Dimethylaminopropylamine Market Outlook:

Dimethylaminopropylamine Market size was valued at USD 1.56 billion in 2025 and is set to exceed USD 2.47 billion by 2035, expanding at over 4.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of dimethylaminopropylamine is estimated at USD 1.63 billion.

The reason behind the growth is impelled by the growing beauty & personal care industry across the globe. The rising demand for sustainable, organic, and clean options among consumers, and the growing consumer awareness of personal health has surged the production of skincare and hair care products.

According to estimates, globally, the beauty & personal care industry is expected to expand by around 3% between 2024 and 2028, reaching a market size of over USD 736 billion by 2028. Particularly, in 2022 global sales of cosmetics reach around USD 100 billion.

In addition to these, the growing usage of cocamidopropyl betaine is believed to fuel dimethylaminopropylamine market growth. The process of making cocamidopropyl betaine entails mixing dimethylaminopropylamine with raw coconut oil, which is mostly utilized as a detergent, and booster in shampoos.

Key Dimethylaminopropylamine Market Insights Summary:

Regional Highlights:

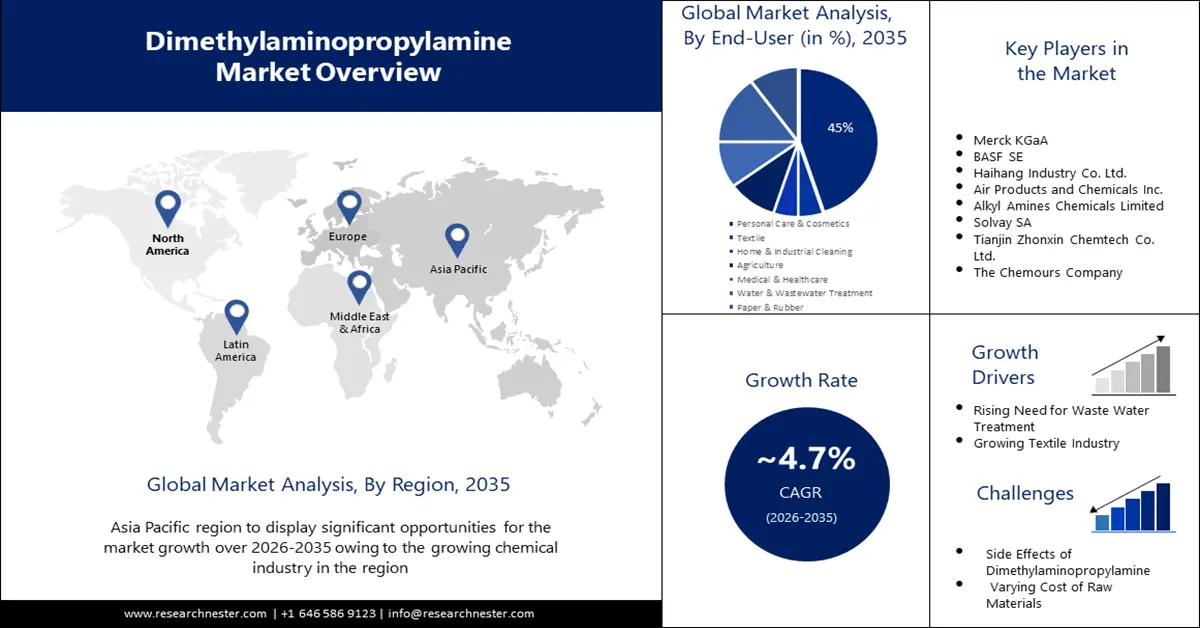

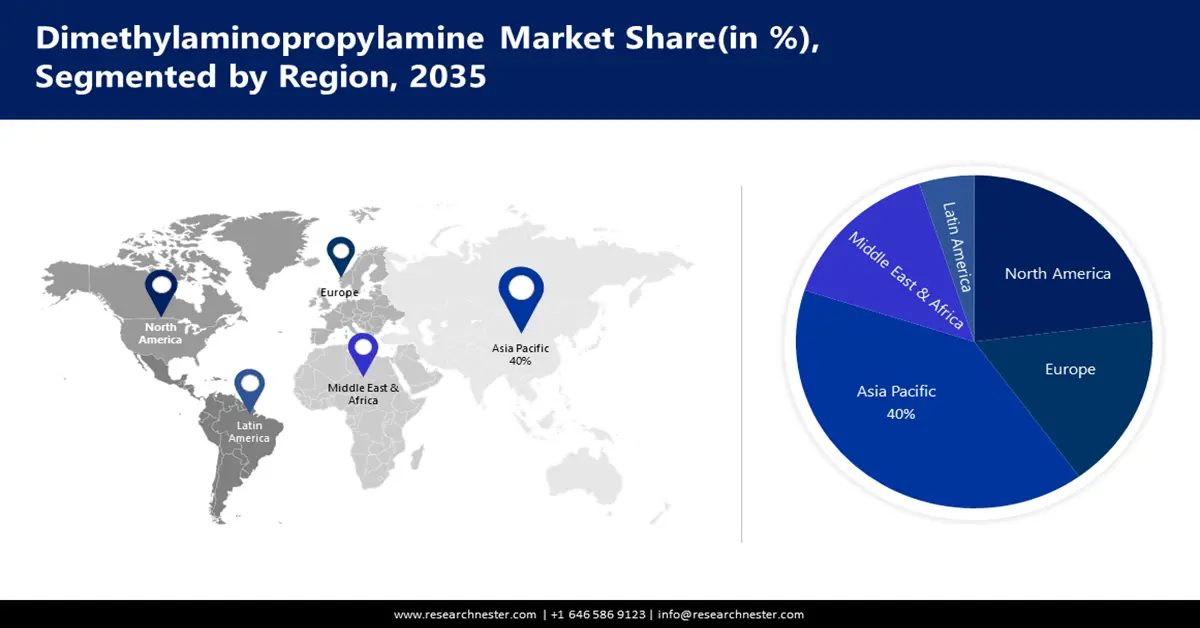

- Asia Pacific dimethylaminopropylamine market will dominate more than 40% share by 2035, driven by a growing chemical industry, particularly in India, which is a major producer of chemicals and personal care products.

Segment Insights:

- The personal care & cosmetics segment in the dimethylaminopropylamine market is expected to attain a 45% share by the forecast year 2035, driven by the extensive use of DMAPA in producing cosmetic raw materials.

Key Growth Trends:

- Rising need for waste water treatment

- Growing textile industry

Major Challenges:

- Rising need for waste water treatment

- Growing textile industry

Key Players: Merck KGaA, BASF SE, Haihang Industry Co. Ltd., Air Products and Chemicals Inc., Alkyl Amines Chemicals Limited, Solvay SA, Tianjin Zhonxin Chemtech Co. Ltd., The Chemours Company, Realet Chemical Technology Co. Ltd..

Global Dimethylaminopropylamine Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.56 billion

- 2026 Market Size: USD 1.63 billion

- Projected Market Size: USD 2.47 billion by 2035

- Growth Forecasts: 4.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 16 September, 2025

Dimethylaminopropylamine Market Growth Drivers and Challenges:

Growth Drivers

- Rising need for waste water treatment - Dimethylaminopropylamine has a standard amine order and is a transparent, nearly colorless liquid that is often used in water treatment solutions since it functions as a flocculant to extract oil and floating solids from wastewater. For instance, more than 65% of the wastewater produced in high-income nations is treated, on average.

- Growing textile industry - Phthalocyanine dyes can be made with dimethylaminopropylamine which can be used to color plastics, nylon, polyacrylonitrile, cellulose fibers, and synthetic varnishes. As a result, textile industry widely uses dimethylaminopropylamine. In 2024, the value added in the textile sector is expected to reach US$171.10 billion. With this expansion of textile industry, the dimethylaminopropylamine market will also expand.

- Increasing number of people with blood pressure issues - It has been proposed that DMAPA derivative diquaternary salts can control blood pressure which is said to impact over 25% of adult people worldwide.

- Dimethylaminopropylamine in the rubber industry - Rubber products are made with DMAPA (dimethylaminopropylamine) since rubber is effectively shielded from ozone breakdown by the reaction product of DMAPA and α, α'- dichloro-p-xylene.

- Surging demand for polyurethane foam - DMAPA is a common catalyst used in the production of polyurethane foam a specialist material used for thermal insulation, that is utilized in shoes, bedding, furniture, and car interiors.

Challenges

- Side effects of dimethylaminopropylamine - In testing using lab animals, the Department of Transportation (DOT) found that the product was "corrosive" to the skin, leading to extreme irritation to an individual's eyes, skin, and mucous membranes, and may result in acute respiratory distress symptoms or a reduction in lung function, and may result in Lung edema. Skin allergies such as blisters, sores, redness, itching, and tightness are a few of these adverse effects, which depend on the level, mode, and length of exposure.

- Varying cost of raw materials such as acrylonitrile and dimethyl amine may hinder the growth of DMAPA market.

- Strict rules and regulations to ensure environmental sustainability

Dimethylaminopropylamine Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.7% |

|

Base Year Market Size (2025) |

USD 1.56 billion |

|

Forecast Year Market Size (2035) |

USD 2.47 billion |

|

Regional Scope |

|

Dimethylaminopropylamine Market Segmentation:

End-User

In dimethylaminopropylamine market, personal care & cosmetics segment is poised to capture over 45% share by 2035. Dimethylaminopropylamine (DMAPA) is a colorless, transparent liquid that is devoid of suspended particles, and is extensively utilized in the production of raw materials for cosmetic products including cocamidopropyl betaine, and palmitamide dimethyl propylamine.

It is utilized in the manufacturing of various cosmetics, shampoos, and soaps for personal hygiene including fabric softeners, liquid soaps, shampoos, and washing and dishwashing detergents. Moreover, cocamidopropyl betaine (CAPB), a frequent addition to liquid soaps and shampoos, is formed using the reagent DMAPA, which is considered suitable for shampoos since they produce fine-bubble foams and do not irritate the eyes.

Application

Surfactants segment in the dimethylaminopropylamine market is expected to gain a significant revenue share in the near future. One class of chemical compounds used to stabilize the contact and reduce surface tension is called surfactants. Surfactants serve as the basis for all formulations in the home care sector and are employed in a number of capacities, such as detergents, emulsifiers, and wetting agents.

In addition, dimethylaminopropylamine, or DMAPA, is a diamine that is used to create a variety of surfactants, which are subsequently employed in the production of textile dyes, emulsifiers, shampoos, antiseptics, wetting agents, and finishing aids.

Our in-depth analysis of the dimethylaminopropylamine market includes the following segments:

|

Application |

|

|

End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Dimethylaminopropylamine Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is likely to hold largest revenue share of 40% by 2035. The market growth in the region is also expected on account of growing chemical industry. One important sector of the Indian economy is the chemical industry since the country is a major producer of paints, dyestuffs, insecticides, fertilizers, and basic organic compounds. India has one of the biggest chemical industries in the world and has been known as a competitive and superior manufacturing destination in the international DMAPA market in recent years.

For instance, more than 12 million metric tons of important chemicals were produced in India in 2022. Furthermore, India ranks fourth globally in terms of income from the beauty and personal care sector in 2022 and is predicted to be among the top 5 global markets by 2025, contributing over 4% of the global cosmetics industry.

North America Market Insights

The North America region will also encounter huge growth for the dimethylaminopropylamine (DMAPA) market during the forecast period and will hold the second position owing to the growing personal disposable income, leading to a higher demand for cosmetics in this region.

This has supported the cosmetic and beauty products manufacturing sector's earnings since consumers have been spending more of their discretionary income on cosmetics than they did in the prior few years. For instance, the United States' disposable personal income rose by around 0.2% in 2023.

Dimethylaminopropylamine Market Players:

- Huntsman International LLC.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Merck KGaA

- BASF SE

- Haihang Industry Co., Ltd.

- Air Products and Chemicals, Inc.

- Alkyl Amines Chemicals Limited

- Solvay SA

- Oleon NV

- TIANJIN ZHONXIN CHEMTECH CO., LTD.

- The Chemours Company

Recent Developments

- BASF SE announced to increase in the price of dimethylaminopropylamine which is employed in numerous additional applications by over USD 0.05/lb. With effect from January 1, 2021, or as long as current contracts allow, BASF will raise the price of dimethylaminopropylamine (DMAPA) by $0.07 per pound in North America. The primary usage of DMAPA is in the synthesis of betaines, which are co-surfactants found in liquid soaps and shampoos. In addition, DMAPA finds usage in a multitude of additional applications such as ion exchange resins, polyurethane catalysts, lubricant additives, and chemicals for water treatment.

- Oleon NV announced to offer of a variety of goods, such as bodying agents, emulsifiers, emollients, and solubilizers to concentrate on low-cost skincare regimens and hassle-free skin-improving treatments. Natural chemistry expert Oleon Health and Beauty (Oleon) provides a range of products for sun care, skin care, and hair care, including bodying agents, emulsifiers, emollients, and solubilizers. The company states that the creation of fatty acid esters with non-toxic and non-irritating properties is still the primary goal of its R&D team. Renewable resources including sunflower, palm, coconut, and rapeseed oil are the source of all basic ingredients.

- Report ID: 5630

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Dimethylaminopropylamine Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.