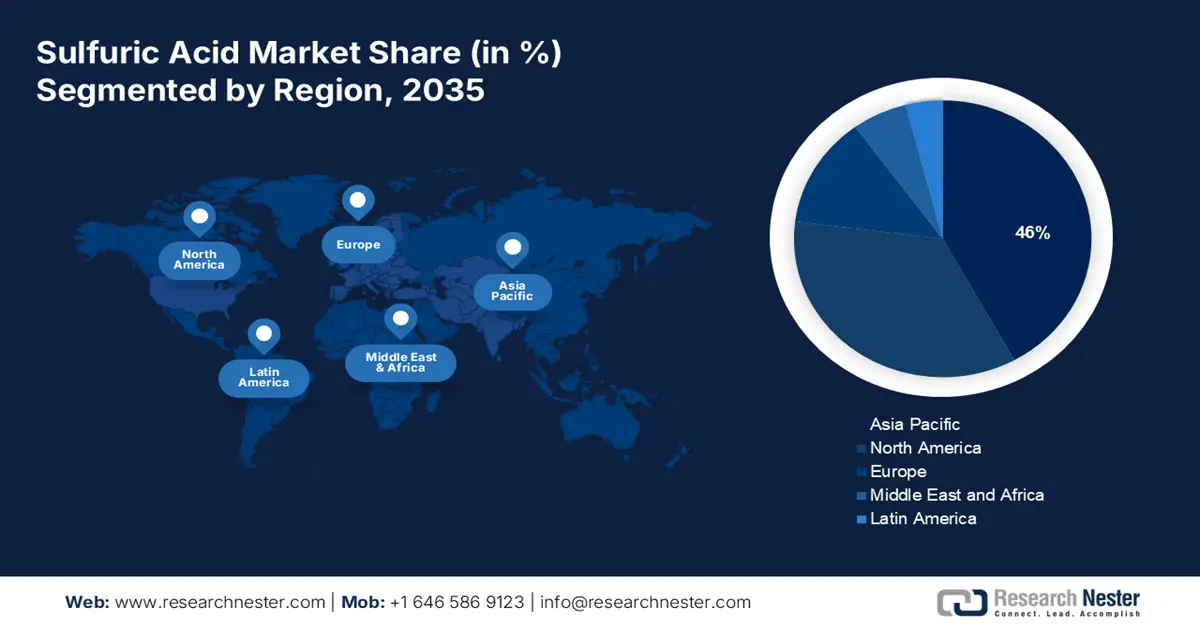

Regional Highlights:

- The Asia Pacific sulfuric acid market is forecasted to hold a 46% share by 2035, fueled by increasing sulfur production and rising fertilizer demand.

- The North America market is projected to achieve a 24% share by 2035, attributed to growing fertilizer demand and widespread sulfur applications.

Segment Insights:

- The fertilizer segment in the sulfuric acid market is anticipated to secure a 38% share by 2035, driven by rising demand for quality crops, increasing population, and the need to boost crop yields.

- The elemental sulfur segment in the sulfuric acid market is projected to hold a 35% share by 2035, fueled by fewer pollution rates of elemental sulfur compared to other raw materials and stricter measures for sulfur gas emission treatment.

Key Growth Trends:

- Increasing Demand for Sulfuric Acid in the Agriculture Sector

- Rising Implementation of Emission Regulations

Major Challenges:

- Restrictions on the use of sulfuric acid due to health and environmental concerns

- Increase in the cost of sulfuric acid

Key Players: Mosaic Company, PotashCorp, Groupe Chimique Tunisien, Maaden - Saudi Arabian Mining Company, OCP Group, PVS Chemicals, Aurubis, Chemtrade Logistics Income Fund, BASF SE, Akzonoble N.V.

Global Sulfuric Acid Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 17.6 billion

- 2026 Market Size: USD 19.31 billion

- Projected Market Size: USD 49.08 billion by 2035

- Growth Forecasts: 10.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (46% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, India, Russia, Germany

- Emerging Countries: China, India, Japan, South Korea, Indonesia

Last updated on : 10 September, 2025

Sulfuric Acid Market Growth Drivers and Challenges:

Growth Drivers

-

Increasing Demand for Sulfuric Acid in the Agriculture Sector – On account of the increasing demand for sulfuric acid from the agriculture sector is expected to expand more in the upcoming years. In 2021 the global capacity to manufacture ammonium nitrate, phosphates, and potash was 319,973 tonnes with an estimated total of 318,652 tonnes by 2022, which is projected to increase sulfuric acid market demand over the forecast period.

-

Rising Implementation of Emission Regulations– From 2017 to 2025, the adoption of standards like New Source Performance Standards NAPSs is expected to increase in order to control emissions of sulfur dioxide, sulfuric acid mist, and particulate matter from H2SO4 production facilities. This will lead to an expansion of the market.

- Increasing Number of Sulphuric Acid Manufacturing Plants – India's State Chief Minister of Odisha, who is also responsible for the IFFCO fertilizer factory at its Paradip division, commissioned a sulfuric acid production facility on July 21, 2021. Estimated to start operation in 2023, the project will cost approximately INR 400 crore USD 48.36 million. A reduction in dependency on chemical imports will be achieved through this new production facility. This is the third factory of IFFCO for the production of sulphuric acid with an output of approximately 2,000 MT per day.

- Rising Production of Nutrition Rich Food Crops –. It is anticipated that there would be a significant increase in the demand for fertilizers as a result of the larger expectation of yield increases from farmers and the decreased availability of fertile land for agricultural practices as a result of expanding urbanization. These additions enrich the soil with elements like potassium, phosphate, and nitrogen. Fertilizers have a 50 % share of global agricultural production, all over the world. This is estimated to contribute to the market growth in the forecast period.

Challenges

-

Restrictions on the use of sulfuric acid due to health and environmental concerns - The increasing concern amongst people about the harmful effects of sulfuric acid is one of the major factors predicted to slow down the sulfuric acid market growth. This release of sulfur dioxide causes sulfur trioxide to be formed in the air, which reacts with water vapor and gives rise to sulfur acid. The formation of acid rain is stimulated by sulfonic acid in the rainfall. The environment, as well as human health, are very negatively affected by acidic rain. It's likely to be very harmful to the forest and wildlife.

-

Increase in the cost of sulfuric acid

- Stringent environmental regulations

Sulfuric Acid Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.8% |

|

Base Year Market Size (2025) |

USD 17.6 billion |

|

Forecast Year Market Size (2035) |

USD 49.08 billion |

|

Regional Scope |

|

Sulfuric Acid Market Segmentation:

Raw Material Segment Analysis

The sulfuric acid market is segmented and analyzed for demand and supply by raw material into elemental sulfur, base metal smelters, and pyrite ore. Out of the three types of sulfuric acid, the elemental sulfur segment is estimated to gain the largest market share of about 35% in the year 2035. The growth of the segment can be attributed to the fewer pollution rates of elemental sulfur when compared to base metal smelters and pyrite ores. A large number of undertakings have adopted stringent measures to treat sulfur gas emissions before releasing them into the atmosphere, with a view to limiting or reducing the environmental pollution. Increasing development activities, like improving the capacity of businesses to produce sulfuric acid products that are manufactured from organic sulfur. Further, the massive rate of elemental sulfur and a ban on sulfur mining are also anticipated to boost the growth of the segment. In 2022, China became the World’s leading sulfur producer by manufacturing over 18 million tons of sulfur. All these factors are estimated to contribute to the growth of the segment.

Application Segment Analysis

The global sulfuric acid market is also segmented and analyzed for demand and supply by application into fertilizer, chemical manufacturing, metal processing, petroleum refining, textile industry, and automotive. Amongst these six segments, the fertilizer segment is expected to garner a significant share of around 38% in the year 2035. The market is likely to benefit from increased demand for better quality crops and an increase in population around the world over the coming years. Rapid development and urbanization are resulting in the decreasing arable land, which has led farmers to resort to fertilizers for increasing crop yields. Market growth is projected to be stimulated by the growing use of H2SO4 as a producer of quality fertilizers for agriculture, thereby increasing production capacity. The production of contaminated sulphuric acid, which results in the regeneration of pure and concentrated H2SO4, is mainly carried out by petroleum and chemical refineries. The regenerated acids are emission low and making them sustainable and environmentally friendly, which leads to a reduction in production costs. This, as a result, is anticipated to create numerous opportunities for the growth of the segment in the coming years.

Our in-depth analysis of the global sulfuric acid market includes the following segments:

|

By Raw Material |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Sulfuric Acid Market Regional Analysis:

APAC Market Market Insights

Sulfuric acid market share in Asia Pacific, amongst the market in all the other regions, is projected to be the largest with a share of about 46% by the end of 2035. The growth of the market can be attributed majorly to the increasing production of sulfur in the region. For instance, in 2022, China produced over 18 million tons of sulfur owing to the reduction in sulfur mining and increased demand from various sectors. Further, the rising demand for sulfuric acid from the Philippines and Indonesia is also expected to contribute to the growth of the market. The market will be expected to increase over the next years, as phosphate fertilizer production becomes more and more of a necessity in view of growing demand from the fertilizer sector and strict environmental regulations on the manufacture of environmentally friendly products. The growth of the Chinese market is expected to be driven by growing demand in industry and phosphoric acid, as a result of increased crop cultivation and better yields. In addition, the region's population growth and demand for food are also anticipated to boost market growth during the forecast period.

North American Market Insights

The North American sulfuric acid market is estimated to be the second largest, registering a share of about 24% by the end of 2035. The growth of the market can be attributed majorly to the increasing fertilizer demand in the region. The main producers of sulfur were countries such as the United States and Canada. It is estimated that the market would benefit from a rise in consumer awareness of hygiene. Moreover, the global market is strengthening as more and more detergents are used. In order to allow for electrons between the batteries' plates, sulfuric acid is used as an electrolyte in a dilute form also known as battery acid. All these factors are anticipated to contribute to the market growth of the region. Further, the presence of supportive policies by the regulatory bodies that promote the market players to opt for further sulfur production.

Europe Market Market Insights

Europe region is likely to register significant growth till 2035. The growth of the market can be attributed majorly to the increasing demand for sulfuric acid in a variety of industries in countries like Germany, France, and the United Kingdom. The opportunities for the European market are generated in developing countries through a strong network of distributors, including multi-brand stores and online retailers. Germany's market for sulfuric acid is dominant, with France and the United Kingdom taking second place. These factors are estimated to contribute to the growth of the market.

Sulfuric Acid Market Players:

- Mosaic Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- PotashCorp

- Groupe Chimique Tunisien

- Maaden - Saudi Arabian Mining Company,

- OCP Group,

- PVS Chemicals,

- Aurubis,

- Chemtrade Logistics Income Fund,

- BASF SE,

- Akzonoble N.V.,

Recent Developments

- WeylChem International GmbH completed the acquisition and integration of INEOS Sulfur Chemicals Spain SLU, the leading Spanish sulfur chemicals arm of INEOS enterprises. The acquired business has a state-of-the-art facility with an annual production capacity of 350,000 tonnes of sulfuric acid in Bilbao. 'WeylChem Bilbao' is now the sole operator of this newly integrated sulfur business.

- For an investment of USD 737.81 million Boliden has announced a plan for the expansion of its zinc smelting plant at Odda in western Norway. A new roaster, a new sulfuric acid plant, and a new cell house would form part of the Odda Facility designed to be able to produce 350,000 tons per year following the plan for a 75 % capacity increase.

- Report ID: 4855

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Sulfuric Acid Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.