Air Pollution Sensors Market Outlook:

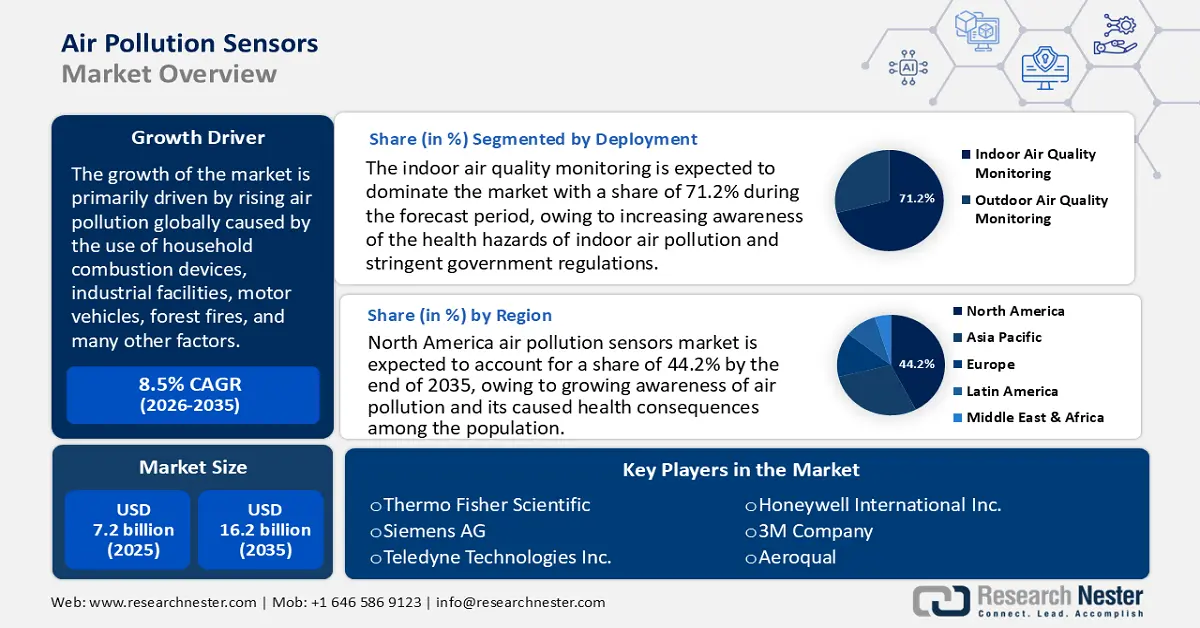

Air Pollution Sensors Market size is valued at USD 7.2 billion in 2025 and is anticipated to surpass USD 16.2 billion by 2035, expanding at a CAGR of 8.5% during the forecast period, i.e., 2026 to 2035. In 2026, the industry size of air pollution sensors is assessed at USD 7.8 billion.

The growth of the air pollution sensors market is primarily driven by rising air pollution globally caused by the use of household combustion devices, industrial facilities, motor vehicles, forest fires, and many other factors. The demand for air pollution sensors increases as air pollution levels rise, driving the need for environmental monitoring, tracking air pollution levels, and detecting trends related to it. Households are highly responsible for the rising air pollution. As revealed by the World Health Organization, 2.1 billion households relied on polluting fuels and technologies for cooking, and 99% of the global population lived in air pollution-prone places exceeding the WHO limits in 2023.

The air pollution sensors market is transitioning from specialized research instruments to mainstream elements of contemporary air-quality management. This is driven by increased policy pressure to achieve tighter air-quality goals, increased public and agency investment in distributed monitoring, and accelerating advances in low-cost sensor technologies and QA procedures as public health recommendations have become more stringent. For instance, the World Health Organization's Air Quality Guidelines of 2021 reduced recommended exposure levels for PM2.5, NO₂, and other pollutants and refocused world attention on air pollution's health cost; government authorities are responding with new standards and tighter monitoring requirements. These policy changes drive the need for more dense monitoring networks to detect hotspots, assess interventions, and show compliance.

Key Air Pollution Sensors Market Insights Summary:

Regional Highlights:

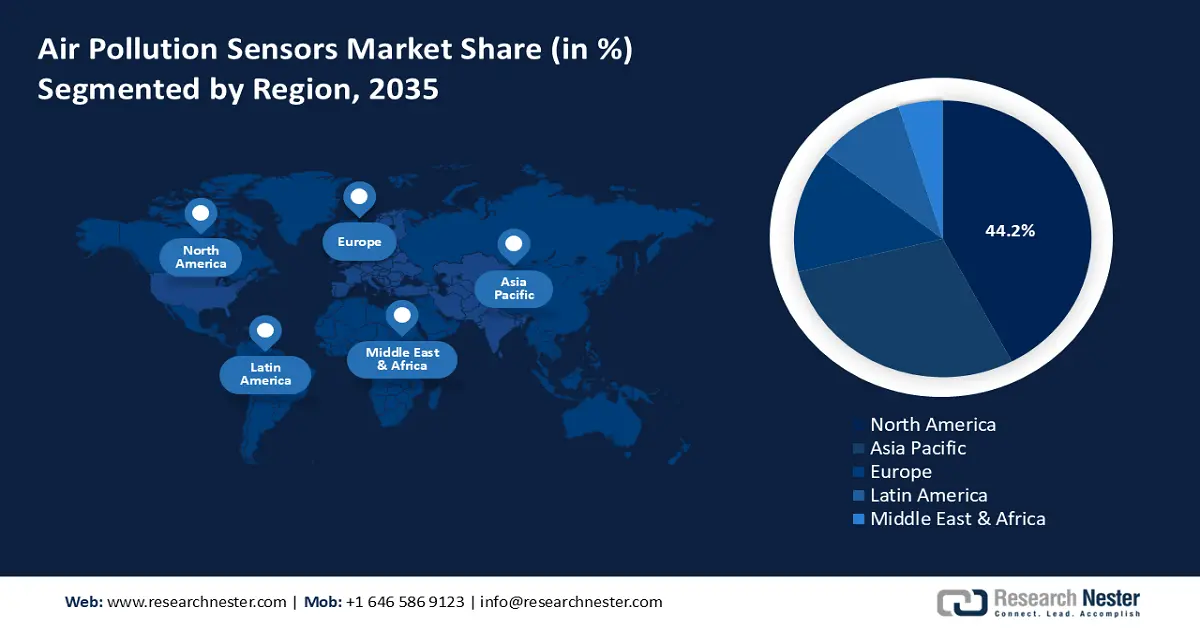

- By 2035, the North America region is projected to secure a 44.2% share in the air pollution sensors market, upheld by rising public awareness of pollution-linked health risks.

- The Asia Pacific region is anticipated to command a substantial share by 2035, supported by extremely high pollution levels across densely populated areas.

Segment Insights:

- The indoor air quality monitoring segment is expected to represent a 71.2% share by 2035 in the air pollution sensors market, propelled by increasing recognition of indoor pollution hazards and stricter regulatory frameworks.

- The electrochemical sensors segment is projected to attain a 42.1% share by 2035, supported by advancements in sensing technologies.

Key Growth Trends:

- Growing health awareness

- Stringent environmental regulations and guidelines

Major Challenges:

- High cost and maintenance

- Poor public awareness and lack of standardization

Key Players: Thermo Fisher Scientific (U.S.), Honeywell International Inc. (Germany), Siemens AG (Germany), 3M Company (U.S.), Teledyne Technologies Inc. (U.S.), Aeroqual (New Zealand), Bosch Sensortec GmbH (Germany), Agilent Technologies (U.S.), Emerson Electric Co. (U.S.), TSI Inc. (U.S.), Horiba, Ltd. (Japan), Omron Corporation (Japan), Figaro Engineering Inc. (Japan), Kanomax Japan Inc. (Japan), Murata Manufacturing Co., Ltd. (Japan).

Global Air Pollution Sensors Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.2 billion

- 2026 Market Size: USD 7.8 billion

- Projected Market Size: USD 16.2 billion by 2035

- Growth Forecasts: 8.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (44.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Indonesia, Mexico

Last updated on : 21 November, 2025

Air Pollution Sensors Market - Growth Drivers and Challenges

Growth Drivers

- Growing health awareness: People globally are increasingly aware of different health consequences of exposure to polluted air, including cardiovascular diseases, respiratory diseases, cancer, obesity, diabetes mellitus, allergies, and others. As a result, the demand for indoor air quality monitoring is increasing, likely to lead to a surge in the use of air pollution sensors. Key players in the market are also active in the development of indoor air pollution sensors. For instance, IKEA unveiled a new VINDSTYRKA air quality sensor in February 2023. The technology features a display to show PM2.5 levels, temperature, humidity, and TVOC.

- Stringent environmental regulations and guidelines: Stringent environmental regulations are obligating the measurement and monitoring of air pollution levels for the protection of public health and the environment. This is significantly fuelling the demand for air pollution sensors. In December 2024, the European Commission disclosed that a revised Ambient Air Quality Directive was enacted, which is obligating to lower the levels of 12 air pollutions, including nitrogen dioxide (NO2), particulate matter (PM2.5 and PM10), sulphur dioxide (SO2), nitrogen oxides (NOx), ozone (O3), benzene, carbon monoxide, arsenic, nickel, cadmium, and others. This is likely to lead to a growing adoption of air pollution sensors by environmental agencies to contribute to reducing air pollution by 2030. In addition, the U.S. Environmental Protection Agency issued guidance in January 2025 to make air pollution sensors accessible, perform period checks, use multiple sources to power the sensors, integrate cloud interfaces with sensors, place sensors away from pollutant sources, and many more.

- The initiation of the smart cities: The demand and adoption of the air pollution sensors are anticipated to surge with rapid smart city initiatives and infrastructural development. As revealed by the International Telecommunication Union in September 2024, virtual sensors have become important in monitoring air pollutants in the execution of smart city initiatives. Similarly, according to the disclosure by the Institute of Electrical and Electronics Engineers in July 2025, the IoT-based MQ135 sensors are delivering 95% accuracy in sensing air pollutants, including CO₂, ammonia, and VOCs, allowing for high-resolution mapping in smart cities.

Challenges

- High cost and maintenance: One of the key challenges of the market is low deployment of air pollution sensors owing to their high price, especially high-accuracy research-level sensors. The total expenses include initial purchases and costs for maintenance and calibration, which are critical to provide accurate and reliable data. This is likely to limit the adoption of advanced air pollution sensors in small and medium enterprises. In addition, the sophistication of the systems requires trained technicians, which can further add to the overall expenses.

- Poor public awareness and lack of standardization: Even though air pollution is a widely documented global phenomenon, several rural and developing areas lack knowledge of its adverse health effects and the tangible benefits of air quality information in real time. Moreover, data gathered by current sensors is not necessarily available or comprehensible to the general public. Along with this, inconsistent test standards, quality assurance practices, and data formats can limit the buyers and agencies from comparing the devices and accepting sensor network data.

Air Pollution Sensors Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

8.5% |

|

Base Year Market Size (2025) |

USD 7.2 billion |

|

Forecast Year Market Size (2035) |

USD 16.2 billion |

|

Regional Scope |

|

Air Pollution Sensors Market Segmentation:

Deployment Segment Analysis

The indoor air quality monitoring is expected to dominate the market with a share of 71.2% during the forecast period, owing to increasing awareness of the health hazards of indoor air pollution and stringent government regulations. Indoor Air Quality (IAQ) equipment for schools, workplaces, and hospitals is rapidly growing in the private sector and public-health vertical. For instance, the U.S. Environmental Protection Agency (U.S EPA) has launched the IAQ Tools for Schools Action Kit that guides how to carry out a practical plan to address indoor air problems. Several companies are also launching novel and advanced indoor air quality monitoring systems to cater to the rising need for monitoring the air quality in residential and public sectors. In February 2022, Honeywell announced the launch of a compact, touchscreen-enabled Indoor Air Quality (IAQ) monitor that alerts building owners and operators of potential measures to improve air quality. It monitors key IAQ parameters, including temperature, indoor air pollutants, and relative humidity, and provides an accurate IAQ index based on the readings.

Technology Segment Analysis

The electrochemical sensors segment is expected to dominate the worldwide air pollution sensors market with a share of 42.1% during the forecast period. These sensors are a cornerstone in monitoring air quality due to their self-evident advantages. In October 2024, Sensirion, a global leader in environmental sensing solutions, announced the launch of next next-generation formaldehyde sensor SFA40, representing a breakthrough in electrochemical sensing technology. These sensors can be used in indoor air quality monitoring devices, air purifiers, and air conditioners.

Type Segment Analysis

The stationary segment is expected to register rapid growth between 2026 and 2035, owing to the constant requirement for city-scale and regulatory monitoring and rising air pollution worldwide. Stationary air pollution sensors provide continuous, accurate, and reliable air quality data, essential for meeting government regulations, protecting public health, and supporting smart city development. Several governments are investing in these air pollution sensors to enhance the air quality. For instance, in 2024, the government of India announced its plan to add 1000 more air monitoring stations under the revised National Ambient Air Quality Standards (NAAQS) to target cities with over 100,000 population.

Our in-depth analysis of the air pollution sensors market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Deployment |

|

|

Technology |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Air Pollution Sensors Market - Regional Analysis

North America Market Insights

North America air pollution sensors market is expected to account for a revenue share of 44.2% by the end of 2035, owing to growing awareness of air pollution and its caused health consequences among the population. The residence of a vast amount of population in the polluted geographical areas is also likely to fuel the demand for indoor air pollution sensors. As reported by the American Lung Association, around 46% of the population (156.1 million people) reside in unhealthy places that are prone to ozone and particle pollution. The adoption of air pollution sensors is also likely to be driven significantly due to the stringent regulations across various countries focused on the reduction of air pollution.

The air pollution sensors market in the U.S. is anticipated to expand at a rapid CAGR throughout the forecast period, owing to continuous smart city initiatives. For example, in October 2023, the New York City Office of Technology and Innovation (OTI) launched the NYC Smart City Testbed Program, allowing private corporations, city agencies, and academic institutions to pilot emerging technologies in the mitigation of the challenges they and the population are experiencing. This is estimated to lead to the integration of air pollution sensors across public spaces so that air pollution levels can be measured and analyzed constantly. The development of IoT-based technologies is influencing the further advancement of air pollution sensors. For instance, in March 2022, Smart Sensor Devices launched HibouAir CO2 Sensor Air Quality Monitor – Indoor (BLE). The IoT-based sensor can be used to track the levels of CO2, volatile organic compounds, humidity, atmospheric pressure, temperature, and others.

Canada is projected to emerge as a rapidly expanding air pollution sensors market during the forecast timeline, as a consequence of the growing demand for indoor devices, driven by rising health concerns about air pollution. An increase in air pollution is also likely to foster the adoption of air pollution sensors. As reported by the government of Canada in March 2025, 9 out of 17 pollutants increased in Canada from 2022 to 2023. The population of the country is also becoming conscious about air pollution-borne diseases, indicating the probability of a rising use of air pollution sensors in indoor environments. Rapid industrialization and urbanization across Canada are also anticipated to fuel the demand for air pollution sensors.

Significant pollutant increases in Canada between 2022 and 2023

|

Pollutants |

Increase by percentage |

|

HCB |

15 % |

|

TPM |

5.8% |

|

Cd |

4.8 % |

|

PM10 |

4.5% |

|

Hg |

4.2% |

Source: canada.ca

Asia Pacific Market Insights

The Asia Pacific air pollution sensors market can acquire a significant revenue share by the end of 2035, attributed to drastically high air pollution levels. People are even dying due to air pollution in the region, indicating a growing demand for the sensors among the health-conscious living population. As updated by the United Nations in November 2024, the Asia Pacific is the region with 70% of global deaths caused by air pollution. Similarly, as per the disclosure by the Climate & Clean Air Coalition, 92% of the population in the Asia Pacific, or around 4 billion people, are exposed to poor quality air that poses a significant health risk. Governments of different countries within the region are also keen to take advanced measures to keep air pollution under control, expected to result in growing adoption of air pollution solutions by government agencies.

India air pollution sensors market is poised to experience a rapid CAGR throughout the stipulated timeframe, due to the continuous development of the low-cost and IoT-enabled sensors. For instance, in November 2024, Oziom launched its latest innovation, Pollusense. It is an IoT-enabled portable air pollution sensor effective for use in construction sites to obtain appropriate and real-time data about pollutants. The government is also initiating multiple programs to monitor and control the levels of air pollution within the country. As revealed by the Press Information Bureau in July 2024, the National Clean Air Program initiated by the Ministry of Environment, Forest, and Climate Change is focused on enhancing air quality across 130 cities, influencing a boost in the use of air pollution sensors.

The air pollution sensors market in China is set to expand exponentially between 2026 and 2035, owing to the consistent smart city initiatives. As updated by the China Daily in September 2024, the occurrence of the Smart China Expo 2023 highlighted the significance of the connected NEV, new-generation IT, intelligent manufacturing and equipment, and smart transportation. This type of initiative is projected to accelerate the adoption of air pollution sensors and the integration of the same in different public places across smart cities. Relevant technological advancements are also expected to cause innovation in the production of air pollution sensors. The government's push for organizations and households to contribute to reducing air pollution is also estimated to boost the adoption of the sensors.

Europe Market Insights

Europe air pollution sensors market is about to hold a remarkable revenue share during the forecast period, with the rapid implementation of stringent regulations focusing on control over air pollution across the region. As per the report by the European Environmental Bureau, published in October 2024, the revision of the Ambient Air Quality Directive was voted on by the EU Council. The revision imposed stricter limitations on certain air pollutants, aligning the directive with the WHO guidelines. These limitations are poised to accelerate the need for tracking through the use of air pollution sensors. Public concerns about indoor air quality have drastically increased since the outbreak of the COVID-19 pandemic, which is expected to fuel the adoption of advanced air pollution sensors in the coming years.

Germany is projected to retain its dominance as a growing air pollution sensors market during the forecast period, on account of the growing focus of regulators on environmental monitoring. For instance, according to the release by Client Earth in July 2024, a court in Berlin challenged the air pollution policy of the federal government by stating that it was insufficient in achieving the national targets and protecting people. Stricter air pollution policies impose the need for households, environmental agencies, and private organizations to monitor air pollution levels more actively, expected to lead to an increasing use of air pollution sensors. Companies are also investing in research and development to leverage AI in air pollution sensors. One such example is the collaboration of BERNARD Gruppe with the University of São Paulo and MeteoIA, and the Max Planck Institute for Meteorology for the generation of the AI-based high-resolution predictions about air pollution in urban areas.

The UK is set to be proven as a growing air pollution sensors market from 2026 to 2035, owing to growing air pollution, leading the governments to implement stricter regulations. As reported by the Department for Environment, Food & Rural Affairs in September 2025, the Average Exposure Indicator (AEI) regarding air pollution in 2024 was 7 µg m-3. In addition, as per the Department of Agriculture, Environment and Rural Affairs in March 2023, through the implementation of the Climate Change Act 2022, the government intends to reduce greenhouse gas emissions by at least 100% by 2050. This is accelerating the need for air pollution monitoring, which is expected to fuel the demand for air pollution sensors. Smart city initiatives are also anticipated to result in the installation of air pollution sensors in different public places across the country.

Key Air Pollution Sensors Market Players:

- Thermo Fisher Scientific (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Honeywell International Inc. (Germany)

- Siemens AG (Germany)

- 3M Company (U.S.)

- Teledyne Technologies Inc. (U.S.)

- Aeroqual (New Zealand)

- Bosch Sensortec GmbH (Germany)

- Agilent Technologies (U.S.)

- Emerson Electric Co. (U.S.)

- TSI Inc. (U.S.)

- Horiba, Ltd. (Japan)

- Omron Corporation (Japan)

- Figaro Engineering Inc. (Japan)

- Kanomax Japan Inc. (Japan)

- Murata Manufacturing Co., Ltd. (Japan)

- Thermo Fisher Scientific is a global leader in analytical instruments, laboratory equipment, and environmental monitoring solutions. In the air pollution monitoring segment, the company provides advanced analyzers and sensors for detecting particulate matter, gases, and other pollutants. Its technologies support regulatory compliance and industrial emissions monitoring. Thermo Fisher’s systems are widely used by environmental agencies and research institutions. The firm’s focus on innovation and precision enhances its standing in the global air quality monitoring market.

- Honeywell International is a diversified technology company offering advanced sensing and control systems for industrial and environmental applications. In the air pollution monitoring sector, Honeywell provides portable and fixed air quality sensors, gas detectors, and connected environmental monitoring systems. The company emphasizes IoT-enabled and data-driven solutions that improve pollution tracking and safety. Its products are extensively used across manufacturing, transportation, and smart city projects. Honeywell’s technological integration and reliability make it a key player in sustainable environmental management.

- Siemens AG is a multinational technology corporation offering automation, digitalization, and environmental management solutions. Within the air pollution domain, Siemens provides monitoring systems, data analytics platforms, and emission control technologies for industrial and municipal use. The company integrates air quality monitoring with smart infrastructure and IoT networks for real-time data collection. Siemens’ sustainability-driven approach aligns with global efforts to reduce environmental impact. Its comprehensive digital and engineering capabilities strengthen its position in the air quality market.

- 3M Company is a science-driven enterprise known for its innovative materials and environmental safety solutions. In the air pollution market, 3M develops air filtration products, respirators, and monitoring devices that enhance air quality and worker safety. Its products cater to both industrial and consumer needs, focusing on efficiency and health protection. The company’s extensive R&D efforts support the development of high-performance materials for pollution control. 3M’s strong global presence and brand reliability contribute significantly to its role in the air quality segment.

- Teledyne Technologies specializes in instrumentation, digital imaging, and aerospace and defense electronics. In the air pollution monitoring field, the company offers precision analyzers and sensors for measuring gas concentrations, particulate matter, and greenhouse emissions. Its subsidiaries, such as Teledyne API, deliver advanced solutions for continuous emissions monitoring and ambient air analysis. Teledyne emphasizes high-accuracy instruments used in regulatory and research applications. Its focus on precision engineering and environmental innovation positions it as a trusted leader in the air quality monitoring industry.

Here are some leading companies in the air pollution sensor market:

The global air pollution sensor market is highly competitive, characterized by the presence of global technology leaders and specialized sensor manufacturers. Leading companies are increasingly investing in R&D activities to develop advanced sensors capable of detecting a wide range of pollutants such as PM2.5, CO2, and VOCs, while ensuring real-time monitoring and data connectivity. The market is also witnessing the emergence of startups and niche companies that are disrupting the area with low-cost, IoT-sensing-enabled devices and new data analysis platforms. These key players are focused on adopting several strategies, such as mergers and acquisitions, partnerships, joint ventures, and product launches, to expand their product bases and strengthen their market position.

Corporate Landscape of the Air Pollution Sensors Market:

Recent Developments

- In February 2022, Honeywell introduced its Indoor Air Quality (IAQ) Monitor, designed to help building owners and operators proactively identify and address air quality issues, thereby reducing the potential risk of airborne contaminant transmission. Developed as part of the company’s Make in India initiative, the compact, touchscreen-enabled device measures key IAQ parameters such as temperature, relative humidity, and indoor air pollutants. It also provides a comprehensive IAQ index based on real-time readings, enabling smarter and more effective indoor environment management.

- In April 2025, Filtrete, the leading trusted brand in residential HVAC air filters, launched the new Filtrete Refillable Air Filter Kit. This innovative solution addresses common consumer challenges by featuring a reusable frame with a lifespan of up to 20 years and a collapsible filter lasting up to 12 months. The filter refills are more cost-effective than traditional filters, reduce storage space by 75%, and cut disposable waste by 20%, offering consumers a cleaner, more sustainable, and budget-conscious approach to maintaining indoor air quality.

- Report ID: 8258

- Published Date: Nov 21, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Air Pollution Sensors Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.