Ammonium Sulfate Market Outlook:

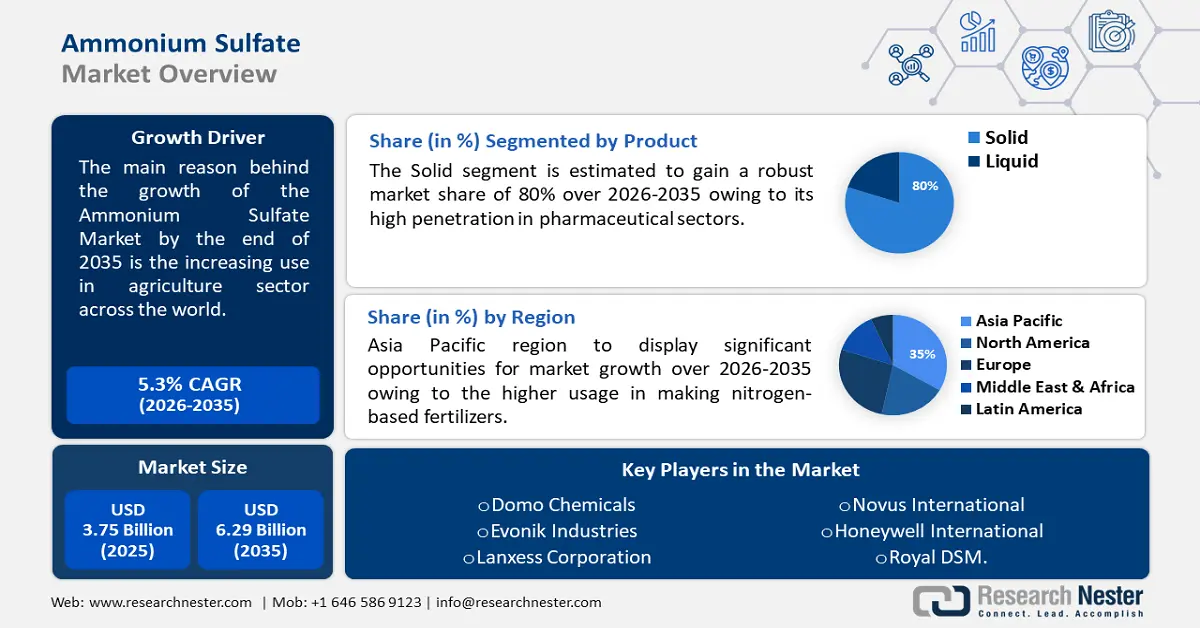

Ammonium Sulfate Market size was valued at USD 3.75 billion in 2025 and is expected to reach USD 6.29 billion by 2035, registering around 5.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of ammonium sulfate is evaluated at USD 3.93 billion.

Alongside creating a need for housing and commercial facilities, the growing population puts increased pressure on farmers to grow more crops on a limited amount of land. One of the main obstacles to crop production is the scarcity of agricultural land.

With 6.60 billion people on the planet in 2006, each person had 0.20 hectares of arable land. The number of people on the planet was 7.4 billion in 2016, and by 2020, each person's share of the land will have dropped to 0.19 hectares as per the Food and Agriculture Organization. It is commonly evaluated that the amount of arable land available globally will continue to diminish, leading to a rise in the usage of fertilizers that are intended to enhance output per hectare. It is projected that these factors will increase ammonium sulfate consumption.

Key Ammonium Sulfate Market Insights Summary:

Regional Highlights:

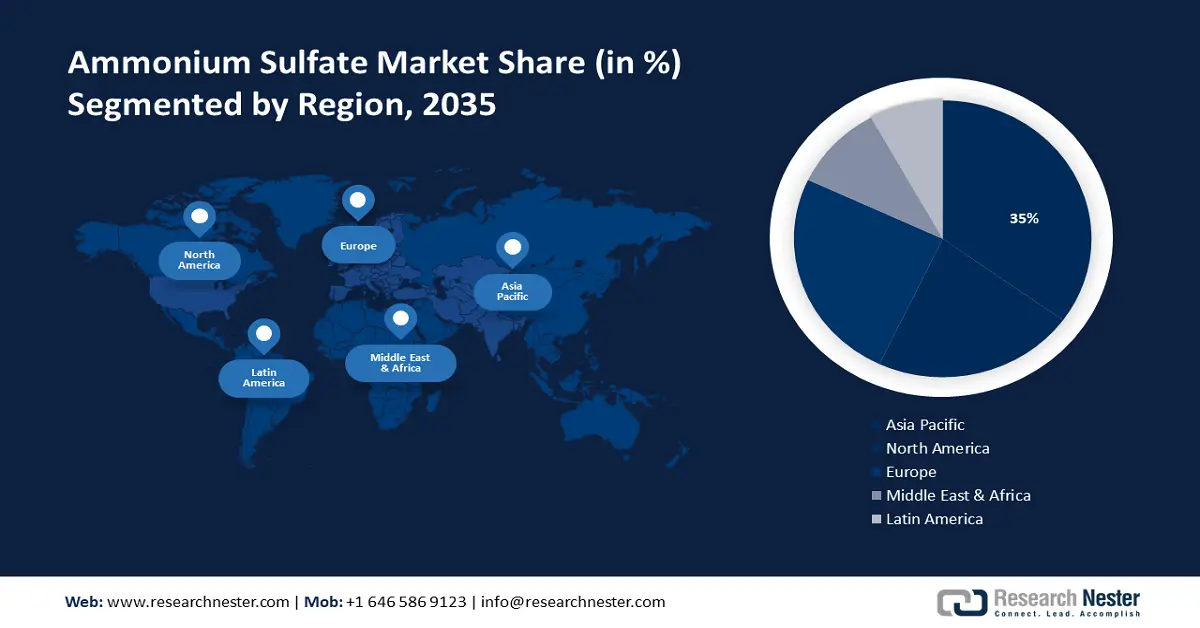

- Asia Pacific ammonium sulfate market will hold more than 35% share by 2035, driven by rapid economic growth, industrialization, and high agricultural fertilizer demand.

Segment Insights:

- Solid segment in the ammonium sulfate market is forecasted to achieve 80% growth by the forecast year 2035, driven by demand for solid fertilizers and pharmaceutical-grade purity.

- The fertilizers segment in the ammonium sulfate market is projected to experience lucrative growth till 2035, driven by rising fertilizer use in agricultural economies.

Key Growth Trends:

- High demand for agrochemicals

- Escalating demand for nylon fibers

Major Challenges:

- Harmful impact on the environment

- Toxic for humans

Key Players: Royal DSM, Honeywell International, Novus International, Lanxess Corporation, Evonik Industries, Domo Chemicals.

Global Ammonium Sulfate Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.75 billion

- 2026 Market Size: USD 3.93 billion

- Projected Market Size: USD 6.29 billion by 2035

- Growth Forecasts: 5.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, India, Germany, Japan

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 17 September, 2025

Ammonium Sulfate Market Growth Drivers and Challenges:

Growth Drivers

-

High demand for agrochemicals - Ammonium sulfate is an acidic fertilizer that acts quickly and is most effective on alkaline soils. Alkaline soil and ammonium-deficient soil can be re-fertilized with a nitrogen concentration of 20–25%. The need for food crops will rise as a result of population growth, which will propel the agrochemicals industry higher.

In 2020, the Food and Agriculture Organization (FAO) projects that around 160,492 million tonnes of ammonia would be used as fertilizer. Ammonium sulfate demand is expected to rise as a result of farmers using more nitrogen-containing fertilizers to boost crop yields. - Escalating demand for nylon fibers - Ammonium sulfate is a byproduct of caprolactam, which is primarily utilized in the manufacture of nylon fibers, and coke oven operations. The increasing demand for nylon fibers in the making of carpets, fishing nets, industrial fabric, and textiles has led to a rise in caprolactam production.

However, it is anticipated that product consumption will expand slowly, leading to an overstock in the in the upcoming years. The product's price has decreased as a result of this aspect. The global output of nylon, or polyamide, was 6.21 million metric tons in 2022.

Challenges

-

Harmful impact on the environment - Chemical and artificial components, which stimulate plant growth, are composed of fertilizers and a variety of agricultural inputs. In the long term, however, they are also detrimental to the environment.

-

Toxic for humans - The human is considered to be harmful to ammonium sulfate. Due to dust and aqueous aerosol inhalation, product exposure could result in serious respiratory infection at the place of processing, manufacture, or transport.

Diarrhea and long-term eye and lung damage may result from repeated contact with the skin. The expansion of the market is projected to be hampered by these obstacles.

Ammonium Sulfate Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.3% |

|

Base Year Market Size (2025) |

USD 3.75 billion |

|

Forecast Year Market Size (2035) |

USD 6.29 billion |

|

Regional Scope |

|

Ammonium Sulfate Market Segmentation:

Product Segment Analysis

Solid segment is likely to hold more than 80% ammonium sulfate market share by 2035. The growth of the segment can be attributed to the surge in demand for the solid category.

Ammonium sulfate crystals in solid form are frequently used as fertilizers in alkaline soils globally because they can improve soil nitrogen levels and address sulfur deficiency. It is expected that crystalline or solid grades will be selected by the pharmaceutical sector due to their purity.

Application Segment Analysis

Fertilizers segment in the ammonium sulfate market is estimated to showcase lucrative growth rate till 2035. Ammonium sulfate is broken down into ammonia, sulfur dioxide, sulphuric acid, nitrogen, and water in the soil.

Nitrogen and sulfur include ammonium sulfate content of 21% and 24% respectively which is a normal nutrient required for fertilizer. However, growth is foreseen to be driven by increasing consumption of fertilizers in agricultural economies.

Production Process Segment Analysis

In production process segmentation, the gypsum process segment in the ammonium sulfate market will hold a notable size in the upcoming years. The reaction of gypsum to ammonium carbonates in the manufacture of ammonia sulfate is a special method. The gypsum process has been chosen as the preferred choice for the production of this compound, which is suited to a wide range of industrial needs.

The market for ammonium sulfate are supported by other production methods. For example, caprolactam, coke oven gas, neutralization, and a number of alternative approaches along with the gypsum process. Gypsum is utilized in various domains numerous times on a large scale. In more than 90 countries over 110 million tons of gypsum is produced and processed.

Our in-depth analysis of the global market includes the following segments:

|

Product |

|

|

Application |

|

|

Production Process |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Ammonium Sulfate Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is expected to hold largest revenue share of 35% by 2035. The Asia-Pacific region is known for its rapid economic growth, industrialization, and expansion of key end-use sectors. Notably, rice plays a crucial role as a staple food across Asia. The Food and Agricultural Organization reports that approximately two billion people in Asia cultivate this crop, and it is a dietary staple for four billion individuals.

Many economies in this area, for instance, India, Bangladesh, and Sri Lanka, rely heavily on agriculture as their main economic activity. While the agricultural sector is advancing gradually, continuous progress is anticipated to create substantial opportunities for the growth of various fertilizers used in farming.

India's status as the largest consumer of pulses globally means it uses 27% of its total production, which constitutes 25% of the global production. Due to the growing population and limited agricultural land, farmers are facing increased pressure. As a result, there is a growing demand for fertilizers, leading to an increase in the demand for ammonium sulfate in the country.

High demand for ammonium sulfate in order to match the need for fertilizers and crop growing industry to propel the market expansion in China.

The high usage of nitrogen-based fertilizers in agricultural practices in Japan is evaluated to boost the demand for ammonium sulfate in the area.

European Market Insights

Ammonium Sulfate Market size for Europe region is estimated to grow substantially through 2035. The agriculture industry in Europe is exponentially growing due to ample land availability and favorable weather conditions. This leads to increased production of various crops, followed by the high demand for fertilizers. However, several organizations are implementing rules concerning synthetic fertilizers in the area. The European Commission has established multiple regulations governing the production and utilization of chemically produced fertilizers to minimize potential pollution of the soil and underground water sources in the region.

In 2022, the Commission intended to create an Integrated Nutrient Management Action Plan, expanding on the Zero Pollution Action Plan. This initiative is designed to improve coordination and focus on addressing nutrient pollution at its origin. Utilizing recovered nitrogen to replace inorganic fertilizers decreases CO2 emissions, while reclaimed phosphates lessen reliance on imported phosphate rock, and the remaining organic fractions can be utilized in local fields.

The growth in the United Kingdom can be attributed to the growing need for fertilizers in crop cultivation. Regulations related to the use of synthetic fertilizers are currently being implemented in the area.

There has been an increasing demand for fertilizers used in the cultivation of various crops, leading to the development of regulations for their use in Germany by multiple agencies.

Ammonium Sulfate Market Players:

- BASF SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Royal DSM

- Honeywell International Inc

- Novus International Inc

- Lanxess Corporation

- Evonik Industries AG

- Arkema S.A.

- Fibrant B.V.

- Domo Chemicals

Recent Developments

- Domo Chemicals has finalized the purchase of Solvay’s "Polyamide" business line, expanding its knowledge and product range in the industry.

- Evonik has successfully concluded a strategic agreement to supply blue sulfate, a high-quality nitrogen fertilizer designed specifically for the needs of American farmers. This collaboration allows Evonik to effectively meet the market's demands and improve agricultural productivity in the US.

- Report ID: 6205

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Ammonium Sulfate Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.