Smartphone Market Outlook:

Smartphone Market size was valued at USD 609.2 billion in 2025 and is projected to reach USD 1.19 trillion by the end of 2035, rising at a CAGR of 7.8% during the forecast period, i.e., 2026 to 2035. In 2026, the industry size of smartphone is estimated at USD 656.7 billion.

The global market is poised for extensive growth in the years ahead, owing to the supply chain, import, and assembly flows playing a critical role. In this regard, the report from the U.S. International Trade Commission revealed that imports of smartphones into the U.S. grew by USD 4.4 billion (7.3 %) in 2022, reaching USD 62.6 billion, which marks the second-largest increase that year. The report also underscored that the growth is followed by a rebound from the COVID-19 pandemic, which had disrupted supply chains and suppressed consumer spending in 2020. Furthermore, along with these higher imports, the U.S. smartphone sales were stagnated owing to the huge inflation, economic uncertainty, and market saturation. Therefore, the combination of the increased imports and flat sales contributed to a buildup of smartphone inventories across the country, thereby positively impacting market growth.

Annual Export Value of Mobile Phones from India

|

Fiscal Year |

Mobile Phone Exports (USD Billion) |

Notes |

|

FY 2013-14 |

6.6 |

Electronics exports, including mobile phones |

|

FY 2021 |

4.14 |

Mobile phones specifically, pre-pandemic surge |

|

April - September 2021 |

1.7 |

Half-year export value; imports decreased |

|

FY2021-22 |

12.4 |

Total electronics exports, mobile phones major component |

|

FY2023-24 |

15.6 |

Continued growth, supported by the PLI scheme |

Source: IBEF

Furthermore, the Bureau of Labor Statistics in February 2025 notes that the U.S. consumer price index tracks price changes for different components such as telephone hardware, calculators, and related consumer information items, which found that approximately half of the category is dedicated to smartphones. It also stated that smartphone prices are quality-adjusted using hedonic regression models to account for improvements such as higher screen resolution, faster processors, and enhanced cameras. Moreover, prices are collected monthly from a range of retail outlets, which include carrier stores, big-box retailers, and online platforms, and directed substitution is applied to reflect consumer upgrades to newer models. It further underscored that there is a special relative calculation index that monitors smartphone price trends within this category.

Key Smartphone Market Insights Summary:

Regional Highlights:

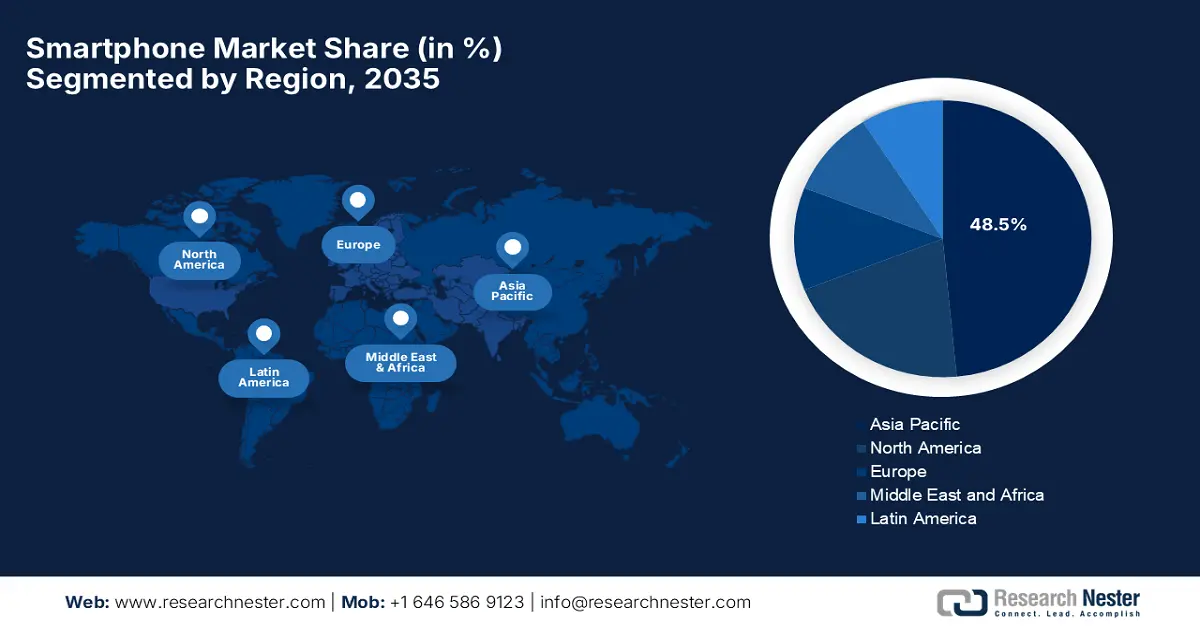

- Asia Pacific is projected to command a 48.5% share of the smartphone market by 2035, owing to rapid urbanization.

- North America is expected to secure a substantial revenue share by 2035, attributed to high smartphone penetration.

Segment Insights:

- The Android segment in the smartphone market is projected to secure an 80.4% revenue share by 2035, supported by its broad device diversity and affordability across price tiers.

- The premium and ultra-premium segment is anticipated to command a 55.6% share by 2035, propelled by rising consumer inclination toward durable, feature-rich devices and advanced generative AI capabilities.

Key Growth Trends:

- Rising adoption of 5 G and advanced connectivity

- Increasing demand for feature-rich devices

Major Challenges:

- Intense competition

- Rapid technological changes

Key Players: Apple Inc. - U.S., Motorola Mobility LLC - U.S., Samsung Electronics Co., Ltd. - South Korea, Sony Corporation - Japan, Nokia Corporation - Finland, HMD Global Oy - Finland, Xiaomi Corporation - China, Oppo Corporation - China, Vivo Communication Technology Co. Ltd. - China, Transition Holdings - China, OnePlus Technology (Shenzhen) Co., Ltd. - China, Lava International Ltd. - India, Micromax Informatics Ltd. - India, Acer Inc. - Taiwan, ASUS Tek.com Inc. - Taiwan

Global Smartphone Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 609.2 billion

- 2026 Market Size: USD 656.7 billion

- Projected Market Size: USD 1.19 trillion by 2035

- Growth Forecasts: 7.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (48.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, South Korea, Japan, India

- Emerging Countries: Vietnam, Indonesia, Brazil, Mexico, United Arab Emirates

Last updated on : 10 November, 2025

Smartphone Market - Growth Drivers and Challenges

Growth Drivers

- Rising adoption of 5 G and advanced connectivity: This is the primary driver for the market since the deployment of 5G networks across all nations is readily enhancing adoption. Also, consumers and enterprises are increasingly upgrading to 5G-enabled devices to benefit from faster download speeds, lower latency, and enhanced connectivity. In this regard, 5G Americas in June 2023 revealed that the worldwide 5G adoption is accelerating at a rapid pace, reaching 1.2 billion connections in the middle of 2023, and is projected to surpass 6.8 billion by the end of 2027, owing to the expanding network deployments and growing consumer demand. It also stated that North America leads with 36% population penetration and is expected to reach 601 million subscriptions. Hence, this growth underscores the role of 5G in enabling next-generation mobile technologies and broadband connectivity across all nations.

- Increasing demand for feature-rich devices: There has been an increased demand for smartphones wherein advanced features such as high-resolution cameras, generative AI capabilities, foldable displays, and enhanced computational power are driving business in this market. The demand for multifunctional devices is at a boom, which combines entertainment, productivity, and connectivity, encouraging manufacturers to make increased investments in R&D. In July 2024, vivo India reported that it made a total investment of INR 3,500 crores (USD 422 million) and the production of 150 million made-in-India smartphones. It also showcased its advanced technologies, which include the ZEISS co-engineered imaging system, next-generation V3+ chip, Sony 50MP sensors, and SCHOTT durable cover glass, along with AI integrations with Google to enhance user experience.

- Increasing IoT integration: This integration of smartphones into broader IoT ecosystems, which includes smart homes, wearables, and connected vehicles, strengthens the market appeal. In addition, these devices now act as central hubs controlling other smart devices, increasing dependency and customer loyalty. This in turn interconnected environment also fuels sales of accessories, apps, and services, contributing to overall market expansion. In March 2025, MediaTek introduced its first-ever high-performance Genio 720 and Genio 520 edge-AI IoT platforms at Embedded World, designed to support generative AI models, multimedia, and connectivity for smart home, retail, industrial, and commercial IoT devices. They are built on a 6nm process with octa-core CPUs and an 8th-generation Neural Processing Unit. Along with this, the high mobile cellular subscription rates indicate widespread adoption of mobile devices, which correlates with market potential and opportunities for new pioneers, hence suitable for overall market growth.

Mobile Cellular Subscriptions per 100 People by Country

|

Country |

Most Recent Year |

Mobile Cellular Subscriptions (per 100 people) |

|

Afghanistan |

2023 |

56 |

|

Albania |

2023 |

93 |

|

Algeria |

2023 |

112 |

|

American Samoa |

2004 |

4 |

|

Andorra |

2023 |

156 |

|

Angola |

2023 |

70 |

|

Antigua and Barbuda |

2022 |

201 |

|

Argentina |

2023 |

138 |

|

Armenia |

2023 |

135 |

|

Aruba |

2022 |

131 |

|

Australia |

2023 |

113 |

|

Austria |

2023 |

122 |

|

Azerbaijan |

2023 |

108 |

|

Bahamas |

2023 |

100 |

|

Bahrain |

2023 |

154 |

|

Bangladesh |

2023 |

114 |

|

Barbados |

2022 |

115 |

|

Belarus |

2023 |

129 |

|

Belgium |

2023 |

103 |

Source: World Bank

Challenges

- Intense competition: The dynamics of market are one of the most competitive industries across almost all nations, wherein several brands are desperate to gain consumer attention. Major pioneers in the industry, such as Apple, Samsung, and Huawei, are constantly competing in terms of emerging brands offering affordable alternatives. This, in turn, leads to a very aggressive pricing strategy, making it challenging for manufacturers to maintain proper profit margins. Therefore, to succeed in these instances, companies need to focus on innovation, marketing, and customer experience. In addition, differentiating products in these crowded sectors necessitates continuous investments in terms of brand publicity and services, followed by product sales, hence posing a major hurdle for market upliftment.

- Rapid technological changes: This is yet another major barrier for the market to capture the desired capital. Technology in smartphones advances at a rapid pace, wherein new features are becoming standard almost every year. On the other hand, innovations such as 5G connectivity, AI-powered cameras, biometric security, and foldable displays have shifted consumer expectations dramatically, creating a major drawback for technologically backward areas. In this regard, manufacturers must make heavy investments in terms of research and development to incorporate these features quickly. Moreover, the fast rate of change also shortens product life cycles, increasing the risk of inventory obsolescence, thereby raising costs associated with frequent upgrades.

Smartphone Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.8% |

|

Base Year Market Size (2025) |

USD 609.2 billion |

|

Forecast Year Market Size (2035) |

USD 1.19 trillion |

|

Regional Scope |

|

Smartphone Market Segmentation:

Operating System Segment Analysis

Based on the operating system Android segment is expected to garner the largest revenue share of 80.4% during the forecast duration. The dominance of the segment is effectively attributable to its unparalleled diversity and affordability across different points from entry-level to exclusive models. On the other hand, the open-source nature of the platform allows OEMs to customize devices for local preferences, further consolidating the segment’s strong position in this field. In June 2025, Google announced that Android 16 is rolling out first to supported Pixel devices, bringing new features to enhance accessibility, multitasking, as well as security. It also stated that the update introduces streamlined notifications with live updates and force-grouping, making it easier to stay informed. Furthermore, Android 16 also introduces the Material 3 Expressive design for a more intuitive interface.

Price Range Segment Analysis

In terms of price range, premium and ultra-premium segments are predicted to capture a significant revenue share of 55.6% in the smartphone market by the end of 2035. The growth in this subtype is highly subject to the consumer shift towards purchasing more durable and feature-rich devices since the replacement cycles lengthen. Also, the buyers are willing to pay premium prices for generative AI capabilities, computational photography, as well as the novel form of factors that are offered by foldable displays. This, in turn, is readily accelerated by telecom carriers promoting the devices through proper financing plans, making them even more accessible. In addition, the rising brand loyalty and ecosystem integration offered by leading smartphone manufacturers reinforce consumer preference for high-end devices, hence denoting a wider segment scope.

Distribution Channel Segment Analysis

Based on the distribution channel online segment is likely to attain a lucrative share of 45.3% in the smartphone market over the analyzed time frame. Consumers are increasingly favoring convenience, competitive pricing, and transparent product comparison offers, which are the key factors driving upliftment of this subtype. Moreover, the growth of brand-owned e-commerce platforms and trusted retailers, coupled with robust digital payment systems, is also propelling the growth of this segment, allowing consumers to purchase high-value electronics online. Also, these online channels have the capability to facilitate direct-to-consumer marketing, and exclusive flash sales create a very compelling purchasing environment. Furthermore, the global expansion of e-commerce infrastructure is a key facilitator of this growth, enabling secure cross-border and domestic online transactions.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Operating System |

|

|

Price Range |

|

|

Distribution Channel |

|

|

Screen Size |

|

|

RAM Capacity |

|

|

Storage Capacity |

|

|

Sales Channel |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Smartphone Market - Regional Analysis

APAC Market Insights

Asia Pacific is expected to dominate the global market of smartphone, capturing the largest revenue share of 48.5% by the end of 2035. The dominance of the segment is highly attributable to rapid urbanization, increasing internet penetration, and a growing consumer demand for advanced mobile technology. The domestic manufacturers in this region are making heavy investments, whereas rising disposable incomes have also fostered a favorable business environment. In September 2025, Sony introduced its Xperia 10 VII, which features a sleek, sophisticated design possessing an enhanced camera functionality for instant shooting. The company also underscored that the device offers excellent photography with larger sensors and three rear focal lengths, ensuring very bright, clear images even in low-light conditions, providing an optimistic market opportunity.

China is the crucial growth engine for the smartphone market in the Asia Pacific, which is a leader in terms of both manufacturing and consumption. The domestic brands in this country are leading in terms of both innovation and design, whereas the government initiatives promoting in-house manufacturing and technological self-reliance have further strengthened the ecosystem. Qualcomm and Xiaomi in May 2025 announced that they extended their 15-year collaboration with a multi-year agreement to drive innovation in premium smartphones, where Xiaomi will be continuing to adopt Snapdragon 8-series platforms across multiple product generations. In this regard, the partnership also consists of automotive, smart home devices, wearables, AR/VR glasses, and tablets, leveraging Qualcomm’s AI, connectivity, and processing technologies, positively impacting market expansion.

India is growing exponentially in the smartphone market, efficiently backed by the presence of government programs that are proactively promoting digital inclusion and affordable connectivity. On the other hand, the local manufacturing initiatives and Make in India policies are also encouraging brands to scale production and capitalize on this field. The Ministry of Communications in March 2025 reported that the country has achieved appreciable milestones in terms of 5G network expansion, where the services are currently available in 99.6% of districts since their launch in October 2022. It also stated that telecom providers have installed 4.69 lakh 5G Base Transceiver Stations, enabling around 25 crore mobile subscribers to access 5G services across the country. Therefore, this rapid growth rate reflects strong adoption and robust infrastructural developments, further strengthening India’s connectivity landscape.

North America Market Insights

North America is predicted to hold a lucrative share in the global smartphone market throughout the discussed tenure. The leadership of the region in the field is primarily driven by its high penetration and extensive purchasing power. The region also benefits from the presence of key market players who are focused on continued innovation, premium devices, and brand loyalty as well. There has been a heightened demand for advanced features such as AI, high-speed connectivity, and integration with smart devices as well. In addition, 5G emergence is enhancing network capabilities, thereby prompting new applications in terms of mobile gaming, augmented reality, and cloud services. Moreover, strategic collaborations between tech giants and telecom operators are also boosting the ecosystem, hence driving sustained market growth in this field.

The U.S. is solidifying its dominance over the regional smartphone market owing to the high competency lead by a few leading brands benefited from a large consumer base. The country also benefits from higher consumer expectations coupled with frequent technology upgrades, since it fuels the demand for premium devices. In addition, the carrier-led promotions and trade-in programs are highly influencing the purchasing patterns in this field. In November 2024, the Pew Research Center revealed that 98% of the population of the U.S. owns a cellphone, wherein 91% own a smartphone, which is a 35% from 2011. The report further underscored that smartphone dependency has also risen, where almost 15% of adults are dependent on smartphones for internet access. Furthermore, this is significantly higher among lower-income and less formally educated citizens, which highlights the deep integration of mobile technology in everyday life.

Mobile Phone Ownership by Age Group in the U.S. (2024)

|

Device Type |

All Adults |

Ages 18-29 |

Ages 30-49 |

Ages 50-64 |

|

Cellphone |

99% |

99% |

98% |

94% |

|

Smartphone |

98% |

97% |

91% |

79% |

|

Cellphone, but not a smartphone |

1% |

2% |

6% |

15% |

Source: The Pew Research Center

Canada also holds a strong position in the smartphone market, efficiently driven by consumers who are seeking both durability and performance. Mobile carriers in the country play a crucial role in market expansion, fueling sales through bundled offers and data plans as well. In this regard, Ericsson Canada in December 2024 announced that it has been recognized as a top corporate R&D investor, ranking 12th nationally in 2023, which invested USD 419 million, up BY one spot when compared to the previous year. The company is recognized as the country’s leading 5G network equipment provider, leveraging local R&D centers, partnerships with over 20 universities, and collaborations with industry and government to drive innovation in this sector. Over the past 20 years, the company has ranked 7th in cumulative R&D spending, reflecting its prominent position in global telecommunications, hence positively impacting market growth.

Europe Market Insights

Europe is expected to acquire the second-largest stakeholder position in the global smartphone market over the analyzed tenure. The region’s prominence in this field is propelled by sustainability and privacy considerations, which are driving demand for environmentally responsible devices and secure software solutions. Also, the regional competition among players is encouraging continued innovation in terms of hardware, camera capabilities, and AI integration. According this Eurostat, in December 2024 reported that the disposal habits of mobile and smartphones revealed that 51% of individuals aged 16 to 74 kept old devices at home, whereas only 11% recycled them. It also underscored that about 18% of people gave away or sold their old phones, and 2% discarded them improperly. Hence, this recycling and disposal awareness can create a sustained supply of refurbished devices, boosting smartphone sales and circular economy initiatives.

Germany is gaining momentum in the regional smartphone market, owing to the strong presence of both domestic and international brands providing high-quality devices. The country emerges as the technological hub, leveraging durability and enhanced performance. Consumers in the country are also extremely valuing after-sales support and brand reputation, reshaping the developmental strategies. In October 2025, Gigaset announced that it had launched two new feature phones, called GL695 and GL795, which are designed for easy use, comfort, and safety, making them ideal for seniors and families. They also possess safety features such as an SOS emergency button, direct-dial contacts, hearing aid compatibility, and 2MP cameras. The devices are priced at €59.99 (USD 69.59) and €69.99 (USD 81.19), and this launch will position the country as a key growth contributor in this field.

The U.K. is growing exponentially in the smartphone market, heavily influenced by early adoption of technology and the presence of mobile operators who play a key role in driving sales through data plans and financing options. Additionally, consumers in the country increasingly consider software updates, cybersecurity, and device longevity, encouraging firms to make extensive R&D in this field. The country’s government in October 2025 reported that its competition and markets authority has confirmed that Apple and Google hold strategic market status in their mobile platforms, covering operating systems, app distribution, browsers, and browser engines. It also stated that this designation recognizes their substantial and established market, thereby enabling the CMA to consider targeted interventions to ensure fair competition and support businesses and consumers. Hence, the SMS status highlights the platforms’ central role in the app economy, which contributes 1.5% of the UK’s GDP, making it suitable for standard market growth.

Key Smartphone Market Players:

- Apple Inc. - U.S.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Motorola Mobility LLC - U.S.

- Samsung Electronics Co., Ltd. - South Korea

- Sony Corporation - Japan

- Nokia Corporation - Finland

- HMD Global Oy - Finland

- Xiaomi Corporation - China

- Oppo Corporation - China

- Vivo Communication Technology Co. Ltd. - China

- Transition Holdings - China

- OnePlus Technology (Shenzhen) Co., Ltd. - China

- Lava International Ltd. - India

- Micromax Informatics Ltd. - India

- Acer Inc. - Taiwan

- ASUS Tek.com Inc. - Taiwan

- Apple Inc. is emerging as one of the most popular and preferred brands among the worldwide population, which has a very strong ecosystem of iOS, iCloud, and proprietary hardware. The firm’s focus lies in advanced computational photography, generative AI, and proprietary chipsets such as A-series and M-series to deliver differentiated performance. On the other hand, the company’s business model emphasizes high-margin devices, recurring services revenue, and customer loyalty

- Samsung Electronics Co., Ltd. remains the prominent player in the smartphone industry, leveraging both premium and mid-range segments as well. The firm is making heavy investments in terms of foldable displays, 5G smartphones, and high-resolution cameras to maintain technological leadership. Samsung deliberately emphasizes vertical integration by producing key components such as OLED displays, memory, and processors, allowing cost and quality control advantages to both retailers and consumers.

- Xiaomi Corporation is identified as the leading player in the mid-range and budget smartphone sectors, which also has a strong presence in Asia, Europe, and Latin America. The firm’s strategy revolves around high-specification devices at competitive prices, supported by both online sales channels and promotions. The company makes huge investments in R&D to integrate advanced features such as AI-enabled cameras, fast charging, and ecosystem products, including smart home devices.

- Oppo Corporation, based in China the firm has established itself as a major smartphone brand with a prime focus on mid-range and premium segments, with innovative features such as high-resolution front cameras and fast-charging technology. The company also leverages strong branding and sponsorship initiatives to attract younger consumers. Furthermore, expansion into emerging markets supported by both offline retail networks and financing schemes is also fostering a profitable business environment.

- Vivo Communication Technology Co. Ltd. competes primarily in terms of mid- to upper-mid smartphone segments, with a very strong presence in the Asia Pacific. The company emphasizes innovative camera systems, AI features, and high-performance devices for gaming and multimedia consumption. Also, its focus on marketing and product localization has allowed Vivo to grow rapidly in emerging markets while gradually expanding into premium segments as well.

Below is the list of some prominent players operating in the global market:

The global smartphone market is extremely competitive with the presence of both emerging and established entities that are focused on continued innovations. Leading pioneers such as Apple focus on premium ecosystems and hardware technologies, whereas Samsung and others leverage foldables, 5G, and AI camera. Regional manufacturing diversification, financing plans, and deeper vertical integration are a few strategies implemented by these players to uplift the market growth internationally. For instance, in August 2025, Apple announced a substantial USD 100 billion acceleration of its U.S. investment, bringing the total to USD 600 billion over the next four years, including the launch of the american manufacturing program to expand domestic supply chains. It also stated that the initiative will support 450,000 supplier and partner roles across all 50 states, focusing on R&D, silicon engineering, software, and AI, hence denoting a positive market outlook.

Corporate Landscape of the Smartphone Market:

Recent Developments

- In October 2025, OPPO announced that it had launched the Find X9 Series globally, and the brand continues to focus on user-centric innovation, catering to a new generation that values imaging, AI, battery life, and seamless connectivity.

- In October 2025, ZTE announced a major push in its global expansion with a prime focus on gaming smartphones for youth. At the ZTE Devices User Congress in Milan, the company introduced its dual-pillar strategy, thereby advancing 2C transformation and a full-scenario AI ecosystem.

- In October 2025, HMD introduced its HMD Touch 4G in India, which is a new category of hybrid phones that blend smartphone features with feature phone affordability. The smartphone has a 3.2-inch display, an SOS key, and dual cameras.

- In September 2025, Samsung announced the launch of its Galaxy M36 5G in India, possessing advanced AI features such as circle to search with Google and Gemini Live, bringing powerful mobile AI experiences to the mid-segment.

- In September 2025, Apple introduced the iPhone 17 Pro and iPhone 17 Pro Max, which are its most powerful and advanced models featuring the new A19 Pro chip for unmatched performance and efficiency.

- Report ID: 8228

- Published Date: Nov 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Smartphone Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.