Smart Grid Sensors Market Outlook:

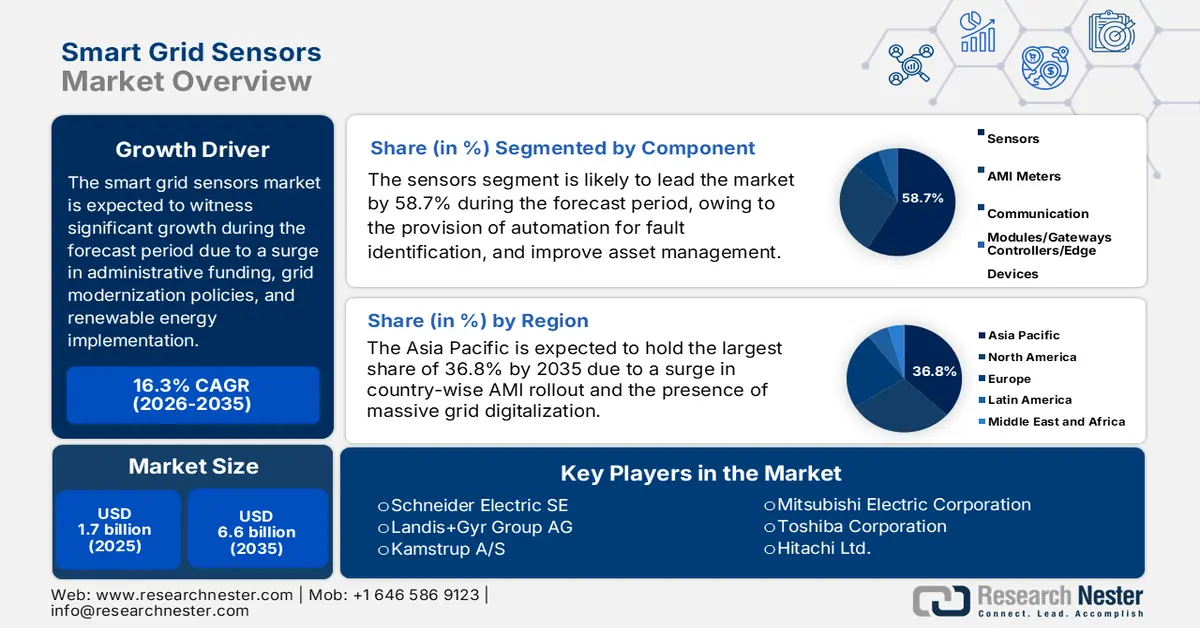

Smart Grid Sensors Market size was over USD 1.7 billion in 2025 and is estimated to reach USD 6.6 billion by the end of 2035, expanding at a CAGR of 16.3% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of smart grid sensors at USD 1.9 billion.

The international smart grid sensors market is witnessing rapid growth, owing to governmental investments in sustainable energy infrastructure, IoT-based monitoring, grid modernization programs, and renewable energy integration. According to official statistics published by the IEA Organization in 2026, the international renewable sources capacity is projected to be more than double by the end of 2030, further increasing by 4,600 GW. In this regard, solar photovoltaic accounts for nearly 80% of the international increase, which is further followed by geothermal, bioenergy, hydropower, and wind. Besides, as per the 2024 IEA Organization article, the international electricity demand has increased by 4.3% as of 2024, denoting a growth of 2.5% from 2023. Additionally, the electricity consumption is continuously changing based on different sectors, which is positively impacting the smart grid sensors market’s growth.

Yearly Electricity Consumption Change by Sector (2023-2024)

|

Sector Type |

2023 (TWh) |

2024 (TWh) |

|

Buildings |

162.0 |

629.0 |

|

Industry |

336.0 |

407.0 |

|

Transport |

40.0 |

40.0 |

Source: IEA Organization

Furthermore, the aspect of digitalization, energy integration, along with the presence of grid modernization programs and expansion in advanced metering infrastructure, are other factors driving the smart grid sensors market’s growth. According to an article published by the Public Power Organization in September 2024, the U.S. Department of Energy’s Office of Electricity issued two standard notices for USD 13 million as funding opportunities. These opportunities constitute USD 8 million for Renewable Integration Management with advanced high-voltage direct current power circuit breakers. In addition, USD 5 million caters to human-centric analytics for Resilient and Modernized power systems. Moreover, as per the 2026 IEA Organization article, India has introduced an INR 3.0 trillion (USD 36.8 billion) scheme for power distribution organizations to strengthen and modernize distribution facilities. This includes the compulsory installation of smart meters, which is projected to cover 250 million devices by the end of 2025, thus denoting an optimistic outlook for the overall smart grid sensors market globally.

Key Smart Grid Sensors Market Insights Summary:

Regional Highlights:

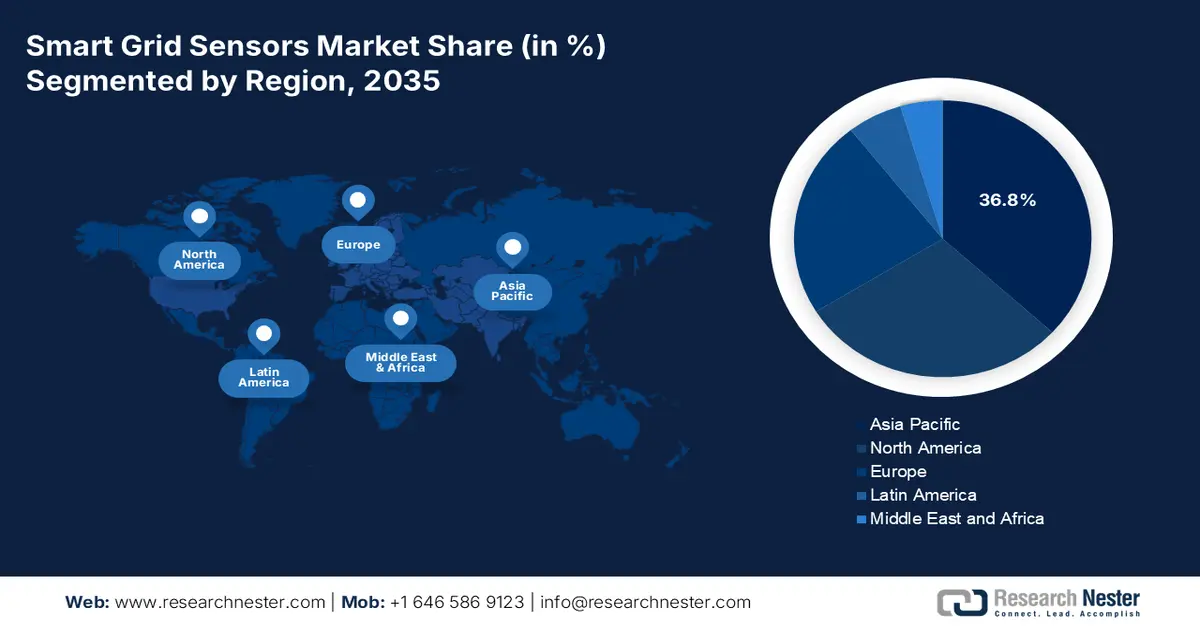

- Asia Pacific is projected to capture the largest 36.8% share by 2035 in the smart grid sensors market, strengthened by expansive AMI deployments, accelerating DER integration, cross-border power exchange, and large-scale grid digitalization initiatives.

- Europe is expected to register the fastest growth through 2035, supported by stringent interoperability requirements, advanced grid automation, and extensive smart meter rollouts across distribution networks.

Segment Insights:

- Sensors sub-segment (component) is forecast to dominate with a 58.7% share by 2035 in the smart grid sensors market, reinforced by its essential function in renewable integration, automated fault identification, optimized asset management, and real-time current and voltage monitoring.

- Utility segment (end use) is anticipated to represent the second-largest share by 2035, aided by widespread adoption for continuous grid performance monitoring, rapid outage detection, predictive maintenance practices, and modernization-driven sensor deployment.

Key Growth Trends:

- Rise in the energy demand

- Increase in industrial electrification

Major Challenges:

- Cybersecurity risks and data privacy concerns

- Interoperability and standardization issues

Key Players: General Electric Company, Itron Inc., Cisco Systems Inc., Honeywell International Inc., ABB Ltd., Siemens AG, Schneider Electric SE, Landis+Gyr Group AG, Kamstrup A/S, S&C Electric Company, Mitsubishi Electric Corporation, Toshiba Corporation, Hitachi Ltd., NTT Data Corporation, GridSense Pty Ltd., LS Electric Co., Ltd., Korea Electric Power Corporation, Larsen & Toubro Limited, Tech Mahindra Limited, Tenaga Nasional Berhad.

Global Smart Grid Sensors Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.7 billion

- 2026 Market Size: USD 6.6 billion

- Projected Market Size: USD 1.9 billion by 2035

- Growth Forecasts: 16.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (36.8% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: China, United States, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Vietnam, Indonesia

Last updated on : 14 January, 2026

Smart Grid Sensors Market - Growth Drivers and Challenges

Growth Drivers

- Rise in the energy demand: There has been a continuous rise in international electricity consumption, demanding smart monitoring to diminish losses and optimize efficiency. As per 2025 official statistics published by the IEA Organization, the international energy demand grew by 2.2% as of 2024, denoting a rapid rare than the yearly average of 1.3% in 2023. This rising demand was owing to the critical weather impact, which led to an estimated 0.3% points to the 2.2% growth. Besides, the energy demand also continued to grow faster than the worldwide economy, which grew by 3.2% in 2024, which is close to its long-lasting average. Moreover, the electricity demand grew increasingly, surging by 4.3% as of 2024, thereby making it suitable for bolstering the smart grid sensors market.

- Increase in industrial electrification: The presence of manufacturing, semiconductor, and chemical industries depends on sensors to readily stabilize power quality and diminish downtime. As per the July 2023 IEA Organization article, the overall electricity share in finalized energy consumption is expected to increase in the Net Zero Emissions by the end of 2050 scenario from 20% as of 2022 to more than 27% in 2030. Besides, China’s electric vehicle sales share has reached 29% in 2022, and the government has targeted 20% of new energy vehicle sales in 2025. Moreover, the electricity share in the energy demand is poised to increase by 4% per year to get on track with the Net Zero by 2050 scenario. Therefore, all these factors are positively impacting the smart grid sensors market internationally.

- Focus on sustainability and climate goals: Governments across different countries are readily investing in grid resilience and clean energy to successfully meet net-zero targets, which is directly skyrocketing the smart grid sensors market. As per the 2024 Ren21 article, USD 310 billion has been allocated as international investment in grids as of 2023, denoting a 5% surge. In addition, the majority of the grid investment in the same was initiated in the U.S., amounting to USD 86.5 billion or 27.9%, along with China providing USD 78.9 billion or 25.4%, which is further followed by Germany, Canada, and India. Furthermore, during this timeline, approximately 1,500 GW of renewable energy projects were awaiting grid connection, doubling to an estimated 3,000 GW, thus denoting an optimistic outlook for the smart grid sensors market.

Challenges

- Cybersecurity risks and data privacy concerns: The smart grid sensors market relies on IoT-enabled connectivity, transmitting vast amounts of real-time data across networks. While this enhances visibility and predictive maintenance, it also exposes utilities to cybersecurity risks. Hackers targeting sensor networks can disrupt grid operations, manipulate data, or cause widespread outages. Data privacy concerns also arise, particularly with AMI sensors that collect consumer usage patterns. Regulatory frameworks such as GDPR in Europe and NIST cybersecurity standards in the U.S. mandate strict compliance, but many utilities lack the resources to implement robust protections. The complexity of securing millions of distributed sensors, each with potential vulnerabilities, creates a significant challenge.

- Interoperability and standardization issues: The smart grid sensors market faces a persistent challenge in interoperability and standardization. Utilities often operate legacy infrastructure built decades ago, with proprietary systems that are not easily compatible with modern sensor technologies. Different vendors provide sensors with varying communication protocols, data formats, and integration requirements, creating fragmentation across the ecosystem. This lack of standardization complicates large-scale deployments, as utilities must invest in middleware or custom integration solutions to ensure seamless operation. International standards bodies such as IEC and IEEE have made progress in defining frameworks, but adoption remains uneven across regions, thereby creating a hindrance to smart grid sensors market expansion.

Smart Grid Sensors Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

16.3% |

|

Base Year Market Size (2025) |

USD 1.7 billion |

|

Forecast Year Market Size (2035) |

USD 6.6 billion |

|

Regional Scope |

|

Smart Grid Sensors Market Segmentation:

Component Segment Analysis

The sensors sub-segment, which is part of the component segment, is anticipated to garner the largest share of 58.7% in the smart grid sensors market by the end of 2035. The sub-segment’s upliftment is highly driven by its importance for integrating renewables, enabling automated fault detection, optimizing asset management, and focusing on real-time monitoring through data on current and voltage health. As per official statistics published by the IEA Organization in 2026, the Europe Commission demonstrated an expected investment of EUR 584 billion (USD 633 billion) in the regional electricity grid by the end of 2030. Of this investment, EUR 170 billion (USD 184 billion) is predicted to be utilized for digitalization, including digital technologies, automated grid management, and smart meters for optimizing and metering field operations, thereby making it suitable for the sub-segment’s growth.

End use Segment Analysis

By the end of the forecast period, the utility segment, part of the end use, is expected to account for the second-largest share in the smart grid sensors market. The segment’s growth is highly fueled by its pivotal role in enabling real-time monitoring of voltage, current, temperature, and power quality across transmission and distribution networks. They allow utilities to detect outages instantly, localize faults, and implement predictive maintenance strategies that reduce downtime and operational costs. Government-led grid modernization programs, such as the U.S. Department of Energy’s Smart Grid Investment Grant Program and the European Union’s Horizon Europe initiatives, provide funding and regulatory frameworks that accelerate sensor adoption. In the Asia-Pacific, large-scale renewable integration in China and India further drives demand for utility-grade sensors to manage bidirectional power flows.

Solution Segment Analysis

The advanced metering infrastructure (AMI) sub-segment, part of the solution, is expected to hold the third-largest share in the smart grid sensors market by the end of the stipulated timeline. The sub-segment’s development is highly propelled by integrating smart meters, communication modules, and sensors to provide two-way communication between utilities and consumers. Sensors embedded in AMI enable real-time monitoring of electricity consumption, outage detection, and demand response, allowing utilities to optimize load management and reduce peak demand stress. Globally, AMI rollouts are accelerating, with Europe expected to develop increased smart meters by 2028, while India and China are scaling nationwide deployments under government-led modernization programs. In North America, utilities leverage AMI sensors to enhance customer engagement, improve billing accuracy, and support distributed energy resource (DER) integration.

Our in-depth analysis of the smart grid sensors market includes the following segments:

|

Segment |

Subsegments |

|

Component |

|

|

End use |

|

|

Solution |

|

|

Application |

|

|

Sensors |

|

|

Power Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Smart Grid Sensors Market - Regional Analysis

APAC Market Insights

Asia Pacific smart grid sensors market is anticipated to garner the largest share of 36.8% by the end of 2035. The market’s upliftment in the region is highly driven by AMI rollouts across ASEAN, South Korea, India, Japan, and China, DER integration, and the aspect of large-scale grid digitalization. As per official statistics published by the ADB Organization in April 2025, the aspect of clean energy investment in the region grew over 900% and successfully reached USD 729.4 billion in 2023, constituting nearly 45% of the international investment. Meanwhile, China accounted for the majority of this investment, along with India and 7 other developing countries in the region, wherein renewables increased 75% of the latest national energy capacity addition as of 2022. Moreover, the ongoing electricity export and import within the region is also uplifting the smart grid sensors market’s growth.

2023 Electricity Export and Import in the Asia Pacific

|

Countries |

Export (USD) |

Import (USD) |

|

China |

1.6 billion |

196 million |

|

India |

1.5 billion |

7.9 million |

|

Thailand |

174 million |

1.9 billion |

|

North Korea |

22.3 million |

- |

|

Malaysia |

60.7 million |

8.1 million |

|

Indonesia |

- |

60.6 million |

Source: OEC

The smart grid sensors market in China is growing significantly due to rapid digitalization of distribution networks, policy continuity, and scalability. In addition, sustained investments in AMI, renewables integration, and grid automation are also responsible for the market’s growth. As per an article published by the State Council Information Office in December 2023, the country accounts for an overall installed power generation capacity of 2.8 billion kilowatts, thus denoting a 13.6% increase year-on-year (YoY). Out of the overall capacity, the solar power generation installed capacity was nearly 560 million kilowatts, demonstrating a 49.9% increase, and meanwhile, the wind power installed capacity is more than 410 million kilowatts, denoting a rise by 17.6% year-on-year (YoY). Besides, the country readily produces 50% of the world’s wind power equipment, along with 80% of the world’s photovoltaic module equipment, thus making it suitable for bolstering the market’s exposure.

The smart grid sensors market in India is also growing, owing to urban load growth, the aspect of escalating distribution automation to support renewables, and is highly fueled by AMI functional requirements and NSGM-based pilots. Based on government data published by the PIB Government in December 2025, the country’s government is readily operating to successfully reach 500 GW non-fossil energy capacity by the end of 2030. Meanwhile, the country has gained the 50% milestone of its very own cumulative electric power installed capacity from non-fossil fuel resources. In addition, the country has effectively surpassed the 250 GW milestone of fossil-fuel power installed capacity as of 2025, and the overall non-fossil power installed capacity has reached 262.7 GW, which denotes 51.5% of the overall installed electricity capacity in the country, thereby bolstering the market’s growth and development.

Europe Market Insights

Europe smart grid sensors market is expected to emerge as the fastest-growing region during the forecast period. The market’s development in the region is extremely propelled by interoperability mandates, automation, distribution, and the presence of massive AMI rollouts. According to an article published by Enlit in February 2024, the penetration of smart meters across the region is projected to increase from nearly 60% in 2023 to 78% by the end of 2028. In addition, there exist 186 million smart electricity meters by the end of 2023, denoting a surge of nearly 4% in 20222. Besides, Italy is considered to comprise the largest market for shipments with nearly 2.6 million units. This is followed by the UK with over 2.5 million units, along with Sweden, comprising 1.4 to 1.5 million units of shipments. In the upcoming years, there has been a prediction of over 88 million smart electricity meters that will be deployed in the overall region, thus making it suitable for bolstering the market’s exposure.

The smart grid sensors market in Germany is gaining increased traction due to the aspect of industrial scale and the presence of robust policy alignment. In addition, the domestic smart grid strategy has emphasized ICT-based optimization and monitoring to associate volatile renewables with consumption, thus fueling pervasive sensing across distribution and transmission. As per official statistics published by the IEA Organization in 2026, the Europe Commission is projected to spend nearly EUR 584 billion (USD 633 billion) as investments in the electricity grid by the end of 2030. Additionally, of this, EUR 170 billion (USD 184 billion) is expected for digitalization, including digital technologies, automated grid management, and smart meters for optimizing and metering across field operations.

The smart grid sensors market in Italy is also developing due to the continued digitalization of distribution networks, along with the presence of the second-generation smart meter rollout. As per an article published by the UNDP Organization in March 2025, the third batch of 18,0 smart meters, along with associated equipment, has delivered more than 14,000 smart meters. This has resulted in installing 32,000 smart meters throughout 2025 for customers in the Central and South distribution network. Besides, in 2024, 3,000 meters have been installed, and meanwhile, 25,000 meters are projected to be installed by the end of 2026. By the end of 2027, 60,000 households are predicted to be readily equipped with smart meters, thereby demonstrating 4.3% of the overall 1.4 million electricity customers. Therefore, this continuous increase in meter installation, the market is growing in the country.

North America Market Insights

North America smart grid sensors market is projected to observe a considerable share by the end of the stipulated timeline. The market’s growth in the region is highly fueled by the existence of reliability mandates, DER integration, and utilities-based modernization programs. Based on government data published by the Department of Energy (DOE) in February 2024, there is a projected surge in the demand flexibility by DERs by 262 GW by the end of 2027, almost matching 271 GW in bulk generation additions during the same timeline. Additionally, in terms of comparison purposes, the U.S. particularly comprises 1,300 GW of generating capacity. Besides, as per the August 2024 DOE article, under the Biden-Harris Administration’s Investing in America agenda, DOE has declared a USD 2.2 billion investment for the country’s grid, especially for 8 projects across 18 states to provide protection against severe weather conditions, additional grid capacity, and low expenses for communities.

The smart grid sensors market in the U.S. is gaining increased exposure, owing to an increase in grid modernization, renewable reliability and integrity, industrial demand, particularly for manufacturing and chemical, along with cybersecurity standards. According to official statistics published by the EIA Government in November 2024, there has been an increase in the aspect of delivering and producing electricity by 12% from USD 287 billion to USD 320 billion as of 2023. Additionally, the capital expense on electricity production surged by 23%, amounting to USD 4.7 billion as of 2023 in comparison to 2022. The majority of this spending is driven by costs associated with constructing Vogtle nuclear plants, which are readily operated by Georgia Power. Besides, the expenditure on electricity transmission systems almost tripled in 2023, surging to USD 27.7 billion, while the capital investment in electricity transmission upsurged to USD 2.7 billion, which is 11%, thus making it suitable for boosting the market.

The smart grid sensors market in Canada is also growing due to clean energy federal funding and transition, hydro and renewables dominance, provincial utility programs, sustainability, and industrial safety. The May 2024 Government of Canada article denoted that USD 22.6 billion has been spent on in-house research and development, of which USD 1.7 billion or 7.5% is deliberately energy-related. Besides, fossil fuels account for the largest energy share by 32% as part of the clean energy transitions. Moreover, the country’s project investor has listed down 470 major projects with a capital value of approximately USD 520 billion planned for construction in the upcoming 10 years. In addition, 183 of these projects are predicted to utilize clean technology, thereby demonstrating suitable investments of USD 116 billion. Therefore, based on these factors, there is a huge growth opportunity for the market in the country.

Key Smart Grid Sensors Market Players:

- General Electric Company (U.S.)

- Itron Inc. (U.S.)

- Cisco Systems Inc. (U.S.)

- Honeywell International Inc. (U.S.)

- ABB Ltd. (Switzerland)

- Siemens AG (Germany)

- Schneider Electric SE (France)

- Landis+Gyr Group AG (Switzerland)

- Kamstrup A/S (Denmark)

- S&C Electric Company (U.S.)

- Mitsubishi Electric Corporation (Japan)

- Toshiba Corporation (Japan)

- Hitachi Ltd. (Japan)

- NTT Data Corporation (Japan)

- GridSense Pty Ltd. (Australia)

- LS Electric Co., Ltd. (South Korea)

- Korea Electric Power Corporation (South Korea)

- Larsen & Toubro Limited (India)

- Tech Mahindra Limited (India)

- Tenaga Nasional Berhad (Malaysia)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- General Electric Company is a major player in grid modernization, offering advanced sensor technologies integrated with its grid management platforms. Its focus on predictive analytics and digital substations positions GE strongly in utility-scale deployments worldwide.

- Itron Inc. specializes in smart metering and sensor solutions, enabling utilities to monitor consumption, detect outages, and optimize distribution networks. Its AMI platforms are widely adopted across North America and Europe, driving strong market penetration.

- Cisco Systems Inc. provides secure networking and IoT-enabled sensor integration for smart grids, ensuring reliable communication between devices and control centers. Its cybersecurity expertise makes it a preferred partner for utilities adopting digital sensor networks.

- Honeywell International Inc. delivers industrial-grade sensors and monitoring solutions that enhance grid reliability and efficiency. Its emphasis on automation and energy management systems supports utilities in achieving compliance and sustainability goals.

- ABB Ltd. is a global leader in power and automation technologies, offering smart grid sensors integrated with its distribution management systems. Its strong presence in Europe and Asia-Pacific reflects demand for interoperable, standards-based sensor solutions.

Here is a list of key players operating in the global market:

The global smart grid sensors market is highly competitive, with global players leveraging innovation, partnerships, and government-backed modernization programs to strengthen their positions. U.S. companies dominate through large-scale deployments and advanced analytics integration, while Europe-based firms focus on interoperability and sustainability aligned with regional energy policies. Manufacturers in Japan and South Korea emphasize precision engineering and IoT integration, supporting regional grid reliability. Malaysia and India-specific firms are expanding rapidly, driven by government investments in digital infrastructure and renewable integration. Besides, in November 2025, Huawei introduced the latest intelligent meter sensing features for the aspect of the intelligent substation. This has been readily possible by significantly collaborating with industrial partners and effectively embracing the overall energy ecosystem, thus suitable for uplifting the smart grid sensors industry.

Corporate Landscape of the Smart Grid Sensors Market:

Recent Developments

- In December 2025, Resideo Technologies, Inc. declared the sale of grid services demand response business to utility clients, such as EnergyHub, enabling Resideo to increasingly focus on its key approach to emerge as the leader in sensing products serving.

- In March 2025, G&W Electric notified its newest evolution of its Viper-ST recloser, significantly featuring extended voltage and present ratings designed to cater to the growing needs of modernized electrical distribution systems.

- In February 2025, TE Connectivity expanded its energy smart grid facility in Germany, along with doubling the production capacity at high-tech engineering hubs, thereby assisting switchgear manufacturers and utilities to future-proof their networks.

- Report ID: 8343

- Published Date: Jan 14, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Smart Grid Sensors Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.