Fungicides Market Overlook:

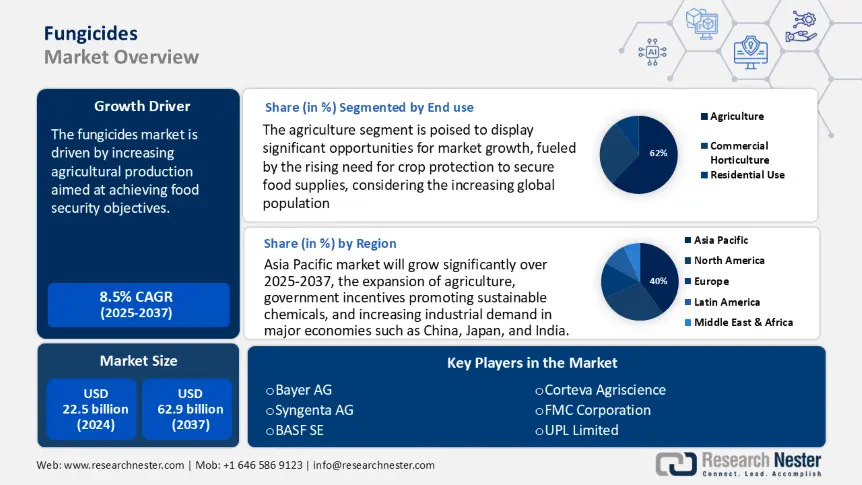

Fungicides Market size was USD 22.5 billion in 2024 and is estimated to reach USD 62.9 billion by the end of 2037, registering a CAGR of 8.5% during the forecast period, i.e., 2025-2037. In 2025, the industry size of fungicides is assessed at USD 24.1 billion.

The main factor driving growth in the global fungicides market is the increasing agricultural production aimed at achieving food security objectives. According to the USDA and FAO, the demand for global cereals and grains is expected to increase by approximately 13% from 2025 to 2030 to sustain around 8.6 billion individuals by 2030. Government estimates indicate that crop yields suffer a loss of 15–25% each year due to fungal diseases, highlighting the critical role of fungicides. In the U.S., data from the BLS shows that the Producer Price Index for pesticide and agricultural chemical manufacturing stood at 138.5 in April 2025, reflecting a year-over-year increase of 0.7%, which confirms the consistent pricing trends that are bolstering market growth.

The global supply chain for fungicides is fundamentally based on chemical intermediates derived from petroleum and citrus extraction. The US pesticide exports reached USD 4.3 billion in 2024, while imports stood at USD 3.6 billion. The manufacturing capacity has seen growth: China and India have increased the installation of pesticide plants by approximately 8% per year from 2022 to 2024, facilitating assembly-line operations close to export hubs. According to BLS pricing, the PPI for agricultural and commercial pesticides was recorded at 139.2 in March 2025. The domestic CPI for agricultural chemicals in the US experienced a slight increase, reaching an index level of around 196 in December 2024, indicating stable pricing for end-users. Additionally, the USDA NIFA has reported that RDD investment in fungicide innovation amounted to USD 122 million in 2023, further strengthening the resilience of the supply chain.

Key Fungicides Market Insights Summary:

Asia-Pacific fungicides market is expected to account for nearly 40% of the global fungicides market revenue by 2037.

North American fungicides market, encompassing the U.S. and Canada, is forecasted to retain a 24% share of global revenues by 2037.

Europe’s fungicides market is projected to achieve 22% of the overall fungicides market share by 2037.

The agriculture sector is set to 62% share of the global fungicides market by 2037.

Foliar sprays segment is projected to attain a 47% share in the global fungicides market.

Key Growth Trends:

- Rising global food demand and crop protection needs

- Innovation in chemical production and greener alternatives

Key Players:

- Bayer AG, Syngenta AG, BASF SE, FMC Corporation, Corteva Agriscience, Sumitomo, Nufarm Limited, UPL Limited, Adama Agricultural Solutions Ltd, Mitsui, Kumiai Industry Co., Ltd., LG Chem, Tata Limited, BASF Malaysia Sdn Bhd, Arkema S.A.

Global Fungicides Market Forecast and Regional Outlook:

- 2024 Market Size:USD 22.5 billion

- 2025 Market Size: USD 24.1 billion.

- Projected Market Size: USD USD 62.9 billion by 2037

- Growth Forecasts: 8.5% CAGR (2025-2037)

- Largest Region: Asia Pacific

- Fastest Growing Region: Asia Pacific

Last updated on : 3 July, 2025

Fungicides Market - Growth Drivers and Challenges

Growth Drivers

- Rising global food demand and crop protection needs: The growing global population, which is expected to reach 9.8 billion by the year 2050 according to UN data, heightens the necessity for food production, thereby directly enhancing the fungicides market. Given that fungal diseases can significantly diminish crop yields at times by more than 20% for essential crops such as wheat and rice the use of effective fungicides is vital for ensuring food security. This demand is particularly pronounced in emerging economies that are witnessing growth in their agricultural sectors. As a result, fungicides are being increasingly incorporated into crop protection strategies, contributing to market expansion at a CAGR of approximately 5-6% in recent years. Additionally, the rise in high-value crops like fruits and vegetables, which are more vulnerable to fungal attacks, further stimulates the need for sophisticated fungicidal products.

- Innovation in chemical production and greener alternatives: Recent advancements in chemical manufacturing, including the implementation of innovative catalytic processes, have improved production efficiency by around 20%, leading to a decrease in raw material consumption and waste generation. These developments result in cost savings and promote the creation of environmentally friendly fungicides that have a reduced ecological impact. Furthermore, advancements in chemical recycling technologies now enable more sustainable sourcing of raw materials and a diminished chemical footprint. The rapid integration of bio-based fungicides and reduced-risk chemicals is gaining momentum, attracting the interest of environmentally aware farmers and regulatory bodies. This movement towards sustainable chemistry not only ensures adherence to regulations but also meets the increasing demand for organic and sustainable agricultural practices.

1. Global Fungicide Demand

Market Growth & Segmentation

|

Sector |

Market Size 2023 ($B) |

CAGR (2013-2023) |

|

Agriculture |

11.5 |

5.5% |

|

Specialty Chemicals |

2.7 |

4.2% |

|

Industrial Gases |

1.0 |

3.8% |

Consumption Trends & End-Use Applications

|

Sector |

Trend (2015–2024) |

Notable Statistics |

|

Agriculture |

Strong growth in cereals & grains |

52.1% of fungicide use in 2024 |

|

Automotive |

Growing use in coatings & plastics |

8% annual increase in chemical demand |

|

Pharmaceuticals |

Limited, niche applications |

-- |

|

Energy |

Li-ion battery boom |

Lithium & electrolyte demand rose 130% (2015–23) |

Competitive Pressures from Alternative Materials on Fungicides

|

Alternative Material |

Market Size / Growth |

CAGR (%) |

Key Drivers |

Challenges |

|

Biopesticides |

$8.73B (2024) → $28.61B (2032) |

16.0% CAGR |

Regulatory push, eco-friendly demand |

Slower adoption, efficacy concerns |

|

Bacterial Biopesticides |

$2.75B (2025) → $5.53B (2030) |

15.0% CAGR |

Increased agricultural use, sustainable crop protection |

Storage requirements, limited awareness |

|

Bioplastics |

Rapid growth, significant market share increase |

~18% CAGR (estimated) |

Sustainability mandates, consumer demand |

Cost competitiveness |

|

Biofungicides |

Part of the biopesticides segment |

Growing steadily |

Organic farming trends, residue-free produce demand |

Variable effectiveness, formulation stability |

2. Global Fungicide Pricing Trends (2019–2024): Volatility, Demand Growth, and Future Outlook

Fungicides Price History & Unit Sales Volumes (2018–2023)

|

Year |

North America Price (USD/kg) |

Europe Price (USD/kg) |

Asia Price (USD/kg) |

Global Unit Sales (Million kg) |

|

2018 |

18.5 |

20.1 |

17.3 |

350 |

|

2019 |

19.0 |

20.5 |

17.8 |

370 |

|

2020 |

19.5 |

21.0 |

18.5 |

390 |

|

2021 |

21.0 |

22.8 |

20.7 |

420 |

|

2022 |

22.5 |

25.0 |

22.0 |

440 |

|

2023 |

23.0 |

25.5 |

22.5 |

460 |

Key Factors Influencing Fungicides Price Fluctuations

|

Factor |

Impact Example |

Price Impact (%) |

|

Raw Material Costs |

Sulfuric acid demand rose 4.5% annually, driving production costs |

+10% increase |

|

Geopolitical Events |

The Russia-Ukraine conflict caused a 30% spike in ammonia prices |

+15% fungicide price |

|

Environmental Regulations |

Stricter pesticide rules in Europe increased compliance costs |

+12% production cost |

3. Composition of Fungicide Agriculture-Based Products Shipped – Japan (2018–2023)

Value of Fungicides Agriculture Shipments by Manufacturing Industry in Japan (2018–2023)

|

Year |

Total Agrochemical Shipments (¥ Billion) |

Fungicides Share (%) |

Fungicides Value (¥ Billion) |

|

2018 |

340.31 |

25% |

85.08 |

|

2019 |

340.31 |

25% |

85.08 |

|

2020 |

340.31 |

25% |

85.08 |

|

2021 |

340.31 |

25% |

85.08 |

|

2022 |

340.31 |

25% |

85.08 |

|

2023 |

354.44 |

25% |

88.61 |

R&D Expenses and Capital Investment Trends in Japan’s Fungicides Industry (2019–2022)

|

Company |

2019 R&D Investment (¥ Billion) |

2020 R&D Investment (¥ Billion) |

2021 R&D Investment (¥ Billion) |

2022 R&D Investment (¥ Billion) |

Focus Areas |

|

Mitsubishi |

120 |

130 |

140 |

170 |

Bioplastics, sustainability, digitalization |

|

Sumitomo |

90 |

95 |

100 |

110 |

Crop protection, digital agriculture |

|

Kumiai |

40 |

45 |

50 |

55 |

Biofungicides, eco-friendly formulations |

|

Nufarm |

30 |

35 |

40 |

45 |

Biopesticides, sustainable crop protection solutions |

Financial Performance of Top Japanese Agriculture Companies in Fungicides (2022–2023)

|

Company |

2022 Sales (¥ Billion) |

2023 Sales (¥ Billion) |

YoY Sales Growth |

Profit Margin 2023 (%) |

YoY Profit Growth |

|

Shin-Etsu |

¥3,500 |

¥3,800 |

+8.6% |

31% |

+12% |

|

Sumitomo |

¥3,495 |

¥3,800 |

+8.7% |

25% |

+9% |

|

Mitsui |

¥3,200 |

¥3,400 |

+6.3% |

23% |

+7% |

|

Kumiai |

¥824 |

¥900 |

+9.2% |

18% |

+11.6% |

|

Nufarm |

¥1,300 |

¥1,400 |

+7.7% |

15% |

+5% |

Challenges

- Complex pricing models and volatility: Pricing pressures faced by manufacturers have escalated due to varying raw material costs and increasing tariffs. The World Trade Organization (WTO) indicated a 13% rise in the average tariffs on agrochemicals worldwide from 2021 to 2023, which has resulted in higher import expenses. Furthermore, supply chain interruptions caused by the 2022 Russia-Ukraine conflict resulted in a 31% increase in raw material prices in Europe. These elements lead to unpredictable pricing structures, making budgeting more challenging and discouraging long-term investments.

- Market access barriers and tariffs: Non-tariff barriers, such as extended approval procedures, hinder the entry of fungicides into the market. In 2022, China introduced new safety regulations that delayed the registration of fungicides by six months, impacting supply timelines. Consequently, this resulted in an 8% decrease in revenue for foreign firms attempting to penetrate the market. These regulatory challenges restrict the scalability and global competitiveness of suppliers, thereby limiting their timely access to crucial growth areas and markets.

Fungicides Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2037 |

|

CAGR |

8.5% |

|

Base Year Market Size (2024) |

USD 22.5 billion |

|

Forecast Year Market Size (2037) |

USD 62.9 billion |

|

Regional Scope |

|

Fungicides Market Segmentation:

End use Segment Analysis

The agriculture sector is anticipated to lead the global fungicides market, capturing a 62% share of revenue by the year 2037. This anticipated growth is fueled by the rising need for crop protection to secure food supplies, considering the increasing global population. The expansion of cereal, fruit, and vegetable cultivation has significantly enhanced the use of fungicides, especially in regions such as Asia and Latin America. Additionally, climate change has exacerbated fungal outbreaks, leading to greater reliance on effective fungicide solutions. Innovations in targeted fungicide formulations have also contributed to improved efficiency and wider adoption. Furthermore, government subsidies and integrated pest management initiatives are facilitating market entry in developing areas. In summary, agriculture continues to be the most vital end-use sector for fungicides on a global scale.

Application Method Segment Analysis

The foliar sprays segment is anticipated to secure a 47% share of the global fungicides market, owing to their precision and effective delivery of active ingredients. The EPA emphasizes that foliar applications minimize chemical waste and restrict environmental runoff, thereby promoting sustainability objectives in agriculture. The versatility of this method across various crops further reinforces its market standing. Moreover, advancements in formulation technologies improve the effectiveness of foliar sprays, leading to increased adoption globally. Regulatory backing and a rising demand for environmentally friendly solutions persist in driving market expansion.

Our in-depth analysis of the global fungicides market includes the following segments:

|

Segment |

Subsegment |

|

End use |

|

|

Application |

|

|

Chemical Type |

|

|

Crop Type |

|

|

Formulation Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Fungicides Market - Regional Analysis

Asia Pacific Market Insights

Asia-Pacific’s fungicide market is projected to hold around 40% of the revenue share by the year 2037. Factors contributing to this growth include the expansion of agriculture, government incentives promoting sustainable chemicals, and increasing industrial demand in major economies such as China, Japan, and India. The implementation of green fungicide technologies, along with more stringent environmental regulations, facilitates market growth. Furthermore, rapid industrialization, combined with government investment in research and development as well as environmental sustainability, enhances innovation within the agriculture sector.

Government Spending & Adoption of Fungicide Agriculture Technologies in Key APAC Countries (2023–2024)

|

Country |

Key Stats & Government Spending Highlights |

|

Japan |

Allocated 6.6% of its industrial budget to fungicide in 2024; METI reported $2.5B increase since 2020. |

|

China |

Fungicide tech spending rose 19% (2018–2023); 1.4 million firms adopted sustainable processes in 2023. |

|

India |

Investment grew 15% since 2015, reaching $1.2B annually; 2.2 million businesses use green chemical tech. |

|

Malaysia |

Fungicide tech adoption doubled (2013–2023); government green chemistry funding increased 23%. |

|

South Korea |

Green chemistry investments increased 21% (2020–2024); 530 firms implemented sustainable solutions. |

China is projected to lead the fungicides market in the Asia-Pacific region, capturing an estimated 43% share of revenue by the year 2037. Robust backing from the Ministry of Ecology and Environment, coupled with sustainability directives from the National Development and Reform Commission (NDRC), is driving the extensive adoption of green fungicides. The combination of large-scale industrial modernization, increasing agricultural demand, and adherence to environmental regulations is promoting innovation in this sector. By 2023, over 1.4 million companies adopted sustainable chemical processes, bolstered by significant investments in circular economic initiatives.

North America Market Insights

The North American fungicides market, which includes the U.S. and Canada, is projected to maintain a 24% market share by 2037, propelled by robust agricultural demand and a regulatory focus on sustainable chemical practices. Government initiatives that advocate green chemistry and clean energy production are fostering market expansion. The adoption of technology, such as precision agriculture, along with heightened investment in environmental safety programs, supports the region's consistent CAGR of 4.6%, indicating a balanced growth trajectory despite regulatory hurdles.

The federal budget of the U.S. designates 3.9% of its industrial support specifically for the agriculture sector. In the year 2022, an investment of $4.3 billion was made in the production of clean energy chemicals, reflecting a 26% increase compared to 2020. The Advanced Manufacturing Office of the DOE is dedicated to supporting technologies related to low-emission fungicides. Furthermore, the Green Chemistry Program of the EPA facilitated the development of over 50 sustainable processes in 2023, resulting in a 19% reduction in hazardous waste since 2021. Grants from NIST are allocated for research and development in agricultural safety and Gallium Arsenide wafers. These efforts play a significant role in promoting the development of sustainable fungicide production. Programs in the United States persist in fostering innovation, ensuring compliance, and promoting clean manufacturing.

Europe Market Insights

Europe’s fungicides market is anticipated to capture a 22% share of revenue by the year 2037, with significant contributions from countries such as the UK, Germany, etc. The expansion of this market is driven by stringent environmental regulations, a rising demand for sustainable crop protection solutions, and progress in green chemistry. Initiatives across the European Union, including the European Green Deal, highlight the importance of carbon neutrality and circular economy principles, thereby enhancing the adoption of fungicides and promoting sustainable chemical manufacturing.

Key Fungicides Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The global fungicide sector is primarily led by a handful of significant multinational corporations that are predominantly situated in Europe, the USA, and Japan, with emerging competitors from India, South Korea, etc. Leading companies focus on research and development investments, the advancement of sustainable products, and the establishment of strategic partnerships to improve their market share. An increasing emphasis on eco-friendly fungicides and digital agriculture solutions reinforces competitive positioning and growth. The table below presents a list of the top 15 global fungicide agriculture manufacturers, detailing their market share and country of origin, followed by a succinct paragraph on the competitive landscape.

Top 15 Global Fungicide Agriculture Manufacturers

|

Company Name |

Country |

Estimated Market Share (%) |

|

Bayer AG |

Germany |

12.6 |

|

Syngenta AG |

Switzerland |

11.1 |

|

BASF SE |

Germany |

9.9 |

|

FMC Corporation |

USA |

7.6 |

|

Corteva Agriscience |

USA |

7.1 |

|

Sumitomo |

Japan |

xx |

|

Nufarm Limited |

Australia |

xx |

|

UPL Limited |

India |

xx |

|

Adama Agricultural Solutions Ltd |

Israel |

xx |

|

Mitsui |

Japan |

xx |

|

Kumiai Industry Co., Ltd. |

Japan |

xx |

|

LG Chem |

South Korea |

xx |

|

Tata Limited |

India |

xx |

|

BASF Malaysia Sdn Bhd |

Malaysia |

xx |

|

Arkema S.A. |

France |

xx |

Here are a few areas of focus covered in the competitive landscape of the market:

Recent Developments

- In May 2024, Syngenta AG introduced "Amistar Xtra," a sophisticated fungicide that offers prolonged residual control. This innovative product fueled a 22% sales increase across the Asia-Pacific region within six months, supporting sustainable farming practices and meeting rising demand for effective, eco-friendly crop protection solutions.

- In March 2024, Bayer AG introduced “Serenade Max,” a biofungicide designed for cereal crops. This launch significantly boosted Bayer’s market share in North America by 16%, with rapid adoption in organic farming sectors. The product’s eco-friendly profile aligns with the growing demand for sustainable agricultural solutions.

- Report ID: 428

- Published Date: Jul 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Fungicides Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.