Cloud Workload Protection Market Outlook:

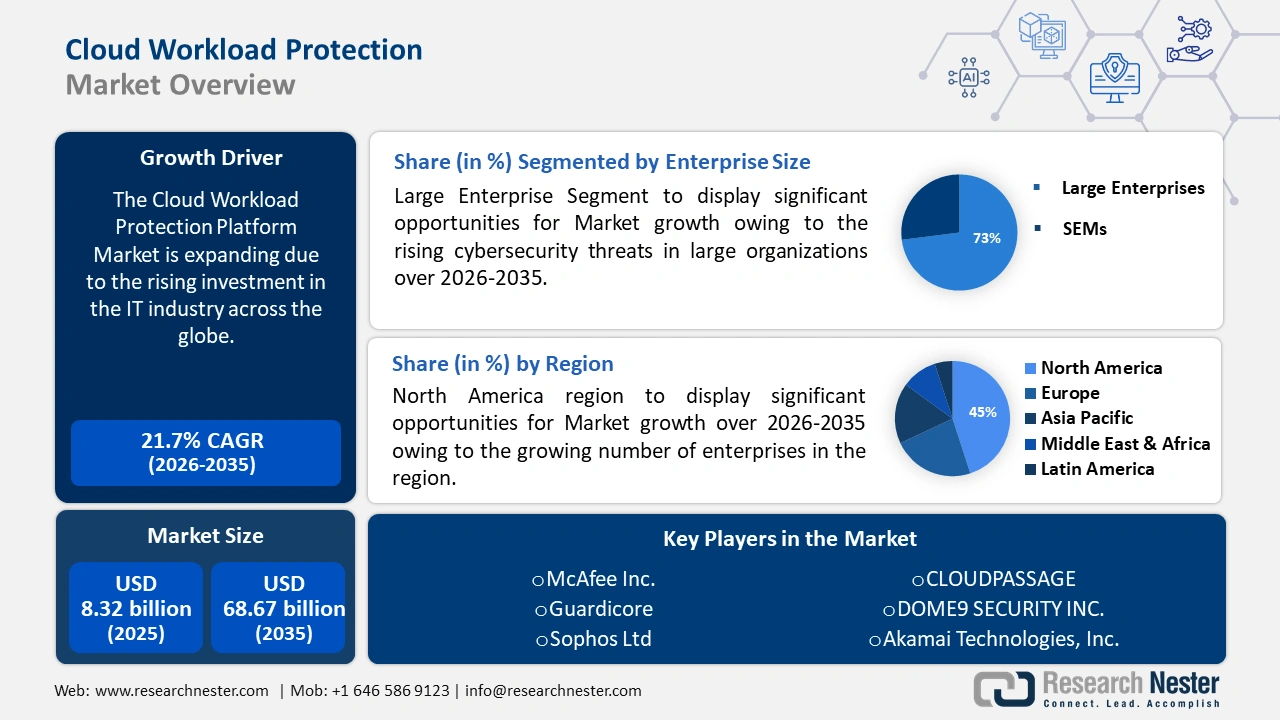

Cloud Workload Protection Market size was valued at USD 8.32 billion in 2025 and is expected to reach USD 68.67 billion by 2035, registering around 23.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of cloud workload protection is evaluated at USD 10.08 billion.

The reason behind the growth is impelled by the rising investment in the IT industry across the globe driven by the increasing digitization of organizations and the need for firms to keep up with the rapid evolution of technology.

According to estimates, Global IT spending increased by around 5% from 2022 to roughly USD 4 trillion in 2023. Particularly, global IT spending is predicted to reach over 4.5 trillion by 2024.

The growing integration of advanced technologies is believed to fuel the market growth. Cloud Workload Protection Platform (CWPP) uses machine learning since it aids in the construction of a security defense system, and supports unified security protection for servers that are not Tencent Cloud.

Key Cloud Workload Protection Market Insights Summary:

Regional Highlights:

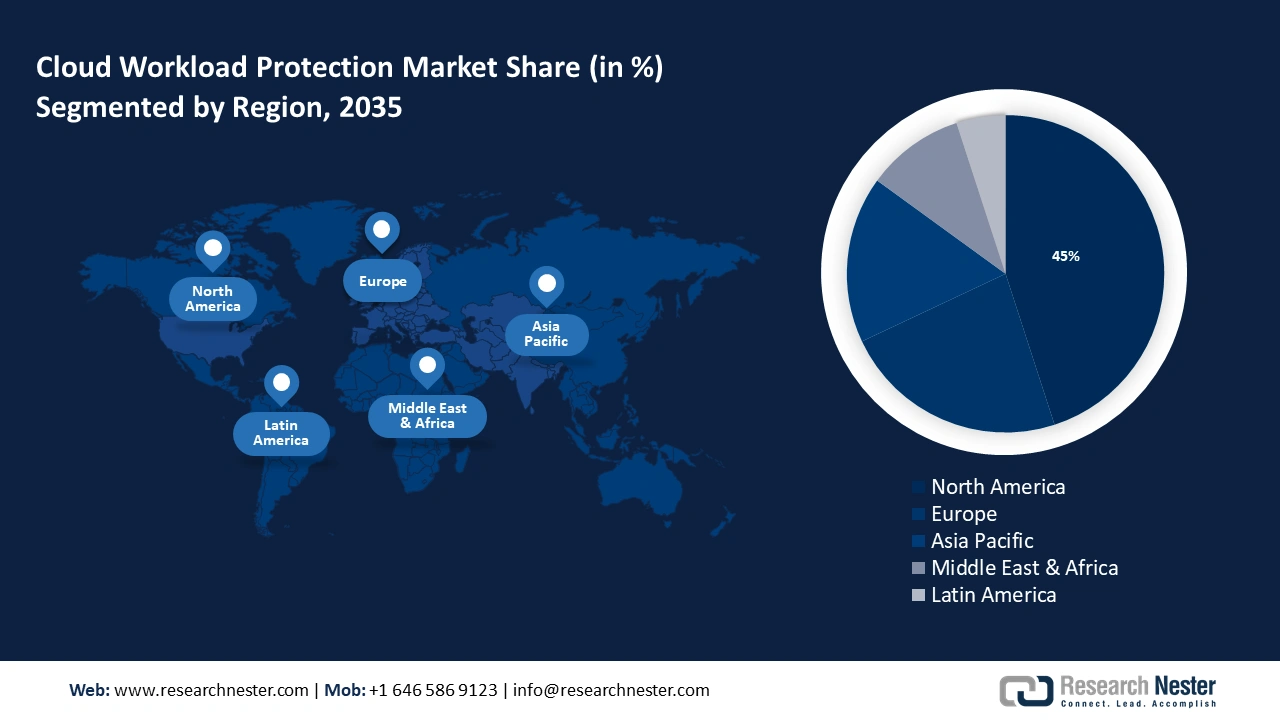

- The North America cloud workload protection market will dominate around 45% share by 2035, driven by the rising number of enterprises, growing cybersecurity concerns, and increased cloud adoption.

Segment Insights:

- The large enterprise segment in the cloud workload protection market is projected to hold a 73% share by 2035, driven by rising cybersecurity threats and regulatory compliance requirements in large organizations.

Key Growth Trends:

- Growing Complexity of the Workload

- Increasing Adoption of DevOps

Major Challenges:

- Stringent regulatory standards

- Complexity associated with managing security across several workloads may limit the adoption

Key Players: McAfee Inc., Guardicore, Sophos Ltd, CLOUDPASSAGE, DOME9 SECURITY INC., Akamai Technologies, Inc., Micro Incorporated, ORACLE CORPORATION, Amazon Web Services (AWS).

Global Cloud Workload Protection Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.32 billion

- 2026 Market Size: USD 10.08 billion

- Projected Market Size: USD 68.67 billion by 2035

- Growth Forecasts: 23.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, India

- Emerging Countries: China, India, Singapore, South Korea, Malaysia

Last updated on : 16 September, 2025

Cloud Workload Protection Market Growth Drivers and Challenges:

Growth Drivers

-

Rising Need for Security - An instrument for detecting and eliminating risks within cloud software is the cloud workload protection, which is employed to protect virtual machines (VMs), cloud infrastructures, containers, and physical servers against internet attacks.

-

Growing Complexity of the Workload- Workloads deployed in multi-cloud and hybrid cloud settings, such as IaaS, PaaS, and CaaS, can be protected by a cloud workload protection that offers visibility into many environments.

- Increasing Adoption of DevOps- Cloud Workload Protection Platforms are made to interact with DevOps which is a continuous innovation and development (CI/CD) procedure where application developers use workloads to swiftly and efficiently generate and publish applications.

Challenges

-

Stringent regulatory standards - Cloud compliance is the act of complying with regulatory standards such as ISO, PCI DSS, HIPAA, and GDPR, which have specific requirements for cloud environments. Establishing robust security controls is a requirement of compliance standards such as ISO 27001 and SOC 2 to safeguard information against unauthorized access and breaches. The requirement for businesses and cloud computing service providers to adhere to relevant regulatory standards for cloud usage aids in reducing risks related to data breaches and cyber threats, which is a crucial part of creating a secure environment for cloud computing. However, cloud services are dynamic and subject to numerous rules, so managing compliance in the cloud can be challenging since it is a continuous commitment to protecting the cloud environment and guaranteeing data integrity rather than a one-time activity.

-

Complexity associated with managing security across several workloads may limit the adoption

- Security concerns may hamper the cloud workload protection market growth

Cloud Workload Protection Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

23.5% |

|

Base Year Market Size (2025) |

USD 8.32 billion |

|

Forecast Year Market Size (2035) |

USD 68.67 billion |

|

Regional Scope |

|

Cloud Workload Protection Market Segmentation:

Enterprise Size Segment Analysis

The large enterprise segment in the cloud workload protection market is estimated to gain a robust revenue share of 73% in the coming years owing to the rising cybersecurity threats in large organizations. Numerous cyber threats pose a threat to large enterprises from ransomware assaults to data breaches, which seriously jeopardize corporate operations and reputation. Owing to their vast networks and expensive assets, large organizations are often the first choice for ransomware operators which may lead to financial losses, reputational harm, and data loss.

Moreover, strict legal requirements about cybersecurity, privacy, and data protection apply to large enterprises, which can have harsh fines and harm to one's reputation for non-compliance.

This has led to increasing adoption of cloud workload protection platforms which is the procedure for keeping an eye out for dangers to cloud workloads and containers and eliminating them to address the concerns found that should be included in the solution.

Component Segment Analysis

The solution segment in the cloud workload protection market is set to garner a notable share shortly. As a "workload-centric security solution," cloud workload protection platform (CWPP) starts the vulnerability assessment process by scanning the workloads for potential security threats and is designed to protect workloads in contemporary data centers and cloud settings.

Industry Segment Analysis

The BFSI segment is poised to garner a noteworthy share. Since technology has advanced, digital banking has become more vulnerable to cyberattacks that seek to compromise financial records, client information, and online banking platforms. Financial institutions are investing more money in cyber security owing to the detrimental effects of cybersecurity threats on the industry. This has led to an increase in the demand for cloud workload protection solutions.

In addition, security risks in the life sciences and healthcare industry today are increasing since the privacy of patients and their data may be compromised by the new cybersecurity threats brought forth by this greater usage of technology, which has led enterprises have use solutions like encryption (68%), identity and access management (66%), risk and compliance to combat threats and assaults.

Our in-depth analysis of the global market includes the following segments:

|

Component |

|

|

Enterprise Size |

|

|

Network Type |

|

|

Industry |

|

|

Deployment |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cloud Workload Protection Market Regional Analysis:

North American Market Insights

Cloud workload protection market in North America is predicted to account for the largest share of 45% by 2035 impelled by the growing number of enterprises. As a result, there is rising anxiety in the United States regarding cybersecurity dangers that can affect small organizations just as much as they can big ones, leading to a higher demand for cloud workload protection platforms.

In addition, all sizes of businesses are spending more on the cloud, driven by rising cloud usage in the region. The United States yearly expenditure on cloud services is currently approaching USD 99 billion and is increasing at a rate of more than 25% per year. Moreover, the public cloud market in the United States is expected to be the largest geographically, with projected spending of more than USD 690 billion by 2027.

European Market Insights

The Europe cloud workload protection market is estimated to be the second largest, during the forecast period led by the growing popularity of cloud computing services. Moreover, between 2021 and 2023, cloud computing adoption in Europe grew by more than 3% points (pp) fueled by growing customer demand and the SaaS segment's increasing use. For instance, more than 45% of EU businesses made cloud computing purchases in 2023.

Cloud Workload Protection Market Players:

- Symantec Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- McAfee Inc.

- Guardicore

- Sophos Ltd

- CLOUDPASSAGE

- DOME9 SECURITY INC.

- Akamai Technologies, Inc.

- Micro Incorporated

Recent Developments

- McAfee Inc. introduced MVISION Cloud Native Application Protection Platform (CNAPP) with several native Amazon Web Services (AWS) integrations to assist clients in continuously identifying and resolving software vulnerabilities and misconfigurations in their AWS environment, support numerous AWS services, and assist clients in protecting their data and apps in Infrastructure as a Service (IaaS) and Platform as a Service (PaaS) environments more simply.

- Akamai Technologies, Inc. added hybrid cloud environments to its Akamai Guardicore Segmentation to improve security. by making application activity visible and simplifying the administration of policies across several cloud providers, and by lowering attack surfaces and reducing cloud-native workload assaults.

- Report ID: 5929

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cloud Workload Protection Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.