Zero Friction Coatings Market Outlook:

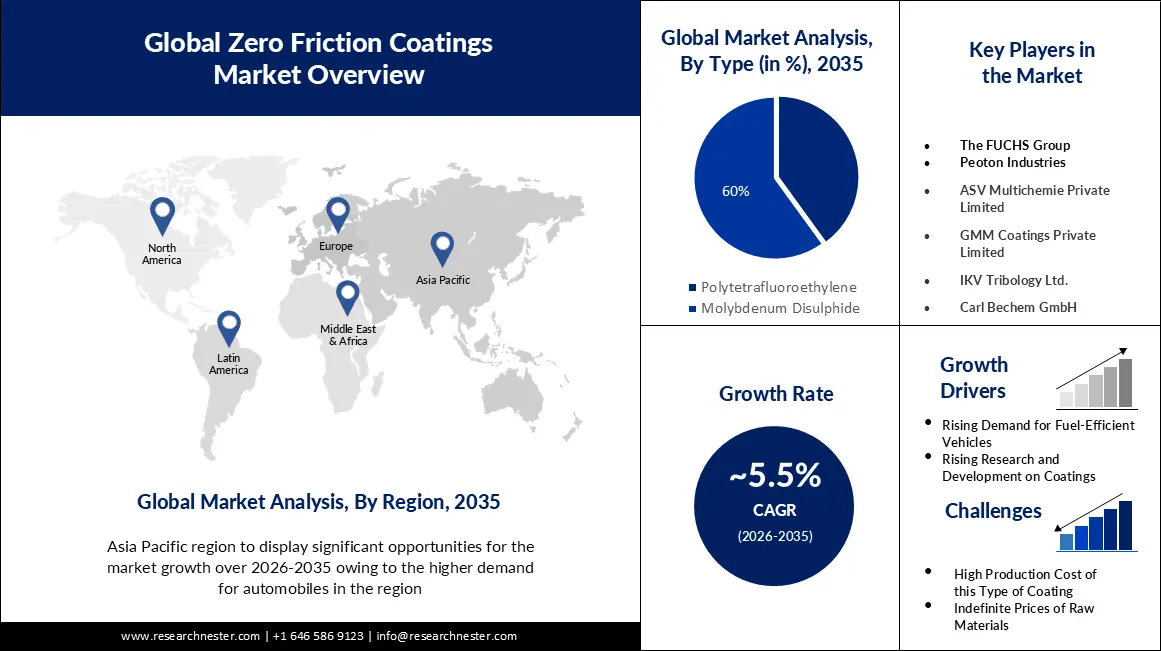

Zero Friction Coatings Market size was over USD 991.8 million in 2025 and is poised to exceed USD 1.69 billion by 2035, growing at over 5.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of zero friction coatings is estimated at USD 1.04 billion.

The growth of the market can be attributed to the growing need to increase the life of components across various industries. The increased demand for zero friction coatings can be owed to their greasing and corrosion-protecting characteristics. The product allows surfaces to come into contact with each other, resulting in less component degradation. It extends component wear life in industries such as automotive, energy, and aerospace.

In addition to these, the factor that is believed to fuel the market growth of zero friction coatings is rising manufacturing and industrialization. Growing industrialization has resulted in the growing need for machinery equipment in all sectors, such as manufacturing, aerospace, energy, and others. This has boosted the importance of productivity, durability, and efficiency of these machines. Zero friction coatings addressed all these requirements by minimizing the friction between the components of the machines.

Key Zero Friction Coatings Market Insights Summary:

Regional Highlights:

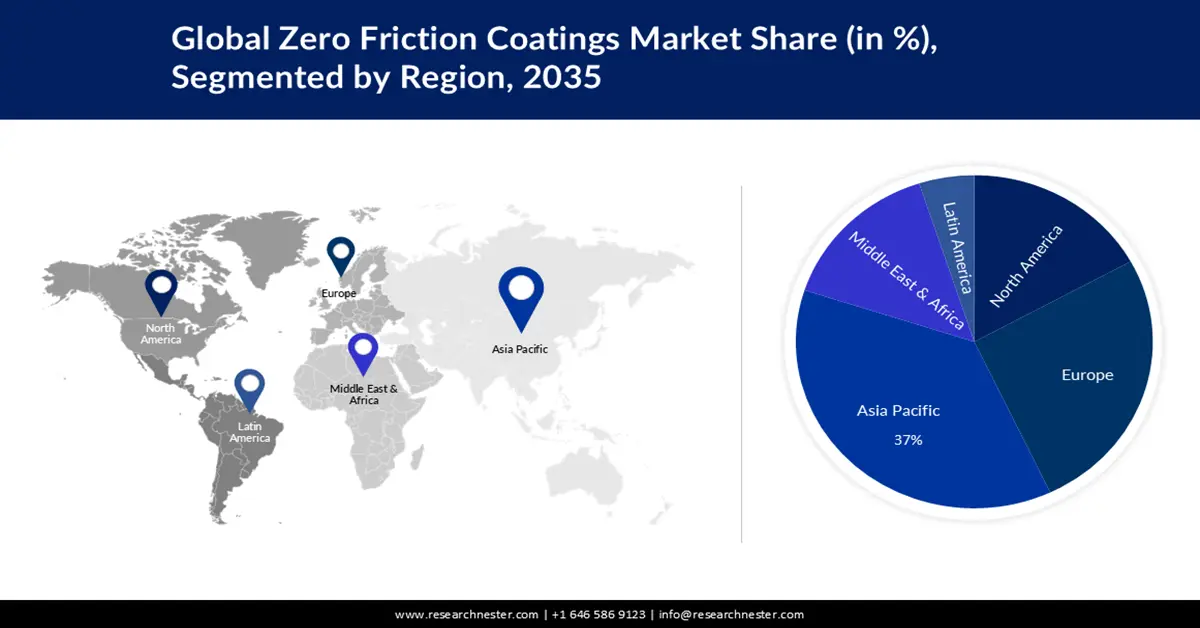

- The Asia Pacific zero friction coatings market is expected to capture 37% share by 2035, driven by the rising automotive industry demanding zero friction coatings to improve efficiency and reduce emissions.

- The Europe market will secure 26% share by 2035, attributed to the adoption of renewable energy sources requiring zero friction coatings to improve efficiency.

Segment Insights:

- The molybdenum disulphide segment in the zero friction coatings market is expected to experience substantial growth through 2035, driven by enhanced load capacity, adherence properties, and corrosion resistance.

- The automobile segment in the zero friction coatings market is expected to achieve a 40% share by 2035, influenced by demand from electric vehicles requiring noise reduction and silent operation.

Key Growth Trends:

- Rising Demand for Low Friction Coating in Healthcare

- Increasing Production of Automobiles

Major Challenges:

- High Coefficient of Friction Under Humidity

- Fluctuating prices of raw materials used in making the coatings

Key Players: PPG Industries, Inc., The FUCHS Group, Peoton Industries, Endura Coatings, DuPont, VITRACOAT, ASV Multichemie Private Limited, GMM Coatings Private Limited, IKV Tribology Ltd., and Carl Bechem GmbH.

Global Zero Friction Coatings Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 991.8 million

- 2026 Market Size: USD 1.04 billion

- Projected Market Size: USD 1.69 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (37% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, India, South Korea, Thailand, Mexico

Last updated on : 11 September, 2025

Zero Friction Coatings Market Growth Drivers and Challenges:

Growth Drivers

-

Rising Demand for Low Friction Coating in Healthcare– The medical business makes use of zero friction coatings in a variety of ways. These coatings prevent matter accumulation on tools ranging from catheters to guide wires to surgical instruments. When it relates to catheters, the sanitization of the catheter, as well as the patient's safety and ease of use, are critical. Low-friction hydrophilic catheter coatings are critical since it prevent friction and keep bacteria at bay. Moreover, it is equally important to sterile the surgical equipment to avoid friction between two objects.

-

Increasing Production of Automobiles – As per the data from the European Automobile Manufacturers' Association, 79.1 million motor cars have been manufactured worldwide in 2021, a 1.3% increase over 2020. Zero friction coating is applied in various ways in the automobile industry, such as reduced friction will lead to higher fuel efficiency and reduce the chances of wear and tear of the engine thus expanding the life of the engine.

-

Growing Use of PTFE-based Low Friction Coatings– Nonstick applications or any application that requires a food-grade coating are among the most common applications for PTFE coatings. The PTFE nonstick fluoropolymer coating has excellent escape characteristics and can resist temperatures as high as 500°F, which is more extreme than any other fluoropolymer. This coating is commonly used in applications that require a smooth, low-friction, immune-to-corrosion coating.

Challenges

-

High Coefficient of Friction Under Humidity – A rise in humidity results in the high absorption of water molecules by some zero friction coatings. As a consequence, it increases in size and reduces the efficacy of the coatings as a lubricant. This results in a rise in the friction levels, which affects the one purpose of zero friction coatings and thus hampers the market growth. Apart from this, the coating also becomes prone to corrosion, especially when applied to metals under high humidity.

-

Fluctuating prices of raw materials used in making the coatings

-

Occurrence of high friction at lower load

Zero Friction Coatings Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.5% |

|

Base Year Market Size (2025) |

USD 991.8 million |

|

Forecast Year Market Size (2035) |

USD 1.69 billion |

|

Regional Scope |

|

Zero Friction Coatings Market Segmentation:

Type Segment Analysis

The molybdenum disulphide segment is estimated to hold 60% share of the global zero friction coatings market in the year 2035. The growth of the segment can be attributed to the enhanced capacity of the molybdenum disulphide to carry a heavy load and even these types of coatings have better adherence properties. MoS2 has a friction coefficient of around and it is a dry film lubricant that restricts fretting and improves the wear life at even high ranges of temperatures from -350 F to +500 F. Besides this, the growing use of MoS2 in automobiles and industrial machinery has further stimulated the segment’s growth. MoS2 do not react with corrosive chemicals and is thus used as an anti-corrosive in essential machinery components

End User Segment Analysis

Zero friction coatings market from the automobile segment is expected to garner a significant share of around 40% in the year 2035. The segment's growth can be linked to their capacity to minimize noise, which makes them perfect for automotive applications where they are utilized to reduce compartment noise, which is a necessity in cars these days. The advent of new electric vehicles has boosted the demand for zero friction coatings because these vehicles are extremely silent and have zero tailpipe noise which is beneficial for the environment. Therefore, the rising use of electric vehicles is going to drive the segment’s growth. The worldwide electric vehicle fleet is predicted to have 77 million passenger vehicles by 2025, an increase from around 20 million units in mid-year 2022.

Our in-depth analysis of the global zero friction coatings market includes the following segments:

|

Type |

|

|

Formulation Outlook |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Zero Friction Coatings Market Regional Analysis:

APAC Market Insights

The zero friction coatings market in Asia Pacific is projected to be the largest with a share of about 37% by the end of 2035. The growth of the market can be attributed majorly to the rising automotive industry in countries, such as China and India. There is growing need for zero friction coatings to improve fuel efficiency, reduce emissions, and extend the life of engine components. China's automotive sector is expected to generate around 23.8 million passenger cars in 2022. The Association of Southeast Asian Nations is the world's seventh-biggest automotive manufacturing hub, delivering around 3.5 million vehicles in 2021. Moreover, the region has some established automakers, such as Honda, BMW, Toyota, Maruti Suzuki, and others.

Europe Market Insights

The European zero friction coatings market is estimated to be the second largest, registering a share of about 26% by the end of 2035. The growth of the market can be attributed majorly to the growing adoption of renewable energy sources, such as wind turbines and solar panels. Zero friction coatings are important in these systems to avoid energy losses. It increases the overall efficiency of renewable energy systems. Europe had 255 gigatonnes (GW) of installed wind capacity as of 2023. Moreover, in 2017, around 15, 700 MW of capacity of wind power was added in Europe, which accounted for around 55% of all the new power capacity. It was enough to suffice the power generation for the entire Europe. Furthermore, the presence of great automobile manufacturers is also expected to augment the market growth in the region.

Zero Friction Coatings Market Players:

- PPG Industries, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- The FUCHS Group

- Peoton Industries

- Endura Coatings

- DuPont

- VITRACOAT

- ASV Multichemie Private Limited

- GMM Coatings Private Limited

- IKV Tribology Ltd.

- Carl Bechem GmbH

Recent Developments

- April 2022: PPG Industries, Inc. has announced the complete acquisition of complete manufacturing business of poweder coatings of Arsonsisi, an Milan-based company. The purchase will offer PPG with a completely computerised powder manufacturing factory in Verbania, Italy, ready for generating small and big batches. PPG will also have metal bonding capabilities across Europe, the Middle East, and Africa (EMEA). This will greatly benefit the PPG since the power sales of Arsonsisi was around USD 15 million in 2021.

- June 2022: The FUCHS Group, a leading international lubricants company, has reached an agreement to acquire Gleitmo Technik AB's lubricants business in Kungsbacka, Sweden, and merge it into its subsidiary FUCHS LUBRICANTS SWEDEN AB. Through a Share Purchase arrangement, FUCHS buys 100% of the stocks in Gleitmo Technik AB, which entails the client base, its line of products, its staff, and the rental arrangement for the Gleitmo office and warehouse in Kungsbacka.

- Report ID: 5277

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Zero Friction Coatings Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.