Printed Circuit Board Market Outlook:

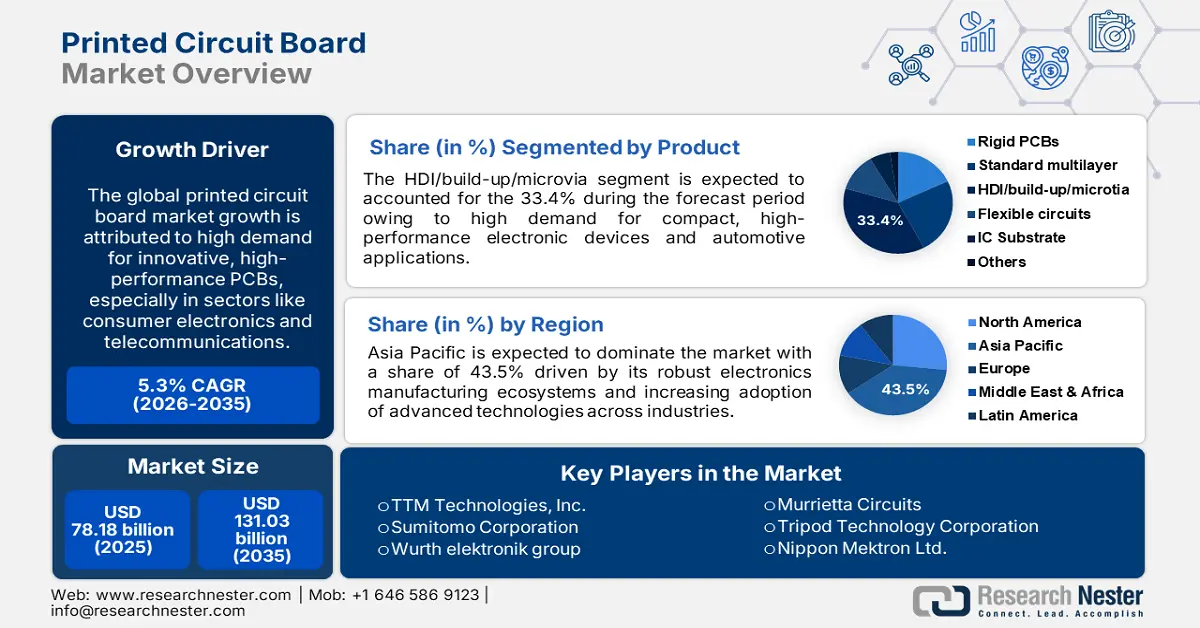

Printed Circuit Board Market size was valued at USD 78.18 billion in 2025 and is likely to cross USD 131.03 billion by 2035, registering more than 5.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of printed circuit board is assessed at USD 81.91 billion.

The steep growth trajectory is modulated by the increasing adoption of advanced electronics with IoT across industries such as automotive and consumer electronics. One of the major factors boosting PCB market growth is the rapid technological development underway in the processes for manufacturing printed circuit boards (PCBs).

The increased use of complex, multilayer PCBs with increased circuit densities is enabling manufacturers to produce compact and more powerful electronic devices. This shift can be observed in smartphones and wearable technologies where demand is rising for miniaturized yet high-functioning components. Furthermore, the increasing integration of IoT devices and implementation of 5G networks present huge opportunities for PCB manufacturers since these technologies require sophisticated circuit boards in support of advanced functionalities.

Many manufacturers in the PCB market are heavily investing in R&D activities to cater to the rising demand for smart, compact PCBs. For instance, in November 2023, TTM Technologies, Inc., announced an intended investment of up to USD 130 million in a new manufacturing plant located in the Town of Dewitt, New York. Similar investments support market growth, enabling manufacturers to produce smaller, more efficient, and more reliable PCB components.

Key Printed Circuit Board Market Insights Summary:

Regional Highlights:

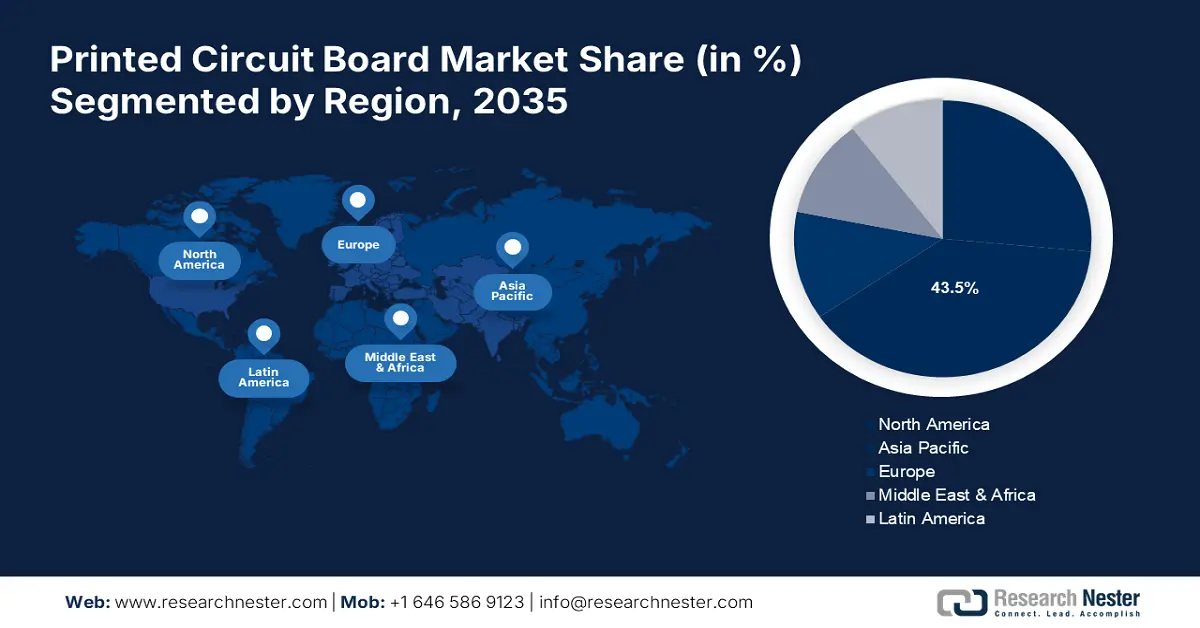

- The Asia Pacific printed circuit board market is anticipated to capture 43% share by 2035, driven by a strong manufacturing base and growing demand for consumer electronics.

Segment Insights:

- The rigid segment in the printed circuit board market is anticipated to secure an 80% share by 2035, driven by the widespread use of rigid PCBs across automotive, industrial equipment, and telecommunications.

- The hdi/build-up/microvia segment in the printed circuit board market is anticipated to experience significant growth till 2035, driven by the rising demand for compact, high-performance electronic devices and increased requirements for higher circuit density in smartphones and wearables.

Key Growth Trends:

- Advanced automotive electronics drive PCB innovation

- 5G infrastructure expansion to foster demand for high-performance PCBs

Major Challenges:

- Raw material price volatility

- Environmental regulations resulting in costly manufacturing adaptations

Key Players: TTM Technologies, Inc., Sumitomo Corporation, Wurth Elektronik Group (Wurth Group), Becker & Muller Schaltungsdruck GmbH, Advanced Circuits Inc., and Murrietta Circuits are some prominent companies.

Global Printed Circuit Board Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 78.18 billion

- 2026 Market Size: USD 81.91 billion

- Projected Market Size: USD 131.03 billion by 2035

- Growth Forecasts: 5.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (43% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, South Korea, Taiwan

- Emerging Countries: China, Japan, South Korea, India, Taiwan

Last updated on : 17 September, 2025

Printed Circuit Board Market Growth Drivers and Challenges:

Growth Drivers:

- Advanced automotive electronics drive PCB innovation- Over the years, the rising sales of electric vehicles have resulted in a high demand for printed circuit boards (PCB) market. As automotive manufacturers profoundly increase their focus toward electrification, so does the requirement for sophisticated PCBs that control and manage power distribution, advanced infotainment systems, and battery management systems. With governments around the world putting more rigorous emission regulations into effect, this trend is only expected to increase. The drive of these regulations is for innovative solutions like advanced PCBs that help in achieving efficiency and environmental friendliness in different industries.

- 5G infrastructure expansion to foster demand for high-performance PCBs- Essentially intended for the installation of the 5G network are high-frequency and high-speed PCBs characterized by higher data transmission rates and lower latency. The demand is not influenced singularly by telecommunication equipment but rather spans any device designed to empower the capabilities of 5G. This goes beyond just smartphones to include IoT devices and edge computing hardware. This growth has resulted in a huge demand for PCB production and innovation.

For instance, AT&S announced in July 2023 that it is expanding PCB manufacturing facilities. This expansion is likely to boost the production of such specialized PCBs by AT&S by 50% while at the same time creating approximately 700 new jobs by the year 2026. This investment specifically targets the growing requirement for high-frequency, fast PCB technology used in 5G infrastructure and advanced applications.

- Industrial IoT proliferation fueling PCB market growth- There has been a significant increase in demand for powerful PCBs that are equipped with sensors as manufacturing plants and their associated industrial processes go digital. The quest for highly reliable and efficient PCBs necessitates advanced monitoring and control systems during the transition to digitization. For example, in July 2024, PCBWay, announced a free upgrade in the material for its multilayer PCBs, which can increase product quality and performance significantly. This can essentially help IIoT-based industries where high-quality and reliable PCBs are required to achieve efficient performance and connectivity.

Challenges:

- Raw material price volatility - The Printed Circuit Board (PCB) Market is influenced by the significant changes in prices of raw materials like copper. Volatility in copper prices may result in more costly production and disruptions in supply chains, eventually affecting the overall stability and price dynamics within the PCB sector. This challenge turns into a roadblock for manufacturers to maintain their profit margins due to unpredictable costs in this competitive printed circuit board (PCB) market.

- Environmental regulations resulting in costly manufacturing adaptations- According to the fourth edition of the Global E-waste Monitor 2024, e-waste is now being generated at alarming rates: in 2022, 62 billion kg of e-waste was produced, which equates to 7.8 kg per capita. Nevertheless, only 22.3 percent—13.8 billion kg—is reported as properly collected and recycled. This mounting e-waste problem is met with common and equally growing challenges PCB manufacturers worldwide face when it comes to fighting stringent environmental regulations. Such regulations are meant to lessen the ecological impacts of electronic waste and ensure that the manufacturing methods are environmentally friendly.

However, results in huge investments in new equipment and processes. The manufacturers have to face restrictions on hazardous substances, enforcing more energy-efficient methods of production, and developing recyclable designs of PCBs.

Printed Circuit Board Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.3% |

|

Base Year Market Size (2025) |

USD 78.18 billion |

|

Forecast Year Market Size (2035) |

USD 131.03 billion |

|

Regional Scope |

|

Printed Circuit Board Market Segmentation:

Product Segment Analysis

The HDI/build-up/microvia segment of the printed circuit board market is growing at a healthy pace and will account for 33.4% share by 2035 due to the rising demand for compact electronic devices with high performance. The large share of this category can be attributed to increasing requirements for PCBs with higher circuit density and better signal integrity in applications like smartphones, tablets, and wearable devices.

Some of the growth factors pertaining to the PCB market include the miniaturization trend in consumer electronics and automotive, for which HDI PCBs are well suited with their ability to provide increased functionality in reduced form factors. Leading PCB manufacturers are heavily pouring capital investments for new advanced HDI manufacturing capabilities to address the rising demand.

Companies such as AT&S and Unimicron Technology are also focusing on research and development related to integrated circuit substrates and packaging technologies. For example, in November 2023, AT&S revealed the good progress it is making, especially in relation to its current “lighthouse project.” The company is about to complete its new research and development center for integrated circuit (IC) substrates and packaging technologies in Leoben-Hinterberg. This state-of-the-art facility will become an exceptional center for developing and producing connection technologies and substrates in high-end technology sector.

Application Segment Analysis

Consumer electronics segments in PCB market is anticipated to dominate the other application segments during the forecast period owing to the continuous need for innovation and fast cycles of product introductions in extremely competitive devices. Expanded device penetration under the umbrella of IoT, as well as the subsequent rollout of 5G, will further meet the demand for advanced PCBs within consumer electronics. Moreover, the increasing integration of AI and machine-learning capabilities into consumer devices is rising the need for more sophisticated PCB designs.

PCB manufacturers are working on the dimensions of the price trends, during which they have to manufacture specialized PCBs for consumer electronics to meet increased consumer demands. They are redefining the way in which PCBs need to be made thinner, more flexible, high-performance, etc., to cater to the evolving requirements of consumer device manufacturers. JEITA, the Japan Electronics and Information Technology Industries Association, published a report in May 2024 stating that the production value of PCBs for consumer electronics in Japan has increased by 96.3% from the previous year.

Substrate (Rigid, Flexible, Rigid-flex)

Rigid segment is anticipated to hold printed circuit board market share of over 80% by 2035, dominantly powered by its prevalent use across various industries, including, automotive, industrial equipment, and telecommunications industries. The dominant share in the PCB market can be attributed to the durability, reliability, and cost efficiency of rigid PCBs for most applications.

The automotive industry, in particular, is witnessing a spike in demand for rigid PCBs, especially as vehicle electrification and provisions for advanced driver-assistance systems ramp up. The major PCB manufacturers are working on enhancing the production lines of rigid PCBs in order to meet rapidly growing demand and advanced recycling process requirements. Corporate institutions now invest in advanced manufacturing technologies for the production of higher-layer count rigid PCBs with better thermal management and signal integrity.

Our in-depth analysis of the global printed circuit board market includes the following segments:

|

Product |

|

|

Substrate |

|

|

Laminate Materials |

|

|

Raw Material |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Printed Circuit Board Market Regional Analysis:

North America Market Insights

North America’s printed circuit board market is anticipated to exhibit a moderate growth rate during the forecast period, attributed to increasing demand from the aerospace and defense industries. There is a strong demand for highly reliable PCBs in the region, which focus on military equipment, satellite communications, and commercial aviation amid an emphasis on technological innovation. Similarly, the rapid development of electric vehicles as well as 5G infrastructure, have significantly enhanced its progress. The integration of 5G technology into electric vehicles has made possible advanced functions such as live navigation, better battery management, and uninterrupted connection which are important for the wider deployment of EVs in North America.

Policy changes made in the recent past are restructuring electronic circuit board manufacture in the United States. According to the U.S. Department of Commerce Bureau of Industry and Security Office of Technology Evaluation report, there has been a 15% increase in domestic production capacity for PCBs in late 2023 compared to 2021, when new policies were enforced. For instance, in Canada, there are untapped opportunities for PCB manufacturers to concentrate on high value-added niche specialty PCBs within a strong aerospace and telecommunications sector. The Canadian aerospace industry is known for its innovation and high-quality production capabilities. As such, developing advanced avionics systems, satellite technology, and unmanned aerial vehicles (UAVs) are some of the areas that Canadian companies have increasingly been focusing on where specialized PCBs that can withstand harsh environments and offer reliable performance are needed.

Asia Pacific Market Insights

Asia Pacific industry is set to account for largest revenue share of 43% by 2035. This growth could be attributed to a strong and large base of manufacturing companies domiciled in China, Japan, and Taiwan. With high production volumes of consumer electronics and steadily growing markets in countries like India, this region currently leads globally in demand for PCBs across all applications. Furthermore, the outlook also shifts to 5G technology, IoT devices, and electric vehicles, further accelerating PCB market growth in the region.

China’s PCB production capabilities are still the strongest in Asia-Pacific. This sector is dominated by corporations, including Wus Printed Circuit and Shennan Circuits. In May 2024, exports of China's PCBs reached USD 1,670 million, and imports accounted for USD 574 million, resulting in a trade surplus of USD 1.1 billion. From May 2023 to May 2024, the exports of printed circuit boards manufactured in China increased by USD 269 million (19.2%), reaching USD 1.67 billion from USD 1.4 billion.

India’s printed circuit board market is growing steadily due to the make in India campaign by the Government of India and its booming domestic electronics industry. In turn, this has resulted in domestic electronics industries being built up through investment hence giving rise to a strong ecosystem that supports PCB production for different applications including consumer electronics, automotive, and telecommunications.

Also, in Japan the PCB manufacturers are more geared toward high value segments and products such as automotive and industrial Printed Circuit Boards which require quality and technical leadership. For instance, Meiko Electronics has announced a major investment in its Vietnam operations to boost automotive PCB capacity by 2023 for Japanese automakers expanding EV production. Given enhanced Vietnam production capabilities, Meiko is likely to tap into the opportunity and take advantage of the increasing adoption trend of EVs and become one of the prominent leaders in Japan’s PCB market.

Printed Circuit Board Market Players:

- TTM Technologies, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Sumitomo Corporation

- Wurth elektronik group (Wurth group)

- Becker & Muller Schaltungsdruck GmbH

- Advanced Circuits Inc.

- Murrietta Circuits

- Tripod Technology Corporation

- Nippon Mektron Ltd.

- Zhen Ding Technology Holding Limited

- Unimicron Technology Corporation

The PCB market is fragmented, with multiple well-established players striving for leadership. Further cementing this growth, companies are shifting toward R&D investments for advanced PCB technologies, from high-frequency to flexible and rigid-flex boards to meet emerging markets in automotive, aerospace, and 5G. Further, they are expanding their footprints for manufacturing globally to reduce supply chain risks and cater to increasing regional demand.

Smaller players are trying to focus on niche segments and develop a strong regional presence to compete effectively. Another trend cropping up in consolidation is through mergers and acquisitions, driven by the aim of achieving scale economies and expanding product portfolios.

Recent Developments

- In June 2024, Taiwan Semiconductor Manufacturing Company of Hsinchu, Taiwan, announced the development of 'Fan-Out Panel-Level Packaging' technology. This new method will replace legacy round wafers with rectangular PCB packaging and increase the wafer usable area by a factor of as much as threefold.

- In May 2024, AT&S announced its intention to sell its Ansan, South Korea plant serving the medical industry. In line with this strategy, AT&S intends to trim its operations and remain focused on other core growth areas in the PCB market.

- Report ID: 6305

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Printed Circuit Board Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.