IoT Sensors Market Outlook:

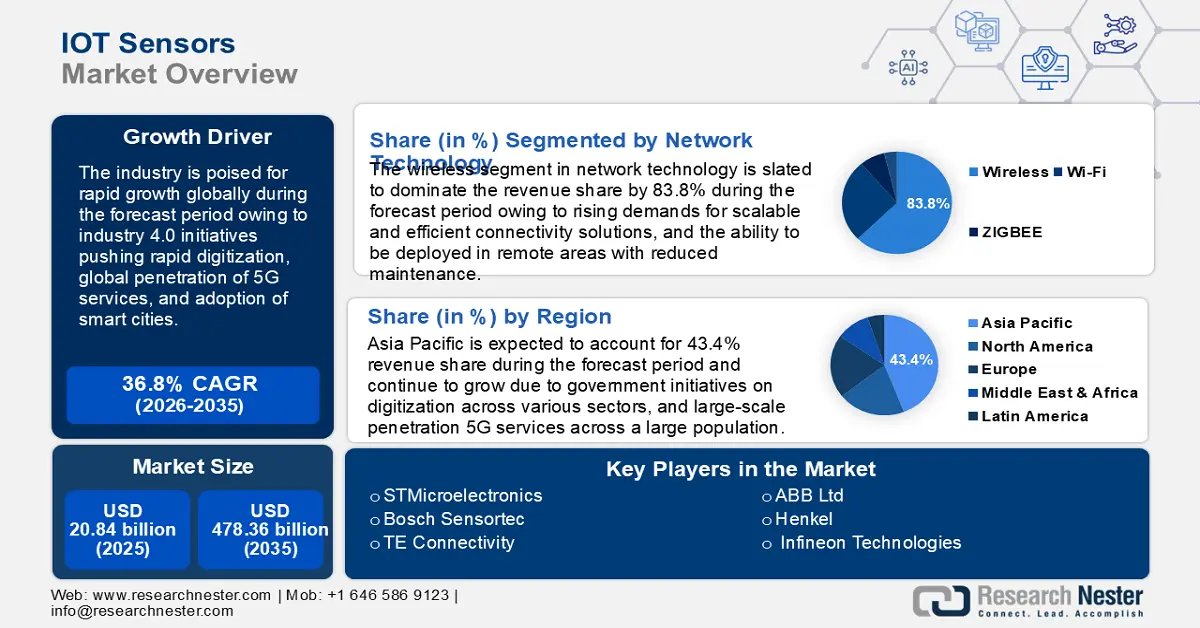

IoT Sensors Market size was over USD 20.84 billion in 2025 and is projected to reach USD 478.36 billion by 2035, growing at around 36.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of IoT sensors is evaluated at USD 27.74 billion.

Internet of Things (IoT) sensors measure physical parameters such as light, pressure, humidity, motion, etc., allowing real-time monitoring. They are the backbone of IoT ecosystems and allow devices to interact with each other and automate tasks in various sectors. The U.S. Telecom Association estimated that there will be more than 20.4 billion connected devices by 2020. Due to rapid digitization, the number can be expected to increase exponentially by 2025. The IoT sensors market is expected to rise significantly during the forecast period owing to the proliferation of smart systems and the increasing adoption of connected devices. With increased digitization globally, the need for IoT sensors is growing to gather real-time data across diverse applications.

Key players in the IoT sensors market are actively engaged in R&D and product innovations to maintain their strategic edge. For instance, in February 2024, OnePlus launched the OnePlus Watch 2 which can offer a central hub in Android 14 for managing data permissions from multiple fitness and health apps and allowing users to sync their health data with health-compatible apps. In August 2024, Medtronic announced the Food and Drug Administration (FDA) approval of the Simplera Continuous Glucose Monitor (CGM) integrated with the Simplera Sync sensor.

Key IoT Sensors Market Insights Summary:

Regional Highlights:

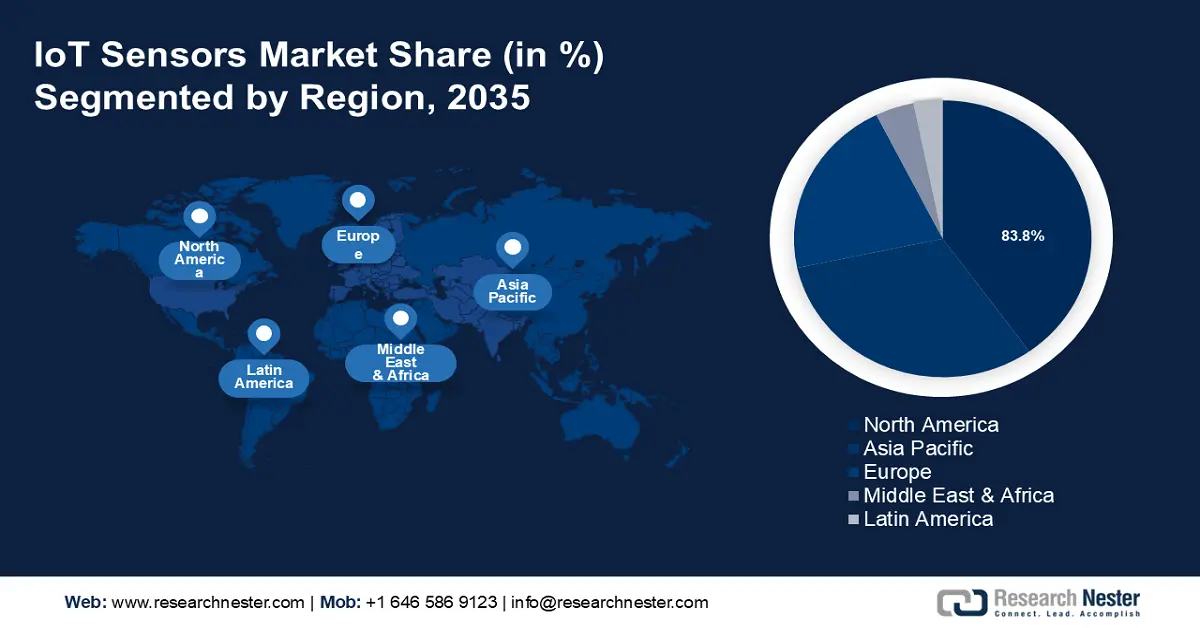

- Asia Pacific IoT sensors market will account for 43.40% share by 2035, driven by advancements in smart technology and rising demand for automation.

Segment Insights:

- The wireless segment in the iot sensors market is poised for substantial growth, achieving an 83.80% share by 2035, driven by demand for scalable, low-maintenance connectivity across various sectors like smart cities and healthcare.

Key Growth Trends:

- Rising demand for industrial automation

- Growing focus on healthcare & wearable devices

Major Challenges:

- Security and privacy concerns

- Lack of standardization and high costs

Key Players: STMicroelectronics, Bosch Sensortec, TE Connectivity, ABB Ltd, Henkel, Cisco, Honeywell, Huawei, Qualcomm, Intel, Siemens AG, Infineon Technologies, Sensata Technologies.

Global IoT Sensors Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 20.84 billion

- 2026 Market Size: USD 27.74 billion

- Projected Market Size: USD 478.36 billion by 2035

- Growth Forecasts: 36.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (43.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Taiwan

Last updated on : 18 September, 2025

IoT Sensors Market Growth Drivers and Challenges:

Growth Drivers

- Rising demand for industrial automation: There is a global push towards industry 4.0, which has heightened the adoption of automation in various sectors such as energy, manufacturing, logistics, etc. The market has been boosted by the demand for smart factories that need to integrate IoT sensors. These sensors enhance operational efficiency by optimizing production processes. Manufacturers are enhancing their IoT sensor products to meet the rising demands. For instance, in May 2023, STMicroelectronics launched a first-of-its-kind waterproof MEMS pressure sensor with a 10-year longevity for industrial IoT expansion.

- Growing focus on healthcare & wearable devices: There has been a significant rise in demands for IoT sensors in the healthcare sector after COVID-19 as IoT assisted in reaching patients remotely and monitoring them using interconnected networks. The demands for remote patient monitoring, wearables, and interconnected medical devices are fuelling the IoT sensors market growth. Additionally, smartwatches and other wearable devices that track individual health have soared in popularity boosting revenue growth. For instance, the India Brand Equity Foundation report in November 2023 stated sales of smartwatches surged by 21% in the Indian market.

- Rapid advancements in wireless technology: The emergence of faster and more reliable wireless technology such as 5G and Low Power Wide Area Networks (LPWAN) is boosting the IoT sensors market. IoT sensors can operate in remote or large-scale environments due to the seamless connectivity offered by advanced wireless technologies. This broadens the reach and allows IoT sensors to maintain real-time data transmission for various industries. In 2020, the World Economic Forum stated that 5G subscriptions are expected to reach 2.6 billion globally, accounting for 65% of the world population, and cellular IoT connections are expected to reach 5 billion worldwide by the end of 2025. Additionally, by 2030, 5G and IoT are expected to reduce global emissions by 15% helping fight climate change.

Challenges

- Security and privacy concerns: The National Institute of Standards and Technology, U.S., identified three major risk mitigation goals related to IoT devices i.e., protecting device security, protecting data security, and protecting individual privacy. Since IoT sensors collect sensitive data such as health information, privacy and security concerns can impede market growth. In the U.S., a law was passed to create IoT security standards in December 2020.

- Lack of standardization and high costs: The lack of standardized protocols and communication standards creates restraints in integrating devices into complex IoT systems and hinders their functionality. Another impediment to market growth can be the high rate of initial investment in IoT sensors.

IoT Sensors Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

36.8% |

|

Base Year Market Size (2025) |

USD 20.84 billion |

|

Forecast Year Market Size (2035) |

USD 478.36 billion |

|

Regional Scope |

|

IoT Sensors Market Segmentation:

Network Technology Segment Analysis

Wireless segment is projected to capture over 83.8% IoT sensors market share by 2035 due to the increasing demand for flexible and scalable connectivity solutions. Wireless allows seamless connectivity between IoT devices and the cloud. Wireless IoT sensors require comparatively less maintenance which has led to higher demands. Additionally, wireless sensors can be deployed in remote areas which makes them ideal for applications in agriculture, smart cities, healthcare, etc. For instance, smart cities like Barcelona have implemented wireless sensor networks for energy-efficient waste management systems. In September 2023, Energous and InPlay launched low-maintenance wireless sensors for IoT industrial applications.

The Wi-Fi segment is expanding significantly, driven by the widespread availability of Wi-Fi networks and the rising demand for reliable, high-speed connectivity in various sectors. WiFi mesh networks can extend coverage to large areas, enabling connection of IoT devices in challenging environments. The introduction of Wi-Fi 6 is a major boost to the growth potential as it is more secure and much faster than its predecessor. In September 2022, Nordic Semiconductor introduced a dual-band Wi-Fi6 nRF7002 companion IC designed to provide seamless Wi-Fi connectivity and location. In 2022, the World Economic Forum estimated that over 335 million homes globally will be smart homes in the next 5 years, and due to this, the demand for Wi-Fi-enabled IoT sensors is projected to rise.

Sensor Type Segment Analysis

The touch sensor segment in IoT sensors market is poised to witness considerable growth during the forecast period owing to rising demand across consumer electronics and industrial applications. The large-scale penetration of smartphones, tablets, and wearable devices integrated with touch-based interfaces is a key driver of market growth. Touch sensors are rapidly being integrated into the automotive industry in advanced driver assistance systems (ADAS) to improve user experience. In February 2023, Henkel launched a novel sensor INKxperience kit for IoT sensor engineering that contains four different technologies, i.e., a Leak Detection Sensor, a Non-Contact Liquid Level Sensor, a Positive Temperature Coefficient Heater, and a Multi-Zone Force Sensitive Resistor. With new innovations in touch sensors, the segment is expected to continue its growth curve.

Our in-depth analysis of the IoT sensors market includes the following segments:

|

Network Technology |

|

|

Sensor Type |

|

|

Vertical |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

IoT Sensors Market Regional Analysis:

North America Market Insights

Asia Pacific industry is predicted to account for largest revenue share of 43.4% by 2035, owing to advancements in smart technology and rising demand for automation across multiple sectors. Additionally, growing investments in 5G networks are accelerating the adoption of IoT sensors in various applications. In 2019, a Stanford University research concluded that 66% households in North America had at least one IoT device, making it the highest density globally.

The U.S. IoT sensors market is rising at a significant pace owing to increasing demand for connected devices across various sectors, smart city initiatives, an increase in smart homes, and technological innovations. U.S. is leading the charge in self-driving vehicles and companies such as Tesla are at the forefront by utilizing IoT sensors to enable autonomous driving. In September 2024, Tesla launched the Actually Smart Summon (ASS) system where drivers can summon their vehicles using voice command.

Furthermore, in July 2024, a study at Texas Mccombs conducted a study that highlighted the importance of IoT sensors in marketing, stating that installing IoT sensors in promotional displays and hoardings can ensure that displays are run in conjunction with ad campaigns. As the U.S. gears for a new era of digitization, the demand for IoT sensors in various applications is expected to rise exponentially in the next decade.

In Canada, the market is experiencing steady growth owing to investments in smart infrastructure and digital transformation across companies. A key driver is the ongoing government investments in precision agriculture where IoT sensors are used to collect real-time data on numerous environmental factors. In February 2022, the government invested USD 875 thousand in Ukko Agro Inc. to develop an analytics platform for efficient pest control. In November 2023, ABB Canada signed a third contract with GHGSat to manufacture optical sensors for C12, C13, C14, and C15 satellites set to be launched into orbit in 2024.

APAC Market Insights

By 2035, Asia Pacific IoT sensors market is predicted to hold more than 43.3% revenue share. Consumer electronics is a key sector that has led the market growth in APAC. Countries like China, India, South Korea, and Japan are leveraging IoT solutions to increase digitization in various sectors. Government initiatives such as India’s Smart Cities Mission and China’s Made in China 2025 are propelling the market growth. Additionally, emerging economies such as Vietnam, the Philippines, and Indonesia are bedrock of rapid economic growth and increasing adoption of IoT in various sectors.

In India, the market is witnessing an impressive growth curve owing to the increased digitization across various sectors combined with the demands of a large population. For instance, the government is pushing to install smart electricity meters in all households in the country which is expected to raise the demand for IoT sensors. A significant demand for IoT sensors is arising from the Smart Cities initiative in India which is projected to conclude by March 2025. Other key sectors which are boosting the demands are healthcare and telecom. In March 2023, Smart Digital Thermometer, IoT-enabled Environmental Monitoring System, and Multichannel Data Acquisition System developed at C-MET were released reiterating focus on indigenously developed IoT sensors.

China is a leading market in IoT sensors owing to the massive rollout of 5G networks across the country driven by rising focus on automation in various sectors. The Made in China 2025 initiative by the government aims at positioning China as a powerhouse in high-tech industries. In March 2024, GSMA’s Mobile Economy China report noted of 1.28 billion unique mobile subscribers in the country and more than 800 million connections of 5G. The large-scale penetration is expected to continue boosting the market demands for IoT sensors. In June 2023, ABB and China telecom launched a joint industrial IoT laboratory in Hangzhou, China. The collaboration aims at developing industrial IoT solutions for companies based in China.

South Korea is witnessing a surge in the market during the forecast period due to the focus on becoming a leader in digital revolution. The government has put initiative such as the Basic IoT Promotion Plan in practice to facilitate digital revolution. The market is characterized by the presence of global and local companies vying for revenue share. Survey by the Ministry of Science, ICT, and Future Planning & Korea IoT Association highlights the personalized IoT service sector to have the most viable growth potential. In May 2023, Korea Land and Housing Company along with Information Technology Consortium launched the Smart Home Platform that provides a secure framework to manage smart home appliances using IoT sensors.

IoT Sensors Market Players:

- STMicroelectronics

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Bosch Sensortec

- TE Connectivity

- ABB Ltd

- Henkel

- Cisco

- Honeywell

- Huawei

- Qualcomm

- Intel

- Siemens AG

- Infineon Technologies

- Sensata Technologies

- Monnit Corp.

Recent Developments

- In May 2024, Neonode signed the first license agreement for touch sensor module technology. YesAR will license the Neonode touch sensor module technology to develop cutting edge holographic infotainment solutions for its customers in the elevator and automative sectors.

- In January 2024, ABB acquired Real Tech to expand its presence with the use of optical sensor technology for the age of smart water. The collaboration is expected to improve real-time water quality monitoring.

- In March 2023, Siemens launched Connect Box, a smart IoT solution to manage small buildings. Connect Box can streamline management of small and medium-sized buildings and follows a user-friendly approach to monitor building performance.

- In March 2021, Jal Jeevan Mission in India deployed sensor-based IoT devices to monitor rural drinking water systems. The IoT sensors are expected to solve the challenges in rural water supply management.

- Report ID: 6435

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

IoT Sensors Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.