Narrowband IoT Market Outlook:

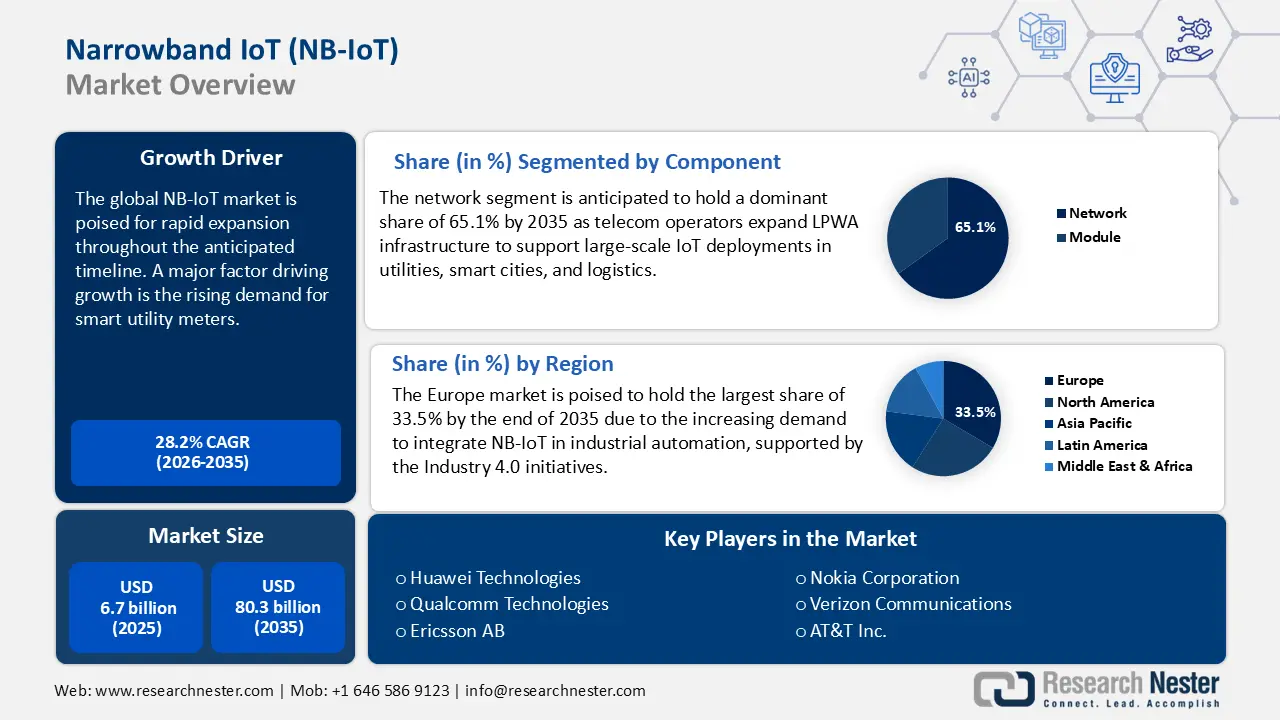

Narrowband IoT Market size was valued at USD 6.7 billion in 2025 and is poised to reach USD 80.3 billion by the end of 2035, expanding at a CAGR of 28.2% during the forecast period, 2026-2035. In 2026, the industry size of narrowband IoT is estimated at USD 8.5 billion.

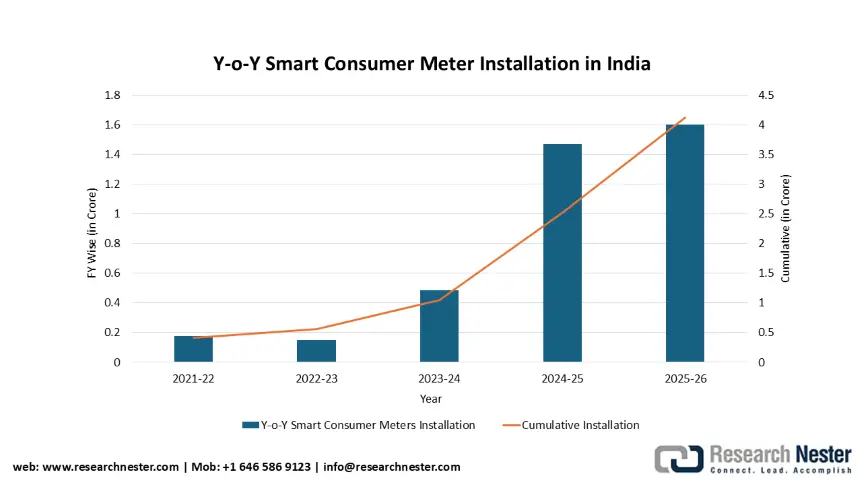

The rapid growth of the narrowband IoT market is fueled by the rising adoption of smart utility meters along with the high inclination towards low-power IoT networks across several domains. NB-IoT systems and solutions are important aspects of the modern utility meters as it enhances the functionality and efficiency of smart meters. According to the National Smart Grid Mission (NSGM), India has installed over 41 million smart consumer meters as of mid-2025, with a total number of 224 million sanctioned under the Smart Metering National Programme (SMNP) and Revamped Distribution Sector Scheme (RDSS).

Source: NSGM

The NB-IoT sector supply chain is characterized by multiple facets. Semiconductors, sensors, and communication modules are a major part of the supply chain and are sourced from Japan, South Korea, and China. These three economies remain the major exporters of electronic components. To briefly map the trade activities, the U.S. imported more than USD 482 million worth of lithium-ion batteries in 2023, a critical component for IoT devices, reflecting a rapid increase from the previous years. The surge is attributed to the surging demand for energy storage solutions in IoT applications. In a report that reinforces the belief of stakeholders in the market, the United Nations Economic Commission for Europe (UNECE) emphasized the vital role of IoT in bolstering trade via inventory management.

Key Narrowband IoT Market Insights Summary:

Regional Highlights:

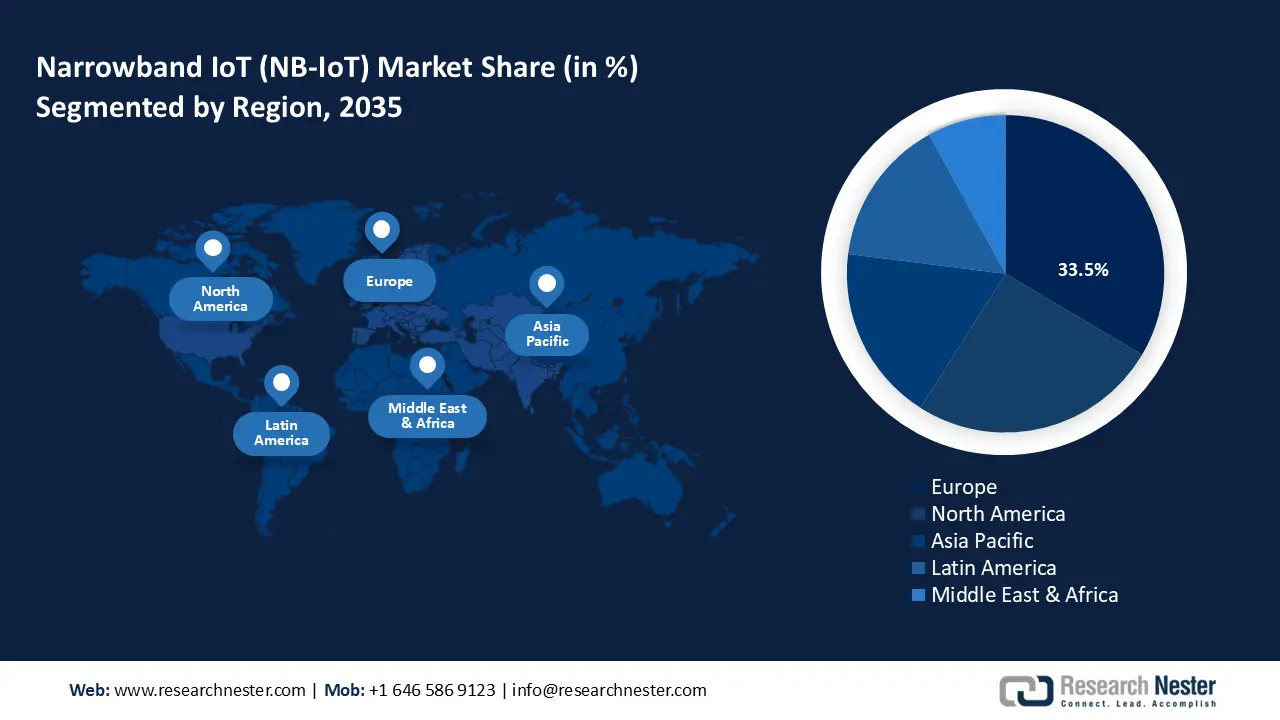

- The Europe narrowband IoT market is projected to command a 33.5% share by 2035, owing to the strong push for industrial automation under the Industry 4.0 framework.

- The APAC region is estimated to capture a 41.6% revenue share by 2035, sustained by rising investments in healthcare digitization, smart infrastructure, and industrial automation initiatives.

Segment Insights:

- The network segment of the narrowband IoT market is anticipated to secure a dominant share of 65.1% by 2035, propelled by expanding LPWA infrastructure supporting large-scale IoT deployments across utilities, smart cities, and logistics.

- The wearables segment is forecasted to witness notable revenue growth through 2035, fueled by the enhanced energy efficiency of NB-IoT modules that extend device battery life.

Key Growth Trends:

- Increasing integration of NB-IoT in smart agriculture

- Deployment of NB-IoT in smart cities enhances urban infrastructure management

Major Challenges:

- Limited network coverage in remote and rural areas impeding NB-IoT device deployment

- Competition from alternative LPWAN & 5G technologies

Key Players: Huawei Technologies Co., Ltd., Qualcomm Technologies Inc., Ericsson AB, Nokia Corporation, Verizon Communications Inc., AT&T Inc., Vodafone Group Plc, Sierra Wireless, Inc., Telit Cinterion, ZTE Corporation, u-blox Holding AG, Sequans Communications S.A., Nordic Semiconductor ASA, Morse Micro Pty. Ltd., Tata Communications Ltd.

Global Narrowband IoT Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.7 billion

- 2026 Market Size: USD 8.5 billion

- Projected Market Size: USD 80.3 billion by 2035

- Growth Forecasts: 28.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: APAC (41.6% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: China, United States, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Singapore, Australia, France

Last updated on : 3 October, 2025

Narrowband IoT Market - Growth Drivers and Challenges

Growth Drivers

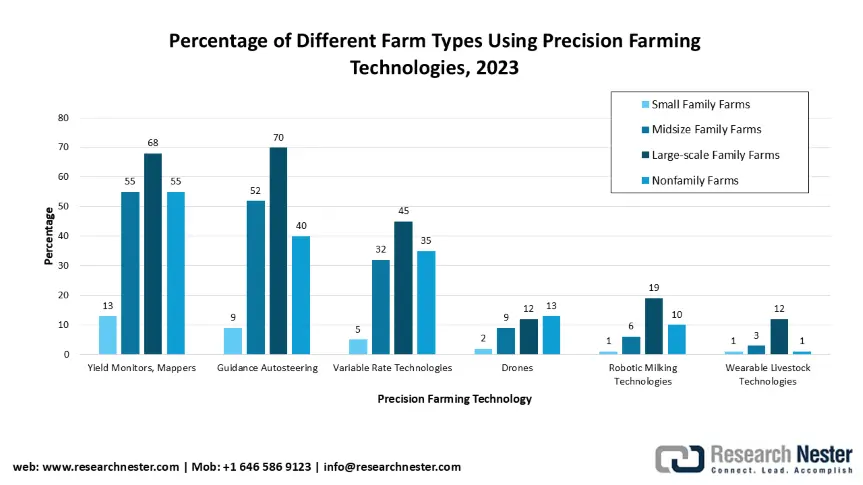

- Increasing integration of NB-IoT in smart agriculture: The rapid adoption of NB-IoT in smart agriculture is expected to fuel the market growth. The rising adoption of yield monitors, soil maps, and other precision tools is creating demand for NB-IoT connectivity to collect, transmit, and analyze real-time farm data. This shift allows smarter decision-making, enhancing productivity and resource efficiency in large-scale agricultural operations. According to a report by the U.S. Department of Agriculture 2023, yield monitors, yield maps, and soil maps were utilized on 68% of large-scale crop farms. It also states that the use of precision agriculture technologies rises significantly with farm size, while small family farms with gross cash farm income below USD 350,000 report the lowest adoption levels across all technology categories.

Source: USDA

- Deployment of NB-IoT in smart cities enhances urban infrastructure management: The integration of smart city programs across multiple economies has created multiple opportunities for the deployment of NB-IoT. Recent developments include the launch of a multi-million-pound NB-IoT network by BT in the UK, which was announced in February 2024. The network is predicted to cover more than 97% of the UK population to enable connectivity for devices such as streetlights and water sensors. The NB-IoT network has facilitated automation of work that requires manual oversight, such as leaks in water infrastructure, creating ample opportunities in the market.

- High adoption of NB-IoT in energy and utilities sector: Energy & utilities have regular, well‐defined use cases in metering, remote monitoring, and grid reliability, often with regulatory mandates, which makes their investment highly predictable. These systems benefit especially from NB-IoT’s long device battery life, ability to reach indoor/subterranean environments, and low traffic per device. For instance, in April 2021, Tata Power-Delhi Distribution Ltd (Tata Power-DDL), a major power distribution utility in North Delhi, started deploying smart meters that use NB-IoT technology. This is noteworthy as it is among the first huge NB-IoT-based smart meter deployments in India. They have already installed 2.3 lakh smart meters using RF tech, and now the NB-IoT meters are being added.

Challenges

- Limited network coverage in remote and rural areas impeding NB-IoT device deployment: Despite the ability of narrowband IoT to provide wide-area connectivity with low power, a significant impediment faced is the insufficient network coverage in rural regions. Operators may prioritize urban deployments due to quicker ROI, causing accessibility challenges in rural areas. This creates uneven investments in infrastructure. Additional challenges occur in spectrum allocation, restricting reliable NB-IoT connectivity.

- Competition from alternative LPWAN & 5G technologies: NB-IoT competes with other low-power wide area network (LPWAN) technologies such as LoRaWAN, Sigfox, and with LTE-M. In many cases, LoRaWAN grants open, unlicensed spectrum operation with lower deployment costs, while LTE-M provides higher mobility support and lower latency as compared to NB-IoT. With the ongoing expansion of 5G massive IoT capabilities, some enterprises may prefer to go directly to 5G-based solutions instead of committing to NB-IoT. This competition creates uncertainty in the ecosystem, as device manufacturers and solution providers hesitate to invest heavily in one standard.

Narrowband IoT Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

28.2% |

|

Base Year Market Size (2025) |

USD 6.7 billion |

|

Forecast Year Market Size (2035) |

USD 80.3 billion |

|

Regional Scope |

|

Narrowband IoT Segmentation:

Component Segment Analysis

The network segment is anticipated to hold a dominant share of 65.1% by 2035 as telecom operators expand LPWA infrastructure to support large-scale IoT deployments in utilities, smart cities, and logistics. The growth is powered by demand for low-power, wide-area coverage and government-backed digital infrastructure programs. A recent example depicting this trend is the U.S. Federal Communications Commission's (FCC) Precision Agriculture Connectivity Task Force, which is aimed at improving connectivity for precision agriculture through the use of advanced network infrastructure. The task force's efforts aim to improve broadband access in rural areas, facilitating the adoption of IoT technologies like NB-IoT for agricultural applications.

Device Type Segment Analysis

The wearables segment is projected to increase its revenue share throughout the forecast timeline. The increase is attributed to the energy efficiency of NB-IoT modules, extending device battery life. A recent example is of August 2025, when Qualcomm Technologies, Inc. revealed its Snapdragon W5+ Gen 2 and W5 Gen 2 Wearable Platforms, with upgraded connectivity features, power efficiency, compact design, and location tracking for next-generation wearables.

Notably, these platforms are the first in the sector to combine satellite connectivity through Skylo’s Narrowband Non-Terrestrial Network (NB-NTN). This innovation allows wearables to support two-way emergency messaging directly from the device, offering greater safety in areas without cellular coverage, for example, enabling adventurers to send SOS alerts during emergencies even when mobile networks are unavailable. Additionally, with a large number of consumers demanding wearable fitness trackers, the opportunity for the application of NB-IoT is immense.

End user Segment Analysis

The automotive segment is expected to lead the narrowband IoT market during the forecast period, owing to the rising demand for connected cars, fleet management, and vehicle tracking solutions that require low-cost, low-power, and wide-area connectivity. Narrowband IoT supports massive implementation of sensors for monitoring vehicle health, telematics, and logistics operations while ensuring long battery life for devices such as trackers. For instance, in March 2024, Getrak, a tracking and telemetry solutions provider, chose the Quectel BC92 high-performance multi-band NB-IoT and GSM dual-mode module for its latest vehicle tracking solution in the fleet management sector. The device uses NB-IoT with 2G fallback alongside GNSS satellite support, ensuring stable connectivity. This trend highlights how NB-IoT is becoming a backbone for the automotive IoT ecosystem.

Our in-depth analysis of the global narrowband IoT market includes the following segments:

|

Segments |

Subsegments |

|

Deployment |

|

|

Device Type |

|

|

End user |

|

|

Component |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Narrowband IoT Market - Regional Analysis

Europe Market Insights

The Europe market is projected to hold the largest share of 33.5% by the end of 2035. The regional narrowband IoT market is supported by a heightened emphasis on industrial automation, supported by the Industry 4.0 initiatives. A key demand segment within Europe is the rising demand for low-power wide-area (LPWA) connectivity across domains such as manufacturing, utilities, agriculture, and transportation.

UK market is slated to hold a leading revenue share in Europe. The narrowband IoT market is boosted by major operator investments toward national connectivity infrastructure. Government policy drivers include the push toward smart cities, net zero emissions, and regulatory pressure on energy efficiency. To address this, in July 2020, Vodafone UK collaborated with the UK Department for Environment, Food and Rural Affairs (Defra) and Forest Research to test how NB-IoT technology could be used to study and overlook the role of trees in addressing climate change. Overall, these initiatives together drive the growth of NB IoT applications in the country.

The NB-IoT ecosystem in Germany is expected to expand at a rapid pace, owing to operator activity, public sector smart city projects, and trials demonstrating NB-IoT’s performance in challenging environments. In energy and utilities, the provider ista conducting measurement tests of NB-IoT in multiple apartments in the Cologne/Bonn area, placing NB-IoT modules on different floors; signal connectivity was successful in 100% of all transmissions in this field trial. Government-funded smart city programs in Germany, backed by EU and federal money, are also enabling funding for infrastructure upgrades and IoT sensor roll-outs, e.g., intelligent lighting, parking, and environmental monitoring that favor NB-IoT.

APAC Market Insights

The APAC market is projected to register a dominant revenue share of 41.6% revenue share throughout the forecast timeline. The growth of the region is underpinned by the rising investments in healthcare digitization, smart infrastructure, and industrial automation across multiple economies in the region. The Industry 4.0 initiatives have proliferated in the region, boosting multiple opportunities to integrate NB-IoT in manufacturing processes.

The China narrowband IoT market is poised to hold a leading revenue share by the end of 2035. China leads the market with nationwide coverage and aggressive government-driven IoT strategies. The market is rising due to its scalability in applications like smart metering and tracking, with 1.8 billion connections till December 2022, driven by the dominance of three major telecoms reporting strong revenue growth. Extensive 5G coverage, leadership in IoT chip supply, and government-backed ecosystem development enable widespread adoption across industries like public services and agriculture. These trends are expected to fuel the demand for NB-IoT solutions in the coming years.

The India narrowband IoT market is poised to expand at a rapid pace owing to government mandates for smart metering and digital infrastructure under the National Smart Grid Mission and the Revamped Distribution Sector Scheme (RDSS). The Smart Meter National Programme (SMNP) aims to install 250 million smart meters, many using NB-IoT for connectivity in challenging situations. Telecom operators such as Bharti Airtel and Vodafone Idea have partnered with meter manufacturers to deploy NB-IoT solutions at scale. in April 2023, Airtel enabled 1.3 million NB-IoT smart meters in Bihar with fallback options on 2G/4G to ensure reliable data transfer. Such initiatives reflect India’s strong commitment to using NB-IoT to modernize utilities and promote digital inclusion in all spheres.

North America Market Insights

North America market is anticipated to garner a robust share from 2026-2035, owing to nationwide deployments of NB-IoT solutions by top telecom operators such as T-Mobile, Verizon, and AT&T for large-scale IoT connectivity. The rising adoption in utilities, logistics, healthcare, and smart cities is creating demand for low-power, wide-area networks. Additionally, government initiatives for the development of smart infrastructure and digital transformation are expected to enhance the demand for NB-IoT adoption across the region.

The U.S. market is likely to expand rapidly due to technological advancements, digitization in several industries, along with favorable government research and policies. A study by the National Institute of Standards and Technology (NIST) issued in September 2025 revealed that federal investments in IoT infrastructure can deliver a return of 10 to 20 times the amount spent, supporting the case for public funding in areas like spectrum and standards. The U.S. IoT Advisory Board has also suggested promoting satellite-based NB-IoT to improve connectivity in rural and agricultural regions. At the same time, companies like Sateliot are working with the FCC to launch satellite NB-IoT services under new 3GPP standards, which would let devices switch seamlessly between terrestrial and satellite networks.

The key players in the Canada market are expected to witness lucrative growth opportunities owing to increasing utilities and large-scale smart meter rollouts, and rising investments and funds by public and private sectors. Canada’s key carriers promote LTE-M/NB-IoT as a part of their IoT profiles and continue expanding network coverage and 5G backbones, complementing NB-IoT deployments. This is expected to fuel the sales of NB-IoT systems and solutions in the coming years.

Key Narrowband IoT Market Players:

- Huawei Technologies Co., Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Qualcomm Technologies Inc.

- Ericsson AB

- Nokia Corporation

- Verizon Communications Inc.

- AT&T Inc.

- Vodafone Group Plc

- Sierra Wireless, Inc.

- Telit Cinterion

- ZTE Corporation

- u-blox Holding AG

- Sequans Communications S.A.

- Nordic Semiconductor ASA

- Morse Micro Pty. Ltd.

- Tata Communications Ltd.

The narrowband IoT market is projected to expand during the forecast timeline. Huawei remains a leading player in the market by leveraging its extensive infrastructure and partnerships across APAC. Verizon has emerged as a key player in the North America market and seeks to expand its NB-IoT coverage across the region. Additionally, emerging players are investing in R&D to improve the scope of application for NB-IoT and expand their revenue shares. Below are the major players of the narrowband IoT market:

Recent Developments

- In September 2025, Mavenir, a cloud-native network infrastructure provider shaping the future of connectivity, announced that Iridium Communications Inc., a global leader in satellite voice and data services, has selected it to deploy the Core Network for its Non-Terrestrial Network (NTN), supporting 3GPP-based Direct-to-Device (D2D) services.

- In March 2025, STMicroelectronics announced that its ST87M01 NB-IoT + geolocation module, now with Wi-Fi positioning, had been certified for use on Deutsche Telekom’s networks. This expands its footprint in Europe and adds options for better indoor or dense-urban localization.

- Report ID: 2925

- Published Date: Oct 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Narrowband IoT Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.