AI in IoT Market Outlook:

AI in IoT Market size was valued at USD 93.6 billion in 2025 and is projected to reach USD 169.2 billion by the end of 2035, rising at a CAGR of 6.8% during the forecast period, i.e., 2026-2035. In 2026, the industry size of AI in IoT is assessed at USD 99.9 billion.

The artificial intelligence in IoT market is poised for extensive growth over the upcoming years due to increasing adoption of smart devices, advancements in machine learning, and heightened demand for intelligent automation across industries. In this regard, the article published by NIST in September 2025 observed that federal research investments in IoT infrastructure have the complete potential to deliver a 10 to 20 times increased return, which reflects the strong economic and national competitiveness benefits. It also underscored that the research identified 11 federal investment areas that needed to address short, medium, and long-term infrastructure gaps, which are limiting adoption. The study also underscored the role of AI by noting that IoT provides data for AI models, whereas AI enhances IoT system intelligence and responsiveness. NIST concluded that a coordinated government approach positions the U.S. well to strengthen IoT infrastructure and long-term innovation capacity.

Furthermore, organizations across the globe are leveraging AI-enabled IoT systems to gain real-time insights, improve operational efficiency, enhance predictive maintenance, and support data-driven decision-making. In this context the as of March 2025, the U.S. Department of Homeland Security reported that its SCITI Labs initiative applies smart city and IoT technologies to strengthen public safety and critical infrastructure resilience through validated, real-world deployments. The program has supported use cases such as intelligent building sensor suites, low-cost flood sensors, and wildfire detection systems, which also include 200 early-stage wildfire sensors deployed across the U.S., Canada, and Germany, enabling detection within 30 to 60 minutes of ignition. By partnering with public agencies and industry, SCITI Labs accelerates the transition of tested IoT solutions into operational environments, hence positively impacting AI in IoT market.

Key AI in IoT Market Insights Summary:

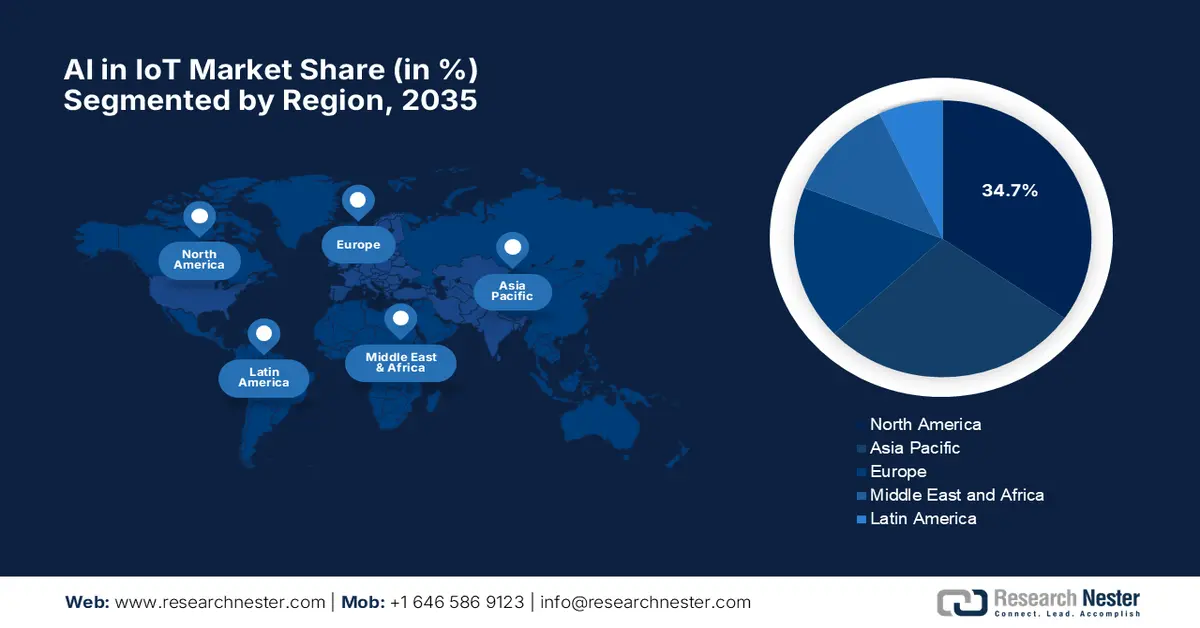

Regional Highlights:

- North America is projected to command a 34.7% revenue share by 2035 in the ai in iot market, underpinned by mature digital infrastructure and strong enterprise adoption across smart manufacturing, healthcare, and logistics enabling integrated AI-IoT deployments

- Asia Pacific is expected to emerge as the fastest-growing region during 2026–2035, stimulated by smart city initiatives, industrial modernization, and large-scale digital transformation strategies accelerating localized AI-enabled IoT applications

Segment Insights:

- The Software segment is forecast to account for a dominant 61.6% revenue share by 2035 in the ai in iot market, supported by its role as the core intelligence layer enabling device management, analytics, middleware, and scalable AI model deployment frameworks

- The Machine Learning & Deep Learning technology segment is anticipated to secure a significant revenue share by 2035, fueled by its ability to transform IoT sensor data into actionable insights through anomaly detection, predictive analytics, and autonomous system optimization

Key Growth Trends:

- Explosion of connected devices & data generation

- Need for real-time processing

Major Challenges:

- Data security and privacy

- Interoperability and standardization

Key Players: Microsoft Corporation (U.S.), IBM Corporation (U.S.), Google LLC (U.S.), Cisco Systems, Inc. (U.S.), NVIDIA Corporation (U.S.), SAP SE (Germany), Oracle Corporation (U.S.), PTC Inc. (U.S.), GE Digital (General Electric) (U.S.), Intel Corporation (U.S.), Siemens AG (Germany), Huawei Technologies (China), Bosch Group (Germany), Samsung Electronics (South Korea).

Global AI in IoT Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 93.6 billion

- 2026 Market Size: USD 99.9 billion

- Projected Market Size: USD 169.2 billion by 2035

- Growth Forecasts: 6.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (34.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: India, Singapore, Vietnam, Indonesia, Brazil

Last updated on : 6 January, 2026

AI in IoT Market - Growth Drivers and Challenges

Growth Drivers

- Explosion of connected devices & data generation: The increase in IoT-connected devices is a primary catalyst boosting the AI in IoT market development. Moreover, the large number of sensors and endpoints generates volumes of data that require intelligent processing, analytics, and automation, efficiently fueling the demand for AI-based IoT solutions. In October 2025, Hyundai Motor Group announced that, in collaboration with NVIDIA and the Korea government, it is building an AI factory powered by 50,000 NVIDIA Blackwell GPUs to advance in-vehicle AI, autonomous driving, smart factories, and robotics. In addition, this initiative also supports Korea’s physical AI ecosystem, combining large-scale IoT data, advanced AI infrastructure, and talent development to create an interconnected, intelligent mobility and manufacturing ecosystem.

- Need for real-time processing: This, coupled with the requirement of advanced analytics, is also fostering a profitable business environment for AI in IoT market. These capabilities are highly essential in smart manufacturing, autonomous systems, and real-time monitoring applications. In August 2025, Siemens reported that it had implemented edge AI-based predictive maintenance on its industrial production lines, embedding Armv9-based AI sensors to monitor vibration, temperature, and energy usage in real time. It also mentioned that these systems can automatically adjust machine parameters, balance loads, and trigger targeted interventions to prevent any type of equipment failures, reduce energy use, and extend asset life. Further, by integrating AI at the edge within Siemens’ MindSphere and industrial edge ecosystems, manufacturers minimize downtime and optimize operational efficiency across smart factories.

- Demand for automation and operational efficiency: Businesses across the globe are opting for AI IoT with a prime focus on automating workflows, particularly in the sectors of manufacturing, logistics, energy, and utilities. Also, Predictive maintenance results in cost savings and productivity improvements, which in turn improve uptake in this sector. In June 2025, Siemens announced that it had partnered with Sachsenmilch to implement its AI-based Senseye predictive maintenance system in the dairy producer’s Leppersdorf facility, which enables early detection of equipment issues and also reduces unplanned downtime. The system analyzes sensor data such as vibration, temperature, and frequencies, and it also allows proactive maintenance. Building on the pilot’s success, Sachsenmilch plans to integrate Senseye with SAP plant maintenance to automate maintenance notifications across its highly automated production lines, benefiting the overall AI in IoT market.

AI-Driven IoT Market Updates from Leading Companies 2025

|

Company |

Details |

Market Opportunity |

|

Wiliot (with Walmart) |

Large-scale deployment of ambient IoT sensors integrated with Walmart’s AI systems across the retail supply chain |

AI-driven supply chain visibility, inventory intelligence, and cold-chain monitoring |

|

Telia Company |

Launch of AI-enabled IoT platform and monitoring service for enterprise customers in the Nordic region |

AI-based IoT data analytics, device monitoring, and operational optimization |

Source: Company Official Press Releases

Challenges

- Data security and privacy: One of the biggest challenges in the AI in IoT market is ensuring strong data security and privacy. IoT devices collect large volumes of data, which includes personal, industrial, and operational information. When the AI systems analyze this data, the risk of cyberattacks, data breaches, and unauthorized access increases, causing an obstacle to widespread adoption in this field. Most of the IoT devices have minimal processing power and weak built-in security, making them vulnerable targets for hackers. In addition, data is often transmitted across networks and cloud platforms, readily expanding the attack surface. In this context, organizations need to make investments in terms of encryption and regular updates, which increases both cost and complexity for AI-enabled IoT solutions.

- Interoperability and standardization: Interoperability is considered to be yet another major challenge hindering the expansion of the artificial intelligence in IoT market due to the variety of devices, platforms, and communication protocols. IoT ecosystems mostly include hardware and software from multiple vendors, each using different standards. Therefore, integration of AI models across the fragmented systems is very complex and time-consuming. In addition, the absence of common standards makes data sharing and system coordination difficult, limiting the effectiveness of AI-driven insights. The existence of this fragmentation also slows down innovation and increases development costs due to the necessity for custom solutions. Furthermore, establishing universal standards and improving cross-platform compatibility are highly essential for enabling smoother integration and broader adoption of AI in IoT environments.

AI in IoT Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.8% |

|

Base Year Market Size (2025) |

USD 93.6 billion |

|

Forecast Year Market Size (2035) |

USD 169.2 billion |

|

Regional Scope |

|

AI in IoT Market Segmentation:

Software Segment Analysis

In the AI in IoT market, software is expected to garner the largest revenue share of 61.6% during the forecasted years. The dominance of the segment is since it provides the intelligence layer for AI IoT, which includes device management, analytics platforms, middleware, and AI model deployment frameworks. Software allows enterprises to process large volumes of IoT data and integrate edge or cloud AI solutions. In October 2025, ASUS IoT announced that it had launched AISVision 365, which is a cloud-native AI-vision platform that is designed to accelerate industrial AI deployment by enabling machine-vision projects directly in the browser. The platform integrates data annotation, model training, and inference management, supporting AI tasks such as classification, segmentation, anomaly detection, and object detection with continuous cloud updates. It also offers flexible deployment across cloud and edge environments, compatible with Windows, Linux, NVIDIA Jetson, and ARM-based hardware, hence denoting a wider segment scope.

Technology Segment Analysis

By the conclusion of 2035, machine learning & deep learning in the technology segment are likely to garner a significant revenue share in the artificial intelligence in IoT market. ML & DL are foundational factors that derive actionable intelligence from IoT sensor data, allowing anomaly detection, predictive insights, automation, as well as self-optimizing systems. In this regard July 2025, AWS announced the general availability of multivariate anomaly detection in AWS IoT SiteWise, which enables industrial customers to automatically identify abnormalities across equipment and asset data. Besides, this capability embeds machine learning directly into the IoT platform, allowing predictive and preventive maintenance without requiring any ML expertise. The firm also mentioned that it helps industries monitor critical assets such as turbines, compressors, and motors in real time, improving operational efficiency and reducing costly downtime.

End use Segment Analysis

The manufacturing segment in the AI in IoT market will grow at a considerable rate over the forecasted period. The growth of the subtype is highly subject to huge operational efficiency gains from predictive maintenance, real-time quality control, and automation. In addition, smart factories and AI IoT initiatives increase productivity and reduce downtime, increasing uptake in this field. The subtype also benefits from AI-based robotics that streamline assembly lines and reduce human error. In addition, the IoT-enabled sensors continuously collect production data, feeding AI models that optimize machine performance and energy usage. Furthermore, AI-powered supply chain analytics help manufacturers predict demand, manage inventory, and minimize delays. The integration of AI in IoT enhances worker safety by monitoring equipment conditions and environmental hazards in real time, hence making it suitable for standard artificial intelligence (AI) in IoT market growth.

Our in-depth analysis of the global AI in IoT market includes the following segments:

|

Segment |

Subsegments |

|

Component |

|

|

Technology |

|

|

End use |

|

|

Deployment Model |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

AI in IoT Market - Regional Analysis

North America Market Insights

North America is anticipated to lead the international artificial intelligence in IoT market with the largest revenue share of 34.7% by the end of 2035. The region’s dominance in this field is attributable to mature digital infrastructure, strong enterprise AI IoT adoption in smart manufacturing, healthcare, and logistics. In this regard, Lantronix Inc. in October 2025 announced the launch of Kompress.ai, which is an AI-powered subscription platform for energy-intensive industries, in partnership with Vodafone IoT. The firm also states that this platform integrates Lantronix’s edge hardware, cloud intelligence, and Vodafone’s IoT connectivity to provide real-time insights, predictive analytics, and automation for industrial air compressor fleets. Furthermore, Kompress.ai helps companies reduce downtime, cut energy costs by up to 30% by supporting Lantronix’s recurring revenue model, hence making it suitable for standard artificial intelligence (AI) in IoT market growth.

The U.S. in the AI in IoT market is growing on account of increased adoption, efficiently fueled by advanced cloud platforms and widespread enterprise IoT deployments. Federal initiatives and smart city projects support AI-enhanced traffic management, energy optimization, and predictive maintenance systems. Synaptics Inc. in October 2025, notified that it has launched the Astra SL2600 Series, which are multimodal Edge AI processors designed for intelligent IoT devices across smart appliances, industrial automation, healthcare, and robotics. Besides, these processors are powered by the Torq Edge AI platform and Google’s Coral NPU, and they also offer high efficiency, security features, and connectivity, thereby enabling scalable AI workloads at the edge. In addition, the SL2600 series supports a wide range of applications by accelerating development through open-source compilers and integrated Arm and Mali technologies.

Canada is witnessing growth in artificial intelligence in IoT market due to government-backed AI research programs and industrial partnerships. Simultaneously, the country is also focused on sustainable industrial processes, smart grid solutions, and healthcare IoT applications, wherein AI helps to monitor environmental conditions, optimize energy consumption, and improve patient outcomes. In April 2025, Bell Canada and Ericsson reported that they field-tested AI-native link adaptation, which is a first-of-its-kind technology in 5G networks and was developed at Ericsson’s Ottawa R&D site. Besides, this AI-based solution dynamically optimizes network performance in real time, improving downlink throughput by up to 20% and spectral efficiency by up to 10%, even under very challenging signal conditions. Hence, the collaboration highlights the prominence of AI integration in IoT-enabled telecom infrastructure, contributing to overall artificial intelligence (AI) in IoT market upliftment.

APAC Market Insights

Asia Pacific is likely to register the fastest growth in the global AI in IoT market, wherein the adoption is mainly influenced by smart city initiatives, industrial modernization, and digital transformation strategies. The region extensively emphasizes localized AI applications, such as intelligent transport, agricultural automation, and predictive infrastructure maintenance, in which IoT sensors are generating large amounts of real-time data for AI processing. In December 2025, SoftBank Group announced that it had acquired DigitalBridge for USD 4 billion with a prime focus on expanding digital infrastructure, including data centers, fiber networks, and edge platforms, thereby enabling scalable AI deployment. The firm also notes that the deal strengthens SoftBank’s ability to support next-generation AI services, improve connectivity for IoT ecosystems, and accelerate industrial and enterprise AI adoption.

China is efficiently growing in the artificial intelligence in IoT market on account of continued innovations in areas such as smart manufacturing, autonomous logistics, and industrial robotics. National policies and technology investments encourage domestic development of AI chips, IoT connectivity standards, and integrated platforms that enable large-scale deployment of AI-enabled IoT solutions. In March 2025, ZTE and China Mobile announced that they had unveiled their 5G‑A × AI Ambient IoT solution at MWC Barcelona 2025 by integrating AI with 5G‑A connectivity, sensing, and computing to support IoT device deployments. Besides, this solution includes AI-enhanced Ambient IoT base stations and management platforms that enable real-time decision‑making and ultra-low‑power connectivity across industrial and smart campus environments. Hence, this release demonstrates how the domestic technology companies are embedding AI into IoT infrastructure to drive next-gen connected systems and intelligent automation.

In India, AI in IoT market is growing exponentially due to the increased utilization in agriculture, healthcare, and urban management. The country’s market also benefits from startups that are combining AI with IoT devices to improve crop yields, monitor health services in remote areas. Government programs supporting digital adoption and AI skill development efficiently accelerate regional artificial intelligence (AI) in IoT market progression. In this regard, the government of India, in December 2025, reported that the country is accelerating its AI-based transformation through the IndiaAI Mission, with more than ₹10,300 crore (approximately USD 1.24 billion) investment and 38,000 GPUs deployed to support startups, research, and public services. In addition, it also mentioned that AI initiatives are enhancing sectors such as healthcare, agriculture, education, and governance, by also promoting digital inclusion through homegrown models such as BharatGen AI and Bhashini, positioning the country as the world’s third most AI-competitive nation.

Key Metrics of India’s AI Ecosystem and Government Initiatives (2025)

|

Metric |

Value |

|

India AI Mission Investment |

₹10,371.92 crore (nearly USD 1.25 billion) |

|

Tech & AI Workforce |

6 million |

|

Indian Tech Sector Revenue (2025) |

USD 280 billion (₹23,240 crore) |

|

Projected AI Economic Impact by 2035 |

USD 1.7 trillion |

|

Number of AI Startups |

1.8 lakh (89% using AI) |

|

Global Capability Centres |

1,800+ (500+ focused on AI) |

|

AI Model & Dataset Platform (AIKosh) |

5,500+ datasets, 251 models |

|

AI-skilled Professionals under Future Skills |

13,500 scholars (500 PhD, 5,000 PG, 8,000 UG) |

Source: Government of India

Europe Market Insights

Europe is solidifying its position in the AI in IoT market due to the presence of strong regulatory compliance, privacy protection, and industrial innovation. The region is mainly focused on integrating AI with IoT for smart mobility, while promoting interoperability between devices across borders. In June 2025, Bosch announced that it is investing more than USD 2.7 billion in AI to drive innovation across assisted and automated driving, manufacturing, and consumer applications. By leveraging agentic AI and multi-agent systems, the firm enhances safety, efficiency, and productivity by providing AI platforms for other companies. On the other hand, through initiatives such as its AI Academy, Bosch is also training thousands of employees to build AI expertise, reinforcing its leadership in AI-driven industrial and mobility solutions, hence making it suitable for standard artificial intelligence (AI) in IoT market growth.

Germany is augmenting its leadership over the regional landscape of artificial intelligence in IoT market, facilitated by a stronger emphasis on Industry 4.0 and precision manufacturing. Companies in the country are leveraging AI-driven IoT platforms for real-time quality control, autonomous factory operations, and predictive analytics, encouraging more players to make investments in the country. In this regard, OECD in November 2025 disclosed that Germany is efficiently advancing AI through a strong national strategy, investments in digital infrastructure, high-performance computing, and data governance to support research, industry, as well as public administration. It also highlighted that initiatives of Gaia-X, HPC programs, and AI centers of excellence foster innovation, SME adoption, and industry-academia collaboration. Furthermore, the focus on ethical AI and sustainability, the country positions itself as a predominant leader in AI research and practical applications within Europe.

In the U.K., the AI in IoT market is showcasing exceptional growth facilitated by the rising acceptance of AI IoT in urban infrastructure, healthcare, and logistics. Smart city projects in the country integrate IoT networks with AI analytics to optimize transportation and manage public services, allowing a continued revenue stream in the artificial intelligence (AI) in IoT market. Simultaneously, public-private partnerships encourage experimentation with AI-enabled IoT platforms, thereby supporting both sustainability and economic growth. In February 2025, Thales announced that it had launched the cortAIx centre in the country by bringing on board 200 specialist AI and data engineers to drive domestic innovation in AI-enabled solutions spanning defence, industrial systems, and connected infrastructure. Further, this expansion is also aligned with national AI growth strategies and fosters integration of advanced AI algorithms with sensor-rich environments, underscoring the role of intelligent analytics in IoT ecosystems for secure operational control.

Key AI in IoT Market Players:

- Amazon Web Services (AWS) (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Microsoft Corporation (U.S.)

- IBM Corporation (U.S.)

- Google LLC (U.S.)

- Cisco Systems, Inc. (U.S.)

- NVIDIA Corporation (U.S.)

- SAP SE (Germany)

- Oracle Corporation (U.S.)

- PTC Inc. (U.S.)

- GE Digital (General Electric) (U.S.)

- Intel Corporation (U.S.)

- Siemens AG (Germany)

- Huawei Technologies (China)

- Bosch Group (Germany)

- Samsung Electronics (South Korea)

- Amazon Web Services is the leader in this field by combining its hyperscale cloud infrastructure with powerful AI and IoT services. The firm’s hallmark products, such as AWS IoT Core, AWS Greengrass, and SageMaker, enable secure device connectivity, edge processing, and scalable machine learning capabilities for enterprises across industries such as manufacturing, logistics, and smart cities. In addition, AWS continues to innovate with no-code tools, digital twins, and edge‑ML acquisitions, expanding IoT use cases.

- Microsoft Corporation positions itself as a frontrunner in the AI IoT through Azure IoT Hub, Azure Digital Twins, and Cognitive Services, by offering an edge‑to‑the cloud ecosystem. The company’s platform supports predictive maintenance, remote monitoring, as well as real-time business insights, which are mostly integrated with generative AI and hybrid cloud solutions. AI-based analytics, digital twin enhancements, and sustainability tools, to drive IoT adoption at scale, are the key focus areas opted for by Microsoft.

- IBM Corporation leverages its long-standing enterprise knowledge with a prime focus to drive AIoT adoption with the Watson IoT platform, focusing on cognitive analytics, edge computing, and digital transformation. On the other hand, the firm’s solutions are mainly targeted at complex industrial applications such as predictive maintenance, supply‑chain optimization, and cybersecurity.

- Google LLC is one of the popular names in this field, which integrates AI and IoT through Google Cloud IoT Core, Vertex AI, and data analytics services that efficiently enable real-time processing and predictive intelligence for connected devices. The firm is best known for its strengths in terms of AI research and scalable cloud platforms, and it targets industries such as energy, transportation, and smart infrastructure with solutions that unify device management, analytics, and visualization.

- Cisco Systems, Inc. is yet another dominant force in this sector that extends its networking leadership into the AIoT space by providing secure connectivity, edge intelligence, and robust data fabrics. Products such as Cisco Kinetic, Edge Intelligence, and Catalyst AI-ready hardware support secure device management and near‑real-time analytics across distributed IoT environments.

Below is the list of some prominent players operating in the global artificial intelligence (AI) in IoT market:

The artificial intelligence in IoT market is extremely competitive, which is driven by major tech conglomerates and industrial leaders who efficiently blend scalable cloud platforms, edge AI capabilities, and connected hardware to enable real-time analytics and autonomous operations across industries. These pioneering companies pursue different strategic initiatives such as cloud‑edge convergence, sector-specific solutions, and AI-enabled predictive services. In November 2025, Avalue Technology Inc. announced that IoT is rapidly evolving from simple connectivity to intelligent, data-driven operations, positively influenced by AI, edge computing, and low-power technologies. The company also highlighted solutions such as the AIB-3588 and ACS10-TGU, which enable real-time analytics, predictive maintenance, and smart city applications by efficiently reducing latency and improving security. In addition, Avalue emphasized that its flexible, energy-efficient computing systems help industries scale IoT deployments and build sustainable, intelligent operations.

Corporate Landscape of the AI in IoT Market:

Recent Developments

- In January 2026, FPT and Telechips entered into a collaboration to launch an AI-powered Intelligent cockpit platform called Smart AI Cabin, showcased at CES 2026. The platform integrates Telechips’ automotive semiconductors with FPT’s AI software, enabling real-time, on-device intelligence for driver personalization, navigation, and energy optimization.

- In December 2025, SoftBank Group announced it would acquire DigitalBridge for a total of USD 4 billion to expand AI infrastructure, including data centers and edge networks. The deal strengthens SoftBank’s ability to scale next-generation AI services while DigitalBridge continues as a separate platform, enhancing global capacity and connectivity for AI deployment.

- In October 2025, Qualcomm announced it would acquire Arduino, combining its edge computing and AI technologies with Arduino’s open-source ecosystem. The new Arduino UNO Q, powered by the Qualcomm Dragonwing processor, enables AI applications with high-performance computing and real-time control.

- In March 2025, Qualcomm Technologies announced that it had acquired Edge Impulse to strengthen its AI and IoT capabilities by enabling over 170,000 developers to build, deploy, and monitor AI models for diverse edge applications, complementing its IoT approach.

- Report ID: 3317

- Published Date: Jan 06, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

AI in IoT Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.