Phosphate Fertilizers Market Outlook:

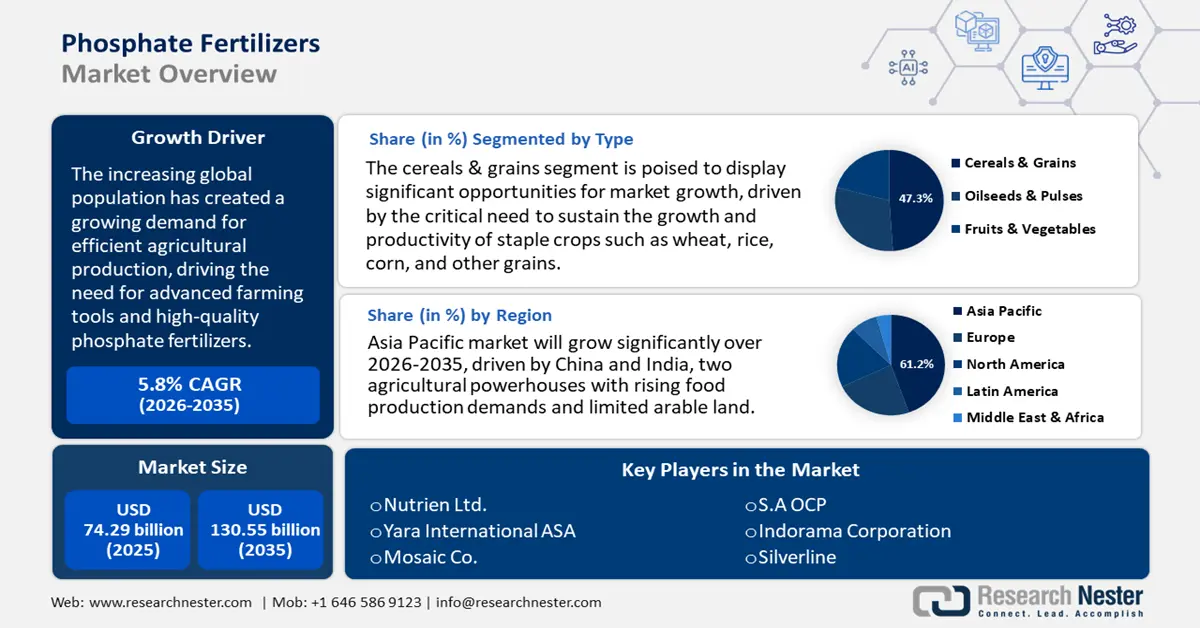

Phosphate Fertilizers Market size was valued at USD 74.29 billion in 2025 and is set to exceed USD 130.55 billion by 2035, expanding at over 5.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of phosphate fertilizers is estimated at USD 78.17 billion.

The increasing global population has created a growing demand for efficient agricultural production, driving the need for advanced farming tools and high-quality phosphate fertilizers. Among these, compound phosphate fertilizers such as Diammonium Phosphate (DAP), Monoammonium Phosphate (MAP), and NPK blends play a crucial role in improving crop yields and sustaining agricultural productivity. The reduction in arable land due to urbanization and environmental degradation has intensified the need for nutrient-rich fertilizers that can maximize output from limited agricultural areas.

Phosphorus is a key nutrient required for plant development, aiding in root growth, flowering, and overall crop productivity. However, phosphorus is often depleted faster through harvesting than it can be naturally replenished in the soil. This imbalance necessitates the application of soluble phosphorus fertilizers to maintain soil fertility and ensure consistent agricultural output. Innovations in precision farming and the growing adoption of efficient irrigation methods like drip and sprinkler systems are further supporting the market growth of phosphatic fertilizers, as they enhance nutrient delivery and reduce wastage.

Nutrien Ltd. stands out as a prominent key player in this sector, being one of the largest global suppliers of agricultural inputs and services. Nutrien supplies a range of high-performance phosphate fertilizers, supporting sustainable farming practices and helping farmers optimize yields. Through continuous investment in research and development, companies like Nutrient are enhancing fertilizer efficiency and promoting responsible phosphorus management to meet the growing food demand while preserving environmental health. Efficient phosphorus fertilizer use remains a cornerstone for modern agriculture, ensuring food security and the long-term viability of farming options.

Key Phosphate Fertilizers Market Insights Summary:

Regional Highlights:

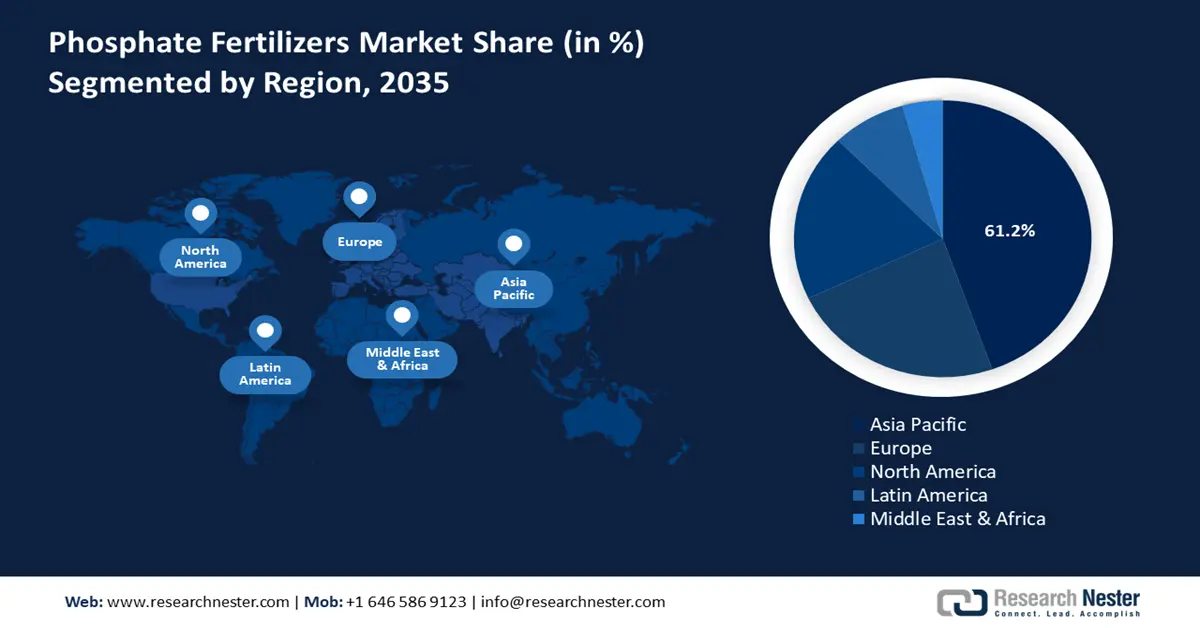

- Asia Pacific leads the Phosphate Fertilizers Market with a 61.2% share, driven by rising food production demands in China and India, with a focus on maximizing crop yields and sustainable agricultural practices, ensuring strong growth through 2035.

Segment Insights:

- The Cereals & Grains segment is expected to achieve 47.3% market share by 2035, fueled by the critical need to sustain growth and productivity of staple crops.

- Monoammonium Phosphate (MAP) segment is expected to achieve a significant share by 2035, driven by its balanced nutrient composition and versatility across crops.

Key Growth Trends:

- Rising global food demand

- Growth in precision and smart farming

Major Challenges:

- Finite phosphate rock and reserves

- High production and transportation costs

- Key Players: Eurochem Group AG, Nutrien Ltd., Yara International ASA, Israel Chemicals Ltd., Coromandel International Ltd., The Mosaic Co., S.A OCP.

Global Phosphate Fertilizers Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 74.29 billion

- 2026 Market Size: USD 78.17 billion

- Projected Market Size: USD 130.55 billion by 2035

- Growth Forecasts: 5.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (61.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Russia, Brazil, Canada

- Emerging Countries: China, India, Brazil, Russia, Mexico

Last updated on : 12 August, 2025

Phosphate Fertilizers Market Growth Drivers and Challenges:

Growth Drivers

- Rising global food demand: As the global population continues to increase, the demand for food creates immense pressure on agricultural systems to increase productivity. Farmers are now more reliant on efficient and sustainable farming practices to meet the growing food needs of both urban and rural populations. One of the key solutions to this challenge is the use of high-quality fertilizers, particularly phosphate-based fertilizers, which are necessary for root development, energy transfer, and overall plant health.

Phosphate fertilizers such as Diammonium Phosphate (DAP) and Monoammonium Phosphate (MAP) play a vital role in improving crop yields by supplying readily available phosphorus. This is particularly important in soils where phosphorus levels are naturally low or depleted due to intensive cultivation. With food security becoming a global priority, the adoption of phosphate fertilizers is expected to grow steadily. A notable company addressing this demand is OCP Group, a global leader in phosphate-based fertilizers, which supplies customized phosphorus solutions to farmers worldwide, helping boost food production while promoting sustainable agricultural practices.

- Growth in precision and smart farming: The adoption of precision agriculture and smart farming technologies is significantly transforming modern agricultural practices. By integrating tools such as GPS-guided equipment, data analytics, soil sensors, and automated irrigation systems, farmers can now apply fertilizers more accurately and efficiently. This target strategy decreases waste, lessens environmental effects, and optimizes nutrient absorption, particularly for phosphate fertilizers.

Phosphate fertilizers, when applied precisely, support optimal root development and energy transfer within plants, leading to higher yields and improved crop quality. Precision techniques also help address the variability in soil phosphorus levels, ensuring that the right amount is delivered exactly where needed. A notable instance is Yara International, a global agricultural company known for its innovative crop nutrition solutions. Through its digital farming platforms and precision tools, Yara helps farmers make informed decisions on phosphate application, improving productivity while promoting sustainable farming practices across diverse geographies.

Challenges

- Finite phosphate rock and reserves: Phosphate fertilizers are primarily produced from phosphate rock, a non-renewable and geologically finite resource. The concentration of these reserves in a few countries, such as Morocco, China, and the U.S., creates geopolitical and supply chain vulnerabilities. As global demand for food and agricultural productivity rises, the pressure on existing phosphate reserves intensifies, raising concerns about long-term availability. Furthermore, the extraction and processing of phosphate rock requires significant energy and has a considerable impact on the environment. These challenges underline the need for sustainable resource management, innovation in fertilizer recycling, and alternative phosphorus sources to ensure the future security of global food production systems.

- High production and transportation costs: The production of phosphate fertilizers involves energy-intensive processes, including mining, beneficiation, chemical treatment, and granulation. These stages rely heavily on fuel and electricity, making overall production costs highly sensitive to fluctuations in energy prices. Additionally, transporting phosphate fertilizers from centralized production facilities to geographically dispersed agricultural regions poses logistical challenges and adds to the cost burden. Remote or underdeveloped areas often face limited infrastructure, further increasing transportation expenses. This high cost can reduce affordability for farmers, particularly in developing countries, and may hinder timely access to essential fertilizers, ultimately affecting agricultural productivity and food security.

Phosphate Fertilizers Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.8% |

|

Base Year Market Size (2025) |

USD 74.29 billion |

|

Forecast Year Market Size (2035) |

USD 130.55 billion |

|

Regional Scope |

|

Phosphate Fertilizers Market Segmentation:

Type (Fruits & Vegetables, Oilseeds & Pulses, and Cereals & Grains)

The cereal and grain segment has emerged as the dominant consumer of phosphate fertilizers, accounting for over 47.3% of the phosphate fertilizers market share. This strong demand is driven by the critical need to sustain the growth and productivity of staple crops such as wheat, rice, corn, and other grains. Phosphate fertilizers play an essential role in enhancing soil fertility, promoting root development, and ensuring adequate phosphorus levels are vital for healthy plant growth and higher yields.

Given the global reliance on cereals and grains as primary food sources, efficient phosphate fertilization is integral to food security. These fertilizers support early plant maturity and improve resistance to environmental stress, directly contributing to yield stability in cereal farming. An industry leader like The Mosaic Company, a major producer and marketer of phosphate fertilizers, has been instrumental in supporting cereal and grain cultivation worldwide. Through tailored phosphate solutions and agronomic support, Mosaic helps farmers achieve optimal crop performance and meet global food demands sustainably.

Products (Triple Superphosphate (TSP), Mono-ammonium Phosphate (MAP), Single Superphosphate (SSP), and Di-ammonium Phosphate (DAP))

Monoammonium phosphate (MAP) dominated the phosphate fertilizers market by maintaining a significant share. MAP’s well-balanced nutrient composition, offering both nitrogen and phosphorus, makes it a highly efficient fertilizer for promoting early root development and strong plant growth. Its water-soluble nature allows for quick nutrient availability, making I suitable for a wide range of crops and soil types. MAP is particularly valued for its versatility, being compatible with various farming methods including broadcasting, banding, and fertigation. Its low nitrogen content minimizes the risk of over-fertilization, while the high phosphorus availability supports energy transfer and flowering in crops. This balanced profile has made MAP a preferred choice among farmers looking to optimize crop yields and nutrient efficiency. PhosAgro, a Russian company, is recognized as one of the foremost global manufacturers of phosphate-based fertilizers, such as MAP. Known for its vertically integrated operations from phosphate rock mining to finished fertilizer production. PhosAgro provides a wide array of granular and liquid mineral fertilizers, consisting of numerous grades, which support farmers in 100 countries across all inhabited continents in effectively managing their crops and maintaining the fertility and health of local soils. PhosAgro’s high-quality MAP formulations and global distribution capabilities make it a key contributor to the growing MAP segment in the phosphate fertilizers market.

Our in-depth analysis of the global phosphate fertilizers market includes the following segments:

|

Type |

|

|

Product |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Phosphate Fertilizers Market Regional Analysis:

Asia Pacific Market Statistics

The phosphate fertilizers market is projected to be dominated by the Asia Pacific region, which is anticipated to account for over 61.2% of the total revenue share. This dominance is largely driven by China and India, two agricultural powerhouses with rising food production demands and limited arable land. These nations are focused on maximizing crop yields to support growing populations and food security, particularly in staple crops like rice, wheat, and vegetables. China, one of the world’s largest consumers and producers of phosphate fertilizers, continues to emphasize high-efficiency fertilizers and sustainable agricultural practices to boost output while mitigating environmental impact.

Meanwhile, India, where agriculture employs nearly half the workforce and contributes about 17% to GDP, is witnessing rapid growth in fertilizer demand. Key crops such as rice, wheat, pulses, and spices require substantial phosphate inputs for optimal growth. A key contributor to this expansion is Coromandel International, a leading fertilizer company in India. It produces a wide range of phosphate-based fertilizers and supports Indian farmers with integrated nutrient solutions and agronomic services, driving sustainable productivity across the country.

Europe Market Analysis

Europe was recognized as the second-largest regional segment in the phosphate fertilizers market during the forecast period. This growth is driven by advanced agricultural practices, sustainable farming initiatives, and strong crop production levels. Among European countries, Germany and the UK are emerging as significant contributors. Germany stands as the fourth-largest agricultural producer in Europe, with a strong emphasis on high-value crops and sustainable nutrient management. German farmers increasingly adopt precision agriculture and environmentally efficient fertilizers to enhance yield and soil health.

The UK, though smaller in arable land area, remains a key phosphate fertilizers market due to its modern farming systems, growing food production demands, and strong emphasis on sustainability post-Brexit. Both nations are investing in nutrient-use efficiency and sustainable agriculture. The leading company is CF Fertilizers UK, a subsidiary of CF Industries Holdings Inc., known for nitrogen-based products, CF Fertilizers also offers blended and compound fertilizers that include phosphate components tailored to UK crop and soil requirements. The company supports British agriculture through its production facilities, agronomic services, and customized nutrient solutions. By partnering with farmers to improve fertilizer efficiency and crop productivity, CF Fertilizers UK plays a significant role in sustaining the demand for phosphate fertilizers across the regions.

Key Phosphate Fertilizers Market Players:

- Eurochem Group AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Eurochem Group AG

- Nutrien Ltd.

- Yara International ASA

- Israel Chemicals Ltd.

- Coromandel International Ltd.

- The Mosaic Co.

- S.A OCP

- Gayatri Fertiplants International Pvt. Ltd

- Indorama Corporation

- Rama Phosphates Ltd.

- Silverline

Key players in the phosphate fertilizers market leverage technologies like precision agriculture, advanced granulation, controlled-release formulations, and sustainable mining practices. These innovations enhance nutrient efficiency, reduce environmental impact, and ensure consistent product quality, helping them maintain leadership in a competitive global phosphate fertilizers market.

Recent Developments

- In February 2022, EuroChem Group AG, a leading global producer of fertilizers, purchased the Serra do Salitre phosphate project located in Brazil. This advanced mining and processing facility, located in Minas Gerais, includes production capabilities for phosphoric and sulfuric acids, along with storage for urea and potassium chloride. The operational mine and processing facility produce 500,000 metric tons of phosphate rock each year. The company anticipates that this acquisition will facilitate market expansion in South America.

- In December 2020, a collaboration agreement was established between PhosAgro-Region and Exact Farming to develop digital services tailored for Russian users of PhosAgro's mineral fertilizers. The two companies aim to jointly create applications for the remote monitoring, evaluation, and optimization of mineral feeding systems utilizing PhosAgro products, as well as to generate and share agronomic knowledge.

- Report ID: 7615

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Phosphate Fertilizers Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.