Smart Grid Cybersecurity Market Outlook:

Smart Grid Cybersecurity Market size was over USD 9.1 billion in 2025 and is estimated to reach USD 25.6 billion by the end of 2035, expanding at a CAGR of 12.2% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of the smart grid cybersecurity is estimated at USD 10.2 billion.

The international market is rapidly evolving since industries and utilities are modernizing their respective energy facilities. In addition, the market is readily shaped by government-funded initiatives, evolving threat landscapes, and emerging technologies. According to official statistics published by the International Monetary Fund in April 2024, Equifax, which is a U.S.-based credit reporting agency, paid over USD 1 billion in penalties after a massive data breach that affected nearly 150 million consumers. This kind of loss has readily quadrupled to USD 2.5 billion, while indirect losses, such as security upgradation or reputational damage, are substantially higher. Besides, the financial industry has suffered over 20,000 cyberattacks, leading to USD 12 billion in losses in the past 20 years, thereby enhancing the market’s demand across different nations.

Furthermore, the presence of quantum-resistant microcontrollers, automated incident response systems, integration of cybersecurity with IoT and edge devices, and blockchain-driven grid security are other trends that are uplifting the smart grid cybersecurity market globally. As per a data report published by OECD in October 2023, grids have been successfully delivering power to industry, businesses, and households for more than 100 years. Besides, the international electricity utilization is poised to grow 20% faster in the upcoming decade. Besides, the objective of reaching national goals caters to adding more than 80 million kilometers of grids by the end of 2040, denoting the equivalent of the total existing worldwide grid. Moreover, solar PV and wind account for more than 80%, thereby making it suitable for expanding the market’s exposure across every nation.

Key Smart Grid Cybersecurity Market Insights Summary:

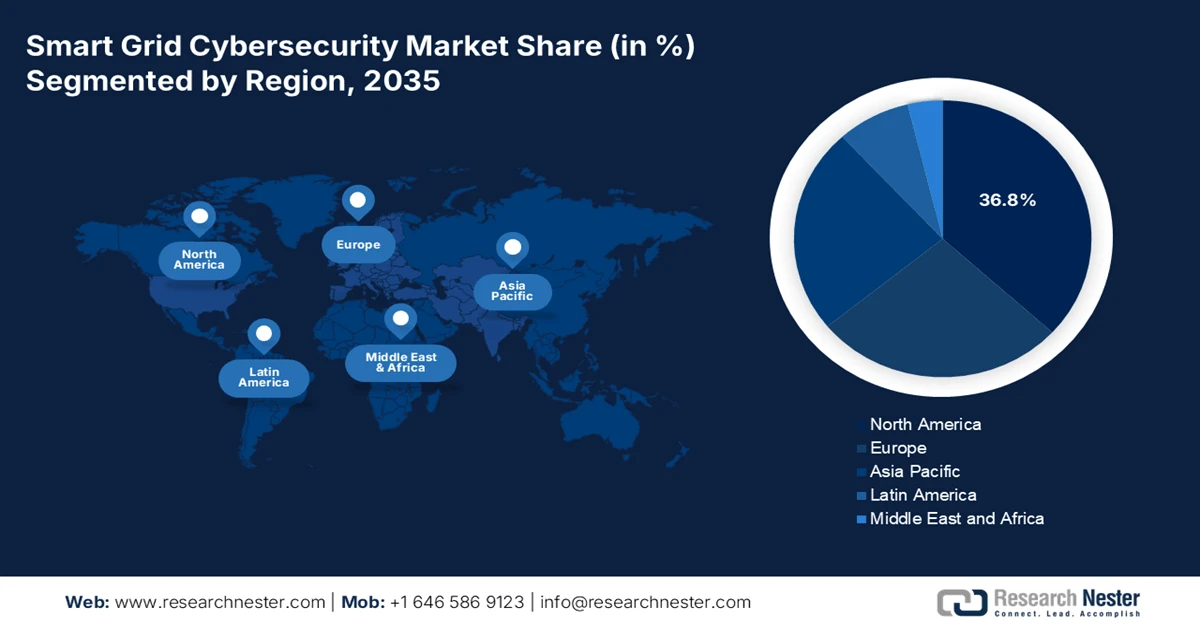

Regional Highlights:

- North America in the smart grid cybersecurity market is projected to command a 36.8% share by 2035, supported by sustained grid modernization initiatives, heightened cybersecurity resilience priorities, and rising utility investments in advanced electricity transmission infrastructure.

- Asia Pacific is anticipated to emerge as the fastest-growing region by 2035, stimulated by accelerating smart grid modernization programs, expanding cybersecurity frameworks, and strong government-backed investments in sustainable energy systems.

Segment Insights:

- The network security segment within the solutions category in the smart grid cybersecurity market is expected to capture a 33.8% share by 2035, reinforced by its essential role in ensuring the safety, integrity, and reliability of data-driven and modernized energy networks.

- The managed security services sub-segment under the services category is projected to hold the second-largest share by 2035, enabled by its capability to deliver continuous monitoring, advanced threat detection, and compliance management for complex smart grid environments.

Key Growth Trends:

- Rise in clean energy investments

- Expansion of distributed energy resources

Major Challenges:

- Increased implementation expenses

- Regulatory fragmentation

Key Players: IBM, Cisco Systems, Honeywell International, General Electric, Schneider Electric, Siemens AG, ABB Ltd, Thales Group, Nokia Corporation, Hitachi Ltd, NEC Corporation, Mitsubishi Electric Corporation, LG CNS.

Global Smart Grid Cybersecurity Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 9.1 billion

- 2026 Market Size: USD 10.2 billion

- Projected Market Size: USD 25.6 billion by 2035

- Growth Forecasts: 12.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, Vietnam, Indonesia, South Korea, Brazil

Last updated on : 4 February, 2026

Smart Grid Cybersecurity Market - Growth Drivers and Challenges

Growth Drivers

- Rise in clean energy investments: Governments are associating green energy funding with cybersecurity demands, thus ensuring that energy and chemical industries are adopting secure digitalized monitoring systems. According to official statistics published by the IEA Organization in June 2025, international energy investment readily increased to a record of USD 3.3 trillion as of 2025 despite economic uncertainty and geopolitical tensions. Besides, investments in clean technologies, such as electrification, efficiency, low-emission fuels, storage, grids, nuclear, and renewables is on the pathway to hit a record amount, constituting to USD 2.2 trillion. This denotes efforts to diminish emissions, as well as ensure the surging influence of energy security concerns, industrial policy, and cost competitiveness of electricity-driven solutions, thus bolstering the market’s evolution.

- Expansion of distributed energy resources: The increasing adoption of electric vehicle charging stations, wind, and solar assets deliberately demands secure communication networks. This is significantly driving the need for the smart grid cybersecurity market internationally. As stated in an article published by the IEA Organization in 2025, over 1.3 million public charging points have been readily added to the international stock as of 2024, demonstrating an increase of over 30% in comparison to 2023. Based on this growth, China comprises nearly 65% of the charging and 60% of the electric light-duty vehicle stock internationally. Besides, the number of public charging points also increased by over 35% in Europe in 2024 and reached more than 1 million, thus bolstering the market’s growth.

International Stock of Public Charging Points by Speed (2018-2024)

|

Year |

Public-Slow (Million) |

Public-Fast (Million) |

Public-Ultra Fast (Million) |

|

2018 |

0.40 |

0.14 |

0.01 |

|

2019 |

0.61 |

0.26 |

0.01 |

|

2020 |

0.90 |

0.36 |

0.02 |

|

2021 |

1.22 |

0.54 |

0.03 |

|

2022 |

1.87 |

0.86 |

0.07 |

|

2023 |

2.65 |

1.36 |

0.10 |

|

2024 |

3.43 |

1.87 |

0.15 |

Source: IEA Organization

- Government regulations and compliance mandates: The existence of national frameworks requires utilities to integrate strong cybersecurity protocols, developing the sustained demand for the market internationally. Based on government estimates as published by the PIB Government in January 2026, CERT-In carefully handled more than 29.4 lakh cyber cases as of 2025 and issued 1,530 alerts, 390 vulnerability notes, and 65 advisories, thereby reflecting a large-scale national cyber response capability. Besides, 231 cybersecurity audit organizations are empaneled, effectively strengthening vulnerability and audit assessment capacity across severe Information Communication Technology infrastructure, thus boosting the market’s development.

Challenges

- Increased implementation expenses: One of the most significant roadblocks in the smart grid cybersecurity market is the high upfront cost of deploying advanced cybersecurity solutions across smart grids. Utilities must invest in secure hardware, encryption technologies, AI-driven monitoring systems, and skilled personnel. For smaller utilities and those in emerging markets, these costs can be prohibitive, slowing adoption. Additionally, integrating cybersecurity into legacy grid infrastructure requires expensive retrofitting, often involving downtime and operational risks. The financial burden is compounded by the need for continuous updates, compliance audits, and incident response capabilities, thereby causing a hindrance in the market’s global expansion.

- Regulatory fragmentation: Regulations in the market vary widely across countries and regions, creating fragmentation and compliance challenges. For instance, the U.S. Department of Energy mandates specific resilience standards, while Europe enforces ENISA guidelines under the Green Deal framework. In Asia, countries such as India and China have their own evolving cybersecurity mandates. This lack of harmonization forces multinational companies to adapt solutions to multiple regulatory environments, increasing complexity and costs. Moreover, inconsistent enforcement means that some utilities may underinvest in cybersecurity, creating systemic vulnerabilities. The absence of a unified global framework slows innovation and complicates cross-border energy trade, as utilities struggle to meet diverse compliance requirements.

Smart Grid Cybersecurity Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

12.2% |

|

Base Year Market Size (2025) |

USD 9.1 billion |

|

Forecast Year Market Size (2035) |

USD 25.6 billion |

|

Regional Scope |

|

Smart Grid Cybersecurity Market Segmentation:

Solutions Segment Analysis

The network security segment, which is part of the solutions segment, is anticipated to garner the highest market share of 33.8% by the end of 2035. The sub-segment’s upliftment is highly driven by the aspect of enabling the safety, integrity, and reliability of modernized and data-based energy facilities. According to official statistics published by the World Economic Forum in January 2025, almost 60% of organizations globally are of the opinion that geopolitical tensions have negatively impacted their cybersecurity approaches. Regarding this, geopolitical turmoil has also impacted the perception of challenges, with 1 in 3 incidents of loss of sensitive information and cyber espionage theft as top concerns. Meanwhile, 45% of cyber-based leaders are focused on operational disruptions and business processes, thus proliferating the demand for network security internationally.

Services Segment Analysis

By the end of the forecast period, the managed security services sub-segment, part of the services segment, is projected to hold the second-largest share in the smart grid cybersecurity market. The sub-segment’s growth is highly fueled by offering utilities and industrial players continuous monitoring, threat detection, and compliance management. The complexity of smart grids, with interconnected IoT devices, distributed energy resources, and cloud-based platforms, makes in-house cybersecurity management challenging. MSS providers deliver scalable solutions that reduce operational burdens, allowing utilities to focus on core energy delivery while outsourcing specialized security tasks. Besides, a key advantage is 24/7 monitoring and incident response, which ensures rapid containment of cyber threats.

Deployment Modes Segment Analysis

The cloud segment in the smart grid cybersecurity market is expected to account for the third-largest share by the end of the stipulated duration. The segment’s development is extremely propelled by enabling flexible, scalable, and cost-efficient solutions. Unlike traditional on-premise systems, cloud-based platforms allow utilities to manage cybersecurity across geographically dispersed assets, including smart meters, electric vehicle charging stations, and distributed energy resources. Cloud deployment supports real-time data analytics and centralized monitoring, which are critical for detecting anomalies and preventing cyber intrusions. The integration of AI and machine learning in cloud environments enhances predictive threat detection, while blockchain-based cloud solutions provide tamper-proof transaction records for energy trading.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Solutions |

|

|

Services |

|

|

Deployment Modes |

|

|

Applications |

|

|

Security Type |

|

|

Subsystems |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Smart Grid Cybersecurity Market - Regional Analysis

North America Market Insights

North America is anticipated to grab the highest market share of 36.8% by the end of 2035. The market’s upliftment is highly fueled by the presence of chemical industry sustainability programs, cybersecurity resilience, and grid modernization. Based on government investments published by the EIA Government in November 2024, there has been an increase in the yearly spending by the majority of regional utilities to develop and deliver electricity by 12% from USD 287 billion to USD 320 billion as of 2023. Moreover, the expenditure on electricity transmission systems almost tripled in the same year, amounting to USD 27.7 billion. In addition, there has also been a surge in electricity transmission, catering to USD 2.7 billion, which is 11% within the same year. Therefore, with the continuous increase in grid modernization, the market is expanding in the region.

The smart grid cybersecurity market in the U.S. is growing significantly, owing to the existence of federal grid modernization programs, chemical industry integration, as well as cyber threat landscape. According to official statistics published by the Industrial Cyber in November 2025, an estimated 70% of overall domestic cyberattacks as of 2024 readily involved critical infrastructure. In addition, the majority of cyberattacks on local and state governments have been readily recorded in almost 44 states in the country. Besides, the manufacturing industry witnessed the highest number of cyber cases at 26%, which is followed by insurance and finance at 23%, and 18% for consumer services, business, and professional. Moreover, the energy industry catered for 10% of attacks, 7% for transportation, 5% for each of retail and healthcare, and 1% for wholesale, thereby driving the market’s growth in the country.

An increase in clean energy chemical production investments, government and industry partnerships, along with sustainability and regulatory alignment, are other factors boosting the market in Canada. As per an article published by Coram in July 2025, there has been a surge in police-reported and hate-motivated crimes by 27%, that is rising from 2,646 to 3,360 cases. In addition, there has been a further 7% increase, along with 4,777 incidents recorded as of 2023, denoting a 32% increase from the previous year. Besides, through the Public Safety Canada Security Infrastructure Program, suitable organizations can receive generous support from almost 50% of the overall project expenses to a maximum of USD 100,000 per project. If the overall expense of a project amounts to USD 160,000, an organization is eligible to gain nearly USD 80,000 in funding, thus bolstering the market’s exposure in the country.

Different Grants and Contribution-Based Projects in Canada (2024)

|

Project Agreement |

Duration |

Description |

Fund Amount |

|

Jewish Russian Speaking Community Of Toronto (JRCC West Thornhill) |

June 2024 to March 2025 |

Provide funding to help the community enhance the security infrastructure by conducting a Security Assessment, and the purchase and installation of a CCTV System, Door Access Control system, Alarm System, Intercom System, Security Window Film, and Incident Response Training. |

USD 40,690.0 |

|

Metropolitan United Church |

June 2024 to March 2025 |

Ensure funding to help the community enhance their security infrastructure, which would then lead to an increase in community safety. Overall activities include the implementation of measures that will contribute to preventing hate crimes. Specific key activities include conducting a security assessment, purchase and installation of CCTV cameras and accessories, and upgraded locks. |

USD 23,688.0 |

|

Our Lady Of Mount Carmel |

June 2024 to March 2025 |

Offer funding to help the community enhance their security infrastructure by purchasing and installing a CCTV system. By providing this organization with security infrastructure, a reduction in hate-motivated crime is anticipated which will lead to an increase in overall community safety. |

USD 3,899.0 |

|

Church Of The Nativity Malvern |

June 2024 to March 2025 |

The purpose of this Security Infrastructure Agreement will contribute to the purchase and installation of a fence and a barrier gate. |

USD 12,818.0 |

|

Chinmaya Mission Toronto |

June 2024 to March 2025 |

The objective is to provide funding to help the community enhance their security infrastructure by purchasing and installing a CCTV System, Door Access Control System, and Alarm System. |

USD 33,688.0 |

|

Hamilton Jewish Federation |

May 2024 to March 2025 |

This Security Infrastructure Agreement will contribute to the purchase and installation of CCTV cameras and supporting equipment, lights, speakers, motion sensors, and access control. By providing this security infrastructure, a reduction in hate-motivated crime is anticipated which will lead to an increase in overall community safety. |

USD 56,219.0 |

Source: Government of Canada

APAC Market Insights

The Asia Pacific smart grid cybersecurity market is expected to emerge as the fastest-growing region during the forecast period. The market’s development in the region is highly propelled by the presence of cybersecurity frameworks, smart grid modernization, and generous investments by the government in sustainable chemical industries. According to official statistics published by the Ember Energy Organization in 2026, there has been a demand for USD 4 to USD 10.7 billion in smart grid investments to deliver clean and reliable energy for expanding the regional economy. In this regard, Indonesia has already effectively deployed more than 1.2 million small meters, which is part of the medium-term plan. Meanwhile, Vietnam’s smart grid roadmap has aimed to prepare distribution networks for large-scale renewable integration, thus proliferating the market’s expansion in the region.

The smart grid cybersecurity market in China is gaining increased traction, owing to the existence of a massive industrial base, government-funded sustainability programs, and an increase in prioritizing smart grid cybersecurity integration into chemical manufacturing. As stated in an article published by the UN China Mission Government in May 2024, the country has witnessed the complete accessibility to the Internet after a 64,000 dedicated global line has been introduced from the domestic Academy of Sciences. Besides, the country is presently home to the largest population of Internet customers in the world, with almost 1.1 billion people, which is 77.5% of the overall population. Moreover, the nation has developed the largest and most innovative cyber infrastructure in the world, with 5G networks covering all counties and municipalities, thus denting an optimistic outlook for the market.

The aspect of launching programs to integrate cybersecurity into chemical industry modernization, along with businesses adopting green chemical processes, is positively driving the market in India. Based on government estimates published by the PIB Government in September 2025, there has been a surge in the index of industrial production (IIP) to 3.5% year-over-year (YoY) as of July, which has been led by 5.4% YoY manufacturing growth. Besides, the country’s manufacturing export engine remained strong, with merchandise exports increasing by 2.5% YoY to USD 184.1 billion between April and August 2025. Moreover, this continuous growth momentum has also been mirrored in the HSBC India Manufacturing Purchasing Manager’s Index (PMI) for manufacturing, thereby making it suitable for bolstering the market’s growth in the country.

Europe Market Insights

Europe smart grid cybersecurity market is projected to witness considerable growth by the end of the stipulated duration. The market’s growth in the region is highly driven by the presence of robust regulatory frameworks, national chemical industry investments, and regional sustainability programs. According to official statistics published by the IEA Organization in 2025, the region has deliberately increased its commitment to clean energy, with investment nearly reaching USD 390 billion as of 2025. Besides, in 2024, renewables generated 50% of the electricity in the whole region, while fossil fuels accounted for only 25%, thereby bringing the investment ratio of renewable generation to fossil fuel power to 35:1 from 6:1. Additionally, investment for building energy efficiency has almost doubled to USD 100 billion, thereby denoting an optimistic outlook for the market.

Investment Trends for Grid Infrastructure in Europe (2015-2035)

|

Grid Type |

2015 (USD Billion) |

2024 (USD Billion) |

2025 (USD Billion) |

2035 STEPS (USD Billion) |

2035 APS (USD Billion) |

|

Low-Emissions Electricity |

59.5 |

118.5 |

128.0 |

108.8 |

121.3 |

|

Grids and Storage |

34.8 |

82.1 |

91.5 |

106.8 |

141.3 |

|

Fossil Fuel Power |

9.5 |

5.5 |

3.5 |

0.8 |

1.1 |

|

Clean Supply |

1.0 |

4.2 |

5.5 |

9.1 |

14.8 |

|

Fossil Fuel Supply |

32.9 |

25.9 |

28.6 |

14.1 |

7.3 |

|

End use |

75.4 |

156.8 |

161.1 |

216.2 |

254.6 |

Source: IEA Organization

The smart grid cybersecurity market in Germany is gaining increased exposure, owing to sustainable chemical expenditure, a rise in the demand for green chemical solutions, and robust governmental support from administrative agencies. Based on government estimates published by the ITA in August 2025, the country’s cybersecurity expenditure exceeded over USD 10 billion as of 2024. Besides, 46% of domestic organizations are presently utilizing cloud computing technology for their respective business processes, while an additional 11% are poised to utilize it in the upcoming years. Moreover, 53% of organizations are focused on increasing investments in artificial intelligence as of 2025, and 55% of companies increased investments by more than 40%. Therefore, with continuous investments, there is a huge growth opportunity for the market in the overall country.

The existence of Innovation Europe-funded sustainability programs, an increase in budget allocations, along with the domestic chemical industry modernization demanding cloud-based cybersecurity solutions to secure distributed energy resources, are uplifting the smart grid cybersecurity market in the UK. As stated in an article published by the UK Government in September 2025, the cybersecurity industry in the country is continuing to grow strongly, with 11% of jobs, 12% of revenue, and almost 21% of gross value added all increasing simultaneously. Additionally, the industry employed approximately 67,300 people in more than 2,100 organizations as of 2024, providing a wide range of services and products. Besides, there also exist massive number individuals in IT, data, risk, and cyber roles, based on which the market is expanding in the country.

Key Smart Grid Cybersecurity Market Players:

- IBM (U.S.)

- Cisco Systems (U.S.)

- Honeywell International (U.S.)

- General Electric (U.S.)

- Schneider Electric (France)

- Siemens AG (Germany)

- ABB Ltd (Switzerland)

- Thales Group (France)

- Nokia Corporation (Finland)

- Hitachi Ltd (Japan)

- NEC Corporation (Japan)

- Mitsubishi Electric Corporation (Japan)

- LG CNS (South Korea)

- Samsung SDS (South Korea)

- Infosys Limited (India)

- Wipro Limited (India)

- Tata Consultancy Services (India)

- Telstra Corporation (Australia)

- Telekom Malaysia Berhad (Malaysia)

- Darktrace (UK)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- IBM is a leader in AI-driven cybersecurity solutions, offering predictive analytics and advanced threat detection systems tailored for smart grids. Its Watson-powered platforms help utilities secure critical infrastructure against evolving cyber threats.

- Cisco Systems focuses on secure network communication for smart grids, leveraging its expertise in routers, firewalls, and cloud-native security. The company’s initiatives emphasize resilience against ransomware and state-sponsored attacks.

- Honeywell International integrates cybersecurity into industrial control systems, ensuring secure operations across energy and chemical sectors. Its solutions protect smart grid automation and enhance compliance with regulatory frameworks.

- General Electric provides end-to-end smart grid solutions, embedding cybersecurity into grid modernization projects. Its focus is on safeguarding distributed energy resources and ensuring secure digital monitoring systems.

- Schneider Electric emphasizes sustainability-linked cybersecurity, aligning with Europe-based Green Deal initiatives. Its EcoStruxure platform integrates cybersecurity with energy management, supporting utilities in achieving secure and efficient grid operations.

Here is a list of key players operating in the global market:

The global smart grid cybersecurity market is highly competitive, with global leaders such as IBM, Siemens, Cisco, and Schneider Electric driving innovation through AI-powered threat detection, cloud-native solutions, and managed security services. Asia-based players, including Hitachi, NEC, and Samsung SDS, are expanding aggressively, leveraging government-backed smart grid modernization programs. India-specific firms, including Infosys and TCS, focus on scalable cybersecurity frameworks for utilities. Strategic initiatives include mergers, partnerships, and research and development investments in blockchain and AI. Besides, in March 2025, Tata Power Delhi Distribution Limited and FSR Global have effectively signed a Memorandum of Understanding (MoU) for collaborating on innovation and policy research in clean energy technologies as well as capacity building, thus creating a positive outlook for the smart grid cybersecurity industry internationally.

Corporate Landscape of the Smart Grid Cybersecurity Market:

Recent Developments

- In October 2025, SEALSQ Corp and Landis+Gyr declared that they have expanded their relationship with the addition of SEALSQ’s cybersecurity solution in Landis+Gyr’s North America-based manufacturing infrastructures.

- In March 2025, Schneider Electric significantly revolutionized grid operations by launching the One Digital Grid Platform, which is an AI-powered and integrated platform, effectively designed to enhance grid efficiency, reliability, and resilience.

- In March 2025, the EY organization notified the unveiling of the latest artificial intelligence capabilities to its very own EY Blockchain Analyzer, known as Smart Contract and Token Review tool.

- Report ID: 8378

- Published Date: Feb 04, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Smart Grid Cybersecurity Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.