Hydrophobic Coatings Market Outlook:

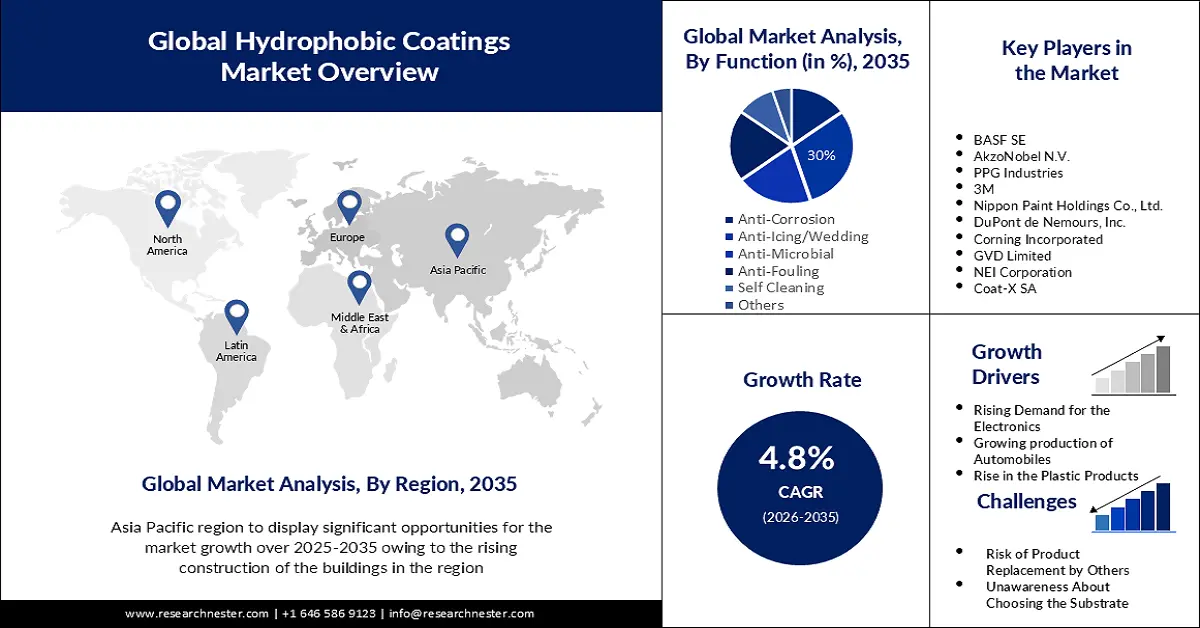

Hydrophobic Coatings Market size was over USD 2.34 billion in 2025 and is anticipated to cross USD 3.74 billion by 2035, witnessing more than 4.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of hydrophobic coatings is assessed at USD 2.44 billion.

The growth of the market can be attributed to the increasing scope of application of hydrophobic coatings in aerospace, textile and construction industries. Growing automobile sales is also predicted to drive market growth in the future. It is calculated that a total of approximately 70 million units of automotive will be sold by the end of 2021. Along with this, rising technological advancements to develop effective underwater and wearable electronics is anticipated to boost the demand for these protective coatings, which in turn is expected to drive market growth in the coming years. Furthermore, growing innovations to formulate hydrophobic coatingss with nano-particles is a crucial factor projected to offer lucrative opportunities for the expansion of market during the forecast period.

Key Hydrophobic Coatings Market Insights Summary:

Regional Highlights:

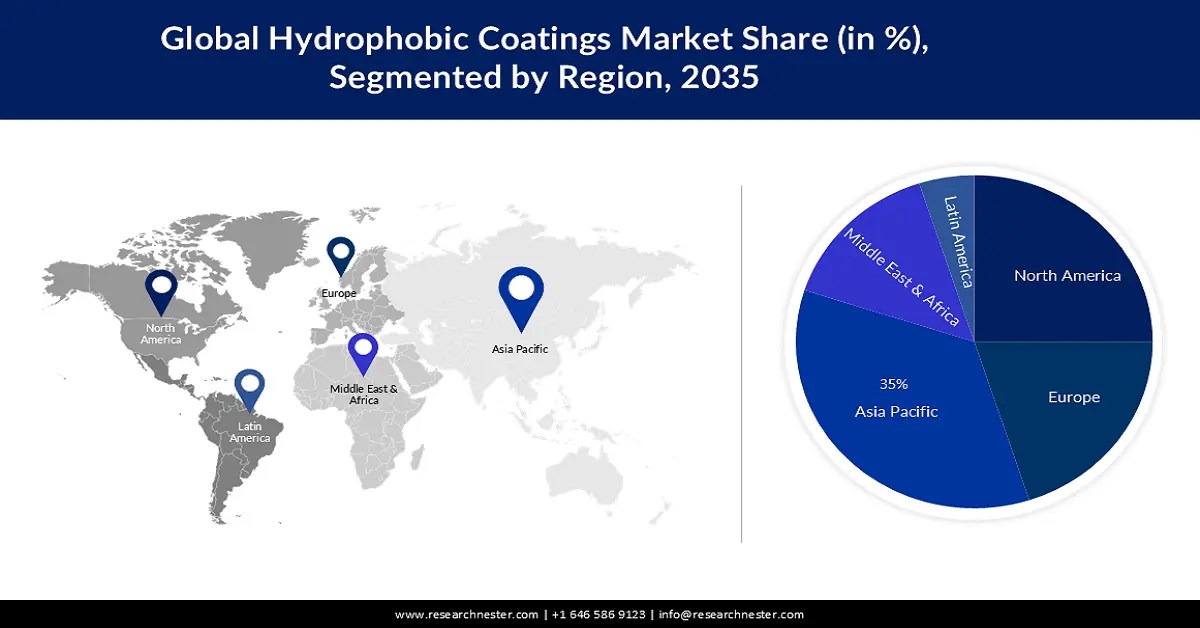

- North America hydrophobic coatings market holds the largest share by 2035, driven by rising demand from multiple industries including automotive and textile sectors.

Segment Insights:

- The anti-microbial segment in the hydrophobic coatings market is anticipated to experience significant growth over 2026-2035, driven by rising use in healthcare for water-resistant surgical tools and medical devices.

- The textile segment in the hydrophobic coatings market is set for significant expansion over 2026-2035, driven by increasing demand for self-cleaning and water-resistant textiles.

Key Growth Trends:

- Rising Usage of Hydrophobic Coatings in Aerospace, Textile Automotive and Construction Industries to Drive Market Growth

- Increasing Advancements in Underwater and Wearable Electronics to Expand Market

Major Challenges:

-

Environmental Concerns Regarding the Aquatic Toxicity of Hydrophobic coatingss to Hamper Market Growth

-

Key Players: 3M Company, PPG Industries, Inc., BASF SE, The Sherwin-Williams Company, NeverWet, LLC, Aculon, Inc., NEI Corporation, Abrisa Technologies, Surfactis Technologies, DryWired, LLC.

Global Hydrophobic Coatings Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.34 billion

- 2026 Market Size: USD 2.44 billion

- Projected Market Size: USD 3.74 billion by 2035

- Growth Forecasts: 4.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 10 September, 2025

Hydrophobic Coatings Market Growth Drivers and Challenges:

Growth Drivers

-

Rising Usage of Hydrophobic Coatings in Aerospace, Textile Automotive and Construction Industries to Drive Market Growth

-

Increasing Advancements in Underwater and Wearable Electronics to Expand Market

Challenges

-

Environmental Concerns Regarding the Aquatic Toxicity of Hydrophobic coatingss to Hamper Market Growth

Hydrophobic Coatings Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.8% |

|

Base Year Market Size (2025) |

USD 2.34 billion |

|

Forecast Year Market Size (2035) |

USD 3.74 billion |

|

Regional Scope |

|

Hydrophobic Coatings Market Segmentation:

The market is segmented by product type into self-cleaning, anti-corrosion, anti-wetting, anti-microbial, and anti-icing, out of which, the anti-microbial segment is anticipated to witness significant growth in the hydrophobic coatings market on account of rising consumption of hydrophobic coatings in the healthcare sector for manufacturing water-resistant surgical tools and medical devices. Based on application, the textile segment is assessed to occupy the largest market share during the forecast period owing to the increasing usage of hydrophobic coatingss to create self-cleaning textiles. Moreover, the clothing industry is estimated to witness a surge in demand for water-resistant and stain-repellent clothing in the coming years as a result of their high durability, which in turn is expected to be a major growth driver for this market segment in the near future.

Our in-depth analysis of the global market includes the following segments

|

By Product Type |

|

|

By Substrate |

|

|

By End User

|

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Hydrophobic Coatings Market Regional Analysis:

North America Market Insights

On the basis of geographical analysis, the hydrophobic coatings market is segmented into five major regions including North America, Europe, Asia Pacific, Latin America and the Middle East & Africa. North America industry is predicted to account for largest revenue share by 2035, on the back of rising demand for hydrophobic coatings from end user industries in the region. Being a major developed nation, the country is a hub for commercial activities in multiple industries, ranging from small-scale to heavy-scale categories, which is evaluated to be one of the leading causes of the intensifying use of waterproof coatings in this region. Apart from these, the U.S. also has a well-established presence in the automotive and textile markets, which is foreseen to make North American region a significant shareholder in the global market over the forecast period. According to the International Trade Administration, the U.S. textile and apparel industry holds a $70 billion share in the global market in terms of industry shipments. Additionally, China is also predicted to grab a notable market share owing to the large industrial throughput of the region.

Hydrophobic Coatings Market Players:

- UltraTech International, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- RPM International Inc

- BASF SE

- P2i Limited

- NEI Corporation

- Abrisa Technologies

- DuPont de Nemours, Inc.

- AccuCoat inc.

- DRYWIRED, LLC

- Aculon Inc

Recent Developments

- Nippon Paint Holdings Co., Ltd. announced the launch of FASTAR, the industry’s first next-generation hydrolysis antifouling paint based on the nanotechnology. It includes a hydrophilic and hydrophobic nanodomain structure for the first time utilising a novel nanotechnology.

- Coat-X SA announced the launch of new superhydrophobic nanolayer that increases the performance of the community mask and commercially available mask. These mask are more environmentally friendly. The newly discovered silicon-based conformal coating can be utilised to create extremely hydrophobic complex 3D surfaces.

- Report ID: 4888

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Hydrophobic Coatings Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.