Air Humidifier Market Outlook:

Air Humidifier Market size was valued at USD 1.07 billion in 2025 and is expected to reach USD 2.05 billion by 2035, registering around 6.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of air humidifier is assessed at USD 1.13 billion.

The growing awareness of poor indoor air quality conditions and respiratory problems is driving the need for sophisticated air humidifiers that operate across multiple functions, specifically in cities that experience poor air quality and limited living spaces. According to a report by the New State of Global Air report 2024, air pollution was the second leading risk factor for death, accounting for 8.1 million deaths globally in 2021, of which non-communicable diseases accounted for up to 90% of the disease burden from air pollution. Therefore, consumers are increasingly seeking solutions to address the problems such as asthma, skin dryness, and nasal congestion stemming from insufficient humidity combined with environmental contamination.

Key Air Humidifier Market Insights Summary:

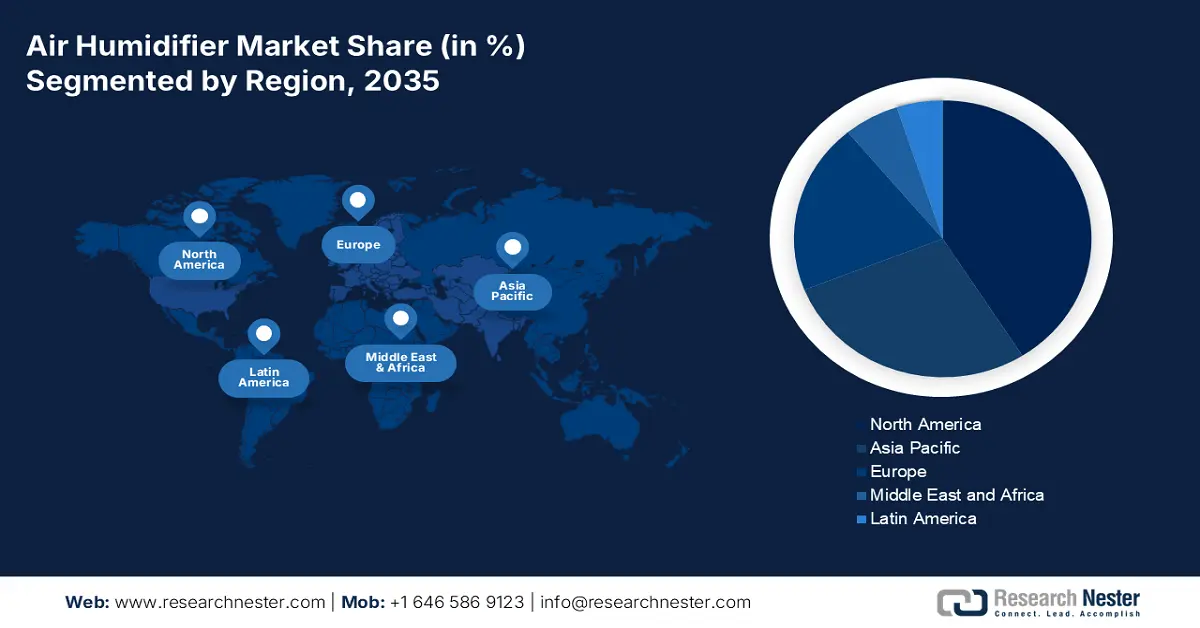

Regional Insights:

- North America is projected to dominate the air humidifier market by 2035, driven by the widespread adoption of HVAC-integrated whole-house humidification systems and the expanding smart home ecosystem.

- Asia Pacific is expected to secure a substantial share by 2035, propelled by rapid urbanization, deteriorating indoor air quality, and growing health awareness among middle-income and tech-savvy consumers.

Segment Insights:

- The cool-mist segment is set to achieve the largest revenue share by 2035, supported by the rising preference for smart, voice-enabled, and child-safe humidification technologies.

- The portable air humidifier segment is anticipated to grow rapidly through 2035, fueled by increasing demand for compact, travel-friendly indoor air care devices among young professionals and frequent travelers.

Key Growth Trends:

- Smart home integration and IoT enabled devices

- Expansion of commercial and healthcare infrastructure

Major Challenges:

- High maintenance requirements and operational costs

Key Players: Honeywell International Inc., Newell Brands Inc., BONECO AG, Dyson Group, Mitsubishi Heavy Industries, Ltd., Condair Group.

Global Air Humidifier Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.07 billion

- 2026 Market Size: USD 1.13 billion

- Projected Market Size: USD 2.05 billion by 2035

- Growth Forecasts: 6.7%

Key Regional Dynamics:

- Largest Region: North America (largest share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, South Korea, Indonesia, Vietnam, Australia

Last updated on : 20 November, 2025

Air Humidifier Market - Growth Drivers and Challenges

Growth Drivers

-

Smart home integration and IoT-enabled devices: There is a rise in consumer preference for the air humidifier sector due to the evolving trend of smart home integration along with IoT capabilities. The consumers are increasingly adopting connected humidifiers that are controlled through mobile applications, aligned with the broader growth of smart home ecosystems. With this trend, the manufacturers are introducing connected air humidifying solutions. For instance, in March 2023, Levoit launched the OasisMist 1000S Smart Tower Humidifier, compatible with Amazon Alexa and Google Assistant, which allows users to control humidity levels, mist output, and schedules through voice or smartphone apps. By embedding smart features into humidifiers, brands are recreating user convenience as well as real-time control, which highlights their strategies for smart living.

-

Expansion of commercial and healthcare infrastructure: The use of humidifiers in hospitals, laboratories, and commercial buildings is expanding due to regulatory guidelines and the growing need for controlled indoor air environments. In healthcare settings, maintaining optimal humidity levels is critical for infection control, patient recovery, and equipment preservation. Similarly, laboratories and cleanrooms depend on precise humidity control to protect sensitive materials and ensure accurate testing conditions. This has led to a surge in demand for reliable, hygienic, and energy-efficient humidification systems tailored for professional use.

Challenges

-

High maintenance requirements and operational costs: The ultrasonic and big capacity models of humidifiers need intensive cleaning along with periodic filter replacement to prevent mold and mineral formation, and bacterial growth. The failure to keep devices maintained is reducing indoor air quality and resulting in health risks, which is compromising customer benefits from their product usage. Users tend to develop dissatisfaction due to these concerns, reducing their long-term usage and generating negative word-of-mouth. The high costs of replacement parts and energy consumption add to the total cost of ownership, discouraging budget-conscious consumers from repurchasing or recommending the product, thereby restraining market growth.

Air Humidifier Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.7% |

|

Base Year Market Size (2025) |

USD 1.07 billion |

|

Forecast Year Market Size (2035) |

USD 2.05 billion |

|

Regional Scope |

|

Air Humidifier Market Segmentation:

Product Type Segment Analysis

The cool-mist segment in air humidifier market is all set to account for the largest revenue share during the stipulated timeframe, attributed to the escalating adoption of smart home technologies. Consumers are seeking humidifiers that integrate applications for control purposes, with voice assistant functionality and real-time moisture tracking systems for individualized comfort solutions. These devices are essential for homes with small children and pets as they produce safe, cool vapor compared to traditional warm-mist models.

The expansion of healthcare facilities and wellness infrastructure is driving the commercial and clinical settings to adopt cool-mist humidifiers. The technology enables hospitals, eldercare facilities, and wellness centers to use these devices, due to their ability to provide humidity control without raising room temperature. Manufacturers are introducing new specialized humidifier models to enhance adoption rates due to the targeted requirements of users, fueling the segmental growth.

Mounting Type Segment Analysis

The portable air humidifier segment is expected to register rapid growth between 2026 and 2035, due to rising demand for lightweight, travel-friendly, and compact air care products. Young professionals, students, and regular travelers prefer these devices as they offer hassle-free utilization and have the ability to fit inside small areas, including hotel rooms, office workspace, and car interiors. Their USB compatibility and quick relief in dry environments make them an ideal personal wellness gadget.

Our in-depth analysis of the global air humidifier market includes the following segments:

|

Product Type |

|

|

Mounting Type |

|

|

Distribution Channel |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Air Humidifier Market - Regional Analysis

North America Market Insights

The North America air humidifier market is expected to dominate the revenue share during the stipulated timeframe, owing to the increasing adoption of whole-house HVAC-integrated humidification systems. As energy-efficient housing becomes a regional standard, builders and homeowners are incorporating central humidifiers to maintain optimal indoor air quality and prevent issues such as static electricity, wood furniture damage, and respiratory discomfort. The trend toward smart homes further supports this shift, with demand rising for connected systems that automate humidity control alongside heating and cooling.

The market in the U.S. is projected to witness rapid growth due to the increasing prevalence of respiratory conditions such as asthma and allergies. Dry indoor environments can exacerbate these health issues, leading consumers to seek solutions that improve air moisture levels. This heightened health awareness is fueling the demand for humidifiers as essential household devices to enhance indoor air quality and alleviate respiratory discomfort. With growing focus on preventive health and wellness, humidifiers are increasingly viewed as proactive lifestyle products.

Asia Pacific Market Insights

The air humidifier market in Asia Pacific is expected to account for a substantial share during the analysis period. This growth is attributed to rapid urbanization and the consequent deterioration in indoor air quality across major cities. Rising levels of indoor pollutants from construction dust, vehicular emissions, and poor ventilation systems are leading to increased health awareness among urban populations. This shift in lifestyle and health consciousness is encouraging the adoption of air humidifiers as a preventive wellness tool, particularly among middle-income households and tech-savvy consumers in countries like China, India, and South Korea.

The growing demand from healthcare facilities and commercial buildings for enhanced indoor air regulation is also fueling the market growth. Hospitals, clinics, and office spaces are increasingly investing in air humidification systems to maintain sterile, humidity-controlled environments for patients and employees. Also, the growing presence of global and regional brands in the region, offering localized and energy-efficient humidifiers tailored to the specific climatic conditions, is further boosting market penetration.

The market in India is expected to witness steady growth, driven by the increasing use of HVAC systems in residential and commercial infrastructure. With the rise in centrally air-conditioned buildings, particularly in Tier 1 and Tier 2 cities, there is a growing need to balance indoor humidity levels to prevent respiratory discomfort and dryness caused by continuous air conditioning. Developers and facility managers are integrating humidification systems to improve indoor comfort and energy efficiency, thereby creating a steady demand for humidifiers in new constructions and smart buildings.

Additionally, rising e-commerce penetration and digital-first consumer behavior are boosting the online sales of air humidifiers. This shift toward digital shopping platforms is enabling brands to reach underserved regions with tailored offerings, user reviews, and promotional deals. Consumers are increasingly opting for compact, user-friendly models that cater to urban lifestyles and space-constrained environments. The convenience of online access, combined with awareness campaigns and influencer marketing, is significantly accelerating product visibility and consumer adoption in both urban and semi-urban areas.

Air Humidifier Market Players:

- Honeywell International Inc.

- Company Overview

- Business Strategy

- Key Technology Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Newell Brands Inc.

- BONECO AG

- Dyson Group

- Mitsubishi Heavy Industries, Ltd.

- Condair Group

- CAREL INDUSTRIES S.p.A.

- Koninklijke Philips N.V.

- Armstrong International Inc.

- Guardian Technologies

- Aprilaire

The air humidifier market is moderately fragmented, with strong competition among global and regional players focusing on innovation, product differentiation, and smart technology integration. Key companies such as Honeywell International Inc., Dyson Ltd., Levoit, and Koninklijke Philips N.V. are emphasizing multifunctional devices with features like app control, HEPA filtration, and energy efficiency. Additionally, emerging brands are targeting niche segments like portable and travel humidifiers. Strategic partnerships, new product launches, and expanding e-commerce channels are enabling companies to strengthen their market presence. Here are some key players operating in the global market:

Recent Developments

- In June 2024, Condair Group announced its plan to establish a new production facility in Richmond, Virginia, United States, marking a strategic move to enhance its proximity to customers and reinforce its position in the American market.

- In July 2023, European start-up Airversa launched Purelle, the world's first Thread-Enabled Humidifier. This innovation aimed to provide seamless integration with smart home ecosystems.

- Report ID: 4016

- Published Date: Nov 20, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Air Humidifier Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.