Distributed Cloud Market Outlook:

Distributed Cloud Market size was valued at USD 4.4 billion in 2025 and is projected to reach USD 21.6 billion by the end of 2035, rising at a CAGR of 17.3% during the forecast period, i.e., 2026-2035. In 2026, the industry size of distributed cloud is assessed at USD 5.1 billion.

The market is demanded by the enterprises for distributed cloud architectures and is being shaped primarily by public sector digitalization, mandates data residency enforcement, and large-scale government cloud procurement programs. In the U.S., the public cloud spending reached USD 411 billion in 2021, according to the U.S. Department of the Treasury in March 2022. This spending is driven by the IT modernization programs, defense workloads, and civilian agencies that require geographically dispersed compute environments for latency reliance and compliance purposes. The report from the leading cloud computing company, Nutanix, in August 2024 reports that nearly 8% of government agencies have currently deployed hybrid multicloud and is expected to surge to 33% within one to three years, which depicts a five-fold increase in adoption.

In Europe, regulatory enforcement is a central growth catalyst. The European Commission and ENISA have highlighted that GDPR, the EU Data Act, and sector-specific sovereignty rules are pushing enterprises to localize data processing while maintaining centralized control frameworks. The report from Eurostat in December 2023 indicated that 42.5 % of enterprises in the EU bought cloud computing services in 2023, with public administration, healthcare, energy, and financial services showing the fastest growth in regionally constrained deployments. On the other hand, the World Bank and OECD note that government-led digital public infrastructure investments are surging, spanning identity systems, tax platforms, and healthcare registries that require distributed compute footprints across national and sub-national jurisdictions. These spending patterns are reinforcing long-term enterprise adoption of distributed cloud models to meet regulatory, operational resilience, and public-sector interoperability requirements across regulated B2B environments.

Key Distributed Cloud Market Insights Summary:

Regional Highlights:

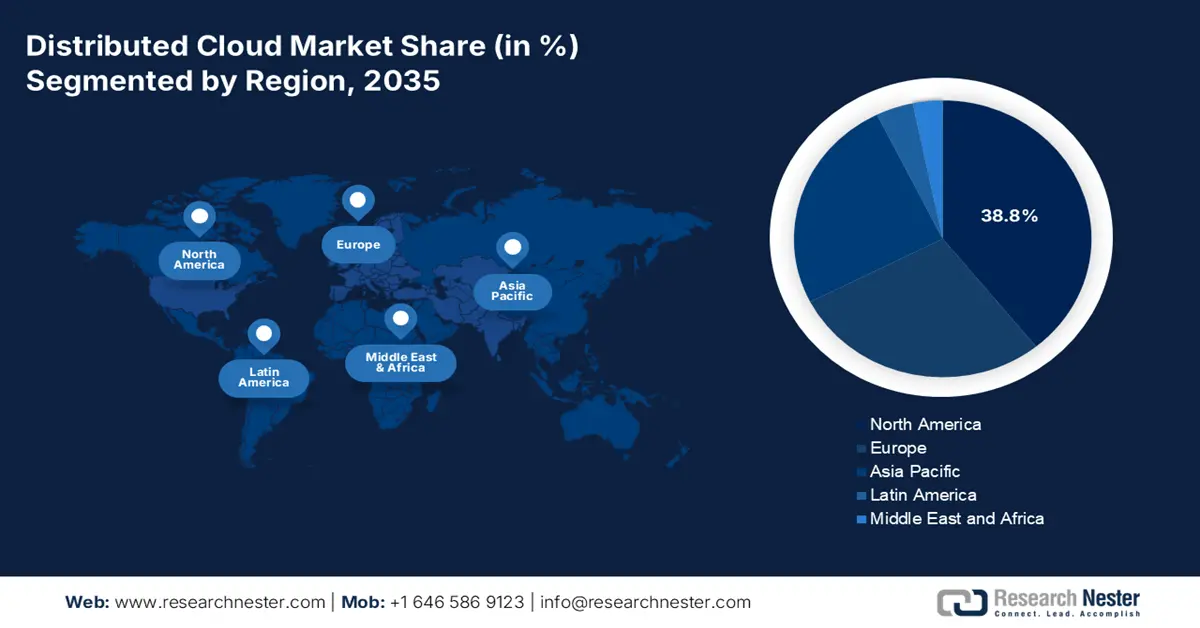

- North America in the distributed cloud market is forecast to account for the largest 38.8% share by 2035, reflecting strong hyperscaler presence and edge infrastructure investments, supported by federal cloud modernization initiatives and rising low-latency requirements across regulated industries.

- Europe is projected to witness accelerated growth by 2035, shaped by stringent digital sovereignty regulations and federated cloud frameworks, bolstered by EU Digital Decade objectives and GAIA-X–driven compliance-focused transformation.

Segment Insights:

- Enterprises (End User) in the distributed cloud market are expected to capture a dominant 75.4% share by 2035, highlighting their aggressive digital transformation agendas and capacity for complex architecture deployment, stimulated by the need for robust cybersecurity frameworks.

- Large Enterprises (Organization Size) are anticipated to maintain a commanding market position by 2035, as their global operational scale and compliance complexity necessitate distributed cloud adoption, strengthened by the rollout of zero-trust architecture strategies.

Key Growth Trends:

- Government cloud & hybrid IT modernization spending

- Defense, national security & zero trust architecture adoption

Major Challenges:

- Exorbitant initial capital expenditure

- Intense competition from hyperscale incumbents

Key Players: Amazon Web Services, Microsoft Azure, Google Cloud Platform, AVM Cloud , Macquarie Telecom, Wipro.

Global Distributed Cloud Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.4 billion

- 2026 Market Size: USD 5.1 billion

- Projected Market Size: USD 21.6 billion by 2035

- Growth Forecasts: 17.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.8% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: India, South Korea, Brazil, Canada, Australia

Last updated on : 6 January, 2026

Distributed Cloud Market - Growth Drivers and Challenges

Growth Drivers

- Government cloud & hybrid IT modernization spending: The public sector modernization programs are the single largest structural driver for the distributed cloud demand. Governments actively require geographically dispersed compute environments to modernize the legacy systems while maintaining continuity and security. The U.S. government spent USD 100 billion in 2022 on IT, and USD 12 billion went to cloud services, based on the CSIS July 2023 data, which is driven by the civilian agencies and defense programs migrating mission workloads to hybrid and distributed environments. The U.S. government has reported that federal agencies operate on a hybrid cloud infrastructure, reflecting the need to distribute workloads across central and edge locations. Similar patterns are seen in Europe, where the European Commission Digital Europe Programme allocates a significant amount to cloud data and public digital services, reinforcing distributed deployment models.

- Defense, national security & zero trust architecture adoption: Defense and national security agencies require a distributed cloud environment to support the resilience, operational continuity, and low-latency processing across the geographically dispersed sites. The U.S. Department of Defense zero trust strategy mandates decentralized data processing closer to users and operational theaters. The report from the GAO in September 2023 has noted that the Department of Defense committed about USD 3 billion for cloud computing contracts, supporting distributed and hybrid architecture. NATO and allied governments have similarly emphasized distributed digital infrastructure to reduce the single-point failure risks. The U.S. notes that the centralized architectures increase systematic risk during cyber incidents, reinforcing the shift toward the distributed deployment.

- Cybersecurity evolution and zero trust models: The shift towards the zero trust security architecture mandates for U.S. federal agencies by the Executive Order 14028 requires continuous verification of access across all network points. A distributed cloud model can enforce consistent security policies at every edge node, reducing the attack surface compared to backhauling all data to a central cloud for inspection. The National Institute of Standards and Technology Special Publication 800-207 on Zero Trust Architecture provides the framework that is pushing enterprises toward distributed security enforcement, a core function of modern distributed cloud platforms. This creates a direct procurement and architectural driver for distributed cloud services as they become the default infrastructure for implementing scalable, compliant zero-trust networks.

Challenges

- Exorbitant initial capital expenditure: Establishing a geographically distributed network of data centers, edge nodes, and interconnection points requires a massive upfront investment, often billions of dollars, creating a prohibitive barrier to entry. New entrants struggle to match the infrastructure density of incumbents. A company tackling this is Equinix, which partners with cloud providers via its Equinix Metal bare metal service, allowing them to deploy in strategic locations without building their own facilities. This capital light model is vital for all enterprise IT spending, highlighting the market shift toward service-based models over owned hardware.

- Intense competition from hyperscale incumbents: The market is dominated by AWS, Microsoft, and Google, which leverage vast economies of scale, existing customer lock-in, and integrated service portfolios. Competing on feature parity is nearly impossible. For example, top players pivoted to a hybrid and ice leadership strategy with IBM Cloud Satellite, focusing on highly regulated industries such as finance and government, where its expertise in security and sovereignty is a differentiator. Despite this, the rising cloud market is demonstrating the intense concentration that new players must overcome.

Distributed Cloud Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

17.3% |

|

Base Year Market Size (2025) |

USD 4.4 billion |

|

Forecast Year Market Size (2035) |

USD 21.6 billion |

|

Regional Scope |

|

Distributed Cloud Market Segmentation:

End user Segment Analysis

Under the end user segment, the enterprises are dominating in the market and are forecast to hold the largest share of 75.4% by 2035. This reflects enterprises' urgent need to digitally transform legacy infrastructure and their substantial capital to invest in the complex distributed architecture. A digital key driver is the mandate for robust cybersecurity frameworks. The report from the Cloud Industry Forum in 2022 has noted that 93% of businesses have indicated that cloud is important for their company’s digital transformation strategy, and 72% of businesses are considering it either very important or vital. This data shows that enterprise-wide prioritization of secure modern IT platforms, which the distributed cloud inherently provides. This robust adoption trajectory is further accelerated by the need for data sovereignty and low-latency edge computing to power real-time applications and AI inferencing across global operations.

Organization Size Segment Analysis

Within the organization size segment, large enterprises are projected to hold a dominant share in the market. These organizations possess the scale, geographic spread, and complex operational requirements that make distributed cloud, with its ability to deploy consistent services across data centers, edge locations, and public clouds, a strategic necessity rather than an option. Their adoption is fueled by initiatives such as zero-trust architecture. The report from Eurostat in December 2023 has depicted that cloud adoption is witnessing a high rate, mainly among the large enterprises, with 77.6% reported purchasing cloud services in 2023. This trend sets the distributed cloud as the foundational architecture for the large-scale digital transformation, enabling it to meet robust compliance and performance demands across diverse jurisdictions.

Enterprises Buying Cloud Services

|

Enterprises |

2021 |

2023 |

|

Small Enterprises |

37.9 |

41.7 |

|

Medium Enterprises |

53.0 |

59.0 |

|

Large Enterprises |

71.6 |

77.6 |

Source: Eurostat, December 2023

Deployment Model Segment Analysis

The deployment model segment, led by the hybrid cloud, is expected to hold the greatest share in the market. This model’s supremacy stems from its ability to balance performance, compliance, and cost efficiency by allowing workloads and data to move seamlessly among the private infrastructure and public cloud services. Its flexibility provides a strategic pathway for organizations undergoing digital transformation, allowing them to monetize incrementally without abandoning existing investments. Further, it serves as a vital enabler for meeting region-specific data residency laws while still leveraging the innovation and scale of public hyperscalers. This positions hybrid cloud not merely as a technical model but as an essential business strategy for operational resilience and competitive advantage.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Service Type |

|

|

Deployment Model |

|

|

Organization Size |

|

|

Application |

|

|

Workload |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Distributed Cloud Market - Regional Analysis

North America Market Insights

North America is dominating the market and is poised to hold the largest share of 38.8% by 2035. The market leadership is anchored in early adoption by hyperscalers, substantial private and public sector investment in edge infrastructure, and robust regulatory requirements for data security and sovereignty. The key drivers include federal cloud modernization, massive private investment in 5G and IoT ecosystems, and the demand for low latency application in healthcare finance and manufacturing. A primary trend is the integration of distributed cloud with zero-trust cybersecurity architectures mandated for U.S. federal agencies, making secure decentralized infrastructure a compliance requirement. Further significant cross-border data flow between the U.S. and Canada, governed by frameworks such as the USMCA, fuels demand for the compliant, geographically optimized cloud services across the region.

In the U.S. distributed cloud market, the push for operationalizing AI is fundamentally reshaping the distributed cloud infrastructure demand and is driven by the federal mandates for secure, low-latency computing at the edge. Announcements such as the Cisco in November 2025 depict that the new Cisco Unified Edge platform directly addresses this critical need by integrating compute networking and security closer to data sources in retail, healthcare, and factory settings. This aligns with the binding requirements of the U.S. Zero Trust architecture mandate and leverages funding from the Infrastructure Investment and Jobs Act for modernizing physical infrastructure. The U.S. trend is the convergence of compliance-funded modernization and AI, where the distributed platforms are no longer optional but the essential foundation for real-time AI inferencing and secure sovereign data processing across the enterprise edge.

Canada market is defined by the strategic public-private partnerships that prioritize data sovereignty and enhanced connectivity. A prime example is Bell Canada’s deployment of Google Distributed Cloud Edge in its network in February 2022, the world’s first implementation of core network functions on this platform. This initiative directly supports national objectives outlined in the Government of Canada’s cloud adoption strategy and aligns with the Canadian Centre for Cyber Security’s guidance on secure sovereign data processing. By integrating Google Cloud’s infrastructure directly into its network, Bell can deliver lower-latency services and keep sensitive data within national borders. This move stimulates the development of a distributed cloud ecosystem vital for serving Canada’s vast geography, supporting everything from remote healthcare to smart cities, while ensuring compliance with robust national cybersecurity and data residency requirements.

APAC Market Insights

The Asia Pacific is the fastest-growing distributed cloud market and is expected to grow at a CAGR of 22.7% during the forecast period 2026 to 2035. The market is driven by rapid digitalization, government-led digital sovereignty initiatives, and the proliferation of data-intensive applications. The primary demand stems from the national strategies such as China’s Digital China, India’s Digital India, and Japan’s Society 5.0, which all incentivize building domestic cloud and edge infrastructure. A key trend is the rise of sovereign cloud ecosystems where the governments mandate local data storage and processing, pushing global hyperscalers to partner with the local telecoms and IT firms. Further, massive investment in 5G rollout and smart city projects across South Korea, Japan, and ASEAN nations is creating a built-in demand for low-latency edge computing nodes.

India’s distributed cloud market is experiencing explosive growth and is driven by the government’s Digital India initiative and a massive, rapidly digitalizing population. The demand is underpinned by the need to support scalable public digital infrastructure, such as the Unified Payments Interface, and to bring low-latency services to a vast geography. The key statistical indicator from the Invest UP in December 2024 shows the scale of this push as over 300 government departments are now using cloud services, which indicates the rapid growth of India’s digital public infrastructure. This government-led migration creates a foundational demand that is being met by strategic partnerships, such as Reliance Jio with Microsoft Azure, to build localized data centers and edge networks ensuing data sovereignty and performance for enterprise and consumer applications alike.

The distributed cloud market in China is the largest in APAC and is fundamentally shaped by the robust data sovereignty laws under the Cybersecurity Law, Data Security Law, and Personal Information Protection Law. These regulations mandate in-country data processing, pushing both the domestic and international businesses to utilize localized cloud infrastructure. A concrete statistical mandate from the People’s Republic of China in May 2025 outlines the government’s direct investment in Digital China’s development plan, released in 2025, indicating a national goal to exceed 300 EFLOPS of computing capacity, which cannot be achieved through centralized data centers alone. It requires geographically distributed compute infrastructure spanning regional data centers, edge facilities, industrial zones, and public-sector nodes. This directly supports demand for distributed cloud architectures that can aggregate, orchestrate, and manage compute capacity across locations.

Europe Market Insights

Europe is leading the distributed cloud market and experiencing a high-growth sector fundamentally shaped by the European Union’s dual strategic imperatives of digital sovereignty and sector-specific digital transformation. Major policy initiatives such as the EU’s Digital Decade targets and the GAIA X project are creating a unified demand for secure federated cloud infrastructure that keeps data within European jurisdiction. This regulatory push, coupled with substantial public funding stimulating the adoption of hybrid and edge cloud models. The core demand is driven by the modernization of critical sectors, most notably healthcare mandates cross-border data sharing for research and care, and manufacturing, where the Industry 5.0 vision necessitates real time on premise data processing in smart factories. Further, this creates a market where compliance with regulations is a significant driver of commercial innovation, enabling the region to be the leader in the market.

Germany’s distributed cloud market is a powerhouse in Europe and is driven by its advanced industrial sector and robust regulatory environment. The primary catalyst is Industry 4.0, where manufacturing giants require real-time analytics and control at the factory edge, necessitating on-premises and hybrid cloud solutions. The demand is reinforced by the government’s national cloud and data strategy, which emphasizes digital sovereignty and secure infrastructure. A recent development is the report from the AtlasEdgein July 2025, indicating it has expanded its footprint in Germany with a new state-of-the-art data center in Stuttgart. The Stuttgart (STR001) facility adds 20 MW of power and 10,000 m² of space in a major industrial hub. Distributed cloud architectures mainly depend on the regionally distributed data centers to place the compute closer to the enterprises, factories, and regulated workloads. Facilities such as the STR001 serve as physical anchor points for distributed and hybrid cloud deployments.

Some Recent Advancement in Germany Related to Distributed Cloud

|

Company |

Launch Month/Year |

Development Details |

|

Alibaba Cloud |

May 2022 |

Third Frankfurt data center with C5 compliance, 100% green electricity, free cooling (>7,000 hours/year), supporting storage/network/database for European digital transformation. |

|

nLighten |

February 2023 |

Edge data center platform for businesses, enhancing low-latency distributed cloud in Germany. |

|

Oracle |

July 2025 |

€2 billion investment in AI/cloud infrastructure, expanding distributed capacity for workloads. |

|

Acronis |

October 2024 |

New cyber-cloud data center in Berlin for secure, distributed cloud services. |

Source: Alibaba Cloud, nLighten, Oracle, Acronis

The UK distributed cloud market is defined by its mature digital economy and a strategic post Brexit focus on becoming a global technology hub. The growth is propelled by a strong financial services sector in London, which demands low-latency secure cloud for algorithmic trading and compliance, and by the government’s plan for digital regulation, aiming to boost innovation while ensuring security. The report from the Cubbit in July 2024 has reported that the company positions itself as a geo-distributed cloud storage enabler where data and storage are spread across multiple geographic locations rather than centralized regions. This directly aligns with the market and is driven by data locality, resilience, and regulatory compliance. Furthermore, the USD 12.5 million funding round signals investor confidence in geo-distributed cloud models, indicating that demand for distributed cloud infrastructure is transitioning from pilot deployments to scalable commercial adoption across Europe.

Key Distributed Cloud Market Players:

- Amazon Web Services (AWS) (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Microsoft Azure (U.S.)

- Google Cloud Platform (GCP) (U.S.)

- IBM (U.S.)

- Alibaba Cloud (China)

- Oracle (U.S.)

- VMware (U.S.)

- SAP (Germany)

- Fujitsu (Japan)

- Atos (France)

- NEC (Japan)

- Tata Consultancy Services (TCS) (India)

- Infosys (India)

- Samsung SDS (South Korea)

- OVHcloud (France)

- Deutsche Telekom (Germany)

- Wipro (India)

- KT (South Korea)

- Macquarie Telecom (Australia)

- AVM Cloud (Malaysia)

- Amazon Web Services is a dominant player in the distributed cloud market, aggressively extending its infrastructure to the edge with services such as AWS Outposts and Local Zones. This strategy allows healthcare providers to process sensitive patient data locally for low-latency analysis while seamlessly connecting to AWS’s central cloud for AI-driven analytics and storage, enabling scalable remote monitoring solutions.

- Microsoft Azure has strategically positioned itself in the distributed cloud market with its Azure Arc and edge computing portfolio. This allows for the management of data and applications across on premises multi cloud and edge environments from a single control plane. For medical device companies this facility build compliant hybrid architectures that keep real-time data processing at the edge while leveraging cloud services. According to the annual report 2024, the company has indicated that it has expanded cloud and AI services across five continents.

- Google Cloud Platform leverages its expertise in data analytics and AI to compete in the distributed cloud market via Google Distributed Cloud Edge. This initiative enables the deployment of Google’s data and AI services directly to carrier networks and enterprise locations, providing the computational power needed for real time analysis of continuous health telemetry streams at their source before aggregating insights.

- IBM is a key player in the regulated sectors of the distributed cloud market, focusing on hybrid cloud and edge solutions with IBM Cloud Satellite. This service allows clients to deploy consistent cloud services anywhere in their own data center at the edge or in other clouds. This is vital for healthcare organizations requiring robust data sovereignty and security for patient monitoring platforms across disparate geographical locations. In 2024, the company has generated a revenue of USD 62.8 billion with a USD 12.7 billion cash flow.

- Alibaba Cloud is expanding its global footprint in the distributed cloud market with solutions such as Alibaba Edge Node Services. By deploying cloud resources at the edge within the telecommunications networks, they enable low-latency data processing essential for real-time applications. This supports advancements in remote patient monitoring by allowing immediate data filtering and alerting at local points of presence across the Asia Pacific region and beyond.

Here is a list of key players operating in the global market:

The distributed cloud market is fiercely competitive and is dominated by hyperscalers such as AWS, Microsoft, and Google, which leverage vast infrastructure to integrate distributed nodes with their core platforms. Strategic initiatives universally focus on partnerships with telecoms for edge locations, hybrid cloud management tools, and industry-specific solutions. The players from Europe and Asia often emphasize data sovereignty and regional compliance. The key strategies include acquisition of edge and AI startups, open source collaboration, and developing seamless application portability across central edge and sovereign clouds to reduce the latency and meet the regulatory demands, making interoperability a critical battleground. For example, in December 2025, Akamai Technologies announced the acquisition of Fermyon, a function-as-a-service company, to offer lower costs and improved performance compared to traditional cloud-native apps.

Corporate Landscape of the Distributed Cloud Market:

Recent Developments

- In December 2025, Akamai launches a program to stimulate the cloud growth for independent software vendors. This new referral-based program offers ISVs path to growth on akamai's globally distributed cloud platform.

- In September 2025, Cubbit and HERABIT announced the launch of geo-distributed cloud storage for businesses. This strategic agreement will offer customers a data storage system on local nodes, ensuring security, independence, high efficiency, competitive costs, and low environmental impact.

- In September 2024, Oracle has expanded its distributed cloud capabilities to help organizations innovate with AI. Some latest innovations include Oracle Database@AWS, Oracle Database@Azure, Oracle Database@Google Cloud, OCI Dedicated Region, OCI Supercluster, and OCI Roving Edge Infrastructure.

- Report ID: 3959

- Published Date: Jan 06, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Distributed Cloud Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.