Sodium Hexametaphosphate Market Outlook:

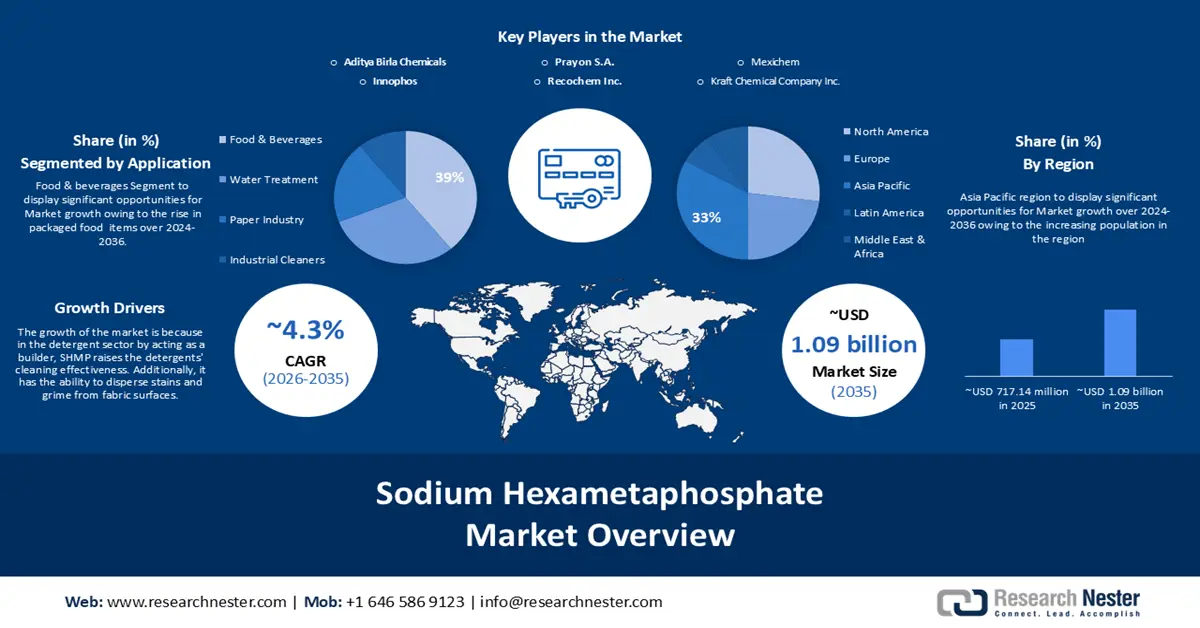

Sodium Hexametaphosphate Market size was over USD 717.14 million in 2025 and is anticipated to cross USD 1.09 billion by 2035, growing at more than 4.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of sodium hexametaphosphate is assessed at USD 744.89 million.

In addition, sodium hexametaphosphate is an extremely effective way to sequester alkali ions and aid in controlling red and black water. Due to this, the chemical sodium hexametaphosphate is in high demand in water treatment facilities, which is fuelling the market for sodium hexametaphosphate.

Key Sodium Hexametaphosphate Market Insights Summary:

Regional Highlights:

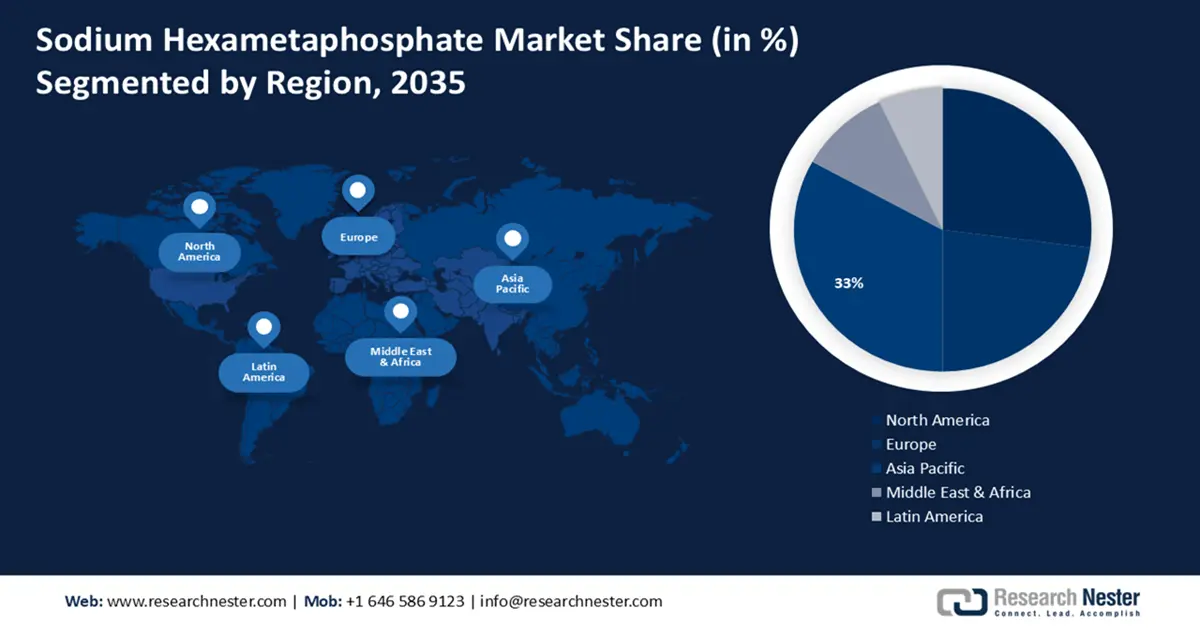

- By 2035, the Asia Pacific region is projected to secure a 33% share of the sodium hexametaphosphate market, supported by the rapid expansion of its food and beverage and chemical industries owing to rising population and income levels.

- North America is anticipated to command about 27% share during the forecast period, sustained by its broad industrial utilization of sodium hexametaphosphate in applications such as titanium dioxide processing and processed foods as urbanization accelerates.

Segment Insights:

- By 2035, the food and beverage segment is expected to capture a 39% share of the sodium hexametaphosphate market, underpinned by the rising adoption of SHMP in food packaging and preservation as demand for processed foods continues to escalate.

- The technical grade segment is projected to hold a 55% share during the forecast period, bolstered by increasing reliance on food-grade SHMP for enhancing product stability, texture, and safety compliance.

Key Growth Trends:

- Growing Utilization in the Food Sector Has Affected Market Demand

- Increasing Awareness of Water Treatment has Grown

Major Challenges:

- Health Issues Cause the Market to Trend Lower

Key Players: Kraft Chemical Company, Inc., Aditya Birla Chemicals, Mexichem, Prayon S.A., Innophos, Chongqing Chuandong Chemical (Group) Co.,Ltd, Israel Chemicals Limited (ICL), Yixing Tianyuan Chemical Co., Ltd., Recochem Inc., Hubei xingfa chemicals group co., LTD.

Global Sodium Hexametaphosphate Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 717.14 million

- 2026 Market Size: USD 744.89 million

- Projected Market Size: USD 1.09 billion by 2035

- Growth Forecasts: 4.3%

Key Regional Dynamics:

- Largest Region: Asia Pacific (33% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: Brazil, Indonesia, Vietnam, Mexico, South Korea

Last updated on : 27 November, 2025

Sodium Hexametaphosphate Market - Growth Drivers and Challenges

Growth Drivers

- Growing Utilization in the Food Sector Has Affected Market Demand- SHMP is used as a sequestrant, emulsifier, and texture modifier in the food business. The need for better food quality and stability, along with the expansion of the processed food industry, is driving the growing usage of SHMP in food applications. The demands of applications used in food processing have an impact on the demand for sodium hexametaphosphate, which is frequently employed in the food industry for a variety of functions. The usage of SHMP in a variety of applications has expanded as a result of the food processing industry's expansion, which has been fuelled by factors such as shifting customer preferences, the desire for convenience foods, and improvements in food technology. The food processing industry will probably continue to experience a strong need for additives like SHMP as food makers look to enhance the sensory qualities, shelf life, and quality of their products. The necessity for creative food formulations and adherence to food safety laws also have an impact on the food industry's adoption of SHMP.

- Increasing Awareness of Water Treatment has Grown- SHMP is widely applied in the purification of water. The need for water treatment chemicals, including SHMP, is driven by the growing need for clean water for both municipal and industrial applications. It aids in reducing the production of scale and managing water hardness. Scale deposits in water systems can be effectively avoided with SHMP. Scale build-up on the surfaces of boilers, pipes, and other water-handling machinery can result in damage and decreased efficiency. SHMP contributes to the upkeep of the effectiveness and integrity of water-related infrastructure by serving as a scale inhibitor.

- Increasing Their Capability of Producing Food Grade Sodium Hexametaphosphate- To meet the growing demand for sodium hexametaphosphate in food applications from the dairy, beverage, and other confectionary food industries, manufacturers of sodium hexametaphosphate are increasing their capability of producing food grade sodium hexametaphosphate. Sodium hexametaphosphate producers are strategically expanding, merging, or acquiring other companies to broaden their product offerings and grow within the worldwide hexametaphosphate industry. Particularly, the Asia Pacific area, which has the greatest need for sodium hexametaphosphate and growth prospects, has seen a number of recent acquisitions.

Challenges

- Health Issues Cause the Market to Trend Lower- The effects of some phosphates in food products on health may be a concern. Market dynamics may be impacted by health-related concerns or shifting consumer perceptions regarding food additives, even though SHMP is generally recognized as safe (GRAS) when used within specified limits. The negative impact that consuming high concentrations of food-grade sodium hexametaphosphate can have on humans is what limits its use. Because pancreatic cancer and kidney issues have been linked to higher sodium hexametaphosphate consumption, people may be discouraged from purchasing food products that include this addition. Consequently, the sodium hexametaphosphate market will have a downward trend.

- Manufacturing facilities that produce sodium hexametaphosphate are now running at lower production rates due to the lockdown and social separation measures. The market's availability of sodium hexametaphosphate has been adversely impacted by this.

- The market for technical grade sodium hexametaphosphate restricts the availability of other polymeric phosphates with comparable chemical characteristics that can serve as sodium hexametaphosphate substitutes.

Sodium Hexametaphosphate Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.3% |

|

Base Year Market Size (2025) |

USD 717.14 million |

|

Forecast Year Market Size (2035) |

USD 1.09 billion |

|

Regional Scope |

|

Sodium Hexametaphosphate Market Segmentation:

Application Segment Analysis

Based on application, the food and beverage segment led the global sodium hexametaphosphate market with a revenue share of 39% during the forecast period. The market is expected to rise as food packaging becomes more and more popular. Sodium hexametaphosphate is used to increase the final product's shelf life. There are numerous uses for sodium hexametaphosphate outside of the food and beverage sector. The ready meal segment of the Indian packaged goods market had sales worth 172.6 million US dollars in 2021. Moreover, Sodium hexametaphosphate (SHMP) is a chemical with multifaceted uses in the food industry and other industrial settings because of its ability to act as an emulsifier, sequestrant, and water treatment agent. In addition to these qualities, the food business requires ingredients with the ability to texturize, emulsify, and thicken. As a result of its use in the food sector for the aforementioned purposes, sodium hexametaphosphate has witnessed a sharp increase in demand.

Grade Segment Analysis

Based on grade, the technical grade segment is predicted to account for 55% share of the global sodium hexametaphosphate market during the forecast period. It is projected that the food and beverage industry's growing need for food-grade sodium hexametaphosphate will propel market expansion. Because of its capacity to enhance the texture, stability, and shelf life of a variety of food products, it is frequently employed as a food additive. Food items can benefit from its sequestrant, emulsifying, and water-biding properties, which can improve their overall quality and attractiveness. Furthermore, food grade sodium hexametaphosphate's safety certifications and regulatory approval are essential to its market expansion. Food grade sodium hexametaphosphate satisfies the high quality and safety standards that consumers and food manufacturers consider when using additives.

Our in-depth analysis of the global sodium hexametaphosphate market includes the following segments:

|

Grade |

|

|

Form |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Sodium Hexametaphosphate Market - Regional Analysis

APAC Market Insights

Asia Pacific industry is set to account for largest revenue share of 33% by 2035, The growing food and beverage industry in the Asia Pacific region is driving the market. Due to factors including population growth, increased disposable incomes, the expansion of the middle class, and rising demand for processed foods, the food and beverage industry is experiencing a boom in the emerging nations of the region. With 4.3 billion people living there, or 60% of the world's population, the Asia-Pacific area is home to China and India, the two most populous nations on earth. Moreover, the expansion of the chemical and petroleum industries in the Asia Pacific area as a whole is also responsible for the rise of the sodium hexametaphosphate sector.

North American Market Insights

The sodium hexametaphosphate market in North America is projected to hold the second-largest revenue share of about 27% during the forecast period. Numerous products, including paints, plastics, and paper, include titanium dioxide. It raises the product's quality in the manufacturing of titanium dioxide. The processed food sector is expanding as a result of Asia Pacific's urbanization and expanding population. It serves as an emulsifier, thickener, and preservative in processed foods.

Sodium Hexametaphosphate Market Players:

- Kraft Chemical Company, Inc.,

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Aditya Birla Chemicals

- Mexichem

- Prayon S.A.

- Innophos

- Chongqing Chuandong Chemical (Group) Co.,Ltd

- Israel Chemicals Limited (ICL)

- Yixing Tianyuan Chemical Co., Ltd.

- Recochem Inc.

- Hubei xingfa chemicals group co.

Recent Developments

- Food Grade Sodium Hexametaphosphate [SHMP] production capacity at Prayon is increased by 10 kt. Food Grade Sodium Hexametaphosphate (SHMP) manufacturing is invested in by Prayon, a global leader in phosphate chemistry. This initiative will assist the global expansion of the Group and is a component of Prayon's growth strategy across multiple industries, including food additives, water treatment, and industrial applications.

- CHEMCON and Aditya Birla Chemicals collaborate on their Platinum Jubilee Edition. The Platinum Jubilee Edition of the Annual Session of Chemical Engineers and the 75th Chemical Engineering Congress (CHEMCON) were held December 27–30, 2022, at Harcourt Butler Technical University in Kanpur. The Indian Institute of Chemical Engineers (IIChE) Kanpur Region organized the conference, which had the theme "Sustainability in Chemical Processes through Digitalization, Artificial Intelligence, and Green Chemistry."

- Report ID: 5752

- Published Date: Nov 27, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Sodium Hexametaphosphate Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.