Rugged Display Market Outlook:

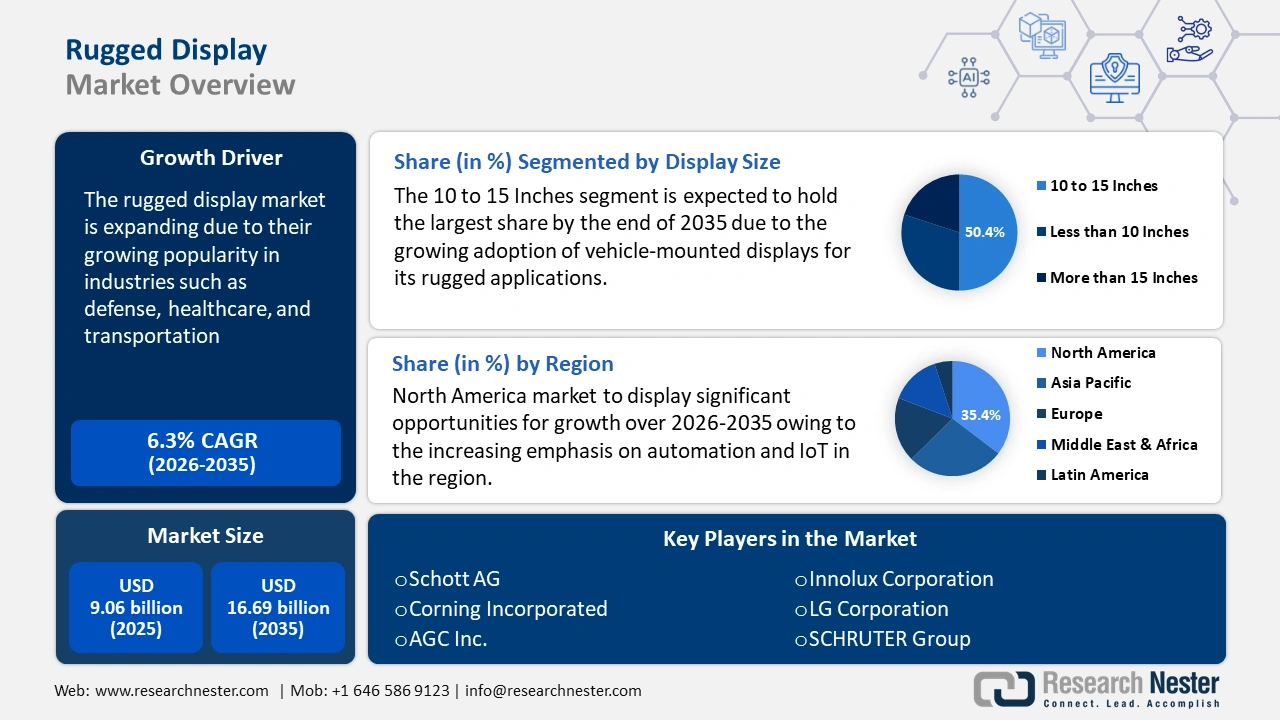

Rugged Display Market size was over USD 9.06 billion in 2025 and is projected to reach USD 16.69 billion by 2035, growing at around 6.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of rugged display is evaluated at USD 9.57 billion.

The market expansion is due to its growing popularity in industries such as defense, healthcare, and transportation. The numerous benefits, including the ability to be read in direct sunlight, the ability to be fully sealed to prevent dust or liquid intrusion, and the strength, durability, and ease of installation in various automotive and defense machinery are also driving the rugged display market. As defense ministries worldwide invest in cutting-edge technologies such as tough gadgets and vehicles to strengthen their military capabilities, sales of rugged displays are expected to expand. According to the Stockholm International Peace Research Institute, the total amount spent on the military worldwide in 2023 was USD 2,443 billion, an increase of 6.8% in real terms from 2022.

Key Rugged Display Market Insights Summary:

Regional Highlights:

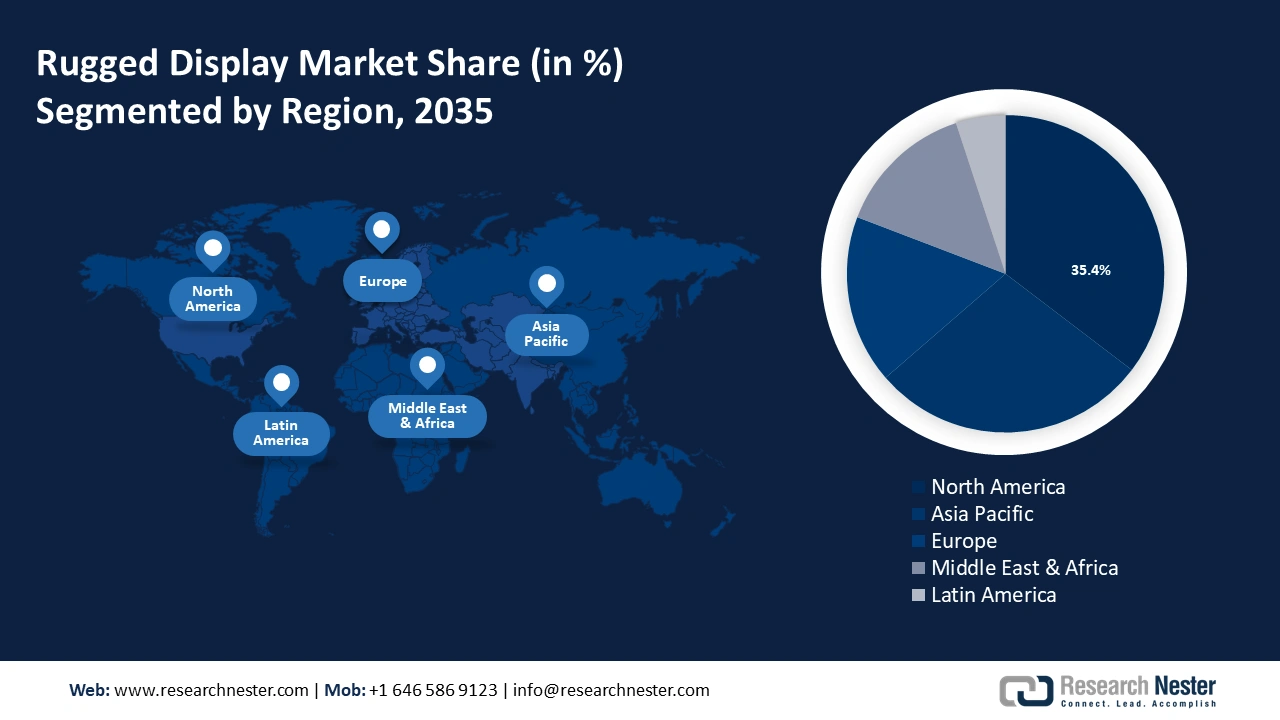

- North America rugged display market will account for 35.40% share by 2035, driven by innovations improving product quality and demand from government, security, aviation, and automobile sectors.

- Asia Pacific market will register huge growth during the forecast timeline, driven by growing display board production and quick uptake of OLED screen displays in retail and high-tech sectors.

Segment Insights:

- The 10 to 15-inch display segment in the rugged display market is expected to hold a 50.40% share by 2035, driven by growing adoption of vehicle-mounted displays and new product introductions.

- Ultra-rugged segment in the rugged display market is projected to secure a notable revenue share by the forecast year 2035, driven by superior performance and certification to meet harsh environmental standards.

Key Growth Trends:

- Increased integration of human machine interface and IoT-based technologies

- Increased field service operations

Major Challenges:

- Increasing raw material costs

- Growing adoption of alternatives

Key Players: Schott AG, Corning Incorporated, AGC Inc., Innolux Corporation, LG Corporation, SCHURTER Group, Sparton Corp, Zebra Technologies Corp., Getac Technology Corp., Trimble Inc..

Global Rugged Display Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 9.06 billion

- 2026 Market Size: USD 9.57 billion

- Projected Market Size: USD 16.69 billion by 2035

- Growth Forecasts: 6.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 18 September, 2025

Rugged Display Market Growth Drivers and Challenges:

Growth Drivers

- Increased integration of human machine interface and IoT-based technologies: The rising demand for human machine interface (HMI) devices is due to their high performance, adaptability, improved brightness, contrast, direct sunlight visibility, wide color gamut, uniform brightness, and durability for demanding applications. Furthermore, as HMI's design and integration expertise satisfies all industry needs, it excels in the healthcare, industrial automation, military, and defense industries.

As a result, the rugged display market will expand due to rising demand, long-term low total cost of ownership with Internet of Things (IoT)-based technologies, and improved screen resistivity in electronic paper displays. For instance, Helios Technologies, Inc., a global pioneer in highly designed motion control and electrical controls technology for a range of end applications, released the new PowerViewTM P70 in September 2023 as part of the all-new Pro Series, Helios' next-generation of premium rugged display-controllers. - Increased field service operations: Field Service Technicians and professionals who work in outdoor or severe environments intend long-lasting screens to maintain productivity and safety. These displays must withstand handling, weather, and collision. The expansion of field service operations in a variety of industries, including utilities, telecommunications, and transportation, is driving up the demand for durable, portable displays. Rugged displays significantly boost operational efficiency and rugged display market expansion by ensuring that technicians can interact with and access critical information while in the field without concerns about the display failing.

- Helps in avoiding data loss: Rugged industrial displays must be able to withstand mechanical stress, such as shocks and vibrations, which are ubiquitous in industrial settings including heavy machinery, transportation, and manufacturing. These screens are made to withstand the shocks and vibrations that come with using machinery. By integrating shock-absorbing mechanisms with secure mounting systems, they maintain functionality and prevent damage or data loss, guaranteeing dependable performance even in the most challenging environments.

Challenges

- Increasing raw material costs: Rising raw material costs for displays, as well as high acquisition costs for display devices, will limit the rugged display market's potential expansion in the coming years. Consumer-grade tablets with touchscreen displays and ruggedized tablet screens are significantly different in price. As a result, the ruggedized display device's higher price will limit market growth.

- Growing adoption of alternatives: Businesses rely on consumer-grade smartphones for their low cost, great performance, and rapid adoption of new and advanced technology. This affects the amount of money that organizations allocate to rugged devices, hindering rugged display market growth.

Rugged Display Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.3% |

|

Base Year Market Size (2025) |

USD 9.06 billion |

|

Forecast Year Market Size (2035) |

USD 16.69 billion |

|

Regional Scope |

|

Rugged Display Market Segmentation:

Display Size Segment Analysis

10 to 15-inch display segment is anticipated to account for around 50.4% rugged display market share by 2035. The segment growth can be attributed to the growing adoption of vehicle-mounted displays for its rugged applications. Also, key players are introducing new products which is accelerating the segment’s growth.

Level of Ruggedness Segment Analysis

The ultra-rugged segment in rugged display market is poised to garner a notable share in the forecast period. The segment’s growth can be attributed to the superior performance and versatility of industrial computers with ultra-rugged features that are employed in OEM devices. The ultra-rugged display is made to survive the harshest environments. A few components in robust displays have typically undergone stress testing or been certified to meet industry and military standards. A durable gadget, for example, might have a hard drive that can withstand impacts or a cover that is resistant to rain.

Vertical Segment Analysis

The consumer electronics segment in rugged display market is estimated to gain a significant share in 2035. The segment growth can be attributed to their paperless assembly factories organizing part movements, disseminating information more rapidly and continuously, and monitoring quality. Sturdy display devices that can sustain large moving consumer electronics facilities and warehouses include tablets, workstations, and adaptable PCs. The market is expanding as a result of rising customer demand for smartphones with durable screens. For instance, in March 2021, Samsung unveiled the new Galaxy XCover 5, a sophisticated and tough gadget designed to satisfy the demands of a workforce that is becoming more mobile.

Our in-depth analysis of the global market includes the following segments:

|

Size |

|

|

Level of Ruggedness |

|

|

Vertical |

|

|

Product |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Rugged Display Market Regional Analysis:

North America Market Insights

North America industry is poised to dominate majority revenue share of 35.4% by 2035. The market growth in the region is expected on account of growing innovations by manufacturers to improve product quality, enhance their creative processes, and drive results. Notable buyers for display in the region include government, security, aviation, automobile, and transportation industries.

The U.S. modern industrial and military sectors necessitate high-performance, long-lasting displays, making the country a prominent player in the rugged display market. Rugged displays that resist harsh environments are in high demand due to the region's substantial industrial operations, defense budget, and technical advancements. For instance, around 8.20.3 billion, or 13.3% of the total federal budget was spent on the U.S. military in 2023.

Canada leads the industry in rugged display sales due to the existence of top manufacturers in the field and a strong focus on modernizing and adopting new technologies. Demand is further increased by the increasing emphasis on automation and IoT, guaranteeing continuing growth and development. According to the government, by 2025, there will be an average of four IoT devices per person and over 30 billion IoT connections. Therefore, the expansion of cutting-edge technologies will drive the market growth in the country.

APAC Market Insights

Asia Pacific will encounter huge growth in the rugged display market during the forecast period. The market is expanding in the region owing to the growing number of display board production facilities and the quick uptake of OLED screen displays. Shopper hardware, retail, BFSI, healthcare, sports, media, and transportation are anticipated to be key drivers of the Asia Pacific region's need for rugged displays.

China's massive industrialization and infrastructure initiatives are causing it to become a major player in the market. The nation's growing investment in the mining, construction, and transportation sectors is escalating demand for rugged displays that can withstand challenging circumstances. According to the International Trade Administration, the focus of China's 14th Five-Year Plan is on new urbanization, energy, water, and transportation infrastructure projects. An estimated USD 4.2 trillion will be invested in new infrastructure during the 14th Five-Year Plan period (2021–2025).

Electronics and robotics are two high-tech businesses in Japan that depend on rugged displays to function well under adverse circumstances. The country experiences numerous natural disasters, which increases the demand for robust, long-lasting display solutions that work well in an emergency. For instance, the total damage incurred by natural disasters in Japan in 2021 was estimated to be USD 2.96 billion.

Rugged displays are in high demand due to South Korea's focus on automation and smart technology in fields like field service and logistics. South Korea is a major player in the rugged display market due to its strong technological industry and the demand for dependable, high-quality equipment.

Rugged Display Market Players:

- Schott AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Corning Incorporated

- AGC Inc.

- Innolux Corporation

- LG Corporation

- SCHURTER Group

- Sparton Corp

- Zebra Technologies Corp.

- Getac Technology Corp.

- Trimble Inc.

There are numerous significant competitors in the fiercely competitive rugged display market. In terms of market share, some of these businesses dominate the market significantly. The industry has grown extremely competitive in recent years due to the quick advancement of display technology and the proliferation of R&D-focused businesses seeking to create novel products for the market.

Recent Developments

- In June 2023, LG Business Solutions USA revealed an eye-catching new digital signage display for public electric vehicle (EV) charging stations, an integrated solution that is designed to assist maximize return-on-investment for installations in hotels, stadiums, shopping malls, and elsewhere.

- In October 2021, SCHOTT AG introduced Xensation α (Alpha), a chemically strengthened lithium aluminum borosilicate (LABS) cover glass designed to compete with the best smartphone cover glasses in the world. This high-performance glass will be featured on new vivo high-end flagship devices.

- Report ID: 6450

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Rugged Display Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.