Green Technology and Sustainability Market Outlook:

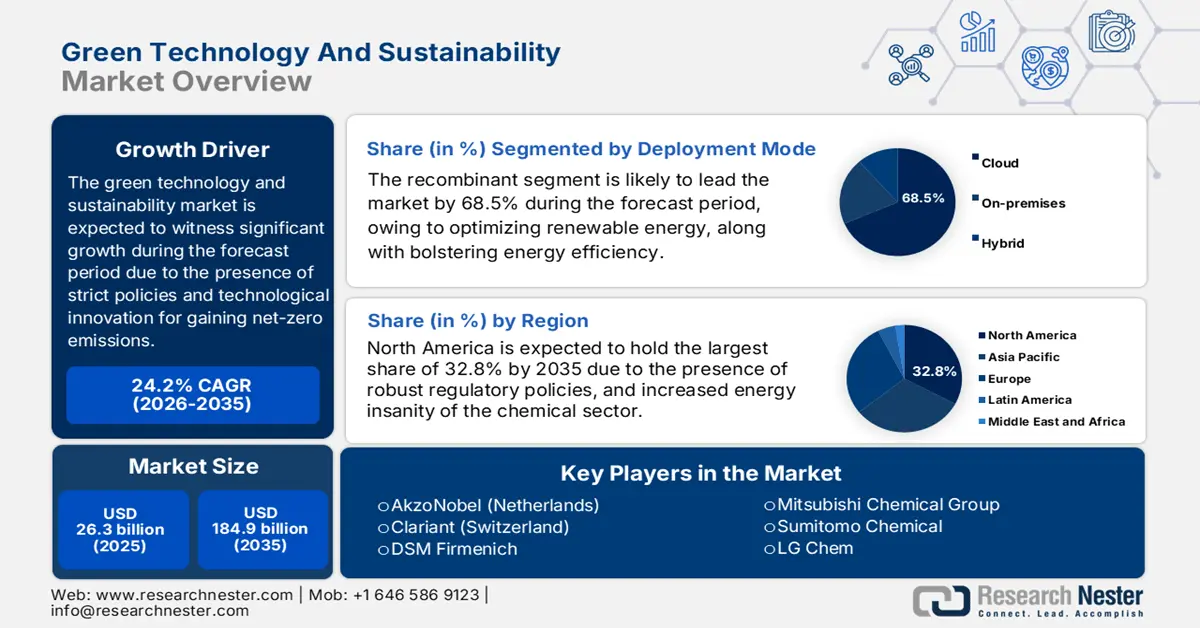

Green Technology and Sustainability Market size was over USD 26.3 billion in 2025 and is estimated to reach USD 184.9 billion by the end of 2035, expanding at a CAGR of 24.2% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of green technology and sustainability is evaluated at USD 32.6 billion.

The green technology and sustainability market is currently witnessing exponential growth, which is fueled by stringent international climate policies, technological advancements, such as the Internet of Things (IoT), blockchain, and artificial intelligence (AI). Besides, according to an article published by the IEA Organization in 2025, direct carbon dioxide emissions, particularly from primary chemical production, remained constant at nearly 935 Mt as of 2022, owing to stagnant production. Moreover, the net zero emission achievement by 2050 has contributed to decouple carbon dioxide emissions from the overall production process globally and successfully reach 18% carbon dioxide emissions by the end of 2030. Therefore, with such risks and the increased focus on targets to achieve net zero approaches, there is a huge growth opportunity for the overall market across different regions.

Direct Carbon Dioxide Emissions from Primary Chemical Production (2010-2030)

|

Year |

Ammonia (Mt CO2/year) |

Methanol (Mt CO2/year) |

High-Value Chemicals (Mt CO2/year) |

Carbon Dioxide Intensity (Mt CO2/year) |

|

2010 |

368.0 |

77.5 |

193.0 |

1.2 |

|

2011 |

381.7 |

85.2 |

196.6 |

1.2 |

|

2012 |

392.9 |

100.3 |

194.6 |

1.2 |

|

2013 |

421.4 |

109.1 |

201.3 |

1.3 |

|

2014 |

411.1 |

140.2 |

204.4 |

1.3 |

|

2015 |

419.0 |

160.0 |

215.1 |

1.3 |

|

2016 |

408.2 |

166.5 |

220.5 |

1.3 |

|

2017 |

405.2 |

188.2 |

229.9 |

1.3 |

|

2018 |

409.2 |

209.0 |

237.2 |

1.3 |

|

2019 |

413.5 |

229.9 |

241.0 |

1.3 |

|

2020 |

421.5 |

233.8 |

244.2 |

1.3 |

|

2021 |

418.0 |

256.9 |

257.1 |

1.3 |

|

2022 |

419.8 |

261.2 |

255.2 |

1.3 |

|

2030 |

311.4 |

209.1 |

248.4 |

0.9 |

Source: IEA Organization

Furthermore, the blockchain for transparency, AI-based carbon tracking, cloud-driven ESG compliance, the adoption of the circular economy, regional leadership, along with the presence of corporate ESG mandates are other factors driving the market globally. As per an article published by the Climate Government in May 2025, the international average carbon dioxide has reached a new record, accounting for 422.7 parts per million as of 2024. In addition, this was 3.7 ppm back in 2023, and meanwhile, at present, the atmospheric carbon dioxide is 50% higher than in previous years, which is increasingly uplifting the market’s demand across different regions. Moreover, the yearly surge in atmospheric carbon dioxide over the past 60 years has been 100 times the natural increases. For instance, since the commencement of the modernized carbon dioxide measurements at Mauna Loa Observatory in Hawaii, the yearly average carbon dioxide was 424.6 as of 2024.

Key Green Technology And Sustainability Market Insights Summary:

Regional Highlights:

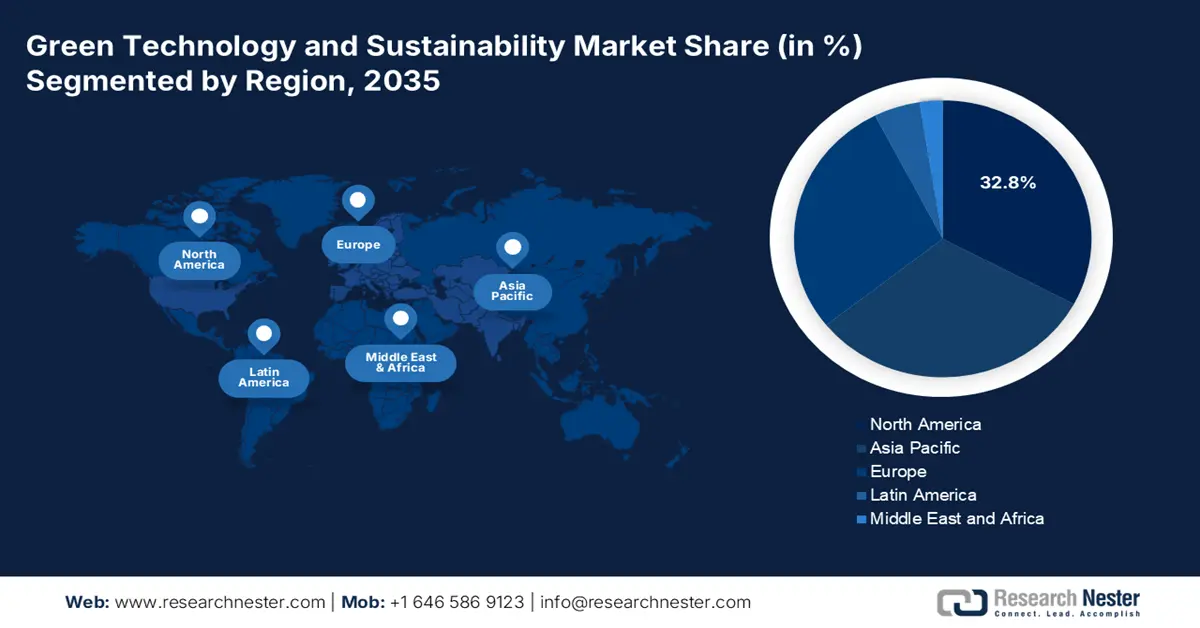

- By 2035, North America is expected to secure a 32.8% share in the green technology and sustainability market, underpinned by intensifying regulatory initiatives and the region’s high industrial energy demand owing to heavy manufacturing usage.

- By 2035, Europe is projected to advance as the fastest-growing region, supported by stringent sustainability regulations, strong industrial depth, and robust funding mechanisms impelled by regulatory simplification efforts.

Segment Insights:

- By 2035, the cloud segment is projected to secure a 68.5% share in the green technology and sustainability market, supported by its role in optimizing renewable energy usage and enhancing IT efficiency through virtualization.

- By 2035, the solutions segment is anticipated to command the second-highest share as it benefits from scalable, interoperable platforms that streamline carbon accounting, energy optimization, and ESG compliance.

Key Growth Trends:

- Increased focus on technological advancement

- Expansion in renewable energy

Major Challenges:

- Increase in capital expenses and investment gaps

- Administrative fragmentation and compliance complexity

Key Players: BASF SE (Germany), Dow Inc. (U.S.), SABIC (Saudi Arabia), LyondellBasell (Netherlands), Shell Chemicals (Netherlands), Evonik Industries (Germany), Solvay (Belgium), Covestro (Germany), AkzoNobel (Netherlands), Clariant (Switzerland), DSM Firmenich (Netherlands), DuPont (U.S.), Mitsubishi Chemical Group (Japan), Sumitomo Chemical (Japan), LG Chem (South Korea), Hanwha Solutions (South Korea), Reliance Industries (India), Tata Chemicals (India), Petronas Chemicals Group (Malaysia), Orica (Australia).

Global Green Technology And Sustainability Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 26.3 billion

- 2026 Market Size: USD 32.6 billion

- Projected Market Size: USD 184.9 billion by 2035

- Growth Forecasts: 24.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (32.8% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: USA, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Indonesia, UAE

Last updated on : 11 December, 2025

Green Technology and Sustainability Market - Growth Drivers and Challenges

Growth Drivers

- Increased focus on technological advancement: An increase in the adoption of IoT, AI, as well as blockchain readily enables real-time monitoring, transparency in reporting, and predictive analytics, which is effectively driving the market internationally. According to a data report published by the IEA Organization in 2025, data centers cater to 1.5% of global electricity demand, which is expected to surge to nearly 3% by the end of 2030. Besides, with increased implementation of artificial intelligence, the total electricity demand from different data centers is poised to double to nearly 945 TWh. Moreover, existing AI applications are comprehensively integrated by the electricity industry for saving nearly USD 110 billion and unlocking 175 GW of transmission capacity, thus suitable for boosting the market.

- Expansion in renewable energy: The aspect of worldwide investment in hydrogen, wind, and solar has fueled the adoption of the green technology and sustainability market. This has readily created the demand for sustainable materials as well as green chemicals. Regarding this, a 2025 IEA Organization report indicated that the global renewable electricity source capacity is anticipated to be double by the end of 2030 and increase by 4,600 GW. This is deliberately and roughly the aspect of adding Japan, Europe, and China’s power generation capacity in combination to the overall international energy mix. Besides, solar photovoltaic caters to nearly 80% of the international increase, and across over 80% of nations, the renewable power capacity is projected to upsurge rapidly between 2025 and 2030.

- Focus on consumer demand: The aspect of growing awareness of climate preference and changes, particularly for eco-friendly products, has escalated the market adoption across different industries. As per an article published by the United Nations Organization in 2023, greenhouse gas emission is projected to increase by 16%. In addition, the predicted surge is 3%, denoting a massive climatic modification. However, based on different regulatory policies, the 2030 greenhouse gas emission is needed to reduce by 28%, especially based on the Paris Agreement 2°C pathway and 42 per cent for the 1.5°C pathway. Therefore, with the presence of these regulations, the market is continuously growing.

Challenges

- Increase in capital expenses and investment gaps: The shift to green technologies requires significant upfront capital, particularly in industries such as chemicals, energy, and manufacturing. Therefore, establishing renewable energy infrastructure, electrified chemical processes, and advanced recycling systems frequently involves generous investment, which can deter smaller firms and emerging economies. While government subsidies and green bonds provide partial relief, the financing gap remains substantial. For example, the International Energy Agency (IEA) has estimated that the international clean energy investment needs to triple by 2030 to meet net‑zero targets. Moreover, in the chemical industry, electrified steam crackers and hydrogen feedstocks demand costly retrofits, making the market adoption slower than anticipated.

- Administrative fragmentation and compliance complexity: One of the most pressing challenges in the green technology and sustainability market is the fragmented regulatory landscape across regions. While Europe has enforced stringent sustainability standards under REACH and the Chemicals Strategy for Sustainability, other regions, such as Asia and Latin America, have less harmonized frameworks. This has created compliance complexity for multinational corporations operating across diverse jurisdictions. Besides, organizations are required to navigate varying definitions of green products, inconsistent carbon accounting methodologies, and differing ESG disclosure requirements. For instance, Europe’s Carbon Border Adjustment Mechanism (CBAM) has imposed tariffs on carbon‑intensive imports, directly impacting exporters from countries with weaker climate policies, thus negatively impacting the market’s growth.

Green Technology and Sustainability Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

24.2% |

|

Base Year Market Size (2025) |

USD 26.3 billion |

|

Forecast Year Market Size (2035) |

USD 184.9 billion |

|

Regional Scope |

|

Green Technology and Sustainability Market Segmentation:

Deployment Mode Segment Analysis

The cloud segment, part of the deployment mode, is anticipated to garner the highest share of 68.5% in the green technology and sustainability market by the end of 2035. The segment’s upliftment is primarily attributed to its ability to optimize renewable energy, boost energy efficiency through virtualization, and centralize IT. In addition, it can significantly reduce carbon footprints, assist businesses in meeting sustainability objectives, reduce e-waste, and lower expenses. According to an article published by the IBEF Organization in January 2024, the cloud technology in India caters to 8% of the country’s GDP, and it has the potential to bolster the nation’s GDP, ranging between USD 310 billion to USD 380 billion. Therefore, with this objective, the segment is extremely useful to positively impact the overall market’s growth and demand across different nations globally.

Offering Segment Analysis

Based on offering, the solutions segment in the market is expected to garner the second-highest share during the forecast period. The segment’s growth is highly driven by the ability to encompass integrated platforms, software, and hardware systems designed to deliver end-to-end sustainability outcomes, including carbon accounting, energy optimization, waste reduction, and supply-chain transparency. Its strength readily focuses on scalability and interoperability, enabling enterprises to embed sustainability into core operations rather than treating it as a peripheral service. Besides, governments and corporations are increasingly mandating comprehensive ESG compliance, which drives demand for bundled solutions capable of automating reporting, monitoring emissions, and aligning with regulatory frameworks such as Europe’s Green Deal and the U.S. EPA climate programs.

Capability Segment Analysis

By the end of 2035, the ESG reporting and compliance sub-segment, which is part of the capability segment, is expected to account for the third-highest share in the green technology and sustainability market. The sub-segment’s development is extremely fueled by regulatory mandates and investor expectations. Besides, ESG reporting tools readily enable companies to measure, disclose, and verify environmental, social, and governance performance, aligning with frameworks such as GRI, SASB, and the Task Force on Climate-related Financial Disclosures (TCFD). Moreover, compliance is no longer optional; regulators in Europe, North America, and Asia-Pacific are enforcing stricter disclosure requirements, including carbon footprint transparency and Scope 1–3 emissions reporting. This has created a surge in demand for digital platforms that automate ESG data collection, ensure audit readiness, and provide real-time dashboards for stakeholders.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Deployment Mode |

|

|

Offering |

|

|

Capability |

|

|

Vertical |

|

|

Application |

|

|

Technology |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Green Technology and Sustainability Market - Regional Analysis

North America Market Insights

North America market is anticipated to garner the highest share of 32.8% by the end of 2035. The market’s upliftment in the region is primarily attributed to the presence of aggressive regulatory drivers and the chemical sector’s high energy intensity. According to a data report published by the EIA Government in July 2023, the industrial sector in the U.S. accounts for 35% of the overall end use energy consumption, as well as 33% of the total energy consumption. Besides, 76% of industrial energy is readily consumed by manufacturing sectors, which is followed by 12% of mining, 7% of construction, and 4% of agriculture. Moreover, the combined energy utilization by chemicals, coal products, petroleum, food, non-metallic minerals, primary metals, and paper accounts for 16.9 quadrillion Btw or 87% of the overall manufacturing energy consumption, thereby making it suitable for boosting the market.

Manufacturing Energy Consumption by Major Manufacturers (2023)

|

Industry Type |

Energy Consumption |

|

Chemicals |

37% |

|

Petroleum and Coal Products |

22% |

|

All other |

13% |

|

Paper |

11% |

|

Primary Metals |

8% |

|

Food |

6% |

|

Non-Metallic Minerals |

4% |

Source: EIA Government

The U.S. in the green technology and sustainability market is growing significantly, owing to the aspect of industrial energy utilization that has elevated the need for digitalized emissions, hydrogen and clean fuels, electrification, and energy efficiency. These have been suitable for the domestic unit operations and feedstocks. As per an article published by the U.S. Department of Energy in September 2025, the Office of Fossil Energy and Carbon Management declared almost USD 6 million in federal funding, which is readily available for research and development projects. The purpose is to assist in establishing a secure domestic supply chain for gallium, which is considered a severe material for the semiconductor, defense, and energy sectors. Moreover, the Technology for Recovery and Advanced Critical-material Extraction–Gallium (TRACE-Ga) approach is also driving the cost-effective and advanced technologies for gallium recovery, thus positively impacting the market’s growth.

Canada in the green technology and sustainability market is also growing due to government-driven climate commitments, electrification, energy transition, technological and innovative investment, circular economy, resource management, and international green economy integration. As stated in the January 2022 IEA Organization data report, the country has readily targeted to reduce greenhouse gas emissions by 40% to 45% by the end of 2030, along with reaching net zero emissions by the end of 2050. Besides, as per an article published by the World Economic Forum in December 2025, the international green economy has significantly surpassed USD 5 trillion and is expected to surge to USD 7 trillion yearly by the end of 2030. This, in turn, has positioned the country to achieve investment, owing to robust ESG frameworks, thus bolstering the market’s growth.

Europe Market Insights

Europe market is projected to emerge as the fastest-growing region during the forecast period. The market’s development in the region is highly propelled by the existence of strict regulations, in-depth industrial capabilities, as well as funding mechanisms. According to an article published by Europe Commission in July 2025, the chemical sector in the overall region is considered the fourth-largest manufacturing industry, comprising 29,000 organizations that provide 1.2 million jobs and support 19 million supply chains. Besides, the action plan constitutes a simplification package, which generously comprises almost €363 million yearly for the overall sector. This includes registration ease for regional fertilizing products, clarification for cosmetics regulations, and simplifying hazardous chemical labelling rules, thus suitable for boosting the overall market.

Germany in the green technology and sustainability market is gaining traction due to the aspect of generously funded transition mechanisms, rigorous climate law, and a large-scale industrial base. As per an article published by the Clean Energy Wire Organization in February 2025, the country has aimed to reach net greenhouse gas neutrality by the end of 2045, constituting targets of diminishing emissions by almost 65% by 2030, as well as 88% by 2040. Moreover, the forestry and land utilization need to comprise negative emissions by minimizing 25 million tons of carbon dioxide equivalents. Additionally, the target of reducing 35 million and 40 million tons of carbon dioxide by the end of 2040 and 2045, respectively. Therefore, with all these precautions and targets, there is a huge growth opportunity for the overall market’s development in the country.

Poland in the green technology and sustainability market is also developing, owing to the presence of Horizon Europe and EU Recovery and Resilience Facility, which generously provides funds, which is aligned with the Chemicals Strategy for Sustainability. This has resulted in enabling SSbD and modernization adoption in an increasingly upgraded industrial base, which progressively caters to the market’s upliftment. As stated in a data report published by the IEA Organization in 2025, the country has emerged as one of the major players in offshore wind, readily aiming for almost 3.4 GW of capacity by the end of 2030. Besides, the total energy mix in the country caters to 32.7% of coal and coal products, which is followed by 32.9% of oil and oil products, 17.6% of natural gas, and 12.9% of biofuels and waste, thereby creating an optimistic outlook for the market.

APAC Market Insights

The Asia Pacific market is projected to witness considerable growth by the end of the stipulated timeline. The market’s growth in the region is effectively driven by compound-driven semiconductor supply chain localization, industrial decarbonization, and rapid clean-energy expansion. According to an article published by the UNDP Organization in March 2025, the region caters to 60% of the world’s population, while depending on fossil fuels for 85% of its overall energy requirements. Besides, the UNDP effectively delivered cost-effective solar energy to 3.6 million people in the region, accounting for 42% of girls and women, by successfully installing solar systems in almost 5,700 institutions. In addition, more than 700 primary schools across the region have been solarized, thereby bolstering the market.

The green technology and sustainability market in China is gaining increased traction, owing to upscaling, industrial depth, and the existence of an integrated policy. As per a data report by the IEA Organization in 2025, the country’s clean energy investment has been over USD 625 billion as of 2024. Besides, the nation’s revolutionary macroeconomic priorities have long shaped its strategy to energy investment by meeting its 5% gross domestic product (GDP) growth in the same year. Moreover, the significant push for smart infrastructure, storage, and grid has witnessed USD 88 billion in distribution and transmission investment in 2025. In addition, the country’s government has readily made contributions for more than 8,000 projects as of 2024, thus denoting an optimistic outlook for the overall market.

The market in India is also growing due to the modernization of chemical-based value chains, policy momentum, and structural growth. According to a data report published by the NITI Aayog in July 2025, the nation’s chemical industry is worth USD 220 billion as of 2023, and is further projected to exponentially grow to USD 400 billion and USD 450 billion by the end of 2030, as well as USD 850 billion to USD 1,000 billion by the end of 2040. In addition, the sector’s dynamic upliftment has trajectorially underscored its potential to play a vital role in the overall country’s aspiration to gain a USD 5 trillion economy. Besides, the country’s contribution to the international chemical industry caters from 3% to 3.5% of the worldwide consumption as of 2023. Therefore, with all such developments and future projections, the market is continuously growing.

Key Green Technology and Sustainability Market Players:

- BASF SE (Germany)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Dow Inc. (U.S.)

- SABIC (Saudi Arabia)

- LyondellBasell (Netherlands)

- Shell Chemicals (Netherlands)

- Evonik Industries (Germany)

- Solvay (Belgium)

- Covestro (Germany)

- AkzoNobel (Netherlands)

- Clariant (Switzerland)

- DSM Firmenich (Netherlands)

- DuPont (U.S.)

- Mitsubishi Chemical Group (Japan)

- Sumitomo Chemical (Japan)

- LG Chem (South Korea)

- Hanwha Solutions (South Korea)

- Reliance Industries (India)

- Tata Chemicals (India)

- Petronas Chemicals Group (Malaysia)

- Orica (Australia)

- BASF SE is readily advancing sustainable chemistry through its Carbon Management Program, targeting a suitable reduction in carbon dioxide emissions by 2030. The company invests heavily in electrified steam crackers and bio-based feedstocks to accelerate low-carbon chemical production.

- Dow Inc. has successfully committed to achieving carbon neutrality by 2050, with an embarked and generous funding for decarbonization projects. Its initiatives include circular plastics, renewable energy integration, and large-scale carbon capture technologies.

- SABIC is upscaling renewable feedstocks and certified circular polymers under its TRUCIRCLE portfolio. The company collaborates globally to advance sustainable materials and reduce emissions across petrochemical operations.

- LyondellBasell is investing in mechanical and advanced recycling technologies to support a circular economy. Its sustainability strategy includes achieving net-zero emissions by 2050 and expanding renewable-based polymers.

- Shell Chemicals is gradually transitioning toward bio-based and recycled feedstocks, aligned with Shell’s broader net-zero ambition by 2050. The company is also developing low-carbon hydrogen and carbon capture solutions to decarbonize chemical production.

Here is a list of key players operating in the global market:

The international green technology and sustainability market is effectively intensified, since incumbents scale low‑carbon feedstocks, electrified processes, and circular chemistry across global portfolios, while aligning with net‑zero pathways and stricter regulations. Notable leaders are generously investing in green hydrogen integration, bio‑based intermediates, PFAS alternatives, and digital emissions management, complemented by Scope 3 supply‑chain programs and mass‑balance certification. Additionally, mergers and acquisitions (M&A) and joint ventures are focused on recycling, carbon capture, and compound‑semiconductor ecosystems, de‑risking critical materials. Besides, in September 2022, Samsung Electronics declared its latest environmental strategy, which is a wide-ranging effort to join international efforts to effectively tackle climate change. This strategy comprises the company’s commitments to gain enterprise-driven net zero emissions as well as plans to utilize increased renewable energy and generously invest in new technologies, thus suitable for the market growth.

Corporate Landscape of the Green Technology and Sustainability Market:

Recent Developments

- In September 2025, WIPRO GREEN has readily unveiled a sustainable fashion technological report to increasingly focus on environmental impacts pertaining to the fashion sector, and adapting green technologies for reshaping the future.

- In December 2024, the Coca‑Cola Company notified the upgraded and voluntary environmental objectives with the purpose of delivering approaches to refresh the overall world and initiate a suitable difference based on sustainability.

- Report ID: 8306

- Published Date: Dec 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Green Technology And Sustainability Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.