Dimethyl Phosphate Market Outlook:

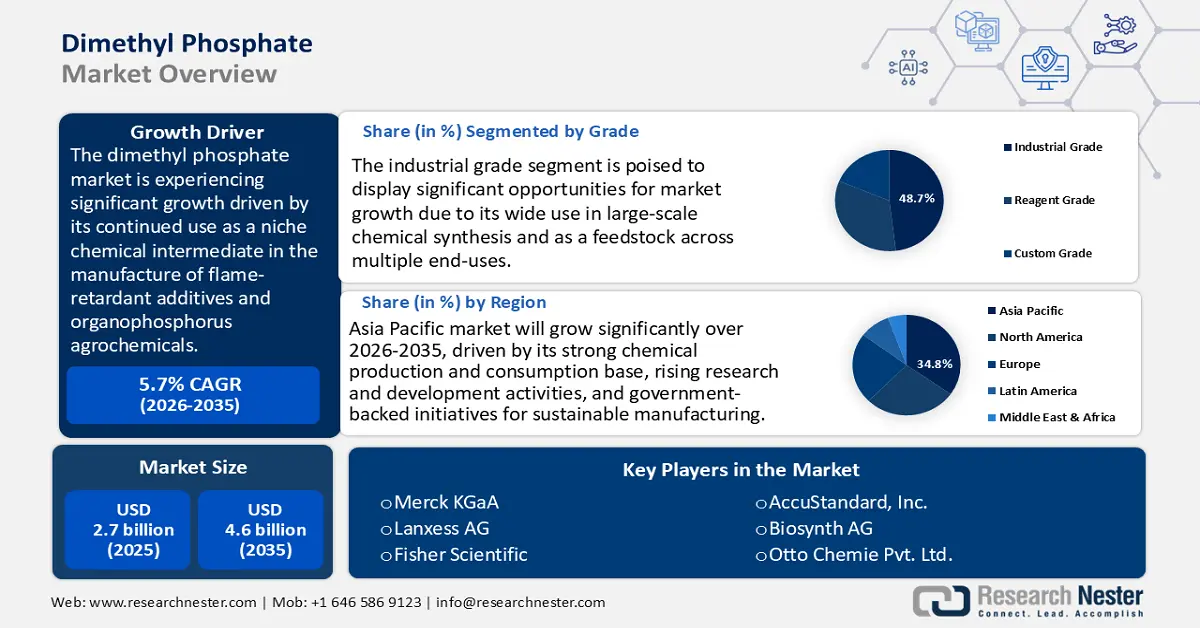

Dimethyl Phosphate Market size was valued at USD 2.7 billion in 2025 and is projected to reach USD 4.6 billion by the end of 2035, rising at a CAGR of 5.7% during the forecast period, from 2026 to 2035. In 2026, the industry size of dimethyl phosphate is estimated at USD 2.9 billion.

The dimethyl phosphate market is expected to grow at a significant pace over the forecast period, primarily driven by its continued use as a niche chemical intermediate in the manufacture of flame-retardant additives and organophosphorus agrochemicals. Dimethyl hydrogen phosphite, according to the IARC Monograph No. 133 (2024), is an organophosphorus compound that has been widely used as an intermediate in the formulations of flame retardants and specialty chemicals. Its status is still above the phrase "not classifiable as to carcinogenicity in humans in view of an ongoing monitoring of its industrial relevance. The historical baseline evidence demonstrates the ongoing relevance of the chemical across multiple downstream industries where reliable performance and regulatory compliance are essential.

Chemical risk management and technical estimation also indicate dimethyl hydrogen phosphite's constant usage as an intermediate for flame retardants, pesticides, lubricant additives, and corrosion inhibitors, indicating its continued relevance as an industrial chemical in high-performance and compliance-driven applications. In addition, the U.S. International Trade Commission's industry analyses of the chemicals sector provide evidence of the perseverance of phosphate intermediates in broader industrial production chains, consistent with their continued role in supply-demand balance.

According to the U.S. International Trade Commission, U.S. trade of "Chemicals & Related Products" in 2022 was USD 326.4 billion, and decreased slightly to USD 322.5 billion in 2023-2024. These amounts represent the size of cross-border shipments in which these intermediates, such as dimethyl phosphate, are embedded, serving assembly lines and end-use applications around the world. Government regulation-for example, the U.S. EPA’s enforcement of the Toxic Substances Control Act (TSCA) Chemical Substance Inventory, ensures that phosphate esters, whether manufactured, processed, or imported, are registered with the Agency and subject to safety and environmental reporting, reinforcing compliance within the industrial supply chain. On the innovation front, US GAO stresses public-private partnership in chemical R&D and advanced analytical capabilities, and states that federal investment in chemical analytics infrastructure enhances competitiveness and better risk management in the deployment of intermediates such as dimethyl phosphate.

Key Dimethyl Phosphate Market Insights Summary:

Regional Highlights:

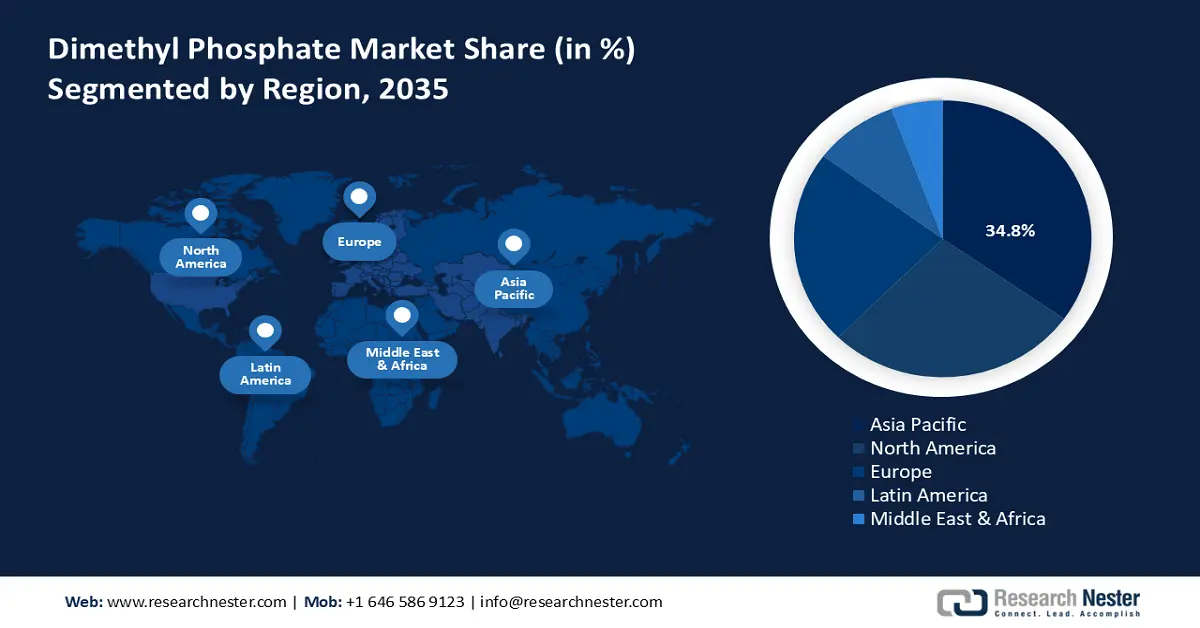

- The Asia Pacific dimethyl phosphate market is anticipated to lead with a 34.8% revenue share from 2026 to 2035, supported by strong regional chemical production, rising R&D expenditure, and expanding investments in sustainable manufacturing.

- The North American region is projected to secure a 27.6% share by 2035, owing to robust chemical manufacturing infrastructure and increasing adoption of phosphorus-based intermediates under green chemistry initiatives.

Segment Insights:

- The industrial-grade segment in the dimethyl phosphate market is projected to command a 48.7% revenue share by 2035, propelled by its extensive utilization in large-scale chemical synthesis and as a feedstock across diverse end-use industries.

- The agrochemical intermediates segment is expected to account for 45.2% of the market share by 2035, driven by rising demand for DMP in manufacturing organophosphorus pesticides amid steady growth in global agricultural production.

Key Growth Trends:

- Agrochemicals demand

- Innovations in catalytic technologies

Major Challenges:

- Infrastructure restrictions in emerging markets

- Producer price volatility

Key Players: Merck KGaA (Germany), Lanxess AG (Germany), Fisher Scientific (Thermo Fisher / Alfa Aesar) (USA), AccuStandard, Inc. (USA), Biosynth AG (Switzerland), Otto Chemie Pvt. Ltd. (India), Clearsynth (India), Toronto Research Chemicals (TRC) (Canada), BLDpharm (China), Alfa Chemistry (USA), Chem Supply (Australia).

Global Dimethyl Phosphate Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.7 billion

- 2026 Market Size: USD 2.9 billion

- Projected Market Size: USD 4.6 billion by 2035

- Growth Forecasts: 5.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (34.8% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: China, India, United States, Germany, Japan

- Emerging Countries: South Korea, Brazil, Indonesia, Mexico, Vietnam

Last updated on : 5 September, 2025

Dimethyl Phosphate Market - Growth Drivers and Challenges

Growth Drivers

- Agrochemicals demand: Dimethyl phosphate (DMP) is an important intermediate in the production of organophosphorus-based pesticides and herbicides, making it a direct, though indirect, foot in the door to agricultural input procurement markets. The U.S. Department of Agriculture (USDA) reports the United States used 3.73 million tons of active ingredients and pesticides globally in 2023, indicating continued use of these in crop protection with a 4% rise over a decade. Furthermore, the mean application intensity in 2023 was 2.40 kg/hectare, and the quantity of traded pesticides to reach other market sizes was 6.7 million tons of formulated products. All these figures clearly indicate that the usage of such substances in the crop protection industry remains strong. With global food demand predicted to increase by 35-56% by 2050, pressure on the agrochemical sector intensifies to ensure that productivity increases are met in a manner that is sensitive to ever more stringent regulations around the environment. In addition, pesticide intermediates are and continue to be regulated by REACH with the European Chemicals Agency (ECHA) to achieve compliance in European markets. As a result, in spite of the increasing compliance cost due to the more stringent regulatory compliance, the fundamental role of DMP in ensuring agricultural yields makes it a resilient demand contributor in the agrochemical value chain.

- Innovations in catalytic technologies: The dimethyl phosphate (DMP) market is becoming highly competitive, and new developments in catalytic technologies have been providing tangible results in terms of enhancement in the production procedures. The IEA Technology Roadmap (2021) on catalytic processes makes clear that if net carbon and energy efficiencies across the chemical sector's catalytic processes are increased, further reductions of energy intensity per tonne of heat delivered by 20% to 40% could be achieved by 2050, resulting in up to 13 exajoules of energy and 1 Gt of greenhouse gas emissions avoided each year, compared to business-as-usual. Catalysts are a key element within the area of energy efficiency; the interest in catalysts is underestimated, as the majority of processes leading to chemical products are intrinsically catalytic. Short-term application of best practice technologies could achieve significant savings, and future disruptive and game-analysis catalytic technologies offer even greater reduction in energy use and emissions. In addition to lowering operating costs, these advances in technology have helped operators achieve compliance with increasingly strict environmental regulations in the EU and the U.S.

- Demand from the specialty & performance chemicals market: The specialty chemicals requiring dimethyl phosphate (DMP) as an additive in coatings, plastics, and polymers are witnessing strong growth. According to a World Bank report, global chemicals sales were projected to increase from USD 4.3 trillion in 2019 to USD 7.3 trillion by 2030, driven largely by growth in emerging markets such as Asia-Pacific, South Asia, Africa, the Middle East, and Latin America. Capital investment of approximately USD 3.6 trillion is expected to support this expansion, with around half allocated to China and nearly USD 1 trillion targeted for other emerging markets. Phosphate esters have become useful as flame-retardants and performance-modifiers in the electronics field. The U.S. Semiconductor device and Components manufacturing industry consisted of 2,545 establishments with 202,029 employees in 2024. Employers shipped USD 52.7 billion of semiconductors and related devices in 2018, to USD 58.7 billion in 2021. The development of this industry is contributing to the market of certain polymers and coatings, including phosphorus intermediates. This integration in DMP of high-performance applications becomes a key supply chain element, leading to sustained demand in line with the industry and technological development.

Trade Dynamics of Dimethyl Methylphosphate

Dimethyl methylphosphonate (DMMP) trade directly influences the dimethyl phosphate market through shared feedstocks, flexible production lines, and overlapping applications. When DMMP exports rise, producers divert key intermediates like POCl₃ toward DMMP, reducing DMP output and firming prices. Regulatory constraints or trade barriers on DMMP often shift downstream buyers toward DMP, boosting its demand. As a result, fluctuations in DMMP trade act as a key driver shaping supply, pricing, and regional demand for dimethyl phosphate market.

Leading Importers and Exporters of DMMP (2023)

|

Country |

Import Value (in USD million) |

Country |

Export Value (in USD million) |

|

Canada |

4.13 |

China |

7.52 |

|

Germany |

1.55 |

Canada |

1.52 |

|

Italy |

1.5 |

Belgium |

1.44 |

Source: OEC

Challenges

- Infrastructure restrictions in emerging markets: Dimethyl phosphate (DMP) manufacturers find significant constraints in locations that do not have state-of-the-art chemical safety infrastructure. According to the OECD report, hazardous waste management is also problematic in low- and middle-income countries where there is limited infrastructure, treatment facilities, and monitoring systems. These hindrances lead to inefficient waste management, greater environmental risks, and higher operating costs than in OECD countries. Such a shortage puts a stop to any consideration of phosphorus-based intermediates like DMP, as suppliers have to invest in an extra set of in-house safety and conformance systems to comply with export demands. For example, many Asian and African producers have bottlenecks in wastewater treatment, which slow down the time for product approvals and hurt export competitiveness. Until significant infrastructure developments are made, these areas will remain behind in their DMP manufacturing capabilities, and supply imbalances will exist, with the developed markets still holding sway over world trade flows.

- Producer price volatility: Producer Price Volatility is a significant impediment for DMP producers, given the volatility of the raw material and energy prices. U.S. Bureau of Labor Statistics (BLS) July 2025 Producer Price Index Report says that final demand goods rose by 0.7% in July 2025, and intermediate demand processed goods also rose 0.8%, which is the biggest improvement since January 2025. This results in rising input costs for raw materials such as diesel fuel, industrial electric power, and other chemicals contribute to higher production expenses, which can increase prices for DMP and related products and directly pressure margins for DMP producers, especially those who do not secure long-term supply contracts. Smaller suppliers, in the lack of scale economies, are more likely to pass the cost increases downstream, undermining competitiveness, particularly in price-sensitive markets. In contrast, larger global players hedge through integrated supply chains, but even they are squeezed when energy costs spike even greater than they are now. The volatility is the long-term pricing being weak, and the continuous fluctuation gives DMP makers a headache in terms of strategic planning.

Dimethyl Phosphate Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.7% |

|

Base Year Market Size (2025) |

USD 2.7 billion |

|

Forecast Year Market Size (2035) |

USD 4.6 billion |

|

Regional Scope |

|

Dimethyl Phosphate Market Segmentation:

Grade Segment Analysis

The industrial-grade segment in the dimethyl phosphate market is expected to grow with the highest revenue share of 48.7% over the forecast years from 2026 to 2035, attributed to its wide use in large-scale chemical synthesis and as a feedstock across multiple end-uses. Several industry forecasts, from providers such as the OECD, point to strong fossil feedstock demand; the chemical sector alone is expected to supply more than one-third of total oil demand growth through 2030 and almost 50% by 2050, emphasizing volume requirements for intermediates such as DMP well into the future. These ties industrial-scale supremacy in that large production sites prioritize cheap bulk intermediary supply. Industrial grade DMP continues to hold a revenue position of its own with petrochemicals as a supportive but not insignificant backbone of a growing economy.

High-purity DMP is the primary raw material for the bulk synthesis of chemicals by phosphorus-based synthesis procedures and as an intermediate in the production of phosphorus-based compounds. OECD indicated that primary chemical production is expected to grow by about 30% by 2030, and almost 60% by 2050, making it evident that the demand for chemical intermediates such as DMP in petrochemical and fertilizer value chains remains high. In parallel, as the flame-retardant feedstock, DMP's role in fire-resistant polymers and coatings is aligned with increasing safety regulations in the building & electronics sectors, although no specific quantitative DMP-specific data points are available under publicly available datasets. Together, the two applications are industrial-grade revenue anchors that merge mass synthesis utility with end-use safety-critical demand.

Application Segment Analysis

The agrochemical intermediates segment is anticipated to grow with a notable dimethyl phosphate market share of 45.2% during the projected years, owing to DMP's contribution to the manufacturing of agrochemicals such as organophosphorus pesticides. World agricultural production is forecast to grow steadily over the coming decade. The USDA and FAO project that global agricultural and fish production will grow by 14%, which translates into greater demand for crop-protection inputs. Agrochemical manufacturers are expected to work closely with DMP as it is an essential raw material for most of them and outshine competitiveness, which is set to further boost the market share of agrochemical intermediates.

Dimethyl Phosphate (DMP) is a major organophosphate precursor used for both pesticide precursors and herbicide intermediates, linking the basic needs of both crop protection-related vendors. The presence of these intermediates in agriculture indicates wide-scale regulated use, as, according to the USDA's Pesticide Data Program (2023), pesticide residues in over 99% of food commodities sampled were at toxin levels below any benchmark established by the Environmental Protection Agency (EPA). At the same time, as per the fertilizer statistics of the FAO, the global phosphorus fertilizer consumption was about 46 million tonnes in 2021, which also proved that P-based intermediates played a pivotal role in both plant protection and soil fertility functions.

End use Industries Segment Analysis

The chemicals end-use segment is expected to grow at a significant dimethyl phosphate market share of 40.8% from 2026 to 2035. The popularity and registrations of DMP are higher than average for specialty chemicals because DMP is incorporated into these products. OECD chemical trade statistics and innovation data highlight a sustained competitive pressure, and innovation in specialty chemicals is still a significant fraction of total global chemical trade. As DMP is used in the formulation of specialty chemicals, it is expected to continue to play its significant role in areas such as construction, coating, and advanced materials, thus contributing a large share to the chemicals sector.

Our in-depth analysis of the dimethyl phosphate market includes the following segments:

|

Segment |

Subsegments |

|

Grades |

|

|

Application |

|

|

End-use Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Dimethyl Phosphate Market - Regional Analysis

Asia Pacific Market Insights

Asia Pacific is expected to hold the dominant position within the dimethyl phosphate market with the largest revenue share of 34.8% from 2026 to 2035, supported by the region's leading chemical production and consumption on the global level. As per the India Ministry of Chemicals and Fertilizers Annual Report 2022-23, the Asia Pacific continues to be a leading participant in the chemical industry globally with important production as well as consumption capacities in the region, including by China, India, Japan, and South Korea. These trends entrench the region's growth in intermediates like dimethyl phosphate (DMP), a common feed for agrochemicals, flame retardants, and specialty chemicals, driving the market as well as innovation in the region. The region is providing a strong force to the growing demand, which can be attributed to fast-moving industrialization, heavy investments in green chemistry, and increasing expenditure on research and development. Asia has a globally leading R&D place again in terms of expenditure, with its R&D spending in 2023 at 46% globally, further cementing its place as a world innovation leader, with the Southeast Asia, East Asia, and Oceania region shown by far as the top R&D spending area. As the Asia and Europe R&D instability global map indicates, the region tops the list with the world's largest R&D investment on account of a relatively larger degree of R&D investment across industries such as chemical manufacturing. Government-enforced programs focused on sustainable manufacturing, environmental regulations, and next-generation manufacturing are providing the right environment for DMP introduction.

China's dimethyl phosphate market is projected to lead the Asia Pacific region with a substantial revenue share over the projected years by 2035, driven by its status as the world's largest chemical producer and consumer. China was responsible for more than 45% of total global chemical sales in 2022, with major investments into state-of-the-art chemical production capability. The policies of the Green Development in the 14th Five-Year Plan of the Chinese Government pay attention to lowering hazardous emissions and pursuing sustainable chemical processes. In addition, China has spent more on clean manufacturing, with R&D expenditure exceeding 3 trillion yuan (about $456 billion), accounting for 2.55% of GDP in 2022. This interest in modernization and environmental compliance is throwing DMP into a pivotal role as an intermediate for China's agrochemical, flame retardant, and specialty chemical industries.

India’s dimethyl phosphate market is predicted to grow with the fastest CAGR in the Asia Pacific region over the projected years, owing to the rising demand for intermediates, DMP in pesticide and herbicide manufacture, in India's agrochemical industry. India ranks fourth in the world as a producer of agrochemical products, and for these products, the demand is bound to increase in front of the rising demand for food security in the country. Long-term specialized commitment, with government policy including multiple benefits like the Production Linked Incentive (PLI) Scheme for Chemicals and subsidies by the Department of Fertilizers, is expected to foster local manufacturing and help decrease import dependency. India’s chemical industry attracted approximately USD 22.8 billion of Foreign Direct Investment (FDI) between April 2000 and September 2024. This sustained FDI growth highlights India as a high-potential host market for Dimethyl Phosphate (DMP) and other chemical intermediates through 2035.

North America Market Insights

The North American dimethyl phosphate market is projected to grow significantly with a revenue share of 27.6% over the forecast years by 2035, characterized by strong regional chemical integration, and in which cross-industry demand by automotive, textiles, and agrochemicals significantly contributes to the size of local markets. North America’s chemical production was dominated by key sectors such as Petroleum and Coal Products Manufacturing (64% of production volume) and Chemical Manufacturing (14%), with over 5,000 sites reporting chemical production. Key chemicals such as ethylene, propane, and sulfuric acid ranked high in production volumes, reflecting strong industry activity. This robust chemical manufacturing landscape supports the growing demand for flame-retardant intermediates and eco-friendly lubricant additives in the region. Furthermore, increasing adoption in clean manufacturing under the concept of green chemistry and circular economy measures is boosting demand for phosphorus-based intermediates in the North and Central America regions. In addition, increasing safety requirements under the OSHA and EPA regulations are also raising compliance costs; however, is fueling innovation in safer chemical synthesis. These factors are likely to strengthen North America's dominance as a pivotal region in the global market by 2035.

The U.S. dimethyl phosphate market is anticipated to dominate the North American region during the projected years, attributed to the country's strong chemical industry, worth USD 486 billion, constituting more than 25% of the country's GDP, with 529,000 people directly employed in this industry. In addition, strong demand for intermediates as DMP for agrochemicals and performance materials, environmental performance has also improved, air emissions of TRI-listed chemicals decreased 32% between 2014 and 2023, while the manufacturing sector GDP increased by 13%, indicating that cleaner production capabilities are consistent with the uptake of DMPs. The U.S. is also the world's top producer of chemicals-believed to make nearly 12% of the world's chemicals. Market potential is supported by a series of capital investments, particularly in the area of sustainable chemistry and high-purity intermediates. Taken collectively, this environment of scale, regulatory momentum, and green practices sets the stage for the U.S. DMP market, where sustainable growth is likely promoted and the rate of sustainable growth is stable.

By 2035, the dimethyl phosphate market in Canada is likely to grow steadily due to the presence of a chemical manufacturing environment in Canada, which registered shipments of CAD 74.9 billion in 2023, of which industrial chemicals declined by shipments of CAD 31.9 billion in the same period. Canadian manufacturing of industrial chemicals increased significantly in 2023, with ethylene production at a record 5.1 million tonnes (+5.4%), and polyethylene production also increased by 5.8% to 3.8 million tons. The chemical sector is projected to grow steadily as demand for chemical intermediates that are widely used in agrochemicals and flame-retardant formulations is rising. However, supply chain vulnerabilities remain, and reliance on rail logistics introduces certain risks, with a total of 2.3 million railcars of chemicals and plastics shipped across the country in 2022. Additionally, to balance industrial development with sustainable operations, the Chemicals Management Plan for Canada puts stringent risk characterization in place and embeds safer production practices, all of which directly impact the market development for intermediate chemicals, such as DMP.

Europe Market Insights

Europe’s dimethyl phosphate market is expected to grow with an upward trend over the forecast period, influenced by stringent environmental and chemical safety regulations serving the framework of the European Union's Registration, Evaluation, Authorization and Restriction of Chemicals (EU REACH) legislation that regulates chemical intermediates with respect to production, import, and use. Europe accounted for the second-largest global market with regard to sales (EUR760 billion in 2022) in the entire region of the chemical industry. The increasing need for flame-retardant intermediates and agrochemical precursors has been corroborated by the EU-wide ambitions under the Green Deal to be climate-neutral by 2050, with a central focus on sustainable chemical innovation. Within Europe, after Brexit, the UK REACH regulation in the United Kingdom for difference from the Swedish REACH; local compliance and testing are required, which increases operational costs in it, but also opens the UK market to investment for local producers. In contrast, Germany, as the largest chemical-producing nation in Europe, made up more than a quarter of the EU's chemical sales in 2022, and has invested notably in advanced industrial-grade intermediates as feedstocks to support its automotive and specialty chemicals industries.

Key Dimethyl Phosphate Market Players:

- Merck KGaA (Germany)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Lanxess AG (Germany)

- Fisher Scientific (Thermo Fisher / Alfa Aesar) (USA)

- AccuStandard, Inc. (USA)

- Biosynth AG (Switzerland)

- Otto Chemie Pvt. Ltd. (India)

- Clearsynth (India)

- Toronto Research Chemicals (TRC) (Canada)

- BLDpharm (China)

- Alfa Chemistry (USA)

- Chem Supply (Australia)

The dimethyl phosphate market features a dispersion of proficient and specific globe suppliers, including compound specialists such as Merck KGaA and Lanxess, and Thermo Fisher, along with Asian manufacturers of DMP, for example, TCI, FUJIFILM Wako, and Apollo Scientific. The competition in the market is anticipated to be driven by pure capabilities, approval for different regulations, and reach across emerging markets. Strategic efforts include environmental regulation-based capacity alignment, branding of high-purity reagents, and upscaling in agrochemical and flame-retardant market segments. Supply-a growing demand for green chemistry certification, driven by investments in safer production and enhanced chemical stewardship; able to lead on new markets.

Top Global Dimethyl Phosphate Market Manufacturers:

Recent Developments

- In March 2025, LANXESS AG presented the latest additions to the portfolio of a sustainable, high-performance solution offering for the paint and coating industry at the European Coatings Show (ECS) in Nuremberg. Products were displayed that included eco-efficient iron oxide yellow pigments (Scopeblue range, up to 35% lower product lifecycle carbon footprint than traditional products) and a full range of green fillers such as colorants, plasticizers, coalescents, flame retardants, preservatives, and solvents. The event also included the company's hygiene concept "Control-Detect-Prevent" (CDP) for industrial plants as well as non-biocidal ad-active ingredients such as Klarix XIT for clean paint production. These new compound technologies highlight LANXESS's focus on sustainable performance and regulatory compliance in chemicals for coatings.

- In March 2024, Azelis established an exclusive distribution agreement with LANXESS under which the phosphorus-based polymer additives of each would be marketed and sold under the Azelis trademark in the United States. The transaction encompasses well-established brands, including Disflamoll, Levagard, Amgard, Reofos, and Emerald Innovation, which are extending Azelis' portfolio in the CASE (Coatings, Adhesives, Sealants, Elastomers) market. The partnership builds on Azelis' technical service presence in its Americas application laboratories, and supports industry segments such as construction, electronics, and transportation. By combining flame-retardant solutions with low flammability, low smoke, and compliance with the Regulations, the collaboration set both companies up to harness growing demand for safety-driven applications in 2024.

- Report ID: 8067

- Published Date: Sep 05, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Dimethyl Phosphate Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.