Polyurethane Foam Market Outlook:

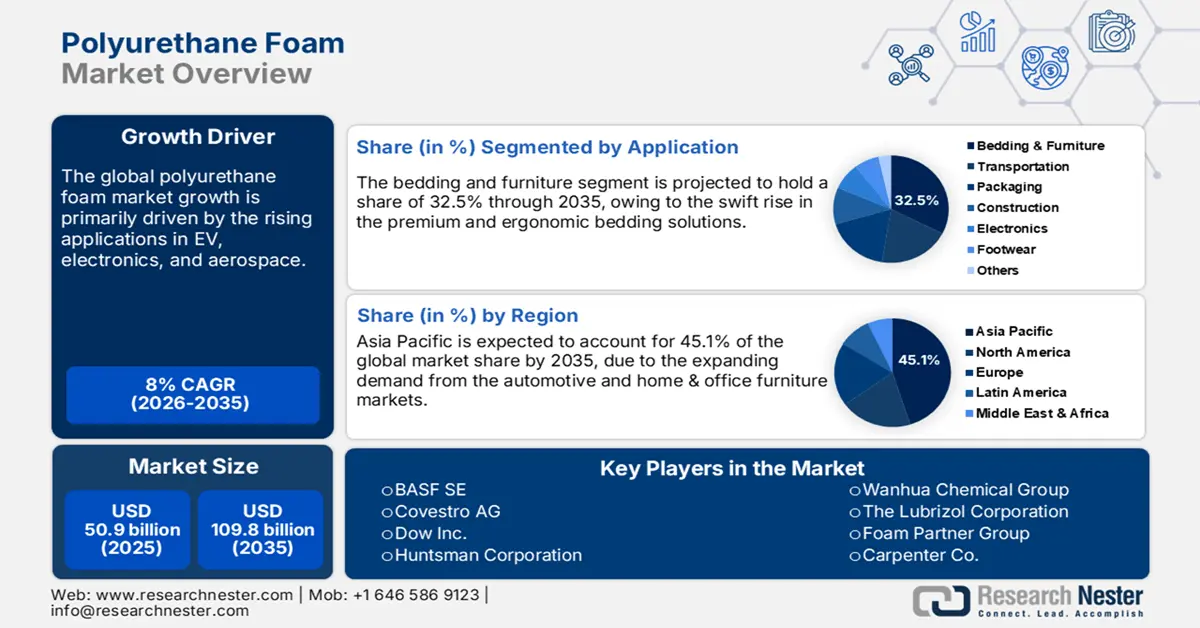

Polyurethane Foam Market size was USD 50.9 billion in 2025 and is estimated to reach USD 109.8 billion by the end of 2035, expanding at a CAGR of 8% during the forecast period, i.e., 2026-2035. In 2026, the industry size of polyurethane foams is estimated at USD 54.9 billion.

The modern construction practices are estimated to double the demand for polyurethane (PU) foams in the coming years. Polyurethane foams are widely utilized in insulation, roofing, and sealing applications, particularly in developed regions. The strong presence of early adopters in North America and Europe is anticipated to drive hefty investments in these markets. A report by the World Bank Group disclosed that in 2024, there was nearly 58% of the urban population, globally. The swift rise in migration to urban areas across the world is also a driving factor for the rampant rise in construction activities.

The smart buildings and eco-friendly construction trends are expected to increase the consumption of polyurethane foams. Programs such as LEED and BREEAM, which focus on energy efficiency and eco-friendly materials, are increasing the demand for lightweight and recyclable polyurethane (PU) foams. Further, the World Economic Forum (WEF) estimates that the push for green buildings is expected to create a USD 1.8 trillion global market by 2030. Thus, climatic changes are anticipated to boost the use of polyurethane foams in buildings and infrastructure to lower carbon emissions and support net-zero construction goals.

Key Polyurethane Foam Market Insights Summary:

Regional Highlights:

- North America is projected to retain the second-largest revenue share by 2035, fueled by sustained construction activity and robust consumer demand for furniture, bedding and packaging driven by new residential and commercial projects.

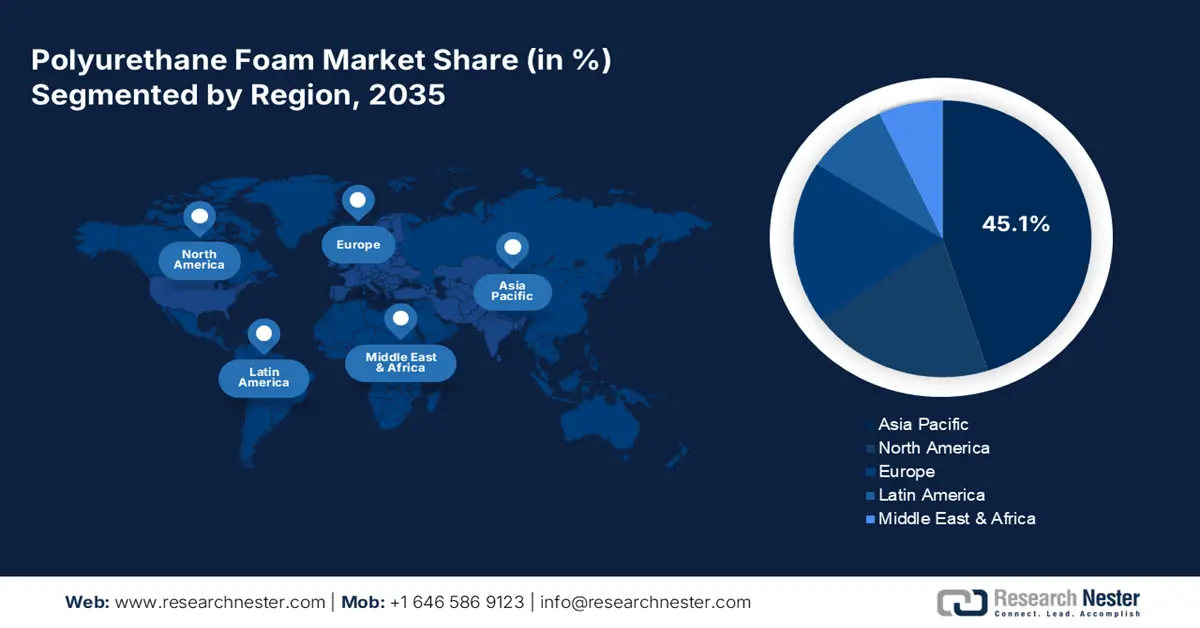

- Asia Pacific is expected to command a 45.1% share through 2035 in the polyurethane foam market, propelled by rapid urbanization and heavy automotive, infrastructure and manufacturing investments.

Segment Insights:

- The flexible polyurethane foam segment is projected to capture 59.6% of global revenue by 2035, supported by its dominance in cushioning and bedding applications driven by superior comfort and durability requirements.

- The bedding and furniture application is anticipated to hold a 32.5% share by 2035 in the polyurethane foam market, buoyed by rising demand for premium ergonomic bedding and expanding urban households.

Key Growth Trends:

- Rising automotive production

- Growth in e-commerce packaging

Major Challenges:

- Competition from alternatives

- Volatile raw material prices

Key Players: Covestro AG, Dow Inc., Huntsman Corporation, Recticel NV, Wanhua Chemical Group, The Lubrizol Corporation, Foam Partner Group, Carpenter Co., JSP Corporation, UBE Industries Ltd., Sekisui Chemical Co. Ltd., Nisso Chemical Co. Ltd., Mitsui Chemicals Inc., Futamura Chemical Co. Ltd.

Global Polyurethane Foam Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 50.9 billion

- 2026 Market Size: USD 54.9 billion

- Projected Market Size: USD 109.8 billion by 2035

- Growth Forecasts: 8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (Highest Share by 2034)

- Fastest Growing Region: Europe

- Dominating Countries: United States, Germany, United Kingdom, China, Japan

- Emerging Countries: India, Brazil, South Korea, Indonesia, Mexico

Last updated on : 22 September, 2025

Polyurethane Foam Market - Growth Drivers and Challenges

Growth Drivers

- Rising automotive production: The automotive industry is one of the major consumers of polyurethane foams, offering lucrative profit margins to key players. The rising vehicle registrations and high use of PU foams in seat cushioning, armrests, headrests, and other comfort-focused components are set to propel the market growth. Continuous innovations, evolving consumer demand for advanced interiors, and fuel economy needs are pushing the application of lightweight polyurethane foams. The Federal Reserve Bank of St. Louis states that in July 2025, the producer price index for motor vehicle trimming and interior trim manufacturing stood at 114.594. This indicates that polyurethane foam manufacturers have a high earning potential in the automotive sector.

- Growth in e-commerce packaging: The rapid expansion of e-commerce trade is boosting a high demand for polyurethane foams. The PU foam’s superior shock absorption, flexibility, and resilience are promoting its application in packaging. The International Trade Administration (ITA) discloses that the global B2B e-commerce market was calculated at USD 28.08 trillion in 2024. Thus, this boosting trade, coupled with evolving consumer demands for enhanced packaging, is anticipated to propel the consumption of polyurethane foams in the years ahead.

- Shift toward sustainable foams: The sustainability trend is anticipated to drive innovation in the polyurethane foam sector during the forecast period. The shift toward bio-based raw materials and recycling technologies is expected to fuel the production of sustainable PU foams. Mechanical recycling allows scrap foams to be shredded and reused in carpet underlays or insulation. Construction, automotive, and packaging are increasingly demanding sustainable materials to meet their own environmental commitments. This is directly creating high-earning opportunities for eco-friendly polyurethane foam producers.

Challenges

- Competition from alternatives: The PU foam manufacturers are facing intense competition from alternative materials, including mineral wool, fiberglass, polystyrene, and natural fibers, depending on end use. All the alternatives have similar cushioning and insulation properties at lower prices, which makes them more attractive. This factor limits the sales of polyurethane foams in the price-sensitive markets. The easier recyclability or biodegradability properties of alternatives also make them a strong competitor against PU foams.

- Volatile raw material prices: The production of polyurethane foams is heavily dependent on the specialized raw materials, such as petrochemicals and primarily toluene diisocyanate. These materials come from crude oil, and since fuel prices often change, they potentially affect the production of polyurethane foams. Thus, supply chain disruptions directly impact the overall cost structure of PU foam manufacturers and their profit margins.

Polyurethane Foam Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8% |

|

Base Year Market Size (2025) |

USD 50.9 billion |

|

Forecast Year Market Size (2035) |

USD 109.8 billion |

|

Regional Scope |

|

Polyurethane Foam Market Segmentation:

Product Segment Analysis

The flexible polyurethane foam segment is projected to capture 59.6% of the global revenue share by 2035. The prime factors boosting the sales of flexible polyurethane foams are their comfort, versatility, and durability. Flexible polyurethane foams are the material of choice for cushioning and comfort applications across many industries. The Polyurethane Foam Association (PFA) disclosed that nearly 2.3 billion pounds of flexible PU were produced in the NAFTA region in 2023. The same source also states that most of the production in North America is led by PFA members. Flexible PU foams are also widely used in the production of bedding mattresses and residential furniture.

Application Segment Analysis

The bedding and furniture segment is anticipated to account for 32.5% of the global polyurethane foam market share, owing to the swift rise in the premium and ergonomic bedding solutions. PU foams are most preferred due to their unmatched comfort, durability, and versatility. Further, the Bureau of Labor Statistics (BLS) reveals that the producer price index for furniture & related products was calculated at 284.432(P) in July 2025. Thus, rapid urbanization and rising disposable incomes are accelerating the demand for home furnishing products, which directly contributes to the increasing consumption of polyurethane foams.

|

PPI industry sub-sector data for Furniture & related product mfg, not seasonally adjusted |

|

Year |

Jan |

Feb |

Mar |

Apr |

May |

Jun |

Jul |

Aug |

Sep |

Oct |

Nov |

Dec |

|

2022 |

244.386 |

246.518 |

250.193 |

252.081 |

254.790 |

257.551 |

259.270 |

261.192 |

262.661 |

262.581 |

265.053 |

266.701 |

|

2023 |

267.118 |

267.861 |

268.501 |

268.433 |

268.849 |

268.778 |

269.692 |

269.238 |

269.002 |

268.159 |

268.535 |

267.876 |

|

2024 |

268.457 |

270.740 |

271.143 |

271.373 |

272.287 |

272.624 |

272.631 |

273.211 |

274.416 |

274.671 |

274.981 |

275.139 |

|

2025 |

275.792 |

277.676 |

277.930 |

279.400(P) |

280.684(P) |

283.018(P) |

284.432(P) |

|

|

|

|

|

Source: U.S.BLS

Density Segment Analysis

The medium-density PU foams are expected to hold a leading global market share throughout the forecast period, due to their balance of performance and versatility. The furniture, bedding, automotive seating, and packaging sectors primarily drive the sales of medium-density PU foams. These density-type PU foams are also in high demand, particularly in the packaging sector. The expanding e-commerce trade and the need for effective protective cushioning of products, such as electronics, appliances, and fragile items, are further propelling the consumption of medium-density PU foams.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Product |

|

|

Application |

|

|

Density |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Polyurethane Foam Market - Regional Analysis

APAC Market Insights

The Asia Pacific polyurethane foam market is projected to capture 45.1% of the global revenue share through 2035. The swift rise in urbanization and industrialization is anticipated to fuel the consumption of polyurethane foams. The expanding automotive and home & office furniture markets are creating a profitable environment for both domestic and international players. The hefty public-private investments in the infrastructure sector are also driving the sales of polyurethane foams. China, India, Japan, and South Korea are some of the leading marketplaces in APAC.

The India polyurethane foam industry is poised to increase at the fastest CAGR from 2026 to 2035. The robust growth in the construction and automotive sectors is set to expand the profit margins of polyurethane foam manufacturers. The Indian Green Building Council reveals that nearly 5,820 green projects are certified & fully operational in the country. The government’s push for affordable housing and energy-efficient buildings is increasing the consumption of rigid PU foams.

North America Market Insights

The North America market is estimated to hold the second-largest revenue share throughout the study period. The furniture, bedding, and packaging industries are accelerating the production and commercialization of polyurethane foams. The robust rise in the new residential and commercial projects is also contributing to the increasing sales of PU foams. Furthermore, the sustainability trends are amplifying the demand for bio-based polyols and recyclable PU foams.

The U.S. polyurethane foam sector is anticipated to be driven by the high per-capita consumption and diversified end-use applications. The growing consumer demand for comfort and ergonomic furniture is likely to accelerate the consumption of polyurethane foams. Government incentives, building codes, and green initiatives are further emerging as key driving factors. In November 2024, the U.S. Green Building Council disclosed that there are over 547,000 LEED-certified residential units. This directly indicates the lucrativeness of the U.S. market for PU foam manufacturers.

Europe Market Insights

The Europe market is anticipated to expand at a robust pace between 2026 and 2035. The well-established automotive and furniture sectors are promoting the sales of polyurethane foams. The rigid PU foams are highly demanded by energy-efficient buildings and smart infrastructure projects in the EU. E-commerce growth is also contributing to the increasing demand for PU foam-based protective packaging solutions. The sales of polyurethane foams in Germany are set to be driven by their expanding applications in the automotive interiors and industrial cushioning sectors. The country’s high standards for comfort, safety, and ergonomics are further driving a high demand for medium- and high-density foams in residential and commercial furniture products. The mature construction industry is also accelerating the commercialization of PU foams.

Key Polyurethane Foam Market Players:

- BASF SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Covestro AG

- Dow Inc.

- Huntsman Corporation

- Recticel NV

- Wanhua Chemical Group

- The Lubrizol Corporation

- Foam Partner Group

- Carpenter Co.

- JSP Corporation

- UBE Industries Ltd.

- Sekisui Chemical Co., Ltd.

- Nisso Chemical Co., Ltd.

- Mitsui Chemicals, Inc.

- Futamura Chemical Co., Ltd.

The global market is highly competitive and is led by the North America and Europe-based players. The industry giants are employing various organic and inorganic marketing strategies. They are entering into strategic partnerships with other players to boost their product offerings. Leading companies are also expanding their operations into emerging markets to earn hefty gains. Technological innovations aimed at the production of sustainable products are also set to double the profits of key players.

Here is a list of key players operating in the global market:

Recent Developments

- In July 2025, Covestro announced the launch of its advanced flame-retardant encapsulation foam. This polyurethane solution is expected to be widely used in EV batteries.

- In March 2025, BASF SE introduced biomass balance flexible polyurethane foam systems. The company is mainly targeting the North American furniture industry.

- Report ID: 5158

- Published Date: Sep 22, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Polyurethane Foam Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.