Phthalonitrile Resin Market Outlook:

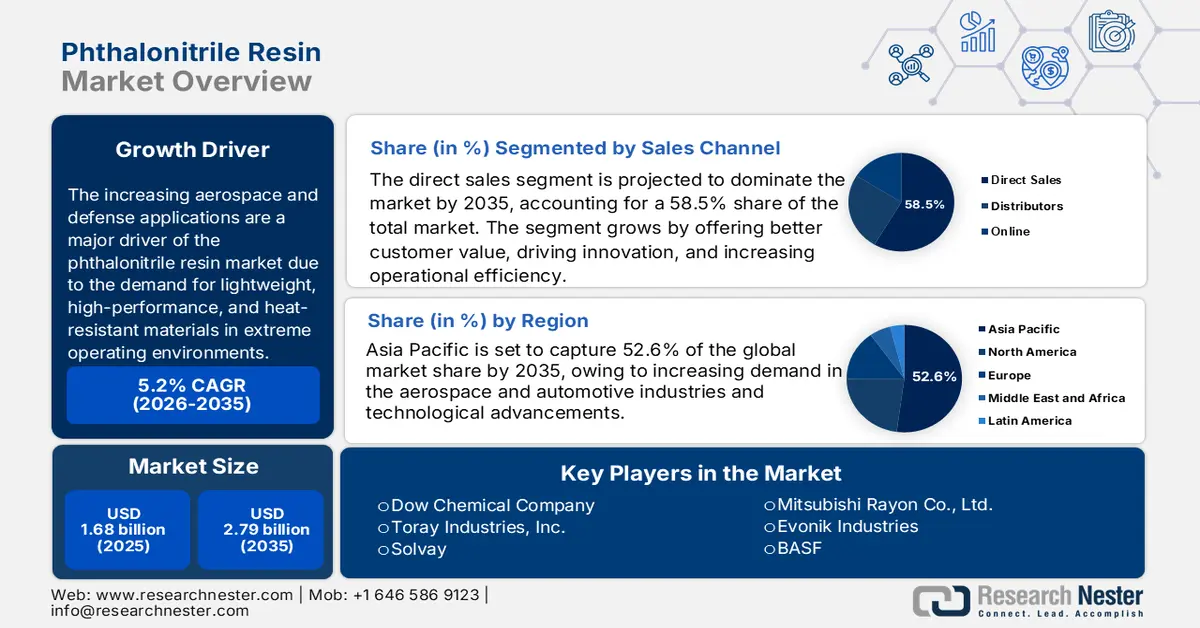

Phthalonitrile Resin Market size was over USD 1.68 billion in 2025 and is poised to exceed USD 2.79 billion by 2035, growing at over 5.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of phthalonitrile resin is estimated at USD 1.76 billion.

The increasing aerospace and defense applications are a major driver of the phthalonitrile resin market due to the demand for lightweight, high-performance, and heat-resistant materials in extreme operating environments. Aerospace and defense components require materials that can withstand high temperatures (above 500 degrees Celsius) and harsh chemical exposure. Phthalonitrile resins outperform traditional epoxy, polyimide, and phenolic resins in thermal stability and flame resistance, making them ideal for jet engine components, rocket and missile casings, and thermal protection systems.

Reducing weight in aircraft and defense equipment enhances fuel efficiency and payload capacity. Phthalonitrile resins are used in carbon fiber-reinforced composites, replacing heavier metal parts in aircraft fuselage and wings, radomes and antenna structures, and hypersonic vehicle components. Moreover, hypersonic vehicles and space exploration missions require extremely heat-resistant and durable materials. Phthalonitrile-based composites are ideal for reusable launch vehicles, space shuttles, and satellite structures due to their low moisture absorption and superior mechanical properties in extreme conditions.

Key Phthalonitrile Resin Market Insights Summary:

Regional Insights:

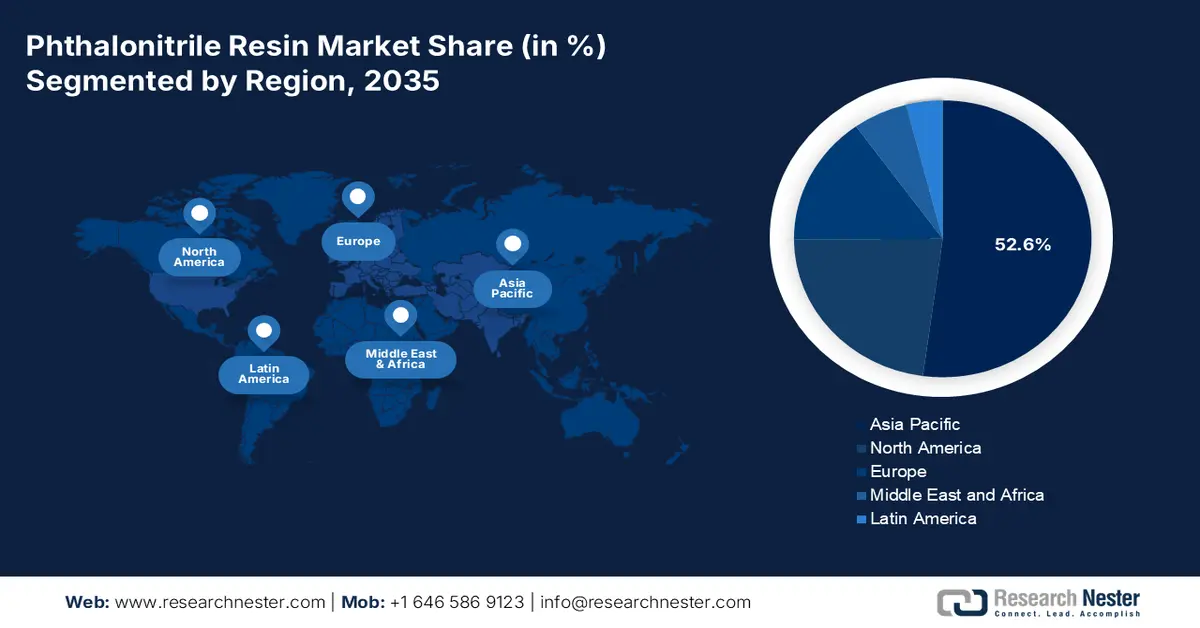

- By 2035, Asia Pacific is projected to secure over 52.6% share in the phthalonitrile resin market, supported by surging aerospace and automotive demand and rapid technological advancement.

- North America is anticipated to witness a steady CAGR through 2035 as its uptake of phthalonitrile resins strengthens across aerospace, defense, and electronics owing to their high-performance material attributes.

Segment Insights:

- The direct sales segment is set to capture nearly 58.5% share by 2035 in the phthalonitrile resin market, underpinned by enhanced customer value delivery that boosts innovation and operational efficiency.

- Pure phthalonitrile resin type is poised to command a substantial share by 2035 as its superior thermal stability, chemical resistance, and mechanical strength make it ideal for demanding industrial applications.

Key Growth Trends:

- Superior thermal and chemical resistance

- Expanding use in electronics

Major Challenges:

- Processing challenges and longer curing time

- Lack of industry awareness and adoption

Key Players: Dow Chemical Company, Toray Industries, Inc., Solvay, Mitsubishi Rayon Co., Ltd., and Evonik Industries.

Global Phthalonitrile Resin Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.68 billion

- 2026 Market Size: USD 1.76 billion

- Projected Market Size: USD 2.79 billion by 2035

- Growth Forecasts: 5.2%

Key Regional Dynamics:

- Largest Region: Asia Pacific (52.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Brazil, Mexico, Indonesia, Vietnam

Last updated on : 3 December, 2025

Phthalonitrile Resin Market - Growth Drivers and Challenges

Growth Drivers

- Superior thermal and chemical resistance: Phthalonitrile resins can withstand temperatures exceeding 400-500 degrees Celsius without degrading. This makes them ideal for aerospace, defense, oil & gas, and space applications where extreme heat exposure is common. Unlike epoxy, phenolic, or BMI resins, phthalonitrile resins maintain mechanical integrity and chemical structure under prolonged thermal and corrosive conditions. This performance advantage drives the replacement of conventional materials in critical components.

Higher thermal and chemical resistance translates to longer service life and reduced maintenance. Industries benefit from lower lifecycle costs and improved reliability, making phthalonitrile resins more attractive. Additionally, the demand for thermally and chemically resistant materials is encouraging R&D investments, fostering new composite formulations and expanded use in emerging sectors like space tech and advanced electronics.

- Expanding use in electronics: High thermal stability is required for advanced devices, such as electronics, which are becoming smaller and more powerful, generating increased heat. Phthalonitrile resins withstand temperatures above 300 degrees Celsius, making them ideal for high-density PCBs, semiconductors, and power modules. Low dielectric constant and dissipation factor support, such as high-frequency signal transmission, radar, and RF systems, as well as 5G infrastructure, drive adoption in telecom, aerospace electronics, and defense systems.Phthalonitrile resins can be used in flexible electronics, thin-film substrates, and additive manufacturing (3D printing), which supports trends in miniaturization and lightweight design.

Challenges

- Processing challenges and longer curing time: Phthalonitrile resins require curing temperatures above 250-300 degrees Celsius, significantly higher than traditional resins like epoxies or BMIs. This increases energy costs, making processing expensive. Many industries lack the specialized ovens and equipment required for high-temperature curing. Also, unlike epoxies or polyimides, which cure quickly, phthalonitrile resins often need longer curing cycles. Slower processing leads to delays in production for aerospace, defense, and electronics applications. Longer curing times also increase labor costs and reduce manufacturing efficiency.

- Lack of industry awareness and adoption: Many industries are not familiar with phthalonitrile resins and their advantages over traditional resins. Engineers and manufacturers often stick to well-established materials rather than exploring new high-performance options. Moreover, phthalonitrile resins are not mass-produced like epoxies or polyimides, leading to higher costs and limited supply chains. Many companies do not consider it a viable alternative due to supply concerns.

Phthalonitrile Resin Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.2% |

|

Base Year Market Size (2025) |

USD 1.68 billion |

|

Forecast Year Market Size (2035) |

USD 2.79 billion |

|

Regional Scope |

|

Phthalonitrile Resin Market Segmentation:

Sales Channel Segment Analysis

Direct sales segment is likely to account for around 58.5% phthalonitrile resin market share by 2035. The direct sales segment grows by offering better customer value, driving innovation, and increasing operational efficiency. Direct selling enables manufacturers to build closer, more trust-based relationships with key buyers in industries such as aerospace, automotive, and electronics. This leads to a better understanding of technical requirements and customization opportunities, which enhances customer satisfaction and loyalty.

With fewer intermediaries, manufacturers receive direct feedback from end-users. This accelerates R&D efforts, enabling quicker adaptation of resin properties to meet evolving industrial needs. Further, bypassing distributors or third-party vendors gives companies greater control over pricing strategies. This can lead to more competitive offers or better profit margins, making the business more sustainable.

Type Segment Analysis

Pure phthalonitrile resin type is anticipated to expand at a significant phthalonitrile resin market share. Pure phthalonitrile resin is a high-temperature polymer renowned for its exceptional thermal stability, chemical resistance, and mechanical strength. These attributes make it particularly suitable for demanding applications in industries such as aerospace, automotive, and electronics.

Additionally, the electronics industry benefits from the resin’s excellent thermal and electrical properties, making it suitable for applications such as printed circuit boards and semiconductor packaging. The superior performance characteristics of pure phthalonitrile resin are driving its adoption across multiple industries, thereby contributing to the overall growth of the market.

Our in-depth analysis of the global phthalonitrile resin market includes the following segments:

|

Type |

|

|

End use |

|

|

Application |

|

|

Sales Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Phthalonitrile Resin Market - Regional Analysis

APAC Market Insights

Asia Pacific in phthalonitrile resin market is expected to hold over 52.6% revenue share by the end of 2035. The market is experiencing notable growth driven by increasing demand in the aerospace and automotive industries and technological advancements. The region’s phthalonitrile resin market is on a robust growth trajectory, fueled by industrial expansion and the increasing adoption of high-performance materials across multiple sectors.

The rapid growth of China’s electronics industry has led to a heightened demand for materials that offer superior thermal and electrical properties. Phthalonitrile resins are employed in applications such as printed circuit boards and semiconductor packaging, contributing to the miniaturization and enhanced performance of electronic devices. Moreover, ongoing R&D efforts in China have resulted in improved manufacturing processes and innovative applications of phthalonitrile resins. Additionally, the country’s emphasis on infrastructure development and renewable energy projects has expanded the use of these resins in construction materials and wind turbine components.

India’s focus on strengthening its aerospace and defense capabilities has led to increased demand for advanced materials. Phthalonitrile resins, known for their high stability and mechanical strength, are suitable for manufacturing components that can withstand extreme conditions. Research institutions like the Defense Materials and Stores Research and Development Establishment (DMSRDE) in Kanpur have developed high-temperature-resistant phthalonitrile resins for such applications.

North America Market Insights

North America is expected to experience a stable CAGR during the forecast period due to an increase over the next several years. The demand for phthalonitrile resins is primarily fueled by their applications in the aerospace, defense, and electronics industries. These resins are valued for their high thermal stability, mechanical strength, and chemical resistance, making them suitable for high-performance components.

The U.S. is anticipated to lead the phthalonitrile resin market, attributed to technological advancements and the presence of key industry players. Canada, on the other hand, is also projected to witness steady growth due to its expanding industrial base and favorable government policies.

Phthalonitrile Resin Market Players:

- Lonza Group

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- DuPont de Nemours, Inc.

- Huntsman Corporation

- Clariant

- Dow Chemical Company

- Toray Industries, Inc.

- Solvay

- Mitsubishi Rayon Co., Ltd.

- Evonik Industries

- BASF

- Rhodia

- Sabic

- Daicel Corporation

Leading companies are heavily investing in R&D to enhance the performance of phthalonitrile resins, improving thermal stability, mechanical strength, and processability. Companies are introducing next-generation resins with faster curing times and improved environmental resistance. This is expanding the range of use cases in automotive lightweighting, 5G infrastructure, and renewable energy.

Here are some of the key players driving the phthalonitrile resin market:

Recent Developments

- In May 2024, Polymer Chemistry published an article on rediscovering phthalonitrile resins. The study mentioned the advancements in resin formulations, where researchers are exploring modifications to phthalonitrile resins to enhance their processability and performance. It was observed that incorporating Si-O-Si chain segments has led to the development of liquid phthalonitrile monomers with lower melting points and viscosities, facilitating easier processing while maintaining excellent thermal properties.

- Report ID: 7504

- Published Date: Dec 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Phthalonitrile Resin Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.