2K Protective Coatings Market Outlook:

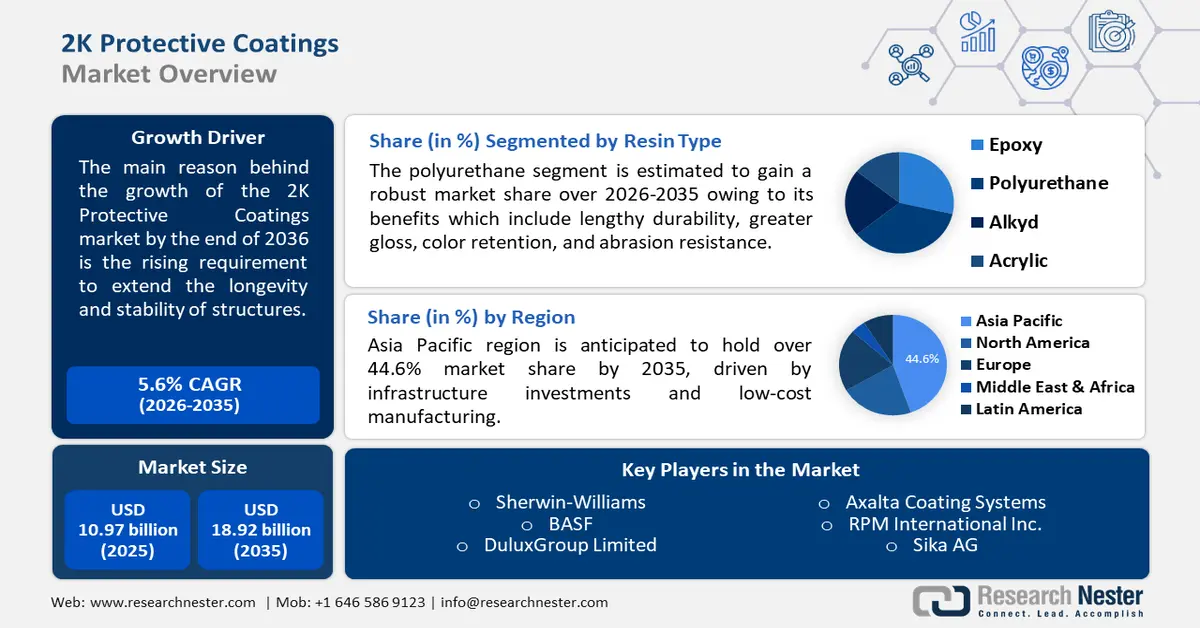

2K Protective Coatings Market size was over USD 10.97 billion in 2025 and is projected to reach USD 18.92 billion by 2035, witnessing around 5.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of 2K protective coatings is evaluated at USD 11.52 billion.

The primary factor that is attributed to the market growth is the expansion of the construction industry in the recent period. Moreover, owing to the rising requirement to extend the longevity and stability of structures, the use of 2K protective coatings has grown in the building and construction industry. It is applied to steelwork, paneling, interior and exterior walls, and wood finishes such as a clear topcoat, a bright color, or varnish in the architectural sector. Furthermore, considering its chemical resistance, it is perfect for coating surfaces in labs, hospitals, recreation centers with pools and spas, and more. In infrastructure projects, where long-term stability and the capacity to survive severe weather conditions, such as acid rains, are necessary to stop leaks and prevent moisture, this kind of coating is also applied to the flooring in bathrooms, kitchens, hotels, and swimming pools. The recent data revealed that in 2020, the total spending in the U.S. construction sector amounted to around USD 2 trillion.

There has been an increase in efficient construction processes, and the longer life of equipment and devices, followed by the rapid industrialization, is anticipated to be a vital factor in escalating market growth. Moreover, the rise in the demand for maintenance of existing substrates in the buildings is further expected to create new opportunities for the global 2K protective coatings market in the forecast period. Thus, the increment in the employment rate in the construction industry is further projected to increase the sales of protective coatings as well. Recent calculations stated that there were almost 10 million construction workers in the United States, approximately 8% of the total working population as of 2021.

Key 2K Protective Coatings Market Insights Summary:

Regional Highlights:

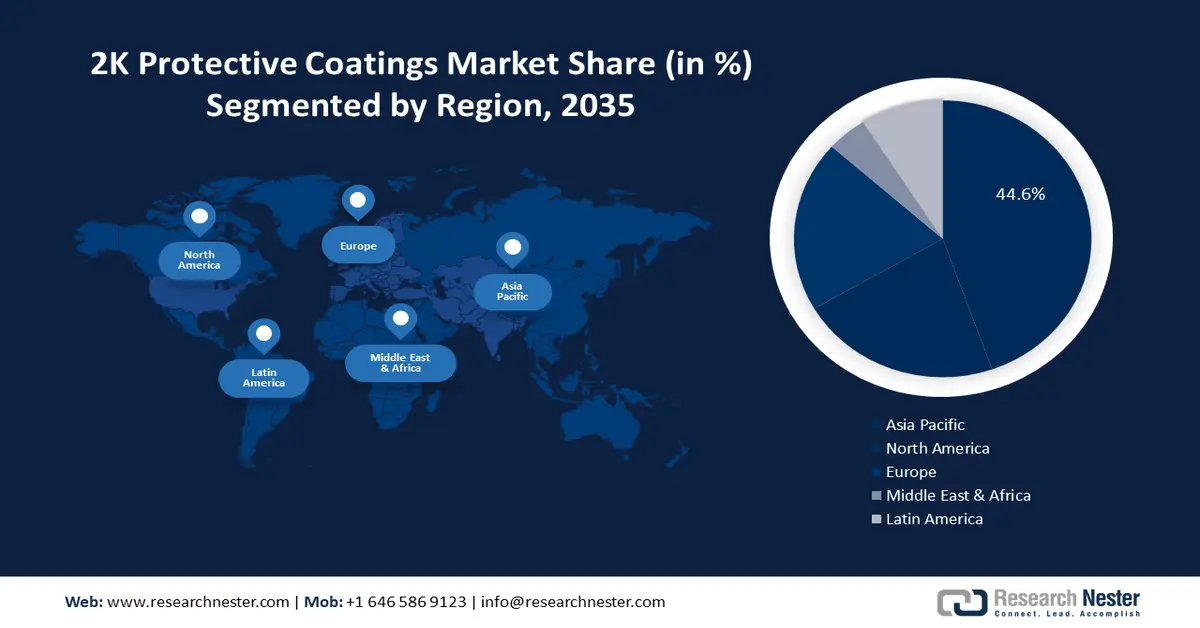

- Asia Pacific 2k protective coatings market will secure around 44.6% share by 2035, driven by infrastructure investments and low-cost manufacturing.

Segment Insights:

- The civil building and infrastructure segment in the 2k protective coatings market is anticipated to experience the fastest growth during 2026-2035, fueled by durability and protection against corrosion, abrasion, and high temperatures in architectural coatings.

- The civil building and infrastructure segment in the 2k protective coatings market is anticipated to experience the fastest growth during 2026-2035, fueled by durability and protection against corrosion, abrasion, and high temperatures in architectural coatings.

Key Growth Trends:

- Expansion of Oil & Gas Industry

- High Investments by Companies in R&D Activities

Major Challenges:

- High Prices of Raw Materials and Energy

- Rising Stringent Governmental Rules

Key Players: PPG Industries, Inc., Akzo Nobel N.V., Hempel A/S, Jotun A/S, Sherwin-Williams, BASF, DuluxGroup Limited, Axalta Coating Systems, RPM International Inc., Sika AG.

Global 2K Protective Coatings Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 10.97 billion

- 2026 Market Size: USD 11.52 billion

- Projected Market Size: USD 18.92 billion by 2035

- Growth Forecasts: 5.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (44.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, India, United States, Japan, Germany

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 10 September, 2025

2K Protective Coatings Market Growth Drivers and Challenges:

Growth Drivers

-

Rising Demand from the Civil Construction and Infrastructure Sector- With properties such as longevity and strong resistance to water and chemicals, 2K protective coating is increasingly being used in the infrastructure and construction sectors. For steelwork, paneling, interior and external walls, and wood finishes such as a clear topcoat, brilliant color, or varnish, it is employed in the architectural sector. On the other hand, owing to its resilience to chemicals, it is perfect for coating surfaces in labs, hospitals, recreation centers with pools and spas, and more. When long-term stability and the capacity to survive severe weather conditions, such as acid showers, are necessary for infrastructure projects, a 2K protective coating is applied. To avoid leaks and moisture, this kind of coating is also used on the floors of hotels, restaurants, baths, and swimming pools. Additionally, 2K protective coatings offer a beautiful finish or paintable surface and don't fade colors, which is predicted to expand the market globally. For instance, as a result of an increasing number of construction and development initiatives, such as the Smart Cities Mission in India, the Taipei Smart City Living Lab project in Taiwan, the Haikou City Brain in China, and Saudi Vision 2030, among others.

-

Expansion of Oil & Gas Industry – 2K protective coatings are the preferred choice in the oil & gas industry for varied processes owing to their great advantages such as corrosion, humidity, UV, and harsh weather conditions. Thus, an expansion in oil & gas is expected to bring lucrative growth opportunities for the global 2K protective coatings market too. Recent statistics reveal that the global oil & gas industry garnered approximately USD 5 trillion in 2022 around the world.

-

High Investments by Companies in R&D Activities – The market for advanced composites is expanding as a result of increased R&D spending, new technological developments, and applications in numerous industries. The growing demand from the infrastructure and construction sectors has resulted in a surge in the demand for 2K protection products. Moreover, it is employed in many different contexts, such as walls, façades, flooring, ceilings, and doors. To increase structural strength, durability, and lifespan, 2K protective coatings are being employed more and more in building infrastructure such as bridges, stadiums, and highways. For instance, World Bank showed the data of the Research and Development expenditure globally to be 2.63% of total GDP in 2020, up from 2.13% of total GDP in 2017.

-

Growth in Real Estate Sector – As per recent estimates, the revenue generation of real estate companies worldwide stood at approximately USD 10 billion in 2021.

Challenges

-

High Prices of Raw Materials and Energy - Since the raw materials for the 2K protective coating are very expensive and their production costs are rising as a result of shifting crude oil prices and exchange rates, the market's growth is anticipated to be constrained over the projected period.

- Rising Stringent Governmental Rules

- Concerns Regarding the Toxic Nature

2K Protective Coatings Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.6% |

|

Base Year Market Size (2025) |

USD 10.97 billion |

|

Forecast Year Market Size (2035) |

USD 18.92 billion |

|

Regional Scope |

|

2K Protective Coatings Market Segmentation:

Resin Type Segment Analysis

The global 2K protective coatings market is segmented and analyzed resin type into epoxy, polyurethane, alkyd, and acrylic. Out of the these, the polyurethane segment is estimated to gain the largest market share over the projected time frame. For instance, in 2020, the polyurethane segment accounted for the greatest market share globally, according to research. This is a result of their benefits, which include lengthy durability, greater gloss, color retention, and abrasion resistance. The market is also growing as a result of the expanding usage of 2K polyurethane in the petrochemical industry for heavy-duty use on buildings, as well as in the automotive industry for automobiles, ships, and aircraft.

End-user Segment Analysis

Furthermore, the global 2K protective coatings market is also segmented and analyzed for demand and supply by end-use industry into petrochemical, marine, power generation, water, and waste treatment, cargo container and oil & gas, and civil building and infrastructure. The civil building and infrastructure segment is anticipated to grow at the fastest rate over the projection period. It is frequently used for wall and floor coatings on civil and commercial structures owing to its durability, aesthetically pleasing performance, and protection against corrosion, abrasion, high temperatures, and fire. Additionally, there has been an increasing use of architectural coatings as high-performance architectural coatings (HiPAC), which is a type of 2k protective coating, in a range of applications, including offices, showrooms, warehouses, supermarkets, schools, industrial workshops, and others. The market for 2K protective coatings is dominated by the infrastructure sector worldwide. In the forecast period, it is predicted to reach a value of USD 6,120 million globally.

Our in-depth analysis of the global market includes the following segments:

|

By Resin Type |

|

|

By Application |

|

|

By End Use Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

2K Protective Coatings Market Regional Analysis:

APAC Market Insights

Asia Pacific region is anticipated to hold over 44.6% market share by 2035, driven by infrastructure investments and low-cost manufacturing. Currently, Asia Pacific is the world's top producer and consumer of 2K protective coating, thanks to rising FDIs and booming industrial sectors brought on by the accessibility of land and inexpensive labor. China's government spending and investment in construction are still increasing exponentially. For instance, China is investing a huge amount of money in infrastructure, making approximately USD 1 trillion in federal spending accessible for construction ventures.

Europe Market Insights

The market in the Europe region is predicted to witness growth in the upcoming years owing to the presence of one of the biggest building industries, and growing awareness for the different types of coatings in the region. As per the estimated data, the building industry contributes around 9% of the GDP of the EU. The demand from the oil and gas sector could help the increase, which is further anticipated to increase the market’s growth in the region. The Connecting Europe Facility invested USD 26 billion to fund TEN-T projects in the EU member states that were of common interest.

2K Protective Coatings Market Players:

- PPG Industries, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Akzo Nobel N.V.

- Hempel A/S

- Jotun A/S

- Sherwin-Williams

- BASF

- DuluxGroup Limited

- Axalta Coating Systems

- RPM International Inc.

- Sika AG

Recent Developments

-

PPG Industries, Inc. has successfully launched PPG AQUACOVER waterborne coating system for shipping containers in China.

-

Akzo Nobel N.V. has decided to invest approximately USD 20 million to increase powder coatings capacity at its site in Como, Italy.

- Report ID: 4592

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

2K Protective Coatings Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.