EMI Shielding Market Outlook:

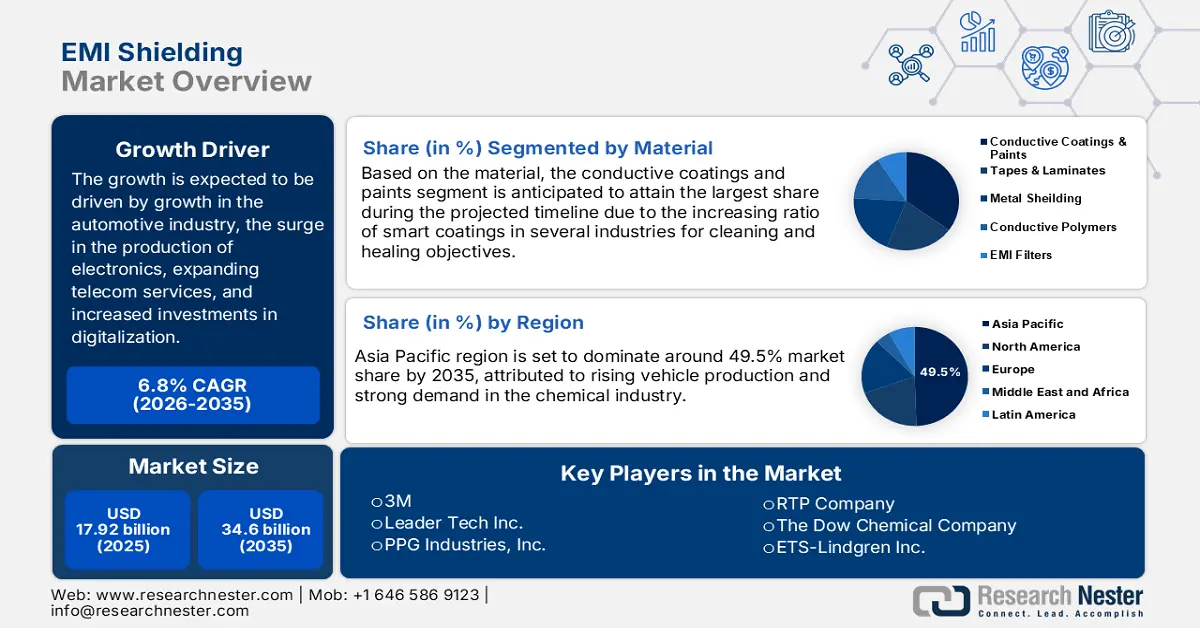

EMI Shielding Market size was over USD 7.84 Billion in 2025 and is anticipated to cross USD 13.52 Billion by 2035, growing at more than 5.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of EMI shielding is assessed at USD 8.24 Billion.

The growth of the market can be attributed to the major expansion of the manufacturing industry worldwide. Manufacturers are extensively using EMI shielding for conductive coatings in various products such as smartphones and military devices which is projected to bring lucrative opportunities in the market growth. For instance, recent reports calculated that in 2022, the manufacturing industry of the United States region generated an amount of approximately USD 6 trillion. In addition, the notably increasing electromagnetic pollution as of digitalization, followed by the worldwide rising adoption of electric vehicles are also projected to propel the growth of the global EMI shielding market over the forecast period.

In addition to these, factors that are believed to fuel the market growth of EMI shielding include the surging ratio of manufacturers who are tapping into the manufacturing industry to provide a protective shield in products to prevent them from electromagnetic waves. The benefits and characteristics of electromagnetic interference shielding have prompted its adoption rate. Thus, an increase in the proportion of enterprises in the manufacturing industry is expected to bolster the sales of EMI shielding in the assessment period. For instance, in 2022, it was calculated that the number of manufacturing businesses counted around 638,590 in the U.S. Moreover, increasing demand for consumer electronics, along with the advancement in telecommunication are some added factors that are anticipated to fuel the market growth throughout the forecast period.

Key EMI Shielding Market Insights Summary:

Regional Highlights:

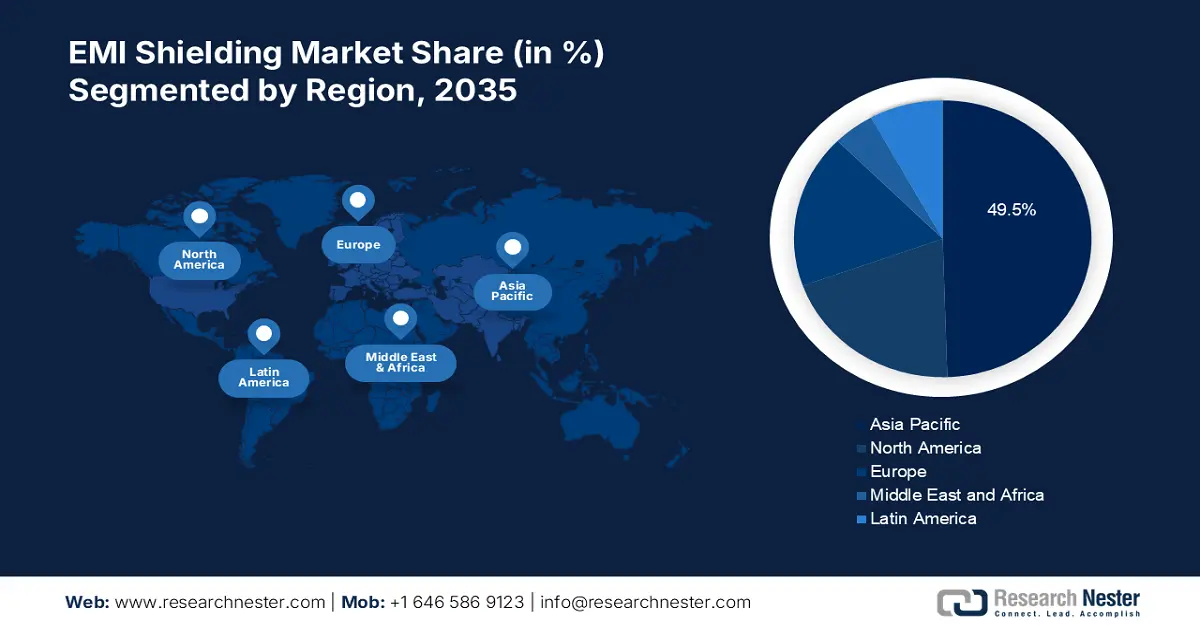

- Asia Pacific’s emi shielding market will dominate over 49.5% share by 2035, attributed to rising vehicle production and strong demand in the chemical industry.

- North America market will register notable growth during the forecast timeline, fueled by semiconductor R&D investment and 5G tech adoption.

Segment Insights:

- The conductive coatings & paints segment in the emi shielding market is expected to achieve a significant share by 2035, attributed to the increasing use of smart coatings in industries and benefits like reduced inspection time and cost-effectiveness.

- The automotive segment in the emi shielding market is forecasted to hold the largest share by 2035, driven by the rise in vehicle production and growing adoption of electric vehicles globally.

Key Growth Trends:

- Growth in the Automotive Industry

- Rise in the Electronics Industry

Major Challenges:

- High Costs of EMI shielding Process

- Additional Expenses Incurred in the Production Process

Key Players: 3M, Parker-Hannifin Corporation, The Dow Chemical Company, ETS-Lindgren Inc., Henkel AG & Co. KGaA, KITAGAWA INDUSTRIES America, Inc., Laird Performance Materials (DuPont de Nemours, Inc.), Leader Tech Inc., PPG Industries, Inc., RTP Company.

Global EMI Shielding Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.84 Billion

- 2026 Market Size: USD 8.24 Billion

- Projected Market Size: USD 13.52 Billion by 2035

- Growth Forecasts: 5.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (49.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, South Korea, Germany

- Emerging Countries: China, India, Taiwan, South Korea, Japan

Last updated on : 9 September, 2025

EMI Shielding Market Growth Drivers and Challenges:

Growth Drivers

- Growth in the Automotive Industry – EMI shielding technology is being heavily used in the automotive industry to enhance the user experience. Automatic sliding doors, keyless ignition, remote starters, power seats, and power windows are being enabled by employing EMI shielding. Thus, the rise in the automotive industry is expected to fuel the EMI shielding market growth. For instance, India is all set to possess the 3rd largest automotive sector in the world, with a revenue generation of 200 billion dollars by 2031.

- Rise in the Electronics Industry – As of the surge in the production of electronics across different spectrums such as aerospace, automotive, telecom & IT, healthcare, and consumer electronics, the utilization of EMI shielding is anticipated to rise considerably to prevent the electronics from malfunctioning. Thus, the rise in the electronics industry is estimated to boost market growth further in the coming years. For instance, the revenue generated by the U.S. electronics industry in 2019 stood up at USD 300 billion.

- Increased Focus on Expanding Telecom Services – The increased demand for steady and stable telecom services by emergency responders, police personnel, and hospital workers is considered to be a growth driver for the increased adoption rate of EMI shielding. Thus, the high spending on telecom services is projected to expand the EMI shielding market size. In 2020, approximately, USD 1,550 billion were spent across the world on telecom services.

- Rise in Expenditure on Research and Development Activities – The data shared by the World Bank revealed that 2.63% of the total Gross Domestic Product (GDP) expenditure was made in 2020, an increment from 2018 with only 2.2% of the total expenditure.

- Worldwide Surging Investment in Digitalization – For instance, global investment in digital transformation is estimated to nearly double between 2022 and 2025, from approximately USD 1.7 trillion to USD 2.7 trillion.

Challenges

-

High Costs of EMI shielding Process - The cost of testing compliance with the norms of various operations, such as cleaning, loading, and unloading, masking, is typically included in the price of EMI shielding solutions. The ultimate product's overall cost goes up as a result of this added expense, which is anticipated to hamper the market growth during the forecast period.

-

Additional Expenses Incurred in the Production Process

- Miniaturization of Electronic Devices

EMI Shielding Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.6% |

|

Base Year Market Size (2025) |

USD 7.84 Billion |

|

Forecast Year Market Size (2035) |

USD 13.52 Billion |

|

Regional Scope |

|

EMI Shielding Market Segmentation:

The global EMI shielding market is segmented and analyzed for demand and supply by application into automotive, defense & aerospace, healthcare, telecom & IT, and consumer electronics. Out of these five segments, the automotive segment is expected to garner the largest market share over the projected time frame. The growth of the segment can be attributed to the rise in demand for the production of vehicles across the world, as the implementation of EMI shielding has radically surged in remote starters, automatic sliding doors, and power seats in automotive. As per the Organization of Motor Vehicle Manufacturers, the global production of vehicles was 80,145,988 units in 2021. This is a rise from 77,711,725 units in 2020. Besides this, the growing adoption and demand for electric vehicles are also estimated to accelerate the segment growth further over the projected time frame.

The global EMI shielding market is also segmented and analyzed for demand and supply by material into tapes & laminates, conductive coatings & paints, metal shielding, conductive polymers, and EMI filters. Amongst these segments, the conductive coatings & paints segment is expected to garner a significant share during the forecast period. The growth of the segment can be attributed to the growing ratio of smart coatings in several industries for cleaning and healing objectives. Moreover, the reduced inspection time, fewer equipment errors, and cost-effectiveness of conductive coatings & paints are some further factors that are anticipated to boost the growth of the segment throughout the forecast period.

Our in-depth analysis of the global EMI shielding market includes the following segments:

|

By Material |

|

|

By Method |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

EMI Shielding Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific region is set to dominate around 49.5% market share by 2035. The growth of the market can be attributed majorly to the huge proportion of facilities that are producing automobiles in the region. Furthermore, the increased demand and production of automobiles in the region are also expected to generate large revenue for the market in the region. As per the International Organization of Motor Vehicles, the total production of vehicles in the APAC region was 46,732,785 units in 2021, a rise from 44,276,549 units in 2020. Similarly, the total sales in the region were 42,663,736 units in 2021, a rise from 40,322,544 in 2020. In addition to this, the high consumption of chemicals is another significant growth driver of the EMI shielding market size in the region throughout the projected time frame. For instance, as of 2020, the chemical industry of the Asia Pacific region contributed to around 60% of the revenues generated by the global chemical industry.

North America Market Insights

Furthermore, the North American EMI shielding market is also estimated to display notable market growth by the end of 2035. The growth of the market can be attributed to the presence of well-established semiconductor and electronics industries, along with the substantial investment in research and development activities in the region. For instance, Semiconductor manufacturing organizations in the United States invested around one-fifth of yearly revenue in R&D activities, totaling a record around USD 51 billion in 2021. Moreover, dynamically rising demand for consumer electronics products, as well as increasing penetration of 5G technology is also anticipated to contribute to the market growth in the region over the projected time frame.

EMI Shielding Market Players:

- 3M

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Parker-Hannifin Corporation

- The Dow Chemical Company

- ETS-Lindgren Inc.

- Henkel AG & Co. KGaA

- KITAGAWA INDUSTRIES America, Inc.

- Laird Performance Materials (DuPont de Nemours, Inc.)

- Leader Tech Inc.

- PPG Industries, Inc.

- RTP Company

Recent Developments

-

The Dow Chemical Company launched DOWSIL EC-6601 Electrically Conductive Adhesive, a next-generation flexible silicone adhesive with electrical conductivity. With exceptional mechanical and conductive properties coupled with superior EMI shielding, this adhesive has broad applications in transportation, communications, and consumer applications.

-

Parker Hannifin Corporation has joined forces with Eviation Aircraft to develop six technology system packages for Alice, the first-of-its-kind all-electric commuter aircraft.

- Report ID: 4320

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

EMI Shielding Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.