Ferrous Sulfate Market Outlook:

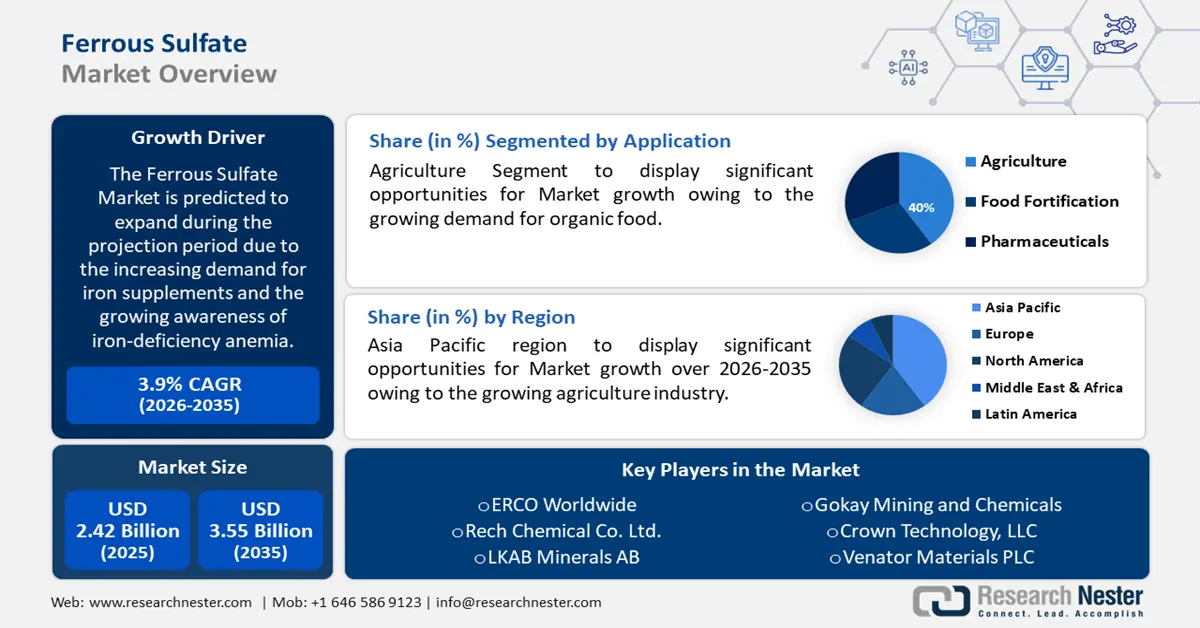

Ferrous Sulfate Market size was over USD 2.42 billion in 2025 and is projected to reach USD 3.55 billion by 2035, growing at around 3.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of ferrous sulfate is evaluated at USD 2.5 billion.

The ferrous sulfate market is expanding due to the rising demand for fertilizers, water treatment, and pharmaceuticals. Ferrous sulfate is essential in agriculture for restoring plant iron deficiency, boosting crop yields, and increasing soil quality. It works especially well to treat chlorosis, a disease brought on by an iron shortage that causes growth retardation and yellowing of the leaves. The necessity for high-quality agricultural products and the growing emphasis on sustainable farming methods fuel the ferrous sulfate market in this industry. According to WHO estimates, anemia affects 269 million children aged 6 to 59 months and half a billion women aged 15 to 49 globally. Anemia affects 106 million women and 103 million children in Africa and 244 million women and 83 million children in South-East Asia. These two regions are the most afflicted.

The increasing demand for clean water, especially in the water treatment sector, drives the ferrous sulfate demand in the market. Water supplies now contain more pollutants as a result of increased industrialization and urbanization. An essential coagulant for purging water of pollutants and impurities so that it is fit for industrial and human consumption is ferrous sulfate. The market's expansion has also been significantly fueled by government legislation requiring clean water standards.

Key Ferrous Sulfate Market Insights Summary:

Regional Highlights:

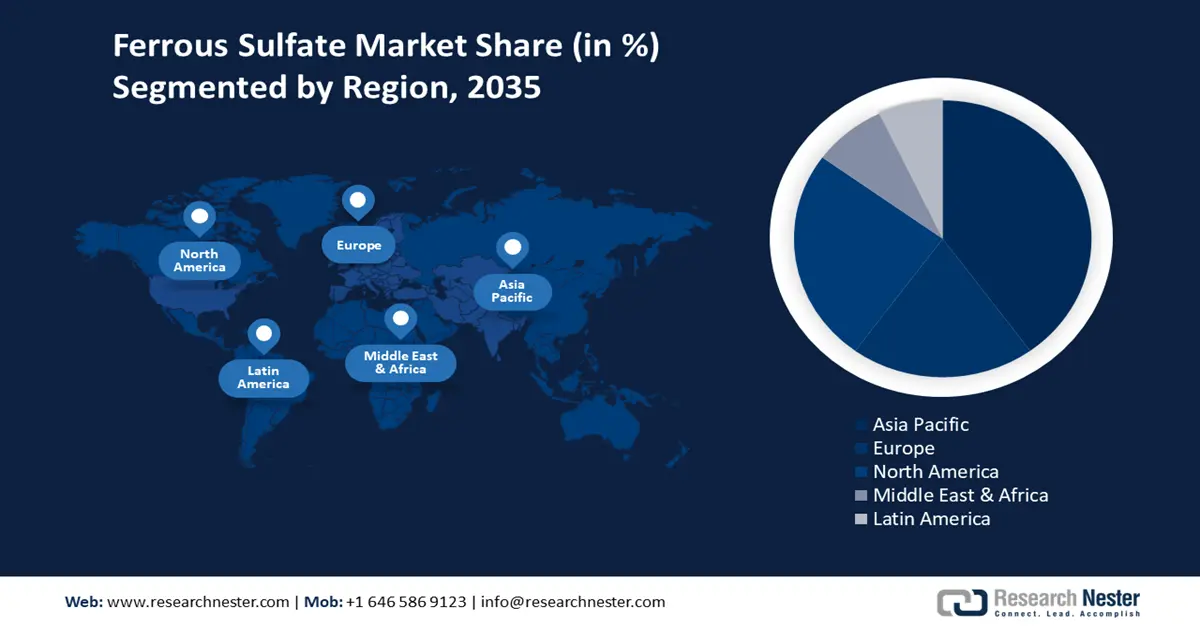

- North America ferrous sulfate market will dominate more than 50.50% share by 2035, driven by advanced water treatment infrastructure and iron deficiency awareness.

- Asia Pacific market will achieve a stable CAGR during 2026-2035, driven by urbanization, industrialization, and demand for water treatment.

Segment Insights:

- The heptahydrate segment in the ferrous sulfate market is projected to secure a 62.60% share by 2035, driven by high solubility useful for pharmaceutical and agricultural applications.

Key Growth Trends:

- Transition towards organic agriculture

- Emphasis on improving aluminosilicates' catalytic properties

Major Challenges:

- Mining and processing adverse effects

- Competition from alternatives

Key Players: Chemland Group, Coogee, Crown Technology, Inc., Kemira, Merck KGaA, Pencco, Inc., Rech Chemicals Co Ltd, Thermo Fisher Scientific Inc., Venator Materials PLC, and KRONOS INTERNATIONAL, Inc.

Global Ferrous Sulfate Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.42 billion

- 2026 Market Size: USD 2.5 billion

- Projected Market Size: USD 3.55 billion by 2035

- Growth Forecasts: 3.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (50.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, India, Japan

- Emerging Countries: China, India, Japan, Brazil, Thailand

Last updated on : 22 May, 2025

Ferrous Sulfate Market Growth Drivers and Challenges:

Growth Drivers

- Transition towards organic agriculture: The growing demand for ferrous sulfate as an organic iron fertilizer for crops is driving this trend of environmentally friendly practices in farming basements. Ferrous sulfate is becoming a natural choice as long as organic farming continues to thrive with a reduced dependency on chemical fertilizers and an increased consciousness of soil health. Around 72.3 million hectares of land are managed organically by at least 3.1 million farmers in 187 countries that practice organic agriculture. Argentina (3.63 million hectares), Spain (2.35 million hectares), and Australia (35.69 million hectares) have the most organic agricultural land. The amount of land utilized for organic farming has grown in all regions.

- Emphasis on improving aluminosilicates' catalytic properties: The increasing need for environmentally friendly water treatment solutions is fueling the ferrous sulfate market's growth. More production facilities are using ferrous sulfate as a coagulant as a result of strict government rules requiring industrial effluents to be cleaned before being released into the environment. It is a popular option for water treatment applications because of its efficiency in eliminating contaminants and pollutants from water, as well as its environmental friendliness. The naturally occurring fluoride level in all Auckland water, except Onehunga water and some other areas of New Zealand, is set between 0.7 and 1.0 parts per million. In New Zealand, fluoridation reduces tooth decay by approximately 40% in the areas where it is implemented, and it costs roughly 50 cents per person per day.

Challenges

- Mining and processing adverse effects: The mining and processing of ferrous sulfate raises environmental concerns, which severely limit market expansion. Ferrous sulfate manufacturing involves significant energy consumption and possible pollution during the extraction and processing stages, which can contaminate soil and water. Environmental restrictions have been strengthened by regulatory agencies around the world, forcing firms to adopt more sustainable practices or risk severe penalties. The market expansion for ferrous sulfate may be restrained by these regulatory restrictions since they raise operating expenses and may restrict manufacturing capabilities.

- Competition from alternatives: The ferrous sulfate market is further challenged by the existence of other goods that provide comparable advantages. The usage of products such as ferric sulfate, poly aluminum chloride, and other organic compounds is growing in applications such as soil supplements and water treatment because of their improved efficacy under specific circumstances and reduced environmental impact. These substitutes are more enticing to end users looking for economical and ecologically friendly solutions since they frequently call for lower dosages and produce less sludge during water treatment procedures.

Ferrous Sulfate Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

3.9% |

|

Base Year Market Size (2025) |

USD 2.42 billion |

|

Forecast Year Market Size (2035) |

USD 3.55 billion |

|

Regional Scope |

|

Ferrous Sulfate Market Segmentation:

Type Segment Analysis

The heptahydrate segment is projected to gain a 62.6% ferrous sulfate market share through 2035. Heptahydrate ferrous sulfate, which is distinguished by its seven water molecules, is mostly utilized in sectors that demand high solubility, including several pharmaceutical and agricultural uses. It is very successful in urgent applications because of its high solubility, which guarantees rapid dissolution. Because of its effectiveness in particular industrial processes, the heptahydrate form is anticipated to experience a significant increase.

Monohydrate ferrous sulfate is recommended because of its excellent purity and efficacy in treating soil iron deficiency and acting as a coagulant in water purification activities. It's an important function in the pharmaceutical industry, especially in goods that contain iron supplements. Its broad use over alternative forms is supported by the form's stability and handling ease, which further increases its application. This well-known application is utilized in many different industries, such as medicine, agriculture, and water treatment.

Application Segment Analysis

Based on the application, the pharmaceuticals segment is likely to hold a noteworthy ferrous sulfate market share by the end of 2035. The pharmaceutical industry uses ferrous sulfate to make iron supplements for treating anemia. In this application, ferrous sulfate is in high demand due to the rising incidence of iron-deficiency anemia, especially in women and children. The pharmaceutical use of ferrous sulfate is anticipated to continue expanding as preventative healthcare and health supplements gain more attention.

Because it effectively coagulates and removes pollutants, the use of water treatment is expanding. Ferrous sulfate has become essential in the wastewater treatment industry due to the strict restrictions and growing demand for potable water. Ferrous sulfate is used by both companies and municipalities to maintain adherence to environmental regulations, which sustains demand.

Ferrous sulfate is an essential ingredient in agriculture that helps plants that are iron deficient, which can otherwise result in poor plant health and decreased agricultural productivity. This industry's use of ferrous sulfate is mostly motivated by the need for food security and the growing focus on sustainable agriculture. Farmers and agricultural businesses favor it because of its ability to improve soil fertility.

Ferrous sulfate is used as a fortifying additive in the food and beverage industry to increase the nutritional value of food items. Ferrous sulfate's rise in this industry is being driven by growing consumer awareness of the health advantages of iron and the growing demand for fortified foods. Further supporting the market rise is its application in animal feed to guarantee the well-being and productivity of cattle.

Our in-depth analysis of the global ferrous sulfate market includes the following segments:

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Ferrous Sulfate Market Regional Analysis:

North America Market Insights

North America ferrous sulfate market is expected to lead the ferrous sulfate industry with a share of 50.5% during the forecast period. The demand for the chemical is driven by the region's advanced water treatment infrastructure and the increased awareness of iron deficiency illnesses. The North American market is distinguished by the existence of well-established competitors and a significant degree of research and development activity focused on enhancing the safety and effectiveness of iron ferrous sulfate products.

The U.S. ferrous sulfate market has been expanding due to the growing need for agricultural applications and water treatment. Ferrous sulfate demand in this area is mostly driven by the region's expanding population, which in turn creates a need for clean water and higher agricultural output. A 2023 UN report states that 26% of people globally experience a shortage of clean water, while 46% of people lack access to properly managed sanitation. By 2050, 2.4 billion people are expected to be affected by water scarcity. As a result, it raises demand for improved regional water management.

Canada also has a role in the ferrous sulfate market, especially through the need for ferrous sulfate in flue gas desulfurization and effluent treatment is being driven by the industrial sector's increasing emphasis on green chemistry as well as the regulatory requirements of wastewater treatment. Millions of individuals worldwide suffer from iron deficiency anemia, which is frequently treated with ferrous sulfate, an iron supplement. Other illnesses, such as pregnancy-related anemia and restless legs syndrome, are also treated with it. Ferrous sulfate is being studied by researchers worldwide for its potential to treat cancer and celiac disease, among other illnesses.

Asia Pacific Market Insights

Asia Pacific is expected to experience a stable CAGR during the forecast period. The ferrous sulfate market is expanding quickly in the area due to urbanization and industrialization. The market in this area is being driven by the growing need for effective water treatment solutions as well as the rising demand for premium agricultural products. The demand for ferrous sulfate is being further increased by governments in the Asia-Pacific region, spending on environmental protection and infrastructure development projects.

The ferrous sulfate market is expanding as a result of China's expanding population and industrial sectors. Bailonggang, close to Shanghai, a city in Eastern China with a population of tens of millions, is one of the biggest wastewater treatment plants in the world. Purifying one-third of the wastewater from a catchment area larger than 270 km², or more than two million cubic meters, was the plant's daily objective. Six dry-installed SPN waste water pumps, six dry-installed ZL axial flow pumps, 241 Amacan submerged waste water pumps, and 65 Amarex KRT and Amarex N submersible motor pumps were all supplied by KSB.

In India, the growing need for portable water due to population growth calls for the development of treatment and distribution systems in addition to research into raw water sources. It accounts for around 2.45% of the world's land area and 4% of its water resources, but it also hosts 16% of the world's population. If population growth continues at its present rate of 1.9% per year, the population is expected to reach 1.5 billion by 2050. Water demand is expected to increase from 710 BCM in 2010 to over 1180 BCM in 2050, with households and companies using nearly 2.5 times as much water, according to the Planning Commission of the Government of India. India's growing urbanization is forcing local governments to provide hygienic conditions, safe drinking water, and infrastructure.

Ferrous Sulfate Market Players:

- Chemland Group

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Coogee

- Crown Technology, Inc.

- Kemira

- Merck KGaA

- Pencco, Inc.

- Rech Chemicals Co Ltd

- Thermo Fisher Scientific Inc.

- Venator Materials PLC

Ferrous sulfate market is expected to grow steadily due to its versatile properties and growing demand across several industries, particularly in advanced technology, agriculture, and pharmaceuticals. Resolving rivalry, raw material, and environmental difficulties while utilizing new market opportunities and technological advancements will be essential to future industry growth.

Here are some leading players in the ferrous sulfate market:

Recent Developments

- In November 2021, Kemira accomplished increasing the UK's ability to produce chemicals for water treatment that are based on iron. In addition to helping to ease the immediate problem of the water chemicals supply situation for the UK water sector, the yearly production is anticipated to expand by more than 100,000 tons annually.

- Report ID: 4985

- Published Date: May 22, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Ferrous Sulfate Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.