PVDF Resin Market Outlook:

PVDF Resin Market size was valued at USD 1.4 billion in 2025 and is projected to reach USD 2.5 billion by the end of 2035, growing at a CAGR of 7.8% during the forecast period from 2026 to 2035. In 2026, the industry size of PVDF resin is estimated at USD 1.6 billion.

The global PVDF resin market is expected to witness significant growth, primarily driven by its emerging clean energy applications, mainly in lithium-ion battery components, and as a solar photovoltaic (PV) module backsheet material. According to the U.S. Department of Energy (DOE), PVDF is among the most essential materials applied in PV backsheets as an insulator and moisture protection of the solar module. PVDF is becoming a high-priority material, as the U.S. Department of Energy’s 2023 Critical Materials Assessment highlights PVDF as a vital fluorine-based cathode binder in lithium-ion batteries, essential for their durability and performance. Fluorine demand for clean energy is expected to grow from 5% of total demand in 2025 to 22% by 2035.

Securing reliable access to such materials will support the DOE’s broader climate strategy, including the goal of achieving 100% clean electricity by 2035, which could slash economy-wide energy-related GHG emissions by a projected 62% in 2035 relative to 2005. Additionally, the Bipartisan Infrastructure Act will invest USD 7 billion in the supply chain and battery material development, which will indirectly help the markets for lithium-ion battery electrode and separator components. The trend towards growth in the PVDF resin market is already demonstrating a likely increasing demand in the use of PVDF resin in cathode binder applications.

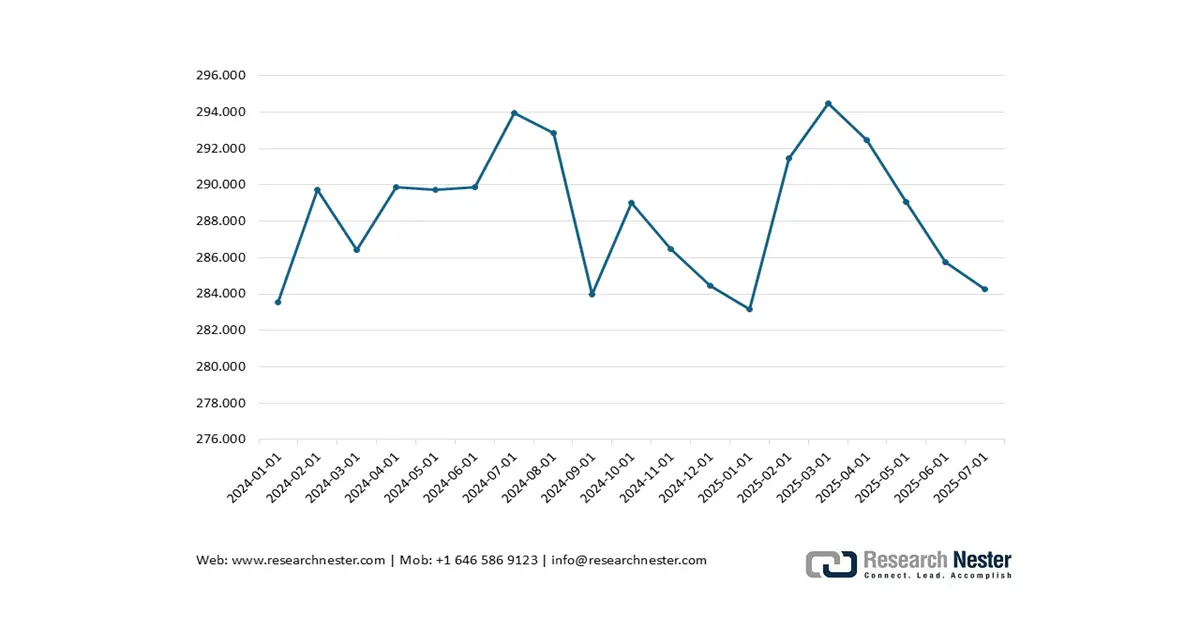

Producer Price Index by Industry: Plastics Material and Resin Manufacturing

(Source: U.S. Bureau of Labour Statistics)

For trade and supply chain, the U.S. International Trade Commission (USITC) invoked a section 337 investigation in 2025 against some of the imports of the PVDF resin on issues of intellectual property infringement. This reflects the additional analysis of the PVDF resin flows across the globe and suggests the rising importance of the material in a strategic role. According to the U.S. Bureau of Labour Statistics (BLS), the Producer Price Index for plastics materials and resins, which includes fluoropolymers like PVDF, averaged 321.25 in June 2024 and rose to 322.19 in June 2025, reflecting a 0.29% year-over-year increase, indicating cost pressure in the wider polymer market. Also, the Trade Act of 2021 includes in its strategic materials under section 74605 the chemically modified PVDF copolymers, and this is an indication of its policy importance regarding the U.S. trade and industrial planning. In addition, the DOE EERE office finances further elaborate advanced material and manufacturing research initiatives, with some initiatives that are likely to have a role in backing PVDF, particularly in innovative energy storage and polymer improvement.

Key PVDF Resin Market Insights Summary:

Regional Highlights:

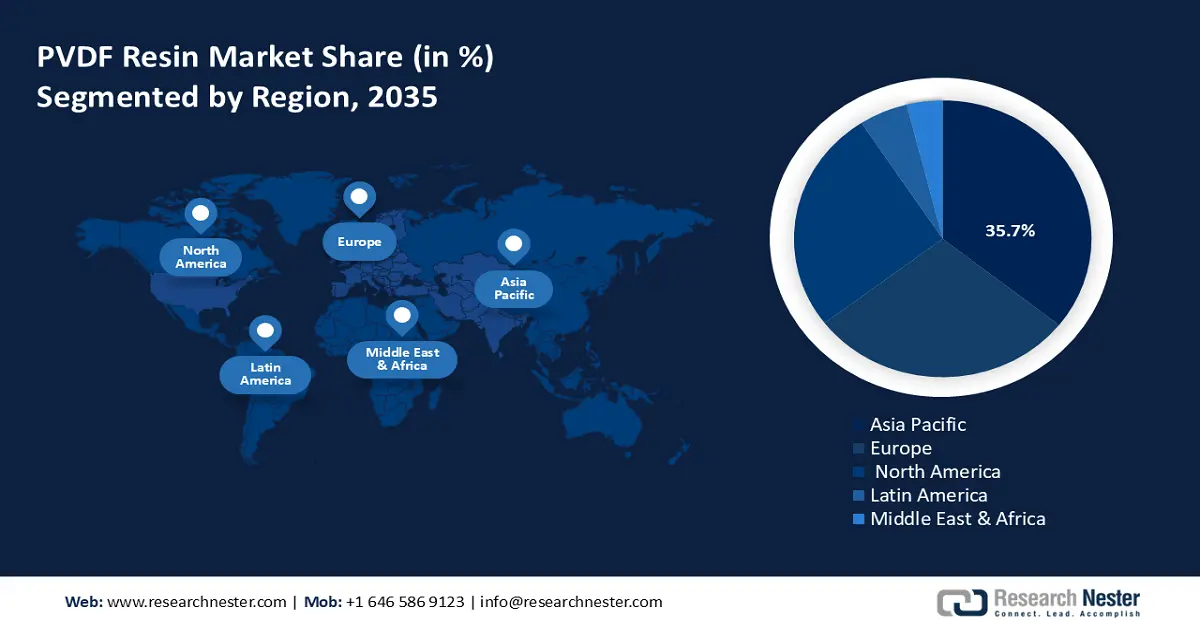

- Asia Pacific PVDF resin market is estimated to hold a 35.7% share over the forecast period 2026-2035, attributed to rising demand for lithium-ion batteries, semiconductors, and industrial filtration.

- North America market is projected to account for 26.2% share by 2035, impelled by growth in electric vehicle manufacturing and battery production.

Segment Insights:

- Alpha segment is projected to account for 60.5% share by 2035 in the PVDF resin market, owing to its chemical and thermal stability.

- Lithium-ion batteries segment is expected to hold a 41.6% share over the forecast period 2026-2035, driven by enhanced electrochemical performance.

Key Growth Trends:

- Industrial decarbonization and emissions pressure

- Regulatory fragmentation, PFAS restrictions by states

Major Challenges:

- Rising regulatory costs pressure small manufacturers

- Technocratic Trade Barriers (TBT) impose intricacy to PVDF resin market accessibility

Key Players: Arkema S.A., Solvay S.A., 3M Company, Dongyue Group Ltd., Huayi 3F New Materials Co., Ltd., Zhejiang Juhua Co., Ltd., Sinochem Lantian Co. Ltd., Zhejiang Fotech International Co., Ltd., SABIC, RTP Company, Gujarat Fluorochemicals Ltd.

Global PVDF Resin Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.4 billion

- 2026 Market Size: USD 1.6 billion

- Projected Market Size: USD 2.5 billion by 2035

- Growth Forecasts: 7.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35.7% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, Germany, Japan, China, South Korea

- Emerging Countries: India, Brazil, Mexico, Vietnam, Thailand

Last updated on : 19 August, 2025

PVDF Resin Market - Growth Drivers and Challenges

Growth Drivers

- Industrial decarbonization and emissions pressure: The global chemical industry is a major emitter of CO2, with an annual industry-wide emission of over 200 million metric tons. The chemical and petrochemical industry in the U.S. uses approximately 40% of the total energy consumed by industries, contributing to significant emissions. Before the 2021 COP26 summit, climate commitments and ESG pressures had increased, and low-carbon and energy-efficient materials such as PVDF, used in solar modules, battery separators, and EV parts, were becoming increasingly in demand. The applications can be easily integrated into global decarbonization plans and, therefore, PVDF is in demand in clean energy supply chains.

- Regulatory fragmentation, PFAS restrictions by states: The lack of national consistency in federal standards has led to 39 U.S. states in 2025 creating more than 350 bills related to PFAS and 5 states passing PFAS restrictions, such as the states of NY, NM, IL, etc. These legislations are tremendously varied, starting off with product labelling requirements to bans on PFAS-containing products. PVDF, which is a fluoropolymer, may also indirectly be affected. This non-consistent landscape puts PVDF resin producers under pressure of having to comply with varying jurisdiction requirements, increases the cost of production, and poses legal hazards. This leads to a delay in the product development process and an increased need for a traceable and compliant supply chain.

- PFAS in drinking water: federal compliance rules: In April 2024, the EPA issued enforceable Maximum Contaminant Levels (MCLs) on a total of six PFAS substances, including a 4 ppt limiting value of both PFOA and PFOS in drinking water. It will start monitoring in 2027 and is expected that the systems must comply with it by 2029. Although PVDF is not a banned chemical, it is chemically closely related and also falls under growing scrutiny within these PFAS regulations. The increased oversight covers those manufacturers who use or form PVDF, accompanied by testing and reporting, supporting the growth of the PVDF resin market in the context of sustainable production processes.

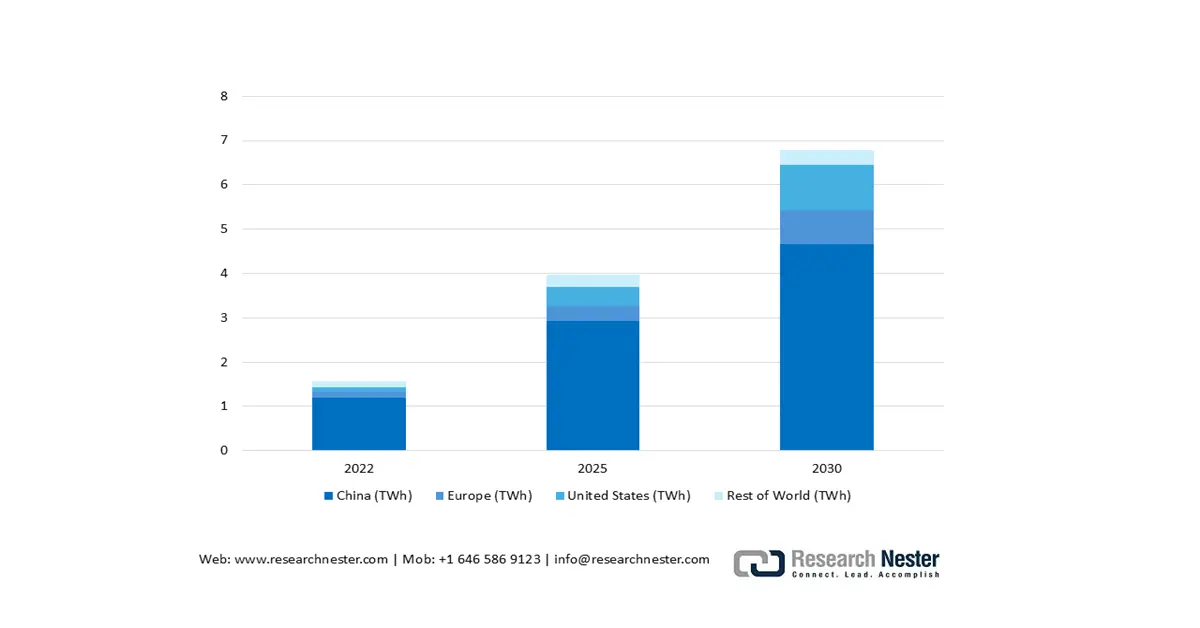

- Production Capacity Analysis: Lithium-ion Battery (LiB)

The rapid expansion of lithium-ion battery manufacturing capacity, projected to grow from 1.57 TWh (2022) to 6.79 TWh (2030), is significantly boosting demand for polyvinylidene fluoride (PVDF) resin, a critical binder and separator coating material in battery electrodes. PVDF’s superior chemical stability and adhesion properties make it indispensable for high-performance batteries, with battery-grade PVDF demand expected to triple by 2030. The manufacturing capacity of LiB in China currently dominates and is estimated to grow to 4.65 TWh by 2030.

Lithium-ion battery manufacturing capacity, 2022-2030

(Source: IEA)

Challenges

- Rising regulatory costs pressure small manufacturers: Rising regulatory costs are increasingly hindering small manufacturers in the PVDF resin market, as compliance with strict environmental and safety standards demands heavy investments in advanced infrastructure. Unlike larger firms, smaller producers often lack the resources to meet these requirements, leading to shrinking profit margins and reduced competitiveness. This has forced some to scale back operations or exit the PVDF resin market, ultimately consolidating production among major players and limiting diversity in the PVDF supply base.

- Technocratic Trade Barriers (TBT) impose intricacy to PVDF resin market accessibility: TBT, such as complex regulatory standards, certification requirements, and technical compliance measures, add significant intricacy to market accessibility in the PVDF resin market. Small and mid-sized manufacturers face challenges in aligning with diverse international specifications, which often demand costly testing and documentation. These hurdles slow cross-border trade, restrict new entrants, and create uneven competition, favoring larger firms with established compliance infrastructure. As a result, TBTs act as hidden obstacles that hinder the broader growth and accessibility of the PVDF resin market.

PVDF Resin Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.8% |

|

Base Year Market Size (2025) |

USD 1.4 billion |

|

Forecast Year Market Size (2035) |

USD 2.5 billion |

|

Regional Scope |

|

PVDF Resin Market Segmentation:

Phase Segment Analysis

The alpha segment in the PVDF resin market dominated the phase segment with the largest revenue share of 60.5% by 2035, owing to its chemical and thermal stability (the strong carbon-fluorine bonds, allowing stability up to at least 160°C). It can be continually processed in regular thermoplastic processing equipment due to its nonpolar structure; thus, it is the default choice to use when chemical-resistant coating applications and membranes are required. The prevalence of the alpha phase has been validated by its popularity in its use in industrial safety. Significantly, PVDF finds application in high-purity chemical processing systems in EPA-regulated facilities because of its inert and strong properties.

Two other primary downstream uses that boost the demand for alpha-phase PVDF resin include coatings and membranes, as coatings are durable and can resist high temperatures, and they are resistant to chemicals due to the alpha-phase. Alpha-phase PVDF is applied in durable coatings, unique weatherability and UV resistance properties of which ensure excellent durability in the long run, making it ideal in exterior building life cycles, and in corrosion resistance of chemical plants in terms of protective layers, particularly architectural and industrial-grade coatings. Alpha-phase PVDF membranes have found extensive application in high-purity filtration products such as water treatment, biopharmaceuticals, and microelectronics, because of low fouling tendencies and high mechanical strength. Based on the U.S. Department of Energy, PVDF-based membranes are critical to the emerging separation process in terms of clean energy and chemical purification processes.

Application Segment Analysis

The lithium-ion batteries segment in the PVDF resin market is expected to grow significantly over the forecast period from 2026 to 2035, with the PVDF resin market share of 41.6%, as PVDF resin in these batteries acts as a cathode binder or a sealer separator on the coatings, helping to enhance the adhesion between the electrode and the casing, mechanical stability, and increased electrochemical performance. In its materials annual report, the U.S. Department of Energy highlighted the use of PVDF in thicker cathode coatings, allowing the development of high-energy-density, thinner batteries at lower cost to reach 150 μm thickness and 40 mg/cm² mass loading, improving energy density and lowering battery size and cost while eliminating toxic solvent use. This increase in performance leads to increased lifecycle and cost-competitiveness, which positively affects PVDF in the EV and energy storage segments.

PVDF resin can be used as a cathode binder in lithium-ion batteries and creates desirable adhesion and mechanical strength to high-energy electrodes. The U.S. Dept of Energy stated, EB curing produces cathode coatings hundreds of microns thick at up to 150 m/min with ≥60% efficiency, eliminating solvents and photo initiators, cutting emissions, and enabling lower-cost, higher-density EV battery production. At the same time, PVDF is a key component as a separator coating material, with direct-coated separators being designed under DOE programs showing a potential 50% reduction in manufacturing cost of batteries compared to traditional NMP-based processes, with an overall available electrochemical performance of about 90-95% that of baseline at all tested voltages.

End use Segment Analysis

The automotive industry segment is anticipated to grow at a PVDF resin market share of 35.8% during the projected years by 2035, attributed to the PVDF’s use, specifically in electric cars as high thermal and chemical resistant battery systems, insulation, and protective coatings. The U.S. Department of Energy considers that advanced polymer binders such as PVDF can contribute to the improved performance and life cycle of EV battery systems, and it is a major contributor to domestic electrification objectives. With government efforts to invest in EVs and manufacture batteries on an industrial scale, PVDF's strategic application to automotive manufacturing is likely to become increasingly cemented.

Our in-depth analysis of the PVDF resin market includes the following segments:

| Segment | Sub-segment |

|

Phase |

|

|

Form |

|

|

Application |

|

|

End-Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

PVDF Resin Market - Regional Analysis

Asia Pacific Market Insights

The Asia Pacific PVDF resin market is estimated to grow with a share of 35.7% from 2026 to 2035, attributed to the increasing demand for lithium-ion batteries, semiconductors, and industrial filtration. Countries such as China, Japan, and South Korea have incorporated the use of PVDF in their national decarbonization strategies and particularly with the application of PVDF in electric cars and energy storage systems. Japan’s Ministry of Economy, Trade and Industry (METI) recognizes PVDF as a key binder material in lithium-ion battery electrodes, underscoring its role in advancing EV battery performance. The widespread use of advanced materials in lithium-ion batteries as electrode additives reflects PVDF's growing importance in clean-energy technologies. Furthermore, South Korea’s Ministry of Environment does support various environmental R&D initiatives, including those related to green technology innovation and the development of eco-friendly materials. For instance, the Korea Environmental Industry & Technology Institute (KEITI), under the Ministry of Environment, is involved in fostering green industry innovation and supporting small and medium-sized enterprises in the green sector through R&D projects aimed at commercialization and technological advancement. Such state-driven investment is driving the use of the PVDF resin into other market segments, such as coatings, electronics, and solid-state batteries.

China’s PVDF resin market is projected to dominate the Asia Pacific PVDF resin market due to the leadership of China in the manufacturing of chemicals and EV batteries. China’s share of global PVDF resin market sales in 2023 was above 40% and the country accounted for about 55% of the global capacity for acetic acid, about 50% of the global carbon black capacity, and about 45% of the global capacity for titanium dioxide. Along with a growing range of innovative end-uses, fluoropolymers such as PVDF are also viewed as strategic materials in the chemical industry strategy of China as part of its move towards high-value-added applications. The Chinese government offers subsidies and capacity increases on fluoropolymers, which strengthens the location of China in the international PVDF resin market.

The chemical, thermal, and UV resistance characteristics in PVDF are also critical to ensuring that batteries perform better and offer greater safety, and in the development of sustainable infrastructure coatings. The Ministry of Ecology and Environment (MEE) of China has established some new regulatory standards for pollutants such as PVDF-related chemicals. Through the 2023 List of New Pollutants to be Managed in Priority and the Inventory of Severely Restricted Toxic Chemicals (2023) formulation by China, MEE has been exercising high control over such chemicals as perfluorooctanoic acid (PFOA) and its similar substances, which also cover applications with polyvinylidene fluoride (PVDF).

India PVDF resin market is growing swiftly due to the increasing applications of lithium-ion batteries, solar, and water treatment industries. India’s chemical industry was valued at USD 220 billion and is expected to reach US$304 billion by 2025, registering a compound annual growth rate (CAGR) of 9.3%. The industry contributes about 7% to India’s GDP and serves various sectors such as textiles, pharmaceuticals, and agrochemicals. Demand for chemicals is expected to grow annually by 9%, with specialty chemicals and petrochemicals driving much of this growth. The Scheme produced by the government under Production Linked Incentive (PLI) incorporates the advanced battery chemicals, which in turn gives a boost in the demand for PVDF as cathode binder and separator coating. The growing domestic manufacturing capacity of batteries in India and the Make-in-India policy are expected to affect the demand for PVDF resin by increasing it up to the year 2034.

North America Market Insights

By the year 2035, the North American PVDF resin market is estimated to grow at a market share of 26.2% of the total PVDF resin market, courtesy of growth in electric vehicle manufacturing, battery production, and the need for high-performance resins when it comes to clean energy and filtration system production. The region benefits from an advanced chemical production industry, as the chemical shipments in North America totalled USD 57.3 billion in June 2025, with a 0.1% increase from the previous month and a 1.7% year-over-year rise. U.S. production of major plastic resins reached 8.6 billion pounds in June, up 6.3% from May and 2.1% from the previous year.

The chemical trade surplus increased to USD 3.2 billion in June, reflecting a strong export performance. Advanced manufacturing is a primary target of federal R&D spending on chemicals, such as PVDF, which reached an estimated USD 159.8 billion in 2022, including 18% of industrial R&D by the private sector. North American chemical producers are increasingly aligning with the U.S. Environmental Protection Agency (EPA) and Department of Energy (DOE) sustainability goals. The DOE’s 2023 Critical Materials Assessment highlights polyvinylidene fluoride (PVDF) as a critical material prioritized for use in electric vehicle (EV) battery binders and filtration membranes in clean technology and semiconductor applications, thereby supporting the PVDF resin market growth in the region.

The U.S. PVDF resin market is projected to grow at a significant rate in North America, owing to the rising chemicals and petrochemicals industry use of energy and emissions, with around 40% of all industrial energy use and emissions. In 2023, the Department of Energy announced funding of USD 78 million to decarbonize the manufacturing of chemicals and to advance process technologies in a variety of processes, including chemical production. The value added provided to the North American economy by the U.S. chemicals sector is USD 866 billion annually, supporting about 6 million jobs.

It stands as an important PVDF resin market to invest in high-performance polymers like PVDFs that are essential in terms of advanced applications like electric vehicle battery binders in the clean technology industry and filtration membranes in the semiconductor industry. This highlights the importance of the sector as a promoter of economic development and technological advancement, and in facilitating the sustainability agenda. The newly prepared FY 2022 budget of the EPA, totalling USD 11.2 billion, also has more funding for clean chemistry, water safety, and infrastructure resiliency needs, all of which are indirect beneficiaries of the use of PVDF-based filtration and membrane technologies.

Canada’s PVDF resin market is predicted to grow substantially over the projected years from 2026 to 2035, driven by the production of advanced materials, PVDF-formulated components, and coatings. Clean energy and the production of clean materials have been a priority area in Canada, and the federal investments have been made under federal programs allotted huge funds to electrification, clean chemistry, and advanced manufacturing. For example, the Clean Growth Program has funded grants in the hundreds of millions to help fund sustainable materials development and industrial emissions minimization. In 2021, Canada pledged USD 1.5 billion Clean Fuels Fund to increase low-carbon fuel and chemical innovation, which will indirectly promote the use of PVDF in green technology industries. The Canadian industry associations report constant growth in the export of chemicals and native domestic capabilities in advanced materials, the fact that places the country in an excellent position to meet the PVDF-related demand in EVs and clean infrastructure.

Europe Market Insights

The European PVDF resin market held a notable share of 28.9% in 2025 and is expected to grow at a CAGR of 6.5% over the forecast years. The specialty chemicals industry is long established in Europe, and policy attention given to high-performance polymers points to a strong presence there. There are major drivers, such as the introduction of stringent REACH regulations, that have resulted in a 45% reduction in substances of very high concern since 2010-2021, which led to innovation in new, safer substances such as PVDF. Moreover, the increasing energy prices and international competition, especially with Asia and the Middle East, have motivated investment in chemical recycling and modernization of the process. For instance, the EU state aid facilitates such projects as a €4 billion ethane cracker in Antwerp by INEOS.

These trends emphasize a movement towards robust, sustainable production processes in which PVDF durability, purity, and performance factors fit quite well with the future needs. By 2022, the UK chemical industry generated £70 billion with a turnover of 1.2% of UK GDP and 15% of exports. The matched investment of £500 million proposed in the government-industry chemistry sector deal was aimed at enhancing sustainable chemical innovation, such as the application of PVDF in batteries and advanced materials. In 2023, Germany’s chemical and pharmaceutical industry had a turnover of €225.5 billion, employed about 479,500 people, and generated 60% of sales from exports. The sector faced a nearly 14% sales decline due to the energy crisis, with €14 billion invested annually in R&D for sustainability and innovation.

Key PVDF Resin Market Players:

- Arkema S.A.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Solvay S.A.

- 3M Company

- Dongyue Group Ltd.

- Huayi 3F New Materials Co., Ltd.

- Zhejiang Juhua Co., Ltd.

- Sinochem Lantian Co. Ltd.

- Zhejiang Fotech International Co., Ltd.

- SABIC

- RTP Company

- Gujarat Fluorochemicals Ltd.

The PVDF resin market is highly competitive, with big vertically integrated specialty chemical companies at its foundation. Arkema has high scale and brand awareness- its Kynar line of products is commonly specified in high-performance applications. Solvay then comes in with its Solef PVDF grade, which is commonly used in membranes and coatings. The Japanese (Daikin, Kureha, AGC, Mitsubishi) focus on high-purity PVDF suited to semiconductor and capacitor markets. North America has a huge presence of 3M, which incorporates the use of PVDF in the filtration system. Companies such as Dongyue, Huayi 3F, and Zhejiang Juhua, in China, are expanding their cost-effective production at fast rates, developing local supply chains that deal with water and industrial-related products. Among the strategic actions are product innovation, capacity growth, and joint ventures, as the example by Arkema in battery-materials PVDF is a model of how companies are positioning themselves to capture the increased demand in the EV space and energy storage.

Top Global PVDF Resin Manufacturers in the PVDF Resin Market:

Recent Developments

- In June 2024, Arkema expanded its sustainable line of PVDF-based powder coating resins, adding up to 40% post-consumer recycled content. The programme forms a part of the drive to circularity by Arkema in high-performance plastics. The enhanced resins are expected to have a technical performance and reduce the carbon footprint by up to 20%, while being applicable in architectural, industrial, and energy sectors. The company has confirmed the commercialisation of such remedies in the North American and European markets, with increasing demand by OEMs with an eye on sustainability measurement.

- In May 2024, Xenia Materials launched a carbon fiber reinforced PVDF material, demonstrated as working with FFF 3D printing hardware. It is a combination that makes it offer the mechanical strength of carbon fiber and the chemical resistance of PVDF, offering greater dimensional stability, less warping, and a more desirable print surface texture. It is specifically designed to be applicable in extreme chemical environments or ATEX-controlled industry settings, including oil & gas, electronics, and battery housings. This launch is considered a strategic decision to use PVDF in the additive manufacturing field, as the demand is increasing in the number of functional and high-performance 3D printable materials in regulated industries.

- Report ID: 8006

- Published Date: Aug 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

PVDF Resin Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.