Polyvinyl Chloride Paste Resin Market Outlook:

Polyvinyl Chloride Paste Resin Market size was over USD 5.7 billion in 2025 and is anticipated to cross USD 8.94 billion by 2035, growing at more than 4.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of polyvinyl chloride paste resin is assessed at USD 5.94 billion.

The polyvinyl chloride paste resin market is witnessing steady growth, accelerated by the rising need from various industries such as packaging, automotive, construction, and healthcare sectors due to its versatility, cost-effectiveness, and durability. Increasing urbanization, infrastructure development in emerging economies, and the shift towards lightweight, sustainable materials further propel polyvinyl chloride paste resin market growth. In construction, PVC paste resin’s cost-effectiveness and durability make it ideal for applications such as roofing, flooring, and piping, particularly in developing countries experiencing infrastructure booms. For instance, Vinythai Public Company Ltd, now part of AGC Chemicals, is a key player in the construction sector using PVC paste resin. The company produces high-quality PVC paste resins used in wall covering, flooring, and synthetic leather-critical components in modern construction projects for both residential and commercial applications.

The automotive industry benefits from PVC paste resin’s lightweight and moldable properties, using it in components such as dashboards and door panels to improve fuel efficiency and design flexibility. Furthermore, the healthcare sector’s reliance on PVC paste resin for medical devices like tubing and blood bags underscores its importance due to its reliability and safety. The packaging industry also contributes to market expansion, with PVC paste resin being favored for its versatility and moisture resistance in creating flexible and rigid packaging solutions.

Companies like Kaneka Corporation exemplify innovation through its creation of Kaneka Biodegradable Polymer PHBH. This demonstrates its wider dedication to sustainable, biodegradable alternatives that are environmentally friendly. This concentration on biodegradable and bio-based polymers demonstrates Kaneka’s proactive approach to aligning its product offerings with evolving global sustainability standards and consumers' demands for greener alternatives. Overall, the market’s growth is underpinned by the PVC paste resin’s adaptability and the rising emphasis on sustainable practices across industries.

Key Polyvinyl Chloride Paste Resin Market Insights Summary:

Regional Highlights:

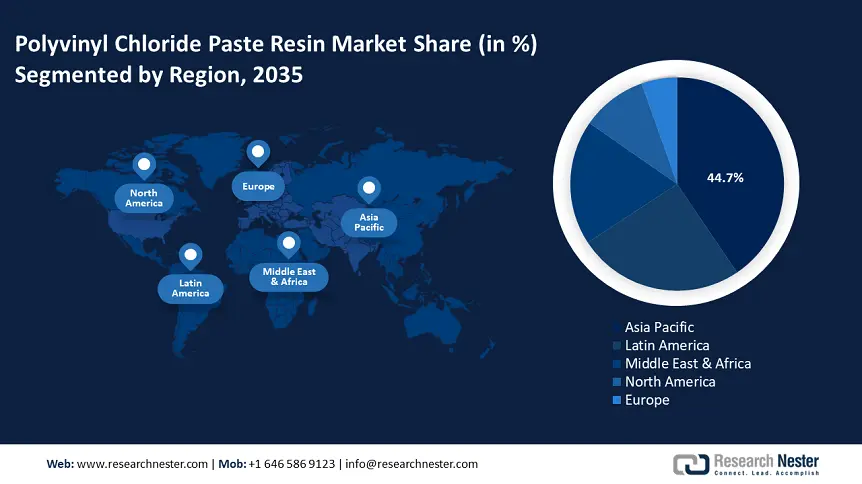

- Asia Pacific commands a 44.70% share in the Polyvinyl Chloride Paste Resin Market, driven by the region’s extensive manufacturing base and demand in synthetic leather, automotive interiors, wallpapers, and flooring, ensuring robust growth by 2035.

Segment Insights:

- The micro-suspension process segment is expected to hold a 54.8% share by 2035, driven by improved filtration, faster plasticizer absorption, and superior processing characteristics.

Key Growth Trends:

- Growing application of PVC paste in the automotive and construction sectors

- Medical and healthcare applications

Major Challenges:

- Disposal & recycling limitation

- Volatility in raw material prices

- Key Players: LG Chem, Orbia, Westlake Corporation, Formosa Plastics Corporation, Tosoh Corporation, Hanwha Solutions Corporation, KANEKA CORPORATION, SCG Chemicals Public Company Limited, Chemplast Sanmar.

Global Polyvinyl Chloride Paste Resin Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.7 billion

- 2026 Market Size: USD 5.94 billion

- Projected Market Size: USD 8.94 billion by 2035

- Growth Forecasts: 4.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (44.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 12 August, 2025

Polyvinyl Chloride Paste Resin Market Growth Drivers and Challenges:

Growth Drivers

- Growing application of PVC paste in the automotive and construction sectors: The PVC paste resin is poised for significant growth, driven by the need for cost-effective, lightweight, and durable materials in the automotive and construction sectors. Additionally, the growth of urban areas, advancements in infrastructure, and the drive for more fuel-efficient vehicles are contributing to a rising demand for PVC paste resins. Additionally, its versatility, durability against various weather conditions, and ease of processing make it appropriate for numerous applications.

In construction, PVC paste resin is favored for its cost-effectiveness, durability, and versatility, making it ideal for products like flooring, wall coverings, and roofing materials. Its resistance to moisture and chemicals enhances its suitability for diverse building environments. The automotive industry benefits from PVC paste resin’s lightweight properties, utilizing it in interior components such as dashboards and door panels to improve fuel efficiency and reduce emissions. The rising need for electric vehicles further amplifies this trend, as manufacturers seek materials that contribute to overall vehicle weight reduction.

Companies like Shin-Etsu Chemicals Co., Ltd., are responding to this demand. Shin-Etsu has announced plans for a major expansion of its PVC paste resin production facility in Japan, with an investment of USD 1.25 billion intended to meet the increasing demands of the construction and automotive sectors. Such strategic initiatives underscore the industry’s commitment to meeting evolving market requirements and highlight the pivotal role of PVC paste resin in modern manufacturing and construction practices.

- Medical and healthcare applications: Rising usage of PVC paste resin in the medical & healthcare industry is driven by the need for safe, flexible, and durable materials for products like gloves, blood bags, and tubing. Increased healthcare spending, aging population, and infection control requirements, especially post-COVID-19, further accelerate the usage of medical-grade PVC resins. PVC paste resin’s ability to be molded into complex shapes without compromising safety or strength makes it an ideal choice for disposable medical items. Additionally, its compatibility with sterilization methods such as ethylene oxide & gamma radiation and its biocompatibility make it an ideal choice for single-use medical applications. The affordability of PVC paste resin compared to alternative polymers also plays a crucial role in its selection for high-volume healthcare production.

In India, Chemplant Sanmar Limited stands out as a leading manufacturer in this domain. As the country’s largest producer of specialty paste PVC resin, with a total capacity of 107,000 TPA across its Mettur and Cuddalore plants, Chemplast Sanmar has been instrumental in meeting the growing global demand for safe and effective medical devices. The company’s commitment to quality and innovation has reinforced its position as a key player in the medical polyvinyl chloride paste resin market.

Challenges

- Disposal & recycling limitation: Recycling PVC paste resin products is challenging due to the presence of additives and complex composite structures, which limit their sustainability appeal. These materials often contain a complex mix of plasticizers, stabilizers, and other additives that complicate traditional recycling processes. Additionally, many PVC applications, such as coated fabrics, flooring, and medical devices, are bonded with other materials, further hindering separation and reprocessing. As a result, mechanical recycling becomes inefficient and costly, while chemical recycling technologies are still in developmental stages and not widely implemented. These factors reduce the overall recyclability of PVC paste resin products, posing environmental concerns and impacting the industry’s ability to align with circular economic goals.

- Volatility in raw material prices: The manufacturing of PVC paste resin relies on essential raw materials, particularly Vinyl Chloride Monomer (VCM), which is obtained through petrochemical processes. The pricing of VCM is influenced by fluctuations in global oil markets. Fluctuations in oil markets are driven by geopolitical tensions, supply chain disruptions, and regulatory changes, which directly impact VCM costs. This price instability affects manufacturing costs and market profitability. This instability compresses profit margins and deters long-term investment in the sector. Additionally, rising costs may be passed on to end-users, potentially affecting demand across key industries such as construction, automotive, and healthcare.

Polyvinyl Chloride Paste Resin Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.6% |

|

Base Year Market Size (2025) |

USD 5.7 billion |

|

Forecast Year Market Size (2035) |

USD 8.94 billion |

|

Regional Scope |

|

Polyvinyl Chloride Paste Resin Market Segmentation:

Manufacturing Process (Micro-Suspension Process and Emulsion Process)

The micro-suspension process segment is predicted to gain the largest polyvinyl chloride paste resin market share of 54.8% during the projected period. This dominance is attributed to the process, resulting in improved filtration, faster plasticizer absorption, and superior processing characteristics. These advantages make the micro-suspension process particularly suitable for applications requiring high-quality coatings, artificial leather, and automotive interiors. A notable instance of a company leveraging the micro-suspension process is Westlake Vinnolit, a leading PVC paste resin producer. Vinnolit has been recognized for its significant market share and commitment to producing high-quality PVC paste resins using advanced manufacturing techniques.

The company’s focus on innovation and quality has solidified its position in the polyvinyl chloride paste resin market, catering to diverse applications across various industries. The preference for the micro-suspension process is expected to continue, driven by the increasing demand for superior-quality PVC materials in end-use industries such as construction, automotive, and healthcare. Companies adopting this process are well-positioned to meet the evolving needs of these sectors, ensuring sustained growth and competitiveness in the global polyvinyl chloride paste resin market.

Grade (High K-Value Grade, Mid K-Value Grade, Low K-Value Grade, Vinyl Acetate Copolymer Grade, and Blend Resin Grade)

The high k-value grade segment is at the forefront of the global polyvinyl chloride paste resin market. This leadership is primarily attributed to the exceptional mechanical properties associated with high K-value grades, such as increased tensile strength, enhanced impact resistance, and superior chemical stability. These attributes make high K-value PVC paste resin particularly suitable for applications demanding structural integrity and durability, such as rigid pipes, window profiles, fittings, and industrial components.

In addition, high K-value resins demonstrate favorable processability in complex fabrication methods like extrusion and injection molding, allowing manufacturers to efficiently produce high-performance end products. The strong demand from construction, infrastructure, and industrial sectors continues to boost the growth of this segment. For instance, SCGC, SCGC, a leading petrochemical manufacturer based in Thailand. SCGC produces a range of PVC paste resins with varying K-values, including high K-values grades such as PC750 (K = 76) and PG770 (KK=79). These resins are designed especially for applications requiring enhanced mechanical strength and durability, such as synthetic leather, flooring, and automotive parts.

Our in-depth analysis of the polyvinyl chloride paste resin market includes the following segments:

|

Manufacturing Process |

|

|

Grade |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Polyvinyl Chloride Paste Resin Market Regional Analysis:

Asia Pacific Market Statistics

The Asia Pacific polyvinyl chloride paste resin market is poised to hold a 44.7% share by the end of 2035. This leadership is attributed to the region’s extensive manufacturing base, particularly in countries like China, India, and Japan, which are recognized as global industrial hubs. The substantial demand for PVC paste resins in applications such as synthetic leather, automotive interiors, wallpapers, and flooring is driven by rapid urbanization, infrastructure development, and a burgeoning middle class. These factors have led to increased consumption of PVC-based products across various sectors.

Shandong Aojin Chemical Technology Co., Ltd. is recognized for its cutting-edge manufacturing methods. Aojin produces high-quality PVC paste resins, including the P450 grade, which is widely used in applications such as synthetic leather, flooring, and wall coverings. The company’s commitment to innovation and quality has solidified its position in both domestic and international markets. Aojin’s strategic investments in research and development have enabled it to produce high-quality PVC paste resins that meet the evolving needs of various industries. The proactive approach has allowed Aojin to maintain a competitive edge and contribute significantly to the region’s dominance in the global polyvinyl chloride paste resin market.

Latin America Market Analysis

Latin America has rapidly emerged as the fastest-growing polyvinyl chloride paste resin market, driven by the expanding consumer goods sector and other industries. Countries such as Brazil, Mexico, and Argentina are witnessing increased demand for PVC-based products, including synthetic leather, wall covering, flooring, and automotive interiors. This surge is attributed to rapid urbanization, infrastructure development, and a growing idle class seeking affordable and durable materials. A significant participant in this industry is Braskem A.A., recognized as the largest petrochemical firm in Latin America. Located in São Paulo, Brazil, Braskem produces an extensive range of thermoplastic resins, including PVC.

The company operates multiple industrial plants across Brazil, the U.S., Mexico, and Germany, with a combined production capacity exceeding 16 million tons of thermoplastic resins and other petrochemicals annually. Braskem’s commitment to innovation is evident in its development of green polyethylene derived from sugarcane-based ethanol, positioning it as a leader in sustainable solutions within the industry. The Latin American polyvinyl chloride paste resin market is poised for continued growth, supported by these key industry players and the region’s ongoing economic development.

Key Polyvinyl Chloride Paste Resin Market Players:

- INEOS Group Limited

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- LG Chem

- Westlake Corporation

- Hanwha Solutions Corporation

- Orbia

- Tosoh Corporation

- Formosa Plastics Corporation

- SCG Chemicals Public Company Limited

- KANEKA CORPORATION

- Chemplast Sanmar

Key players in the polyvinyl chloride paste resin market leverage advanced polymerization technologies like micro-suspension and emulsion processes to ensure superior product quality. They also invest in research and development for bio-based alternatives, enhancing performance, sustainability, and application versatility to maintain competitive polyvinyl chloride paste resin market positions.

Recent Developments

- In February 2023, INEOS acquired specific oil and gas assets from Chesapeake Energy in southern Texas for $1.4 billion in cash. This purchase of Chesapeake's South Texas assets and operations aligns with INEOS' strategy to develop a globally integrated portfolio focused on energy transition and high-quality energy solutions.

- In October 2022, Westlake Vinnolit expanded its range of lower-carbon GreenVin® products by introducing GreenVin bio-attributed PVC, produced from renewable ethylene. This new addition is now available.

- Report ID: 7614

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.