Phenoxy Resin Market Outlook:

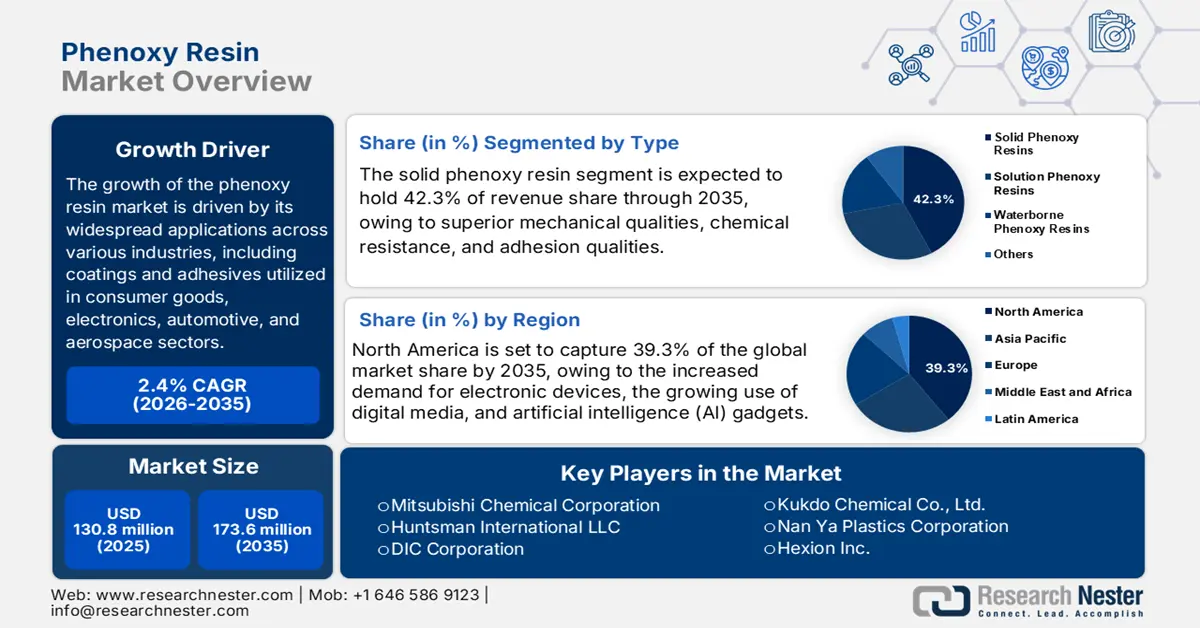

Phenoxy Resin Market was USD 130.8 million in 2025 and is estimated to reach USD 173.6 million by the end of 2035, expanding at a CAGR of 2.4% during the forecast period, i.e., 2026-2035. In 2026, the industry size of phenoxy resin is estimated at USD 133.7 million.

The global phenoxy resin market is projected to grow significantly over the forecast years, primarily driven by its widespread applications across various industries, including composites, protective coatings, and adhesives utilized in consumer goods, electronics, automotive, and aerospace sectors. Due to the increasing need for strong and efficient materials, manufacturers are incorporating phenolic resins in a diverse array of applications. The exceptional adhesive properties, flexibility, and chemical resistance of these resins render them suitable for numerous uses. In response to the rising focus on sustainable solutions, bio-based phenoxy resins have been developed to meet consumer needs and regulatory requirements. For example, as per the Sumitomo Chemical 2024 Sustainability Report, their commercialization of bio-based phenoxy resin as a part of their Sumika Sustainable Solutions generated ¥588.7 billion of sales revenue in fiscal 2023. These resins are directly aligned with climate objectives and stringent requirements of emissions regulation, as there is an increased customer and policy pressure on the growth of sustainable resins. The rapid growth in the use of these resins reflects the increasing priority companies place on sustainability.

Moreover, the phenoxy resin market is expanding as new advancements in polymer technology continue to emerge. Recent studies have pointed to new bio-based epoxy resins with improved characteristics, including flame retardancy and recyclability, as a solution to the environmental and health issues of petroleum-based resins. For instance, a bio-based resin exhibited a 135.2°C and flexural strength at 157.2 MPa, which is higher than petroleum alternatives, and therefore supports the growth of the phenoxy resin industry due to the technological developments. Additionally, according to the World Paint and Coatings Industry Association (WPCIA), the worldwide paint and coatings industry was worth USD 185.5 billion in 2023, a growth rate of 3.2% from the previous year. The growing need for coatings across a range of industries, including manufacturing, automotive, and construction, was the main factor in this expansion.

Supply chain perspective phenoxy resin manufacturing requires feedstocks, which include bisphenol derivatives and epichlorohydrin (or other phenol expected + epoxide chemistries). The manufacturers of resin are increasing capacity, especially in Asia, in order to satisfy local demand. International resins and associated chemical movement are controlled, as the U.S. requires TSCA import certifications on chemical substances such as specialty resins. In addition, raw phenolic intermediates or epoxide raw materials are imported into manufacturing bases (e.g., Southeast Asia, East Asia), and resins are exported to large demand bases. In 2023, the U.S. exports of phenolic resin, such as phenoxy resin, were around USD 256,727.63 million, which is a recovery from the lows of the past years. This recovery in the value of trade indicates the sustained market activity and contributes to the current increasing trend of the phenoxy resin industry in recent years. Certain regulatory measures are competitive in nature; for instance, the U.S. Commerce Department recently omitted phenoxy resins under specific countervailing duty coverage when imposing the duties on epoxy resins in China, suggesting that phenoxy resins have different trade policies.

Furthermore, the Producer Price Index of Plastics Material and resin manufacturing showed 316.849 in June 2025, 315.075 in July, and 316.263 in August, which means that the prices remain unchanged, and the growth of the phenoxy resin market will be supported. Moreover, publicly funded initiatives like NASA phenoxy resin with pendant ethynyl groups, in terms of R&D and deployment, have better glass transition temperatures and solvent resistance through thermal crosslinking, which develops resin durability, a fundamental development to grow phenoxy resin in high-performance applications, as well as synthesis and curing of phenoxy resin with pendent ethynyl groups giving rise to crosslinked thermoplastics with higher solvent resistance and temperature stability, continue to support their increasing use in coating and composite work.

Key Phenoxy Resin Market Insights Summary:

Regional Highlights:

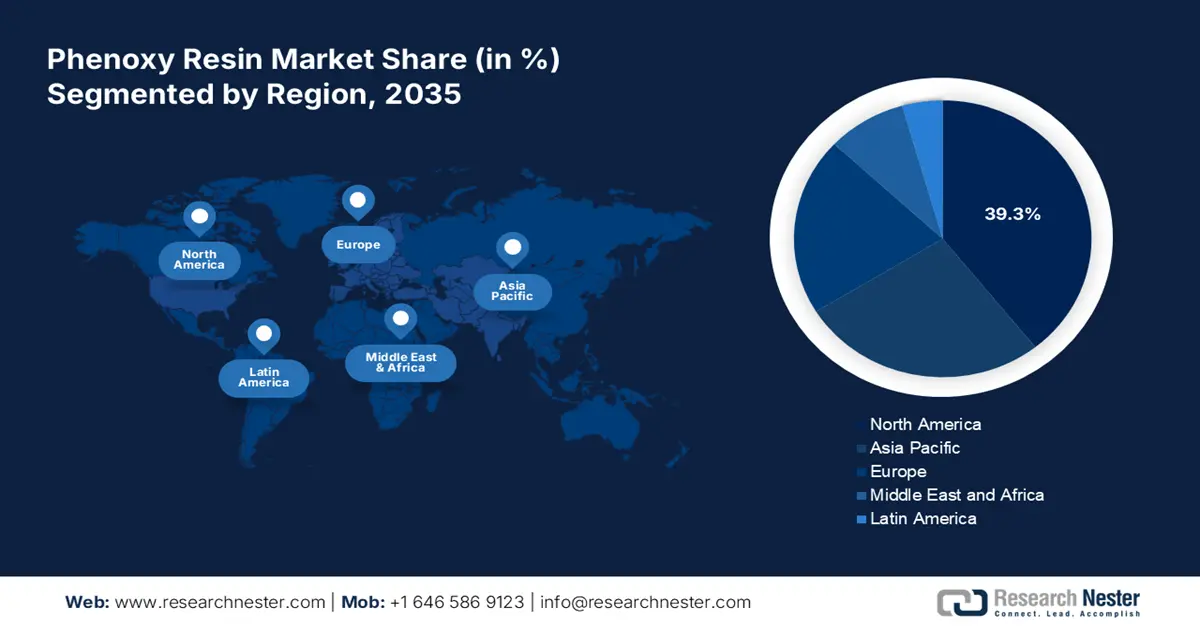

- North America is projected to hold a 39.3% share of the phenoxy resin market, anchored by rising adoption in electronics for component protection and low-VOC automotive coatings.

- Asia Pacific region is expected to grow considerably, reinforced by expanding industrial applications and advancements in additive manufacturing using phenoxy-based materials.

Segment Insights:

- Solid phenoxy resin segment is projected to secure a 42.3% share in the phenoxy resin market, propelled by its superior mechanical qualities, chemical resistance, and adhesion qualities.

- By 2035, the coatings segment is anticipated to expand significantly, supported by its excellent binding capabilities, chemical resistance, and durability.

Key Growth Trends:

- Rising demand for high-performance coatings

- Increasing adoption in the 3D printing industry

Major Challenges:

- Environmental concerns

- Regulation of volatile organic compounds (VOCs)

Key Players: Mitsubishi Chemical Corporation, Huntsman International LLC, DIC Corporation, Kukdo Chemical Co., Ltd., Nan Ya Plastics Corporation, Hexion Inc., Showa Denko K.K., Olin Corporation, 3M Company, Merck KGaA, SABIC, Eastman Chemical Company, InChem Corporation, Shin-A T&C Co., Ltd., Avenex

Global Phenoxy Resin Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 130.8 million

- 2026 Market Size: USD 133.7 million

- Projected Market Size: USD 173.6 million by 2035

- Growth Forecasts: 2.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (39.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Singapore, United Arab Emirates

Last updated on : 7 October, 2025

Phenoxy Resin Market - Growth Drivers and Challenges

Growth Drivers

- Rising demand for high-performance coatings: The growing need for high-performance coatings across a range of end-use sectors is one of the main factors propelling the phenoxy resin market's expansion. Due to their exceptional weatherability, chemical resistance, and durability, these coatings are perfect for use in the automotive, aerospace, and architectural industries. Manufacturers are increasingly using phenoxy resins because of their exceptional adhesion qualities and versatility as industries look for ways to improve the quality and durability of their goods. For example, Mitsubishi Chemical Corporation categorizes phenoxy-type epoxy resins as High molecular weight epoxy resin (phenoxy resin) in their jER Product line of epoxy resin. This type of resin provides good mechanical properties, adhesion, and chemical resistance, making it appropriate for coating, adhesives, and composites. The development of phenoxy resin formulations is being further aided by the trend toward eco-friendly and lightweight materials, which enable them to satisfy strict environmental standards while preserving high-performance qualities.

- Increasing adoption in the 3D printing industry: In recent years, 3D printing, sometimes referred to as additive manufacturing, has expanded quickly in several industries, including consumer goods, automotive, healthcare, and aerospace. The fabrication of functional prototypes, tools, and end-use parts is one area where phenolic resins have shown great promise for 3D printing applications due to their exceptional mechanical qualities, chemical resistance, and thermal stability. Phenoxy resins provide precise, accurate products with smooth surface finishes because they shrink little and have good dimensional stability during printing. This qualifies them for uses including consumer electronics, medical equipment, and aerospace components that call for precise tolerances and complex designs.

- Increasing use in electronics sector: Phenoxy resins have good chemical resistance and thermal stability, which is why they are capable of being used to encapsulate and protect delicate electronic components. For example, a thermoplastic phenoxy compound such as Huntsman Phenoxy PK HJ resin is highly compatible with epoxies and substrates, such as aluminum and glass. Phenoxy resins are very chemically resistant, have high mechanical strength and thermal stability, thus suitable to be used as electronics components, protecting and sealing functions. They have better adhesion, which ensures good bonding to a wide range of substrates, thus being durable in extreme environments such as moisture, heat, and mechanical stress. Automotive and 3D printing products are also other areas that gain advantages of these properties because they increase the longevity and performance of products. Such a tendency is supplemented by the increasing automotive and 3D printing uses, which bring the growth of the phenoxy resin market.

Trade Dynamics

Global Import of Phenolic resins, in primary forms by country, 2024

|

Country/Region |

Import Value (USD Thousands) |

Import Quantity (Kg) |

|

China |

309,767.11 |

91,486,900 |

|

Germany |

141,954.34 |

75,820,000 |

|

United States |

128,469.66 |

N/A |

|

European Union |

127,842.15 |

67,332,000 |

|

Canada |

103,989.79 |

80,751,900 |

Source: worldbank.org

Global Export of Phenolic resins, in primary forms by country, 2024

|

Country/Region |

Export Value (USD Thousands) |

Export Quantity (Kg) |

|

United States |

261,963.18 |

113,865,000 |

|

European Union |

239,818.76 |

89,584,100 |

|

China |

239,683.63 |

143,203,000 |

|

Germany |

204,429.87 |

73,489,400 |

|

Japan |

189,252.25 |

32,580,500 |

Source: worldbank.org

United States Phenolic resins, in primary forms imports by country, 2024

|

U.S. |

Partner Country |

Import Value (1000 USD) |

Quantity (kg) |

|

Canada |

65,750.12 |

42,139,300 |

|

|

Singapore |

12,446.99 |

3,603,670 |

|

|

India |

9,695.80 |

1,752,720 |

|

|

Germany |

8,988.02 |

2,739,300 |

|

|

Brazil |

7,113.30 |

2,287,330 |

|

|

Korea, Rep. |

7,051.68 |

2,266,200 |

|

|

Japan |

3,388.19 |

393,916 |

|

|

China |

3,131.73 |

1,541,810 |

|

|

Belgium |

1,814.28 |

308,350 |

|

|

France |

1,347.03 |

134,297 |

Source: worldbank.org

United States Phenolic resins, in primary forms, exports by country, 2024

|

U.S. |

Partner Country |

Export Value (1000 USD) |

Quantity (kg) |

|

Canada |

104,997.31 |

78,039,600 |

|

|

Mexico |

70,865.98 |

19,598,600 |

|

|

China |

17,753.42 |

3,444,970 |

|

|

Brazil |

5,700.66 |

1,356,220 |

|

|

Japan |

5,501.42 |

199,401 |

|

|

Colombia |

4,817.28 |

1,070,360 |

|

|

Other Asia, nes |

4,344.26 |

646,118 |

|

|

Korea, Rep. |

3,280.67 |

486,237 |

|

|

Thailand |

3,241.32 |

479,198 |

|

|

Netherlands |

3,169.49 |

778,616 |

Source: worldbank.org

Challenges

- Environmental concerns: As governments throughout the world step up their efforts to battle climate change and decrease pollution, industries are under increasing pressure to adopt sustainable practices and reduce their environmental imprint. Regulators and environmental campaigners are concerned about phenolic resins because, like many other chemical compounds, they can present environmental dangers during production, use, and disposal. The strict environmental restrictions and growing environmental concerns are a major restricting factor affecting the phenoxy resin market. Moreover, there is the issue of waste management of resin-based by-products and the disposal at the end of life of the products, particularly those in regions without advanced chemical recycling facilities. Growing pressure to disclose environmental audit and compliance with ESG puts an operational burden on the manufacturers, so that small and mid-level manufacturers cannot scale.

- Regulation of volatile organic compounds (VOCs): The production and use of adhesives and coatings release volatile organic compounds (VOCs). VOCs can negatively impact both the environment and human health in addition to contributing to air pollution. As a result, producers are compelled to create low-VOC or VOC-free coating and adhesive compositions since regulatory bodies place stringent restrictions on VOC emissions. The creation of ecologically friendly formulations frequently involves higher production costs and may sacrifice some performance features, which presents obstacles for market expansion, even though certain phenoxy resin-based products satisfy these regulatory standards. Furthermore, the level of adherence to VOC also differs depending on the region, which necessitates the formulation of individual markets, increasing the cost of R&D and certification. VOC emissions are also becoming stricter around the world, so manufacturers are moving towards greener chemistry development, and outdated phenolic chemistries are being phased out that would not comply with the strict limits of emissions.

Phenoxy Resin Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

2.4% |

|

Base Year Market Size (2025) |

USD 130.8 million |

|

Forecast Year Market Size (2035) |

USD 173.6 million |

|

Regional Scope |

|

Phenoxy Resin Market Segmentation:

Type Segment Analysis

The solid phenoxy resin market segment is projected to gain a 42.3% share through 2035, primarily due to its superior mechanical qualities, chemical resistance, and adhesion qualities. Solid phenoxy resins are frequently employed in coatings, adhesives, and sealants. Applications needing high-performance coatings with improved weather resistance and durability are better suited for them. For example, the 4,510,296 patents by NASA are solid phenoxy resins, which are pendant to ethynyl groups, which crosslink when heated, increasing their solvent resistance and usability temperature. Such cured solid resins are suitable for durable applications such as coatings, adhesives, and composite matrices. These resins are frequently utilized in wood coatings, varnishes, and printing inks. Usually, they are dissolved in solvents to create transparent, high-gloss coatings.

Phenoxy resin is available in pellet or flake forms, making it easy to handle and process. These solid types provide uniform quality and can be easily melt-processed, making them suitable for coatings and adhesives that need dependable performance. In a study, the phenoxy resin pellets were subjected to a pressure of 70 kg/cm2 for characterizations to add mechanical strength and adhesion to composite materials, thereby increasing their durability, which is important in aerospace and automobile use. High molecular weight phenoxy thermoplastics offer better mechanical, chemical, and thermal stability, which is necessary in demanding structural adhesive and coating applications. It is due to their significance in high-performance composite matrices in aerospace and electronics, which NASA research highlights as warranting the growth of this segment of the market with improved toughness and durability, allowing increased use in industries.

Application Segment Analysis

The coatings segment is poised to grow at a significant rate by 2035. Coatings manufactured from phenoxy resin are widely utilized in a variety of industries due to their excellent binding, resistance to chemicals, and durability. For instance, these phenoxy-resin coating systems, which are modified with hexakis(4-(hydroxymethyl)phenoxy)cyclotriphosphazene, have better chemical resistance, thermal stability, adhesion, and corrosion protection. These characteristics create an increasing need for phenoxy resin coating in processes that require high-performance and long-lasting coating of surfaces. Additionally, in the automotive, aerospace, and marine industries, they are widely employed to apply protective coatings on metal surfaces. For example, epoxy-phenoxy hybrid coatings provide improved adhesion, corrosion resistance, and lower VOC emissions, which reinforce the trend of using phenoxy resins in sustainable and high-performance coating systems in the industrial and protective industries.

Protective industrial coatings are essential in providing metal surface protection in harsh environments. As per the NASA research on corrosion-protective paints based on electrically conducting polymers, the effectiveness of these materials in increasing the life of metal surfaces subjected to demanding conditions is shown. They are used to give corrosion resistance properties to mild steel subjected to saline and acidic environments, and they also provide corrosion resistance properties in regions where the protective coating is scratched, which highlights the importance of protective industrial coatings in lengthening the life cycle and reliability of metal structures in adverse environments. Meanwhile, marine and corrosion-resistant coatings are also contributing to market growth by offering protection to ships and offshore platforms against severe corrosion by saltwater. The use of phenoxy coatings, which are made of epoxy, is a successful barrier film that shields metals, increasing their structural integrity and lifespan at sea. The growth in the phenoxy resin coatings in this subsegment is driven by the growing demand for durable and environmentally compliant marine coatings.

End Use Segment Analysis

The automotive segment in the phenoxy resin market is projected to grow significantly by 2035, owing to the rising demand for durable coatings, adhesives, and composites. The number of applications of advanced materials in the automotive parts industry is high, as indicated by the U.S. Bureau of Economic Analysis that the U.S. has imported more automotive vehicles, parts, and engines valued at USD 52.0 billion in 2022, which is a substantial growth compared to the previous years, reflecting the rising demand of automotive parts and, consequently, the demand of new advanced materials such as the phenoxy resins. Phenoxy resins offer higher adhesion, chemical, and impact resistance, which are required in vehicle body coating, structural adhesives, and lightweight parts. The U.S. Department of Energy emphasizes the move to lightweight, fuel-efficient automobiles and the move to more use of phenoxy resins in performance and sustainability. In addition, EPA regulations favor low-emission materials, which are in line with the use of phenoxy resin. All these contribute to the consistent expansion of the market in phenoxy resin in automotive applications, with official government statistics to support it.

Our in-depth analysis of the global phenoxy resin market includes the following segments:

| Segment | Subsegment |

|

Type |

|

|

Application |

|

|

End-Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Phenoxy Resin Market - Regional Analysis

North America Market Insights

North America phenoxy resin market is expected to dominate highest revenue share of 39.3% during the forecast period from 2026 to 2035, attributed to the extensive use of phenoxy resin in the electronics sector to encapsulate and protect electronic components. The heat stability and chemical resistance of these resins are essential in safeguarding the endurance of the electronic devices. There are several reasons for the increased demand for electronic devices, including the growing use of digital media, the Internet, cloud computing, and artificial intelligence (AI) gadgets. Moreover, the EPA’s automotive plastic parts coating guidelines require a reduction in VOC emissions to increase air quality. This has led to the demand for low-VOC coatings, which in turn increases the use of phenoxy resins in North America since it has good adhesion and resistance to chemicals, contributing to the growth of the phenoxy resin market in the automotive industry. Additionally, recent statistics released by the U.S Census Bureau show that new residential construction in North America was 1,307,000 housing starts and 1,312,000 building permits in the month of August 2025, reflecting a steady growth in the demand for phenoxy resin. The increasing usage of the resin in coating and adhesive is causing this growth, as it improves the quality and life of construction materials.

U.S. is projected to dominate the North American region with a significant share of phenoxy resin market over the forecast years, driven by its enhanced research and development capabilities and high need for automotive products. For example, the U.S. automotive industry produces top research and development (R&D), which spends about USD 130 billion in research and development, and is ranked third in the world in research and development investment. The massive investment contributes to the development of the safety, efficiency, and sustainability of vehicles. Such attention to innovation and performance in the auto industry generates an increasing need for sophisticated materials such as phenoxy resins. In addition, the electronics industry also supports the increasing demand for this resin, as the IPC in March 2025 noted that the electronics industry demand was at its strongest point in almost one year, with significant growth in customer and manufacturing activity. This expansion in the electronics industry fuels the requirement for sophisticated materials such as the phenoxy resins, which are utilized in the coatings and adhesives of electronic parts since they have superior qualities.

Moreover, the focus on sustainable materials can be found in industries, as stated in its white paper on sustainability issues in the electronics manufacturing sector, the Chief Technologist Council of the IPC suggested the need to use materials that are environmentally friendly. The low volatile organic compound (VOC) emissions and durability of phenoxy resins meet these sustainability objectives, which have motivated the use of these resins in different applications.

The market in Canada is likely to expand steadily by 2035, due to the growing need for high-performance adhesives and coatings in the building and automotive sectors. The country’s strict environmental laws are encouraging producers to use eco-friendly and sustainable resins, which is driving market expansion. For example, the Single-use Plastics Prohibition Regulations of Environment and Climate Change Canada, issued in the Canada Gazette, which bans the manufacture and sale of certain types of plastics, promotes the use of more sustainable products, and drives the resin market toward more environmentally friendly resins. In addition, the adaptability and compatibility of water-based phenoxy resins with a broad variety of substrates and additives make them appropriate for a number of applications. For instance, the analysis of the screening of epichlorohydrin, which is one of the major precursors of phenoxy resins in Canada, focuses on the low levels of environmental release of the chemical and controlled usage in protective coatings and polymers. This regulatory control is one that contributes to the safe development of the phenoxy resin applications and leads to the development of the phenoxy resin market in Canada through compliance and sustainable industrial applications. Among other applications, they can be found in adhesives, wood coatings, industrial coatings, automotive coatings, and architectural coatings. Waterborne phenoxy resins are also perfect for demanding applications where performance is crucial because of their exceptional adhesion, chemical resistance, and durability.

Asia Pacific Market Insights

The Asia Pacific phenoxy resin market is expected to grow substantially over the forecast years from 2026 to 2035, influenced by a combination of environmental initiatives and industrial demands. Phenoxy resins are suitable for use in cutting-edge applications that require exceptional mechanical strength, chemical resistance, and thermal stability due to their unique properties. The need for specialty materials such as phenoxy resins is expected to rise as these sectors develop and expand. In addition, the use of phenoxy resins in 3D printing and additive manufacturing technologies opens up new market opportunities by empowering producers to create intricate and high-performing components efficiently. For instance, the OSTI report illustrates the creation of 3D printable all-polymer epoxy composites reinforced by polyphenylene ether (PPE), a polymer derived from phenoxy resins, to create high-strength, thermally stable components through additive manufacturing. This new technology fits into the rising phenoxy resin market in the Asia Pacific by developing enhanced production of complex and high-performance parts, powering the regional market expansion based on automotive, aerospace, and electronic applications.

The phenoxy resin market in China is expected to lead the Asia Pacific region during the projected years, mainly driven by the demand for sealant, which has been fueled by the expanding construction and retail industries. Additionally, a steep increase in the production of phenolic resin in China, propelled by the construction of urban buildings, as well as wood processing industries, is also supporting the market growth. China in 2020 manufactured approximately 1.43 million tons of phenolic resin, which is used in plywood, refractory materials, and insulation, among others, which are necessary in construction. The growing urban infrastructure promotes the development of phenoxy resin usage, with the growing production capacity and the stable market demand in the coastal provinces such as Shanghai and Jiangsu. Furthermore, these resins are utilized in composites, adhesives, and coatings that improve the durability and structural soundness of building projects. The need for phenoxy resins in construction applications is expected to rise as the global building industry experiences strong growth, especially in developing nations. China's construction industry has also notably expanded over the recent years, boosting the growth of phenoxy resin as an essential application. For example, the value added of construction in China increased to 8,994,900 million RMB in 2024, indicating high levels of urbanization. This development forms the basis of the growing demand for phenoxy resins in the construction sector, which has enhanced the market for the resin as infrastructure building gains momentum in China.

India’s market is expected to grow with the fastest CAGR during the forecast years from 2026 to 2035, attributed to the demand for paints and coatings, benefiting from the growing aerospace and shipping industries. With an emphasis on industrial and decorative paints, Berger Paints is putting in place two new plants in Bengal and Odisha worth 2,000 crore with an objective of increasing production capacity by 25-30% to concentrate on industrial and construction chemicals. This investment is an indicator of rising demand for phenoxy resins in the construction and coating industries of India, and it contributes to the high growth trend in the resin market. In addition, according to the USITC report, India is an important supplier and exporter of epoxy resins such as phenoxy resins, owing to its developed chemical knowledge and capital infrastructure. These align well with the robust market growth of phenoxy resin with increasing construction and auto industry needs in the Indian market.

Europe Market Insights

Europe is anticipated to expand significantly in the phenoxy resin market over the projected years by 2035, driven by surging demand in the automotive, aerospace, and electronics industries; strict environmental laws that encourage the use of eco-friendly materials and the development of bio-based and sustainable resin structures, which drive innovation and market growth. In addition, the high-performance and durability of materials in the automotive and aerospace industries, where the production of the European epoxy resin has been 323,000 tonnes in recent years, resulting in sales of about 1.055 billion, reflecting a vital role of phenoxy resins in the coating and adhesive of these industries. Moreover, the adoption of phenoxy resin in construction, metal, and wood industries is due to environmental regulations that are creating pressure on the use of solvent-free and low-VOC industrial coatings. Sustainable bio-based phenolic resins that have been innovated to boost performance and minimize environmental impact respond to the EU sustainability objectives and market growth. Moreover, growth in the UK market is assisted by the development of technologies of phenoxy resin, harder and faster to cure, which help industries such as automotive and electronics, which have been the subject of scientific research in phenoxy-modified epoxy. Meanwhile, in Germany, phenolic resin has been developed due to the construction and manufacturing industries looking to innovate in terms of recycling and bio-based resins to consume these resins.

Key Phenoxy Resin Market Players:

- Mitsubishi Chemical Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Huntsman International LLC

- DIC Corporation

- Kukdo Chemical Co., Ltd.

- Nan Ya Plastics Corporation

- Hexion Inc.

- Showa Denko K.K.

- Olin Corporation

- 3M Company

- Merck KGaA

- SABIC

- Eastman Chemical Company

- InChem Corporation

- Shin-A T&C Co., Ltd.

- Avenex

Leading companies in the phenoxy resin market are actively engaged in research and development to innovate and introduce new products to maintain a competitive edge in the market. The phenoxy resins market is characterized by a competitive environment, with several major competitors attempting to increase their market share through partnerships, mergers, acquisitions, and new product development. Businesses are concentrating on diversifying their product lines and allocating resources towards research and development to meet the changing needs of end-user sectors. Offering high-performance, environmentally friendly resin solutions that satisfy strict industrial standards is what fuels the market's fierce competition.

Here is a list of key players operating in the market:

Recent Developments

- In May 2024, PPG announced it would construct a new paint and coatings manufacturing plant in Tennessee as part of a USD 300 million investment in new state-of-the-art manufacturing plants throughout North America. This investment is focused on increasing production capacity in high-performance coatings, including those utilizing phenoxy resins with effective adhesion properties, chemical, and durability. The new plant will have the latest technologies to address the growing needs of state-of-the-art materials in the automotive, industrial, and protective coatings industries. The growth of PPG is indicative of the increasing market potential due to the increasing demand for more sustainable and performance-oriented coating solutions, which is in line with the increased applications of phenoxy resin in high-end manufacturing sectors across the globe.

- In February 2024, DCM Shriram Chemicals confirmed that it entered the advanced materials industry, including the production of epoxy resin, and is expected to invest INR 1000 crores in this direction over the next few years to become a state-of-the-art production facility of epoxy resin. This expansion is supported by the company's Epichlorohydrin (ECH) plant in Jhagadia, Gujarat, which is predicted to be commissioned in Q1 2024-25, since more than 80 percent of all Epichlorohydrin (ECH) produced in the world is utilized in the production of epoxy. The liquid epoxy resins, hardeners, solvent cuts, reactive diluents, and formulated resins are the products found in the portfolio of DCM Shriram, which are geared to be used in wind blades, electric vehicles, aerospace, electronics, fireproofing, and lightweight industries. This business plan is consistent with the trend in the increasing demand for phenoxy resin and other sophisticated materials in India, making DCM Shriram more likely to take advantage of the rising domestic and international consumption.

- Report ID: 7652

- Published Date: Oct 07, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Phenoxy Resin Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.