Pressure Sensor Market Outlook:

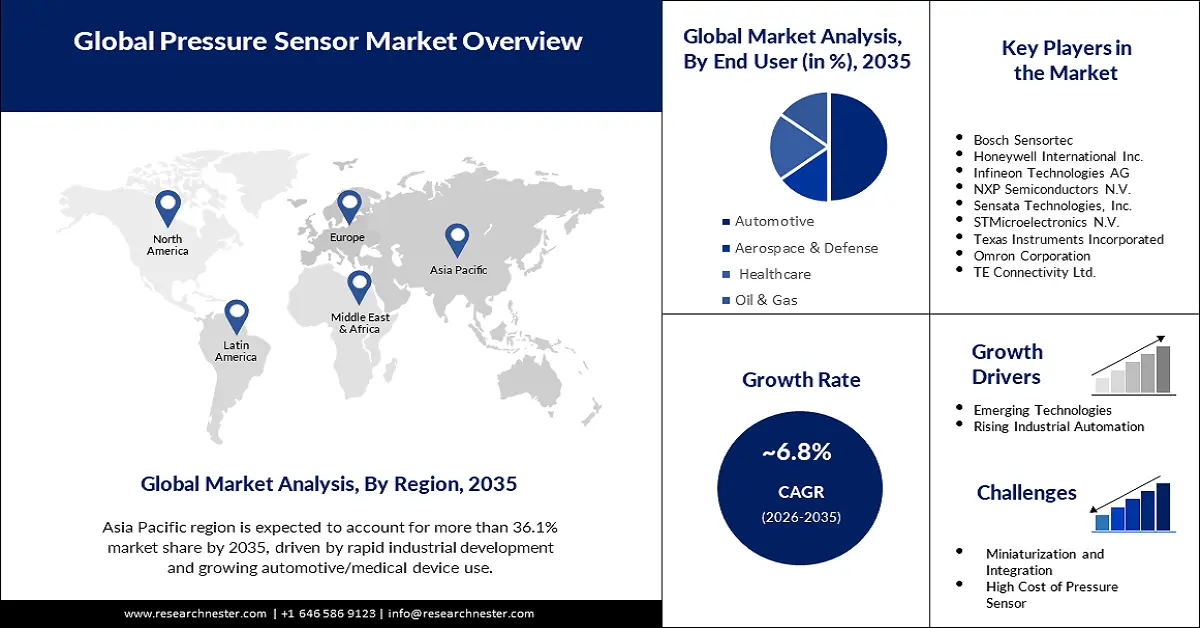

Pressure Sensor Market size was valued at USD 16.76 billion in 2025 and is expected to reach USD 32.36 billion by 2035, registering around 6.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of pressure sensor is evaluated at USD 17.79 billion.

The modern infrastructure utilizes pressure sensors as essential components to supervise both HVAC systems and water supply networks, along with gas pipelines and fire suppression systems. The real-time pressure readings from these sensors boost operational safety as well as enhance system efficiency. Pressure sensors assist in detecting anomalies, as they guarantee regulatory adherence and prevent costly failures through predictive maintenance. The infrastructure depends heavily on pressure sensors for maintaining the system's health and energy utilization reduction due to its increasing complexity.

Smart city developments and urbanization patterns are accelerating the use of pressure sensors for improving building automation practices and energy savings. Companies are innovating to address rising requirements within smart infrastructure through their development of advanced sensor solutions. For instance, in March 2024, Amphenol’s All Sensors subsidiary introduced the AABP Series, a leadless miniature package pressure sensor designed to meet diverse design needs, emphasizing product support and supply chain stability. The product launch demonstrates the industry’s focus on sensor technology development for smart infrastructure requirements, enabling more responsive, intelligent, and sustainable urban development.

Key Pressure Sensor Market Insights Summary:

Regional Highlights:

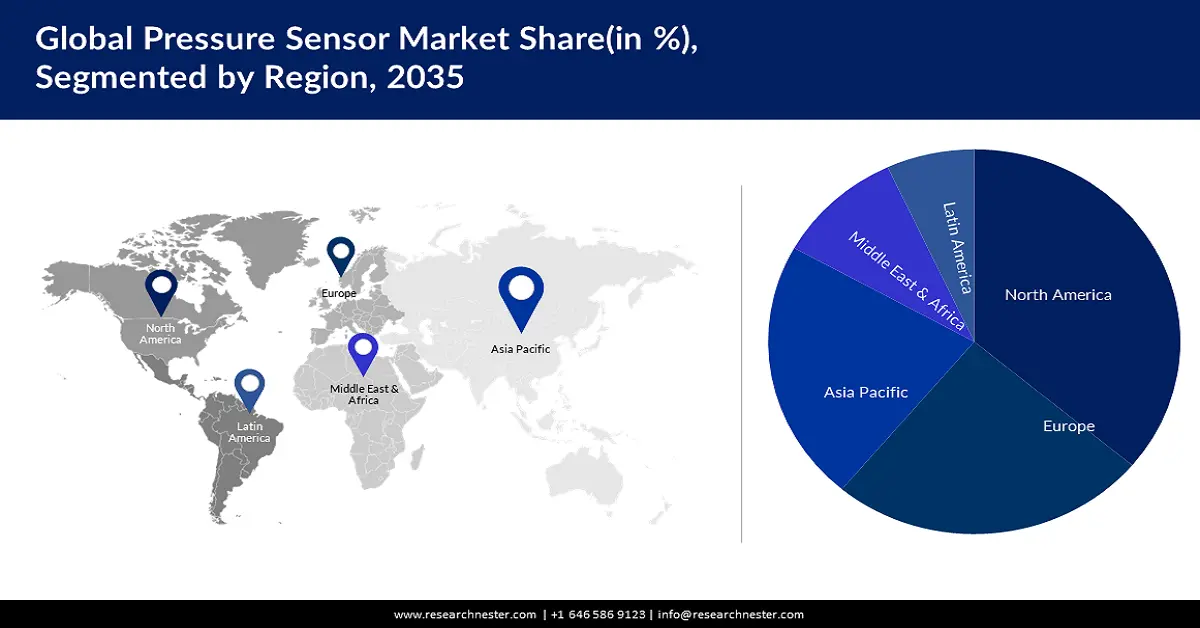

- Asia Pacific pressure sensor market will secure around 36.1% share by 2035, driven by rapid industrial development and growing automotive/medical device use.

- North America market grows rapidly by 2035, driven by rising automotive safety system requirements and smart home technologies.

Segment Insights:

- The automotive segment in the pressure sensor market is projected to capture a significant share by 2035, influenced by the increasing adoption of pressure sensors for vehicle electrification and safety.

- The absolute pressure sensors segment in the pressure sensor market is anticipated to see the fastest growth over 2026-2035, driven by advancements in sensor technology enhancing performance and versatility.

Key Growth Trends:

- Rising adoption of EVs

- Industrial automation and industry 4.0

Major Challenges:

- Complex calibration and maintenance

Key Players: Bosch Sensortec GmbH, TE Connectivity Ltd., Honeywell International Inc., STMicroelectronics N.V., NXP Semiconductors N.V., Infineon Technologies AG, Sensata Technologies, Inc., First Sensor AG, Amphenol Corporation, Emerson Electric Co.

Global Pressure Sensor Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 16.76 billion

- 2026 Market Size: USD 17.79 billion

- Projected Market Size: USD 32.36 billion by 2035

- Growth Forecasts: 6.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (36.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, Japan, South Korea, India, Taiwan

Last updated on : 11 September, 2025

Pressure Sensor Market Growth Drivers and Challenges:

Growth Drivers

- Rising adoption of EVs: The surging global demand for pressure sensors, owing to the rising adoption of electric vehicles and hybrid vehicles, is fueling the market growth. As per a report from the International Energy Agency, in April 2024, the global electric car registrations reached nearly 14 million units in 2023, marking a 35% year-on-year increase. Modern vehicles demand efficient pressure and temperature monitoring systems due to the increasing sales of EVs, which is creating a critical need for managing battery performance, tire pressure, and thermal regulation.

Automotive sensor manufacturers are continually developing advanced pressure sensor technologies that specifically meet the needs of EV applications. For instance, in Infineon Technologies AG, in September 2023, launched the XENSIV SP49 tire pressure monitoring sensor through the integration of MEMS and ASIC technologies to enable functionalities for auto-position sensing and blowout detection. The automotive companies are also adjusting their sales targets, with rising EV adoption rates, demonstrating how sensor technologies are adapting to changing vehicle design principles. - Industrial automation and industry 4.0: Pressure sensors within industrial automation and Industry 4.0 serve as critical components for system health evaluation while enhancing operational performance levels. Pressure sensors provide real-time data monitoring capabilities while performing predictive maintenance tasks that boost operational performance. Manufacturers are developing improved product lines to address the changing requirements of industrial automation and IoT-based systems. For instance, in April 2024, TE Connectivity expanded its IoT wireless pressure sensor offerings with the introduction of the 65xxN and 69xxN series. These sensors support short-range (Bluetooth Low Energy) and long-range (LoRaWAN) communications, respectively, providing flexible solutions for various industrial monitoring challenges.

Challenges

- Complex calibration and maintenance: The industries such as oil & gas and medical device applications need highly precise pressure sensor calibration as it ensures accurate measurements throughout their operational life span. Specialized equipment and expertise typically make this process complicated. The operation of pressure sensors requires routine maintenance to stop them from drifting or malfunctioning, which can potentially compromise the system output. Accessing sensors operating in remote locations or harsh environments like offshore platforms or extreme temperatures creates barriers for accessing them due to the difficulty it causes to perform maintenance and calibration, extending the operational costs and system downtime.

Pressure Sensor Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.8% |

|

Base Year Market Size (2025) |

USD 16.76 billion |

|

Forecast Year Market Size (2035) |

USD 32.36 billion |

|

Regional Scope |

|

Pressure Sensor Market Segmentation:

End use Segment Analysis

The automotive segment is expected to hold a significant revenue share during the assessment period. The automotive industry is increasingly adopting pressure sensors owing to manufacturers’ rising focus on vehicle electrification. EVs depend on pressure sensors to track vital systems consisting of battery cooling mechanisms, thermal management elements, and tire pressure monitoring systems. Electric vehicle manufacturing is growing rapidly, so there is an increasing need for sensors that are engineered exclusively for these automotive uses, leading to improved electric vehicle performance along with increased safety levels.

Type Segment Analysis

The absolute pressure sensors segment is expected to account for the fastest growth during the stipulated timeframe. The advancements in sensor technology, such as enhanced sensitivity as well as miniaturization, are improving the performance and versatility of absolute pressure sensors. The accuracy levels and expanded utility reach of absolute pressure sensors enable their deployment in various industries, including aerospace, automotive manufacturing, and healthcare systems.

Our in-depth analysis of the global pressure sensor market includes the following segments:

|

End use |

|

|

Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Pressure Sensor Market Regional Analysis:

Asia Pacific Market Insights

The Asia Pacific pressure sensor market is expected to hold a significant share during the forecast period. Rapid industrial development is significantly driving the market expansion. There is an increasing demand for pressure sensors due to the growth of industries such as manufacturing, automotive, and oil & gas. In addition, the continually rising automation processes are creating an immediate requirement for advanced sensors to track and regulate machinery operations.

The market is fueling, due to the increasing implementation of automotive technologies across Japan, India, and China. Increasing global production of vehicles, together with the growing EV automotive industry, is resulting in expanding pressure sensor demand. The region is experiencing a rise in tire pressure monitoring systems and engine management as these sensors essetial for safety features in automotive systems.

The China pressure sensor market is projected to witness rapid growth in the near future. The medical devices industry expansion is accelerating the demand for pressure sensors. The medical equipment devices, such as oxygen concentrators, ventilators, and anesthesia machines, depend on pressure sensors to verify oxygen supply levels and track device flow rates. According to the State Council Information Office of China, as of the end of 2024, China’s population aged 60 and above reached 310.31 million, accounting for 22% of the total population, with those aged 65 and above numbering 220.23 million, representing 15.6% of the population. The healthcare demands from the aging population are creating a requirement for improved medical devices.

North America Market Insights

Asia Pacific region is expected to account for more than 36.1% market share by 2035, driven by rapid industrial development and growing automotive/medical device use. The automotive sector is utilizing pressure sensors at higher rates due to safety and driver-assistance system requirements enforced by regulations and consumer preferences.

The U.S. market is expected to grow at a steady pace in the forthcoming years. Smart home technologies serve as a primary growth factor for the market. Pressure sensors find extensive applications throughout modern homes as they assist HVAC systems and water filtration systems, and work with smart appliances. Pressure sensors enable performance assessment and optimal energy management alongside sustainable environmental control, which makes them indispensable for contemporary smart homes.

Pressure Sensor Market Players:

- Bosch Sensortec

- Company Overview

- Business Strategy

- Key Technology Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Honeywell International Inc.

- Infineon Technologies AG

- NXP Semiconductors N.V.

- Sensata Technologies, Inc.

- STMicroelectronics N.V.

- Texas Instruments Incorporated

- Omron Corporation

- TE Connectivity Ltd.

- Robert Bosch GmbH

The pressure sensor market is highly competitive, with key players continuously advancing their technologies to meet evolving industry demands. Leading companies such as Honeywell International Inc., Bosch Sensortec, Siemens AG, and Sensata Technologies dominate the market, offering a wide range of pressure sensors for automotive, industrial, and medical applications. These companies focus on innovation through product development, such as MEMS-based sensors and wireless solutions, to enhance performance and energy efficiency. Strategic partnerships, mergers, and acquisitions further strengthen their market positions, while smaller players are also gaining traction by focusing on niche applications and specialized sensor solutions. Here are some key players operating in the global market:

Recent Developments

- In May 2024, Parker Hannifin announced the launch of a pressure sensor, SCP09, a versatile and reliable solution for mobile machinery and industrial hydraulic applications. This product is designed specially to provide precise pressure measurements for a wide range of applications.

- In May 2023, STMicroelectronics introduced the ILPS28QSW, the industry's first waterproof MEMS pressure sensor with a 10-year longevity program, specifically designed for industrial applications. This sensor provides high accuracy, environmental robustness, and an IP58 rating, making it ideal for applications like gas and water metering, weather monitoring, and home appliances.

- In March 2023, Valeport launched the SWiFT Deep CTD, a new addition to their SWiFT profiler range, designed for CTD measurements at depths of up to 6000m. This compact, robust device integrates Bluetooth wireless technology, a rechargeable battery, and an integral GNSS module for geo-location. The SWiFT Deep CTD delivers accurate conductivity, temperature, and depth measurements, along with computed salinity, density, and sound velocity.

- Report ID: 4990

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Pressure Sensor Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.