Melamine Polyphosphate Market Outlook:

Melamine Polyphosphate Market size was valued at USD 365.2 million in 2025 and is projected to reach USD 649.3 million by the end of 2035, rising at a CAGR of 5.9% during the forecast period, from 2026 to 2035. In 2026, the industry size of melamine polyphosphate is evaluated at USD 388.5 million.

The global melamine polyphosphate market is anticipated to grow significantly over the projected years, primarily driven by rising demand for flame retardants that are environmentally friendly and are halogen-free in industrial use, especially in electronics, automobile, and construction industries. This requirement is intimately connected with the severe requirements of governments all over the globe that are striving to minimize the consumption of dangerous substances. For example, the Environmental Protection Agency (EPA) focuses on the substitution of flame retardants with safer and low-toxicity flame retardants like MPP because of its thermal stability and decreased environmental and health hazards. The process of MPP is effective as it breaks down the endothermically releasing inert nitrogen gases and fosters the formation of char, which increases the resistance to fire without producing any harmful byproducts.

Additionally, investment in RDD of flame-retardant substitutes to the use of brominated compounds to facilitate growth in the melamine polyphosphate market, with stricter chemical safety measures. As per the report by the Washington State Department of Ecology, safer flame retardants can be available and safer options, and promote regulatory restrictions that hasten the demand for halogen-free flame retardants such as Melamine Polyphosphate. Moreover, the rise in bio-based polymers all over the world is an indication of a high tendency towards the use of sustainable materials based on the use of flame retardants, which also contributes to the growth of the market.

The melamine polyphosphate supply chain can be defined by the process where melamine producers of melamine and phosphoric acid are the primary raw material suppliers, whose large manufacturing centers are growing in Asia and North America to satisfy the increasing world demand. Pilot-scale manufacturing tests ensure that phosphoric acid and urea polymerization processes are best suited for the production of high-quality polyphosphate compounds as flame retardants. There is a significant melamine trade in the world, as the U.S. imported USD 51,759.37 million of melamine in 2023 (23,464,600 metric tons) of melamine imports from various countries such as India, the Netherlands, and Germany. The U.S. exports melamine to Canada, the UK, Brazil, and EU countries in significant amounts. In terms of resin precursors, USD 44,239.26 million in 2023 of primary form melamine resins were imported in the U.S.

In addition, the trend of prices of the specialty chemicals, including melamine derivatives like melamine polyphosphate, can be measured well by the U.S. Producer Price Index (PPI) of other chemical product and preparation manufacturing. The U.S. Producer Prices Index (PPI) for other chemical product and preparation manufacturing in August 2025 was 181.094, indicating the growing cost of production of specialty chemicals, such as flame-retardant additives. This upward trend is in line with the rising demand for melamine polyphosphate, which is necessitated by the increased fire safety regulations.

Key Melamine Polyphosphate Market Insights Summary:

Regional Insights:

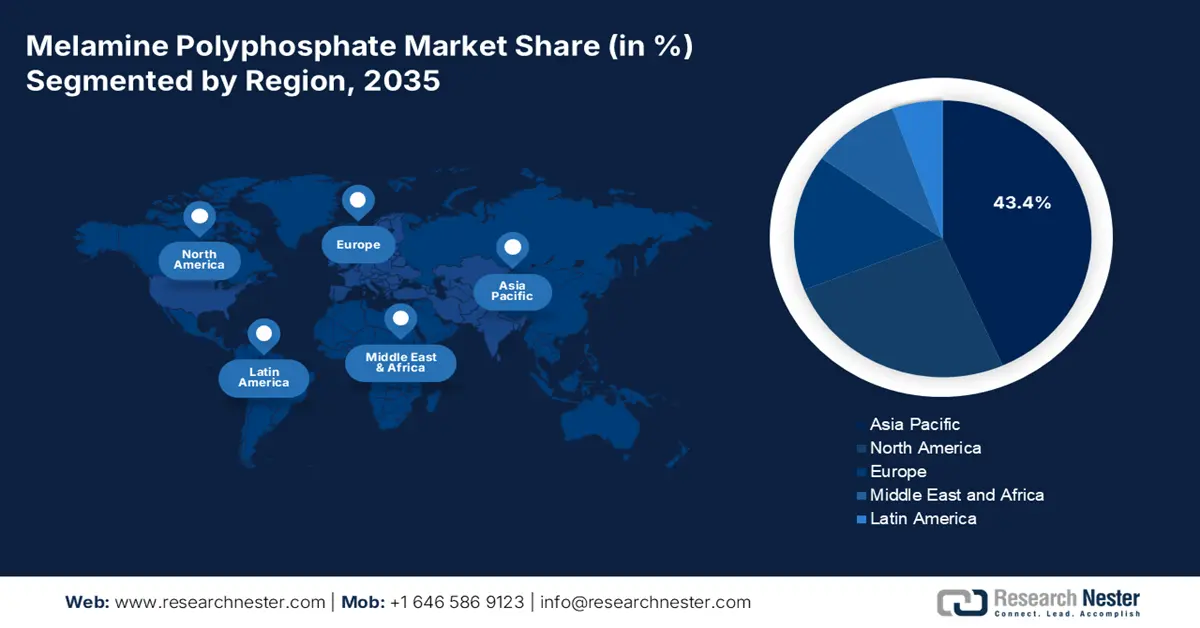

- The Asia Pacific melamine polyphosphate market is projected to dominate from 2026 to 2035, owing to rapid expansion of the electronic and electrical components industry.

- The North America market is anticipated to hold a 25.6% share by 2035, impelled by stringent regulatory pressure on halogenated flame retardants.

Segment Insights:

- The solid form segment is projected to account for 73.5% share by 2035, propelled by the ease of handling, storage, and application in various industries.

- The flame retardants segment is likely to hold a noteworthy share by 2035, driven by increasing demand for fire safety compliance across industries.

Key Growth Trends:

- Increasing awareness about fire safety regulations

- State level bans on organohalogen flame retardants

Major Challenges:

- Volatility in raw materials

- Limited technology availability

Key Players: BASF SE, Clariant AG, Israel Chemicals Ltd., Huber Engineered Materials, Italmatch Chemicals S.p.A., Nutrien Ltd., Jiangsu Yoke Technology Co., Ltd., Zhenjiang Sanwa Flame Retardant Tech., Zhejiang Wansheng Co., Ltd., Beijing Dongke United Technologies, AmFine Chemical Corporation, Nippon Carbide Industries Co., Inc., Zhejiang Longyou GD Chemical Industry, Shandong Shouguang Jianyuanchun Co., Zibo Tianheng New Nanomaterials Tech.

Global Melamine Polyphosphate Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 365.2 million

- 2026 Market Size: USD 388.5 million

- Projected Market Size: USD 649.3 million by 2035

- Growth Forecasts: 5.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (Dominant share from 2026–2035)

- Fastest Growing Region: North America

- Dominating Countries: China, Japan, Germany, United States, South Korea

- Emerging Countries: India, Vietnam, Indonesia, Thailand, Malaysia

Last updated on : 24 October, 2025

Melamine Polyphosphate Market - Growth Drivers and Challenges

Growth Drivers

-

Increasing awareness about fire safety regulations: As more individuals become aware of fire safety regulations, the melamine polyphosphate market for melamine polyphosphate, a unique chemical that prevents fires, is expanding quickly. Governments and significant groups have strengthened these regulations, stating that we must employ flame-resistant materials in a variety of applications. For example, the Canadian government under the Canadian Environmental Protection Act (CEPA) has officially classified melamine and its derivatives (including melamine polyphosphate) as Certain Organic Flame Retardants, focusing on the fact that they are used to delay the ignition and propagation of fire in plastics, cloths, and building materials. This group is included in the Chemicals Management Plan in Canada, through which the regulatory controls and risk management mechanisms have been permitted to ensure that these substances are used safely and with higher fire safety requirements.

- State level bans on organohalogen flame retardants: State bans on flame retardant (FR) products in the U.S. are restructuring flame retardant (FR) markets, changing how halogenated flame retardants are being replaced with safer flame retardants such as melamine polyphosphate (MPP). For example, the Environmental Conservation Law of New York State, section 37-1007, which becomes effective on December 1, 2024, does not allow the sale of electronic displays, upholstered furniture, and mattresses that have more than 1,000 ppm of organohalogen flame retardants (OFRs). The same laws are applicable in other states such as California, Washington, and Maine. Such regulatory fragmentation forces manufacturers to switch to non-halogenated FRs on a blanket basis to be able to access markets in the nation. MPP is a halogen-free and thermally stable material that is gaining popularity as a substitute.

- Market pulls by non-hazardous classification incentives EU/REACH: Regulatory classification is driving preference on the melamine polyphosphate market with non-halogenated flame retardants such as melamine polyphosphate (MPP). In the direction of hazard-based classifications under the REACH regulation, the European Chemicals Agency (ECHA) and the Chemicals Strategy of Sustainability of the European Commission are heading. There are extra scrutiny or restrictions on substances regarded as PBT (Persistent, Bioaccumulative, Toxic), vPvB, CMR, or ED. Whereas MPP and other phosphorus nitrogen FRs endorsed by PINFA (Phosphorus, Inorganic and Nitrogen Flame Retardants Association) tend not to be categorised as PBT, vPvB, or CMR according to the EU legislation. This compliance safety profile is more desirable for MPP by formulators who have goals of compliance resilience, especially in such sectors as consumer goods and electronics.

Import/Export Trends

United States Melamine resins, in primary forms imports by country, 2023

|

U.S. |

Partner Country |

Import Value (USD thousands) |

Quantity (kg) |

|

Canada |

17,552.85 |

11,316,200 |

|

|

Norway |

9,213.43 |

1,748,140 |

|

|

Germany |

3,989.40 |

1,083,930 |

|

|

Other Asia, nes |

3,509.82 |

1,237,380 |

|

|

Japan |

2,329.47 |

596,582 |

|

|

India |

2,112.94 |

868,011 |

|

|

France |

1,311.73 |

387,949 |

|

|

Mexico |

1,196.19 |

476,502 |

|

|

Thailand |

1,179.44 |

420,370 |

|

|

United Kingdom |

1,176.87 |

150,611 |

Source: worldbank.org

United States Melamine resins, in primary forms, exports by country, 2023

|

Destination Country |

Export Value (USD thousands) |

Quantity (kg) |

|

|

Mexico |

34,720.96 |

6,781,100 |

|

|

Canada |

19,866.76 |

12,343,300 |

|

|

European Union (aggregate) |

79,709.83 |

48,106,700 |

|

|

Germany |

88,248.63 |

30,992,000 |

|

|

Sweden |

34,692.59 |

12,341,300 |

|

|

Slovenia |

32,263.50 |

13,584,600 |

|

|

Thailand |

30,288.12 |

16,202,300 |

|

|

Japan |

27,590.99 |

8,067,580 |

|

|

Singapore |

26,929.62 |

9,187,090 |

|

|

India |

24,539.23 |

51,913,500 |

Source: worldbank.org

Challenges

- Volatility in raw materials: The melamine polyphosphate market may encounter challenges due to the fluctuating costs of the raw materials used to produce melamine polyphosphate. For the companies that create melamine polyphosphate, this might be a problem as it impacts both their production costs and sales revenue. Additionally, hardly any people are now taking melamine polyphosphate since they are unaware of its benefits.

- Limited technology availability: Despite MPP's superior thermal stability and fire resistance, it might not be the best option for every application. Alternative flame retardants may be required in certain situations due to technological constraints, such as incompatibility with particular polymers or the requirement for even higher degrees of flame retardancy. Research and development initiatives are also always changing. Future developments of even more environmentally friendly and effective flame-retardant products could threaten MPP's market position.

Melamine Polyphosphate Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.9% |

|

Base Year Market Size (2025) |

USD 365.2 million |

|

Forecast Year Market Size (2035) |

USD 649.3 million |

|

Regional Scope |

|

Melamine Polyphosphate Market Segmentation:

Form Segment Analysis

The solid form segment is projected to grow with the largest revenue share, 73.5% by 2035, due to the ease of handling, storage, and application in various industries. Solid melamine polyphosphate is a popular option for producers and end users due to its stable and practical shape. Benefits of the solid form include ease of transportation, a lower chance of spills, and easier integration into manufacturing procedures. Its considerable melamine polyphosphate market share has also been aided by its ability to improve flame retardancy in a variety of materials, such as thermoplastics and thermoset polymers. The segment's strength is further supported by its extensive use in vital applications in a variety of sectors with strict fire safety regulations. Solid Melamine Polyphosphate's fire-resistant qualities preserve the structural integrity and functionality of materials used in products such as household goods, automotive parts, electrical appliances, and building supplies.

Powder form with fine particle size (5 to 20 micrometres) can be used to ensure consistent dispersion of polymers and coatings to increase flame retardancy in thermoplastics and thermoset materials. Granules and pellets make the handling and dosing of automated manufacturing lines much easier, minimizing spillage, and the process is more efficient. These forms combined can affirm the preeminence of the solid segment as they are applicable in manufacturing and regulatory compliance with fire safety regulations. These segments have wide application in products such as electrical appliances, automotive components, and construction materials, where the product regulations encourage better fire resistance.

Application Segment Analysis

The flame retardants segment is likely to hold a noteworthy share by the end of 203. Melamine polyphosphate's vital significance in improving fire resistance across a range of industries is responsible for this substantial melamine polyphosphate market share. The growing emphasis on fire safety regulations in many industries has led to a strong demand for flame retardants as a main application category. When used as a flame retardant, melamine polyphosphate successfully lowers a material's flammability without sacrificing its structural soundness. Due to this, it is an essential part of products that must adhere to strict fire safety regulations, such as household goods, automobile parts, electrical appliances, and building supplies. The effectiveness of Melamine Polyphosphate in mitigating fire hazards, coupled with its environmentally friendly profile, has contributed to its substantial market share within this application segment.

Additive flame retardants are physically incorporated in polymers without chemical bonding, and are easy to use and economical. They boost fire resistance in a variety of uses like construction material, electronics, and textile applications, which fit well with the stringent safety requirements worldwide. Chemically bonded reactive flame retardants have increased durability and stability, which makes these reactive retardants critical in high-performance applications such as automotive parts and electrical insulation. The two segments enjoy increased governmental fire safety requirements and increased demand for highly sustainable and halogen-free solutions.

End Use Segment Analysis

The construction & building segment is expected to grow with a significant market share over the forecast period from 2026 to 2035. Strict fire safety laws like the European Union Construction Products Regulation (CPR) and U.S. fire safety standards drive the growth of this sector with the use of flame-retardant materials in insulation, surfaces, and building materials as a mandatory requirement. The growing nature of urbanization and investment in infrastructure increases the need to find fire-resistant materials that ensure the structural integrity and minimize the risk of fire. These regulatory environments and market needs are catalysts of constant innovations and use of melamine polyphosphate in construction uses, which will greatly push the growth of the melamine polyphosphate market as a whole.

Our in-depth analysis of the melamine polyphosphate market includes the following segments:

|

Segment |

Subsegment |

|

Form |

|

|

Application |

|

|

End-Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Melamine Polyphosphate Market - Regional Analysis

Asia Pacific Market Insights

The Asia Pacific melamine polyphosphate market is projected to dominate over the projected years from 2026 to 2035, owing to the rapid expansion of the electronic and electrical components business. For example, the East Asia-Pacific region dominates the global electronic products value chain, with intra-regional trade achieving 71 percent of the global electronic goods trade and drawing in foreign direct investment worth 270 billion directed towards low-value-added production activity. This large production base and industrial advancement necessitate the use of melamine polyphosphate as a flame retardant in electronics production, coating, and plastics to meet fire safety standards and environmental policies.

In addition, the stringent fire safety and building regulations, as well as building material regulations such as China (GB 8624 2012) building materials fire safety standards, support the market growth. The ASEAN electrical safety on PV/BESS installations and national standards of flame-retardant standards are increasing the demand for materials used in construction, appliances, and infrastructure. Furthermore, growth of urbanization and infrastructure increases the demand for flame-retardant plastics in wiring, insulation, housings in buildings, and in transport. Moreover, deployment of energy, renewable, and battery storage, which involves materials subjected to high-temperature heat, electrical hazards, and requires safer casing/envelopes, which melamine polyphosphate qualifies as a non-halogen flame retardant. This is highlighted by the ASEAN requirement that demands greater electrical safety of rooftop PV and BESS installations.

China’s melamine polyphosphate market is expected to dominate the Asia Pacific region by 2035, mainly due to the high rate of industrialization, growing construction, electronics, and motor vehicle sectors, and strong government programmes to increase the quality and safety standards of fire precautions and standards. The fact that the country specializes in halogen-free flame retardants facilitates market growth, which is coupled with a high level of production as well as consumption of glass fiber reinforced polyamides and synthetic resins. In October 2015, the volume of industrial production of glass fiber reinforced plastic products in China was 256,024 tons, which shows a steady increase with well-established manufacturing capacities. This high-volume production is behind the growing application of melamine polyphosphate as a halogen-free flame retardant in these composite products, which have played a significant role in increasing the market in China.

The demand of melamine polyphosphate in China is projected to be driven by the regulatory drive by the government towards safer material and the rising investment in infrastructure as the Chinese vigorous state regulations supporting green building materials, such as the mandatory energy conservation code of new urban buildings and the increased acquisition of environmentally friendly materials, cause the need in safer and greener products such as melamine polyphosphate. This regulatory climate has facilitated the fast market growth of melamine polyphosphate in China, particularly in the construction and infrastructure related to carbon reduction and fire protection.

The melamine polyphosphate market in India is likely to grow with the fastest CAGR from 2026 to 2035, attributed to the increasing manufacturing and construction industries, strict fire safety standards, and the growth of awareness in the industry about fire risks, which are driving the melamine polyphosphate market in India. The standards of flame retardant (IS 11871:2014) are enforced by the Bureau of Indian Standards and seek to encourage the use of safer polymeric materials in buildings, textiles, and automobiles. Increasing automobile manufacturing in India and infrastructure development drive stronger demand for flame retardants, such as melamine polyphosphate, as more vehicles become electric, and sustainability regulations become stricter. The rapid growth of the industry is expressed by the statistics provided by the Ministry of Chemicals and Fertilizers in their " Statistics at a Glance 2024," with the production of more than 5.3 million units of automobiles in 2023. This growth, in conjunction with long-term infrastructure growth, increases the demand for flame retardants, such as melamine polyphosphate, to sustain and satisfy fire safety needs and market growth in India.

North America Market Insights

The North America melamine polyphosphate Market is anticipated to grow with a substantial revenue share of 25.6% over the forecast years by 2035, attributed to the stringent regulatory pressure on the use of halogenated flame retardants, which is driving manufacturers to seek non-halogen, phosphorus nitrogen-based flame retardants, such as melamine polyphosphate. Recently, the U.S. EPA introduced new major new use regulations on some halogenated flame retardants under TSCA, indicating stricter regulation of the traditional flame retardants and creating space to switch to alternatives. Fire safety and building codes are also growing stricter in residential, commercial, and electrical systems, which are driving the need for plastics, coatings, wiring, and insulation materials to have good flame-retardant characteristics. For instance, foam plastic insulation should satisfy surface burning requirements, such as flame spread limits certified to the ASTM E84 test or UL 723 test, and thermal barrier requirements such as 1/2-inch wallboard (gypsum) or other materials (IBC Chapter 26, Section 2603; IRC Section R316).

Additionally, the increased use of electronics, telecommunications, and electrical infrastructure in urban and rural modernization requires lower-hazard flame-retardant materials, particularly where halogen emission is not required. Moreover, the increased knowledge about human health and environmental safety promotes the replacement of the old brominated or chlorinated products. The U.S. Consumer Product Safety Commission (CPSC) has started to make a rule to restrict the use of additive non-polymeric organohalogen flame retardants on consumer goods, signifying the current strict use of the flame-retardant alternatives.

The market in the U.S. is expected to lead the North America region over the forecast period by 2035, owing to the stringent fire safety regulations in both the construction, electronics, and automotive industries in the U.S., aided by the presence of major manufacturers and the high level of innovation. For instance, IBC, which is applicable in all states of the U.S., has stringent fire safety standards for building materials, which encourage the use of new fire-resistant materials. This regulatory framework is directly favorable to the development of melamine polyphosphate in the U.S. as a preferred non-halogenated flame retardant for building use. Additionally, a strong construction industry supported by both government and non-government investments supports a steady demand for flame-resistant materials. Moreover, the corrosion resistance and thermal stability of the melamine polyphosphate allow its use in glass fiber reinforced polyamides commonly used in electrical and electronic equipment. For instance, the National Institute of Environmental Health Sciences (NIEHS) identifies melamine polyphosphate as a good flame-retardant due to its thermal stability and low toxicity, which has been used in electrical and electronic devices. This offers increased demand for melamine polyphosphate in the U.S., with industries switching to less hazardous and environmentally friendly fire protection measures. The U.S. Environmental Protection Agency states that the market of flame retardants will likely increase dramatically as stricter fire safety standards are enacted and more individuals become aware of the danger of fires.

The melamine polyphosphate market in Canada is expected to expand substantially, mainly propelled by regulatory focus on flame retardants that are friendly to the environment, strong growth in industries in electronics, textiles, and construction, and continuous infrastructural development. Canadian policy puts a strong emphasis on sustainable manufacturing and rigorous adherence to fire safety regulations, driving an upsurge in the demand for melamine phosphate as a powerful flame retardant. For instance, the emphasis on fire safety and sustainable manufacturing, as seen in Canada through its focus on restricting harmful flame retardants such as DBDPE, as pointed out by the American Chemistry Council through its North American Flame-Retardant Alliance (NAFRA), aids in understanding the stress on sustainable manufacturing and fire safety. This control environment encourages safer substitutes like melamine phosphate, which makes the market in Canada grow faster in regard to its market penetration by creating customer demand for the use of effective and ecologically friendly flame retardants that meet rigorous fire safety regulations. Environment and climate change, Canada, and Health Canada have stringent appraisals on flame-retardant elements to safeguard and ensure adherence to the environment, to aid in the consistent growth of the market.

Europe Market Insights

The European market is predicted to grow steadily by 2035, mainly driven by healthy regulatory changes, industrial development, and the need to use safer products. Aromatic brominated flame retardants have been identified by the European Chemicals Agency (ECHA) under the REACH process as potential objects of EU-wide restriction, with alternative phosphorus-based nitrogen systems (non-halogen, including melamine polyphosphate) being promoted. Most non-halogenated flame retardants are nowadays evaluated by ECHA as having no or low hazard, which provides them with regulatory privilege over the old halogenated ones. Meanwhile, the high-tech goods sector in Europe is on the increase, which drives the need for flame-retardant materials in electronics, wiring, casings, and components. Additional pressure is placed on the environment and health, and by EU programs such as Safe and Sustainable by Design and the Chemicals Strategy on Sustainability, the industry has additional incentives to use safer flame retardants. Fire safety statistics in the UK indicate that 588,855 residential fire safety inspections were carried out in England in the year ending March 2025, which is an improvement of 2.9% over the previous year.

In Germany, regulatory pressure is being exerted by national regulations, e.g., technical approvals of flame retardants in building materials developed by DIBt, and research studies by Umweltbundesamt of flame-retardant emissions, increasing interest in halogen-free alternatives. The DIBt of Germany grants national technical acceptances to the fire-retardants applied to timber and wood-based building materials in order to guarantee their adherence to the stringent fire safety standards. This regulatory system is promoting safer flame retardants such as melamine polyphosphate, which has increased its melamine polyphosphate market base in the construction industry in Germany.

Key Melamine Polyphosphate Market Players:

- BASF SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Clariant AG

- Israel Chemicals Ltd.

- Huber Engineered Materials

- Italmatch Chemicals S.p.A.

- Nutrien Ltd.

- Jiangsu Yoke Technology Co., Ltd.

- Zhenjiang Sanwa Flame Retardant Tech.

- Zhejiang Wansheng Co., Ltd.

- Beijing Dongke United Technologies

- AmFine Chemical Corporation

- Nippon Carbide Industries Co., Inc.

- Zhejiang Longyou GD Chemical Industry

- Shandong Shouguang Jianyuanchun Co.

- Zibo Tianheng New Nanomaterials Tech.

The melamine polyphosphate market for melamine polyphosphate is expected to grow steadily due to its versatile properties and growing demand across a number of industries, particularly in the construction, automotive, and advanced manufacturing sectors. Future market expansion will be dependent on resolving rivalry, raw material availability, and environmental concerns, as well as capitalizing on new market opportunities and technological breakthroughs.

Recent Developments

- In June 2025, BASF SE introduced Basotect EcoBalanced, the first high-quality melamine resin foam on the planet that can have as much as 50 percent lower product carbon footprint (PCF) than regular grades. Basotect 3 EcoBalanced, which was made with 100 percent green electricity and renewable feedstock of organic waste and biomass, can be used to assist the transportation and construction industries in achieving their net-zero objectives. The product is an easy drop-in solution because it has the same performance as the traditional grades, with only slight changes to its manufacturing process. It minimizes the use of fossil resources and greenhouse emissions that contribute to the achievement of sustainability goals by customers.

- In June 2025, Clariant AG launched AddWorks PPA, a PFAS-free polymer processing aid, which is used in polyolefin extrusion. The innovation lowers the amount of energy used during the production process and offers a more environmentally safe alternative to the conventional fluoropolymers. AddWorks PPA can help manufacturers to comply with high environmental standards, improve the quality and efficiency of processes, and improve products. The first users in Europe and North America were enjoying better sustainability profiles and lower carbon footprints of their manufacturing processes, making Clariant the leader in green polymer additive technologies.

- In March 2023, Eurotecnica announced a new feature of its fifth-generation melamine technology, the G5 Euromel 2e Total Green feature. With this innovation, the plants in areas that produce melamine will run fully on renewable energy and will not require fossil fuels in power distribution. The G5 Euromel technology, which has been installed in 29 plants across the globe with an overall capacity of more than 1.28 million metric tons per year, has a new feature of a Total Green option, which is in line with global sustainability objectives. Through the incorporation of thermal energy storage systems, Eurotecnica can also be seen to be committed to lowering its carbon emissions and to encouraging green industrial practices, including the Andasol TES in Spain.

- Report ID: 7637

- Published Date: Oct 24, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Melamine Polyphosphate Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.