Specialty Polystyrene Resin Market Outlook:

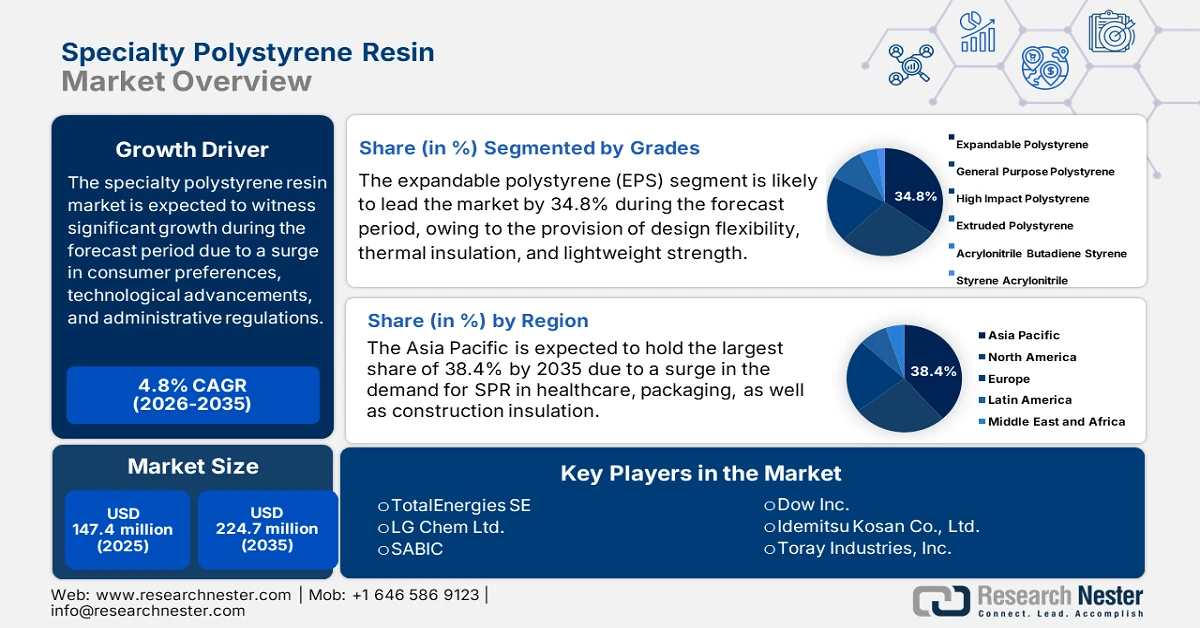

Specialty Polystyrene Resin Market size was over USD 147.4 million in 2025 and is estimated to reach USD 224.7 million by the end of 2035, expanding at a CAGR of 4.8% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of specialty polystyrene resin is estimated at USD 154.4 million.

The global specialty polystyrene resin market is predicted to expand steadily, with support from evolving customer preferences, regulatory frameworks, and technological innovation, along with packaging and sustainability. According to official statistics published by NLM in October 2022, just 2% of plastic packaging materials are significantly recycled as packaging materials internationally. Besides, 30% of plastic-based packaging items are either too small or complex to recycle, including small wrappers or sachets and multi-layered materials. Moreover, plastic-specific materials are the most utilized packaging materials, and almost 26% of the overall utilization of polymers in packaging makes it the largest application of plastic materials. Meanwhile, Europe Commission has the objective to diminish plastic wastage by 55% as of 2025, which is suitable for proliferating the specialty polystyrene resin market’s growth globally.

Furthermore, the integration with smart manufacturing, expansion into high-performance electronics, healthcare advancements beyond packaging, digitalized supply chain transformation, and customization for niche applications are other drivers for uplifting the specialty polystyrene resin market internationally. As per a data report published by the Tech Government in 2025, the deep tech startup ecosystem in India has reached nearly more than 3,600 startups, with over 60% in artificial intelligence, which is followed by AR/VR, blockchain, Internet of Things (IoT), as well as big data and analytics. Besides, stakeholder consultations suggested that smart energy management solutions tend to diminish energy consumption by 3% to 5%. Therefore, with this continuous growth in smart manufacturing, the market’s exposure is poised to experience growth and expansion.

Key Specialty Polystyrene Resin Market Insights Summary:

Regional Highlights:

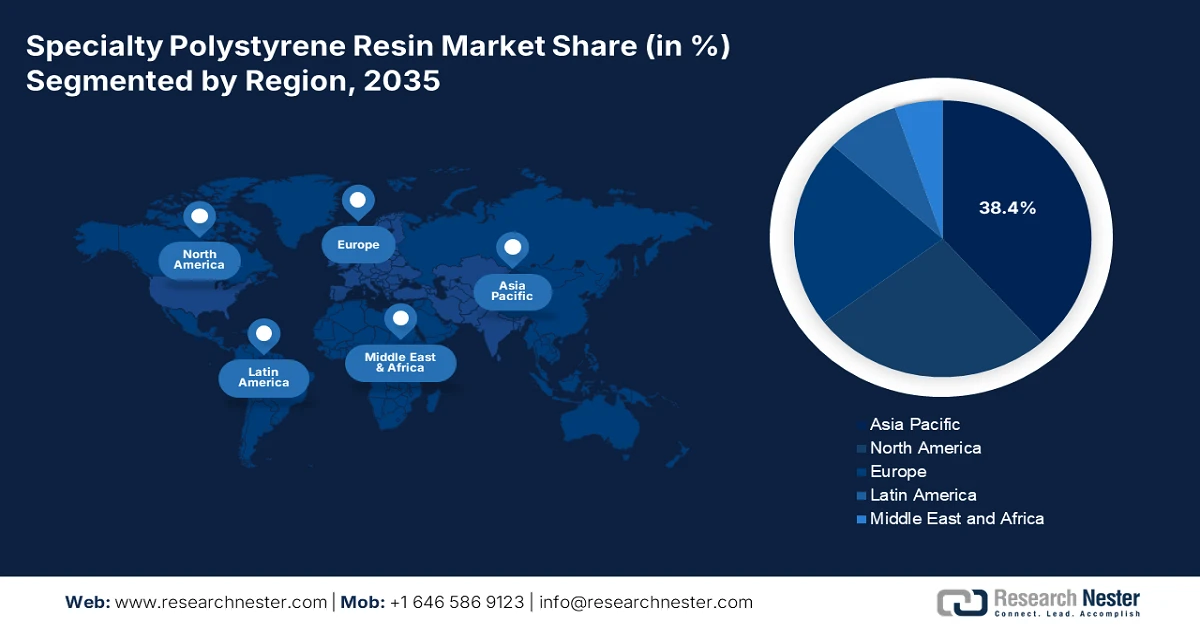

- The Asia Pacific region in the specialty polystyrene resin market is projected to command the largest 38.4% share by 2035, underpinned by rising demand across healthcare, packaging, and construction insulation applications alongside increasing government investment in advanced manufacturing and sustainable chemicals.

- Europe is expected to register the fastest growth by the end of the forecast period, supported by strong policy backing, expanding chemical industry investments, and intensified focus on low-carbon technologies and sustainability-driven industrial programs.

Segment Insights:

- The expandable polystyrene (EPS) sub-segment within the grades segment of the specialty polystyrene resin market is projected to secure a leading 34.8% share by 2035, supported by its widespread adoption across packaging and insulation applications on account of its design flexibility, lightweight strength, shock absorption, and thermal insulation capabilities.

- The protective packaging segment under applications is expected to represent the second-largest share by 2035, benefiting from accelerating e-commerce, global logistics expansion, and rising demand for lightweight, durable, and temperature-sensitive packaging solutions enabled by EPS-based cushioning materials.

Key Growth Trends:

- Rise in the demand for lightweight substitutes

- International push for digitalized infrastructure

Major Challenges:

- Raw material price volatility

- Regulatory pressures on plastics

Key Players: INEOS Styrolution (U.S.), Trinseo PLC (U.S.), BASF SE (Germany), TotalEnergies SE (France), LG Chem Ltd. (South Korea), SABIC (Saudi Arabia), Chevron Phillips Chemical Company LLC (U.S.), Dow Inc. (U.S.), Idemitsu Kosan Co., Ltd. (Japan), Toray Industries, Inc. (Japan), Mitsubishi Chemical Group Corporation (Japan), Sumitomo Chemical Co., Ltd. (Japan), UBE Corporation (Japan), Sekisui Chemical Co., Ltd. (Japan), Asahi Kasei Corporation (Japan), Chi Mei Corporation (Taiwan), Formosa Plastics Corporation (Taiwan), Lotte Chemical Corporation (South Korea), Hanwha Solutions Corporation (South Korea), Kumho Petrochemical Co., Ltd. (South Korea).

Global Specialty Polystyrene Resin Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 147.4 million

- 2026 Market Size: USD 154.4 million

- Projected Market Size: USD 224.7 million by 2035

- Growth Forecasts: 4.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (38.4% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: China, United States, Germany, Japan, South Korea

- Emerging Countries: India, Vietnam, Malaysia, Indonesia, Thailand

Last updated on : 21 January, 2026

Specialty Polystyrene Resin Market - Growth Drivers and Challenges

Growth Drivers

- Rise in the demand for lightweight substitutes: There has been an increase in the utilization of specialty polystyrene resin as a lightweight alternative option to heavy polymers and metals. This has been suitable for the aerospace and automotive industries, wherein emission reduction and fuel efficiency are critical for the specialty polystyrene resin market globally. According to government estimates published by the Department of Energy in 2025, a 10% reduction in vehicle weight tends to result in a 6% to 8% fuel economy optimization. Besides, replacing conventional steel components and cast iron with lightweight materials directly lowers the weight of the chassis by almost 50%. Besides, the ongoing styrene polymers supply is also deliberately uplifting the market across different nations.

2023 Styrene Polymers Export and Import

|

Countries |

Export (USD) |

Import (USD) |

|

South Korea |

3.0 billion |

- |

|

China Taipei |

2.3 billion |

- |

|

Belgium |

1.5 billion |

- |

|

China |

- |

3.0 billion |

|

Germany |

- |

1.2 billion |

|

U.S. |

- |

1.2 billion |

|

Global Trade Valuation |

19.8 billion |

|

|

Global Trade Share |

0.087% |

|

|

Product Complexity |

0.72 |

|

Source: OEC

- International push for digitalized infrastructure: The rollout of smart devices and 5G networks is readily driving the demand for the specialty polystyrene resin market, particularly for heat-resistant and durable resins for electronics manufacturing. As stated by an article published by the PIB Government in August 2025, the digitalized economy in India significantly contributed 11.7% to national income between 2022 and 2023, and further increased by 13.4% between 2024 and 2025. Besides, there has been a surge in the production of electronics goods from ₹1.9 lakh crore to ₹11.3 lakh crore as of 2024 and 2025, denoting a 6-fold growth. Simultaneously, the exports of electronics products upsurge from ₹38,000 crore to ₹3.27 lakh crore within the same duration, marking an 8-fold increase, thus making it suitable for boosting the overall specialty polystyrene resin market’s exposure.

- Growth in additive manufacturing: The specialty polystyrene resin market is being readily engineered for 3D printing applications, thereby enabling personalized production in industrial designs, consumer goods, and healthcare. According to official statistics published by the UNICEF Organization in October 2025, 50% of all internationally manufactured goods are poised to be printed by utilizing additive manufacturing technology by the end of 2060. In addition, across disaster-prone or low-income nations, supply chain spending regularly absorbs 60% to 80% of humanitarian budgets, thus making the localization of additive manufacturing logistically advantageous. Therefore, with an increase in the aspect of additive manufacturing, the market is gaining increased exposure across different regions.

Challenges

- Raw material price volatility: The specialty polystyrene resin market is highly dependent on styrene monomer, which is derived from crude oil and natural gas. Fluctuations in global oil prices directly impact production costs, creating uncertainty for manufacturers. For instance, geopolitical tensions, supply chain disruptions, and OPEC production decisions often cause sharp swings in crude oil prices. This volatility makes it difficult for SPR producers to maintain stable pricing and long-term contracts with customers. Additionally, the rising demand for alternative polymers such as polypropylene and PET intensifies competitive pressure, forcing SPR producers to absorb cost increases rather than passing them on to consumers, which, in turn, is negatively impacting the market’s growth.

- Regulatory pressures on plastics: Governments worldwide are tightening regulations on single-use plastics, directly affecting demand for the specialty polystyrene resin market in packaging and consumer goods. Europe’s Single-Use Plastics Directive and similar policies in North America and Asia are pushing companies to reduce reliance on polystyrene-based products. These regulations not only restrict certain applications but also impose higher compliance costs on manufacturers, who must invest in recycling infrastructure and sustainable alternatives. For instance, bans on expanded polystyrene (EPS) food containers in several U.S. states have reduced demand in the foodservice sector. Compliance with environmental standards also requires significant research and development spending, which smaller companies may struggle to afford.

Specialty Polystyrene Resin Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.8% |

|

Base Year Market Size (2025) |

USD 147.4 million |

|

Forecast Year Market Size (2035) |

USD 224.7 million |

|

Regional Scope |

|

Specialty Polystyrene Resin Market Segmentation:

Grades Segment Analysis

The expandable polystyrene (EPS) sub-segment, which is part of the grades segment, is anticipated to garner the largest share of 34.8% in the specialty polystyrene resin market by the end of 2035. The sub-segment’s upliftment is highly driven by its importance for its design flexibility, shock absorption, excellent thermal insulation, and lightweight strength. According to a data report published by the Global EPS Organization in April 2024, EPS recycled content tends to be achieved at levels ranging from 10% to 30%, depending on different applications. Besides, 66,000 metric tons, that is over 30% of EPS has been diverted from the landfill located in North America. Simultaneously, the average recycling rate for EPS packaging in Europe is 40%, while the recycling rate in South Korea, China, and Japan accounts for more than 50%, thereby bolstering the sub-segment’s expansion globally.

Application Segment Analysis

Based on the application, the protective packaging segment in the specialty polystyrene resin market is projected to hold the second-largest share. The segment’s growth is highly fueled by its dominance, which stems from the rapid expansion of e-commerce, global logistics, and food delivery services, which require lightweight, durable, and shock-resistant materials. SPR, particularly expandable polystyrene (EPS), is widely used in protective packaging due to its cushioning properties, cost-effectiveness, and recyclability potential. The rise of temperature-sensitive goods such as pharmaceuticals and fresh food has further boosted demand for insulated packaging solutions. Regulatory pressures on single-use plastics are reshaping the segment, pushing manufacturers to develop bio-based and recyclable SPR grades.

Polymer Source Segment Analysis

By the end of the stipulated timeline, the oil-based sub-segment, part of the polymer source segment, is expected to account for the third-largest share in the specialty polystyrene resin market. The sub-segment’s development is highly attributed to its importance, driven by petrochemical feedstocks such as styrene monomer, oil-based SPR remains the most widely used due to its established supply chains, cost efficiency, and versatile performance characteristics. Despite growing interest in bio-based alternatives, oil-based resins retain a competitive edge in high-volume applications like automotive interiors, electronics housings, and industrial packaging. Their mechanical strength, impact resistance, and thermal stability make them indispensable across multiple industries. However, the segment faces challenges from volatile crude oil prices and increasing regulatory scrutiny over carbon emissions.

Our in-depth analysis of the specialty polystyrene resin market includes the following segments:

|

Segment |

Subsegments |

|

Grades |

|

|

Application |

|

|

Polymer Source |

|

|

End use |

|

|

Industrial Vertical |

|

|

Molecular Weight |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Specialty Polystyrene Resin Market - Regional Analysis

APAC Market Insights

The Asia Pacific specialty polystyrene resin market is anticipated to garner the highest share of 38.4% by the end of 2035. The market’s upliftment in the region is highly driven by healthcare applications, packaging, and construction insulation. Additionally, government spending on advanced manufacturing and sustainable chemicals across South Korea, Malaysia, Japan, India, and China is also bolstering the market’s growth. According to official statistics published by the BCM Organization in July 2024, chemical production has readily increased over 3% as of 2204 and 2025, with the Asia Pacific continuing to be one of the main growth drivers. Besides, the chemical output in the region constituted 1.8% in 2022, which is followed by 4.9% in 2023, 3.3% in 2024, and 3.5% in 2025. Therefore, with the continuous growth of chemicals, there is a huge growth opportunity for the specialty polystyrene resin market in the overall region.

The specialty polystyrene resin market in China is growing significantly due to the prioritization of sustainability in chemical production, along with government expenditure and stringent recycling mandates. As per an article published by the Ministry of Foreign Affairs in May 2023, the country has proactively supported the operation and construction of the Centre for Chemistry and Technology (ChemTech Center) by donating USD 30,000 to the OPCW. Besides, as of 2023, the country has decided to provide €50,000 from donation balances, particularly for the Fellowship Program within the ChemTech Center. Moreover, the nation is the second largest budget contributor to the OPCW, with its share increasing from 0.8% to 15.2% as of 2023. By the end of 2022, the nation significantly contributed over €39 million to the regular OPCW budget, which is suitable for bolstering the market.

The specialty polystyrene resin market in India is also growing, owing to industrial growth, sustainability approaches, governmental funds for advanced polymers, and generous investment provisions. As stated in an article published by the IBEF Organization in October 2025, the packaging sector’s growth in the country is effectively underpinned by expansion across middle class population, with a projected increase in packaged food, amounting to Rs. 29,563 crore (USD 3.4 billion) by the end of 2027. Besides, the food and beverage packaging in the country was worth Rs. 3,31,595 crore (USD 38.3 billion) as of 2025, which is further projected to increase to Rs. 4,53,625 crore (USD 52.5 billion) by the end of 2030, implying an estimated 6.5% growth rate. Therefore, due to ongoing growth in the packaging sector, the market in the country is continuously growing.

Europe Market Insights

Europe specialty polystyrene resin market is expected to emerge as the fastest-growing region by the end of the forecast period. The market’s development in the region is highly propelled by the existence of government bodies, chemical industry investments, increased focus on sustainability, and administrative programs. Based on government estimates published by the Open Access Government Organization in July 2022, with revenue of over €38 billon until 2030 from the regional Emissions Trading System (ETS), the Innovation Fund in the region has aimed to develop suitable financial incentives for public authorities and organizations to invest in next-generation low-carbon technologies. Besides, across energy-intensive industries, there has been the allocation of €1.1 billion for 7 projects, thereby making it suitable for boosting the market.

The specialty polystyrene resin market in Germany is gaining increased traction due to the presence of robust healthcare, construction, and automotive industries, along with green chemicals and chemical production capacity. As stated in an article published by the Federal Ministry for Economic Affairs and Energy in February 2024, the Federal Ministry for Economic Affairs and Climate Action (BMWK) has made the provision of €3.5 billion from the Climate and Transformation Fund for a duration ranging between 2027 and 2036. This is extremely suitable for importing green hydrogen along with its derivatives from different regions. Besides, the objective of the country’s federal government is to readily foster the decarbonization of industry, accounting for 94 TWh to 130 TWh every year by the end of 2030, thereby ensuring sustainability for the market’s expansion.

The specialty polystyrene resin market in the UK is also developing due to innovation in packaging, sustainability mandates, and ensuring alignment with the zero plastic waste strategy. According to official statistics published by the UK Government in November 2025, £74 million has been generously put forth by the country’s government for conducting research regarding robots and artificial intelligence (AI) integration into medicines. This also includes utilizing fuel from nuclear power and recycling it into cancer radiotherapies for backing life sciences innovators. Besides, the country’s life sciences industry is considered a suitable force for growth, readily generating £150 billion as a yearly turnover. Therefore, with continuous funding scope in the healthcare industry, there is a huge demand for the market in the overall nation.

North America Market Insights

North America specialty polystyrene resin market is projected to witness considerable growth by the end of the stipulated timeline. The market’s growth in the region is highly driven by construction insulation, healthcare, and packaging demand. According to official statistics published by the EPA Government in October 2025, packaging and containers make up the majority of municipal solid waste, accounting for 82.2 million tons of generation, which is 28.1% of the overall generation. Besides, the recycling rate of generated packaging and containers has been 3.9%, and meanwhile, the combustion of containers and packaging was 7.4 million tons, which is 21.5% of the total combustion with energy recovery. Additionally, this also constitutes 30.5 million tons of landfills, which is 20.9% of the overall landfilling, thus bolstering the market’s demand in the region.

The specialty polystyrene resin market in the U.S. is gaining increased exposure due to recycling and sustainability mandates, energy-efficient construction, along with the presence of advanced safety and manufacturing regulations. As per a data report published by the Recycling Partnership Organization in 2024, 21% of residential recyclables are readily recycled, with every material type falling under-recycled. In addition, 76% of residential recyclables are significantly lost at the household level, significantly underscoring the importance of engagement and accessibility. Moreover, just 43% of households are eager to participate in recycling, 59% utilize recycling services, and 57% of recyclable material is put in recycling containers. Besides, recycling facilities in the country tend to process 95% of the recyclable material thar are received into saleable commodities, thus driving the market’s growth.

State-Wise Recycling Accessibility in the U.S. (2024)

|

|

Single-Family Recycle Access |

Multifamily |

Al Households |

|||

|

City Name |

Total |

Curbside |

Drop-Off |

Recycle Access |

Recycle Access |

Non-Recycle Access |

|

Alabama |

61% |

31% |

305 |

10% |

48% |

52% |

|

California |

97% |

94% |

3% |

89% |

95% |

5% |

|

Delaware |

99% |

99% |

0% |

89% |

97% |

3% |

|

Florida |

90% |

85% |

5% |

16% |

66% |

34% |

|

Georgia |

76% |

38% |

38% |

19% |

62% |

36% |

|

Hawaii |

82% |

82% |

0% |

25% |

64% |

36% |

|

Illinois |

85% |

75% |

10% |

41% |

74% |

26% |

Source: Recycling Partnership Organization

The specialty polystyrene resin market in Canada is also growing due to clean energy chemical product funding, waste reduction and circular economy policies, as well as medical device and healthcare growth. As stated in an article published by Global Affairs Canada in January 2024, the country’s 10-Year Commitment to Global Health and Rights (10YC) has continued to ramp up domestic spending to cater to an average of USD 1.4 billion yearly between 2023 and 2024, along with USD 700 million for sexual and reproductive health and rights (SRHR) every year. In addition, USD 1.2 billion in overall international investments under the 10YC denotes a 2% increase and is being delivered through almost 605 projects with more than 366 partners. Besides, there has been a 14% surge in SRHR programming investment, along with USD 567.4 million invested in comparison to USD 496 million, thus making it suitable for boosting the market.

Key Specialty Polystyrene Resin Market Players:

- INEOS Styrolution (U.S.)

- Trinseo PLC (U.S.)

- BASF SE (Germany)

- TotalEnergies SE (France)

- LG Chem Ltd. (South Korea)

- SABIC (Saudi Arabia)

- Chevron Phillips Chemical Company LLC (U.S.)

- Dow Inc. (U.S.)

- Idemitsu Kosan Co., Ltd. (Japan)

- Toray Industries, Inc. (Japan)

- Mitsubishi Chemical Group Corporation (Japan)

- Sumitomo Chemical Co., Ltd. (Japan)

- UBE Corporation (Japan)

- Sekisui Chemical Co., Ltd. (Japan)

- Asahi Kasei Corporation (Japan)

- Chi Mei Corporation (Taiwan)

- Formosa Plastics Corporation (Taiwan)

- Lotte Chemical Corporation (South Korea)

- Hanwha Solutions Corporation (South Korea)

- Kumho Petrochemical Co., Ltd. (South Korea)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- INEOS Styrolution is recognized as the global leader in styrenics, with a strong portfolio in GPPS, HIPS, and EPS resins. The company has invested heavily in circular economy initiatives, including advanced recycling technologies, to meet sustainability demands and regulatory pressures.

- Trinseo PLC readily focuses on performance materials and sustainable solutions, with SPR production integrated into its plastics and rubber division. Despite restructuring challenges in 2025, the company is pivoting toward recycled and bio-based resins, aligning with global packaging and automotive sustainability trends.

- BASF SE leverages its global chemical leadership to drive innovation in specialty resins, particularly in construction, insulation, and healthcare packaging. The company’s research and development emphasize bio-based polymers and energy-efficient materials, supported by Europe Green Deal funding for sustainable chemical production.

- TotalEnergies SE integrates SPR production within its petrochemicals division, focusing on expandable polystyrene (EPS) for insulation and packaging. The company has expanded its low-carbon chemical portfolio, investing in recycling and renewable feedstocks to strengthen its market share in Europe.

- LG Chem Ltd. is a major APAC player, with SPR applications across electronics, automotive, and consumer goods. The company has prioritized bio-based and high-performance resins, supported by South Korea’s government-backed green chemistry programs, positioning it for rapid growth in the Asia Pacific.

Here is a list of key players operating in the global specialty polystyrene resin market:

The international specialty polystyrene resin market is highly competitive, with 205 major manufacturers spanning the U.S., Europe, Japan, South Korea, India, Malaysia, and Australia. Key players such as INEOS Styrolution, BASF, LG Chem, and Reliance Industries dominate through scale, innovation, and sustainability initiatives. Strategic priorities include bio-based resin development, recycling technologies, and energy-efficient production processes. Companies are leveraging government-backed green chemistry programs, research and development collaborations, and digital supply chain optimization to strengthen market positions. Besides, in October 2025, Trinseo declared that it has commenced the receipt of chemically styrene monomer through depolymerization. The company received this from the newly operational recycling facility developed by Indaver, which is the company’s partner, thereby creating a huge growth opportunity for the specialty polystyrene resin industry globally.

Corporate Landscape of the Specialty Polystyrene Resin Market:

Recent Developments

- In July 2025, Bakelite declared its successful acquisition of Sestec to deliberately enhance its position as one of the sustainability leaders in the adhesive industry. In addition, this acquisition is regarded as a transformative step for the organization’s thermoset specialty resins.

- In June 2025, DCM Shriram Ltd approved to sign a definitive deal to completely acquire the ownership of Hindusthan Specialty Chemicals Ltd for ₹375 crore. This particular move has positioned DCM for tactical expansion into the advanced materials segment, which has unlocked synergies with its current chemicals portfolio.

- In June 2025, Aditya Birla Group notified the expansion of its U.S. advanced materials business by acquiring Cargill Incorporated’s 17-acre specialty chemical manufacturing in Georgia.

- Report ID: 8358

- Published Date: Jan 21, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Specialty Polystyrene Resin Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.