Ammonium Polyphosphate Market Outlook:

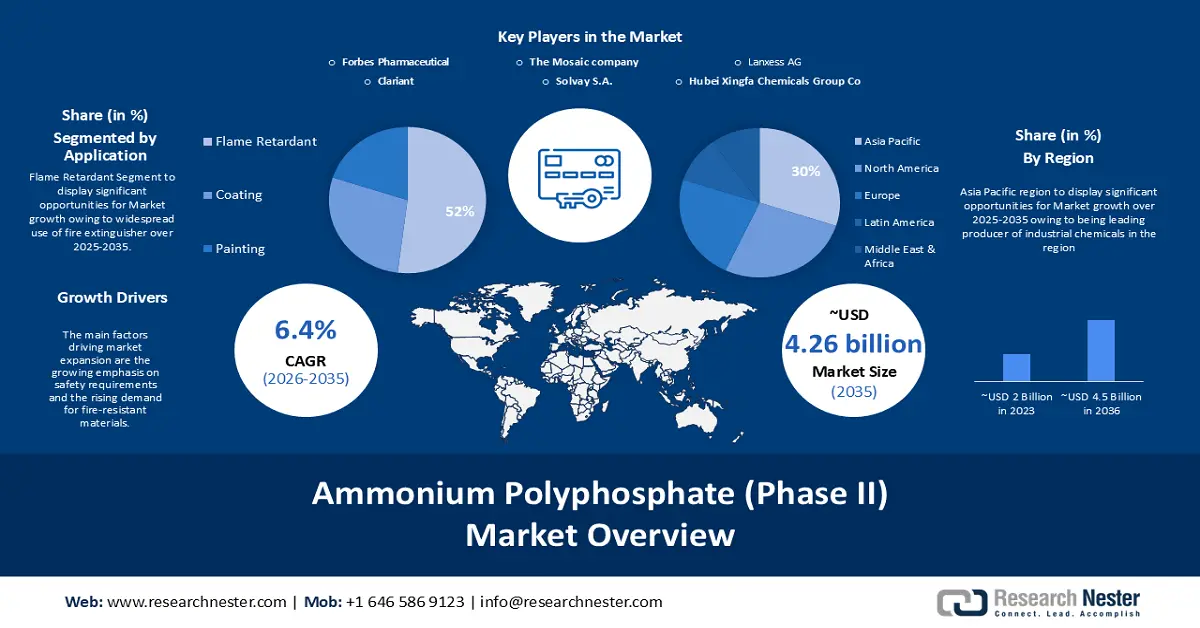

Ammonium Polyphosphate Market size was over USD 2.29 billion in 2025 and is projected to reach USD 4.26 billion by 2035, witnessing around 6.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of ammonium polyphosphate is evaluated at USD 2.42 billion.

The main factors driving market expansion are the growing emphasis on safety requirements and the rising demand for fire-resistant materials. A total of 1,504,500 fires in 2022 caused 13,250 injuries and 3,790 civilian deaths.

In addition, the market is anticipated to rise as a result of emerging nations' fast urbanization and infrastructure development initiatives. Additionally, new product developments and creative uses should present market participants with profitable prospects, thereby increasing demand overall.

Key Ammonium Polyphosphate Market Insights Summary:

Regional Insights:

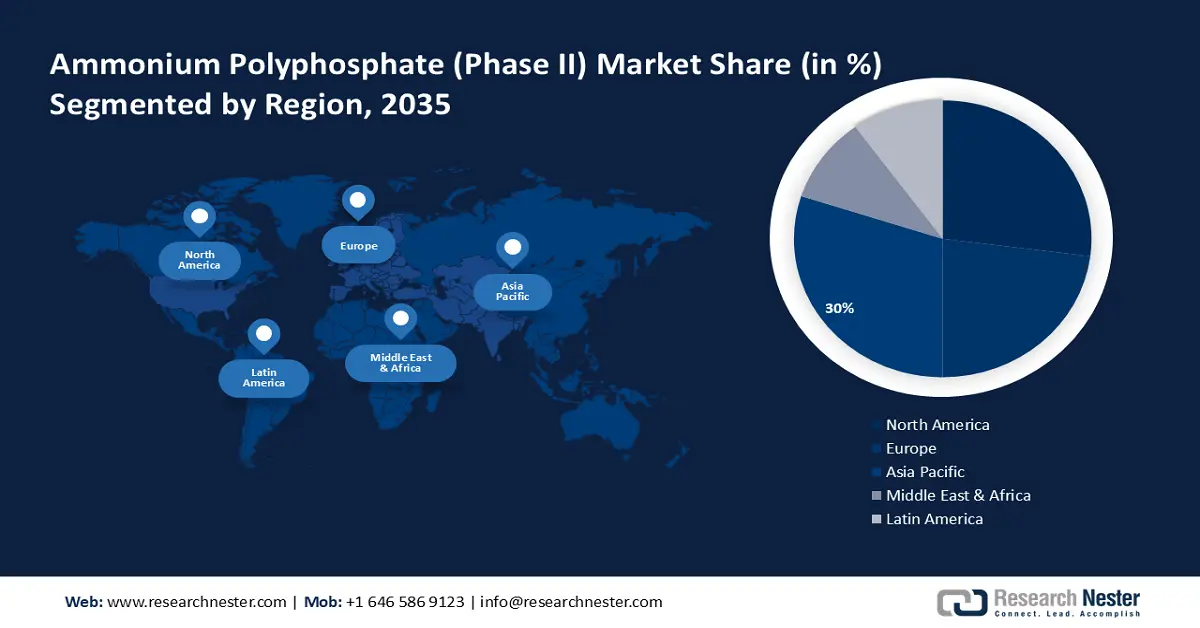

- Asia Pacific is projected to secure nearly 30% share by 2035 in the ammonium polyphosphate market, supported by sustained fertilizer consumption growth across countries with expanding agricultural needs.

- North America is anticipated to capture around 27% share by 2035, underpinned by regulatory transitions that are reshaping fertilizer usage patterns.

Segment Insights:

- The flame-retardant segment in the ammonium polyphosphate market is poised to command about 52% share during 2026–2035, spurred by the widespread reliance on ammonium-phosphate-based fire extinguishing systems.

- The fertilizers segment is expected to account for roughly 40% share through 2035, influenced by the rising adoption of MAP for efficient soil management.

Key Growth Trends:

- Increasing Demand for Fertilizers in The Ammonium Polyphosphate Market

- Common Use as a Flame Retardant Will Increase Market Size

Major Challenges:

- Ammonium polyphosphate's toxicity to hinder market expansion

Key Players: Clariant IGL Specialty Chemicals Private Limited, The Mosaic Company, Forbes Pharmaceuticals, United Phosphorus Limited Potash Corp., Hubei Xingfa Chemicals Group Co., Lanxess AG, Jordan Phosphate Mines Company, Solvay S.A., Huber Engineered Materials.

Global Ammonium Polyphosphate Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.29 billion

- 2026 Market Size: USD 2.42 billion

- Projected Market Size: USD 4.26 billion by 2035

- Growth Forecasts: 6.4%

Key Regional Dynamics:

- Largest Region: Asia Pacific (30% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: Brazil, Indonesia, Vietnam, Mexico, Turkey

Last updated on : 27 November, 2025

Ammonium Polyphosphate Market - Growth Drivers and Challenges

- Increasing Demand for Fertilizers in The Ammonium Polyphosphate Market- Ammonium polyphosphate is used in food additives as an emulsifier and as a fertilizer. Farmers continue to prefer chemical compounds for stable, healthy plant development and higher yields. The great rise of the agri-based sector has led to a huge increase in the demand for agricultural products, which in turn has motivated farmers to boost farm productivity and generate higher-quality yields. Increasing the ammonium polyphosphate market is the goal of applying ammonium polyphosphate in agriculture, which is essential to reaching this goal. The nation in Asia consumed over 42 million metric tons of nutrients in 2021. India and Brazil, with respective consumption of 29.8 and 21.17 million tons, came next.

- Common Use as a Flame Retardant Will Increase Market Size- Global demand for ammonium polyphosphate is primarily driven by its widespread use as a flame retardant. Since ammonium polyphosphate is flame retardant, its use in industrial settings for safety purposes in the event of an accidental fire in a combustible environment is anticipated to drive up global demand for the substance. Its market is expected to grow as a result of the industry's growing adoption of ammonium polyphosphate as a flame retardant.

- Growing Need for Ammonium Polyphosphate Will Aid in Market Expansion- Ammonium polyphosphate is an inorganic salt of polyphosphoric acid and ammonia that is non-reactive and thermally stable. Unlike ammonium polyphosphate (Phase I), it is non-volatile and stable up to a temperature of around 3000 C. It is one among the most widely used non-halogen fire retardants for commercial applications because of its effectiveness. It decomposes into ammonia and non-hazardous polymeric acid when exposed to heat or fire. One widely used application for it is the expanding fireproof coating. Global demand from the chemical sector is expected to be a major driver of the ammonium polyphosphate market share expansion during the forecast period.

Challenges

- Ammonium polyphosphate's toxicity to hinder market expansion- Globally, especially in India, ammonium polyphosphate is being utilized more and more as fertilizer in agricultural economies. It is anticipated that this will result in increased frequency of direct contact with it, which is harmful to human health. Growing consumer awareness of inorganic chemicals' toxicity is contributing to an increase in the public's dislike of them. thereby causing the demand for ammonium polyphosphate to decline, which will be averse to the ammonium polyphosphate ammonium polyphosphate market growth.

- A market hurdle is the availability of substitute flame-retardant materials. The market for APP-II is being impacted by alternatives including phosphorous-based flame retardants and halogenated chemicals, which are becoming more popular.

- Notwithstanding the advantages that ammonium polyphosphate provides, end consumers are still not fully aware of all of its uses. Promoting APP-II's advantages to prospective clients is essential for expanding the ammonium polyphosphate market.

Ammonium Polyphosphate Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.4% |

|

Base Year Market Size (2025) |

USD 2.29 billion |

|

Forecast Year Market Size (2035) |

USD 4.26 billion |

|

Regional Scope |

|

Ammonium Polyphosphate Market Segmentation:

Application (Flame Retardant, Coating, Painting)

Based on application, the flame-retardant segment in the ammonium polyphosphate market is predicted to hold largest revenue share of about 52%during the forecast period. The most frequently visited locations, like homes, offices, and schools, have fire extinguishers installed. Monobasic ammonium phosphate, an essential component of fire extinguishers made of dry chemical powder, is used in flame retardant applications. Ammonium phosphate smothers the fire by cutting off the oxygen supply and coating the source. The fire extinguishers contain monobasic ammonium phosphate under pressure. Also, these are the fire extinguishers that are most frequently used, especially in households. Fire extinguishers with an ammonium phosphate base are being used more frequently to put out electrical fires as well as flames caused by grease, gasoline, and flammable materials like wood. When a portable fire extinguisher is deployed, it usually extinguishes the fire within the first two minutes, or 94% of the time.

End Use (Manufacturing, Chemical, Fertilizers, Paints)

Based on end use the fertilizers segment in the ammonium polyphosphate market is anticipated to hold the largest share of about 40% during the forecast period. Granular fertilizer's main ingredient is mono-ammonium phosphate (MAP). The two most desired characteristics of MAP are its ability to regulate pH and its solubility in water. For long-term, robust plant growth, farmers still favor ammonium phosphate. In high-pH soils, the increased need for MAP is driving the market. Ammonium phosphate is used in powdered form in suspension fertilizers. Additionally, MAP has excellent handling and storage qualities, which are increasing customer demand for it. But the market's expansion is being constrained by the continuous discussion about the possible effects of fertilizers based on ammonium phosphate on the environment.

Our in-depth analysis of the global ammonium polyphosphate market includes the following segments:

|

Product Type |

|

|

Application |

|

|

End Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Ammonium Polyphosphate Market - Regional Analysis

APAC Market Forecast

Asia Pacific industry is estimated to hold largest revenue share of 30% by 2035. The major producer of industrial chemicals is Asia Pacific. Because of this, the area is the world's leading producer of ammonium polyphosphate, and it is anticipated that it will hold this position for the foreseeable future. Asia Pacific's growing population has caused a shift in the region's fertilizer need. The majority of the demand for ammonium phosphate is expected to come from China and India. Furthermore, the expansion of the ammonium phosphate industry in the area is being bolstered by the proliferation of fertilizer factories. Over two thousand kg of fertilizer were used per hectare of arable land in Malaysia in 2021. Compared to other countries, Timor-Leste used 0.5 kg of fertilizer per hectare of arable land in 2021.

North American Market Statistics

Ammonium polyphosphate market in North America is projected to hold largest revenue share of about 27% during the projected period. Over the course of the forecast period, the ammonium phosphate market in North America is expected to develop at a relatively moderate rate. Tight regulations pertaining to the application of inorganic fertilizers are impeding the expansion of the ammonium phosphate business in the area. In these two regions, the usage of organic fertilizers is the main emphasis of producers.

Ammonium Polyphosphate Market Players:

- Forbes Pharmaceuticals

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Clariant IGL Specialty Chemicals Private Limited

- The Mosaic Company

- United Phosphorus Limited Potash Corp.

- Hubei Xingfa Chemicals Group Co.

- Lanxess AG

- Jordan Phosphate Mines Company

- Solvay S.A.

- Ma’aden-Saudi Arabian Mining Company

Recent Developments

- December 2021: At its existing location in Daya Bay, Guangdong Province, China, CLARIANT started building a new flame-retardant production facility. With the new facility, CLARIANT will be able to better meet the region's increasing need for flame retardant solutions while also increasing production capacity.

- January 2022: With success, Huber Engineered Materials purchased MAGNIFIN Magnesiaprodukte GmbH & Co KG. The product line that was formerly offered by MAGNIFIN and represented by Martinswerk GmbH has been seamlessly incorporated into Fire Retardant Additives (FRA), Huber's strategic business unit. Through this strategic combination, Huber's line of smoke suppressants, halogen-free fire retardants, and specialty aluminum oxides is strengthened, greatly increasing its market share globally.

- Report ID: 5768

- Published Date: Nov 27, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Ammonium Polyphosphate Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.