Green Energy Market Outlook:

Green Energy Market size was valued at USD 195.12 billion in 2025 and is expected to reach USD 529.57 billion by 2035, registering around 10.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of green energy is assessed at USD 213.56 billion.

The market growth can primarily be ascribed to global shift from non-renewable sources of energy, such as coal and petroleum, to renewable energy. According to the data from the International Energy Agency (IEA), the annual renewable capacity additions increased by 45% in 2020, which accounted for almost 280 GW.

Green energy is important as it aids in mitigating the negative consequences of fossil-fuel-generated energy. Since green energy is a clean source of energy, it emits no greenhouse gases, protecting the environment while producing efficient and desired results. Moreover, green energy has been a replacement for the energy generated from burning fossil fuels. Furthermore, there has been an increase in greenhouse gas emissions from the industry sector. Hence, the rapid growth of industrialization is set to fuel the global green energy market revenue. Nearly 24 percent of the greenhouse emission in the year 2020 came from the industry sector in the United States.

Key Green Energy Market Insights Summary:

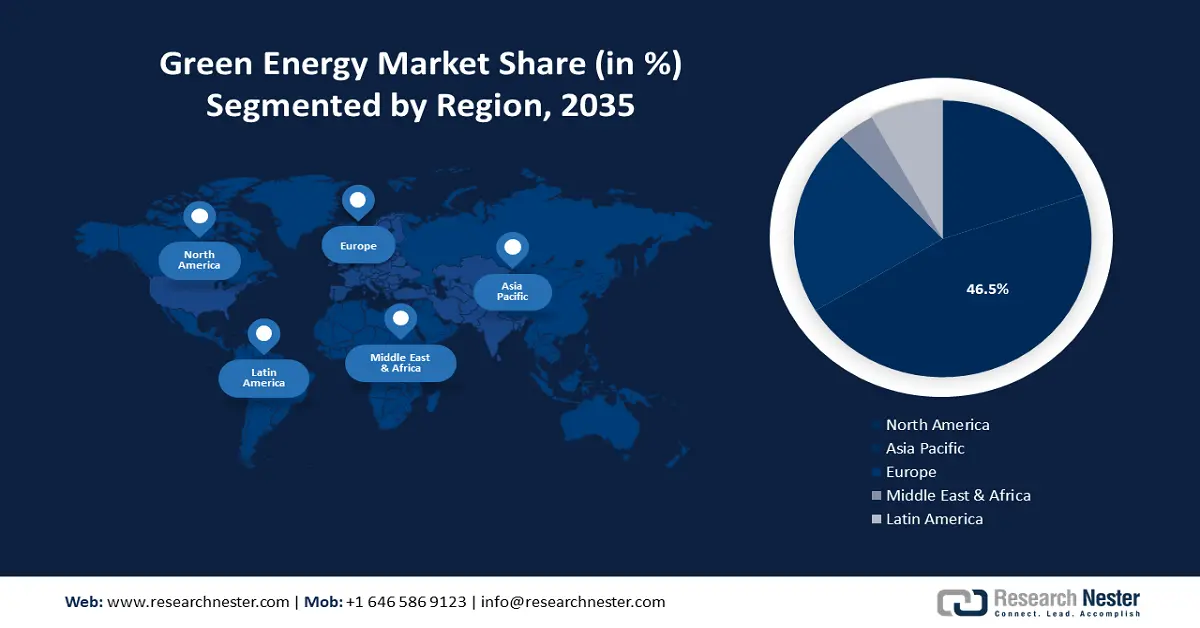

Regional Highlights:

- Asia Pacific green energy market will hold around 46.5% share by 2035, fueled by high solar and hydro energy adoption in countries like China and India.

Segment Insights:

- The commercial segment in the green energy market is projected to secure the highest market share by 2035, attributed to rising demand for clean energy and environmental policy shifts in commercial sectors.

- The hydro energy segment in the green energy market is set for noteworthy growth during 2026-2035, fueled by the rapid construction of hydropower plants and their sector-wide utility.

Key Growth Trends:

- Growing Awareness Among People to Use Green Energy for Electricity

- Rising Government Initiatives to Promote Green Energy

Major Challenges:

- Growing Awareness Among People to Use Green Energy for Electricity

- Rising Government Initiatives to Promote Green Energy

Key Players: Siemens AG, DuPont de Nemours, Inc., Envision Group, The Dow Chemical Company, Enel X (Enel Spa), Adwen GmbH, Suzlon Energy Limited, Ming Yang Smart Energy Group Ltd, Cybrid Technologies Inc., GE Group.

Global Green Energy Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 195.12 billion

- 2026 Market Size: USD 213.56 billion

- Projected Market Size: USD 529.57 billion by 2035

- Growth Forecasts: 10.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (46.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 8 September, 2025

Green Energy Market Growth Drivers and Challenges:

Growth Drivers

-

Growing Awareness Among People to Use Green Energy for Electricity - The residential sector is the main user of electricity across the globe. Therefore, there is a need to raise awareness among them to use green energy for consumption rather than relying on fossil fuels. Hence, it is expected to drive the growth of the global green energy market. According to the United States Environmental Protection Agency, approximately, 60 percent of the electricity in the United States comes from fossil fuels burning, such as natural gas, and coal.

-

Rising Government Initiatives to Promote Green Energy - As per the India Brand Equity Foundation, the Union budget 2022-2023 allocated USD 2.57 billion to drive the manufacturing of high-efficiency solar modules for the government.

-

Increasing Need for the Reduction of Greenhouse Gas Emissions - Energy-related carbon dioxide emission has increased by 6 percent in the year 2021 across the globe accounting for 36.3 billion tonnes.

-

Rising Adoption of Electric Vehicles - As per the data reported by International Energy Agency, total electric vehicle sales accounted to reach 6.6 million in the year 2021 across the globe.

-

Surging rate of Urbanization - As per the data stated by the United Nations, approximately 68 percent of the global population would live in urban areas by 2050.

Challenges

-

Developing New Green Energy Sources Requires High Initial Investment – Infrastructure development for the development of new resources demands significant upfront investments. The cost of producing power rises as a result of these investments, particularly in the early years. The first step for the developers is to identify places that are acceptable to the general public, have good resources, and have access to transmission lines. Locating a potential solar location involves several years of monitoring to determine if they are acceptable or not. The workers also need to receive training on how to install, use, and maintain the new technologies. Before the performance may be optimized, some require operational knowledge under specific climatic conditions. Throughout the projected period, this issue is estimated to impede the market's expansion for green energy.

- Irregular Changes in Climate Conditions for Green Energy

- Lack of Workers for the Installation, Operation, and Maintenance of New Technologies

Green Energy Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.5% |

|

Base Year Market Size (2025) |

USD 195.12 billion |

|

Forecast Year Market Size (2035) |

USD 529.57 billion |

|

Regional Scope |

|

Green Energy Market Segmentation:

Type Segment Analysis

The hydro energy segment is projected to witness noteworthy growth over the forecast period. The segment growth is impelled by rapid construction of hydropower plants, and their wide application across sectors. Moreover, hydropower is the pillar of low-carbon electricity generation, supplying nearly half of it globally today. Hydropower contributes 55% more than nuclear and more than all other renewables combined, including wind, solar PV, bioenergy, and geothermal. According to the data from the IEA, the total global hydropower capacity was valued at 1308 GW in 2020.

Application Segment Analysis

The commercial segment is anticipated to garner highest revenue by the end of 2035, attributed to growing demand for energy by this sector. Further, majority of companies are investing more on renewable energy owing to various environmental concern. Energy use is intimately related to climate change. The ecology is harmed by fossil fuels, and their prices are unstable. Hence, the environment could be preserved by substituting clean energy sources for fossil fuels. Also, government has launched various policies, making use of renewable energy stringent for commercial sector.

Our in-depth analysis of the global market includes the following segments:

|

By Application |

|

|

By Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Green Energy Market Regional Analysis:

APAC Market Insights

Asia Pacific region is expected to account for more than 46.5% market share by 2035. The market growth can be ascribed to highest utilization and adoption of solar and hydro energy in the region, along with high adoption of green energy in major countries such as China, India, and Japan. Solar power production in China increased from 39 TWh in 2015 to 260 TWh in 2020, while the total hydropower generated in 2019 crossed 1,302.00 TWh.

North American Market Insights

The market in North America is also anticipated to grow substantially over the forecast period, backed by growing awareness regarding growing pollution and its adverse effect on the environment. Moreover, government are initiating various strategies in order to increase the adoption of green energy in this region. They are also investing in green energy.

Green Energy Market Players:

- Siemens AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- DuPont de Nemours, Inc.

- Envision Group

- The Dow Chemical Company

- Enel X (Enel Spa)

- Adwen GmbH

- Suzlon Energy Limited

- Ming Yang Smart Energy Group Ltd

- Cybrid Technologies Inc.

- GE Group

Recent Developments

-

Siemens Gamesa Renewable Energy (Siemens AG) to supply wind turbines for three 1,044 MW wind power projects in Hai Long in Taiwan.

-

November 2022: Enel X (Enel Spa) announced a collaboration with Cogenio to install photovoltaic systems in 2 Marchesi Antinori wine cellars

- Report ID: 3366

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Green Energy Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.