Smartphone Sensors Market Outlook:

Smartphone Sensors Market size was over USD 114.5 billion in 2025 and is estimated to reach USD 432 billion by the end of 2035, expanding at a CAGR of 15.9% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of smartphone sensors is assessed at USD 132.7 billion.

The worldwide smartphone sensors market is considered the foundational enabler of a modernized mobile intelligence, deliberately shifting the device from just a communication tool into a context-wave portal to the digitalized world. The market is witnessing strong growth, which is propelled by the combination of innovative connectivity, escalated customer demand for sophisticated features, and on-device artificial intelligence (AI). According to an article published by the World Economic Forum in April 2023, there were more than 8.5 billion mobile subscriptions in use globally as of 2022, compared to a population of 7.9 billion. Besides, as stated in the September 2025 PIB Government report, smartphone exports are projected to increase in India by ₹1 lakh crore between 2025 and 2026, denoting a 55% surge from the previous year, thus making it suitable for the boosting the market’s growth.

Furthermore, the proliferation of multi-sensor camera systems, the rise in sensor fusion centers, advancements in under-display sensors, and increased focus on always-on and low-power sensing are also fueling the smartphone sensors market globally. As per an article published by the UK Government in June 2022, adult internet users in the UK usually spend an average of more than 3.5 hours a day online, with 68% of the time on smartphones. Besides, the mobile expenditure in the country indicated that online spending outside the household was £179 billion. Meanwhile, 1/3rd of the population has been registered to utilize mobile payments, further denoting 7.4 million people. Moreover, there are a massive number of manufacturers of mobile devices, and the increased sales of the latest smartphones and tablets are shared with each other, thus constituting a huge growth opportunity for the overall market.

Sales Distinction Between Smartphones and Tablets (2022)

|

Brands |

Smartphone |

Tablet |

|

Apple |

40% to 50% |

40% to 50% |

|

Samsung |

20% to 30% |

10% to 20% |

|

|

0% to 5% |

- |

|

Amazon |

- |

20% to 30% |

Source: UK Government

Key Smartphone Sensors Market Insights Summary:

Regional Highlights:

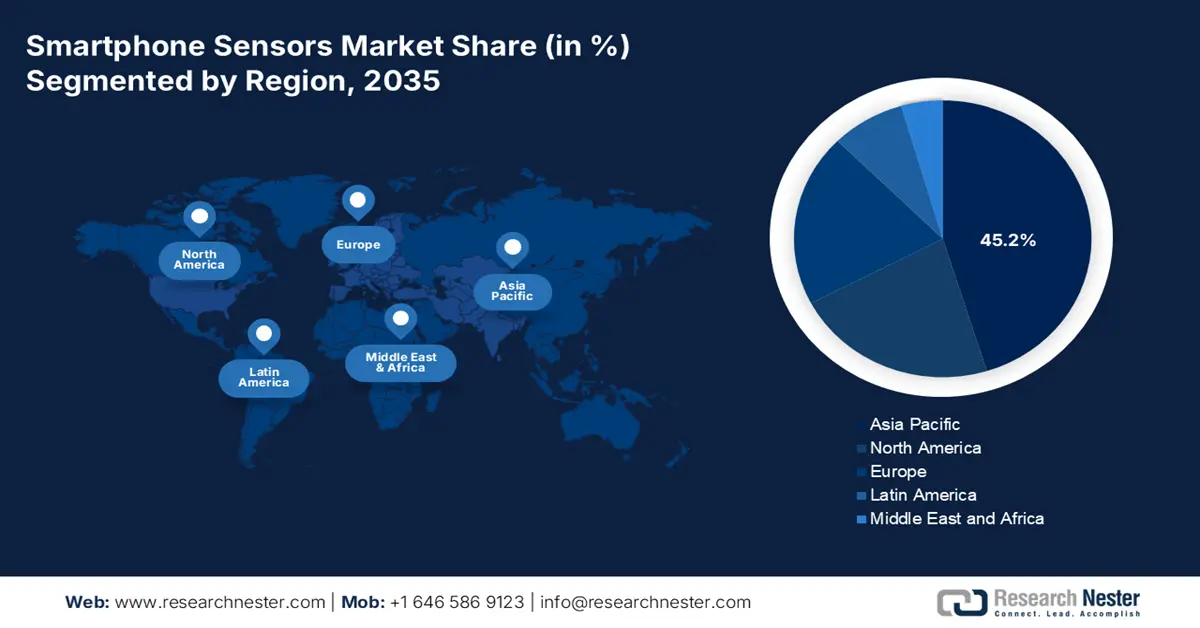

- By 2035, Asia Pacific in the smartphone sensors market is anticipated to secure a 45.2% share, bolstered by vast manufacturing competencies, strong governmental backing, and intensifying domestic consumption across emerging smartphone segments owing to these combined growth levers.

- Over 2026–2035, Europe is expected to exhibit the fastest growth in the smartphone sensors landscape, supported by rising adoption of mid-to-premium devices and stringent regulatory frameworks shaping advanced on-device security features impelled by increasing emphasis on data protection.

Segment Insights:

- By 2035, the non-contact sensors segment is projected to hold a 92.5% share in the smartphone sensors market , reinforced by the increasing dependence on remote and proximity data acquisition that underlies modern smartphone interaction enhanced by evolving AR and gesture-based functionalities.

- During 2026–2035, the wired interface sub-segment is set to command the second-largest share, supported by its critical role in securing high-speed and reliable sensor connectivity essential for sensitive and real-time applications uplifted by expanding mobile adoption across major economies.

Key Growth Trends:

- Expansion in 5G and 6G networks

- Integration of machine learning (ML) and on-device AI

Major Challenges:

- An increase in regulatory scrutiny

- Integration and software obstacles

Key Players: Sony Group Corporation (Japan),Samsung Electronics (South Korea),STMicroelectronics (Switzerland),Broadcom Inc. (U.S.),Qorvo, Inc. (U.S.),Texas Instruments (U.S.),TDK Corporation (Japan),AMS-OSRAM AG (Austria),Bosch Sensortec GmbH (Germany),Analog Devices, Inc. (U.S.),Murata Manufacturing Co., Ltd. (Japan),Qualcomm Technologies, Inc. (U.S.),GoerTek Inc. (China),AAC Technologies Holdings Inc. (China),Sunny Optical Technology (Group) Company Limited (China),OmniVision Technologies, Inc. (U.S.),Alps Alpine Co., Ltd. (Japan),Knowles Electronics, LLC (U.S.),Infineon Technologies AG (Germany),NXP Semiconductors N.V. (Netherlands)

Global Smartphone Sensors Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 114.5 billion

- 2026 Market Size: USD 132.7 billion

- Projected Market Size: USD 432 billion by 2035

- Growth Forecasts: 15.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (45.2% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Japan, South Korea, Germany

- Emerging Countries: India, Vietnam, Indonesia, Brazil, Mexico

Last updated on : 20 November, 2025

Smartphone Sensors Market - Growth Drivers and Challenges

Growth Drivers

- Expansion in 5G and 6G networks: The aspect of low-latency and high-speed connectivity has unlocked data-based applications that depend on real-time sensor input. This comprises cloud gaming, which demands ultra-responsive motion sensors, along with real-time collaborative AR, which relies on the fusion of position, motion, and camera data. According to an article published by the ORF Organization in May 2025, the real-world 5G has impacted the majority of sectors, with its international economic valuation projected to reach USD 13.2 trillion by the end of 2035, thus leading to 22.3 million employment opportunities. Besides, in China, the optical communication equipment is expected to gain a 60% share in the global market, while a 25% share in the case of the router and switch sector, which is positively impacting the smartphone sensors market.

- Integration of machine learning (ML) and on-device AI: The proliferation of standard AI-based processors in the smartphone sensors market has created a direct and huge demand for high-quality sensor data. AI-specific models for features such as scene optimization in voice assistant wake-word detection, predictive user behavior modeling, and photography all demand a reliable and constant stream of data from different sensors. As per an article published by NLM in February 2023, consumers utilize smartphones for 36% during the daytime. Besides, through deep learning, the state-of-the-art accuracy for smartphones is increased from 78.2% to 80.0%. Therefore, this digitalized phenotyping is suitable for leveraging different sensors that are embedded in smartphones to understand the presence of psychological behavior and the state of consumers.

- Increased customer demand for enhanced security: Smartphones are emerging as central to digitalized identity and finance, thus the demand for strong and hardware-based security is becoming paramount. This has readily driven the adoption of innovative biometric sensors, which include ultrasonic fingerprint scanners, as well as sophisticated 3D facial recognition systems. As stated in the August 2024 Invest India Government article, the average monthly data consumption in India has reached 20.2 GB in March 2024, which has been up from only 0.2 GB, thereby reflecting a yearly 54.0% growth rate. Therefore, telecom organizations have readily invested in strong security solutions to provide protection for user-based data and maintain trust, which is highly bolstering the smartphone sensors market globally.

Challenges

- An increase in regulatory scrutiny: Modernized smartphones are considered dense collections of personal and sensitive data, the majority of which is achieved by their sensors. This has made them a prime target for cyberattacks, and any kind of vulnerability in a sensor’s data pathway or firmware can result in critical breaches. Simultaneously, governments in different nations are adopting stringent data privacy regulations, which further impose strict requirements regarding the sensor data collection, processing, and storage. Besides, compliance with these evolving and diversified legal frameworks significantly adds complexity and expense to sensor integration and development, thus potentially slowing down the overall roll-out of data-based and latest features in the smartphone sensors market.

- Integration and software obstacles: The aspect of hardware in the smartphone sensors market is one of the parts of the overall equation. The complete potential of innovative sensors is only recognized through sophisticated software algorithms for data interpretation, calibration, and sensor fusion. Besides, developing this software is highly complicated and demands an in-depth partnership among software platform providers, smartphone OEMs, and manufacturers. Meanwhile, delays, poor optimization, and incompatibilities in software development can prevent a high-performance sensor from providing its intended user experience, rendering the hardware's benefit controversial and resulting in performance inconsistencies across various devices.

Smartphone Sensors Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

15.9% |

|

Base Year Market Size (2025) |

USD 114.5 billion |

|

Forecast Year Market Size (2035) |

USD 432 billion |

|

Regional Scope |

|

Smartphone Sensors Market Segmentation:

Operation Segment Analysis

By the end of 2035, the non-contact sensors segment, within the operation category, is anticipated to hold the largest share of 92.5% in the smartphone sensors market. The segment’s upliftment is extremely attributed to underscoring the fundamental nature of modernized smartphone interaction, which is significantly based on remote and proximity data gathering in comparison to the physical touch. In addition, the segment’s dominance is propelled by functionalities that tend to define an overall smartphone. Besides, image sensors for photography, proximity sensors for screen management during calls, positioning sensors for navigation, and ambient light sensors for display brightness adjustment all operate without the need for direct physical contact. Moreover, the growth of innovative features, such as augmented reality and gesture control, depends on motion data and camera, further cementing the centrality of the segment.

Connectivity Technology Segment Analysis

The wired interface sub-segment, which is part of the connectivity technology aspect, is expected to cater to the second-largest share in the smartphone sensors market during the projected timeline. The segment’s growth is highly driven by its importance in providing security, reliability, and high speed for both external and internal sensor connectivity, which are essential for sensitive and real-time applications. According to an article published by the World Economic Forum in August 2023, when it comes to mobile internet accessibility, within just ₹12 or ₹299, the newest mobile phone is set to bridge the digitalized division between the urban and rural population, especially in India. Besides, China is the world’s largest mobile phone market with 954 million users, followed by 493 million in India, 274 million in the U.S., and 83 million in Japan. Therefore, a wired connection is highly important to be developed across these countries, which is positively uplifting the segment’s growth internationally.

Integration Segment Analysis

The integrated sensor hubs sub-segment, as part of the integration segment, is projected to constitute the third-largest share by the end of the forecast duration in the smartphone sensors market. The segment’s development is highly propelled by a tactical shift from discrete components to system-based solutions. An integrated center significantly combines different sensors, including a barometer, magnetometer, gyroscope, and an accelerometer, within a single module with a dedicated low-power processor. Therefore, this integration is highly fueled by three notable factors, such as space savings, power efficiency, and performance. Meanwhile, by fusing data on a single chip, the center offers more reliable and accurate motion tracking for applications, such as gaming and navigation, while offloading processing from the main application processor, thereby making it suitable for the segment’s upliftment.

Our in-depth analysis of the smartphone sensors market includes the following segments:

|

Segment |

Subsegments |

|

Operation |

|

|

Connectivity Technology |

|

|

Integration |

|

|

Application |

|

|

Type |

|

|

End user Demographics |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Smartphone Sensors Market - Regional Analysis

APAC Market Insights

Asia Pacific in the smartphone sensors market is anticipated to garner the highest share of 45.2% by the end of 2035. The market’s upliftment in the region is highly attributed to a combination of huge manufacturing capacity, robust government funding, and voracious domestic consumption. The region is also considered the world’s largest production center, which is led by Vietnam and China, along with being the largest consumer market, with nations such as Indonesia and India witnessing increasing growth in mid-range smartphone integration. According to an article published by the ORF Organization in December 2024, the online gaming sector in India has been growing by 28%, and is further projected to amount to 33,243 crore by the end of 2028. This has significantly supported the country’s ambition for a USD 1.0 trillion digital economy, which has boosted the market’s exposure.

The smartphone sensors market in China is growing significantly, owing to its emergence as both the world’s largest consumer market and manufacturing base, along with an increase in governmental expenditure on the sensor and semiconductor ecosystem. Besides, the Ministry of Industry and Information Technology (MIIT) proactively promotes the core electronic component development, which includes high-end CMOS image sensors, to diminish import dependency and achieve increased valuation in the international smartphone supply chain. As stated in the August 2024 ITIF Organization article, 55% of international semiconductor patent applications are based in the country since 2022, which has surpassed Japan and the U.S. Additionally, the country’s R&D rate of 7.6% in such applications caters to only 40% of America, which denotes a huge growth opportunity for the smartphone sensors market.

The smartphone sensors market in India is also growing due to the government’s Digital India strategy, along with the Production Linked Incentive (PLI) scheme, suitable to ensure smartphone manufacturing. The PLI scheme is usually available on the Ministry of Electronics and IT (MeitY) website and is instrumental in propelling localized production processes, with an increase in smartphone export growth. As per the August 2024 IBEF Organization article, the smartphone market in the country has shipped 69 million units in the first quarter of 2024, which reflected a 7.2% year-over-year (YoY) growth. In addition, in the second quarter, there have been 35 million shipments, denoting a 3.2% growth. Besides, the entry-premium segment witnessed the maximum growth, with a valuation ranging between USD 200 to USD 400, thus uplifting the market in the overall country.

Europe Market Insights

Europe in the smartphone sensors market is expected to emerge as the fastest-growing region during the projected period. The segment’s development is highly propelled by an increase in the consumer base for middle-to-higher tier devices, along with strict regulations for shaping product features. Besides, the region is focused on data security and privacy, which is readily enforced by regulations, such as the General Data Protection Regulation (GDPR), thus increasing the need for sophisticated on-device security sensors, including innovative facial recognition and fingerprint systems. As per a data report published by Europe Commission in June 2025, EUR 208.1 billion of the regional budget has been dedicated to ensuring a digitalized transition. This represents nearly 15.1% of the total regional budget, thereby making it suitable for the market’s development in the overall region.

The smartphone sensors market in Germany is gaining increased traction, owing to its strong technological and industrial base, especially in the Industry 4.0 and automotive fields. The country’s tactical focus on implementing mobile devices into logistics and smart factories demands smartphones with secure, precise, and highly durable sensors. As per an article published by the Clean Energy Wire Organization in June 2024, information and communication technologies are responsible for almost 8% of the country’s carbon dioxide emissions, adding nearly 20 million smartphone sales annually. Moreover, price-sensitive users, sustainability enthusiasts, pragmatists, and long-term users, making up to a 60% share, are effectively open to utilizing smartphones for long and purchasing refurbished devices, thus creating an optimistic outlook for the market.

The smartphone sensors market in the UK is also developing due to its dominating fintech industry and increased consumer adoption of flagship devices. The market’s growth in the country is also driven by the need for strong security and authentication sensors, including 3D facial scanning and ultrasonic fingerprint, which are crucial for digitally identified and mobile banking applications. As stated in the 2025 UKRI Organization, an initial industrial strategy challenge fund investment of £70 million has been provided by the Digital Security by Design (DSbD), along with an additional £13.5 million in grants. In addition, recognized industry co-investment amounts to £270 million, which is also suitable for ensuring digitalized security, with the inclusion of partners, such as Engineering and Physical Sciences Research Council (EPSRC), Innovate UK, and Economic Social Research Council (ESRC).

North America Market Insights

North America in the smartphone sensors market is predicted to grow steadily by the end of 2035. The market’s growth in the region is highly driven by advancements in 5G and 6G connections, the presence of flagship models through organizational contributions, investments in edge computing and AI, and increased focus on data security and privacy. As stated in an article published by 5G Americas Organization in July 2024, the region’s 5G adoption accounts for 32% of overall wireless cellular connections. This has readily doubled the international average, resulting in an 11% growth rate, along with 22 million new connections. Besides, as per the September 2024 5G Americas Organization article, the U.S. National Spectrum Strategy has identified severe frequency bands, including 7.1 GHz to 8.4 GHz and 3.1 GHz to 3.4 GHz, which are poised to play a pivotal role in shaping the 6G landscape in the region.

The smartphone sensors market in the U.S. is gaining increased exposure, owing to a surge in the consumer adoption of premium devices, along with significant R&D investment. In addition, the sensors integration for innovative ICT applications, such as context-aware computing and augmented reality (AR), federally funded provision, and increased governmental spending are also fueling the smartphone sensors market in the country. According to the August 2025 FCC Government report, the US National Science Foundation (NSF) has successfully seeded a standard flagship program, RINGS, which is a USD 40 million grant funding with 11 industrial partners to escalate long-lasting pre-competitive research projects. These partners tend to stimulate the use-based vertical and research vectors adoption to ensure 6G connections, which is catering to the market’s growth in the overall country.

The smartphone sensors market in Canada is also propelling due to its robust research institutions and tactical focus on supply chain and digitalized infrastructure resilience. The sensor technologies development for critical environments and customized industrial applications, which has significantly influenced customer device requirements, is also bolstering the market in the country. According to an article published by the Government of Canada in February 2025, an estimated 99% of the population in the country has access to mobile coverage in 2022. Besides, expansion in supplement mobile network coverage is suitable for optimizing the country’s telecom networks. Meanwhile, as per the March 2025 CRTC data report, there has been an increase in mobile phone subscribers, accounting for 37.7 million, which denotes a 1.0% quarterly change, along with a 2.9% 12-month change, thus bolstering the smartphone sensors market.

Quarterly Continuous Growth in Canada’s Mobile Phone Revenue

|

Years and Quarters |

Quarter 1 |

Quarter 2 |

Quarter 3 |

Quarter 4 |

|

2022 |

33.4 million |

33.9 million |

34.6 million |

35.0 million |

|

2023 |

35.1 million |

35.5 million |

36.2 million |

36.5 million |

|

2024 |

36.1 million |

36.6 million |

37.1 million |

37.2 million |

|

2025 |

37.3 million |

37.7 million |

- |

- |

Source: CRTC

Key Smartphone Sensors Market Players:

- Sony Group Corporation (Japan)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Samsung Electronics (South Korea)

- STMicroelectronics (Switzerland)

- Broadcom Inc. (U.S.)

- Qorvo, Inc. (U.S.)

- Texas Instruments (U.S.)

- TDK Corporation (Japan)

- AMS-OSRAM AG (Austria)

- Bosch Sensortec GmbH (Germany)

- Analog Devices, Inc. (U.S.)

- Murata Manufacturing Co., Ltd. (Japan)

- Qualcomm Technologies, Inc. (U.S.)

- GoerTek Inc. (China)

- AAC Technologies Holdings Inc. (China)

- Sunny Optical Technology (Group) Company Limited (China)

- OmniVision Technologies, Inc. (U.S.)

- Alps Alpine Co., Ltd. (Japan)

- Knowles Electronics, LLC (U.S.)

- Infineon Technologies AG (Germany)

- NXP Semiconductors N.V. (Netherlands)

- Sony Group Solutions is considered the international market leader in smartphone image sensors, well-known for its increased performance CMOS sensors that readily dominate flagship and mid-range devices. Its ongoing development in technologies, such as large-scale and CMOS sensors, has set the industrial standard for videography and mobile photography. Besides, as stated in its 2024 annual report, the consolidated operating income amounted to 1,035.3 billion yen as of 2023, along with 4.3 trillion yen as adjusted EBITDA.

- Samsung Electronics is a primary player that supplies innovative ISOCELL image sensors that are crucial components in its very own Galaxy smartphones and those of other major OEMs. The organization has strongly made advancements in high-resolution sensors and pixel isolation technology to gain a generous market share.

- STMicroelectronics is one of the dominating forces in environmental and motion sensors, providing a massive portfolio of low-power and high-performance MEMS magnetometers, gyroscopes, and accelerometers. Its sensors comprise standard features, such as context-awareness, navigation, and screen rotation for computing in several smartphones. Meanwhile, according to its 2024 annual report, the company generated USD 13.2 billion in net revenues, denoting a 23.2% decrease from the previous year.

- Broadcom Inc. is the most notable radio frequency filters and front-end modules supplier, which are necessary sensor-adjacent components that tend to ensure suitable signal reception for connectivity features, such as cellular, Wi-Fi, and GPS. Its significantly integrated solutions enable dependable position and communication performance in smartphone sensors.

- Qorvo, Inc. readily specializes in offering RF connectivity and solutions that are critical for ensuring smartphone position sensors functionality, especially for emerging cellular standards and GPS. Its components ensure accurate and efficient location tracking and wireless data transmission for comprehensive sensor applications.

Here is a list of key players operating in the global smartphone sensors market:

The international smartphone sensors market is effectively fragmented and competitive, and readily dominated by established organizations from South Korea, Japan, Europe, and the U.S. The market’s landscape is significantly defined by the need for advancement in performance, power efficiency, and miniaturization. Notable strategies, such as generous investment provision in R&D to pioneer cutting-edge technologies, such as innovative CMOS image sensors, along with sensor fusion algorithms, are readily fueling the market’s demand across different countries. Besides, in October 2024, Sony Semiconductor Solutions Corporation declared the upcoming introduction of the ISX038 CMOS image sensor, which is suitable for automotive cameras. This is considered the industry’s first-ever product that tends to simultaneously processes and ensures YUV and RAW images, thereby making it suitable for the smartphone sensors market globally.

Corporate Landscape of the Smartphone Sensors Market:

Recent Developments

- In September 2024, Elliptic Labs presently deployed more than 500 million devices, and readily shipped its AI Virtual Proximity Sensor INNER BEAUTY on Transsion’s Tecno Phantom V Series smartphones.

- In June 2024, Samsung Electronics notified three latest mobile image sensors, which are designed for both sub and main cameras in smartphones, namely the ISOCELL JN5, the ISOCELL GNJ, and the ISOCELL HP9.

- In December 2023, electronRx announced its plan to unveil foneDx, which is a democratized and scalable technology, significantly installed in modernized smartphones, and the sensor technology utilization can harness digital monitoring to evaluate consumers’ lung and heart health.

- Report ID: 8253

- Published Date: Nov 20, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Smartphone Sensors Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.