Amino Resins Market Outlook:

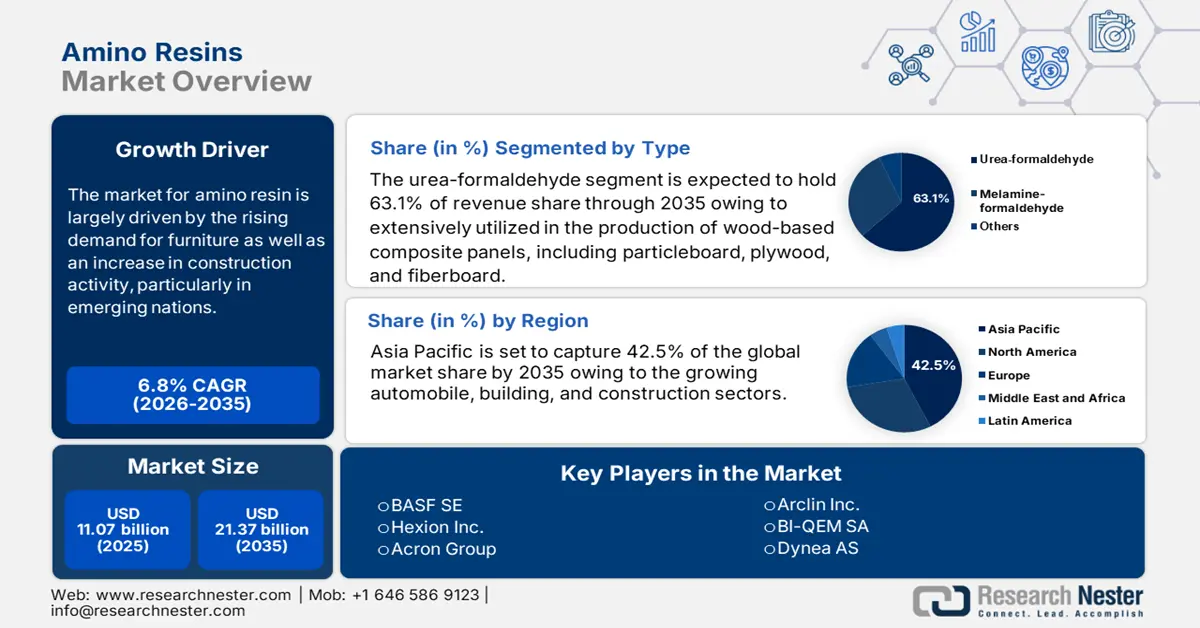

Amino Resins Market size was over USD 11.07 billion in 2025 and is projected to reach USD 21.37 billion by 2035, witnessing around 6.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of amino resins is evaluated at USD 11.75 billion.

Amino resins are used extensively in the global furniture and construction industries, especially in the manufacturing of wood-based panels like plywood, particleboard, and medium-density fiberboard (MDF). These resins, which provide great strength and endurance, are utilized as adhesives in these products. The amino resins market is largely driven by the rising demand for furniture as well as an increase in construction activity, particularly in emerging nations. For instance, in August 2023, construction spending totaled USD 1.98 trillion, up 7.4% from the year before.

The growing emphasis on environmentally friendly and sustainable materials is helping the market for amino resins. To satisfy the strict environmental requirements and the increasing demand for green construction materials, manufacturers are investing in developing amino resins that are low in emissions and free of formaldehyde. The market is seeing new growth opportunities as a result of this move toward environmentally friendly solutions. The need for resins with lower volatile organic compounds (VOCs) is growing as businesses and consumers alike become more environmentally sensitive, which is driving amino resins amino resins expansion.

Key Amino Resin Market Insights Summary:

Regional Highlights:

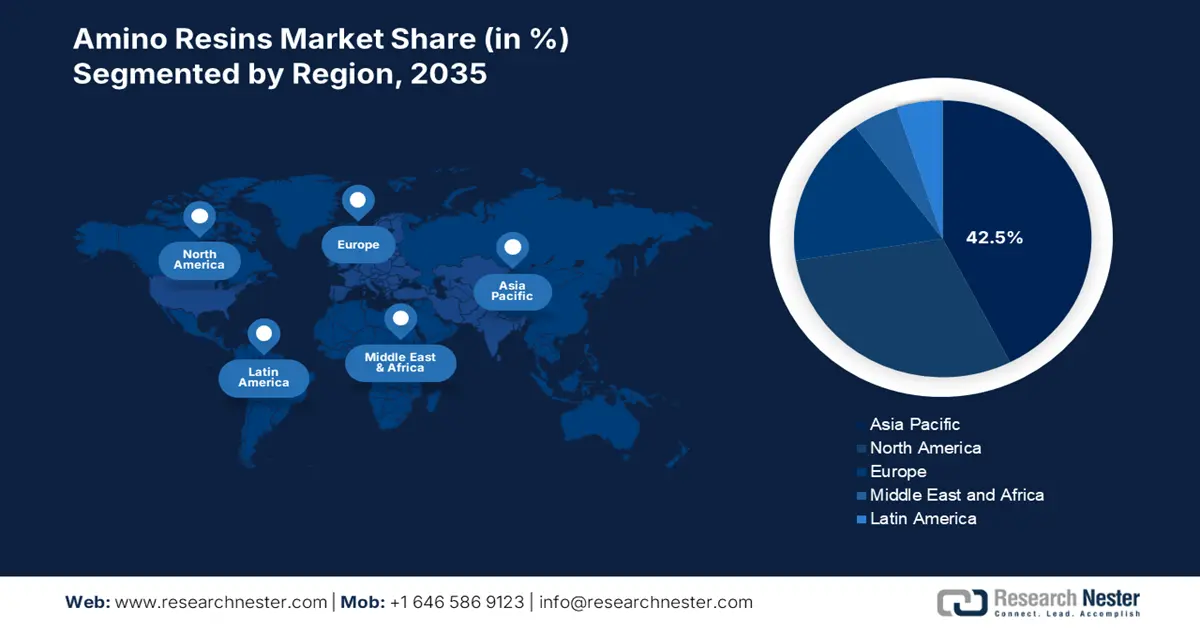

- The Asia Pacific amino resins market is projected to capture a 42.50% share by 2035, driven by the growing automobile, building, and construction sectors in the region.

- The North America market is expected to achieve a stable CAGR over the forecast period 2026–2035, driven by the need for long-lasting coatings and strict environmental regulations.

Segment Insights:

- The urea-formaldehyde type segment in the amino resins market is projected to hold a 63.10% share by 2035, driven by extensive usage in wood-based composite panels due to affordability and versatility.

- The building & construction segment in the amino resins market is projected to achieve a 47.70% share by 2035, attributed to rising demand for furniture and building materials driven by global construction activity.

Key Growth Trends:

- Developments in resin manufacturing technology

- Growing interest in ornamental laminates

Major Challenges:

- Formaldehyde volatility

- Exorbitant production costs

Key Players: BASF SE, Hexion Inc., Acron Group, Arclin Inc., BI-QEM SA, Dynea AS, Ercros SA, Chimica Pomponesco Spa, LRBG Chemicals Inc.

Global Amino Resin Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 11.07 billion

- 2026 Market Size: USD 11.75 billion

- Projected Market Size: USD 21.37 billion by 2035

- Growth Forecasts: 6.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (42.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Mexico

Last updated on : 8 September, 2025

Amino Resins Market Growth Drivers and Challenges:

Growth Drivers

-

Developments in resin manufacturing technology: High-performance amino resins with enhanced durability, water resistance, and heat tolerance have been developed as a result of recent developments in resin manufacturing technology. These developments are broadening the range of industries in which amino resins can be used, including packaging, electronics, and automobiles. Additionally, improved amino resin formulations are expanding the use of amino resins in coatings, especially in high-gloss and long-lasting finishes for furniture and appliances, which enhances the final items' aesthetic appeal.

-

Growing interest in ornamental laminates: Since amino resins have a strong bond and are resistant to heat and moisture, they are widely employed in the creation of decorative laminates. Floors, cabinets, countertops, and furniture are just a few of the many uses for these laminates. Demand for decorative laminates is being driven by consumers' growing desire for long-lasting and aesthetically pleasing interior décor, which is helping the amino resins market.

- Growing interest in eco-friendly construction materials: The need for green building materials is rising as the construction sector shifts to a more sustainable model. The usage of amino resins in environmentally friendly building projects is growing, especially those with minimal formaldehyde emissions. In the upcoming years, the amino resins market is anticipated to have development prospects due to this tendency. Innovative building techniques and materials are effective at lowering carbon emissions, as buildings account for around 40% of global energy-related emissions, according to a September 2024 World Economic Forum article.

Challenges

-

Formaldehyde volatility: The effects of formaldehyde emissions on health and regulatory compliance make them a major concern in the global amino resin market. In many different applications, including particle boards, MDF, and plywood, amino resins like urea-formaldehyde (UF) and melamine-formaldehyde (MF) are utilized extensively. However, when these resins are made and used, formaldehyde, a volatile organic compound (VOC), may be released. Increased formaldehyde emissions can cause respiratory disorders, inflammation, and other health hazards in addition to concerns with indoor air quality. As a result, formaldehyde emissions from items containing these resins are being restricted by legislation and heightened monitoring.

-

Exorbitant production costs: The market for amino resins is significantly constrained by high manufacturing costs, which are mostly brought on by the high cost of raw materials such as formaldehyde, urea, and melamine. Energy costs, supply chain interruptions, and environmental regulations can all affect the price of these commodities. Operational costs are further increased by the intricate production process, which calls for exact chemical interactions. Higher compliance costs are another consequence of strict environmental laws for formaldehyde emissions. These elements raise the total cost of manufacture, which reduces amino resin's ability to compete with other goods. The amino resins market for amino resin may therefore have limited growth potential since sectors including wood adhesives, automotive, and construction may need less expensive substitutes.

Amino Resins Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.8% |

|

Base Year Market Size (2025) |

USD 11.07 billion |

|

Forecast Year Market Size (2035) |

USD 21.37 billion |

|

Regional Scope |

|

Amino Resins Market Segmentation:

Type Segment Analysis

The urea–formaldehyde segment in amino resins market is projected to gain about 63.1% share through 2035. Urea-formaldehyde (UF) resin, a polymeric condensation result of formaldehyde and urea, is one of the most significant formaldehyde resin adhesives. It is extensively utilized in the production of wood-based composite panels, including particleboard, plywood, and fiberboard. Urea-formaldehyde resins are widely used as the main adhesive for wood products for a number of reasons, including their affordability, ease of use in a range of curing conditions, adaptability, low cure temperature, resistance to mold growth, superior thermal properties, the absence of color in the cured product, and the excellent water solubility of the (uncured) resin. Resins are also particularly helpful in applications involving molded objects and adhesives.

End-use Segment Analysis

Based on the end-use, the building & construction segment in amino resins market is likely to hold a 47.7% share by the end of 2035. It is anticipated that growing institutional, home, and commercial activity worldwide would raise demand for amino resin. The market is growing as a result of the increased demand for plywood, chipboard, particleboard, medium-density fiberboard, and sawdust board for furniture such as tables, chairs, shelves, and cabinets brought on by the rise in home construction. Additionally, laminates, which are utilized in the furniture and building industries, are made from the majority of the amino resins produced in the sector.

Our in-depth analysis of the global amino resins market includes the following segments:

|

Type |

|

|

Form |

|

|

Category |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Amino Resins Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific is expected to lead the amino resins market with a share of 42.5% during the forecast period, owing to the growing automobile, building, and construction sectors in the region. Growing consumer spending and the region's growing population are fueling the expansion of the building and construction sector as well as the automobile sector. India's population is now just over 1.428 billion, surpassing China's 1.425 billion, according to the UN's World Population Dashboard, as reported by the news agency Bloomberg. This is expected to lead to a significant demand for amino resins from developing nations like China and India.

China's market is being driven by the expanding building and furniture industries, as well as rising automobile coating usage. Over the projected period, rising automotive manufacturing in the nation is expected to boost the growth of the amino resin market. Rapid industrialization, rising construction activity, and the growth of furniture production in India all contribute to the country’s solid lead. For instance, the Indian furniture market, valued at about USD 22 billion, has almost doubled in size during the past ten years.

North America Market Insights:

North America is expected to experience a stable CAGR during the forecast period due to the growing need for long-lasting and scratch-resistant coatings in the furniture, construction, and automobile sectors. The expansion of the market is also supported by the growth of infrastructure projects, the increased usage of wood adhesives, and strict environmental rules that encourage the use of eco-friendly resins.

The growing need for lightweight materials in the automotive industry is driving considerable growth in the U.S. amino resins market. With the help of influential groups like the American Automobile Association (AAA), the American auto industry has been moving toward more fuel-efficient automobiles. According to recent statistics, to increase fuel efficiency and reduce emissions by 20%, around 50% of new automobile models are using lighter materials. This trend is also being driven by the US Environmental Protection Agency's approval of tighter emission limits and the quest for sustainable automobile products.

One of the main factors propelling Canada’s amino resins market is the continuous growth of the Canadian building sector. Improved materials with resistance and endurance are needed in construction applications. The manufacturing of adhesives, coatings, and engineered wood products, all essential to building processes, involves the use of amino resins more.

Amino Resins Market Players:

- Bakelite Synthetics

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BASF SE

- Hexion Inc.

- Acron Group

- Arclin Inc.

- BI-QEM SA

- Dynea AS

- Ercros SA

- Chimica Pomponesco Spa

- LRBG Chemicals Inc.

There are numerous regional and local companies in the worldwide amino resins market. Every competitor is constantly vying for a bigger market share in this fiercely competitive industry. Because of their superior qualities and growing use in industries including automotive, paints and coatings, chemicals, and packaging, amino resins are becoming much more and more in demand. Amino resins are utilized as an additive in certain applications and as a crucial component in others, such as molding compounds, laminating resins, and adhesives.

Here are some leading players in the amino resins market:

Recent Developments

- In April 2023, BASF SE and SWISS KRONO Group are extending their long-term collaboration by implementing more environmentally friendly procedures and solutions. The two partners are collaborating to lower the carbon footprint of the wood-based panel industry through the creation of innovative products and the computation of the product carbon footprint (PCF).

- In July 2022, Hexion Inc. declared that it has started producing formaldehyde at its Baytown, Texas, manufacturing facility using bio-based methanol. After that, the formaldehyde is supplied to a big client who uses bio-benzene to create methylene diphenyl diisocyanate (MDI), which results in a product with more environmentally friendly qualities due to much fewer air emissions than those made using methanol derived from fossil fuels.

- Report ID: 1004

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Amino Resin Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.