Circuit Breaker Market Outlook:

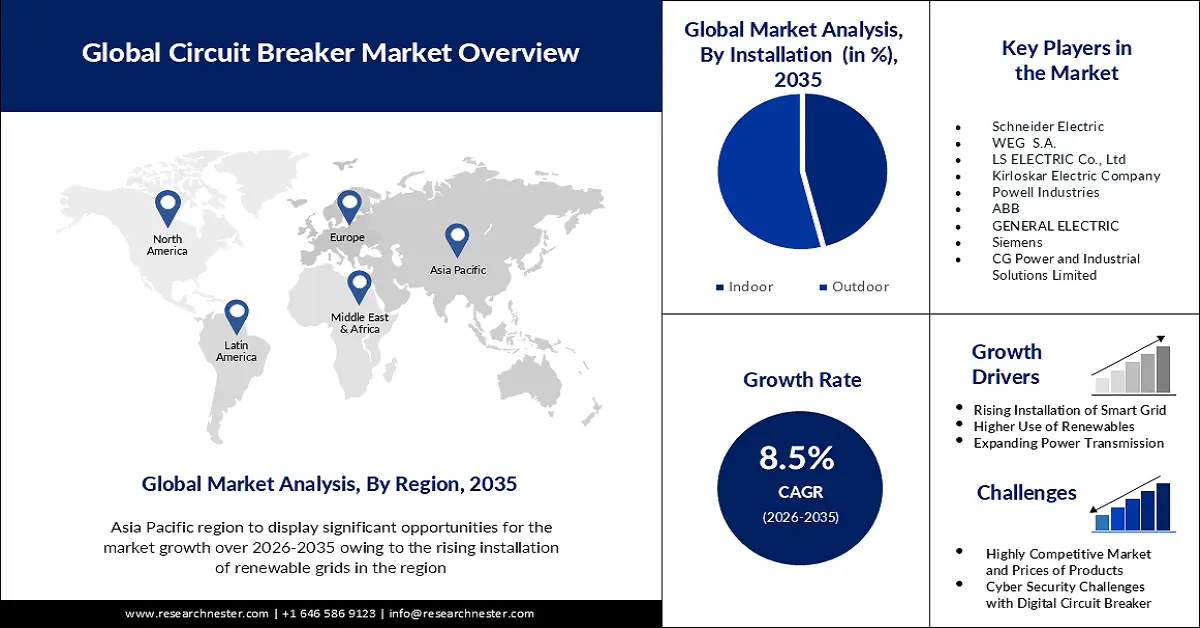

Circuit Breaker Market size was over USD 24.4 billion in 2025 and is poised to exceed USD 55.17 billion by 2035, growing at over 8.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of circuit breaker is estimated at USD 26.27 billion.

The growth of the market can be attributed to the growing investment in power generation. Power infrastructure must be expanded and upgraded when governments invest in power-producing projects. This includes the installation of more reliable circuit breakers for reliable power generation and supply. According to the International Energy Agency, investment in the power sector increased by 8% to USD 2.4 trillion in 2022. The majority of the investment is done in energy-efficient technologies.

Besides this, the factor that is also responsible for the market growth of circuit breakers is the growing age of grid infrastructure. As grid infrastructure ages, it necessitates more frequent upkeep and repairs. Circuit breakers are vital parts for preventing electrical faults and overloads on the grid. Upgrading or replacing aging circuit breakers can assist minimize the frequency of repairs and maintenance. The majority of electric transmission and distribution lines were built in the 1950s and 1960s with a 50-year average lifespan, currently, many of these lines are deteriorating or expired.

Key Circuit Breaker Market Insights Summary:

Regional Highlights:

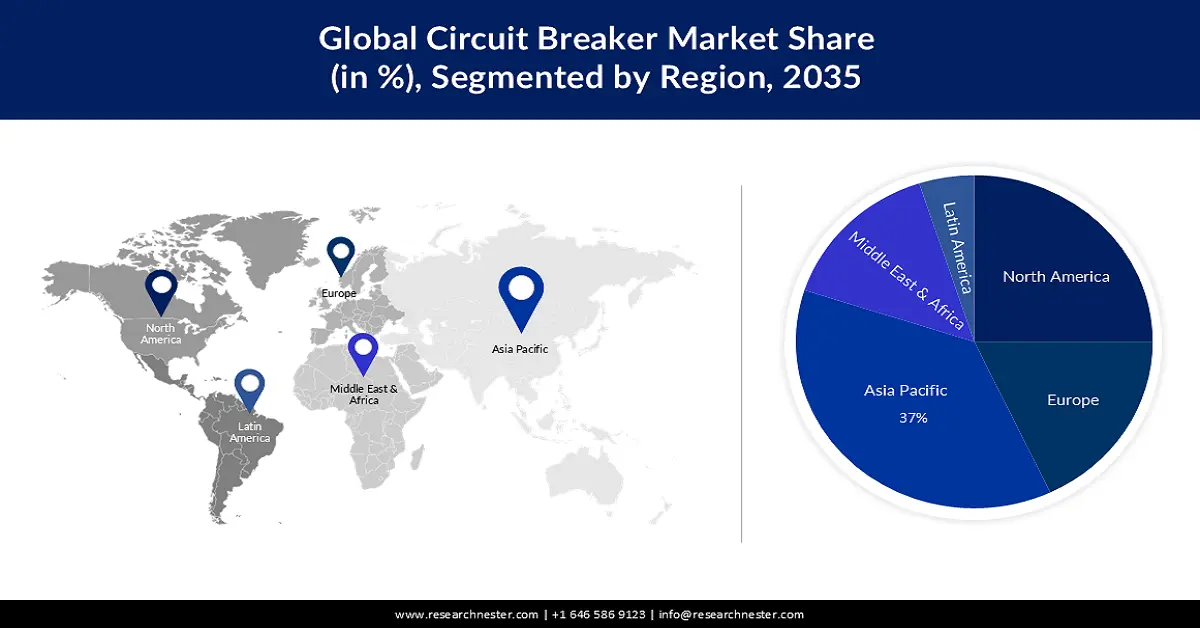

- The Asia Pacific circuit breaker market is projected to achieve a 37% share by 2035, fueled by growing infrastructural development and transmission line redevelopment.

- The North America market is expected to capture a 25% share by 2035, driven by industrial sector expansion, including manufacturing and energy.

Segment Insights:

- The outdoor segment in the circuit breaker market is projected to secure a 46% share by 2035, fueled by the increasing installation of wind and solar plants requiring safe isolation in power systems.

- The gas segment in the circuit breaker market is projected to hold a 38% share by 2035, driven by rising investment in green energy and suitability for high-voltage renewable systems.

Key Growth Trends:

- Rising Use of Renewables for Electricity

- Increasing Transmission & Distribution Networks

Major Challenges:

- Pressure of Cost and Prices

- Fast Expiry of Old Circuit Breaker

Key Players: Eaton, Schneider Electric, WEG S.A., LS ELECTRIC Co., Ltd, Kirloskar Electric Company, Powell Industries, ABB, GENERAL ELECTRIC, Siemens, CG Power and Industrial Solutions Limited, Mitsubishi Electric Corporation.

Global Circuit Breaker Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 24.4 billion

- 2026 Market Size: USD 26.27 billion

- Projected Market Size: USD 55.17 billion by 2035

- Growth Forecasts: 8.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (37% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 11 September, 2025

Circuit Breaker Market Growth Drivers and Challenges:

Growth Drivers

- Rising Use of Renewables for Electricity– The growing use of renewable energy sources. Circuit breakers are essential in controlling the supply and flow of electricity from renewable sources to the grid. Over the years 2022-2027, global renewable power capacity is predicted to increase by 2 400 gigatonnes (GW). Moreover, by 2025, around 35% of global power generation will be met by renewable sources

- Increasing Transmission & Distribution Networks– To distribute electricity to consumers, transmission and distribution networks must be expanded. This growth necessitates the construction of new substations, power lines, and distribution infrastructure, all of which necessitate the use of circuit breakers for protection and control. Electricity networks are the foundation of secure and dependable power systems, with about 80 million km of transmission and distribution lines in place worldwide today.

- Rising Importance of Smart Grid Technology– Circuit breakers are used in a variety of ways in smart grid network to improve grid performance, reliability, and efficiency. Circuit breakers outfitted with modern sensors and communication capabilities are enabled by the smart grid. To achieve Net Zero Emissions, globally, by 2050, investment in smart grids must more than triple by 2030.

Challenges

- Pressure of Cost and Prices – Enormous rivalry in the circuit breaker industry has resulted in pricing constraints, with companies frequently faced with the difficulty of balancing quality and features while maintaining reasonable prices.

- Fast Expiry of Old Circuit Breaker

- Security Caused by Digital Integration

Circuit Breaker Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.5% |

|

Base Year Market Size (2025) |

USD 24.4 billion |

|

Forecast Year Market Size (2035) |

USD 55.17 billion |

|

Regional Scope |

|

Circuit Breaker Market Segmentation:

Insulation Type Segment Analysis

The gas segment is projected to held 38% share of the global circuit breaker market in 2035. The growth of the segment can be attributed to the rising investment in green energy. According to the International Energy Agency, meeting long-term sustainability targets may necessitate a 50% increase in global grid spending over the next decade. Moreover, renewables lead to new power generation investment, accounting for 70% of the USD 530 billion invested in all new generation capacity in 2021. In renewable energy applications, particularly in high-voltage systems, gas-insulated circuit breakers are often employed. The distinct advantages, such as improved high-voltage handling and efficient protection against short circuits and overloads make them suitable for application in renewable grids.

Installation Segment Analysis

In the year 2035, the outdoor segment in the circuit breaker market is predicted to have a large proportion of roughly 46%. The rising installation of wind and solar plants is expected to drive the growth of the segment. Global solar PV capacity addition investments climbed by more than 20% in 2022, exceeding USD 320 billion. Moreover, in 2022, 93% of the entire 900 GW of built wind capacity was in onshore systems, with the remaining 7% in offshore wind farms. Outdoor circuit breakers are used to isolate specific components of solar or wind power plants from the rest of the system. This enables safe maintenance, repairs, and troubleshooting without disrupting the entire operation.

Our in-depth analysis of the global market includes the following segments:

|

Installation |

|

|

Insulation Type |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Circuit Breaker Market Regional Analysis:

APAC Market Insights

Circuit breaker market share in Asia Pacific is predicted to be the greatest among all other regions, with a share of approximately 37% by the end of 2035. The growth of the market can be attributed majorly to the growing infrastructural development which will increase the demand for various circuit breakers. As of May 2023, in China, there were around 40,000 tens of thousand square meters of housing, which further increases to nearly 50,000 tens of thousands of square meters in June 2023. Furthermore, growing initiatives for the redevelopment of transmission lines. The Indian government announced a plan worth USD 29 billion to connect renewable energy by building transmission lines by 2030.

North American Market Insights

The circuit breaker market in North America is expected to be the second largest, with a share of around 25% by the end of 2035. The growth of the market can be attributed majorly to the industrial growth in the region. The region's industrial sector, which includes manufacturing, oil and gas, mining, and other industries, demands reliable electrical distribution and protection solutions. In 2022, overall petroleum output in the United States was estimated to be at 19.988 million barrels per day (b/d), with crude oil accounting for 11.883 million b/d and the rest being hydrocarbon gas liquids.

Circuit Breaker Market Players:

- Eaton

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Schneider Electric

- WEG S.A.

- LS ELECTRIC Co., Ltd

- Kirloskar Electric Company

- Powell Industries

- ABB

- GENERAL ELECTRIC

- Siemens

- CG Power and Industrial Solutions Limited

- Mitsubishi Electric Corporation

Recent Developments

- Eaton announced the acquisition of 50% stake of Jiangsu huineng Electric Co., Ltd., a China-based low-voltage circuit breaker manufacturer. This acquisition will benefit the global distribution channels in various segment, such as grid modernization, commercial and industrial buildings, and renewable energy.

- ABB India has announced the launch of Formula DIN-Rail, it is a complete range of circuit breakers for retail market, including Residual Current Circuit Breakers (RCCBs), Miniuatre Circuit Breakers (MCB), and Isolators

- Report ID: 5125

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Circuit Breaker Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.