Industrial Coatings Market Outlook:

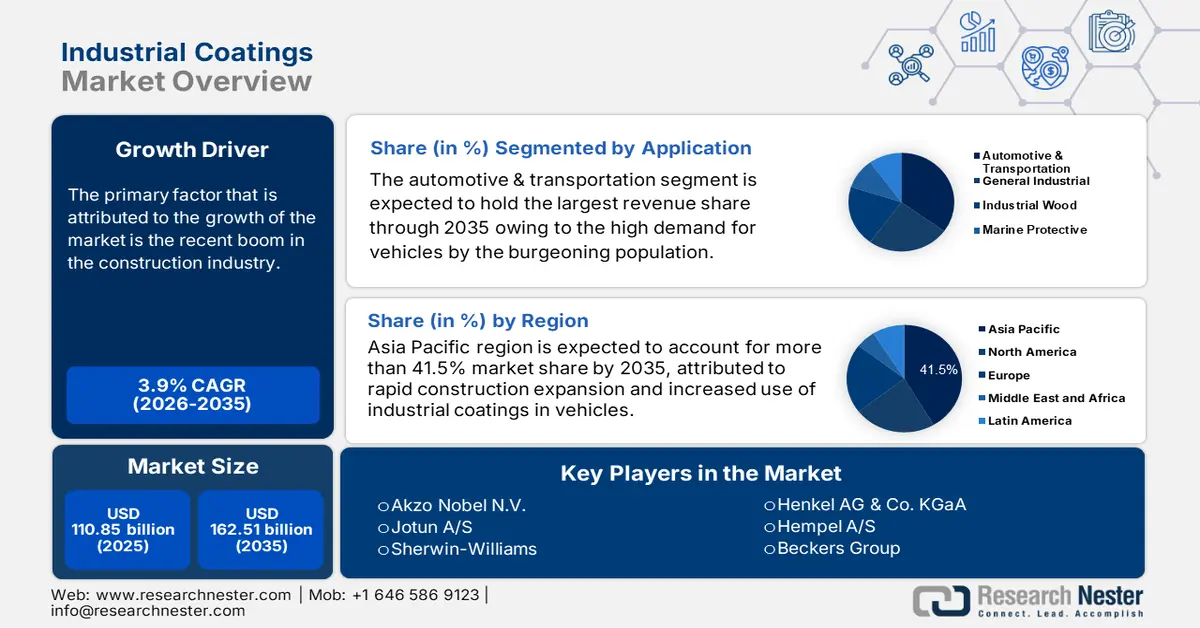

Industrial Coatings Market size was valued at USD 110.85 billion in 2025 and is likely to cross USD 162.51 billion by 2035, registering more than 3.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of industrial coatings is assessed at USD 114.74 billion.

The primary factor that is attributed to the growth of the market is the recent boom in the construction industry. The high spending on the construction industry is expected to bring lucrative growth opportunities for market growth in the assessment period. For instance, the total spending in the U.S. construction sector was calculated to be approximately USD 2 trillion in 2020. Additionally, the escalation in the demand for industrial coatings from a wide range of industry verticals such as automotive, electronics, aerospace, oil & gas, mining, marine, and power generation is expected to propel the growth of the industrial coatings market over the projected forecast period.

Most industrial coatings are used to prevent the corrosion of metals and concrete. They have diverse applications and are available with various specifications for differing requirements and functions in the construction sector. Thus, the rising investments in building infrastructure and buildings are anticipated to bring in generate for industrial coatings in the forecast period. Moreover, radically increasing urbanization across the globe and traction toward sustainability are some further factors that are fueling the growth of the market during the forecast period. In addition, the growing demand for environmentally-friendly coatings as well as the need for efficient processes and durable coatings with better aesthetics is also considered to be a growth factor for significant revenue generation of global industrial coatings. Also, rapid urbanization, growth in the middle-class population, rising disposable incomes, and high spending capacity are projected to bring in lucrative growth opportunities for the utilization of industrial coatings in the forecast period.

Key Industrial Coatings Market Insights Summary:

Regional Highlights:

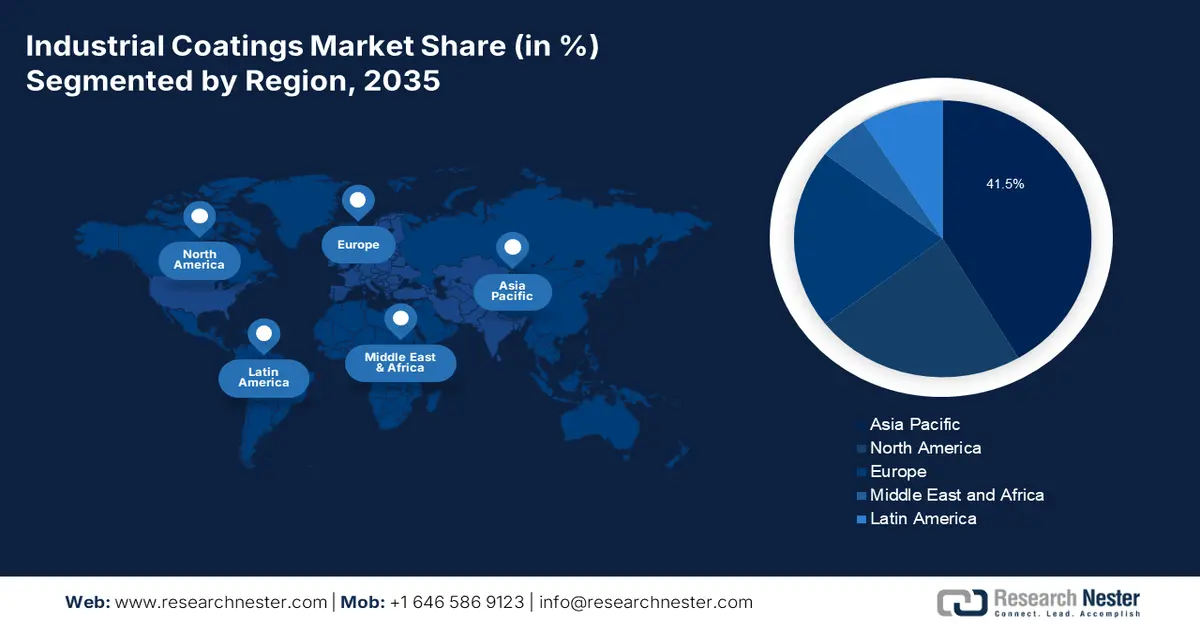

- Asia Pacific industrial coatings market is predicted to capture 41.5% share by 2035, driven by rapid construction expansion and increased use of industrial coatings in vehicles.

- North America market will achieve significant revenue share by 2035, driven by rapid industrial sector expansion and growing car sales and production.

Segment Insights:

- The automotive & transportation segment in the industrial coatings market is projected to secure the highest market share by 2035, driven by growing vehicle demand and the protective benefits of industrial coatings.

- The water-based segment in the industrial coatings market is expected to secure a significant share by 2035, driven by low VOC emissions, fire safety, and cost-effectiveness of water-based coatings.

Key Growth Trends:

- Growth in the Production of Electronics

- Soared Expenditure in Research and Development (R&D)

Major Challenges:

- Adverse Effect on Environment

- Growing Costs of Raw Materials

Key Players: PPG Industries, Inc., Akzo Nobel N.V., Jotun A/S, Sherwin-Williams, BASF, Axalta Coating Systems, Nippon Paint Holdings Group, Henkel AG & Co. KGaA, Hempel A/S, Beckers Group.

Global Industrial Coatings Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 110.85 billion

- 2026 Market Size: USD 114.74 billion

- Projected Market Size: USD 162.51 billion by 2035

- Growth Forecasts: 3.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (41.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, India, United States, Japan, Germany

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 10 September, 2025

Industrial Coatings Market Growth Drivers and Challenges:

Growth Drivers

- Rapid Maturing of Automotive Industry - Growing usage of industrial coatings for automotive maintenance, repair, and aftermarket painting on account of visual appearance, surface protection, and corrosion resistance is expected to propel the demand for industrial coatings. Thus, the expansion of the automotive industry is expected to increase the sales of industrial coatings in the forecast period. For instance, the automotive industry of India is anticipated to become the 3rd largest automotive industry in the world by the year 2030, with a revenue generation of 200 billion dollars.

- Growth in the Production of Electronics – The production of electronics requires the application of industrial coatings to improve the aesthetic looks along with making it durable and a protection layer against heat and harsh extreme conditions such as rust and others. Therefore, the high production rate of electronics in order to meet consumer demand is anticipated to bring lucrative growth opportunities in the upcoming years. As per recent studies, it was figured that the production of domestic electronics production in India escalated from USD 30 billion in 2014-2015 to USD 70 billion in 2020-2021.

- High Level of Steel Production - Global steel production rose from the year 2020 with 1,870 million tons to 1,950 million tons in 2021, equivalent to a 4% increase.

- Soared Expenditure in Research and Development (R&D) – The government and major key players in the market are focused on developing advanced and eco-friendly industrial coatings for rising concerns regarding environmental pollution. Hence, the rising research and development activities are expected to increase awareness about industrial coatings among the population during the analysis period. As per statistics shared by World Bank, it has been calculated that the global expenditure on research and development stood up at 2.63% of the total GDP in 2021, a considerable rise from 1.99% in 2013.

- Worldwide Progression in Chemical Industry – For instance, in 2019, the total global revenue of the chemical industry reached approximately USD 3.90 trillion.

Challenges

- Adverse Effect on Environment - Despite the evident benefits for businesses, industrial coatings have been linked to a wide range of environmental problems, including greenhouse gas emissions, global warming, and air pollution. In addition, inappropriate waste management at manufacturing firms has a negative impact on biodiversity in various regions. Hence, this factor is estimated to hinder the market growth.

- Growing Costs of Raw Materials

- Stringent Government Rules on the Usage of Volatile Organic Compounds (VOC)

Industrial Coatings Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

3.9% |

|

Base Year Market Size (2025) |

USD 110.85 billion |

|

Forecast Year Market Size (2035) |

USD 162.51 billion |

|

Regional Scope |

|

Industrial Coatings Market Segmentation:

Application Segment Analysis

The global industrial coatings market is segmented by application into general industrial, automotive & transportation, industrial wood, marine protective, packaging, and others. Out of these, the automotive & transportation segment is attributed to garner the highest market share by 2035, owing to the high demand for vehicles by the burgeoning population. The International Organization of Motor Vehicle Manufacturers (OICA), released global sales of vehicle statistics which revealed that it rose from 56,398,471 units in 2021 to 53,917,153 units in 2020. Whereas, the global production of vehicles was calculated to be 57,054,295 units in 2021, an increase from 55,908,989 units in 2020. The need for industrial coatings in the manufacturing processes of automotive owing to their high degrees of corrosion resistance, chemical resistance, and protection from UV and weather is an essential part of making the vehicles durable.

Technology Segment Analysis

The global industrial coatings market is also segmented and analyzed for demand and supply by technology into water-based, solvent-based, powder, and others. Out of these, the water-based segment is attributed to holding the most significant share of the market during the assessment period. The advantages of water-based industrial coatings such as low VOC emissions during the application, easy cleansing process, reduced risks of fire, and others are expected to increase its adoption rate for various kinds of applications in numerous industries. Furthermore, the cost-effective benefit of water-based industrial coatings is also anticipated to make it a preferable option for coating applications in the automotive and construction industry.

Our in-depth analysis of the industrial coatings market includes the following segments:

|

By Resin |

|

|

By Technology |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Industrial Coatings Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific region is expected to account for more than 41.5% market share by 2035, attributed to rapid construction expansion and increased use of industrial coatings in vehicles. Also, the increased utilization of industrial coatings in vehicles, along with the presence of major key players and leading exporters and importers of vehicles in the region is anticipated to bring lucrative growth opportunities for the market in the forecast period. International Organization of Motor Vehicle Manufacturers (OICA) statistics revealed that the total production of vehicles in the region was 46 million in 2021, a rise from 44 million in 2020.

North American Market Insights

On the other hand, the North America industrial coatings market is also projected to hold a significant market share during the forecast period. The rapid expansion in the industrial sector has resulted in high industrial goods production which in turn has generated the need for industrial protective coatings in the region. Also, the rise in sales and production of cars, rapid growth in building activity, and the continuous investment by major key players in research and development activities are anticipated to create a positive outlook for the growth of the market in the North America region. Moreover, the high consumer spending and rapid escalation in Gross Domestic Product (GDP) are other factors that are estimated to contribute positively to market growth.

Industrial Coatings Market Players:

- PPG Industries, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Akzo Nobel N.V.

- Jotun A/S

- Sherwin-Williams

- BASF

- Axalta Coating Systems

- Nippon Paint Holdings Group

- Henkel AG & Co. KGaA

- Hempel A/S

- Beckers Group

Recent Developments

-

PPG Industries, Inc. has finally launched PPG ENVIROCRON HeatSense powder coating. This high-quality industrial coating is expected to apply in heat-sensitive wood, and wood-composite applications, such as medium-density fiberboard (MDF), hardwood, plywood, and similar products.

-

Akzo Nobel N.V. and Sikkens continue their partnership with Mercedes-Benz. This partnership is expected to enhance the supply of vehicle refinish products and services in China and Indonesia.

- Report ID: 4576

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Industrial Coatings Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.