Platform as a Service Market Outlook:

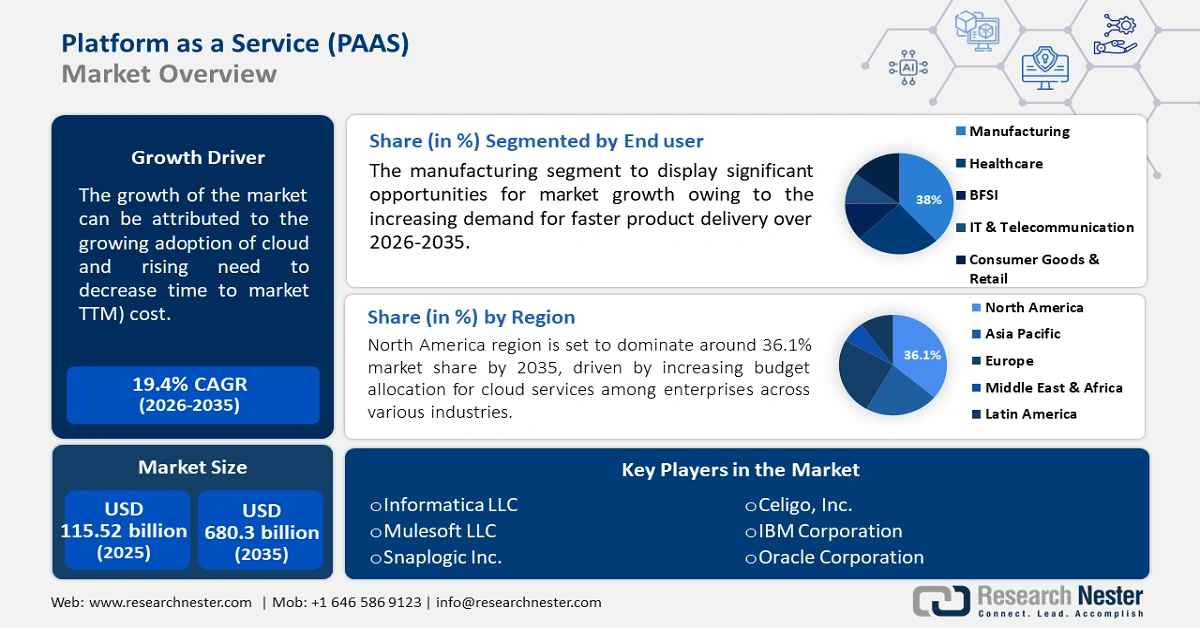

Platform as a Service Market size was valued at USD 115.52 billion in 2025 and is expected to reach USD 680.3 billion by 2035, registering around 19.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of platform as a service is assessed at USD 135.69 billion.

The market growth is driven by growing adoption of cloud and rising need to decrease time to market (TTM) cost. It is calculated that more than 93% of the total enterprises in the world already use cloud services. About 30% of all IT budgets are allocated for cloud computing.

In addition, the market revenue is propelled by rising use of PaaS to simplify utility improvement management, deployment, and scaling, thereby facilitating better developer productiveness and innovation, which in turn is projected to drive market growth. Moreover, PaaS offers a self-serviceable, bendy and agile application version, which allows easy import of compiled code in J2EE and.NET framework and immediate deployment of constructed programs. Furthermore, PaaS is able to provide less cost of application development and lower TTM that help in adjusting the approach to software product development, avoid development wastes, and ensure good cooperation.

Key Platform as a Service (PaaS) Market Insights Summary:

Regional Highlights:

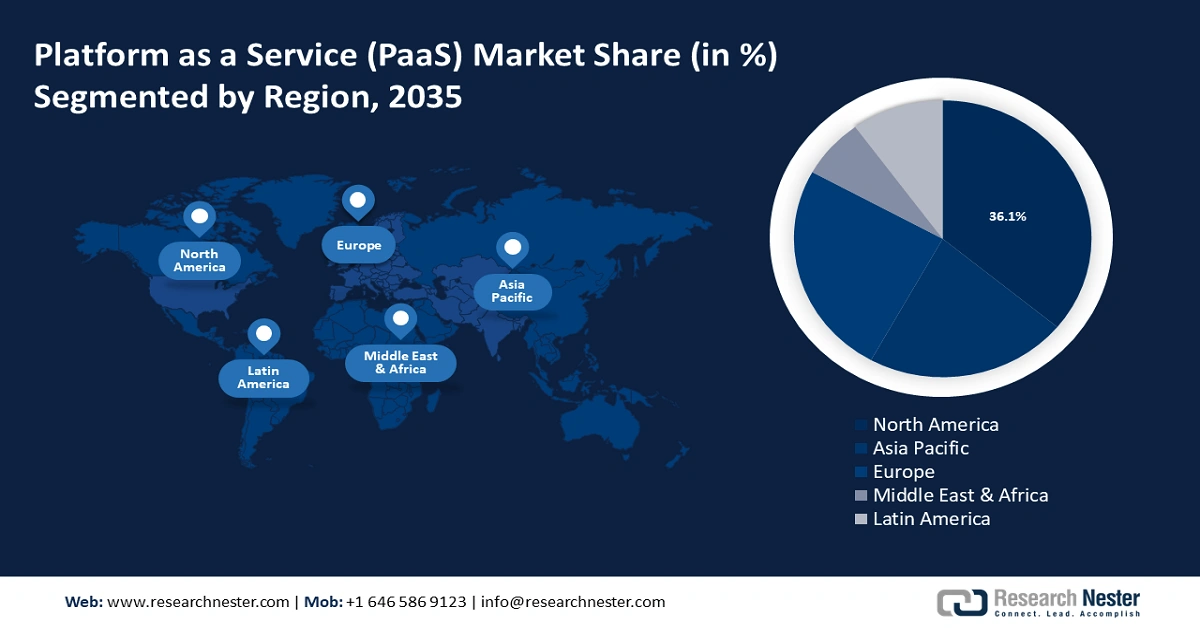

- North America PaaS market will dominate over 36.1% share by 2035, driven by increasing budget allocation for cloud services among enterprises across various industries.

- Asia Pacific market projects massive growth during the forecast timeline, driven by rise in the number of enterprises and growing digital transformation boosting market growth.

Segment Insights:

- The manufacturing segment in the platform as a service market is projected to hold a dominant share by 2035, fueled by growing demand for faster product delivery and increased e-commerce activity.

- The application paas segment in the platform as a service market is expected to hold a significant share from 2026-2035, fueled by benefits like reduced coding time and global adoption in government organizations.

Key Growth Trends:

- Growing Adoption of Cloud Services

- Rising Penetration of Digitization

Major Challenges:

- Privacy issues associated with the public cloud

- Low awareness among SMEs about the platform as a service (PaaS)

Key Players: Boomi, Inc., Informatica LLC, Mulesoft LLC, Snaplogic Inc., Celigo, Inc., IBM Corporation, Oracle Corporation, Jitterbit, Inc., TIBCO Software Inc., Flowgear, SAP Group.

Global Platform as a Service (PaaS) Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 115.52 billion

- 2026 Market Size: USD 135.69 billion

- Projected Market Size: USD 680.3 billion by 2035

- Growth Forecasts: 19.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, India

- Emerging Countries: China, India, Japan, Singapore, Brazil

Last updated on : 8 September, 2025

Platform as a Service Market Growth Drivers and Challenges:

Growth Drivers

-

Growing Adoption of Cloud Services – PaaS offers a foundation on which developers may construct or modify cloud-based applications. Almost 44% of all applications are still installed locally, and roughly 95% of businesses plan to expand their cloud investment over the next 12 months.

-

Rising Penetration of Digitization – PaaS may have the biggest influence on how successfully businesses' digital changes turn out. A digital-first firm strategy has been embraced by 55% of startups, but 90% of all businesses have already implemented digitization in their organizations

-

Rise in the Number of New Enterprises – Higher new enterprises are expected to drive the demand for the platform as a service. Almost 300 million people worldwide are attempting to launch nearly 150 million enterprises. It is anticipated that around 50 million new firms are to be started annually since approximately one-third will be started. or roughly 137,000 each day.

-

Need to Reduce Time to Market – PaaS has the potential to reduce the product deployment time by reducing the time on coding, by increasing the scalability, and offering cost-effective and faster deployment of products and services. Around 71% of the sampled goods underwent the concept-to-launch process in around two years. Moreover, in energy products and services, the lowest TTM is around 7 years, however, for some products or services it can reach up to 20 years.

-

Rise of Internet of Things (IoT) Connected Devices – IoT PaaS platforms give users greater autonomy over their systems connected to the Internet of Things (IoT) and freedom from being tied to a single software platform. In 2021, there were around 12 billion, connected devices an approximately 8% increase in the total number of IoT connections. Also, it is anticipated that nearly 27 billion gadgets would link to the Internet of Things.

Challenges

- Privacy issues associated with the public cloud- Due to the possibility of data being exposed in an unencrypted form on a computer owned and maintained by a company other than the data owner. Moreover, there is a chance that information processed or stored on the cloud will be used improperly. Public cloud services provide an inherent risk to data privacy.

- Low awareness among SMEs about the platform as a service (PaaS)

- Rising Risk of Cloud Washing

Platform as a Service Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

19.4% |

|

Base Year Market Size (2025) |

USD 115.52 billion |

|

Forecast Year Market Size (2035) |

USD 680.3 billion |

|

Regional Scope |

|

Platform as a Service Market Segmentation:

End-user Segment Analysis

The manufacturing segment is predicted to dominate the market share by 2035. The segment growth can be attributed to increasing demand for faster product delivery and heightened production in the manufacturing industry. Owing to the rising e-commerce the demand of the products is constantly increasing, along with this need of the manufacturing industry to reduce time to market duration. According to projections in a UNCTAD report, the share of online retail sales in total retail sales rose from 16% to 19% in 2020 as a result of the sharp increase in e-commerce combined with the movement restrictions brought on by COVID-19. Moreover, with the rise in The greatest share was reported by the Republic of Korea in 2020, at 25.9%, up from 20.8% the previous year.

Type Segment Analysis

The application PaaS (APaaS) segment is set to hold significant market share by 2035. The segment growth is due to increasing adoption of APaaS applications among various government organizations across the world. Moreover, the benefits of APaaS such as reduced coding time, added development capabilities without involving more staff, accessibility to support tools, support for geographically circulated teams, and efficient administration of application development lifecycle will boost the segment growth.

Our in-depth analysis of the global market includes the following segments:

|

By Type |

|

|

By Vertical |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Platform as a Service Market Regional Analysis:

North American Market Insights

North America region is set to dominate around 36.1% market share by 2035. The market growth is propelled by increasing budget allocation for cloud services among enterprises among different industries including, telecommunication, BFSI, IT, and government and public sectors. In 2019, more than 85% of the cloud experts in the United States stated that cloud is anticipated to revolutionize the banking sector in the country by the end of 2021 by lowering the overall bank costs. Moreover, around 94% of American businesses use at least one cloud, such as public cloud, private cloud, and hybrid, with hybrid being the most common option.

APAC Market Insights

The Asia Pacific platform as a service (PaaS) market is set to observe massive growth till 2035, on account of rise in the number of enterprises in the region and increasing use of cloud services. Over 15,000 new business of business service industry was registered in 2022. The sector surpassed all the sector, moreover, manufacturing sector came in second over the examined time period, with over 3000 businesses.

Furthermore, growing digital transformation will boost the market growth. According to the International Trade Administration, the use of cloud services by both central and local government offices is encouraged by the Government of Japan's Digital Agency. For instance, Digital Agency declared in October 2022 that agencies under the Government of Japan will use "Government Cloud" services throughout the fiscal year.

Platform as a Service Market Players:

- Boomi, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Informatica LLC

- Mulesoft LLC

- Snaplogic Inc.

- Celigo, Inc.

- IBM Corporation

- Oracle Corporation

- Jitterbit, Inc.

- TIBCO Software Inc.

- Flowgear

- SAP Group

Recent Developments

-

January, 2021: Microsoft announced the introduction of Wisely, which is the newest addition in the company’s blockchain-enabled CPaaS offerings for enterprises, OTT players, mobile carriers, marketers, and industry regulators to advance their quality of service.

-

September, 2020: Oracle announced the expansion of its security portfolio with new cloud services designed to automatically help data from the risks posed by cyber threats and protect cloud workloads. The three new cloud services, including Oracle cloud guard, Oracle data safe, and Oracle maximum security zones, offer centralized security configuration and automated enforcement of security practices.

- Report ID: 3244

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Platform as a Service (PaaS) Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.