Solid State LiDAR Sensor Market Outlook:

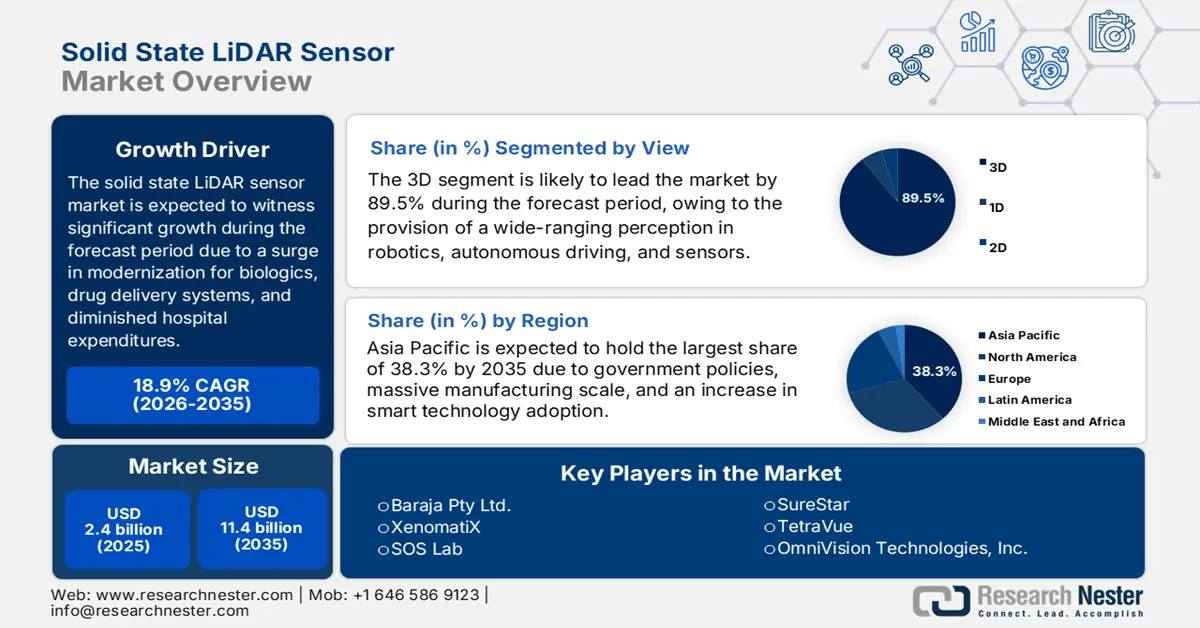

Solid State LiDAR Sensor Market size was over USD 2.4 billion in 2025 and is estimated to reach USD 11.4 billion by the end of 2035, expanding at a CAGR of 18.9% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of solid state LiDAR sensor is evaluated at USD 2.8 billion.

The worldwide solid state LiDAR sensor market is presently evolving from a specialized component for research and restricted automotive utilization to enable a standard technology for intelligence and autonomy across different sectors. This transition is highly driven by the fundamental benefit of solid state designs, such as potential mass production, compact size, and enhanced reliability at reduced expenses in comparison to mechanical predecessors. According to an article published by the United Nations Organization in 2025, digital technologies have readily made advancements and are rapidly growing, accounting for almost 50% of the developing world’s population. Additionally, the International Labor Organization has estimated that the shift to a green economy can create 24 million employment opportunities by the end of 2030, which is positively impacting the overall market.

Furthermore, the aspect of artificial intelligence (AI), along with a focus on sensor fusion, a sudden transition towards software-defined performance, Industrial consolidation, and proliferation beyond automotive, are also uplifting the solid state LiDAR sensor market globally. As per a data report published by the UNCTAD Organization in October 2024, China successfully manufactured 58% of the global electric vehicles, which readily cemented its position as the topmost dominating player in the industry. Besides, Germany comprised 4,109,371 vehicles, which is followed by 1,505,076 in France, 2,451,222 in Spain. Likewise, in America, Canada comprised 1,553,026 vehicles, the U.S. with 10,611,555 vehicles, 4,002,047 in Mexico, and 2,324,838 in Brazil. Meanwhile, generous investments in the car manufacturing sector also denote a huge growth opportunity for the overall market.

Global Car Manufacturing Industry Shifting Investments in Trade Facility (2023)

|

Countries |

Car Manufacturing (Million) |

|

Japan |

8,997,440 |

|

India |

5,851,507 |

|

Korea Republic |

4,243,597 |

|

Thailand |

1,841,663 |

|

Others |

2,006,197 |

Source: UNCTAD Organization

Key Solid State LiDAR Sensor Market Insights Summary:

Regional Highlights:

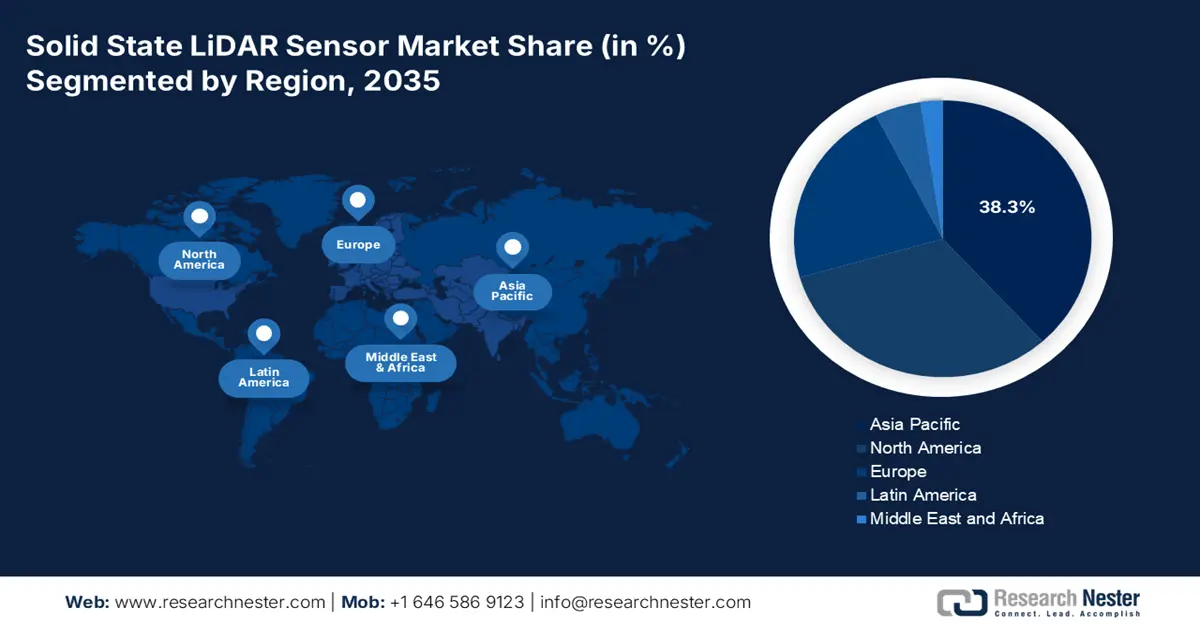

- By 2035, Asia Pacific in the solid state LiDAR sensor market is poised to command a 38.3% share, supported by large-scale manufacturing strength and accelerating adoption of smart technologies.

- By 2035, Europe is projected to advance at the fastest pace, strengthened by a mature automotive base and stringent ADAS-centric regulatory mandates.

Segment Insights:

- By 2035, the 3D segment in the solid state LiDAR sensor market is anticipated to capture an 89.5% share, sustained by its capability to deliver high-precision environmental perception for advanced systems.

- By 2035, the automotive application segment is expected to secure the second-largest share, bolstered by rising global emphasis on safety enhancement and vehicle automation.

Key Growth Trends:

- Advancements in semiconductor technologies

- Rise in smart infrastructure

Major Challenges:

- Limitations in environment and performance

- Intense competition and increased developmental expenses

Key Players: Velodyne Lidar, Inc. (U.S.), Valeo SA (France), Innoviz Technologies Ltd. (Israel), Luminar Technologies, Inc. (U.S.), Aeva, Inc. (U.S.), Ouster, Inc. (U.S.), Cepton, Inc. (U.S.), Hesai Group (China), RoboSense (China), Continental AG (Germany), ZF Friedrichshafen AG (Germany), LeddarTech Inc. (Canada), Quanergy Systems, Inc. (U.S.), Blickfeld GmbH (Germany), Baraja Pty Ltd. (Australia), XenomatiX (Belgium), SOS Lab (South Korea), SureStar (China), TetraVue (U.S.), OmniVision Technologies, Inc. (U.S.).

Global Solid State LiDAR Sensor Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.4 billion

- 2026 Market Size: USD 2.8 billion

- Projected Market Size: USD 11.4 billion by 2035

- Growth Forecasts: 18.9%

Key Regional Dynamics:

- Largest Region: Asia Pacific (38.3% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Singapore, Israel, Sweden, Netherlands

Last updated on : 20 November, 2025

Solid State LiDAR Sensor Market - Growth Drivers and Challenges

Growth Drivers

- Advancements in semiconductor technologies: The aspect of progression in micro-electro-mechanical systems (MEMS) fabrication has directly enabled the production of cheap, compact, and reliable solid state LiDAR sensors, which have made them viable for customer vehicles. According to the 2025 Semiconductors Organization article, the chips that are powering modernized smartphones comprise over 15 billion transistors, which is creating a positive impact on the solid state LiDAR sensor market internationally. Besides, America’s share in chip manufacturing accounted for 10% as of 2022, which is projected to increase by declaring more than 100 projects across 28 states, which has totaled for over half a trillion dollars as private investment, thus uplifting the market.

- Rise in smart infrastructure: The investment provision, both in the form of private and government, in smart cities, automated warehouses, and intelligent traffic systems is leading to a huge demand for the solid state LiDAR sensor market. This is significantly useful for guiding, monitoring, and mapping autonomous machines in structured environments. As per a data report published by the UN-Habitat Organization in 2024, based on digitalized transformation, cities are generously contributing, with a USD 1.8 trillion valuation as of 2022, while the market of smart city technologies is forecasted to boost from USD 121 billion in 2023 to USD 301 billion by the end of 2032. Therefore, with such contributions and future forecasts, the market is poised to witness extreme growth and expansion.

- An increase in Industry 4.0 adoption: The solid state LiDAR sensor market is considered a standard cornerstone technology for Industry 4.0 for offering data-based decision-making in autonomous systems and smart factories. In addition, the provision of real-time and high-precision spatial data, which are crucial to ensure advanced connectivity and automation, is also fueling the market’s exposure across different nations. As stated in an article published by the World Economic Forum in April 2022, there has been a surge in Industry 4.0 production line availability from 5% to 15%, which utilizes energy sensors to diminish power consumption by almost 40%. This approach readily saves more than USD 200,000 per year in energy, thereby denoting an optimistic approach for the overall market.

Challenges

- Limitations in environment and performance: Despite significant innovations, the solid state LiDAR sensor market’s performance under diversified and real-world conditions remains a severe challenge. Sensors usually tend to struggle with signal-based degradation in critical weather conditions, such as snow, fog, and heavy rain. Moreover, interference from direct sunlight and other LiDAR sensors can develop noise in the point cloud data that compromises reliability. This has readily necessitated expensive and complicated signal processing algorithms to filter out the noise. In the case of automotive applications, wherein safety is the paramount, the aspect of achieving all-weather, consistent, and all-lightning performance is extremely non-negotiable.

- Intense competition and increased developmental expenses: The solid state LiDAR sensor market is severely characterized by exceptionally increased research and development (R&D) spending needed for iterating, testing, and designing complicated ASICs and photonic chips. Likewise, there exists the pressure to diminish unit expenses to meet automotive OEM targets immensely, which has created a severe profitability squeeze. This is exacerbated by a fragmented and crowded vendor landscape, wherein different established players and startups are efficiently competing in a restricted number of high-volume production contracts. Therefore, this intensified competition has significantly fueled price wars, further resulting in thinning margins as well as making it severely challenging for organizations to gain sustainable profitability.

Solid State LiDAR Sensor Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

18.9% |

|

Base Year Market Size (2025) |

USD 2.4 billion |

|

Forecast Year Market Size (2035) |

USD 11.4 billion |

|

Regional Scope |

|

Solid State LiDAR Sensor Market Segmentation:

View Segment Analysis

The 3D segment, which is part of the view, is anticipated to account for the largest share of 89.5% in the solid state LiDAR sensor market by the end of 2035. The segment’s upliftment is highly driven by its ability to offer comprehensive and precise environmental perception for applications, such as security, robotics, and autonomous driving. In addition, it is also essential for sophisticated object detection, accurate localization, and real-time mapping. According to an article published by the NHB Organization in December 2023, the global 3D concrete printing sector was valued at USD 210 million as of 2022. Moreover, there have been forecasts regarding its substantial growth, with a predicted valuation of USD 9.095.1 million by the end of 2031, further reflecting a 52.0% growth rate, which in turn, is highly bolstering the overall segment in the market.

Application Segment Analysis

By the end of 2035, the automotive in the application segment is expected to account for the second-largest share in the solid state LiDAR sensor market during the projected period. The segment’s growth is highly propelled by the international push towards enhanced safety and vehicle automation. In addition, within this particular segment, the technology caters to two essential factors, such as successfully enabling ADAS, including autonomous emergency braking as well as adaptive cruise control, along with serving as a foundational sensor for an increased level of autonomous driving. Besides, the ultimate notable driver for the segment’s growth is regulatory, wherein companies, such as Euro NCAP are adopting vehicle autonomy assessments into their respective 5-star safety ratings, which has significantly mandated the advanced sensing integration.

End use Segment Analysis

The automotive OEMs segment, as part of the end use industry, is expected to constitute the third-largest share in the solid state LiDAR sensor market by the end of the forecast duration. The segment’s growth is fueled by its crucial role in acting as the standard gatekeeper for mass-market adoption and also the primary source of volume-based expense reduction. Its tactical focus expands beyond mere procurement to long-lasting and in-depth partnerships with LiDAR suppliers, frequently comprising strategic investments and joint development deals. Besides, for an OEM, the selection of a LiDAR provider is considered a multiple-year commitment, which is associated with particular vehicle platforms, thus making a suitable decision based on both sensor performance as well as the suppliers’ financial stability, functional safety credentials, and manufacturing capability.

Our in-depth analysis of the solid state LiDAR sensor market includes the following segments:

|

Segment |

Subsegments |

|

View |

|

|

Application |

|

|

End use Industry |

|

|

Range |

|

|

Technology |

|

|

Component |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Solid State LiDAR Sensor Market - Regional Analysis

APAC Market Insights

Asia Pacific in the solid state LiDAR sensor market is anticipated to garner the highest share of 38.3% by the end of 2035. The market’s upliftment in the region is highly attributed to the unparalleled combination of huge manufacturing scale, robust governmental and industrial policies, and an increase in the smart technologies adoption. Besides, China’s Made in China 2025 strategy has readily prioritized innovative sensors, while Production Linked Incentive (PLI) and Make in India schemes in India proactively foster a national manufacturing ecosystem. According to an article published by the East Asia Forum Organization in March 2024, electric vehicles accounted for 10% of overall automobile sales in Thailand as of 2023. However, in 2024, the country’s approximate production capacity was 350,000 vehicles every year, which denotes a huge growth opportunity for the market.

The solid state LiDAR sensor market in China is growing significantly, owing to an upsurge in governmental expenditure on the photonics and semiconductor industry that readily underpines the LiDAR production. This is considered the ultimate component of the Made in China 2025 tactical strategy, which is driving the continuous growth of the market in the country. Besides, the Ministry of Industry and Information Technology (MIIT) directly ensures generous funding for pilot smart city projects, which has created a huge demand for LiDAR in public security applications and intelligent traffic systems. As per the 2025 SEMI Organization article, organizations such as Toshiba, Hynix, Micron, TSMC, and Samsung combinedly account for 43% of the semiconductor capacity. Therefore, the presence of notable organizations with generous contributions is driving the overall market.

The solid state LiDAR sensor market in India is also growing due to an increase in government-based investment and an upsurge in the semiconductor industry, which is boosting exponentially, along with standard approvals from the Ministry of Electronics and Information Technology (MeitY) to attract international manufacturers. This particular strategy is proactively developing a suitable ecosystem for solid-state LiDAR production to cater to the burgeoning industrial automation and automotive markets. According to the August 2025 PIB Government report, the size of the country’s semiconductor sector has been continuously growing, with a USD 38.0 billion valuation in 2023, USD 45 to USD 50 billion between 2024 and 2025, which is further projected to increase to USD 100 billion to USD 110 billion by the end of 2030, thus boosting the overall market’s demand in the country.

Europe Market Insights

Europe in the solid state LiDAR sensor market is expected to emerge as the fastest-growing region during the projected period. The market’s development in the overall region is highly fueled by its strong presence of an automotive manufacturing base, along with the presence of strict regulatory frameworks. In addition, the region’s compulsory adoption of Advanced Driver-Assistance Systems (ADAS) under the General Safety Regulation demands the latest vehicle models to implement innovative sensing technologies, such as LiDAR, which is also bolstering the market. For instance, as per an article published by the SPIE Organization in April 2022, Horizon Europe has allocated a budget of €95.5 billion (almost USD 108 billion) for photonics. This particular technology has been designed under the organization’s scope, which approves collaborative projects, thereby making it suitable for the market’s development.

The solid state LiDAR sensor market in Germany is gaining increased traction, owing to its leading automotive sector’s focus towards autonomy, which is backed by strong governmental partnerships. Besides, the Federal Ministry for Digital and Transport readily funds massive projects, such as the Testfeld Autonomes Fahren Baden-Württemberg, to significantly validate automation in driving functions in real-world conditions, thus developing the increased demand for high-performance LiDAR. According to a data report published by the ITA in November 2024, the automotive industry in the country supports almost 780,000 employment opportunities, generating more than USD 611 billion in overall sales as of 2023, denoting an over 11.0% from 2022. This comprises USD 496.3 million for motor vehicles, USD 15.7 million for trailers, and USD 99.8 million for parts and accessories, thus boosting the market’s exposure.

The solid state LiDAR sensor market in the UK is also developing due to a unique combination of administrative agility and tactical R&D focus. Additionally, the country’s Centre for Connected and Autonomous Vehicles (CCAV) readily operates under the wide-ranging policy framework that proactively supports the commercialization of self-driving vehicles. This has directly stimulated the overall market’s demand in the country, and it is highly complemented by generous investment from the UK Research and Innovation (UKRI). As per an article published by the UKRI Organization in March 2025, there has been an investment of £28 million to create cutting-edge AI as well as control systems for driverless vehicles. This investment comprised partners, including the Centre for Connected and Autonomous Vehicles (CCAV) and Innovate UK, which is responsible for driving the market growth in the country.

North America Market Insights

North America's solid state LiDAR sensor market is expected to make steady advancements by the end of the forecast period. The market’s growth in the region is highly propelled by strong R&D, robust defense contracts, and early implementation in smart and autonomous vehicles infrastructure. Besides, notable drivers such as substantial U.S. Department of Defense (DoD) funding for innovative sensing mandates and technologies for intelligent transportation systems from the Department of Transportation (DOT) are also fueling the market’s growth. According to an article published by the U.S. Department of State in October 2022, the Defense Department has modernized and expanded manufacturing capabilities based on a USD 372 million investment. Besides, the U.S. manufacturing is considered the ultimate innovation engine for 70% of R&D and 55% of overall patents, thus suitable for the market.

The U.S. in the solid state LiDAR sensor market is growing steadily, owing to the existence of robust defense-based advancement and regulatory-specific commercial implementation. Besides, the DoD is regarded as the primary catalyst, with generous funding provision for sensing and cyber technologies that directly caters to resilient development for autonomous systems. As stated in the March 2023 Department of Defense report, there has been the provision of USD 1.5 billion and USD 1.3 billion in 2022 and 2023 for security cooperation, which creates an optimistic outlook for the overall market. Meanwhile, the synergy between defense-based R&D and public infrastructure expenditure has created an aggressive and dual-track demand driver. This, in turn, has made the country an international leader, which is suitable for the market’s growth in the region.

Yearly Notable Army Readiness Investments in the U.S.

|

Army Components |

2022 |

2023 |

2024 |

|

End strength |

971,501 |

954,000 |

951,800 |

|

Ground readiness |

USD 11.2 billion |

USD 12.7 billion |

USD 12.5 billion |

|

Aviation readiness |

USD 2.9 billion |

USD 3.6 billion |

USD 3.3 billion |

|

Depot maintenance |

USD 1.5 billion |

USD 1.7 billion |

USD 1.7 billion |

|

Infratsructure |

USD 8.4 billion |

USD 9.7 billion |

USD 8.9 billion |

Source: Department of Defense

The Canada in the solid state LiDAR sensor market is also gaining increased exposure due to the existence of the supply chain and industrial capability that has leveraged its strength in advanced manufacturing and AI. Besides, the federal government’s Strategic Innovation Fund (SIF) has been generous, allocating grants to a domestically innovative sensor manufacturing strategy, which has explicitly aimed at making the country a notable player in the market’s supply chain. As per an article published by the Government of Canada in July 2024, the Minister of Innovation, Science and Industry notified a USD 120 million investment in a more than USD 220 million project, which is managed by CMC Microsystems (CMC). This particular investment supports the country’s network by bridging the gap between stakeholders to support the design, manufacturing, and marketing of semiconductors.

Key Solid State LiDAR Sensor Market Players:

- Velodyne Lidar, Inc. (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Valeo SA (France)

- Innoviz Technologies Ltd. (Israel)

- Luminar Technologies, Inc. (U.S.)

- Aeva, Inc. (U.S.)

- Ouster, Inc. (U.S.)

- Cepton, Inc. (U.S.)

- Hesai Group (China)

- RoboSense (China)

- Continental AG (Germany)

- ZF Friedrichshafen AG (Germany)

- LeddarTech Inc. (Canada)

- Quanergy Systems, Inc. (U.S.)

- Blickfeld GmbH (Germany)

- Baraja Pty Ltd. (Australia)

- XenomatiX (Belgium)

- SOS Lab (South Korea)

- SureStar (China)

- TetraVue (U.S.)

- OmniVision Technologies, Inc. (U.S.)

- Velodyne Lidar, Inc. is well-known for its early mechanical LiDAR systems that powered the first autonomous vehicles generation. The organization has also transitioned to solid-state solutions by focusing on progressive perception software to cater to its sensor hardware.

- Valeo SA is one of the notable automotive suppliers that has successfully gained a major milestone by adopting the first-ever commercially available solid-state LiDAR, which is the organization’s SCALA system, on vehicle production, including the Mercedes-Benz S-Class. This has positioned the organization as the top-most leader in bringing affordable and automotive-grade LiDAR systems to the mass market. As per its 2024 annual report, the company generated EUR 21,492 million, along with 8% in EBITDA, amounting to EUR 2,863 million, which represented 13.3% of sales.

- Innoviz Technologies Ltd. has been recognized for its high-performance solid state LiDAR sensors, such as the InnovizOne, which has been designed particularly to cater to the strict demands of the majority of automotive OEMs. The firm has deliberately secured effective designs, such as the BMW, thereby highlighting its focus on series production and reliability for autonomous driving. Meanwhile, its 2024 annual report stated USD 42.4 million in revenue sales, denoting 2.3 times the achievement level, resulting a boom in LiDAR shipments.

- Luminar Technologies, Inc. has readily distinguished itself by creating long-lasting and high-resolution LiDAR by utilizing its outstanding 1,550 nm laser technology. This provides superior performance in challenging conditions. Besides, the organization has readily forged the majority of partnerships with international automakers, such as Mercedes-Benz and Volvo, to carefully integrate its sensor into cutting-edge customer vehicles.

- Aeva, Inc. has its focus on making advancements in its 4D LiDAR technology, which significantly measures velocity along with distance by utilizing Frequency Modulated Continuous Wave (FMCW) principles. This strategy offers inherent resistance to ensure interference from other sunlight and LiDARs.

Here is a list of key players operating in the global market:

The international solid state LiDAR sensor market is extremely fragmented and effectively competitive, which is readily characterized by a mixture of established automotive suppliers and pure-play startups. Notable players are strongly adopting tactical partnerships with different automotive OEMs to achieve design success for future autonomous vehicles and Advanced Driver-Assistance Systems (ADAS). Meanwhile, the aspect of differentiation is increasingly propelled by software, with organizations creating proprietary-based perception algorithms to ensure valuation of raw sensor data. Besides, in October 2024, LeddarTech Holdings Inc. declared the successful conclusion of a tactical license deal with Solid State LiDAR Protection Inc. to successfully produce and commercialize advanced LiDAR sensor and module products, which caters to the solid state LiDAR sensor market’s upliftment globally.

Corporate Landscape of the Solid State LiDAR Sensor Market:

Recent Developments

- In November 2025, Curiosity Lab collaborated with Opsys and the City of Peachtree Corners to successfully introduce solid state LiDAR technology, which is the Advanced LiDAR Technology Opsys Sensors (ALTOS) Gen 2 LiDAR, to enable high-performance with increased resolution and reliability.

- In January 2022, Opsys Tech notified a suitable deal to effectively supply LiDAR systems to HASCO, which is the world’s leading auto parts supplier, for ensuring inclusion in production vehicles.

- Report ID: 8257

- Published Date: Nov 20, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Solid State LiDAR Sensor Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.