Operational Predictive Maintenance Market Outlook:

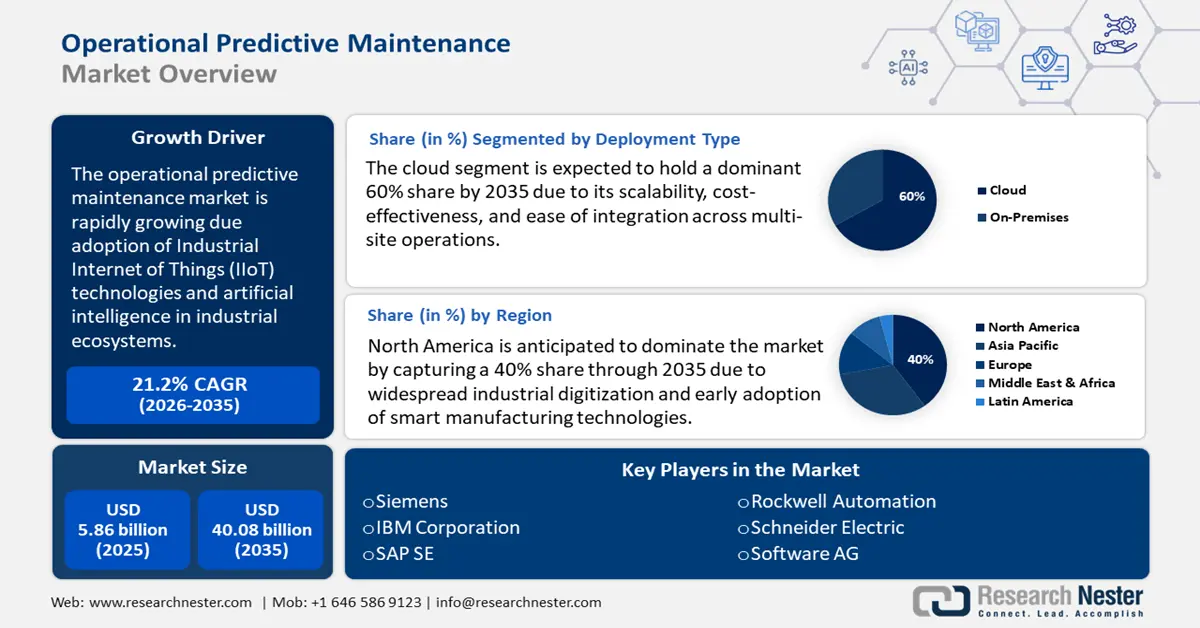

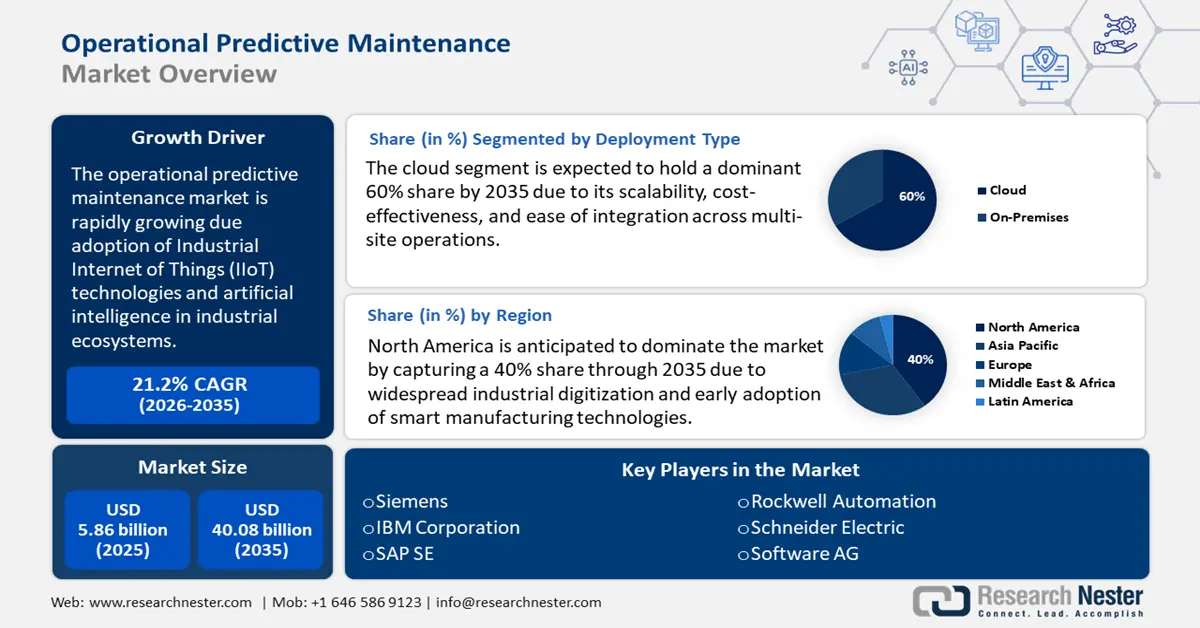

Operational Predictive Maintenance Market size was valued at USD 5.86 billion in 2025 and is expected to reach USD 40.08 billion by 2035, registering around 21.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of operational predictive maintenance is evaluated at USD 6.98 billion.

One of the most significant drivers of the market is the widespread adoption of Industrial Internet of Things (IIoT) technologies and artificial intelligence in industrial ecosystems. Predictive maintenance solutions increasingly depend on sensor-generated data, edge computing, and cloud platforms to monitor equipment health. AI models analyze anomalies, forecast potential failures, and recommend corrective measures, creating a seamless feedback loop for maintenance scheduling.

Industries such as manufacturing, oil & gas, power generation, and aviation are integrating predictive maintenance within their operational technology stacks to replace reactive and preventive maintenance strategies with predictive, data-centric models. In September 2024, Siemens Mobility expanded its use of IoT-enabled predictive maintenance in rail fleets through its Railigent X platform. The platform integrates real-time sensor data from trains and AI-driven analytics to predict component failures and optimize maintenance scheduling. This has led to a reported 25% reduction in train downtime across key European rail networks.

Key Operational Predictive Maintenance Market Insights Summary:

Regional Highlights:

- North America operational predictive maintenance market will account for 40% share by 2035, attributed to widespread industrial digitization and adoption of smart manufacturing.

- Asia Pacific market will account for significant revenue share by 2035, driven by rapid industrialization and push towards smart manufacturing.

Segment Insights:

- The cloud segment in the operational predictive maintenance market is expected to dominate by 2035, influenced by the cloud's scalability, cost-effectiveness, and ease of integration across multi-site operations, supporting AI-driven analytics.

- The manufacturing segment in the operational predictive maintenance market is expected to secure a 30% share by 2035, driven by the integration of IIoT and sensor technologies that enable real-time monitoring and optimize maintenance schedules.

Key Growth Trends:

- Growing demand for asset optimization and reduced downtime

- Regulatory pressure and compliance mandates in critical infrastructure

Major Challenges:

- Complex integration process

- Shortage of skilled labor in AI and industrial analytics

Key Players: IBM Corporation, Microsoft Corporation, SAP SE, General Electric Company, Schneider Electric SE, Siemens AG, Rockwell Automation, Inc., PTC Inc., Uptake Technologies Inc., SAS Institute Inc.

Global Operational Predictive Maintenance Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.86 billion

- 2026 Market Size: USD 6.98 billion

- Projected Market Size: USD 40.08 billion by 2035

- Growth Forecasts: 21.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: China, India, Japan, Singapore, Malaysia

Last updated on : 18 September, 2025

Operational Predictive Maintenance Market Growth Drivers and Challenges:

Growth Drivers

- Growing demand for asset optimization and reduced downtime: Unplanned downtime remains one of the expensive issues across energy, transportation, and heavy machinery. Operational predictive maintenance significantly mitigates this risk by enabling early fault detection and condition-based alerts. This not only helps extend asset lifespan but also minimizes the operational and financial risks of unexpected equipment failure. A report by the U.S. Department of Energy notes that facilities implementing predictive maintenance can expect up to a 30% reduction in maintenance costs and a 45% decrease in breakdowns. This outcome is increasingly appealing to investors focused on asset-heavy enterprises aiming to improve operational efficiency and maximize ROI.

- Regulatory pressure and compliance mandates in critical infrastructure: Industries such as utilities, chemical processing, and public transportation are operating under strict safety standards and must meet compliance requirements imposed by regulatory agencies. Additionally, government-backed initiatives for adopting advanced monitoring systems in sectors such as rail infrastructure and nuclear energy further bolster the adoption of predictive maintenance. A recent example highlighting the impact of regulatory pressure on the operational predictive maintenance market is the U.S. Federal Railroad Administration’s (FRA) proposed regulations in October 2024. These regulations aim to enhance railroad track safety by mandating the use of Track Geometry Measurement Systems (TGMS)alongside traditional visual inspections. The FRA’s initiative highlights the increasing regulatory emphasis on adopting advanced technologies for proactive maintenance.

- Digital twin adoption and the evolution of smart factories: The rise of digital twins, i.e., virtual replicas of physical assets, is transforming how maintenance strategies are executed. By synchronizing real-time operational data with digital simulations, organizations gain predictive insights into wear patterns, stress points, and component failures. This convergence of digital twin technology with predictive maintenance is accelerating its application in smart factory initiatives and Industry 4 deployments.

Challenges

- Complex integration process: Predictive maintenance relies heavily on real-time data from diverse equipment and systems. However, many organizations still operate in environments where machinery, sensors, and IT systems are not interconnected. Thus, integrating legacy systems, IoT devices, and cloud platforms into a unified data framework can be technically complex and costly.

- Shortage of skilled labor in AI and industrial analytics: Implementing and managing predictive maintenance systems requires specialized skills in data science, machine learning, and industrial engineering. There is a growing talent gap in professionals who can both understand industrial processes and design robust AI models for predictive tasks. Hence, this shortage slows down adoption and increases dependence on third-party vendors, limiting in-house innovation and scalability.

Operational Predictive Maintenance Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

21.2% |

|

Base Year Market Size (2025) |

USD 5.86 billion |

|

Forecast Year Market Size (2035) |

USD 40.08 billion |

|

Regional Scope |

|

Operational Predictive Maintenance Market Segmentation:

Deployment Mode Segment Analysis

The cloud segment is expected to hold a dominant 60% share by 2035 due to its scalability, cost-effectiveness, and ease of integration across multi-site operations. It enables real-time monitoring and data access from anywhere, which is crucial for large and distributed industries. Cloud platforms also support seamless updates and AI-driven analytics without heavy IT infrastructure. This flexibility makes the cloud the preferred choice for modern, agile maintenance strategies.

End use Segment Analysis

The manufacturing segment holds a significant market share of around 30% through 2035 due to the need to minimize unplanned downtime and enhance equipment reliability. The integration of industrial IIoT and sensor technologies allows real-time monitoring of machinery that enables early detection of potential issues and optimizes maintenance schedules. In general, advancements in AI and machine learning further refine predictive models, improving accuracy and efficiency in maintenance planning. These factors contribute to improved operational efficiency, reduced maintenance costs, and extended asset lifecycles in the manufacturing industry.

Our in-depth analysis of the global operational predictive maintenance market includes the following segments:

|

Deployment mode |

|

|

End use |

|

|

Component |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Operational Predictive Maintenance Market Regional Analysis:

North America Market Insights

North America is anticipated to dominate the market by capturing a 40% share through 2035 due to widespread industrial digitization and early adoption of smart manufacturing technologies. Top companies from energy to aerospace are investing in AI-driven maintenance to enhance equipment reliability. Additionally, federal initiatives supporting Industry 4 adoption have accelerated this trend. The region’s strong tech ecosystem also encourages rapid innovation in predictive analytics tools.

In the U.S., the demand for predictive maintenance is rising as manufacturers prioritize cost efficiency and operational uptime. As industrial assets age and labor costs rises, Companies in the U.S. are turning to machine learning and sensor-based monitoring for predictive insights. Major industrial players such as GE Electronics, IBM and Rockwell Automation are driving large scale deployments. Additionally, stricter regulatory standards for safety and compliance are pushing firms to adopt proactive maintenance models.

The operational predictive maintenance market in Canada is growing steadily, powered by its emphasis on sustainable operations and infrastructure. The mining, utilities, and transportation sectors are especially active, using predictive tools to extend asset life and prevent failures in remote or harsh environments. A notable example of growth in Canada’s predictive maintenance market is the recent success of Nanoprecise Sci Corp, an Edmonton-based company specializing in AI-driven predictive maintenance solutions. In March 2025, Nanoprecise secured USD 38 million in Series C funding, comprising both equity and debt, to enhance its Energy Centered Maintenance platform and expand global operations. Its ECM approach integrates ultra-low power wireless sensors with AI and machine learning algorithms to provide real-time diagnostics and actionable insights for industrial equipment. This technology is extremely beneficial for mining, oil and gas and manufacturing sectors, where equipment reliability and energy efficiency are critical.

Asia Pacific Market Insights

Asia Pacific is anticipated to garner a significant market share from 2026 to 2035 due to rapid industrialization and a strong push towards smart manufacturing across China, India and South Korea. Top industries in the region are leveraging AI and IoT to reduce maintenance costs and boost factory uptime. Additionally, collaborations between global tech firms and regional manufacturers are accelerating the deployment of predictive maintenance solutions. In 2024, Siemens integrated its Senseye Predictive Maintenance solution, enhanced with generative AI capabilities, into BlueScope’s operations. This integration aimed to accelerate knowledge sharing across global teams and support BlueScope’s digital transformation strategy.

China’s operational predictive maintenance market is expanding due to its deep investment in digital manufacturing under the Made in China 2025 agenda. Top firms in China are integrating AI and machine vision for predictive upkeep in robotics and semiconductors. The manufacturing sector’s focus on reducing downtime and improving efficiency has led to increased implementation of AI and IoT-based predictive maintenance solutions.

The operational predictive maintenance market in South Korea is rising due to strong government backing through initiatives such as the Intelligent Factories 2030 plan. The country’s advanced manufacturing sectors, especially in electronics and automotive, are rapidly adopting AI and IoT technologies to reduce downtime. Further, widespread digitalization and smart factory conversions are driving demand for predictive solutions. The rising small and medium enterprises participation in Industry 4 efforts is fueling broader market adoption.

Operational Predictive Maintenance Market Players:

- Siemens

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- IBM Corporation

- SAS Institute Inc.

- Software AG

- Rockwell Automation

- eMaint by Fluke Corporation

- SAP SE

- Schneider Electric

- SKF

The operational predictive maintenance market is dominated by key players such as Siemens, IBM, GE Digital, and Schneider Electric, who leverage AI, IoT, and cloud technologies. These companies compete through strategic partnerships, advanced analytics platforms, and tailored industry solutions to strengthen its global presence.

Here are some leading players in the operational predictive maintenance market:

Recent Developments

- In February 2025, GE Aerospace and Scandinavian Airlines (SAS) finished a predictive maintenance project to make SAS’s Embraer E190 planes more reliable and efficient. The project used flight and maintenance data to spot common problems with the planes’ bleed systems and flight controls, helping SAS quickly find and fix issues.

- In January 2025, FutureMain Co., Ltd., a company that makes AI-based predictive maintenance tools, completed a successful test project with South Aramco, Saudi Arabia’s national oil company. This success is helping FutureMain expand into the Middle East, using local support and strong networks to introduce its ExRBM solution and grow internationally.

- Report ID: 7647

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Operational Predictive Maintenance Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.